Authorise Another Person to Act on Behalf of Self (Add Authorised Signatory)

1. Overview

This service is available to all the registered users of the e-Filing portal. This service enables registered users of the e-Filing portal who are not able to verify their ITRs / Forms / Service Requests owing to absence from the country or being a non-resident, or for any other reason, to authorize another person to verify ITRs / Forms / Service Requests. The service also allows users to register as Representative Assessees and register themselves to act on behalf of another person.

2. Prerequisites for availing this service

-

Valid User ID and Password

-

PAN is linked with Aadhaar number

3. Process/Step-by-Step Guide

3.1 Register to Act on Behalf of Another Person

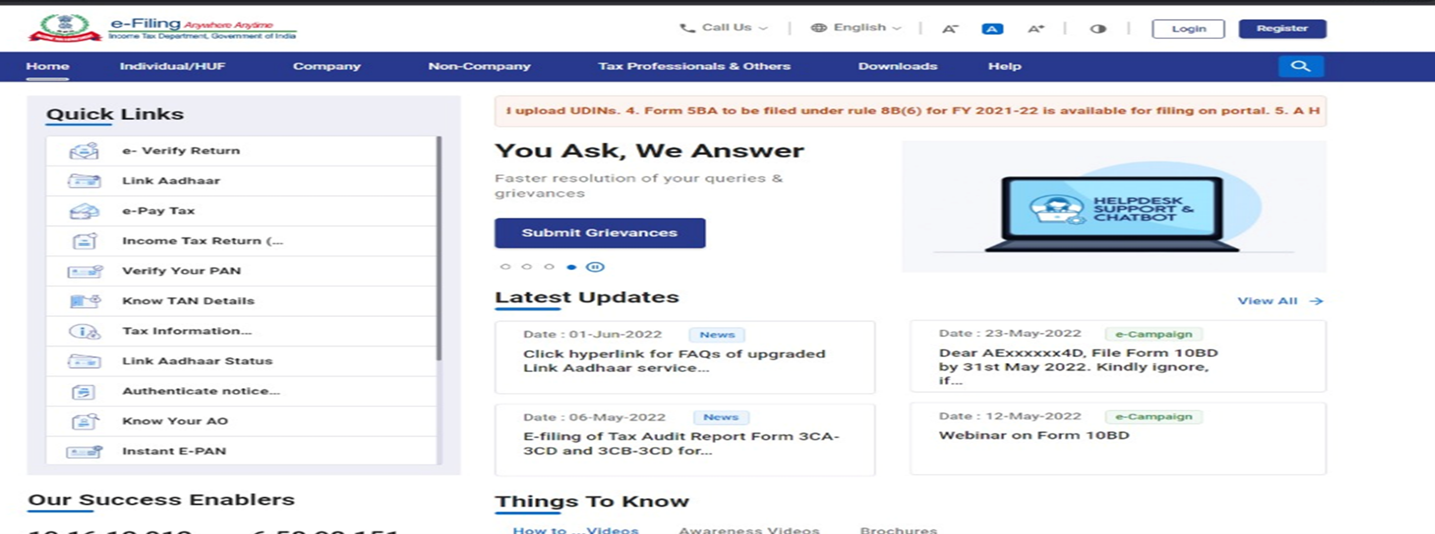

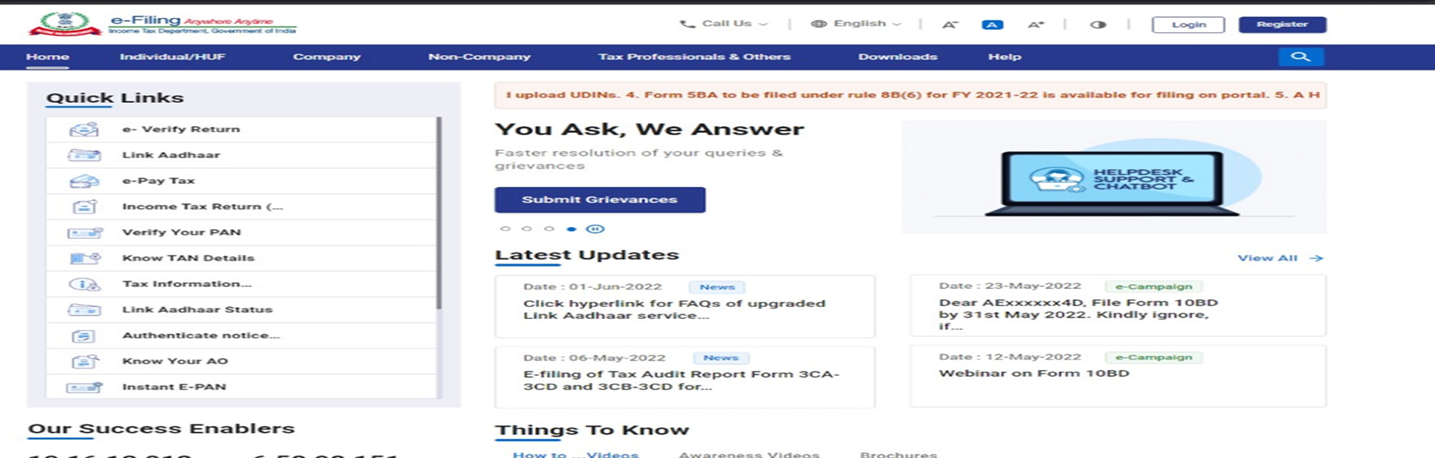

Step 1: Go to the e-Filing portal homepage.

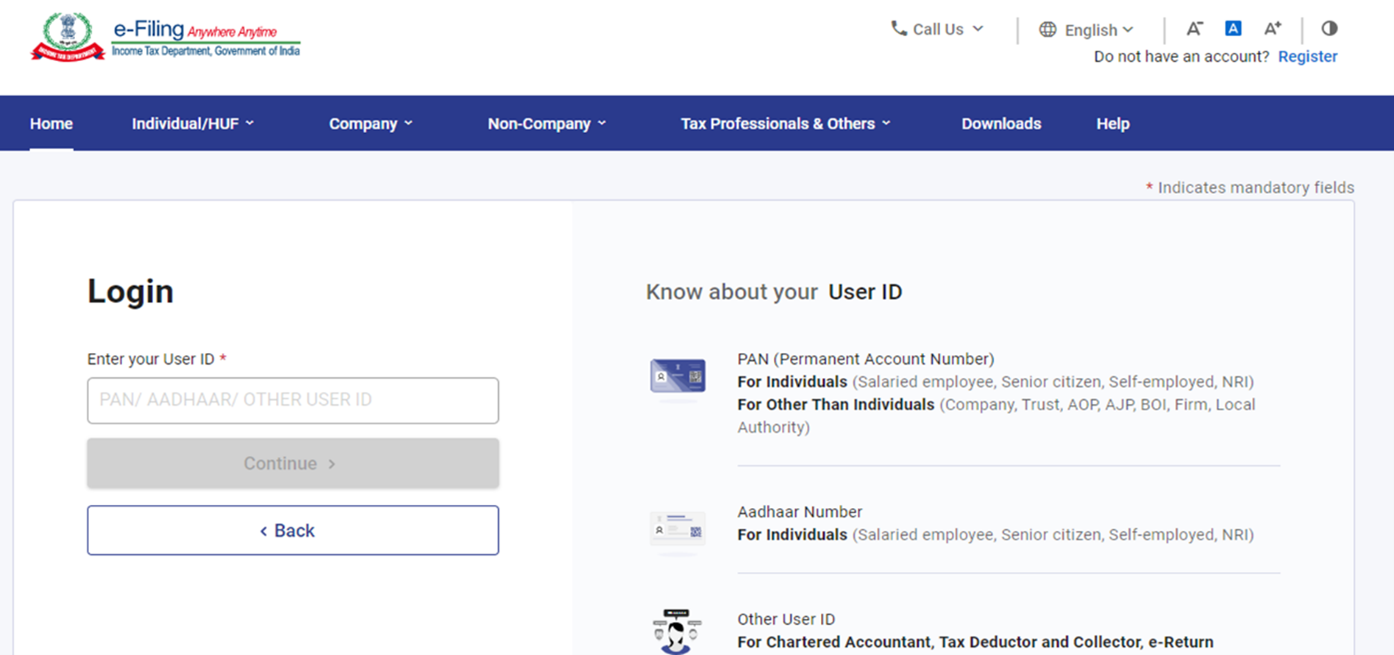

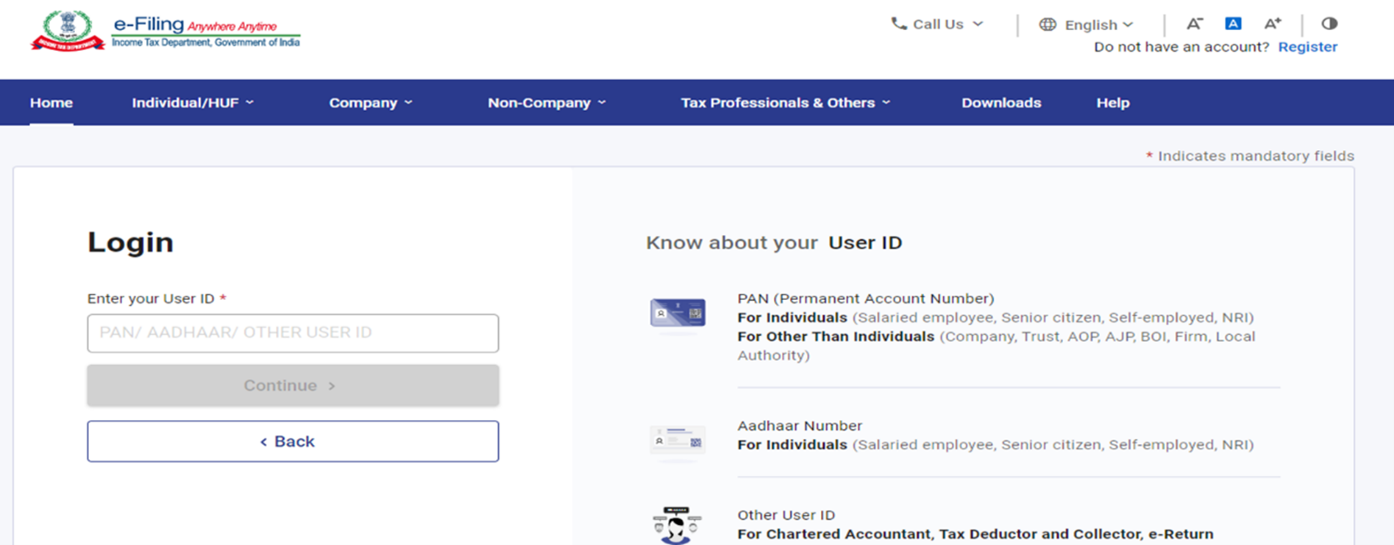

Step 2: Enter the User ID and Password.

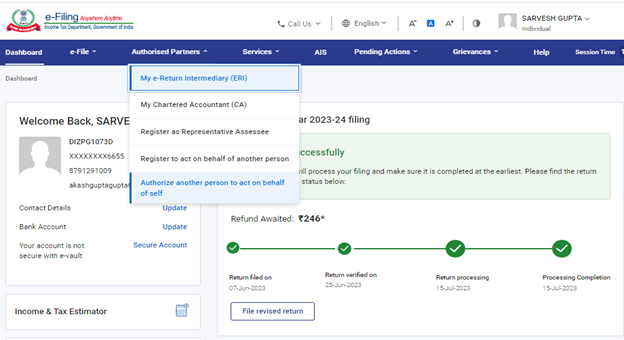

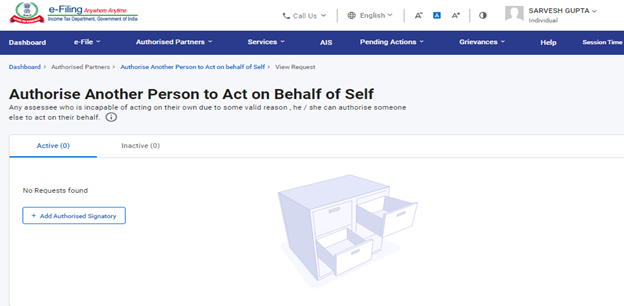

Step 3: Go to Authorised Partners click on Authorise Another Person to Act on behalf of Self

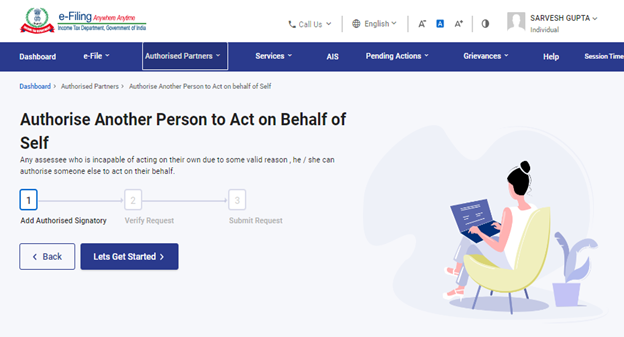

Step 4: Click on Let’s Get Started

Step 5: Click on + Add Authorised Signatory

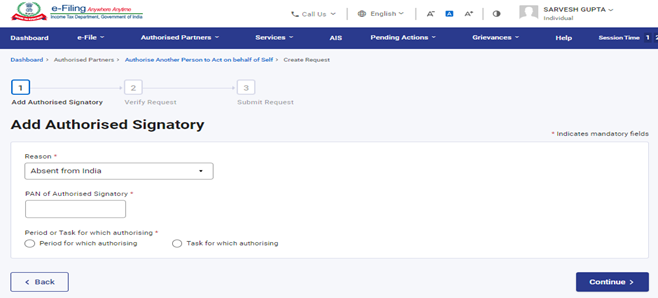

Step 6: Select the Reason to Add Authorised Signatory, Enter the PAN of Authorised Signatory and Select the Period (Start date -to- End date) or Task for which Authorising.

Note:

For below tasks Authorised Signatory can be added:

- Submission and verification of Return of Income

- Verification of Return of Income

- Submission of Form

- Submission of Service Request

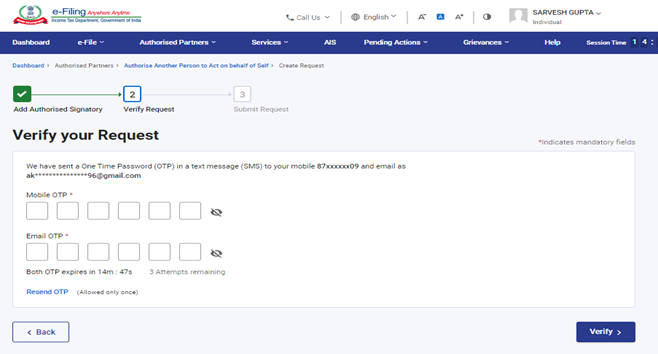

Step 7: Now enter the 6-digit OTP received on e-Filing registered Mobile no. and email id to verify the request

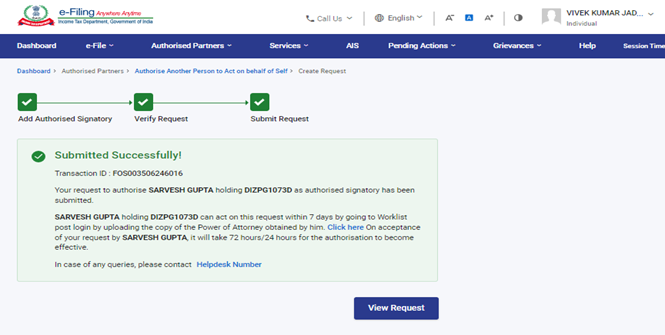

Step 8: Request has been submitted successfully now the Authorised Signatory will accept the request within 7 days. will be processed by Income Tax Department within 7 days.

Click on view request to view the request.

3.2 Acceptence of request by Authorised Signatory:

Step 1: Go to the e-Filing portal homepage.

Step 2: Enter the User ID and Password.

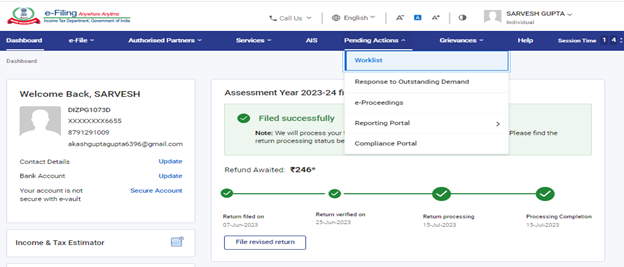

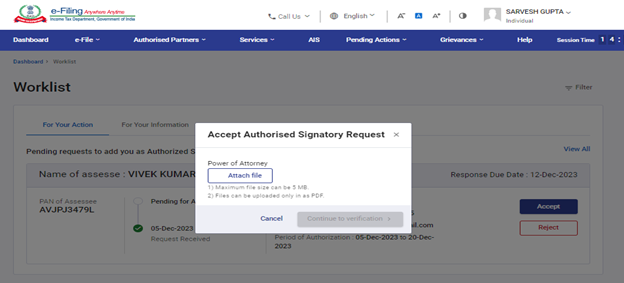

Step 3: Go to Pending Actions click on Worklist

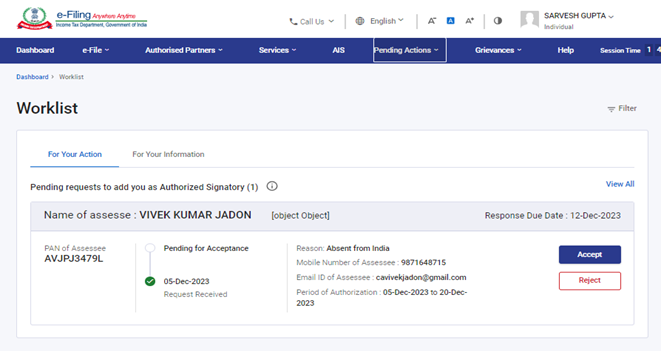

Step 4: Worklist will open where you can see request raised by Assessee to Add Authorised Signatory. Click Accept to accept the request.

Step 5: Now attach the Power of Attorney by clicking on Attach file and click on continue to verification

Note:

1) Maximum file size can be 5 MB.

2) Files can be uploaded only in as PDF.

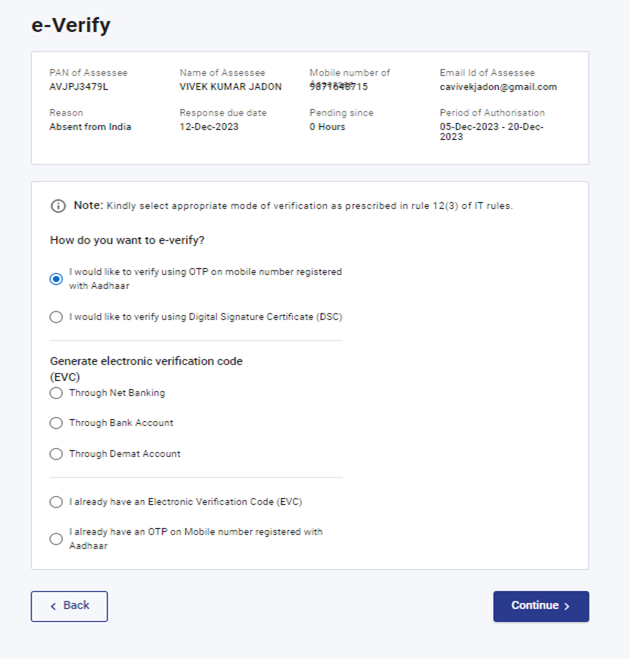

Step 6: Now verify the request through below modes of verification:

After Verification Income tax department will process the request and will take 24 to 72 hours for the authentication to become effective.

Related Topics

- Login

- PAN Aadhaar link

- Dashboard

- Income Tax Return

- File ITR

- Home Page

- How to e-Verify

Glossary

|

Acronym/ Abbreviation |

Description/Full Form |

|

AO |

Assessing Officer |

|

AY |

Assessment Year |

|

AOP |

Association of Persons |

|

BOI |

Body of Individuals |

|

CA |

Chartered Accountant |

|

CPC |

Centralized Processing Centre |

|

ERI |

e-Return Intermediary |

|

LA |

Local Authority |

|

TDS |

Tax Deducted at Source |

|

EXTA |

External Agency |

|

ITDREIN |

Income Tax Department Reporting Entity Identification Number |

|

HUF |

Hindu Undivided Family |

|

EVC |

Electronic Verification Code |

|

DSC |

Digital Signature Certificate |

|

ITD |

Income Tax Department |

|

ITR |

Income tax return |