FO_77_ERI Bulk ITR Upload and View_User Manual_FAQ_V.0.1

1. Overview

Upload Income Tax Return (Bulk) and View Income Tax Return (Bulk) functionalities are applicable for Type 1 e-Return Intermediary (ERI) registered on the e-Filing portal. This is a post-login service. ERIs can upload ITR and see the status of filed ITRs on behalf of their clients.

2. Prerequisites for availing this service

- The ERI should be a Type 1 ERI

- Valid and active PAN should be added as a client by ERI, and accepted by the client

- PAN should be an active client of the ERI

3. Step-by-Step Guide

3.1 Upload Income Tax Return (Bulk)

Step 1: Log in to the e-Filing portal using your user ID and password.

Step 2: Click Services > Upload Income Tax Return (Bulk).

3.1.1 Download Pre-Filled Data of Client

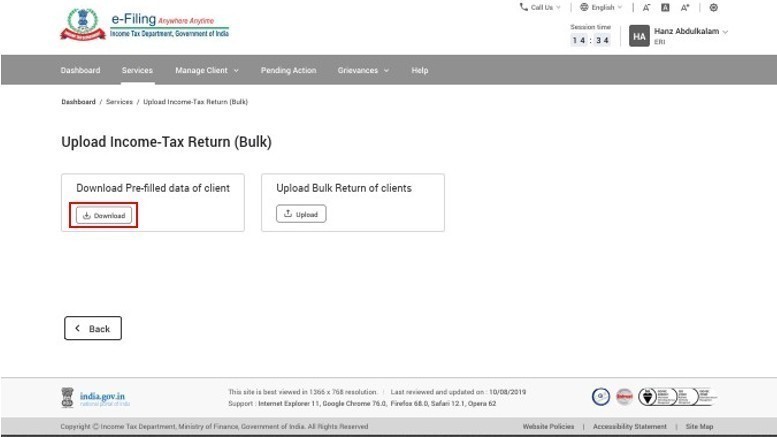

Step 1: On the Download Pre-Filled Data of Client tab, click Download.

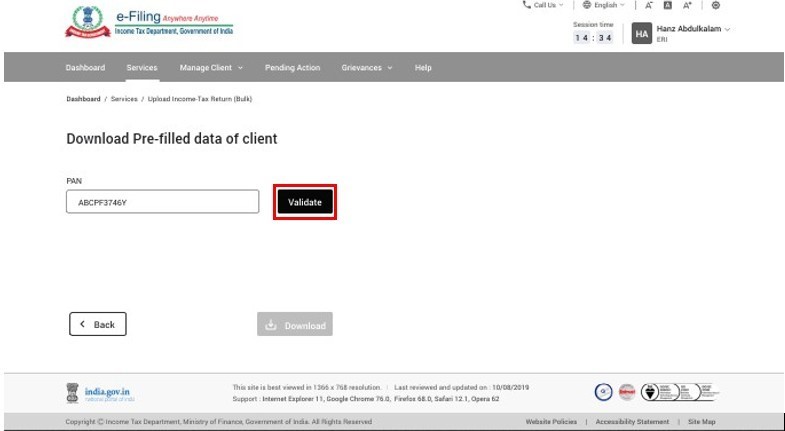

Step 2: Enter the client PAN and click Validate.

Download Prefill is a onetime consent-based service. If consent is not taken from added client to download prefill data, please follow below steps:

- Navigate to Manage Client >> My Client page and search for added client

- Click on Add Service, and add Prefill service for a specific duration

- A transaction Id will be generated and sent to client on registered email and mobile for verification

- Client can access pre-login ‘Verify service request’ functionality to provide consent

- Client will have to provide his PAN and Transaction Id, verify the service name and ERI name, provide OTP details and complete the verification.

- Post OTP verification by client, ERI can download prefill data of the client.

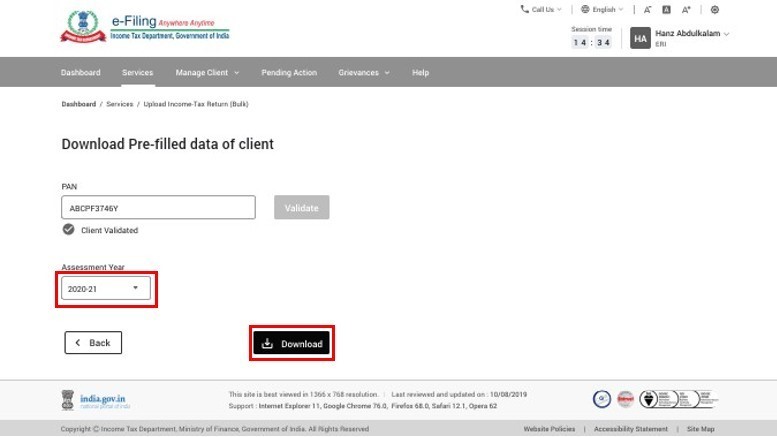

Step 3: After validation, select the required Assessment Year from the dropdown menu and click Download.

The pre-filled JSON for the selected PAN and AY is downloaded in your system.

3.1.2. Upload Bulk Returns of Clients

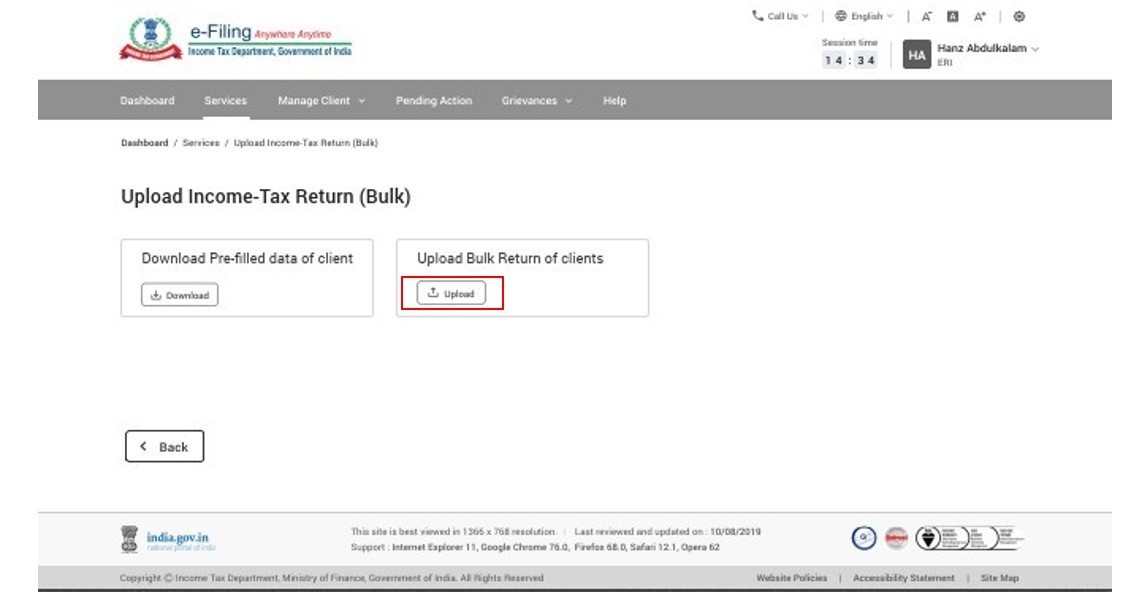

Step 1: On the Upload Bulk Return of Clients tab, click Upload.

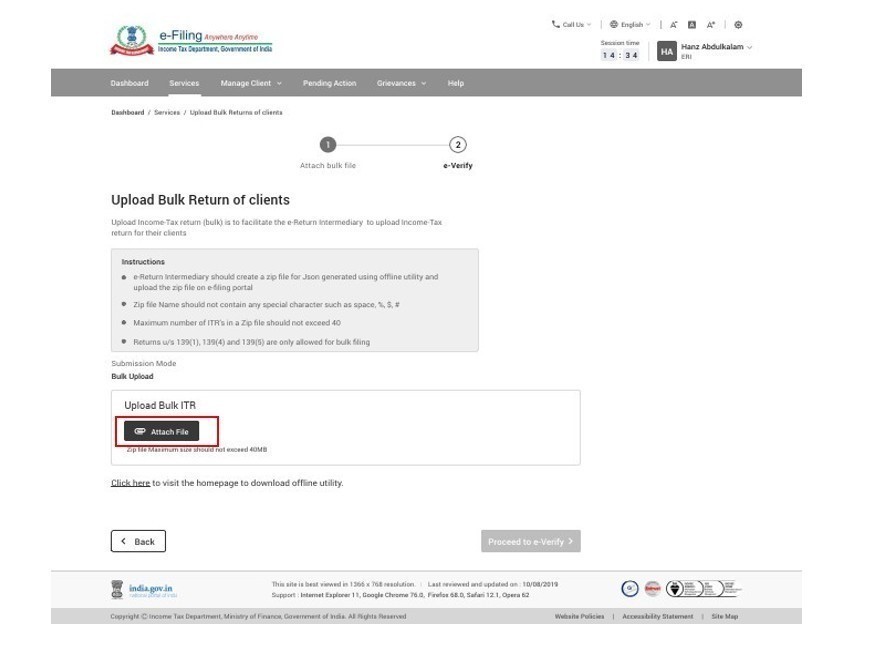

Step 2: Click Attach File to attach the required zip file.

Note:

- The maximum size of the zip file should not exceed 40 MB.

- The maximum number of ITRs/JSON in a zip file should not exceed 40.

- Only ITRs having filing section as 139(1), 139(4) and 139(5) should be uploaded

- The zip file should contain files with only JSON format.

- The name of the JSON should be PAN of the Taxpayer (<PAN of Client>.json)

- Please ensure ZIP to be done of JSON file and not the folder (Select the JSON files as shown and right click → Send to → Compressed (zipped folder).

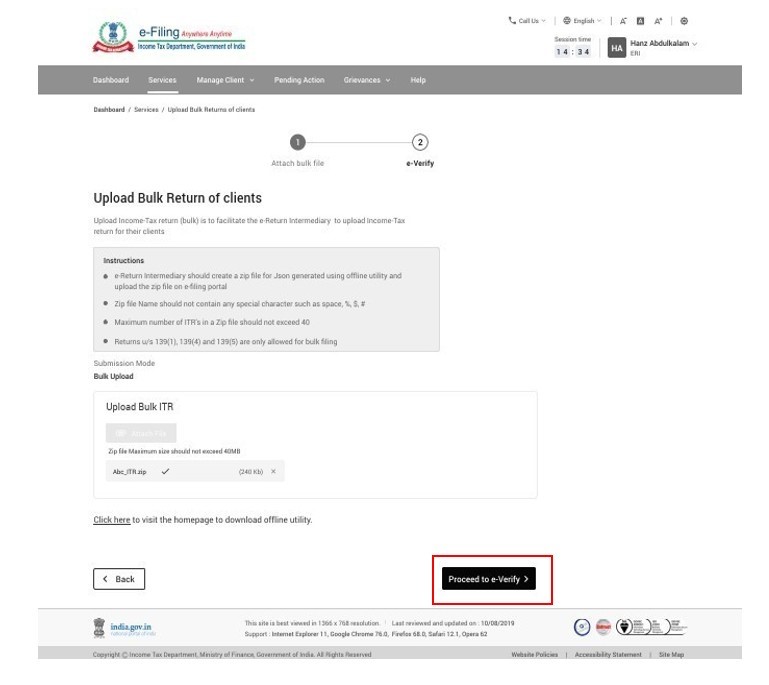

Step 3: Click Proceed to e-Verify.

Step 4: Refer to the user manual on e-Verify to know more about the e-Verification process.

Note: e-Verify can be done using Bank EVC, Demat EVC, Aadhaar OTP & DSC

Once the ERI e-verifies the zip file, the file will be sent for validation. Once validated successfully, the taxpayer has to e-verify its return to complete the return filing process.

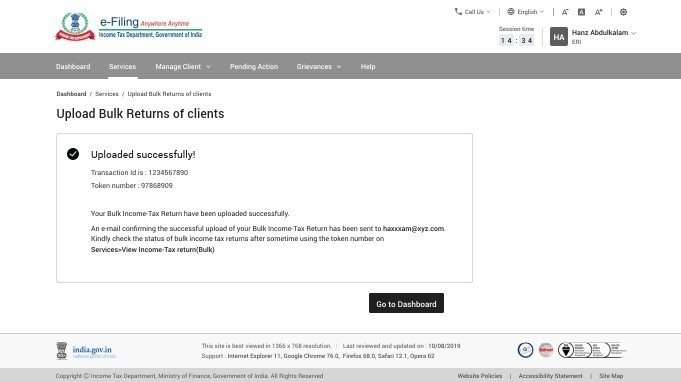

On successful verification, a success message is displayed, and an email confirmation is sent on your email ID.

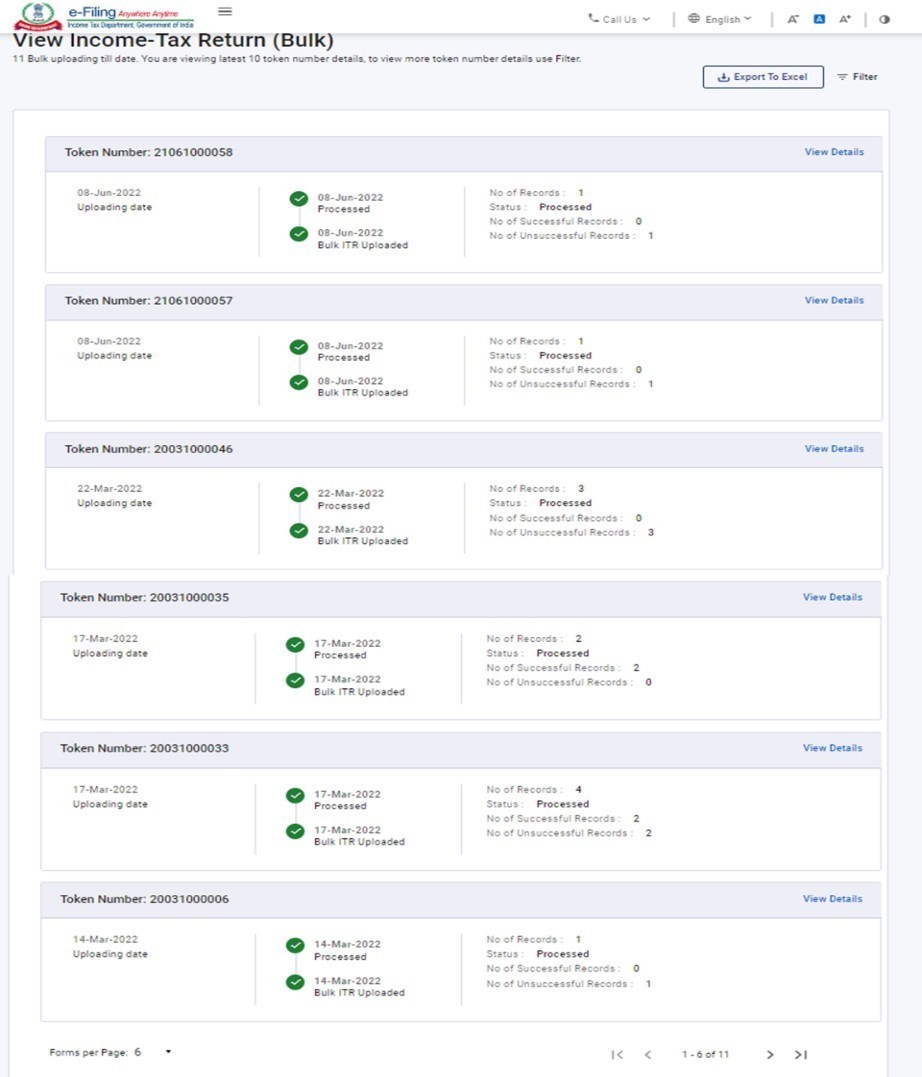

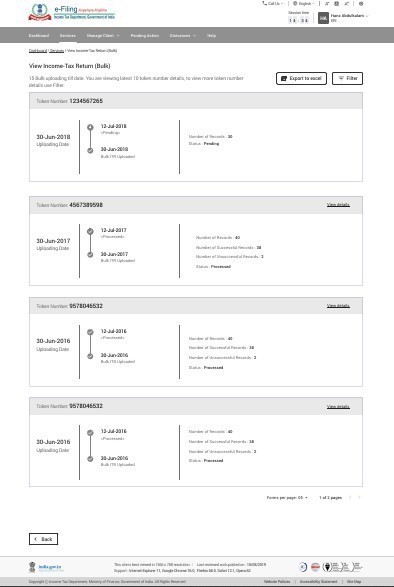

3.2 View Income Tax Returns (Bulk)

Step 1: Log in to the e-Filing portal using your user ID and password.

Step 2: Click Services > View Income Tax Returns (Bulk).

Note: Validate Bulk Processor will run every 10 minutes and will pick up the files in queue for further validations. Validated files will be processed successfully.

In case validation is failed, it will generate error report which will include error details.

The details of the Token Number/ Bulk Returns uploaded with their status is displayed.

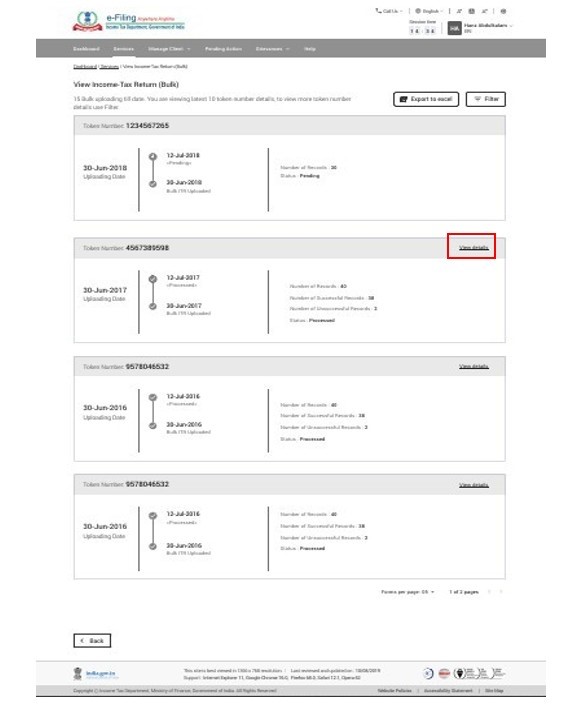

Step 4: Click View Details in the Token Number tile to see the details of each ITR/JSON uploaded, and their respective status:

- Validation failed – if JSON validation fails

- Successfully e-verified – If JSON validation is passed and successfully e-verified by taxpayer

- Pending e-verification- If JSON validation is passed but not e-verified by taxpayer

- Invalid Input- when the zip file uploaded has folder inside instead of json files

- Invalid filename- when the zip file uploaded does not have all json files

Step 5: Click View Details on Individual Acknowledgement Number tile to see the life cycle screen.

Related Topics

Login

Dashboard

Add Client

My ERI

Worklist

Profile

Return Generation

Offline Utility

ERI Bulk ITR Upload and View > FAQs

1. Is the bulk ITR upload and view service available to all ERIs?

No, this service is available to Type 1 ERIs only.

2. What are the details that can be viewed by the ERI availing the bulk ITR upload and view service?

The ERI can view the status of the bulk returns uploaded by the user. The statuses include:

- Validation failed – if JSON validation is failed

- Successfully e-verified – If JSON validation is passed and successfully e-verified by Taxpayer

- Pending e-verification- If JSON validation is passed but not e-verified by Taxpayer

The ERI can also view the life cycle of the desired ITR.

3. What are the few pointers that ERIs should keep in mind while bulk uploading ITR?

The following need to be kept in mind while adding the attachment for bulk uploading ITR:

- The maximum size of the zip file should not exceed 40 MB.

- The maximum number of ITRs/Json in a zip file should not exceed 40 files.

- Only ITRs having filing section as 139(1), 139(4) and 139(5) are allowed to be uploaded

- The zip file should contain files with only JSON format

- PAN should be of resident taxpayer only.

Glossary

|

Acronym/Abbreviation |

Description/Full Form |

|

DOB |

Date of Birth |

|

ITD |

Income Tax Department |

|

NRI |

non-resident Indians |

|

NSDL |

National Securities Depository Limited |

|

OTP |

One Time Password |

|

PAN |

Permanent Account Number |

|

SMS |

Short message service |

|

UIDAI |

Unique Identification Authority of India |

|

UTIISL |

UTI Infrastructure Technology & Services Limited |

|

AY |

Assessment Year |

|

ERI |

e Return Intermediary |

|

DTT |

Data Transmission Test |

|

API |

Application programming interface |

Assessment Questions

Q1. What are all the possible e-Verification methods from the list below?

- OTP on mobile registered with Aadhaar

- DSC

- EVC

- Static Password

Ans: 1. OTP on mobile registered with Aadhaar; 2. DSC; 3. EVC

Q2. An ERI can upload a maximum of 20 JSON files while bulk uploading ITRs for his/ her clients.

- True

- False

Ans – 2. False