1. Overview

The Central Board of Direct Taxes (CBDT) has issued Circular No.11/2024 dated October 1, 2024, which supersedes all previous instructions regarding condonation of delay under Section 119(2)(b) of the Income-tax Act, 1961in filing income tax returns claiming refunds or carry forward of losses. The circular provides comprehensive guidelines, empowering different authorities to accept or reject such claims based on monetary limits.

Every assessee or taxpayer is required to file their Income Tax Return within time prescribed under section 139(1)/139(4) of Income Tax Act, 1961. However, it may be possible that taxpayer for any genuine hardship or reason is not able to file Income Tax Return within specified time and might have to face heavy interest and penalties.

In such kind of situation taxpayer has two options:

1.File ITR-U u/s 139(8A), or

2. File ITR u/s 139(9A) after approval of request for condonation of delay in filing ITR.

In case of filing ITR-U the taxpayer cannot file return beyond four years from the end of relevant assessment year and also has to pay i.e. 25%/ 50%/ 60%/70% additional tax as per section 139(8A). However, in case of a genuine hardship, taxpayer can file a Condonation Request under section 119(2)(b).

If condonation request is accepted by the competent Income Tax Authority, then there is no need to pay any additional tax, interest or penalty.

Therefore, condonation of delay in ITR filing is special relief provided by Income TaxDepartment under section 119(2)(b).

In this User Manual we will discuss the step by step process of Filing ITR after accepting Condonation request by Income Tax Authority and also discuss some FAQs related to same.

2. Prerequisites for availing this service

- Valid User ID and Password

- PCIT order with unique number ordering condonation the delay (DIN of the Condonation order)

- Valid bank account details

- Form 26AS & AIS

3. Step-by-Step Guide

3.1. Filing of ITR u/s 139(9A) after condonation of delay u/s 119(2B)

Filing of ITR u/s 139 (9A) for the relevant Assessment years for which PCIT has condoned the delay. (Kindly note that in ITR u/s 139(9A)can be filed using offline utility only, the option of online filing is not available)

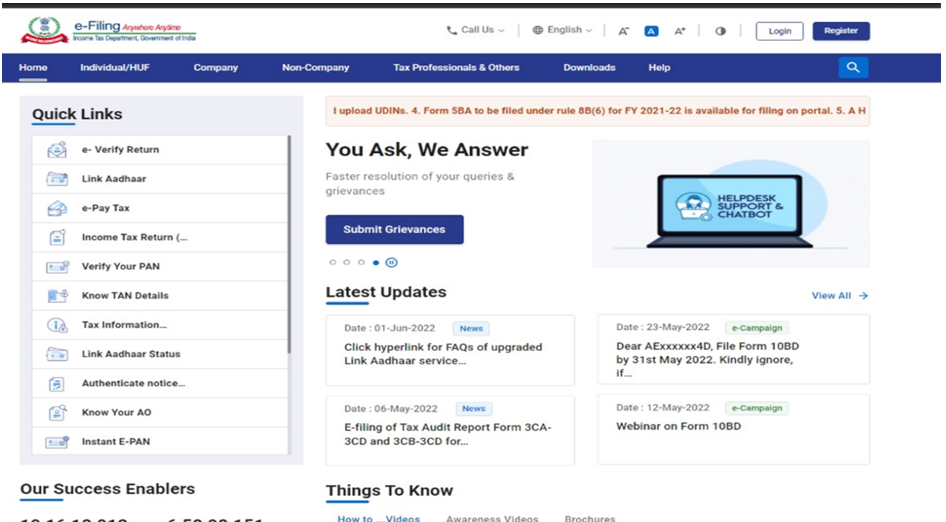

Step 1: Go to the e-Filing portal homepage.

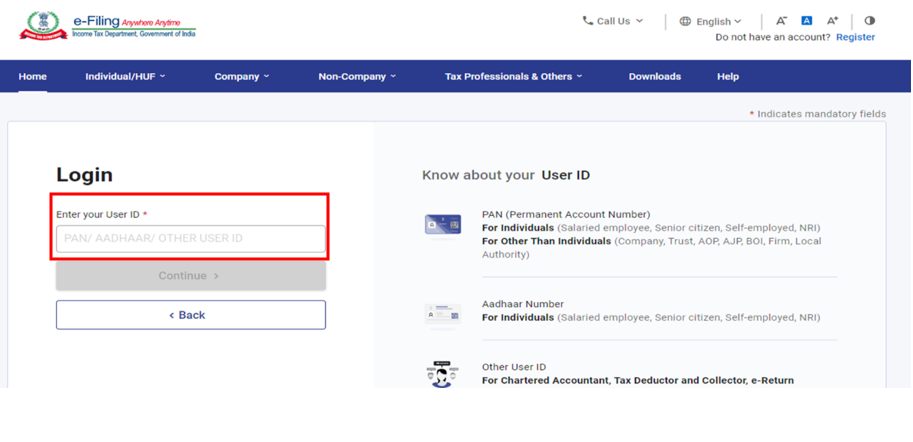

Step 2: Enter the User ID and Password.

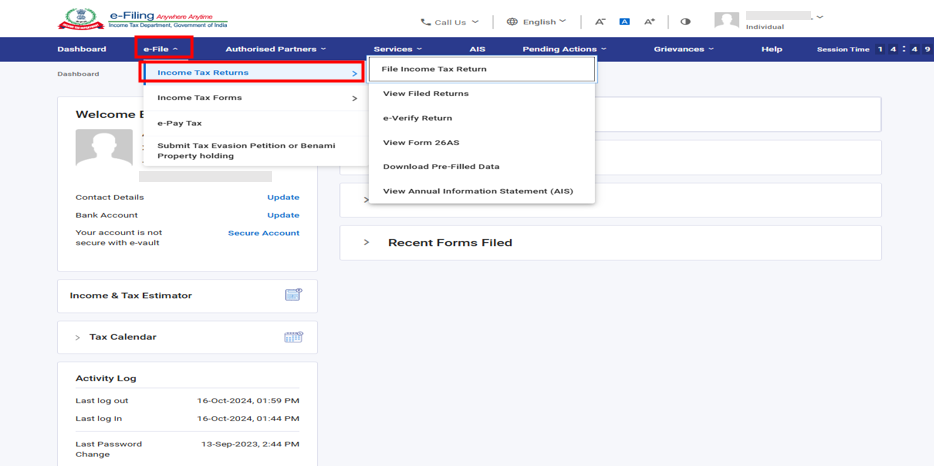

Step 3: Go to the “e-file” tab and select “Income Tax Returns”.

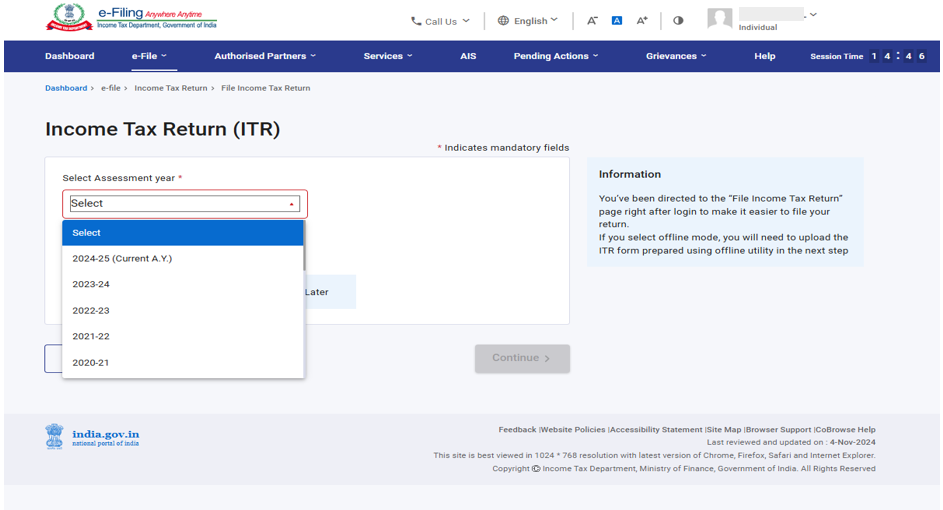

Step 4: Select the assessment year for which you have to file the return.

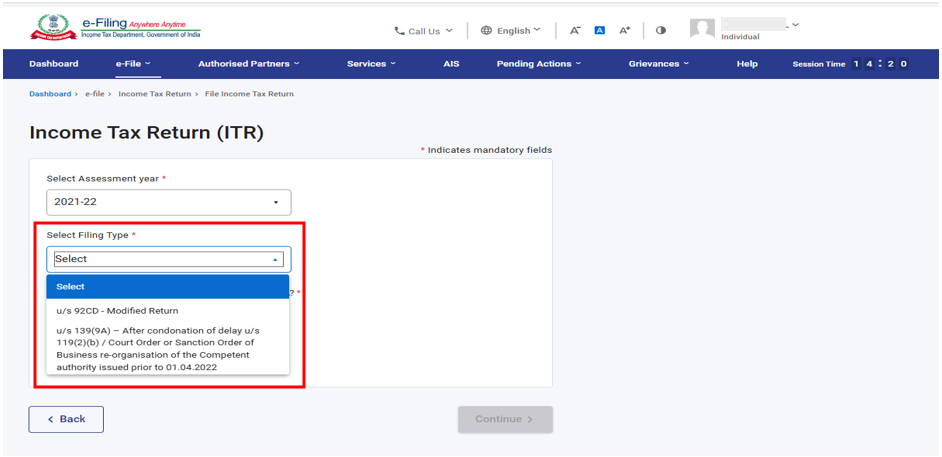

Step 5: choose the filing type “u/s 139(9A)- After Condonation of delay u/s 119(2)(b)”

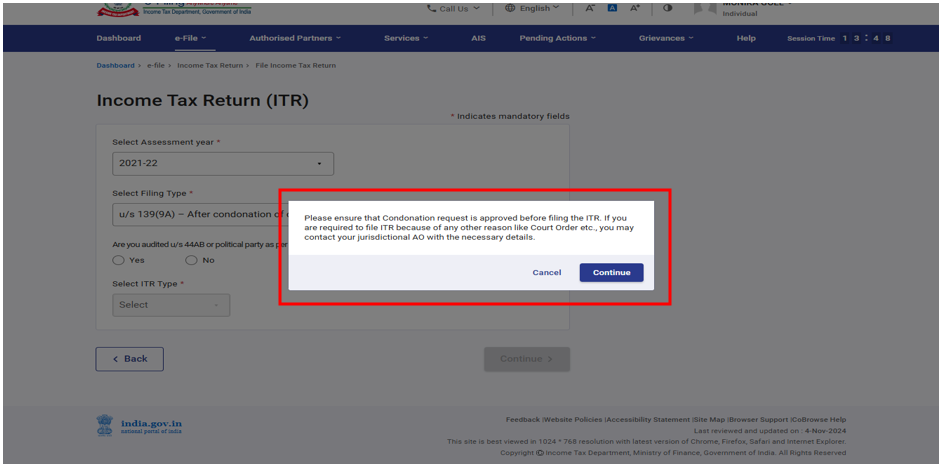

Step 6: Please ensure that the condonation request is approved before filing ITR and click continue.

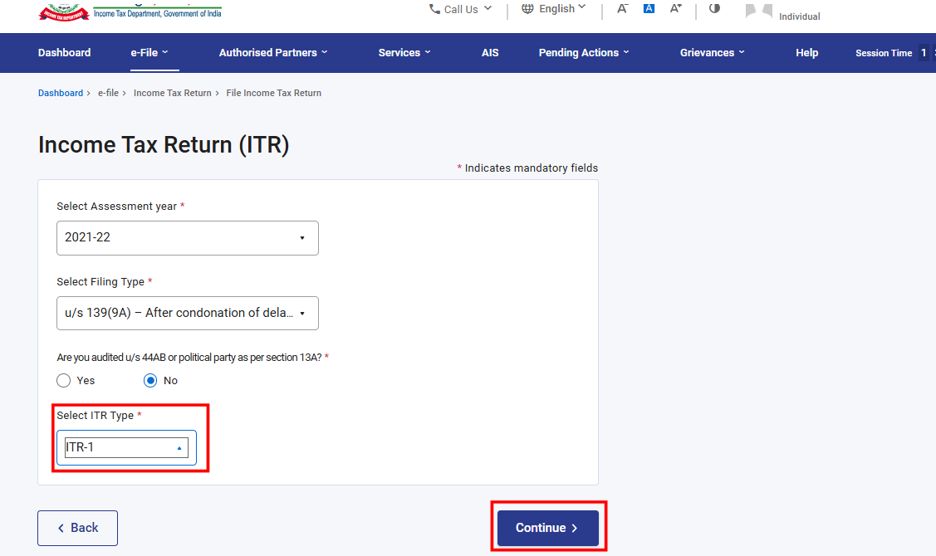

Step 7: Select ITR Type and click Continue.

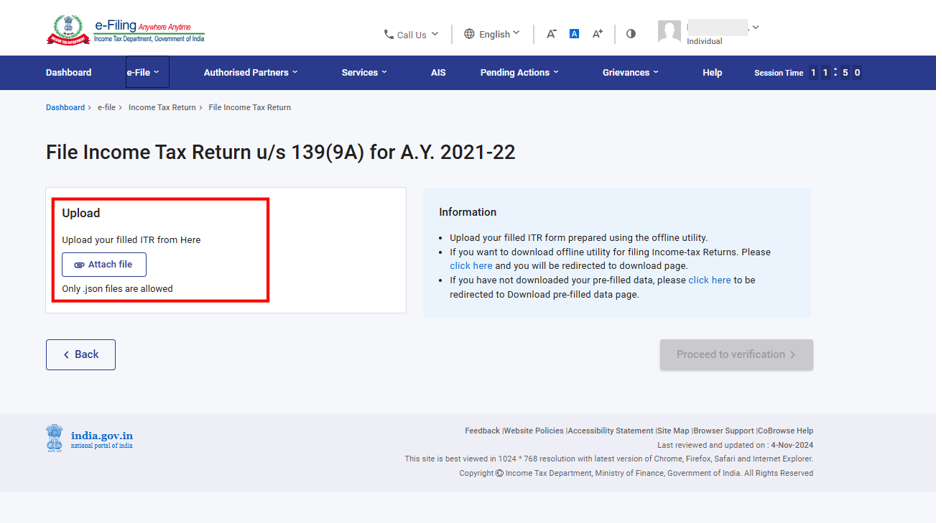

Step 8: Upload JSON prepared as per steps at section no. 4 and file your return by verifying it. You shall get a success message. Keep a note of transaction ID for future reference.

(For How to prepare ITR in offline utility and generate the JSON, follow section no. 4)

4. How to Prepare the ITR in Utility and generate the JSON file

Step 1: Go to Home Page of e-filing portal.

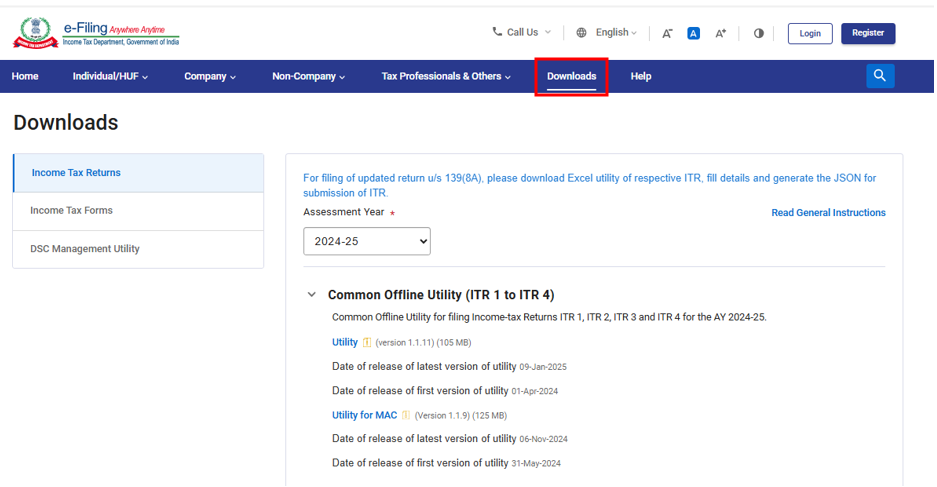

Step 2: click on Downloads on Home Page.

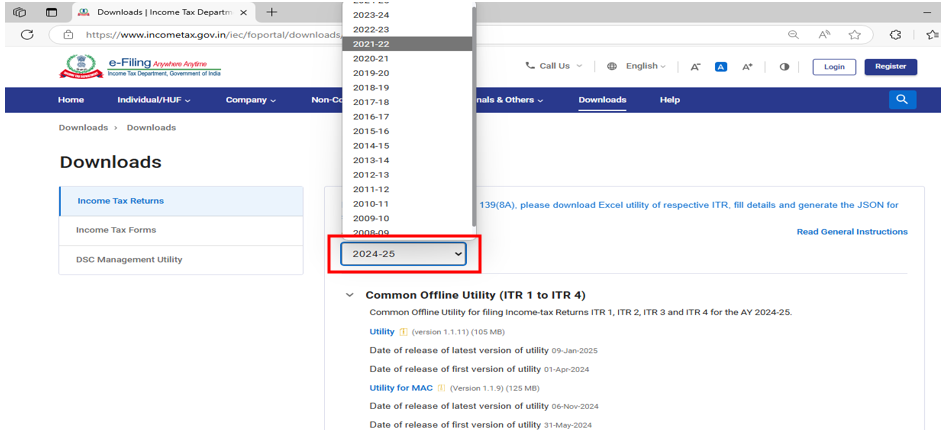

Step 3: In Income Tax return category, select the relevant AY for which you are going to file the ITR.

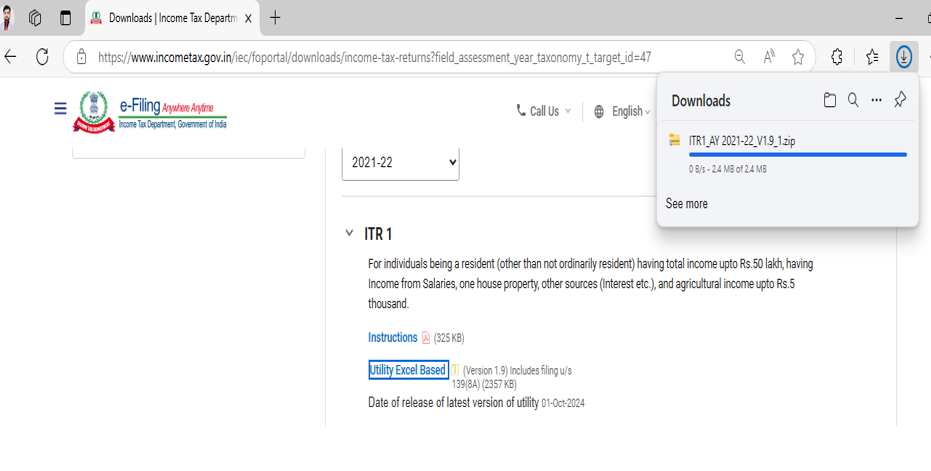

Step 4: Now Download the Install the excel utility in your System.

Step 5: Prepare the Excel utility.

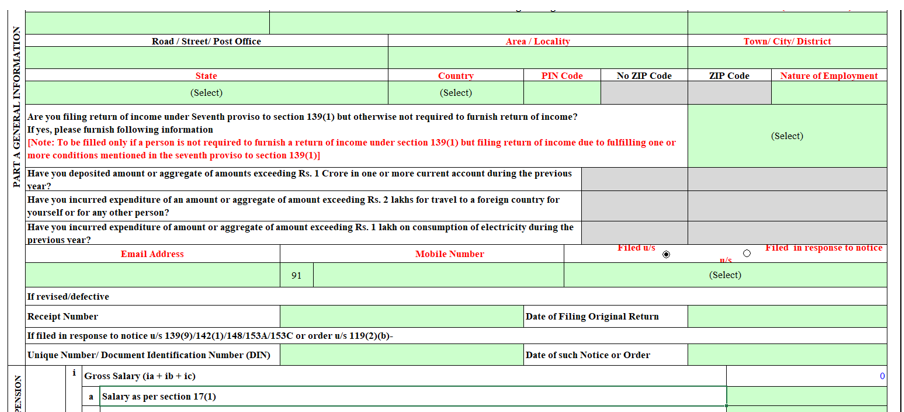

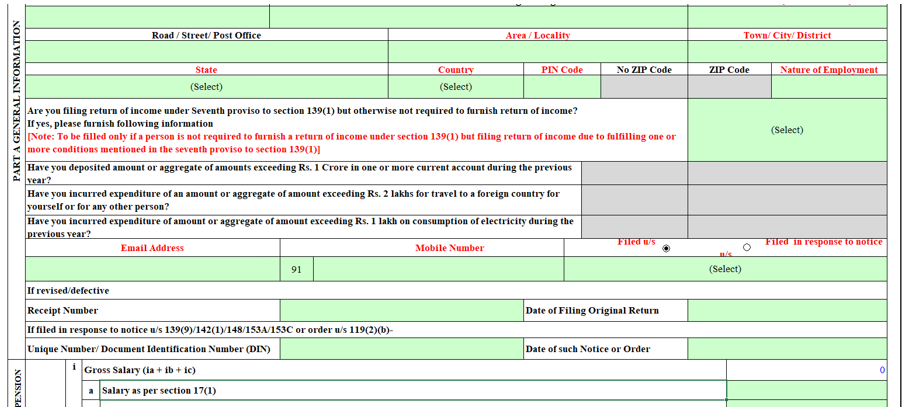

Step 6: In Filing Information mention the Unique Number/ Document Identification Number and Date of Order of Condonation Order.

Step 7: Prepare the ITR in the Utility and create the JSON.

5. Related Topics

Glossary

|

Acronym/ Abbreviation |

Description/Full Form |

|

AO |

Assessing Officer |

|

AY |

Assessment Year |

|

CA |

Chartered Accountant |

|

CPC |

Centralized Processing Centre |

|

EVC |

Electronic Verification Code |