1.Overview

New functionality has been enabled on e-Filing portal where taxpayer can make Demand Payment as Regular Assessment Tax under Minor Head 400 through Post and Pre-login without providing Demand Reference Number.

2. Prerequisites for availing this service

Pre-login

- Valid and active PAN; and

- Valid Mobile Number to receive One Time Password.

Post-login

• Registered user on the e-Filing portal

3. About the Form

3.1. Purpose

Taxpayer can make Demand Payment as Regular Assessment Tax (400) without Demand Reference Number via pre-login (before logging into e-Filing portal) or post-login (after logging into e-Filing portal) facility.

3.2. Who can use it?

Taxpayer who wants to make Demand payment without Demand reference Number.

4. Step-by-step guide:

Steps to make Demand Payment as Regular Assessment Tax (400) (Post Login)

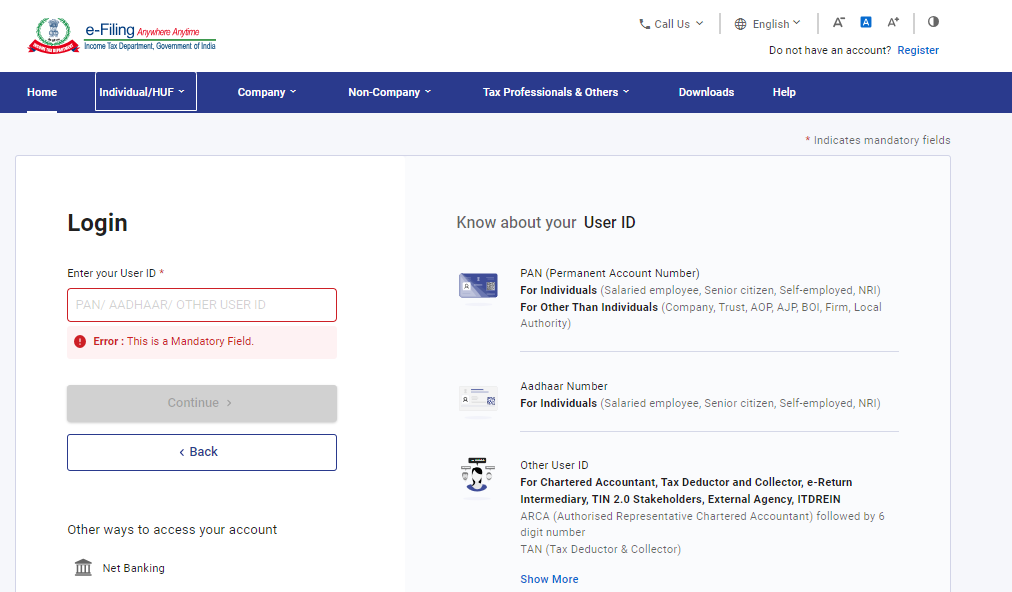

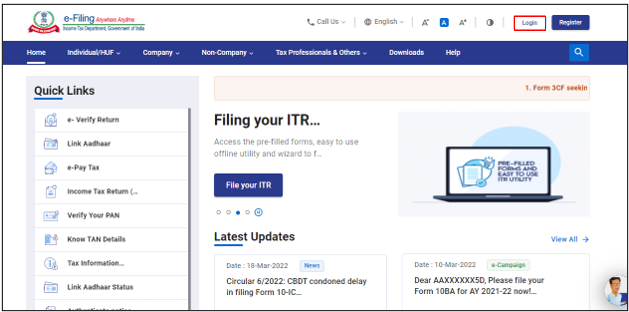

Step 1: Log in to the e-Filing portal with user ID and password.

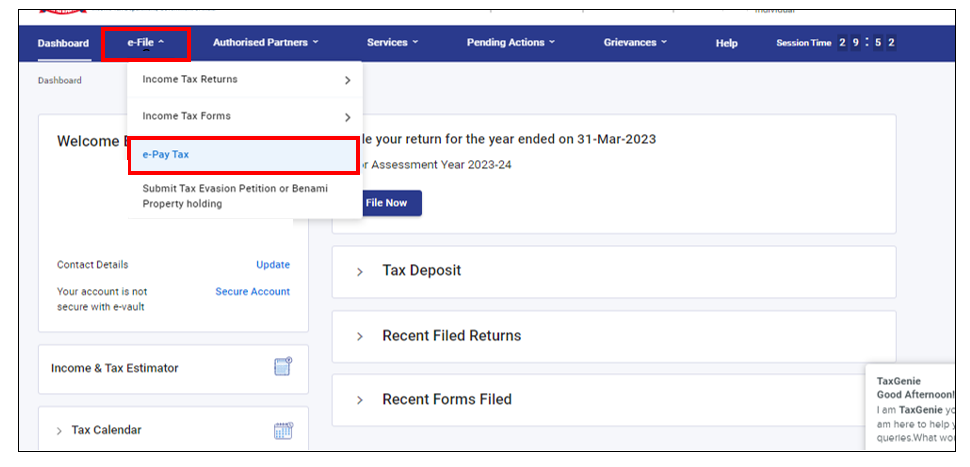

Step 2: On the Dashboard, click e-File > e-Pay Tax.

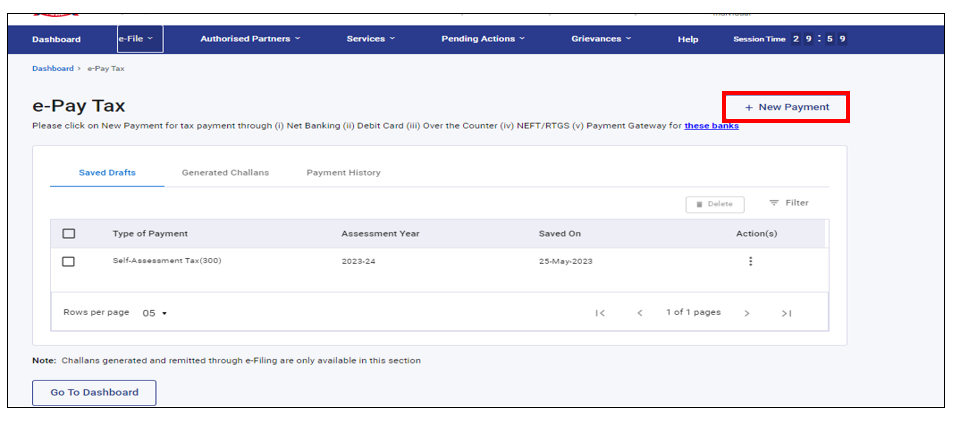

Step 3: On the e-Pay Tax page, click the New Payment option to create a new Challan Form.

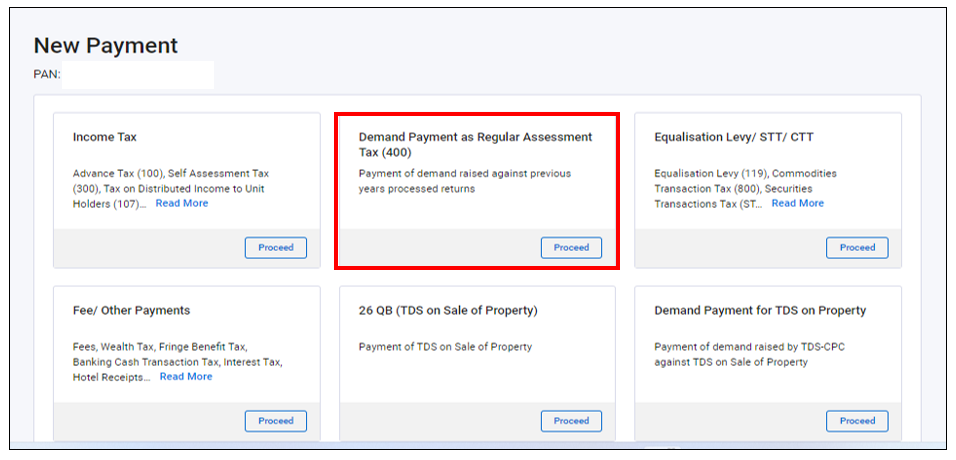

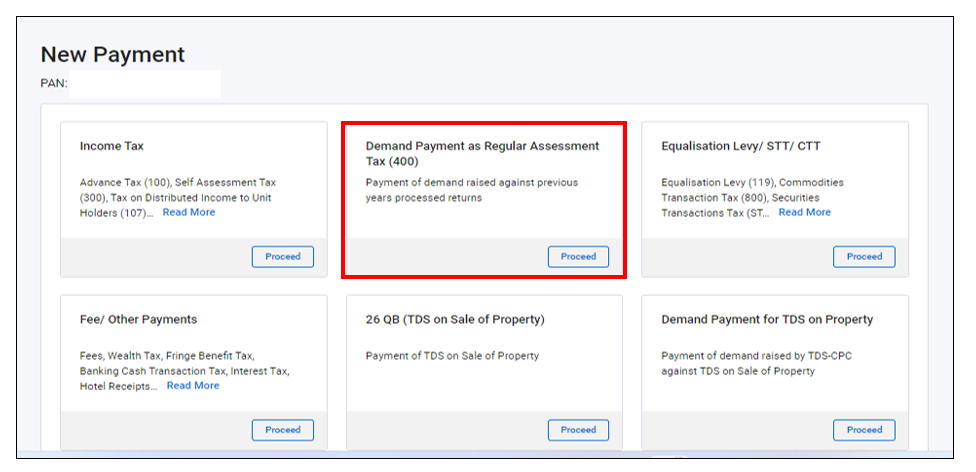

Step 4: On the New Payment page, click Proceed on the Demand Payment as Regular Assessment Tax (400) tile.

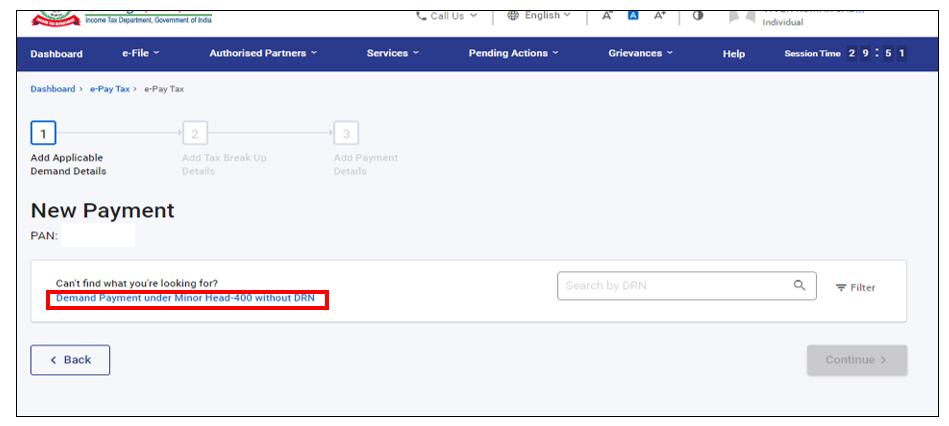

Step 5: On the Applicable Demand Details page, click Demand Payment under Minor Head-400 without DRN hyperlink.

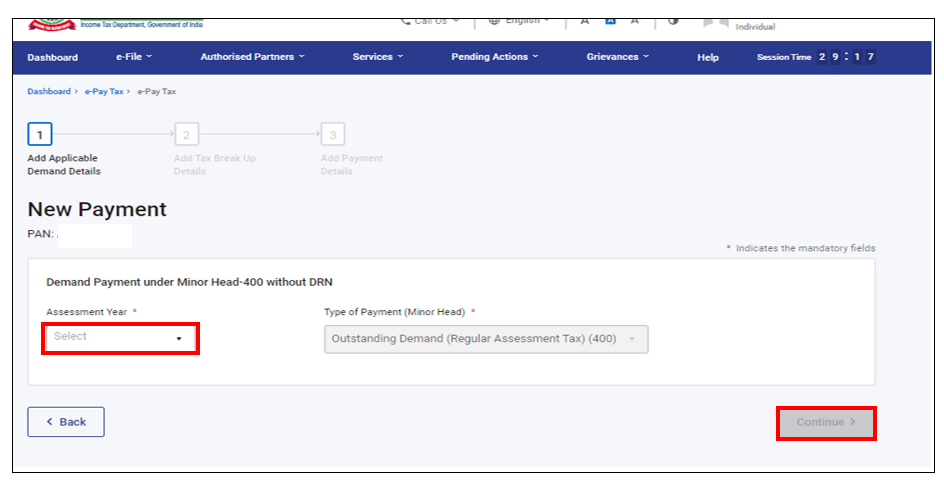

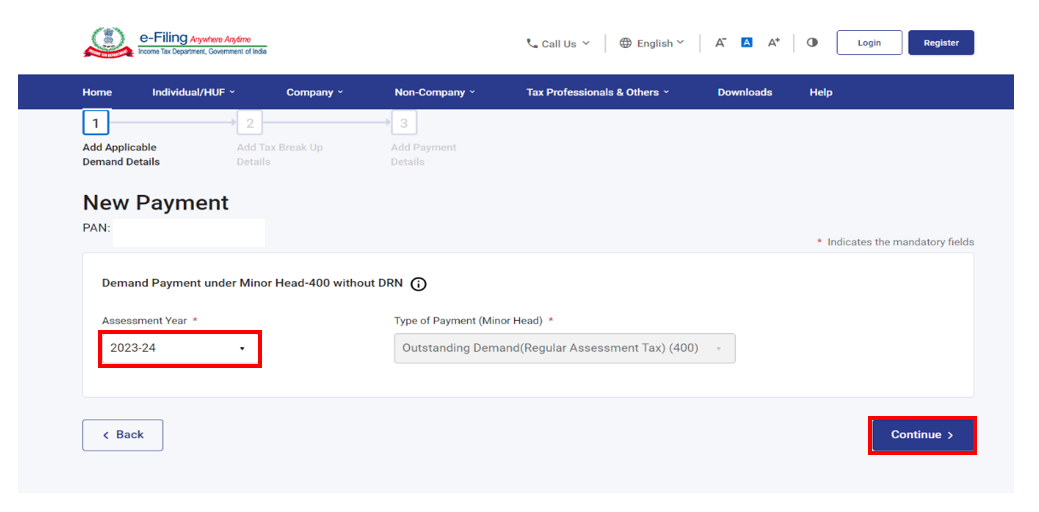

Step 6: On the next page, select the relevant Assessment Year and click on Continue button.

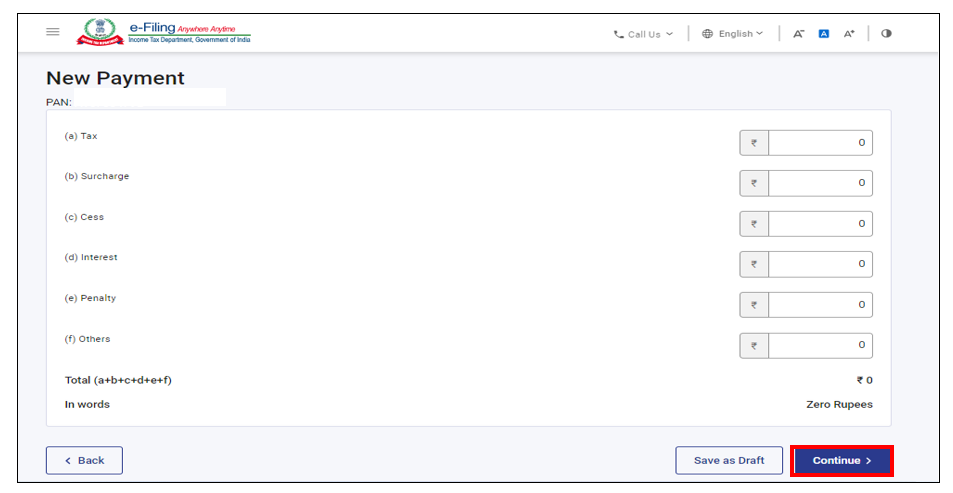

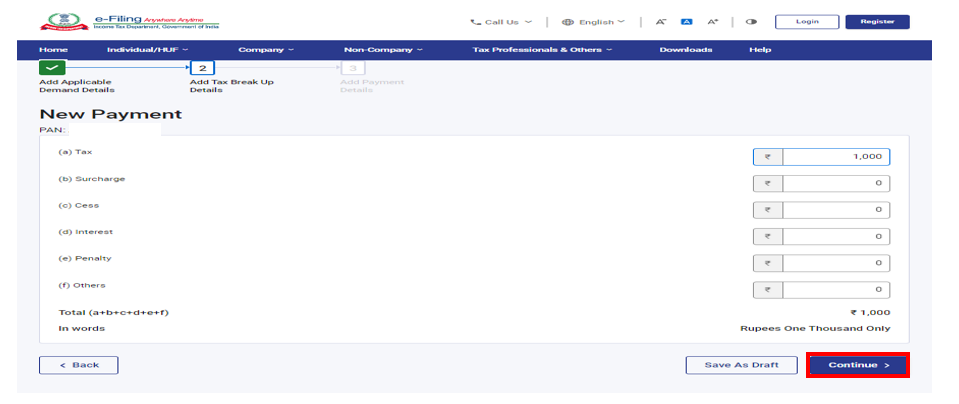

Step 7: On the Add Tax Breakup Details page, add the breakup of total amount of tax payment and click Continue.

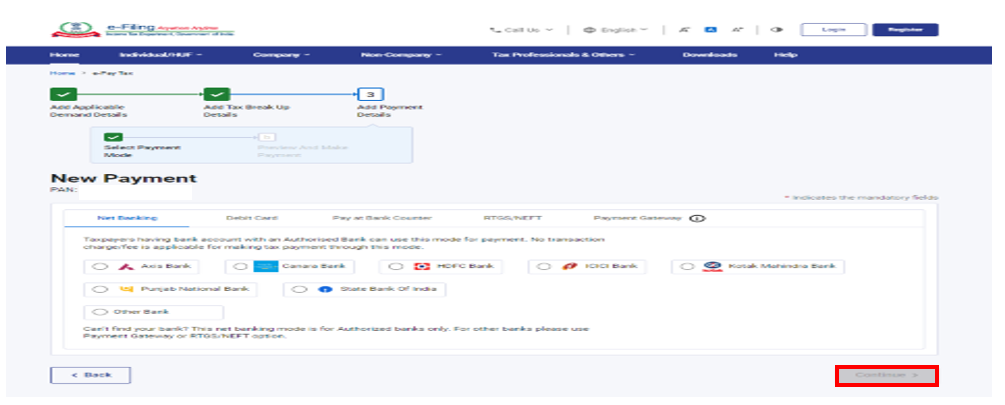

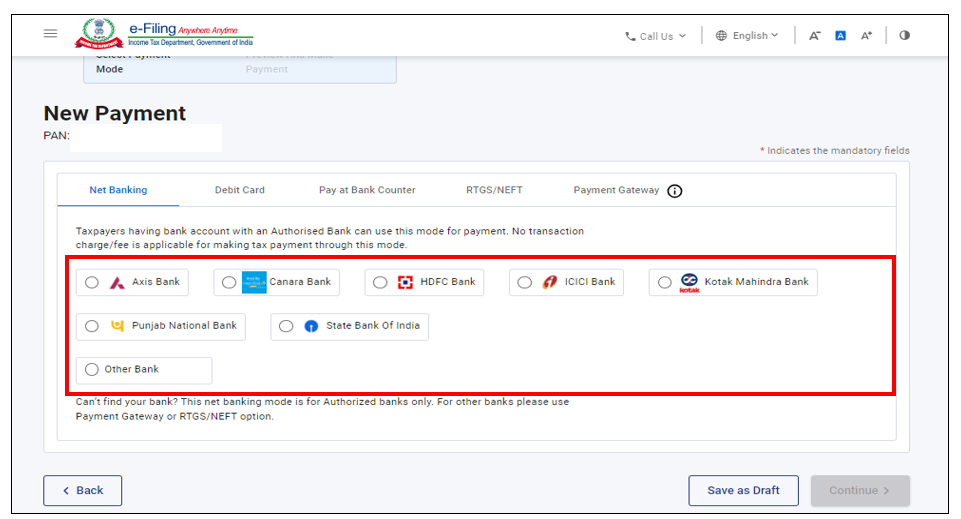

Step 8: Taxpayer is required to select the required payment mode and proceed to make the payment.

Steps to make Demand Payment as Regular Assessment Tax (400) (Pre- Login)

Step 1: Go to the e-Filing portal homepage and click e-Pay Tax.

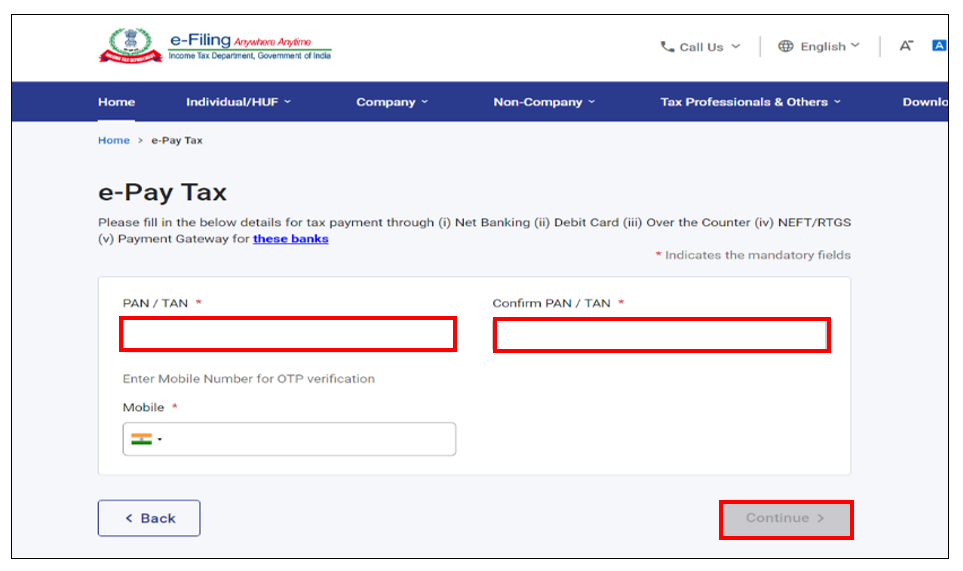

Step 02: On the e-Pay Tax page, enter PAN and enter it again in the Confirm PAN / TAN box and enter mobile number (any mobile number). Click Continue.

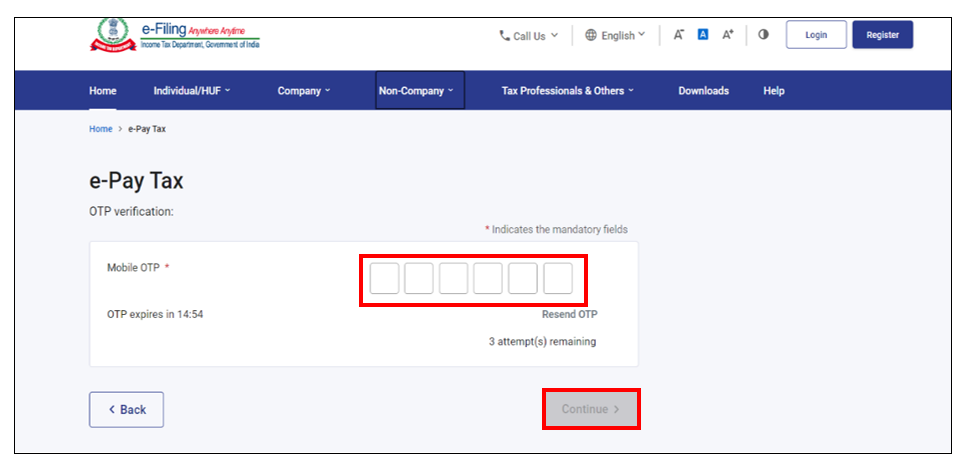

Step 3: On the OTP Verification page, enter the 6-digit OTP received on the mobile number entered in Step 2 and click Continue.

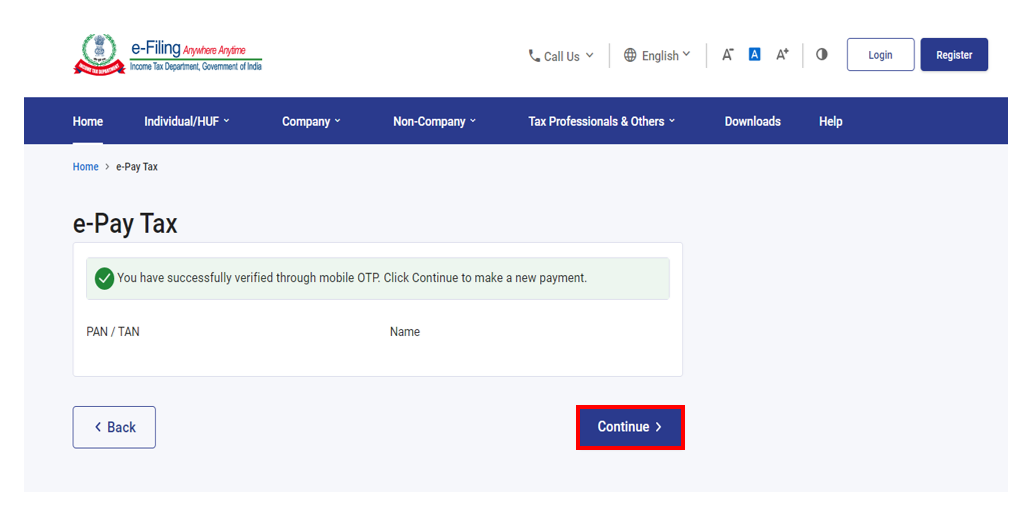

Step 4: After OTP verification, a success message with entered PAN/TAN and Name(masked) will be displayed. Click Continue to proceed.

Step 5: On the e-Pay Tax page, click Proceed on the Demand Payment as Regular Assessment Tax (400) tile.

Step 6: On the next page, taxpayer needs to select the relevant Assessment Year and click on Continue button.

Step 7: On the Add Tax Breakup Details page, add the breakup of total amount of tax payment and click Continue.

Step 8: Taxpayer is required to select the required payment mode and proceed to make the payment.