1. Over 2.7 crore ITRs have been filed as on 14 July 2024, which is 13% more compared to returns filed during the same period last year. The number of ITRs filed per day has crossed 13 Lakhs on 13 July and is increasing everyday as the due date of 31st July 2024 is approaching. While the milestone of filing of 1 crore of ITRs for AY 2024-25 arrived on 23rd June 2024, the 2 crore milestone arrived on 7th July which is also earlier than last year.

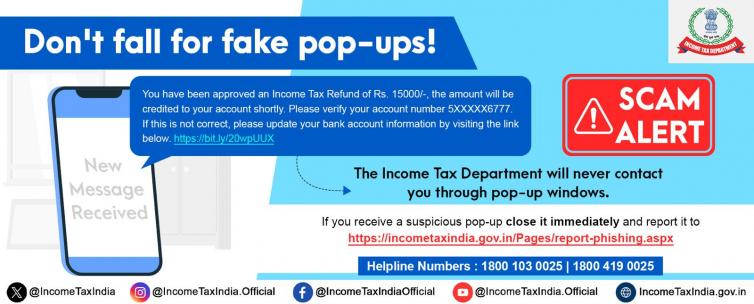

Taxpayers facing any technical problem related to filing may reach out to our tollfree helpdesk numbers (1800 103 0025 or 1800 419 0025) or Efilingwebmanager@incometax.gov.in .

2. Attention Taxpayer !! Please compare the tax liability under the New Tax and Old Tax regime before filing of the return. For more details please refer 'Latest Updates'!

3. ITR-1, ITR-2,ITR-3, ITR-4, ITR-5, ITR-6 & ITR-7 for AY 2024-25 are enabled for filing in offline as well as Online mode at e-filing portal ! Excel Utilities of ITR-1, ITR-2, ITR-3,ITR-4, ITR 5, ITR-6 and ITR-7 for AY 2024-25 are also live now !!

4. For best results, please use Edge, Chrome, or Firefox browsers.

5. According to the RBI Notification, in the case of non-individuals, a Legal Entity Identifier (LEI) No. is required for Credit of Refunds exceeding Rs. 50 crore. For hassle-free refund processing, please submit LEI details in Login->Dashboard->Services->LEI.

6.New Forms 1 (Aircraft Leasing business), 10-IEA, 1 {Dividend exempt u/s 10(34B)} , 3AF, 1 (Ship Leasing Business), 10-IFA has been enabled on portal. Refer Latest Updates for details.

7. e-Pay Tax service is now enabled for Bandhan Bank. Please refer Latest Update for list of banks available for tax payment.

8. Attention Deductors/Collectors!! Deductee/collectee having PAN status as 'Inoperative' attracts higher TDS/TCS rates. For more details please refer Latest Updates.