1. Overview

The Rectification Status service is available to all registered users of e-Filing portal to view the status and details of the rectification requests submitted by them. It enables the registered users to view the rectification details according to the request type submitted. The registered user can view the details of the following types of requests submitted:

- Reprocess the return

- Tax Credit Mismatch correction

- Additional information for 234C Interest

- Status correction (Applicable for ITR 5 and ITR 7 only till AY 2018 – 2019)

- Exemption section correction (Applicable for ITR 7 only till AY 2018 – 19)

- Return Data Correction (offline) XML upload

- Return Data Correction (online)

- Order for which rectification is submitted but does not have DIN mentioned

- Order for which rectification is submitted with DIN mentioned

2. Prerequisites to Avail This Service

- Registered user on the e-Filing portal with valid user ID and password

- Rectification Request submitted online through the e-Filing portal

3. Step-by-Step Guide

Step 1: Log in to the e-Filing portal using your user ID and password.

Step 2: On your Dashboard, click Services > Rectification Request > Rectification Status.

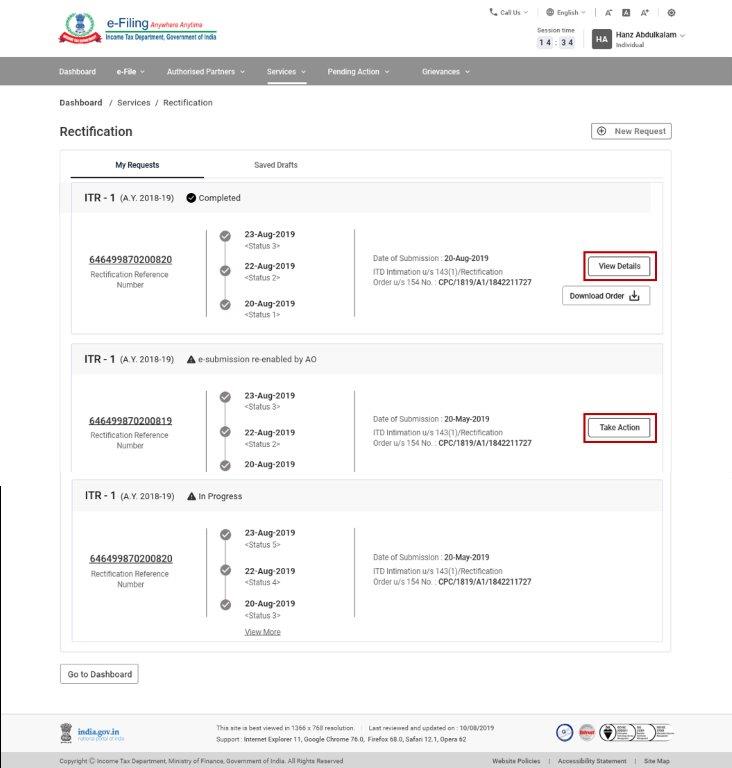

Step 3: On the Rectification Status page, click Rectification Reference Number to view the rectification details based on the Request Type (Income Tax Rectification or Wealth Tax Rectification) submitted by you.

Step 4: You can select Take Action or View Details against the Rectification Reference Number.

Note:

- In case you select Take Action - You will be taken to the e-Proceedings page for submission of responses to all notices, communications and orders.

- In case you select View Details - Rectification request status will be displayed as - Submitted / Completed / Rejected / In progress/ Condonation of Delay Request Accepted/ e-submission re-enabled by AO.