Add Clients (by ERIs) > User Manual

1. Overview

The Add Clients service is available to all Type 1 registered ERI users in the e-Filing portal. With this service, you will be able to add registered PAN users as clients to perform certain actions on their behalf, including filing of returns and forms.

Additionally, the (Type 1) ERIs can register the taxpayers (PAN users) on the e-Filing portal while adding them as clients in case the taxpayer is not registered.

With this service, the (Type 1) ERIs will also be able to view the details of active / inactive clients on the e-Filing portal (post-login).

After adding your client successfully, you will be able to perform the following actions on behalf of your added client:

- View and File Income Tax Forms

- View Rectification Status and Submit Rectification Request

- View Tax Credit Mismatch Details

- Submit Service Request (Refund Reissue / Condonation for delay in submission of ITR-V)

- Submit Grievances and view their status

- File Income Tax Return (bulk), View Bulk Filed Return

- Download Prefilled data

- View Annual Information Statement/ 26AS (will be available later)

- View Notices (will be available later)

- Respond to Outstanding Tax Demand (will be available later)

2. Prerequisites for availing this service

- Registered ERI on the e-Filing portal with valid user ID and password

- Consent from taxpayer before adding him / her as client.

In addition to the general prerequisites, the following prerequisites are required to be ensured based on the category of taxpayers to be added as clients.

|

Description |

Pre-requisites |

|

Adding PAN users as Clients |

|

Note: While adding a non-individual taxpayer as a client, the Principal Contact of taxpayer must be registered with e-Filing.

3. Step-by-Step Guide

Step 1: Log in to the e-Filing portal using user ID and password.

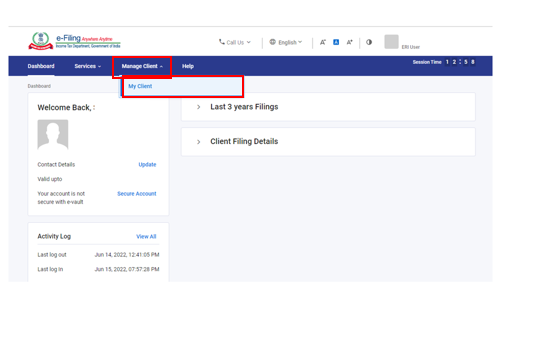

Step 2: On your Dashboard, Click Manage Client > My Client.

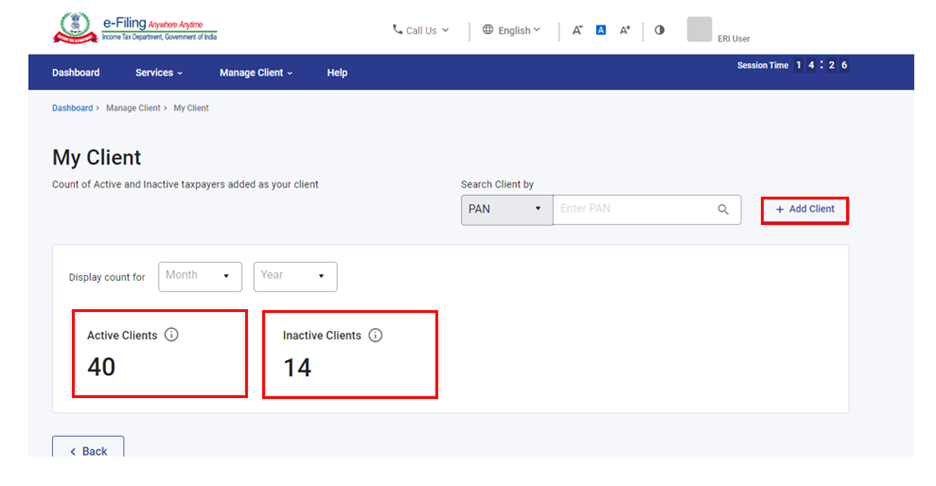

Step 3: On the My Client page, you will be able to view the count of active & inactive client details. Click Add Client to add a taxpayer as your client.

Step 4: On the Add Client page, you can:

|

Add registered taxpayers as clients |

Refer to Section 3.1 |

|

Add unregistered taxpayers as clients |

Refer to Section 3.2 |

3.1. Add registered taxpayers as clients

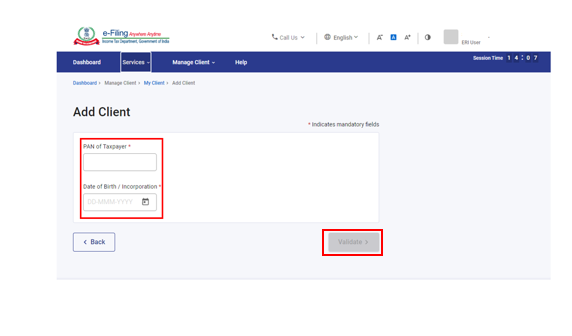

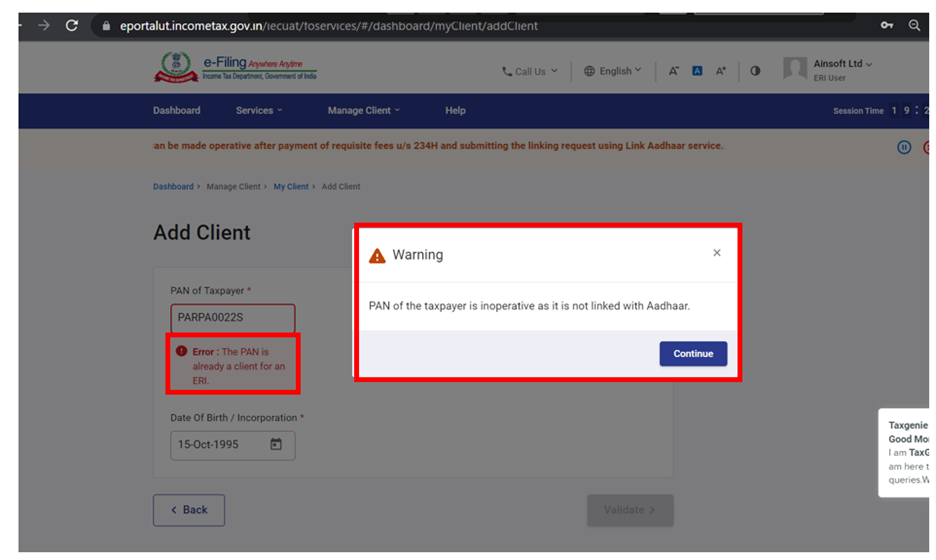

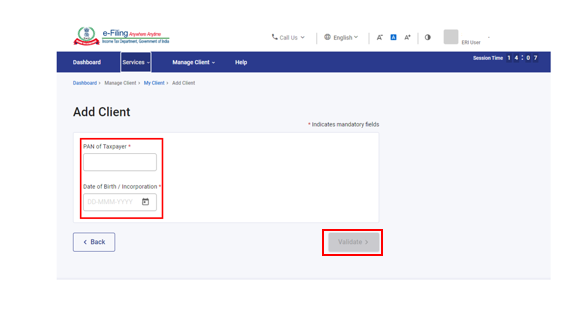

Step 1: On the Add Client page, enter the PAN of the taxpayer and select the Date of Birth / Date of Incorporation. Click Validate.

Note: If PAN of the client is inoperative, you will see a warning message in pop-up while entering the PAN and DOB that PAN of the taxpayer is inoperative as it is not linked with Aadhaar.

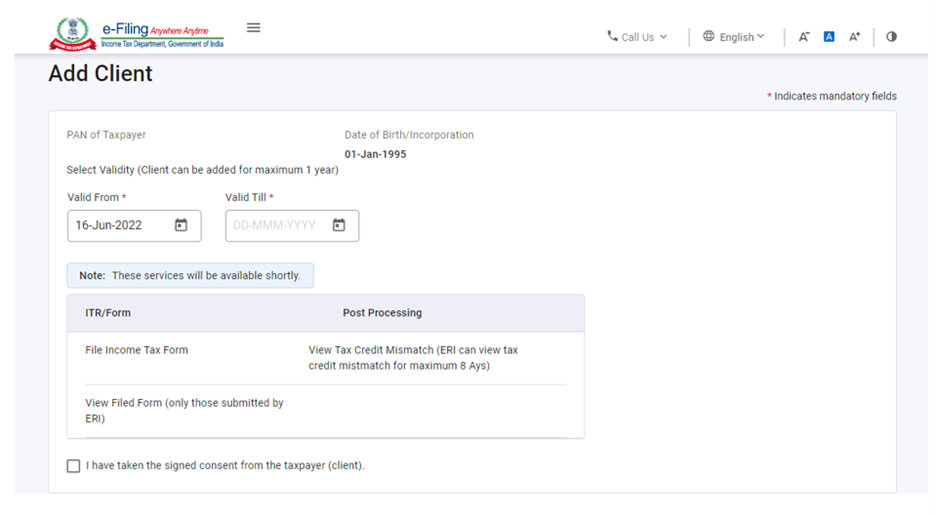

Step 2: After successful validation, review the details and the services which can be accessed on behalf of the added client.

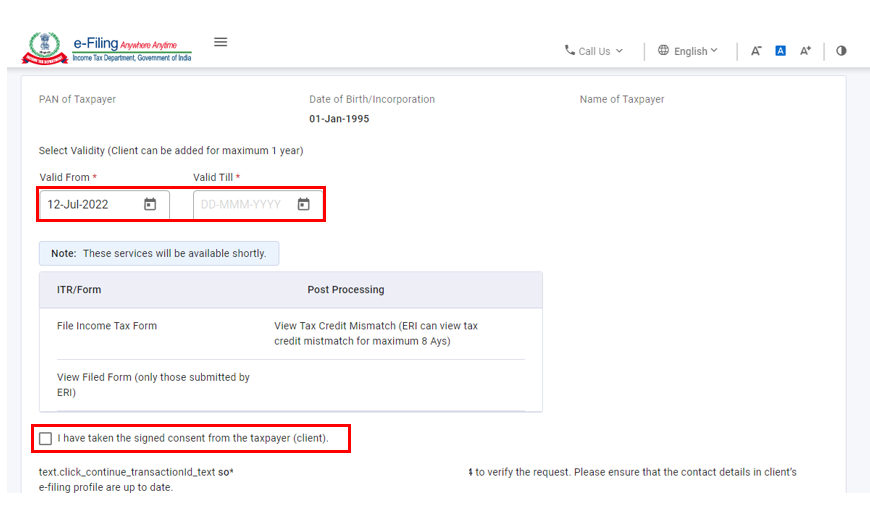

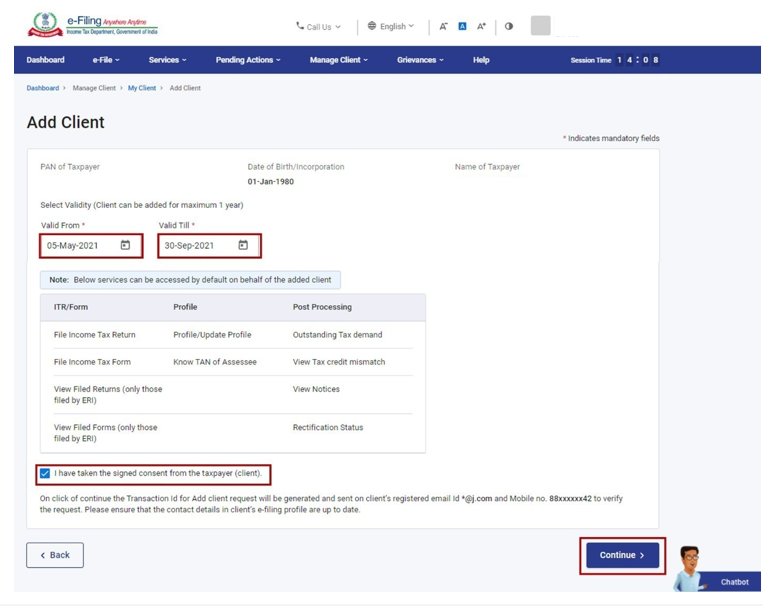

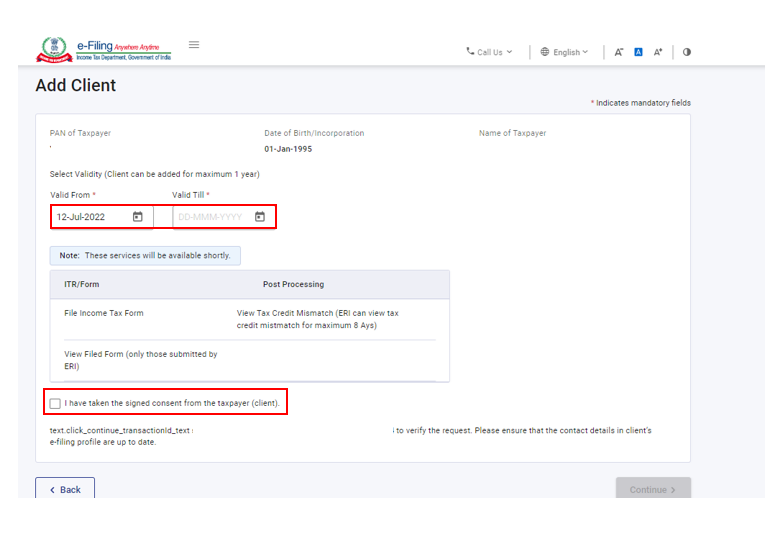

Step 3: On the Add Client page, select the validity period (by selecting the Validity From and Validity Till dates) and select the checkbox I have taken the signed consent from the taxpayer (Client) and click Continue.

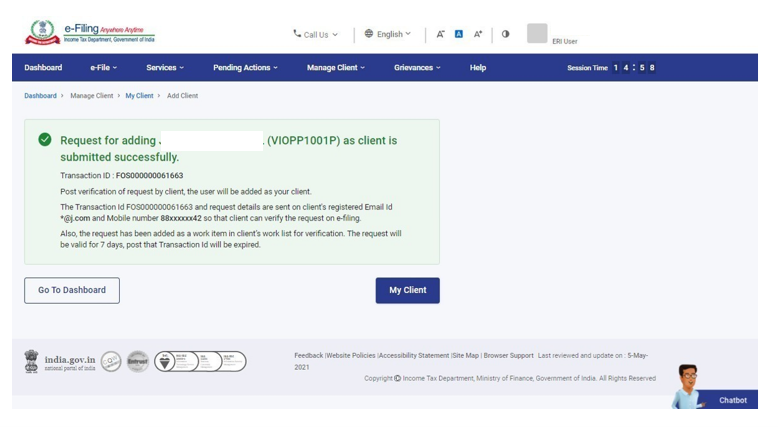

On successful submission of the request, a success message is displayed along with a Transaction ID. Please keep a note of the Transaction ID for future reference. The request is sent to the email ID and mobile number of the taxpayer registered in the e-Filing portal for verifying the request through the portal using pre-login ‘Verify service request’ functionality. After approval by the taxpayer, he / she will be added as client for you.

4.2. Add unregistered taxpayers as clients

Step 1: On the Add Client page, enter the PAN of the taxpayer and select the Date of Birth / Date of Incorporation and click Validate.

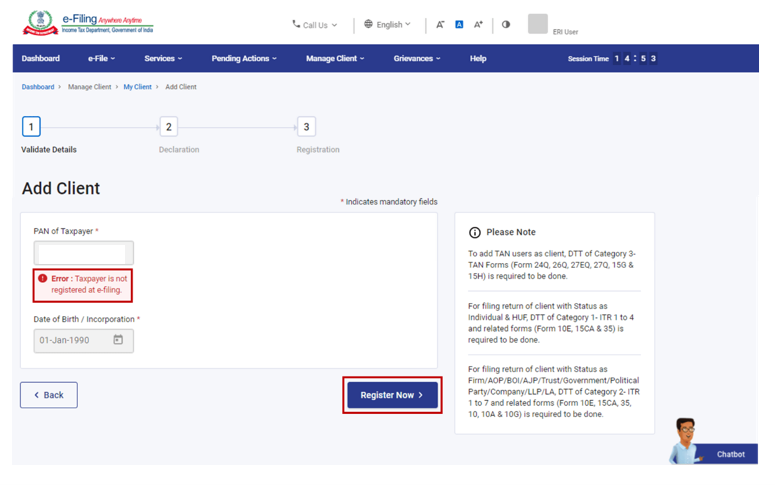

Step 2: An error message Taxpayer not registered at e-Filing will be displayed on the page. You will have to register the taxpayer before adding him / her as your client. Click Register Now.

Step 3: On the Declaration page, review the services which can be accessed on behalf of the added client. Select the validity period (by selecting the Validity From and Validity Till dates) and select the checkbox I have taken the signed consent from the taxpayer (Client) and Click Continue.

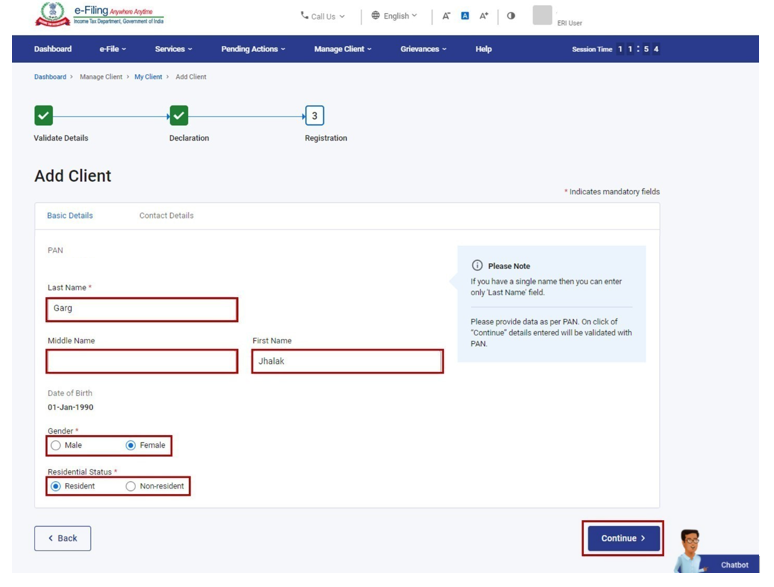

Step 4: On the Registration page, the Date of Birth / Date of Incorporation (based on the PAN) will be pre-filled under the Basic Details tab. Enter Name, select Gender and Residential status and click Continue.

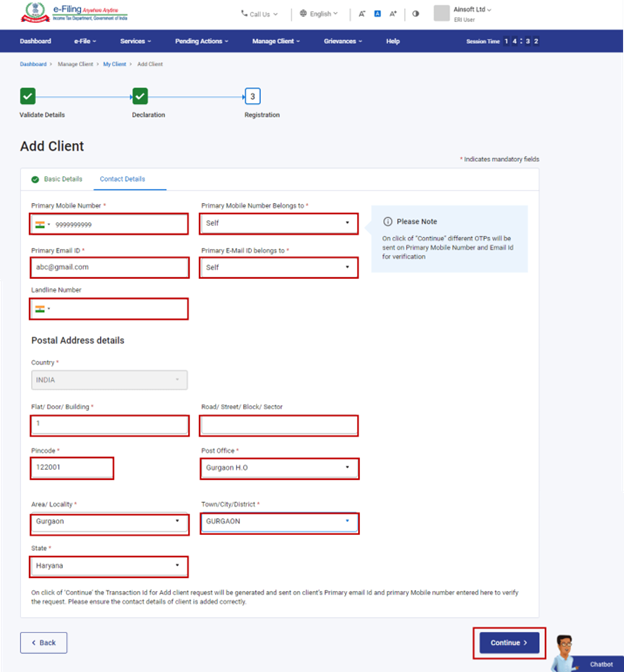

Step 5: On the Registration page, enter the Mobile Number, email ID and Postal Address details under the Contact Details / Principal Contact details tab (depending on the category of the PAN entered) and click Continue.

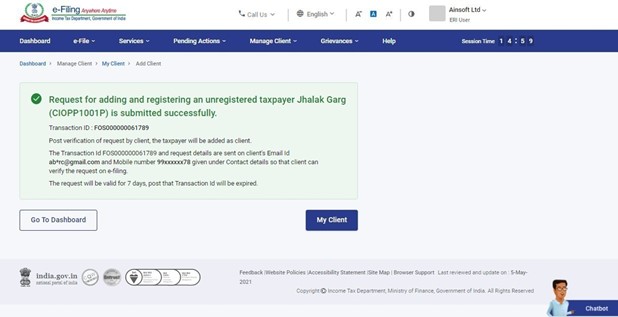

On successful submission of the request, a success message is displayed along with a Transaction ID. Please keep a note of the Transaction ID for future reference. The request is sent to the email ID and mobile number of the taxpayer for verifying the request through the portal using pre-login ‘Verify service request’ functionality. After approval by the taxpayer, he / she will be added as client for you.

4. Related Topics

Login

Dashboard

My ERI

Registration

Add Clients (by ERIs) > FAQss

1. Who is an ERI? What are the different categories of ERIs?

e-Return Intermediaries (ERIs) are authorized intermediaries who can assist taxpayers / TAN users with filing Income Tax Returns (ITRs) or Statutory/ Administrative Forms or other Income Tax related services.

There are three types of ERIs as categorized by the Income Tax Department:

- Type 1 ERIs: File Income Tax Returns / Forms in the e-Filing portal by using Income Tax Department utility / Income Tax Department approved utilities on e-Filing portal,

- Type 2 ERIs: Create their own software application / portal to file Income Tax Returns / Forms on the e-Filing portal through Application Programming Interface provided by Income Tax Department, and

- Type 3 ERIs: Develop their own offline software utilities instead of using Income Tax Department utility available on the e-Filing portal to enable users to file Income Tax Returns / Forms.

2. What is Add Clients (by ERIs) service?

With this service, the Type 1 ERIs will be able to add registered / unregistered PAN users as clients in the e-Filing portal. After the PAN users are added as clients, the Type 1 and Type 2 ERIs will be able to perform actions on behalf of their client upon their request or as required.

3. Who can use this service to add clients?

Only Type 1 ERI (through e-filing portal) and Type 2 ERI (through API) will be able to add PAN users as clients on the e-Filing portal.

4. If the PAN is not registered on the e-Filing portal, will I be able to add the user as a client?

Yes. You will be able to add the user as a client on the e-Filing portal. To do so, you must have access to the Basic Information & Contact details of the taxpayer and additionally obtain consent from the taxpayer for adding him / her as a client.

5. What kind of services can I perform once I have added the taxpayer (who is a PAN user) as my client?

After adding a PAN user as your client successfully, you will be able to perform the various services on behalf of your added client including:

- View and file bulk Income Tax Returns

- Download Prefill data

- View and file Forms (view of forms filed by you)

- Respond to outstanding demand (will be available later)

- View Tax Credit Mismatch details

- View Notices (will be available later)

- Submit and View grievances

- rectification

- Submit Service Request (Refund Reissue / Condonation for delay in submission of ITR-V).

7. Will I be able to perform the actions on behalf of my client immediately after I submit my request for adding the taxpayer as my client?

No. You will not be able to immediately perform actions on behalf of the client. After you add a client, a request is sent to email ID and mobile number of the client for verification. Upon approval by the client of your request through the e-Filing portal within 7 days, you will be able to perform further actions.

8. What is the duration within which the client is required to approve my request?

The client must validate the request raised by you within 7 days on the e-Filing portal to add him/her as a client. After 7 days, the request ID would expire, and you will have to initiate the process again.

9. What happens if my Transaction ID expires, and no action is initiated by the taxpayer?

If the request is not approved by your client within 7 days of raising the request, it will expire, and you will have to raise the request again. Once the request is raised, only the request for verification is sent to the email ID and mobile number of the taxpayer, registered on the e-Filing portal, for verifying the request through the portal.

10. Is there a reminder sent to the taxpayer?

No reminders / notices are sent to the taxpayer for verification of the service request.

Glossary

|

Acronym/Abbreviation |

Description/Full Form |

|

AY |

Assessment Year |

|

ITD |

Income Tax Department |

|

ITR |

Income Tax Return |

|

HUF |

Hindu Undivided Family |

|

TAN |

TDS & TCS Account Number |

|

ERI |

e-Return Intermediary |

|

API |

Application Programming Interface |

|

PAN |

Permanent Account Number |

|

TDS |

Tax Deducted at Source |

|

TCS |

Tax Collected at Source |

Assessment Questions

(Note: The correct answer is in boldface.)

Q1. What is the duration for which the request raised by the ERI for adding clients is active?

a) 24 hours

b) 5 days

c) 7 days

d) 30 days

Answer – c) 7 days

Q2. Who can add clients through their own API?

a) Type 1 ERIs

b) Type 2 ERIs

c) Type 3 ERIs

d) All of the above

Answer – b) Type 2 ERIs