The new and intuitive official website of Income Tax Department which deals with e-Filing of returns/forms and other related functionalities.

Quick Links

Our success enablers

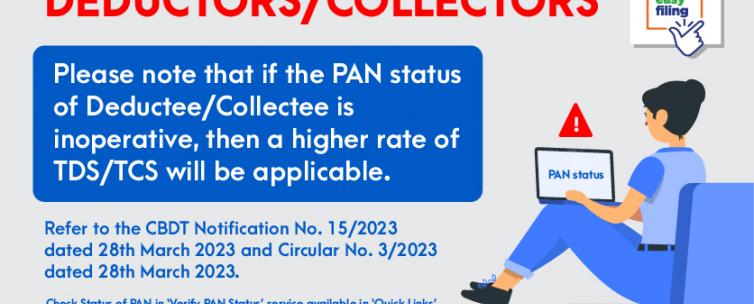

1. ITR-1, ITR-2,ITR-3, ITR-4 & ITR-6 for AY 2024-25 are enabled for filing in offline as well as Online mode at e-filing portal ! Excel Utilities of ITR-1, ITR-2, ITR-3,ITR-4 and ITR-6 for AY 2024-25 are also live now !! 2. ATTENTION! CBDT vide Circular No. 7/2024 has extended the due date for filing of Form 10A & 10AB to 30.06.2024 for the category of applicants as mentioned in the circular. Refer to latest updates for more details. 3. Attention Deductors/Collectors!! Deductee having PAN status as 'Inoperative' attracts higher TDS/TCS rates. However, for the transactions entered into upto 31.03.2024 with inoperative PANs, deductors/ collectors shall have no liability to deduct TDS/TCS at higher rate if PAN becomes operative on or before 31.05.2024. Refer Latest Updates. 4. New Forms 1 (Aircraft Leasing business), 10-IEA, 1 {Dividend exempt u/s 10(34B)} , 3AF, 1 (Ship Leasing Business), 10-IFA has been enabled on portal. Refer Latest Updates for details. 5. According to the RBI Notification, in the case of non-individuals, a Legal Entity Identifier (LEI) No. is required for Credit of Refunds exceeding Rs. 50 crore. For hassle-free refund processing, please submit LEI details in Login->Dashboard->Services->LEI.