1. Overview

As per sub-section (1) of section 159 of the Income-tax Act, 1961, where a person dies, his legal representative shall be liable to pay any sum which the deceased would have been liable to pay if he had not died.

Further, as per sub-section (3) of the said section, the legal representative of the deceased shall be deemed to be an assessee. Hence, the legal representative of the deceased person is required to file the income tax return on his/her behalf for the income earned as representative assesses of the deceased person.

2. Prerequisites for availing this service

- Valid User ID and Password of Legal Heir

- PAN of deceased

- PAN is linked with Aadhaar number of deceased (Recommended)

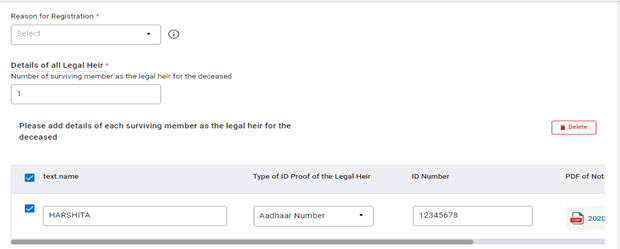

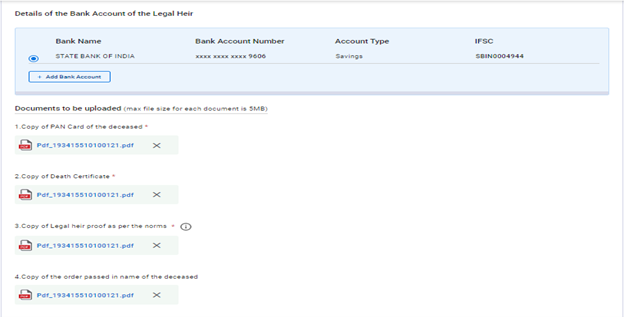

- Documents required for Legal heir registration:

- Copy of PAN Card of the deceased

- Copy of Death Certificate

- Copy of Legal heir proof as per the norms

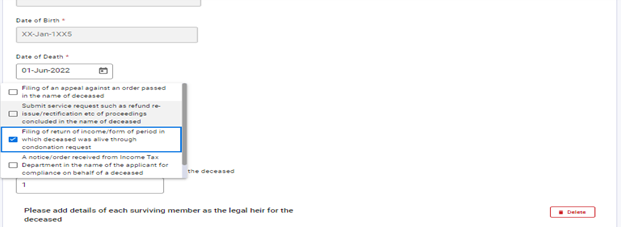

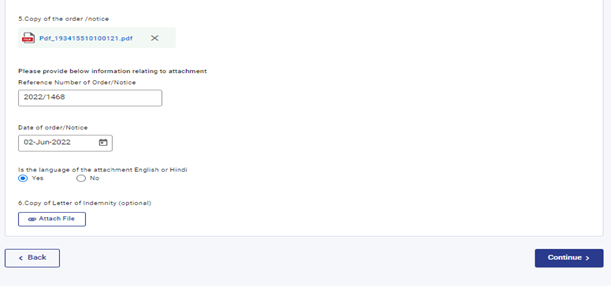

- Copy of the order passed in name of the deceased (Mandatory only if the reason for registration is ‘Filing of an appeal against an order passed in the name of deceased’).

- Copy of Letter of Indemnity (optional)

3. Process/Step-by-Step Guide

3.1 Register as Legal heir of Deceased

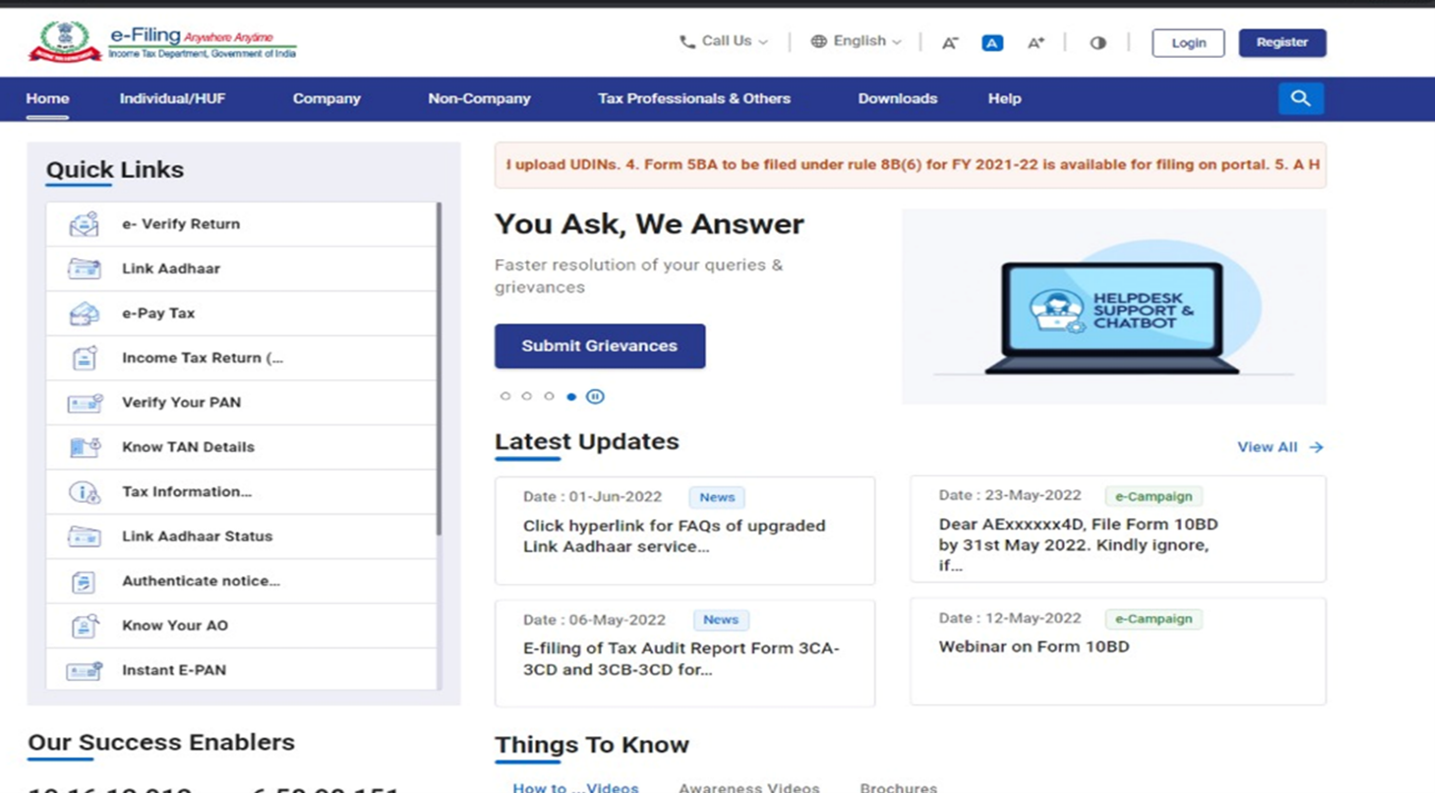

Step 1: Go to the e-Filing portal homepage.

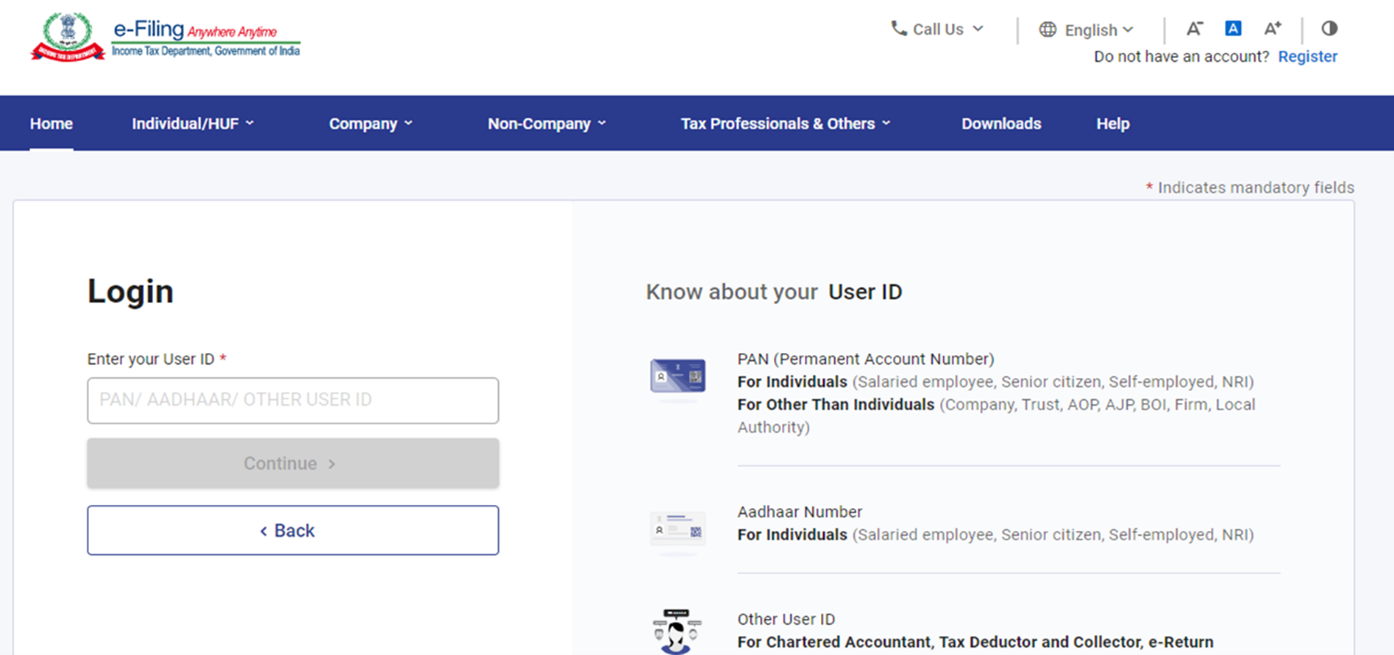

Step 2: Enter the User ID and Password of Legal Heir.

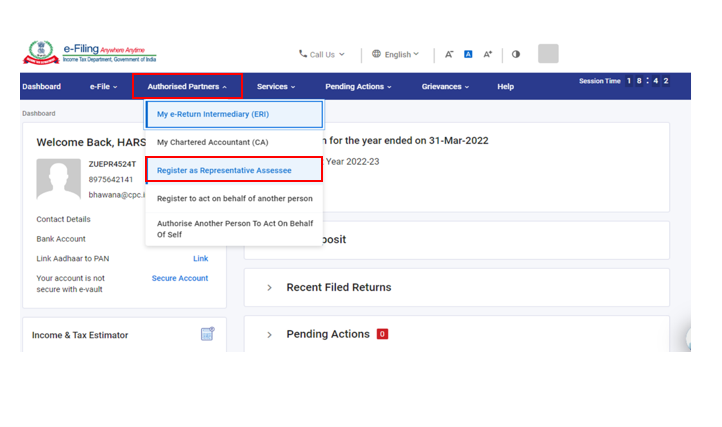

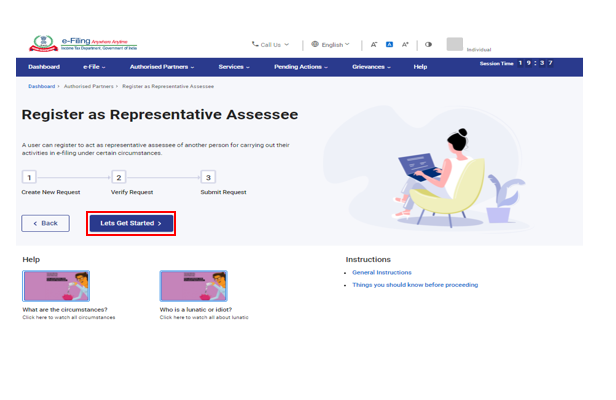

Step 3: Go to Authorised Partners and click on Register as representative assessee.

Step 4: Click on Let’s Get Started.

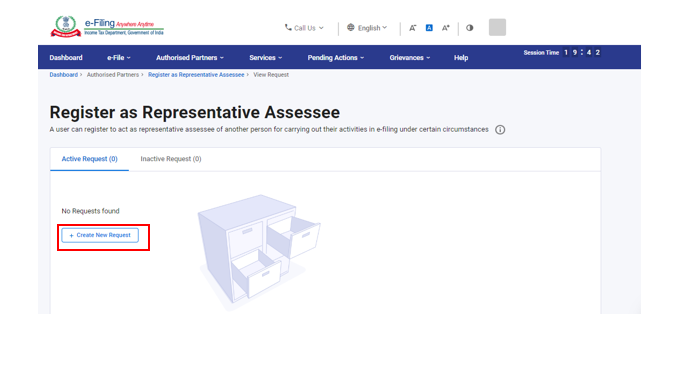

Step 5: Click on +Create New Request.

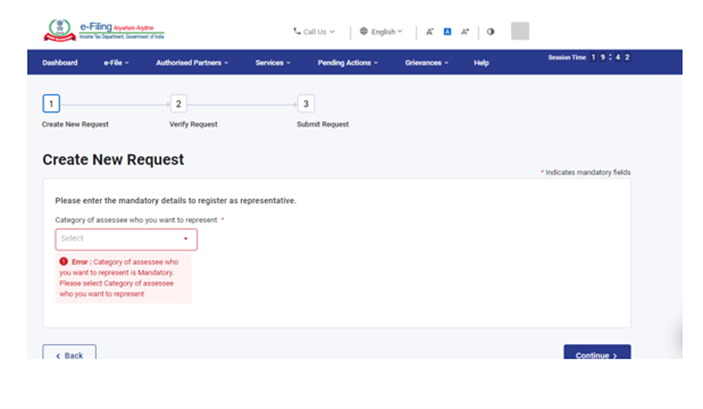

Step 6: Select the Category of assessee to whom you want to represent.

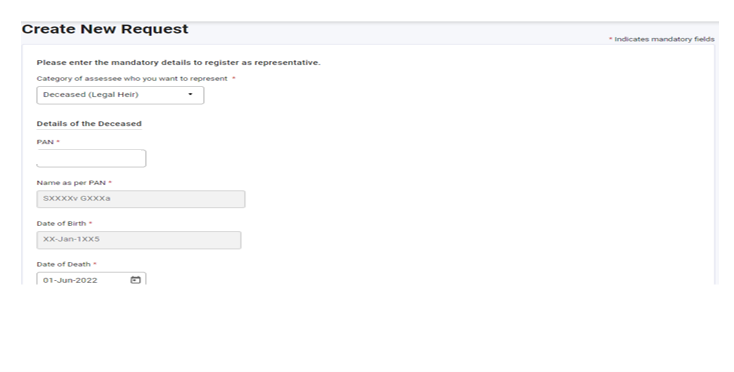

Step 7: Select the category of assessee as Deceased (legal heir), enter the mandatory details (PAN, DOB etc.) of the deceased and upload the mandatory attachments.

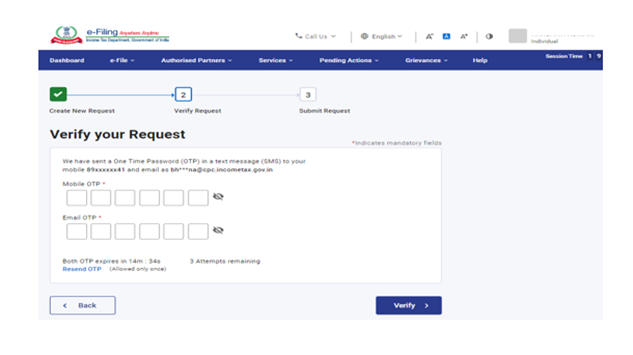

Step 8: To verify the request, enter the OTP received on your mobile no. and email ID of the legal heir registered on e-filing portal.

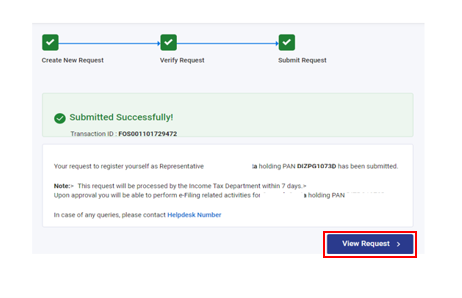

Step 9: Request has been submitted successfully will be processed by Income Tax Department within 7 days.

Click on View Request to view the request.

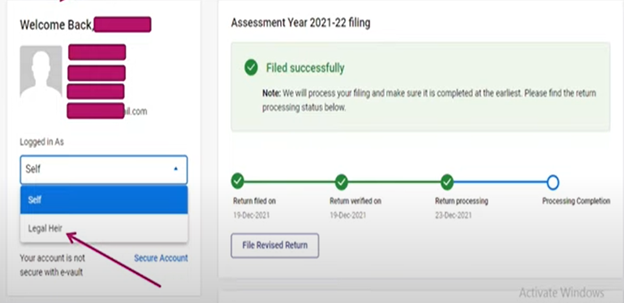

Step 10: After approval of request by Income tax department representative assessee, legal heir will be notified on email and SMS. The legal heir can login to e-filing portal with its own credentials and after login, in profile section switch to representative assessee (as legal heir).