1. Overview

The e-Verify service is available to both registered and unregistered users on the e-Filing portal.

You can e-Verify your Income Tax Return using any of the several modes available. Additionally, you can also e-Verify any other Income Tax related submissions / services / responses / requests on the e-Filing portal to complete the respective processes successfully. You can choose any one of the following modes available for e-Verification:

- Digital Signature Certificate

- Aadhaar OTP

- Electronic Verification Code (using bank account / demat account)

- Electronic Verification Code (using Bank ATM - offline method)

- Net Banking

2. Prerequisites for availing this service

- Registered user on the e-Filing portal with valid user ID and password

- Acknowledgement Number (to e-Verify ITR without logging into the e-Filing portal)

- You have filed a return or an ERI has filed the return on your behalf (to e-Verify ITR)

| e-Verification Method | Prerequisite |

| Digital Signature Certificate |

|

| OTP on mobile number registered with Aadhaar |

|

| Bank Account EVC / Demat Account EVC |

|

| Net Banking |

|

3. Step-by-Step Guide

| Sl. No. | Scenario | Section |

| 1 |

e-Verify your ITR (immediately after filing) or any other Income Tax related submissions / services / responses / requests using the following options: |

|

| a | DSC* | Refer to Section 3.1 |

| b | Generate Aadhaar OTP | Refer to Section 3.2 |

| c | Existing Aadhaar OTP | Refer to Section 3.3 |

| d | Existing EVC | Refer to Section 3.4 |

| e | Generate EVC through Bank Account | Refer to Section 3.5 |

| f | Generate EVC through Bank Account | Refer to Section 3.6 |

| g | Net Banking** | Refer to Section 3.7 |

| h | Generate EVC through Bank ATM option (offline method) | Refer to Section 3.8 |

| 2 |

e-Verify your ITR pre-login / post login. Applicable in case of the following:

Important Note: Please note vide Notification No. 5/2022 dated 29.07.2022, w.e.f. 01/08/2022 the time-limit for e-verification or submission of ITR-V shall be 30 days from the date of filing the return of income. However, where the return is filed on or before 31.07.2022 the earlier time limit of 120 days would continue to apply. |

Refer to Section 3.9 (pre-login) or Section 3.10 (post-login) |

*You can use Digital Signature Certificate as a preferred option of e-Verification if you choose to e-Verify your ITR immediately after filing your Income Tax Returns (instead of selecting I will verify Return Later option).

**You can use Net Banking as a preferred option of e-Verification only after logging in to the e-Filing portal.

3.1 e-Verify using Digital Signature Certificate (DSC)

Note: You will not be able to e-Verify your ITR using Digital Signature Certificate if you select the e-Verify Later option while submitting Income Tax Return. You can use DSC as an e-Verification option if you choose to e-Verify your ITR immediately after filing.

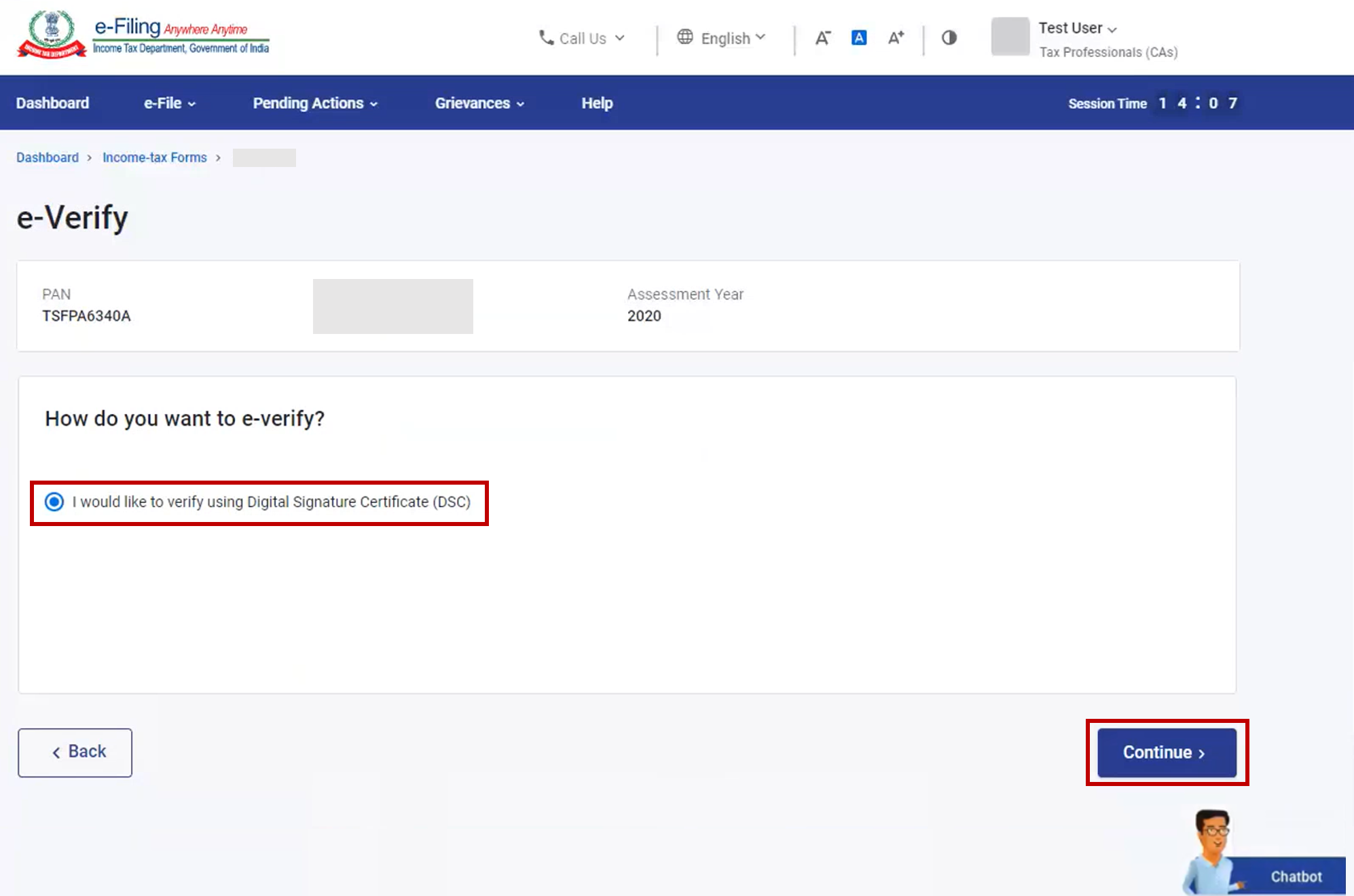

Step 1: On the e-Verify page, select I would like to e-Verify using Digital Signature Certificate (DSC).

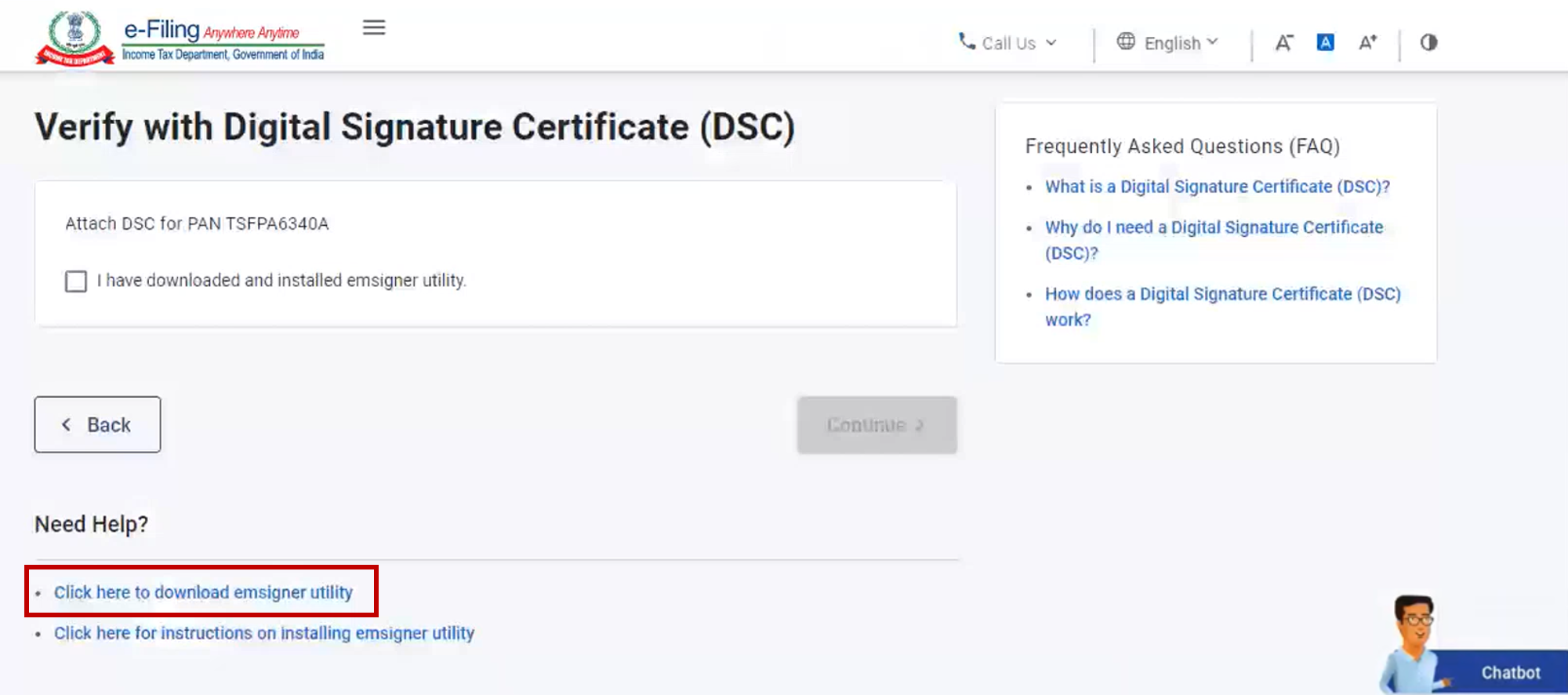

Step 2: On the Verify Your Identity page, select Click here to download emsigner utility.

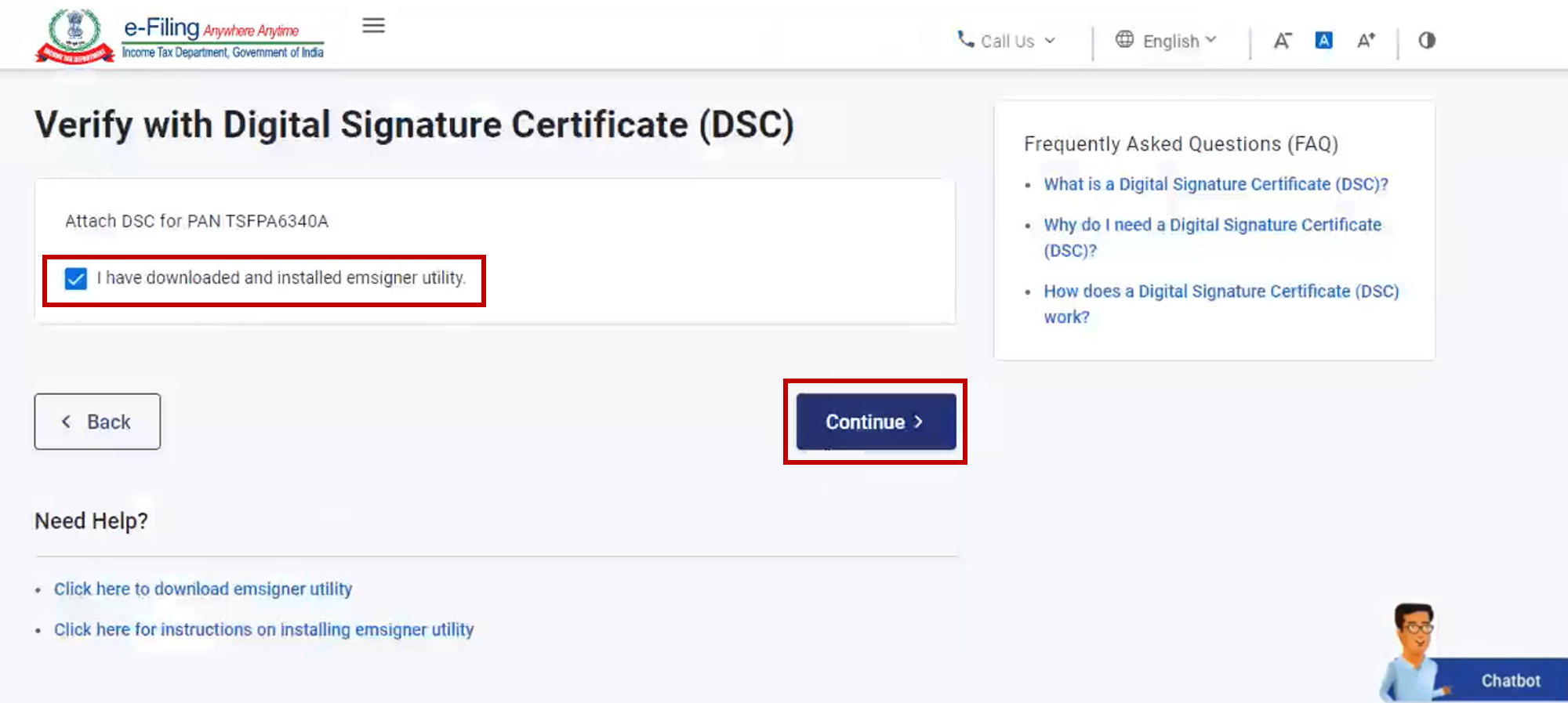

Step 3: After the download and installation of emsigner utility is complete, select I have downloaded and installed emsigner utility on the Verify Your Identity page and click Continue.

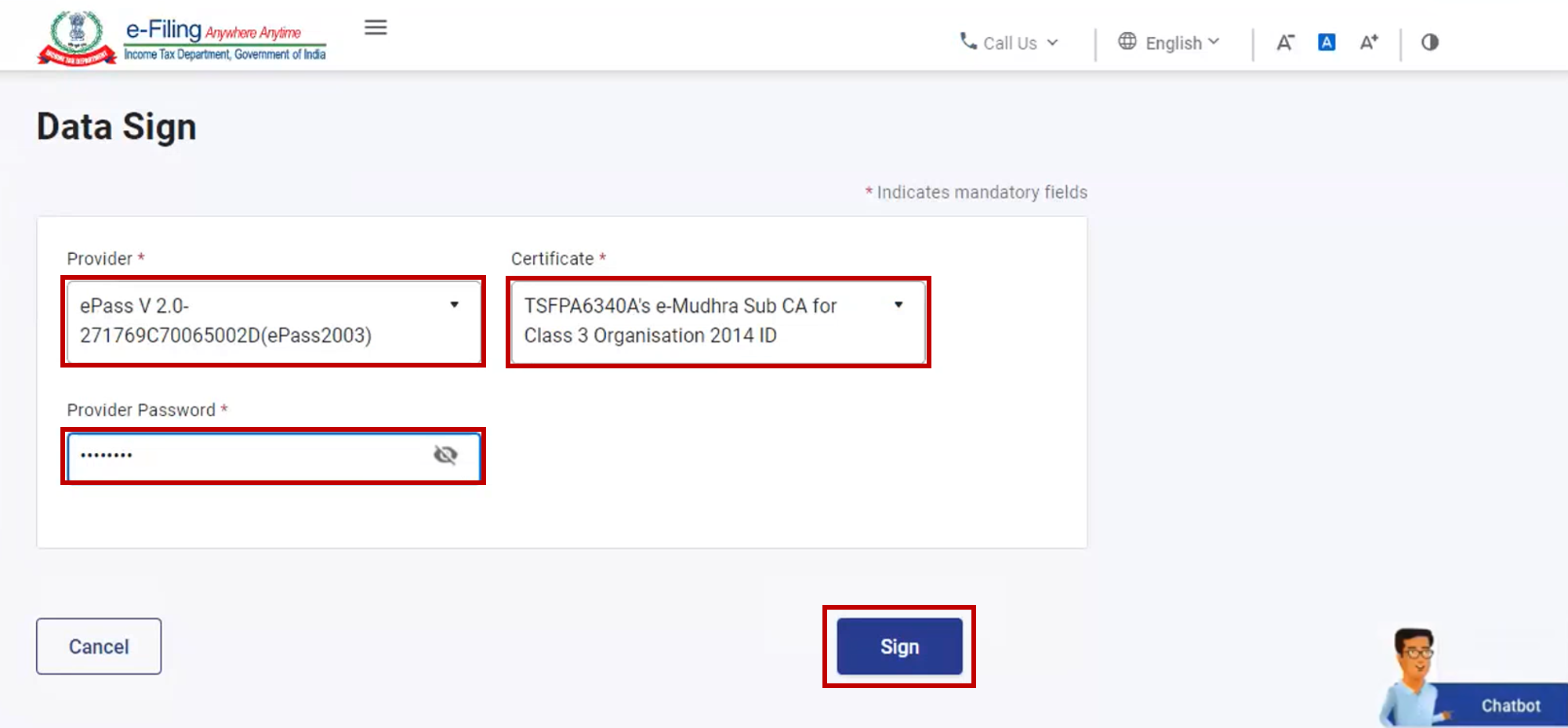

Step 4: On the Data Sign page, select your Provider, Certificate and enter the Provider Password. Click Sign.

A success message page is displayed along with a Transaction ID. Please keep a note of the Transaction ID for future reference. You will also receive a confirmation message on your email ID and mobile number registered on the e-Filing portal.

3.2 e-Verify after generating Aadhaar OTP

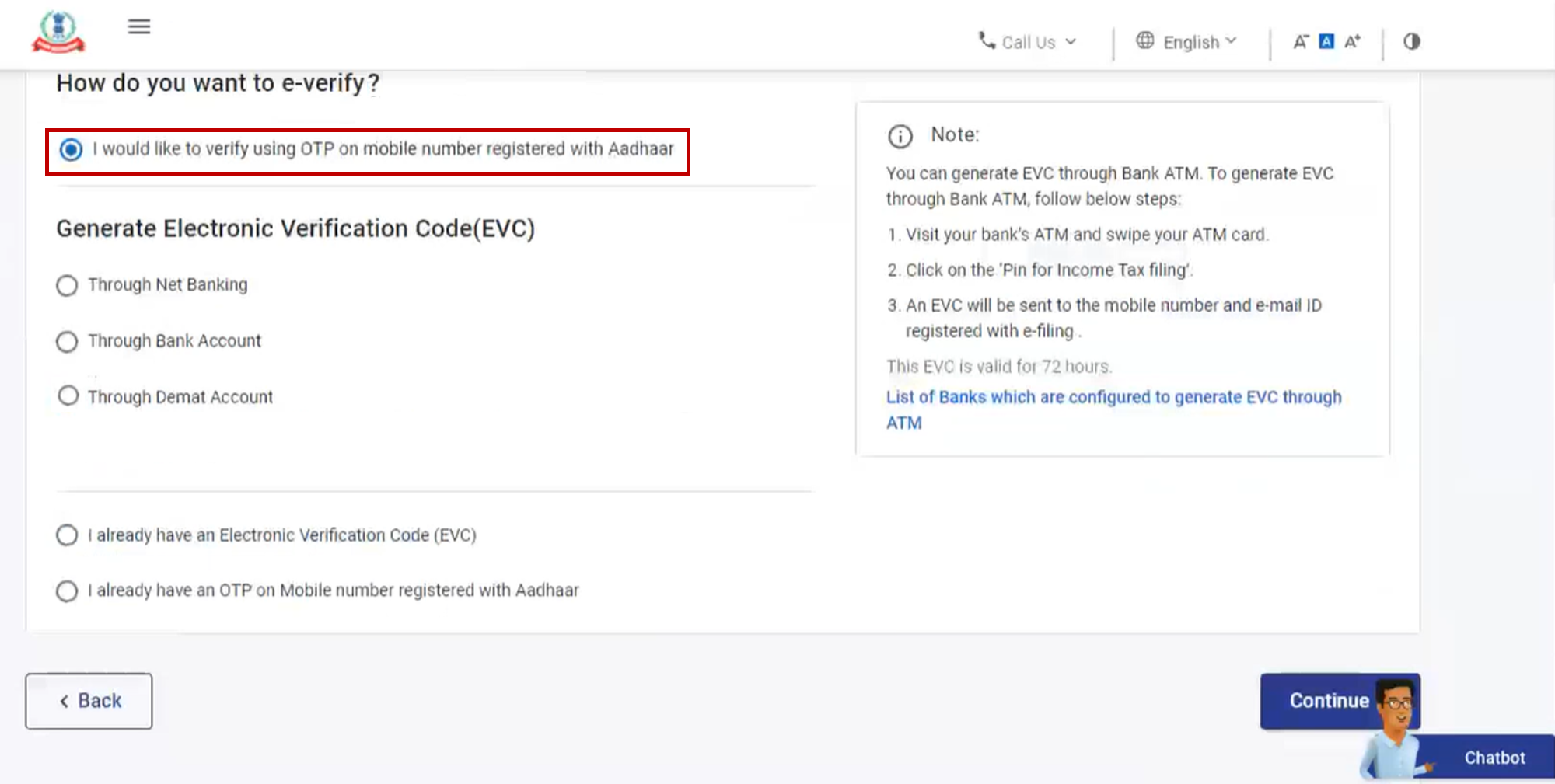

Step 1: On the e-Verify page, select I would like to verify using OTP on mobile number registered with Aadhaar and click Continue.

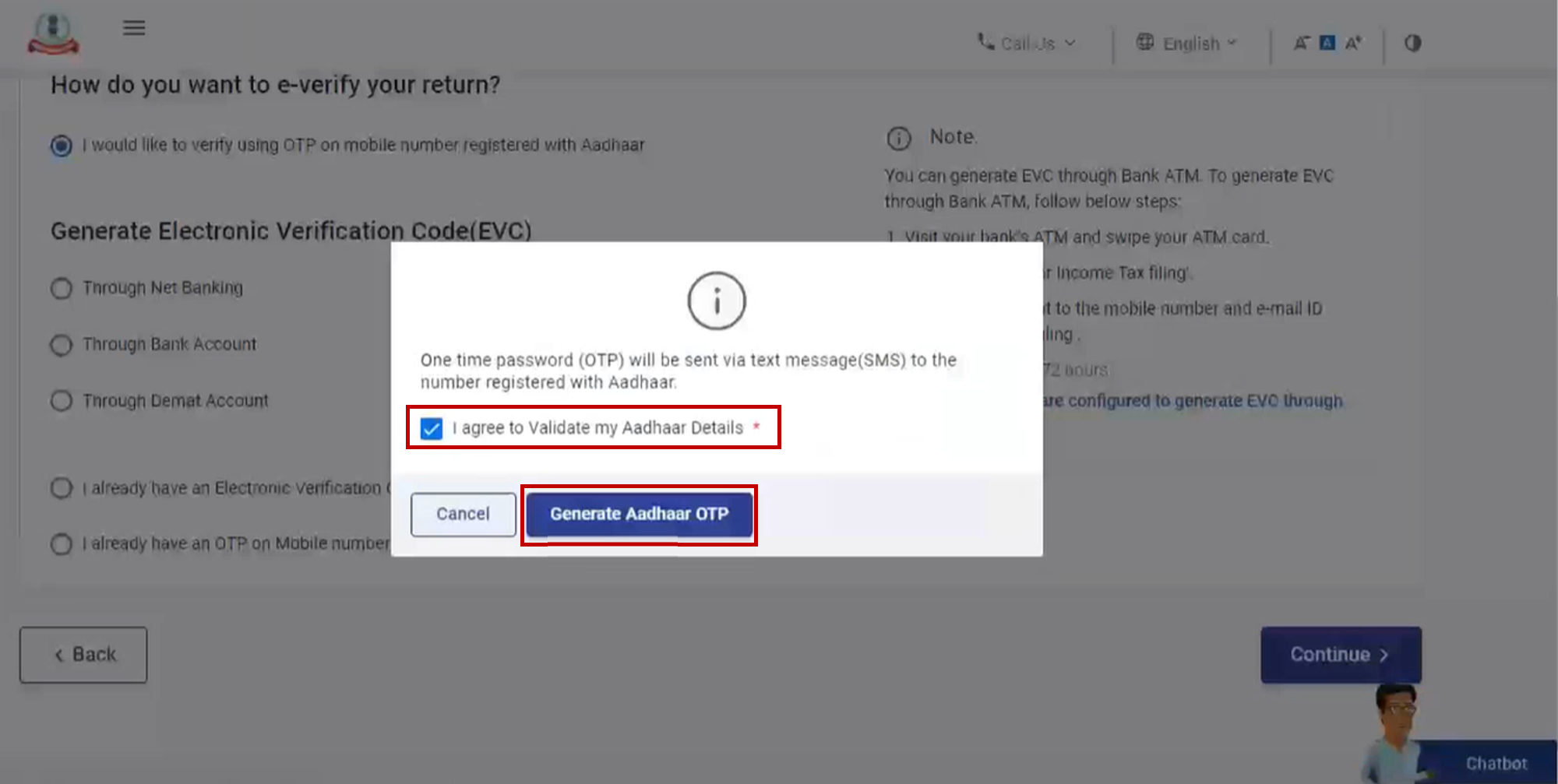

Step 2: On the Aadhaar OTP page, select the I agree to validate my Aadhaar Details checkbox and click Generate Aadhaar OTP.

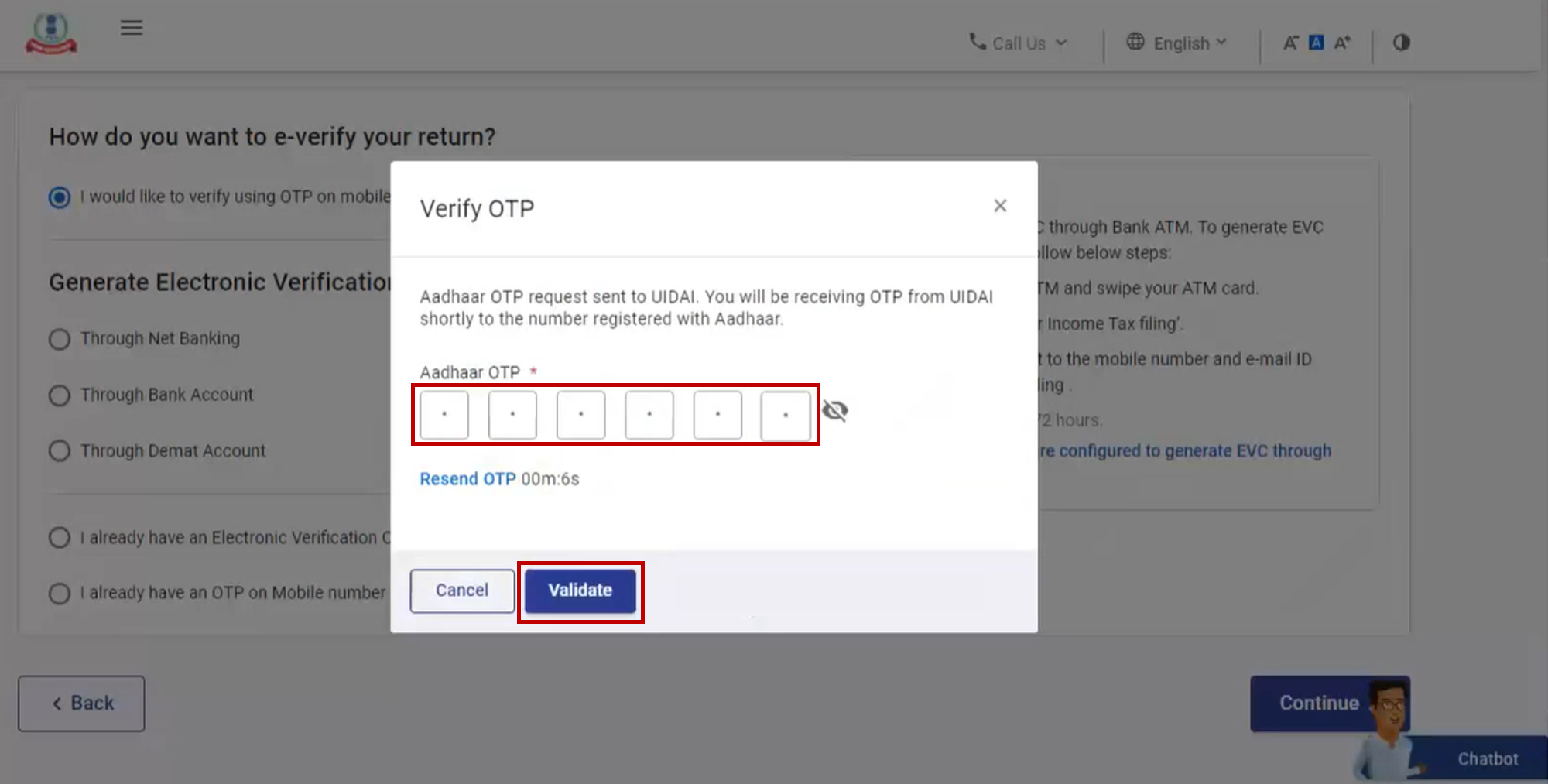

Step 3: Enter the 6-digit OTP received on your mobile number registered with Aadhaar and click Validate.

Note:

- OTP will be valid for 15 minutes only.

- You have 3 attempts to enter the correct OTP.

- The OTP expiry countdown timer on screen tells you when the OTP will expire.

- On clicking Resend OTP, a new OTP will be generated and sent.

A success message page is displayed along with a Transaction ID. Please keep a note of the Transaction ID for future reference. You will also receive a confirmation message on your email ID and mobile number registered on the e-Filing portal.

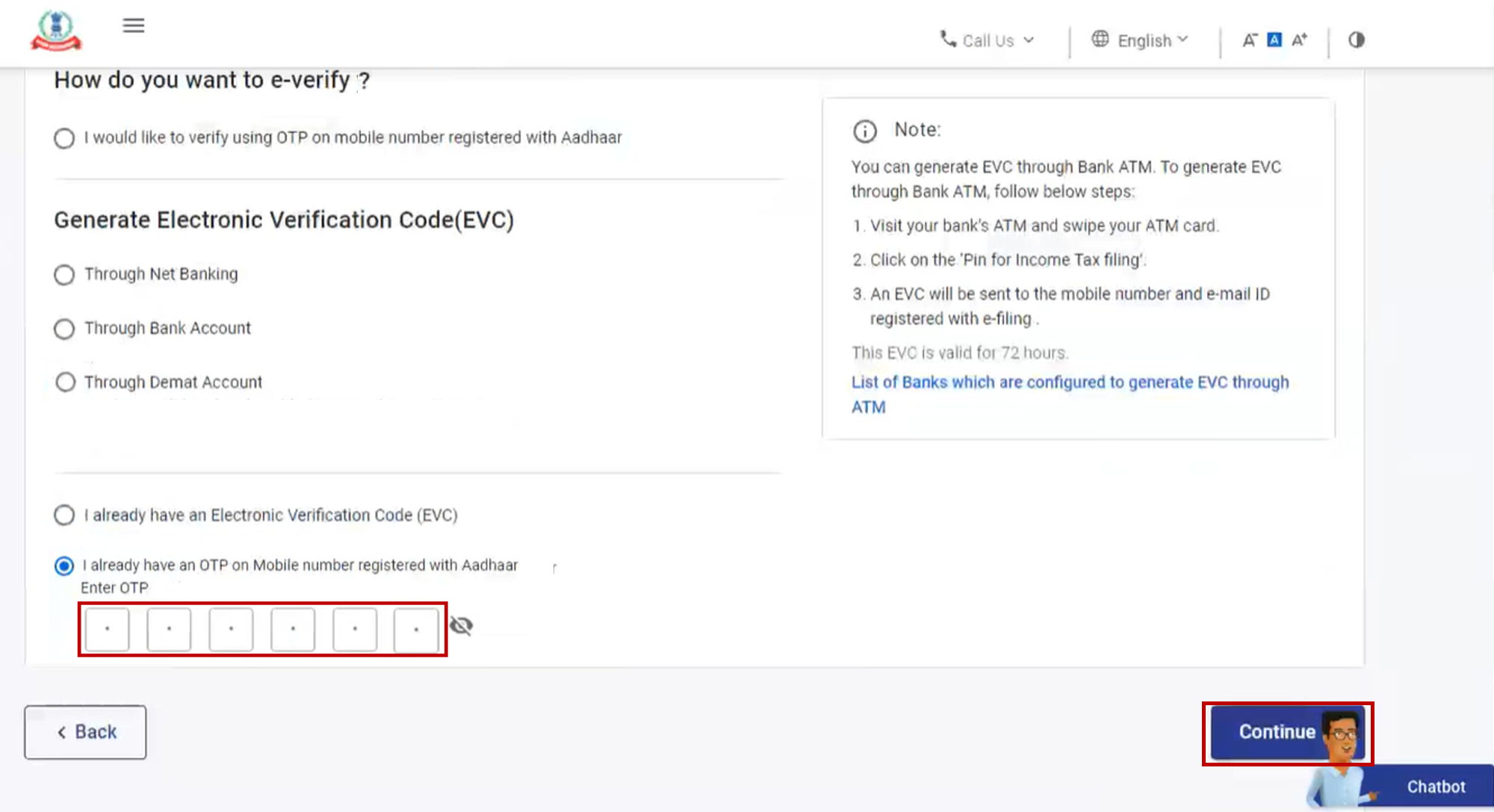

3.3 e-Verify using existing Aadhaar OTP

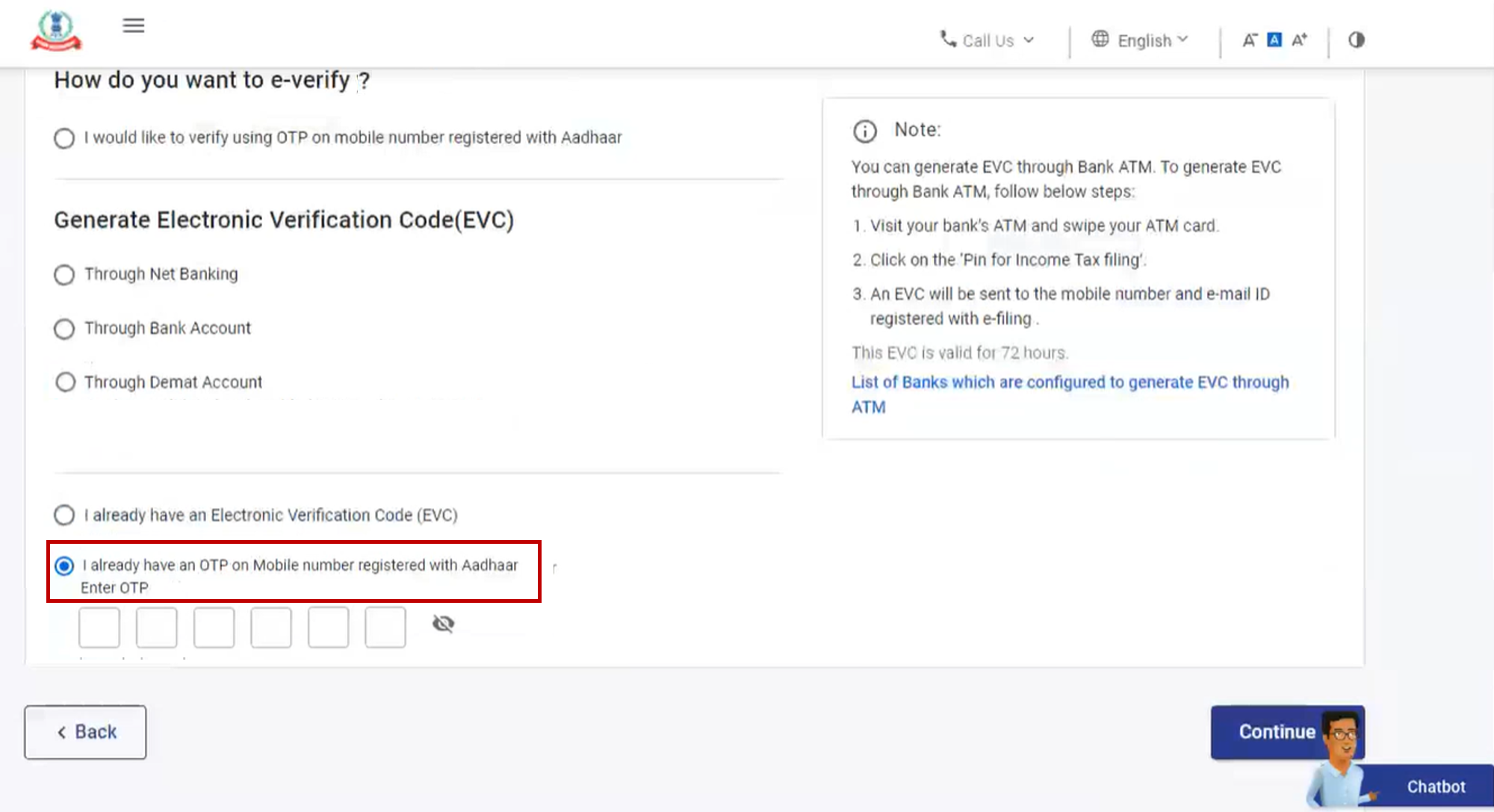

Step 1: On the e-Verify page, select I already have an OTP on Mobile number registered with Aadhaar.

Step 2: Enter the 6-digit OTP available with you and click Continue.

Note:

- OTP will be valid for 15 minutes only.

- You have 3 attempts to enter the correct OTP.

- The OTP expiry countdown timer on screen tells you when the OTP will expire.

- On clicking Resend OTP, a new OTP will be generated and sent.

A success message page is displayed along with a Transaction ID. Please keep a note of the Transaction ID for future reference. You will also receive a confirmation message on your email ID and mobile number registered on the e-Filing portal.

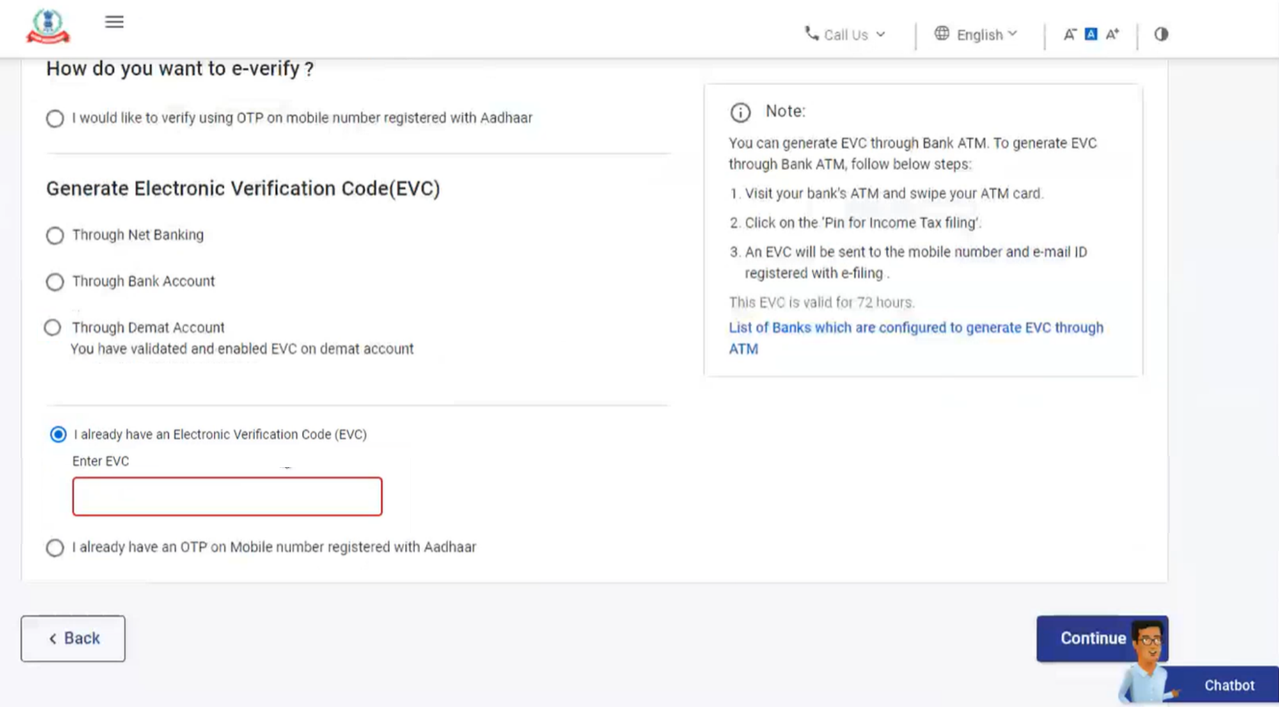

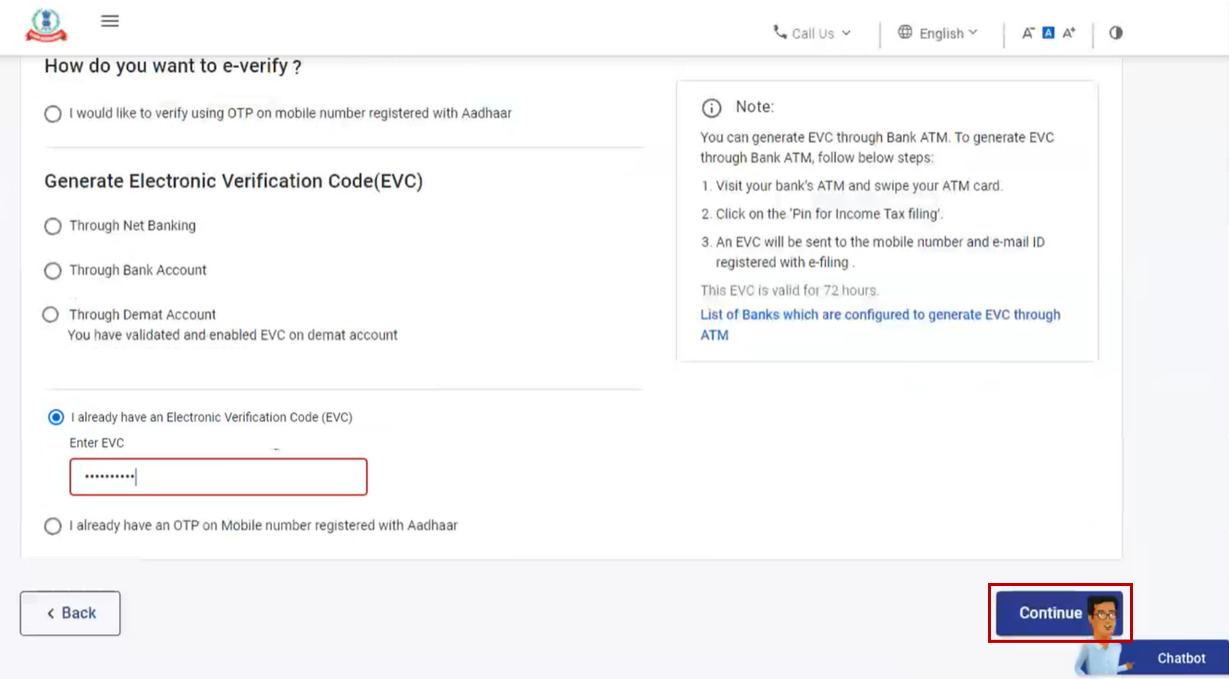

3.4 e-Verify using existing Electronic Verification Code (EVC)

Step 1: On the e-Verify page, select I already have an Electronic Verification Code (EVC).

Step 2: Enter EVC in the Enter EVC textbox and click Continue.

A success message page is displayed along with a Transaction ID and EVC. Please keep a note of the Transaction ID and EVC for future reference. You will also receive a confirmation message on your email ID and mobile number registered on the e-Filing portal.

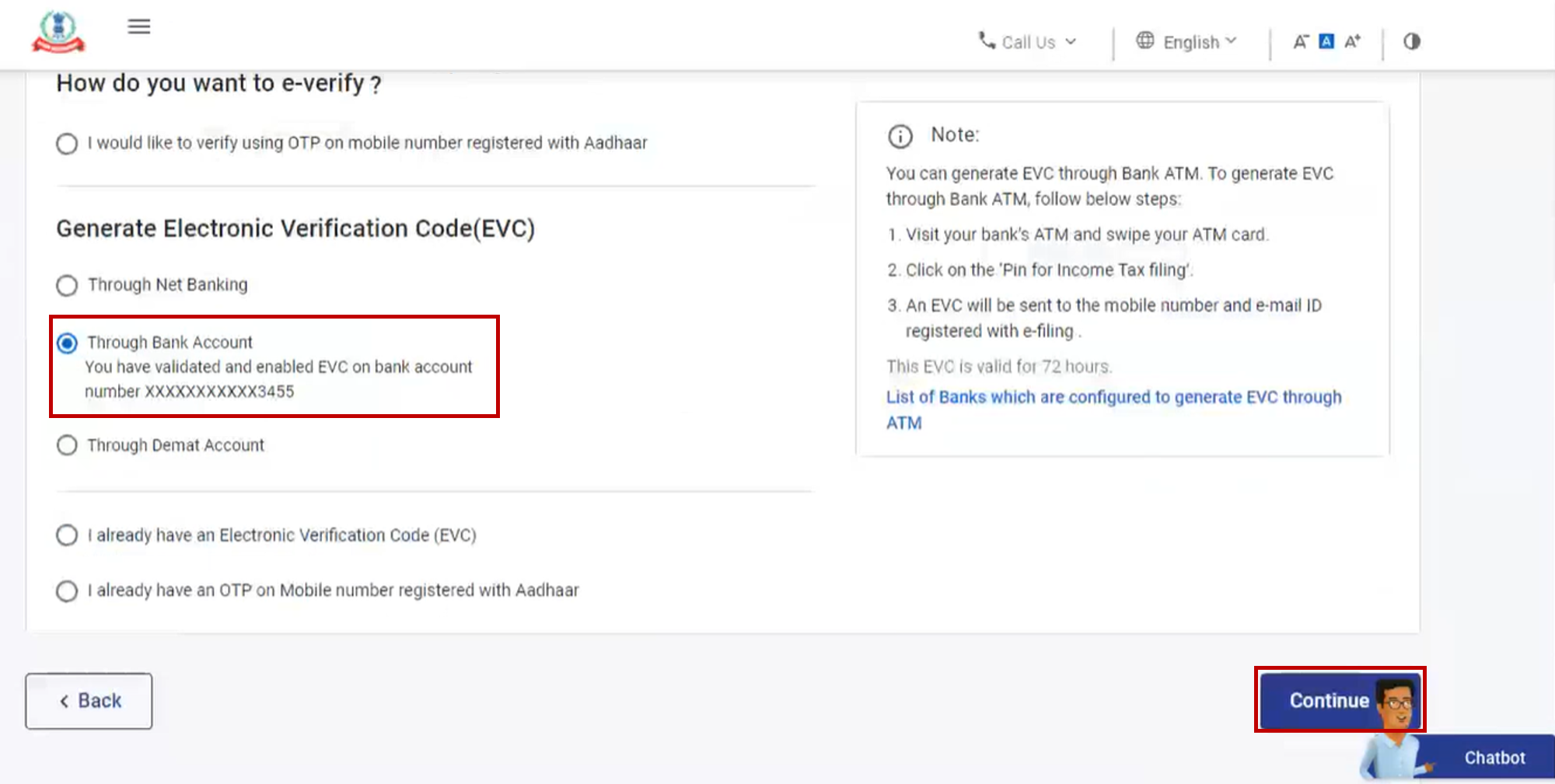

3.5 e-Verify after generating Electronic Verification Code (EVC) through Bank Account

Step 1: On the e-Verify page, select Through Bank Account and click Continue.

Note:

- EVC will be generated and will be sent to your mobile number and email ID registered with your pre-validated and EVC enabled bank account.

- If you have not pre-validated your Bank Account yet, refer to the My Bank Account user manual learn how to pre-validate and EVC-enable your bank account.

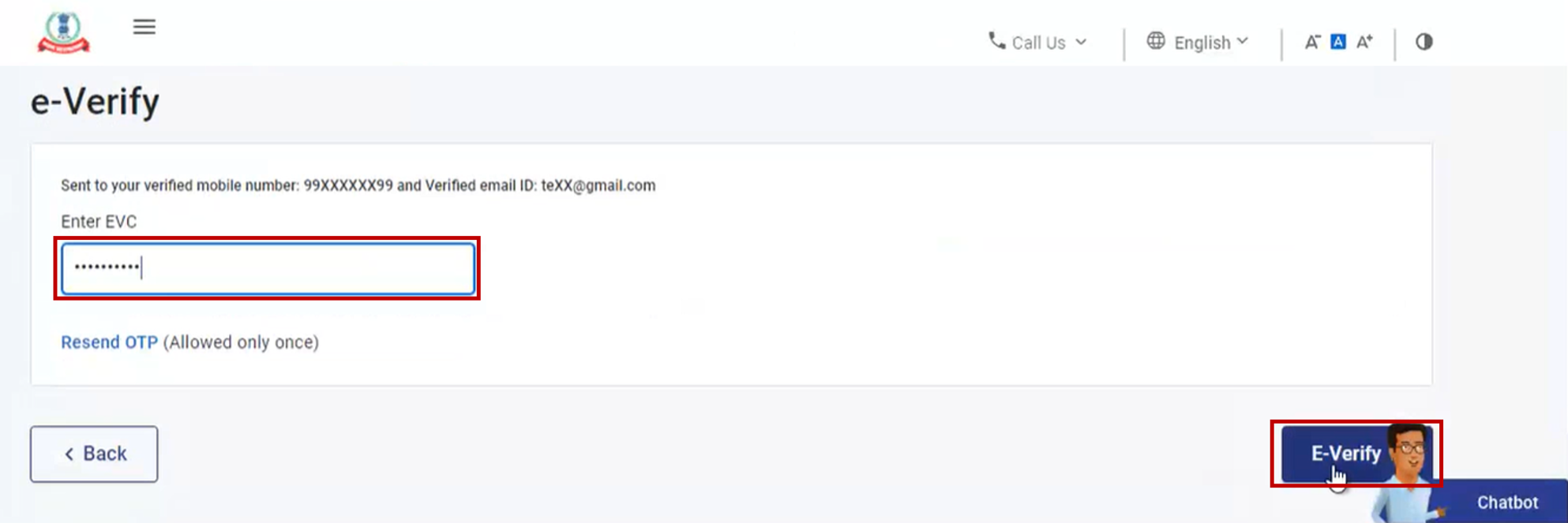

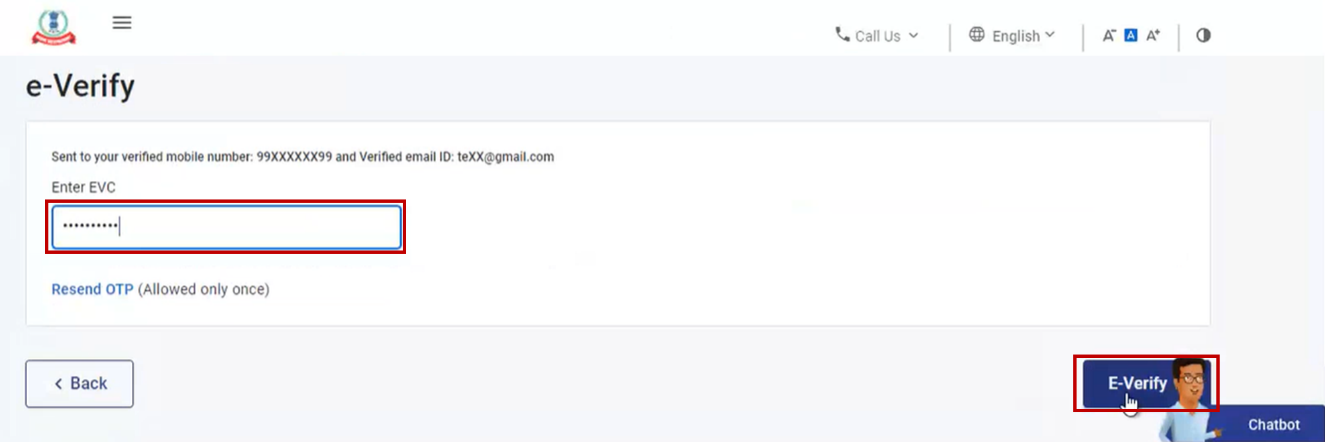

Step 2: Enter the EVC received on your mobile number and email ID registered with your bank account in the Enter EVC textbox and click e-Verify.

A success message page is displayed along with a Transaction ID and EVC. Please keep a note of the Transaction ID and EVC for future reference. You will also receive a confirmation message on your email ID and mobile number registered on the e-Filing portal.

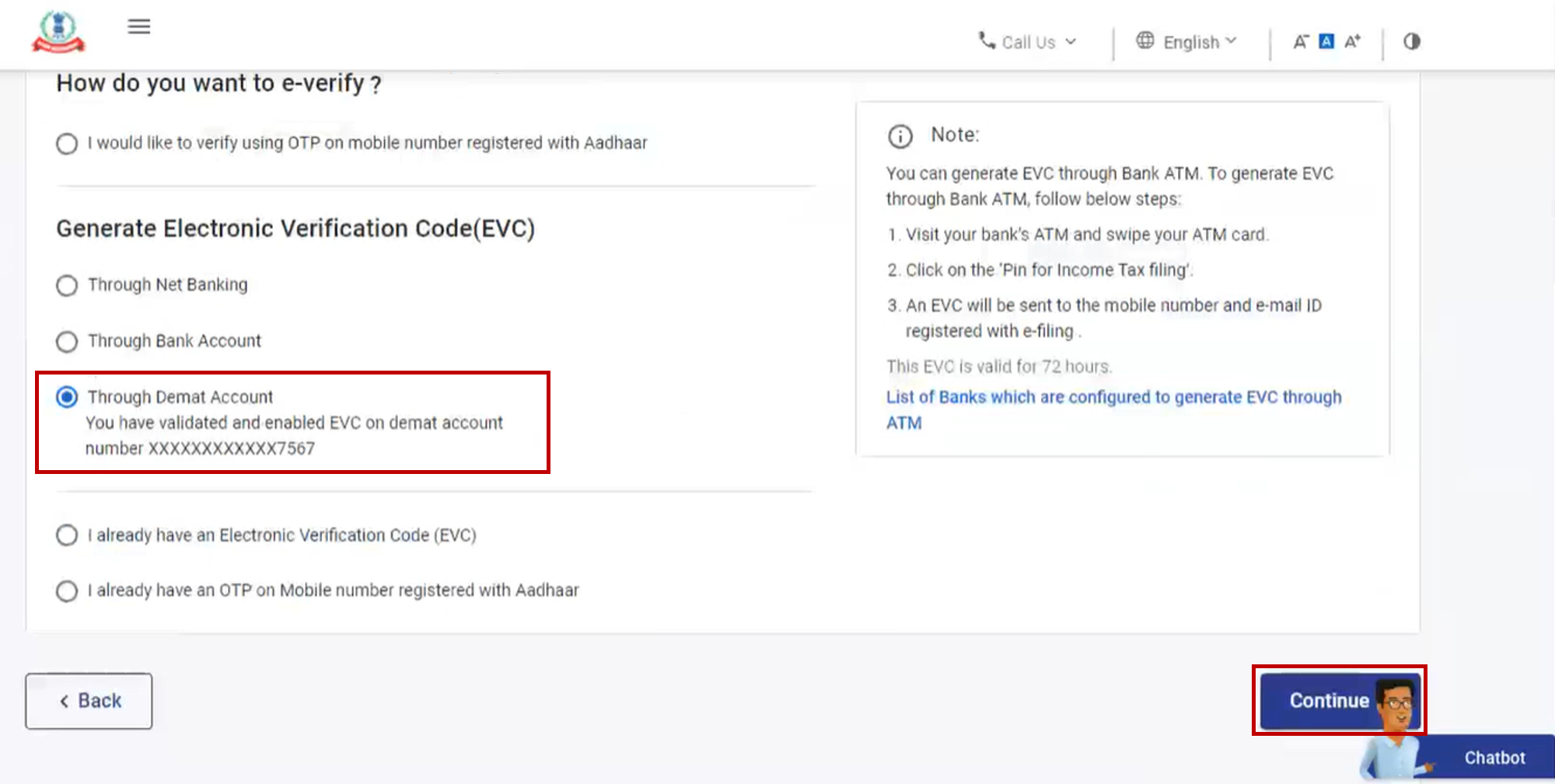

3.6 e-Verify after generating Electronic Verification Code (EVC) through Demat Account

Step 1: On the e-Verify page, select Through Demat Account and click Continue.

Note:

- EVC will be generated and will be sent to your mobile number and email ID registered with your pre-validated and EVC-enabled demat account.

- If you have not pre-validated your demat account yet, refer to the My Demat Account user manual learn how to pre-validate and EVC-enable your demat account.

Step 2: Enter the EVC received on your mobile number and email ID registered with your demat account in the Enter EVC textbox and click e-Verify.

A success message page is displayed along with a Transaction ID and EVC. Please keep a note of the Transaction ID and EVC for future reference. You will also receive a confirmation message on your email ID and mobile number registered on the e-Filing portal.

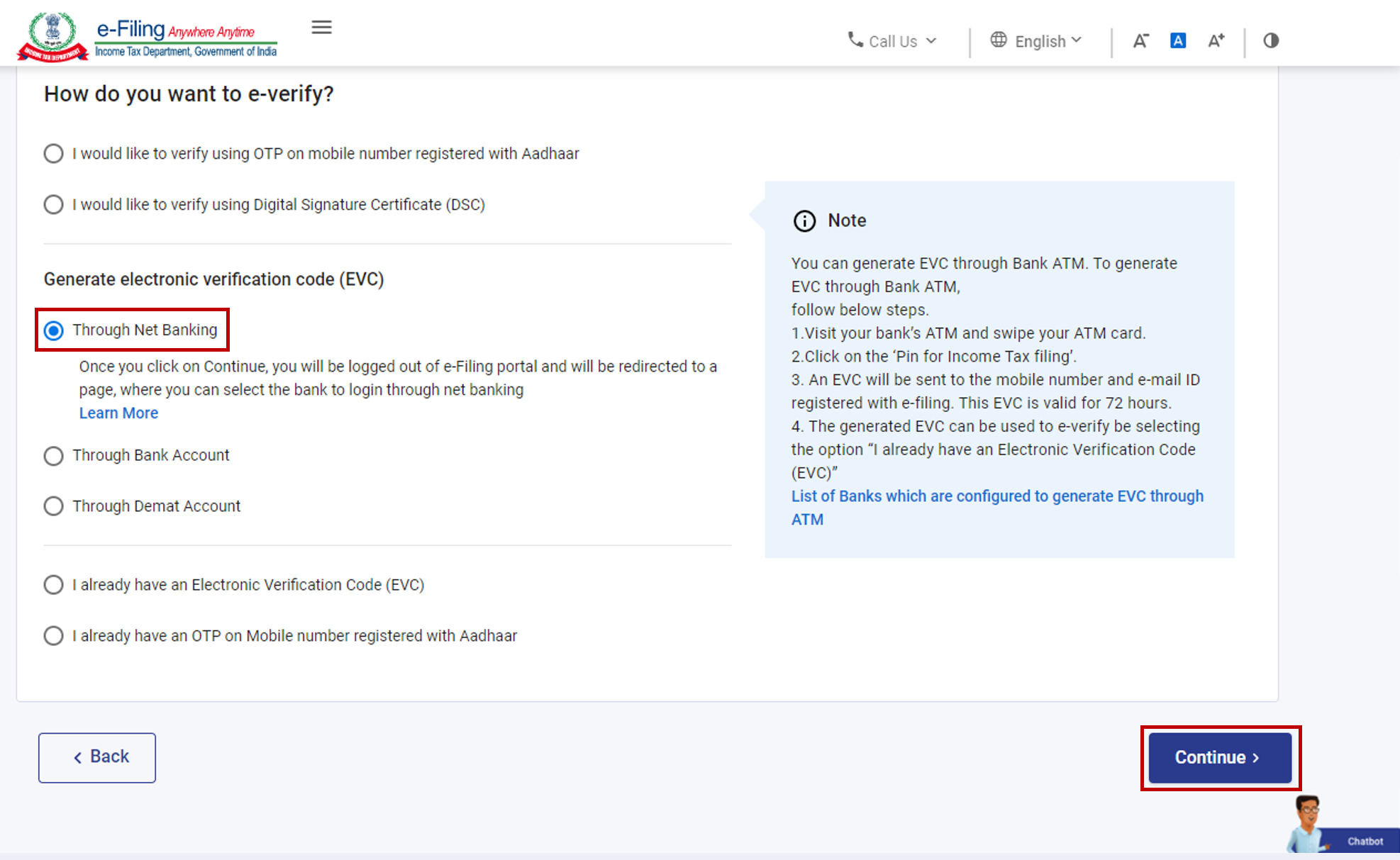

3.7 e-Verify using Net Banking

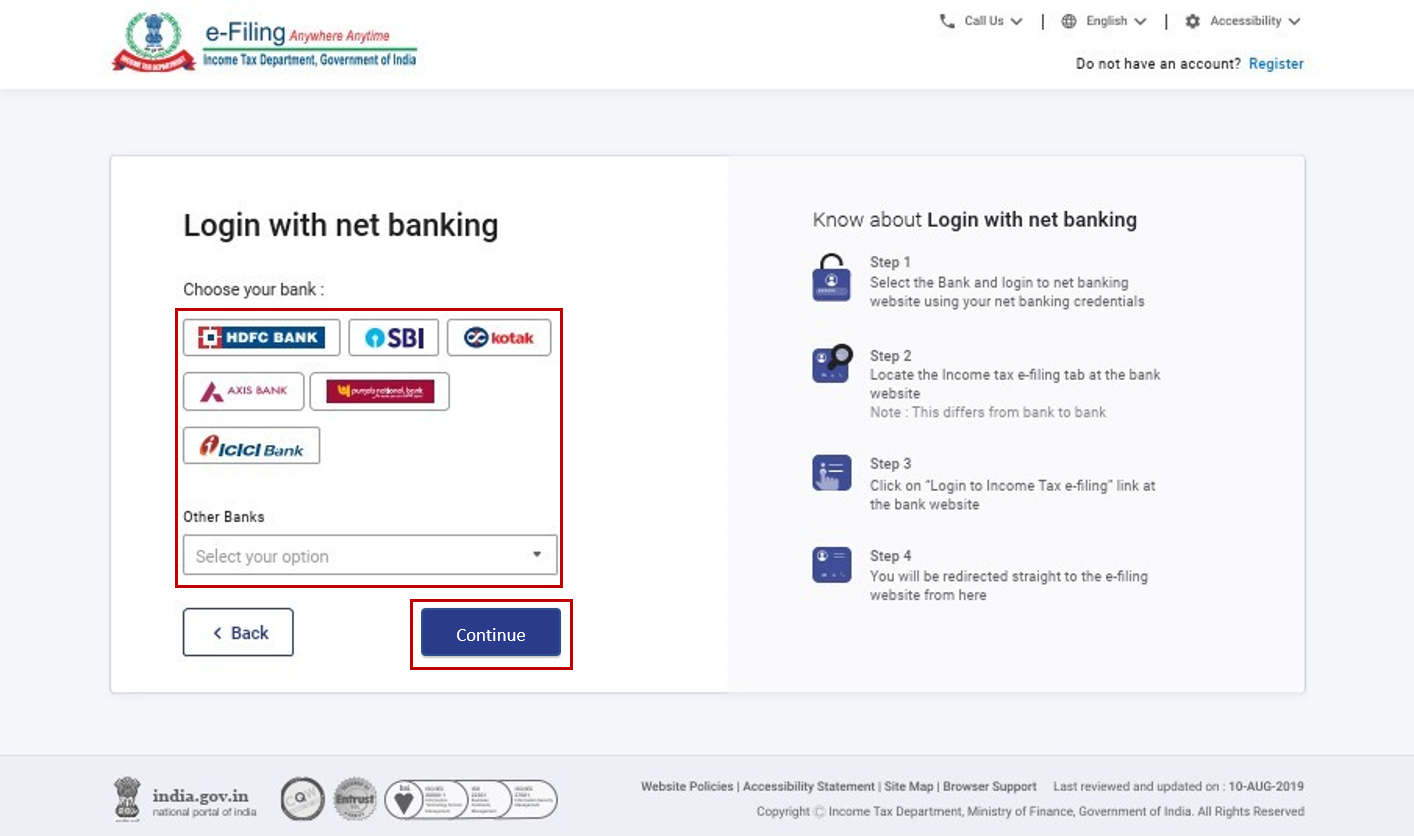

Step 1: On the e-Verify page, select Through Net Banking and click Continue.

Step 2: Select the bank through which you want to e-Verify and click Continue.

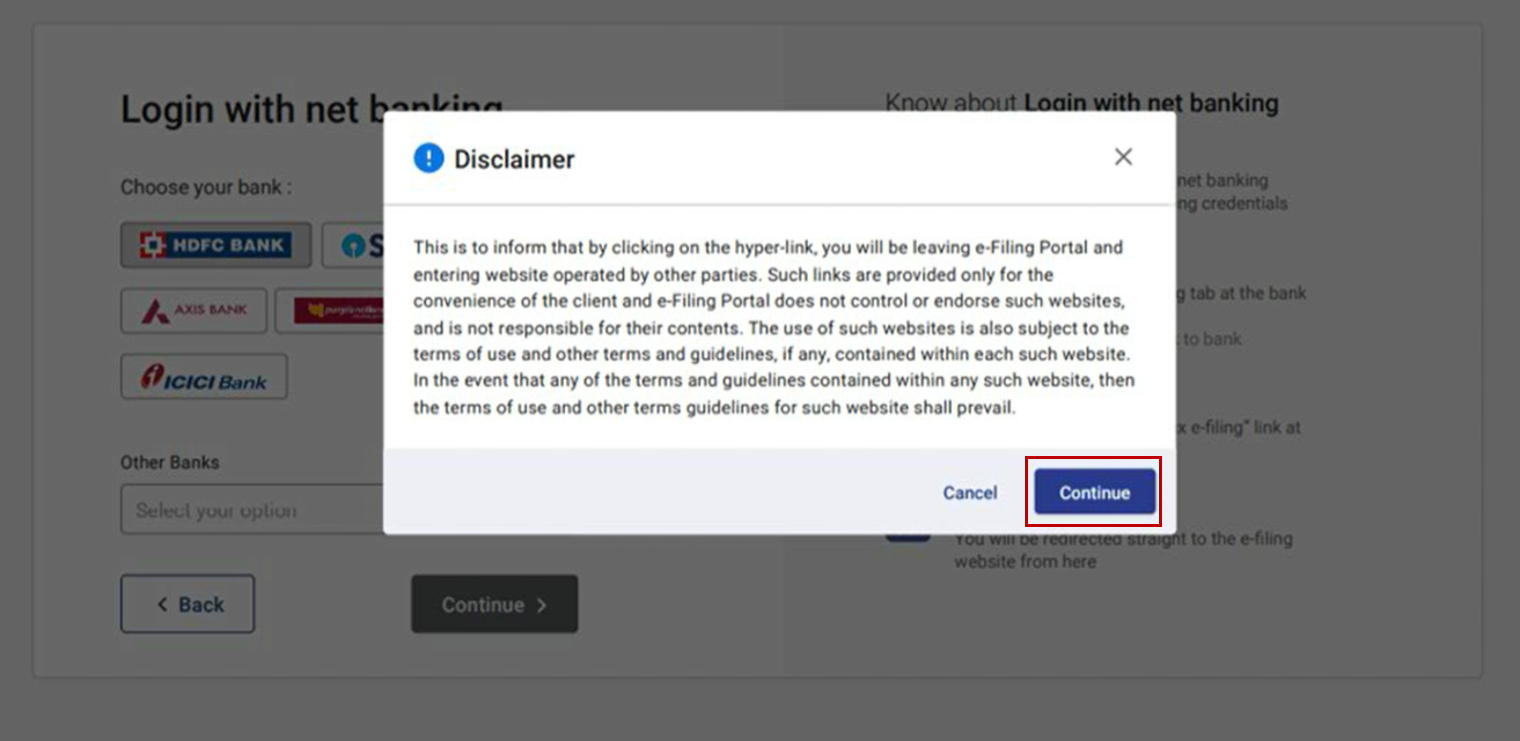

Step 3: Read and understand the disclaimer. Click Continue.

Note: After this, you will be taken to the Net Banking login page of your Bank Account.

Step 4: Log in to your Net Banking using your Net Banking user ID and password.

Step 5: Click the link to log in to e-Filing from your bank's website.

Note: You will be logged out of internet banking, and logged in to the e-Filing portal.

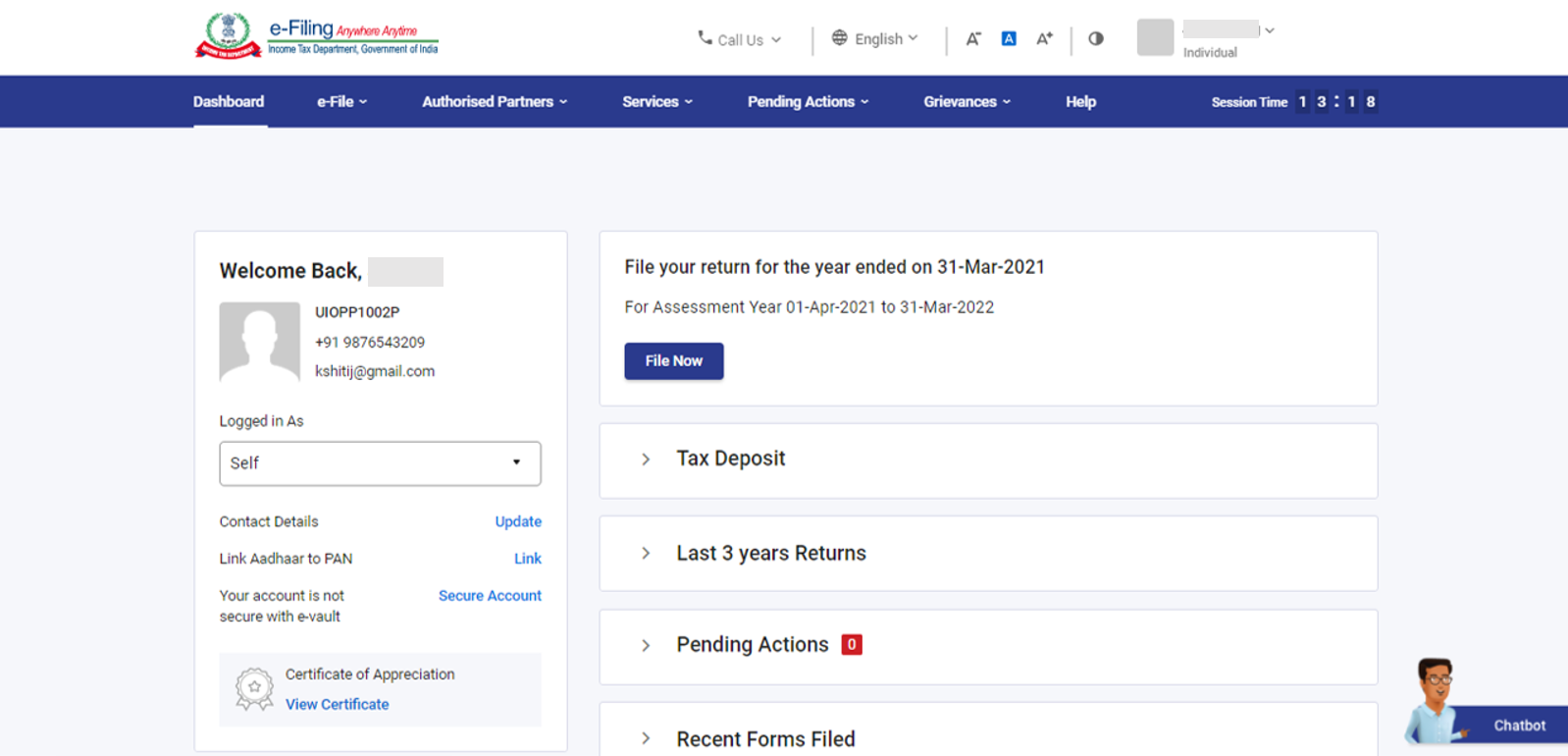

Step 6: On successful login, you will be taken to the e-Filing Dashboard. Go to the respective ITR / Form / service and click e-Verify. Your ITR / Form / Service will be e-Verified successfully.

A success message page is displayed along with a Transaction ID. Please keep a note of the Transaction ID for future reference. You will also receive a confirmation message on your email ID and mobile number registered on the e-Filing portal.

3.8 Generate Electronic Verification Code (EVC) through Bank ATM (Offline Method)

Step 1: Visit your bank’s ATM and swipe your ATM card.

Note: The service to generate EVC through Bank ATM is provided by certain banks only.

Step 2: Enter PIN.

Step 3: Select Generate EVC for Income tax Filing.

An EVC will be sent to your mobile number and email ID registered with the e-Filing portal.

Note:

- You must have linked the PAN with your respective bank account and the same PAN should be registered with e-Filing portal.

- List of Banks through which you can generate EVC through Bank ATM option - Axis Bank Ltd, Canara Bank, Central Bank of India, ICICI Bank, IDBI Bank, Kotak Mahindra Bank and State Bank of India.

Step 4: The generated EVC can be used to e-Verify the return by selecting I already have an Electronic Verification Code (EVC) as a preferred choice of e-Verification. Refer to Section 3.4 Existing EVC in this user manual to complete the process.

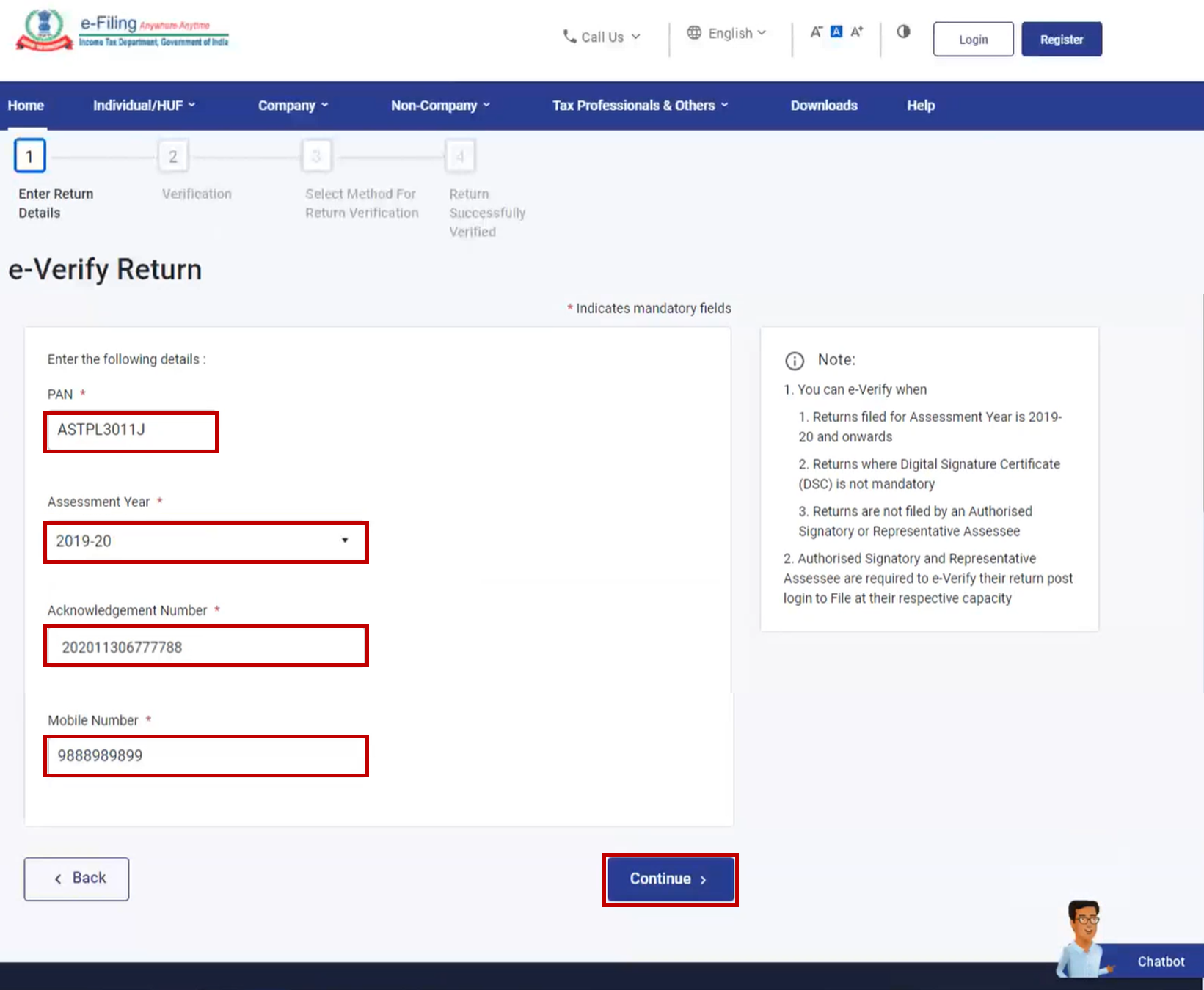

3.9 e-Verify Return (Pre-Login)

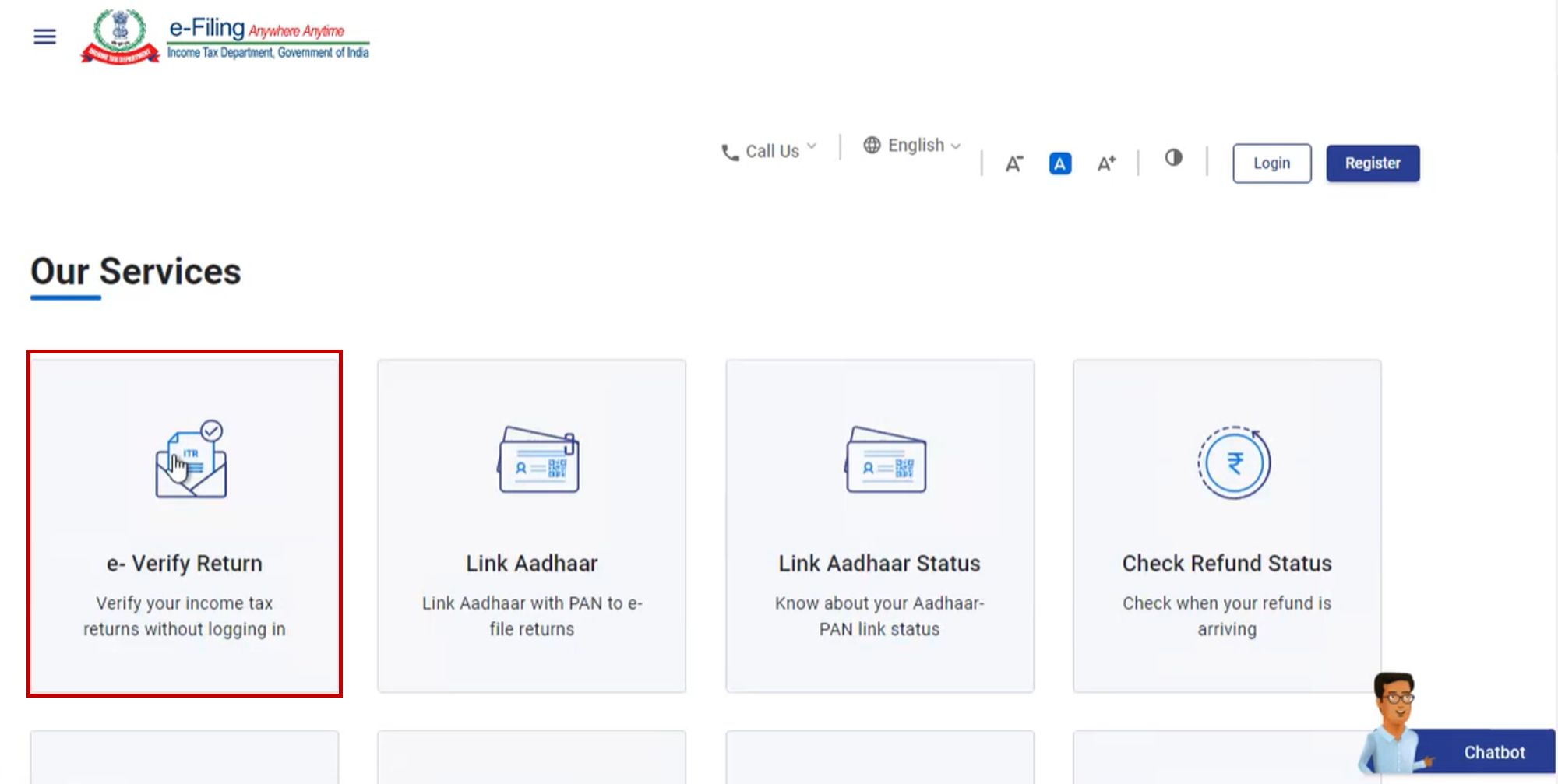

Step 1: Go to the e-Filing portal homepage and click e-Verify Return.

Step 2: On the e-Verify Return page, enter your PAN, select the Assessment Year, enter Acknowledgment Number of the ITR filed and Mobile Number available with you and click Continue.

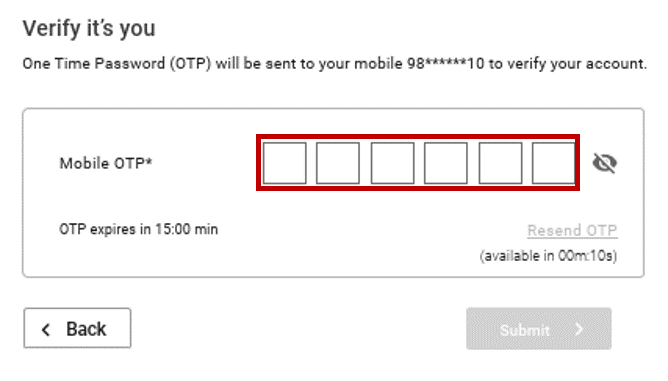

Step 3: Enter the 6-digit Mobile OTP, received on the mobile number entered in Step 2.

Note:

- OTP will be valid for 15 minutes only.

- You have 3 attempts to enter the correct OTP.

- The OTP expiry countdown timer on screen tells you when the OTP will expire.

- On clicking Resend OTP, a new OTP will be generated and sent.

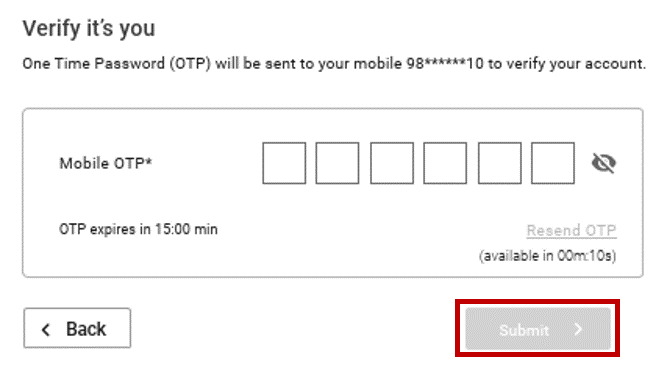

Step 4: Click Submit.

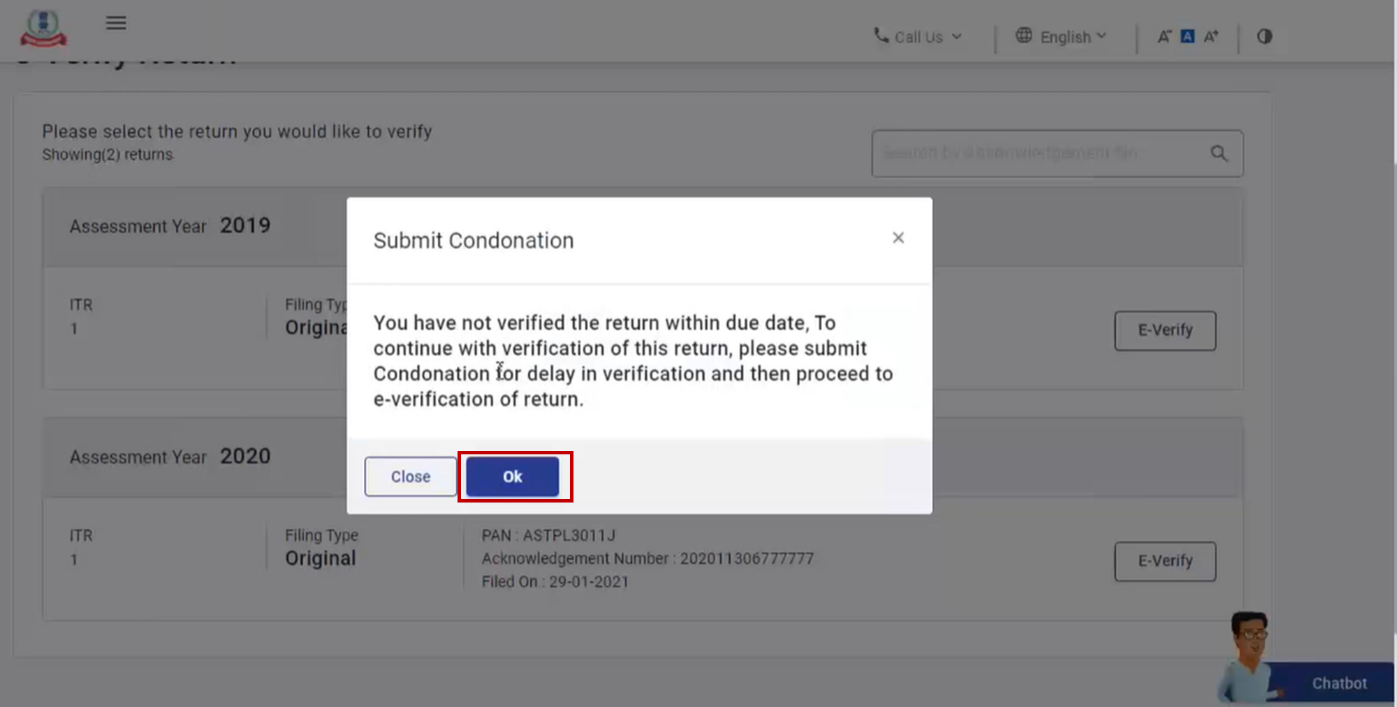

| If you are e-Verifying the return after 120 / 30 days of filing | Go to Step 5 (for submission of Condonation of Delay request) |

| If you are e-Verifying the return within 120 / 30 days of filing | Go to Step 7 directly |

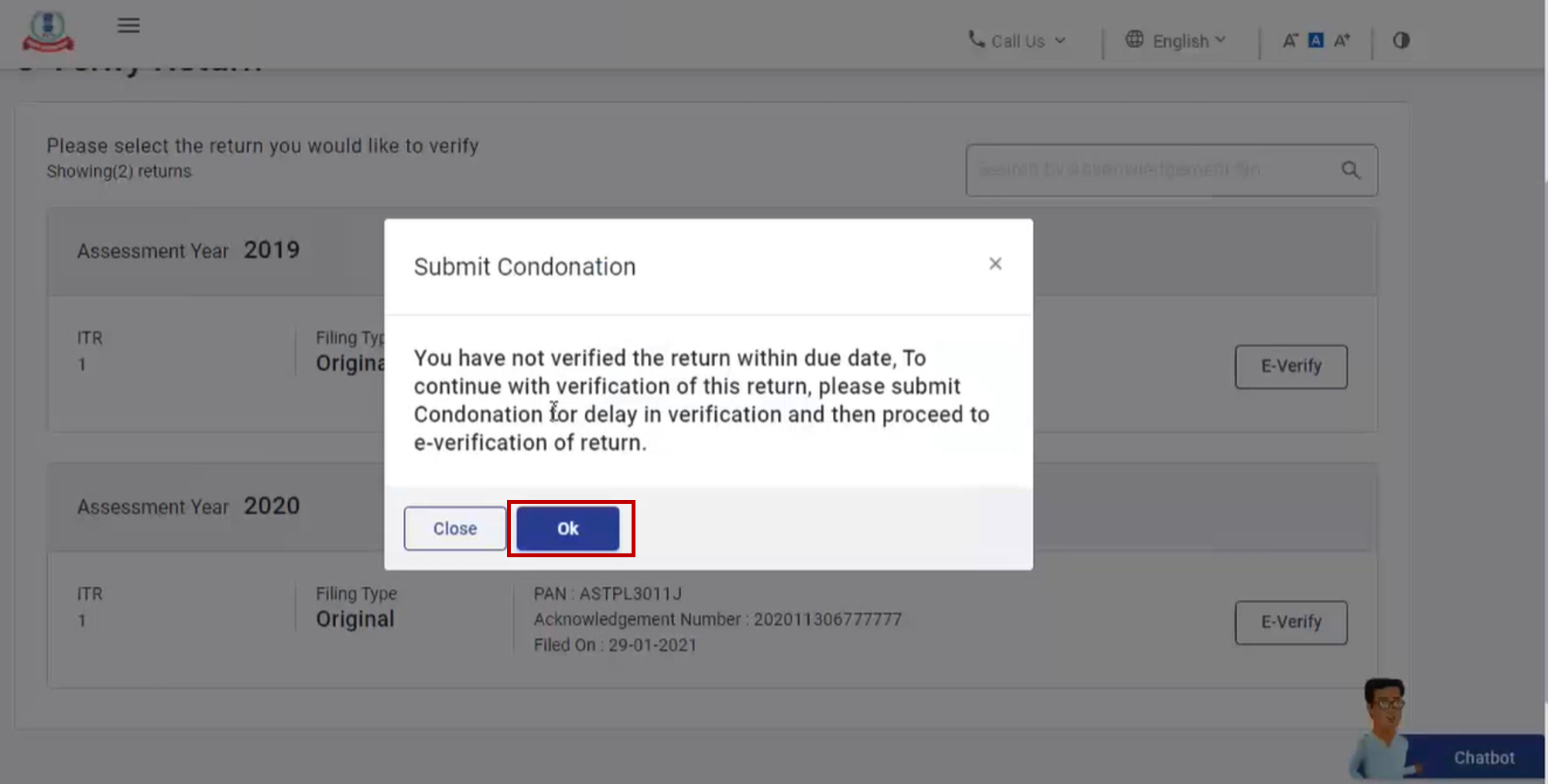

Step 5: If you are e-Verifying the return after 120 / 30 days of filing, click Ok.

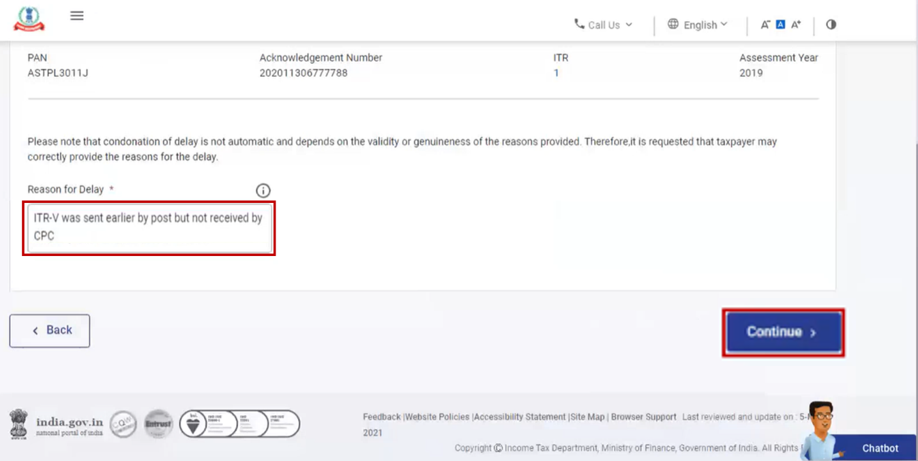

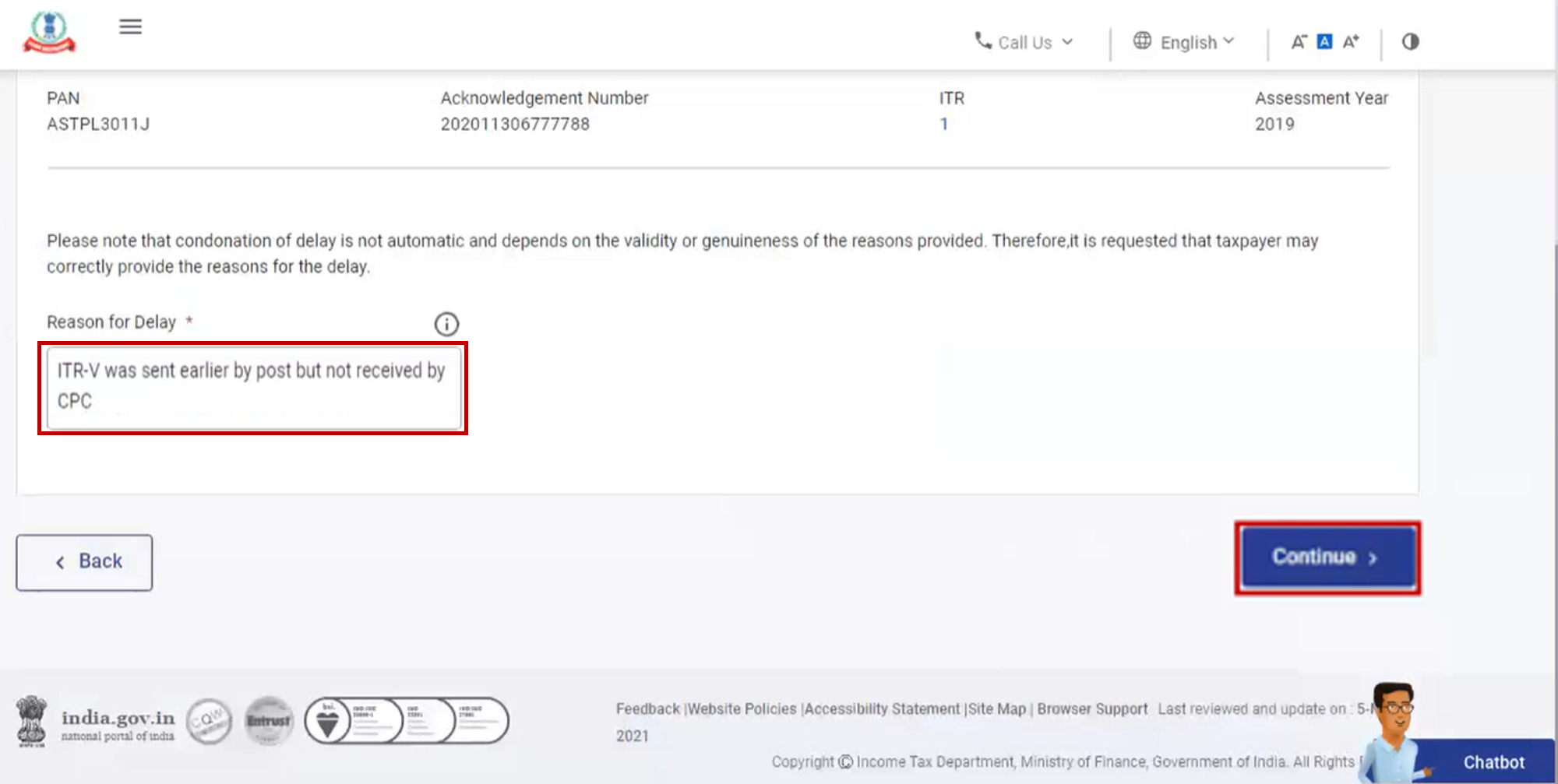

Step 6: For submitting condonation delay request, select the Reason of Delay from the dropdown and click Continue.

Note: In case you select Others from the dropdown, enter the reason for delay in the Remarks textbox and click Continue.

Step 7: Refer to the tale below to proceed further:

| Mode of e-Verification (choose any one) | Section |

| Generate Aadhaar OTP | Refer to Section 3.2 |

| Existing Aadhaar OTP | Refer to Section 3.3 |

| Existing EVC | Refer to Section 3.4 |

| Generate EVC through Bank Account | Refer to Section 3.5 |

| Generate EVC through Demat Account | Refer to Section 3.6 |

| Generate EVC through Bank ATM option (offline method) | Refer to Section 3.8 |

3.10 e-Verify Return (Post-Login)

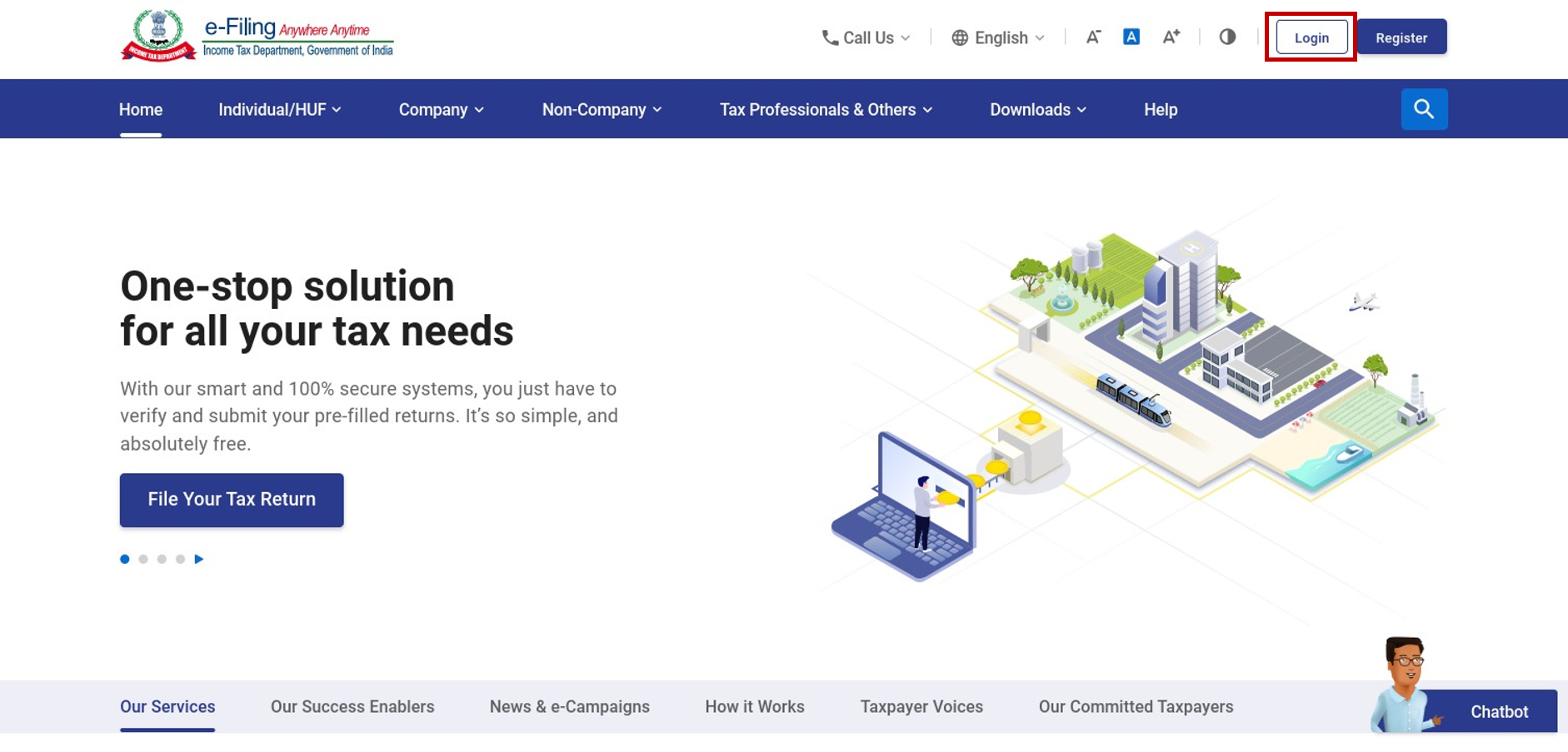

Step 1: Log in to the e-Filing portal using your user ID and password.

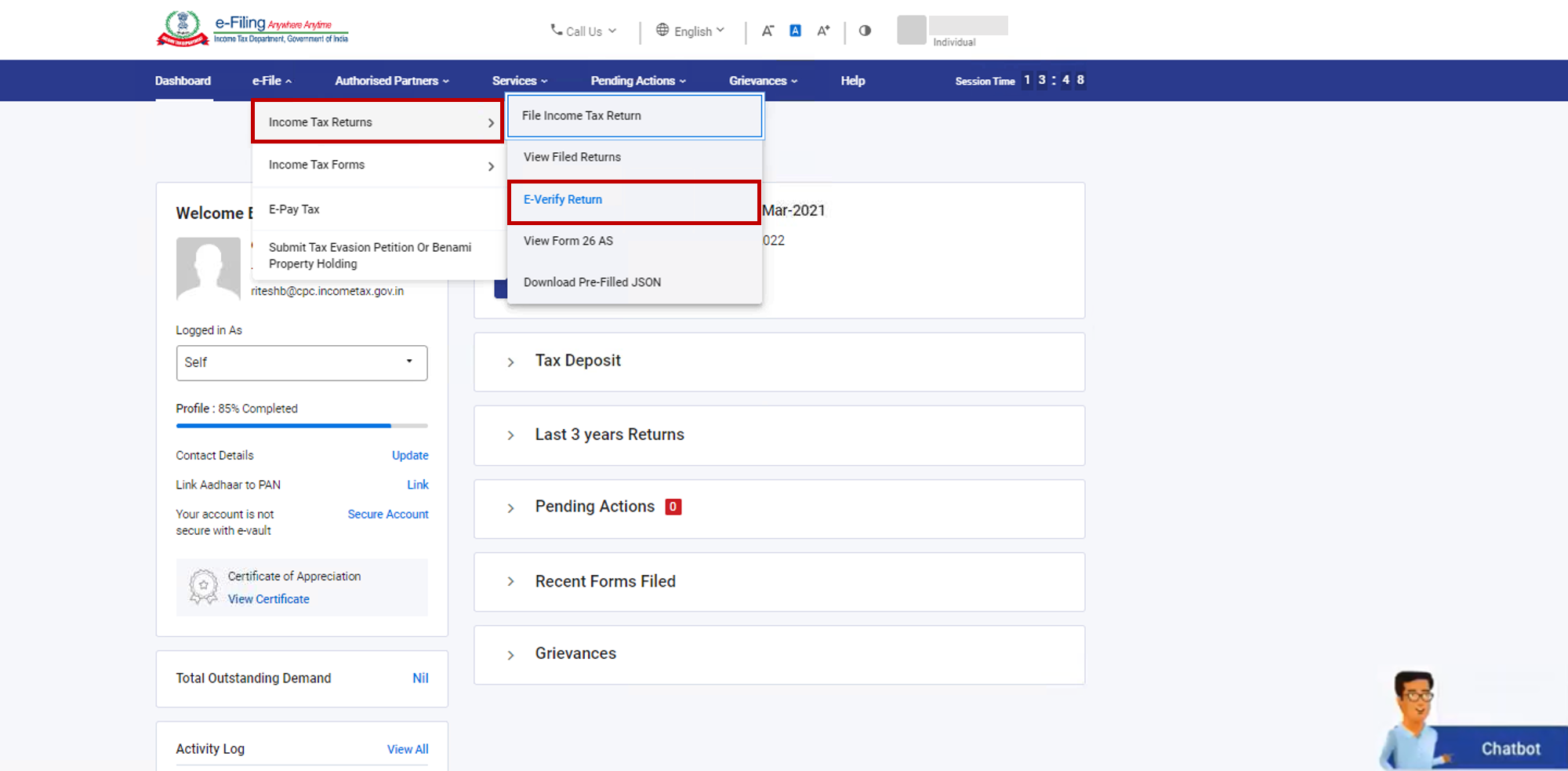

Step 2: Click e-File > Income tax return > e-Verify Return.

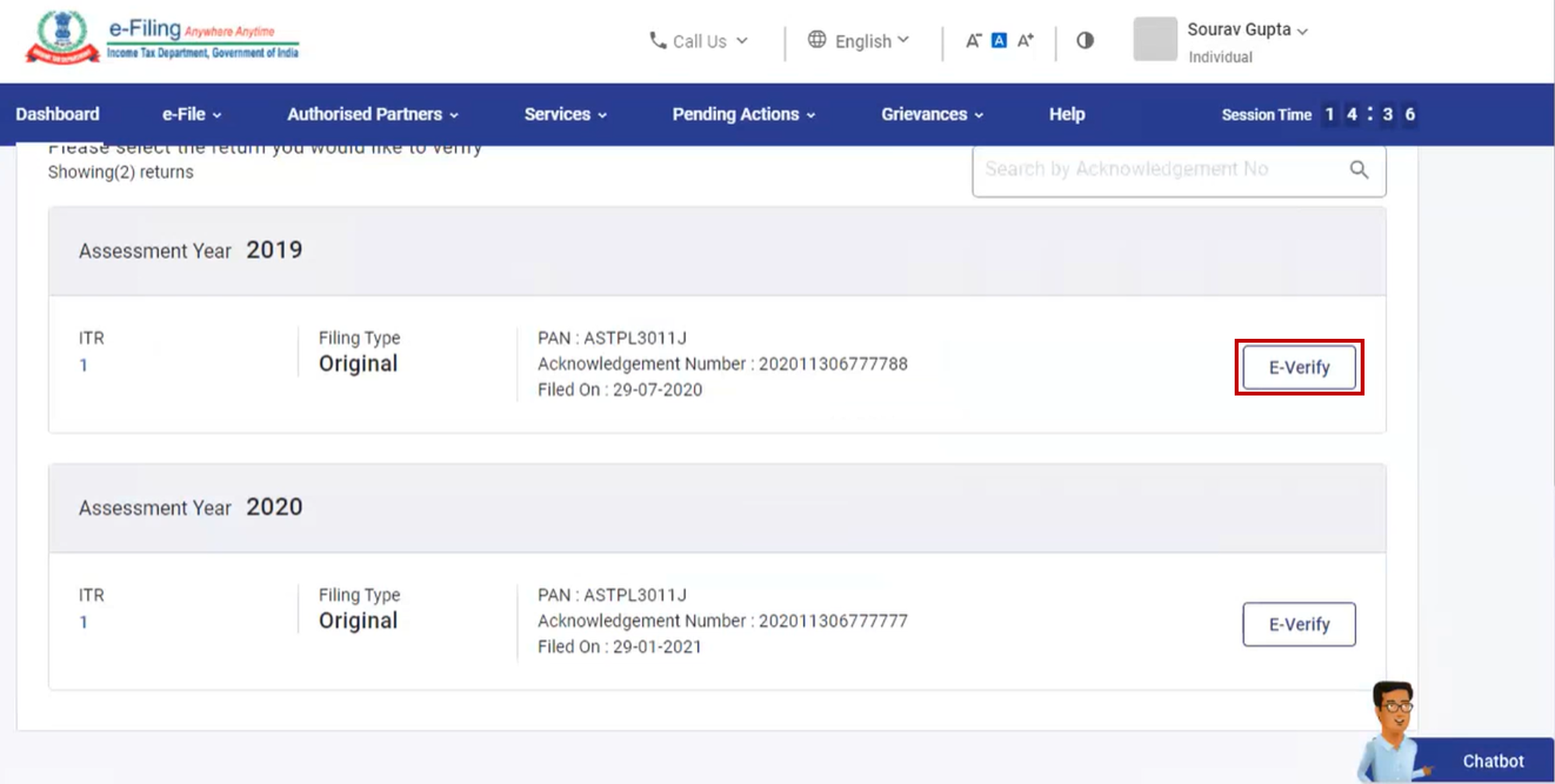

Step 3: On the e-Verify Return page, click e-Verify against the unverified return.

| If you are e-Verifying the return after 120 / 30 days of filing | Go to Step 4 (for submission of Condonation of Delay request) |

| If you are e-Verifying the return within 120 / 30 days of filing | Go to Step 6 directly |

Step 4: If you are e-Verifying the return after 120 / 30 days of filing, click Ok.

Step 5: For submitting condonation delay request, select the Reason of Delay from the dropdown and click Continue.

Note: In case you select Others from the dropdown, enter the reason for delay in the Remarks textbox and click Continue.

Step 6: Refer to the table below to proceed further:

| Mode of e-Verification (Choose any one) | Section |

| Generate Aadhaar OTP | Refer to Section 3.2 |

| Existing Aadhaar OTP | Refer to Section 3.3 |

| Existing EVC | Refer to Section 3.4 |

| Generate EVC through Bank Account | Refer to Section 3.5 |

| Generate EVC through Demat Account | Refer to Section 3.6 |

| Net Banking | Refer to Section 3.7 |

| Generate EVC through Bank ATM option (offline method) | Refer to Section 3.8 |