1. Overview

Form 15CA is available to all persons requiring to file declaration form of the foreign remittance made outside India. This Form is filed for each remittance made by a person responsible for such remittance, before remitting the amount and can be submitted in both online and offline modes. This service enables the registered users to file Form 15CA online through the portal.

2. Prerequisites for availing this service

- Registered user of the e-Filing portal with valid user Id and Password

- CA should have filed Form 15CB (for Part – C only)

3. About the Form

3.1 Purpose

This form enables the users to file Information to be furnished for payments to a non-resident not being a company, or to a foreign company.

Form 15CA is filed for each remittance made by a person responsible for such remittance, before remitting the account. In some cases, a certificate from Chartered Accountant in form 15CB is required for uploading Form 15CA online.

3.2 Who can use it?

Any category of taxpayer, Authorized Signatory and Representative Assessee can use Form 15CA to furnish information regarding payment made to a non-resident not being a company or to a foreign company.

4. Form at a Glance

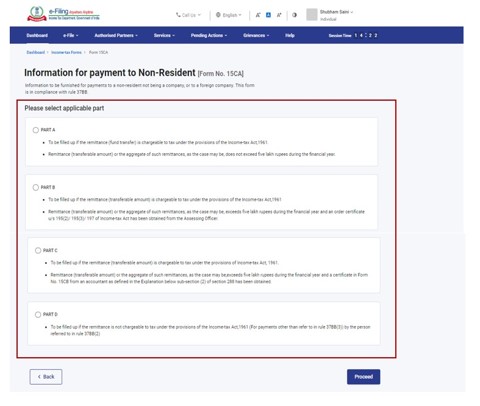

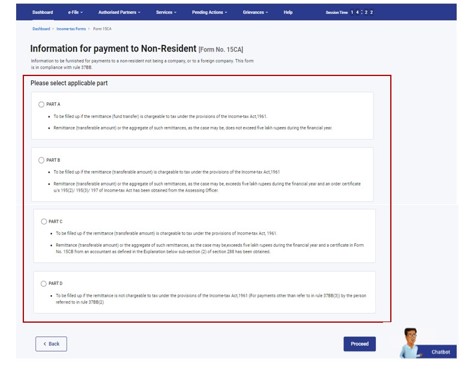

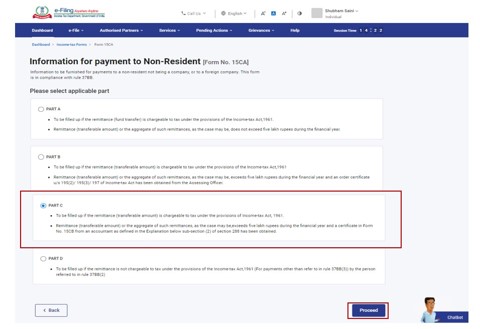

Form 15CA has four sections:

- Part A – If remittance or the aggregate of such remittance is chargeable to tax and does not exceed 5 lakh rupees during the financial year

- Part B - If remittance is chargeable to tax and the remittance or the aggregate of such remittances exceeds 5 lakh rupees during the financial year and an order/certificate u/s 195(2)/195(3)/197 has been obtained from the AO

- Part C - If remittance is chargeable to tax and the remittance or the aggregate of such remittances exceeds 5 lakh rupees during the financial year and a certificate in Form No. 15CB from an accountant has been obtained

- Part D – If remittance is not chargeable to tax

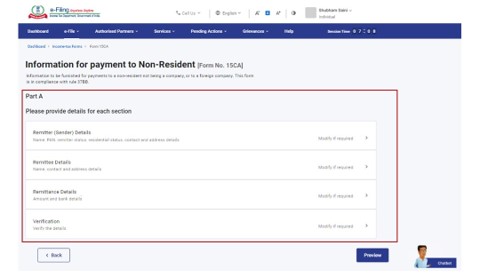

Form 15CA – Part A

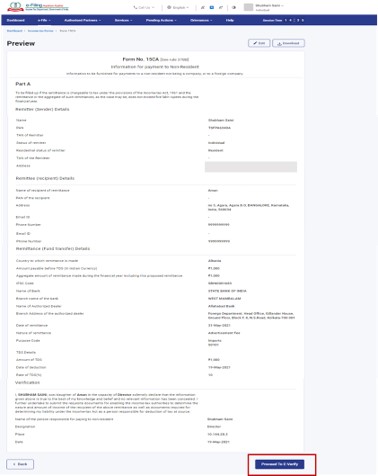

Details of Remitter, remittee and the remittance details are entered. It also includes the verification from the person submitting the form.

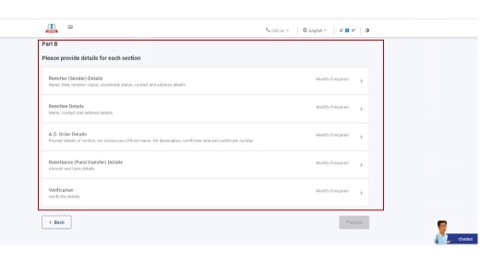

Form 15CA – Part B

Enter the details on remitter, remittee, AO Order Details and the remittance details. It also includes a verification from the person submitting the form.

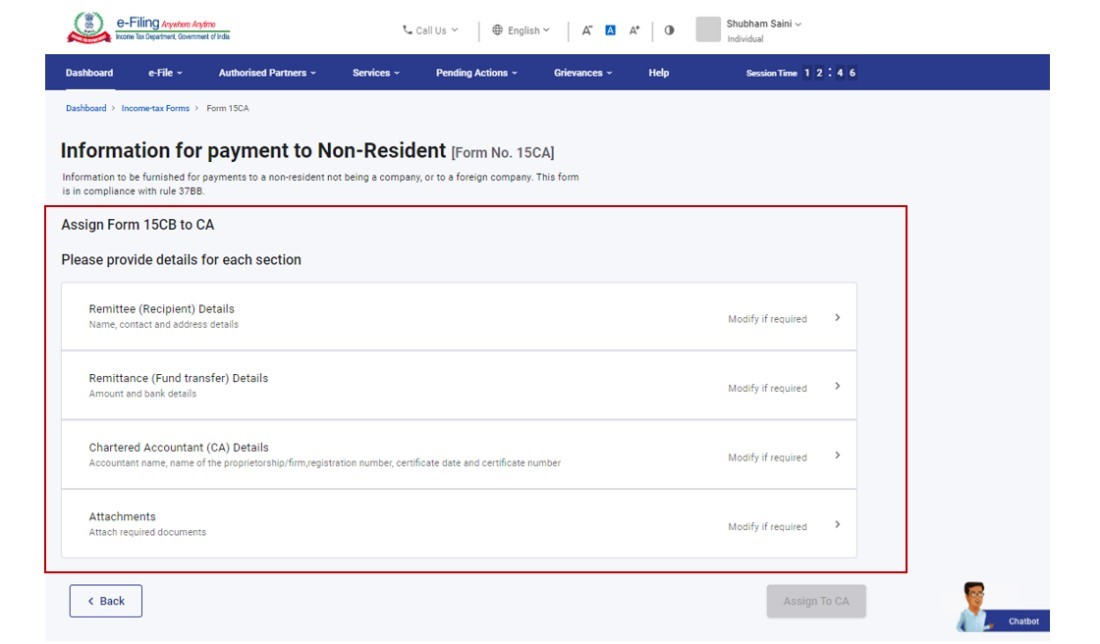

Form 15CA – Part C

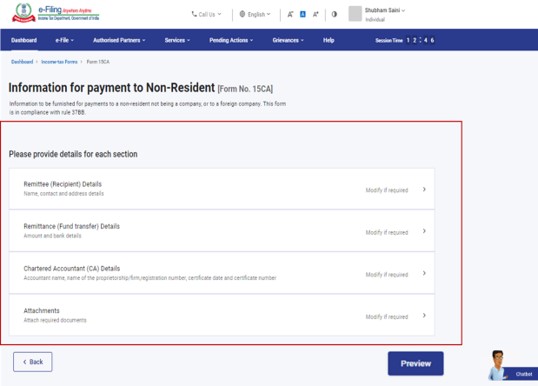

Apart from the remittee and the remittance details, enter the details of the CA who gave certificate under Form 15CB and the related attachments.

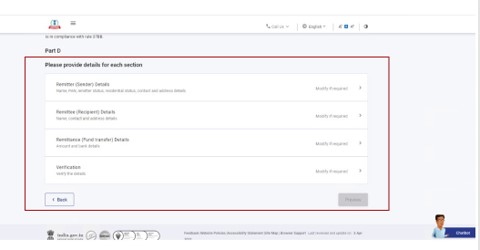

Form 15CA – Part D

Enter the remitter, remittee and remittance details. It also includes the verification from the person submitting the form 15CA.

5. How to Access and Submit

You can fill and submit Form 15CA through the following methods:

- Online Mode: Through the e-Filing Portal

- Offline Mode: Through Offline Utility

Note:

Refer to Offline Utility Statutory Forms to learn more.

Follow the below steps to fill and submit Form 15CA through online mode.

5.1 Submitting Form 15CA – Part A/B/D Online

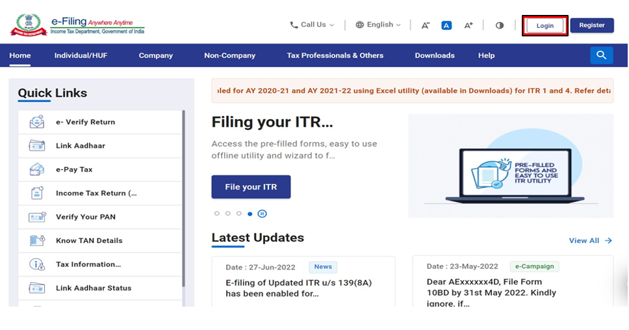

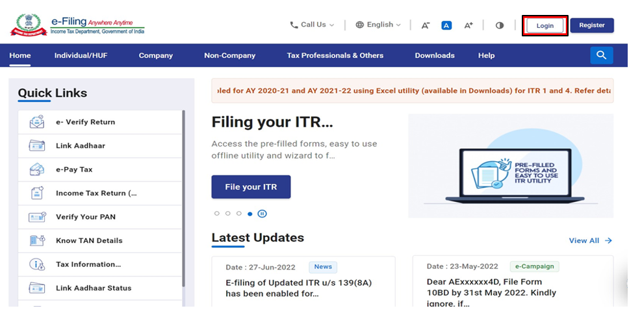

Step 1: Login to the e-Filin.g portal using your user ID and password.

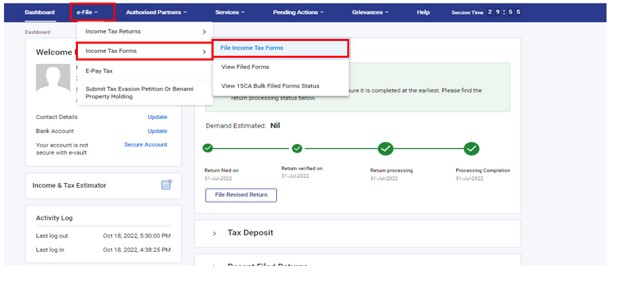

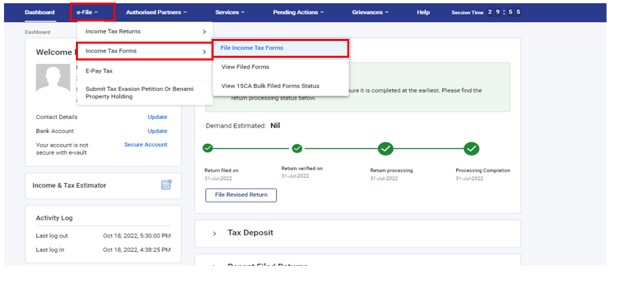

Step 2: On your dashboard, click e-file > Income tax forms

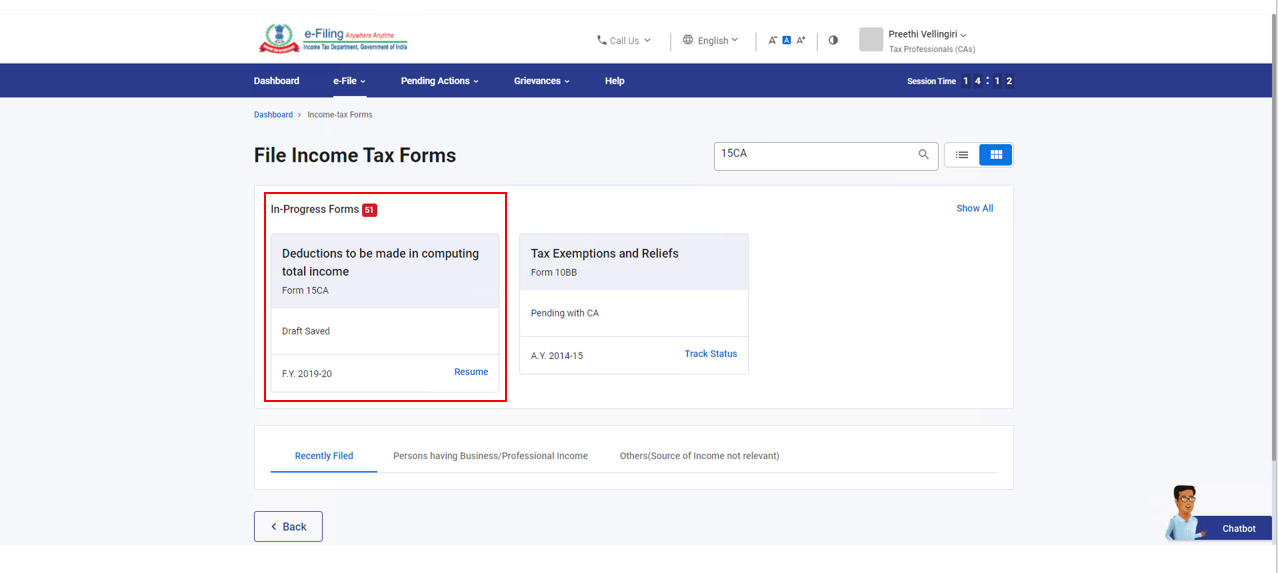

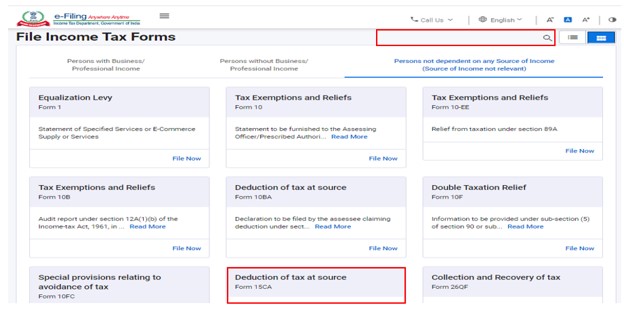

Step 3: On the File Income Tax Forms page, select the Form 15CA . Alternatively, enter Form 15CA in the search box to file the form.

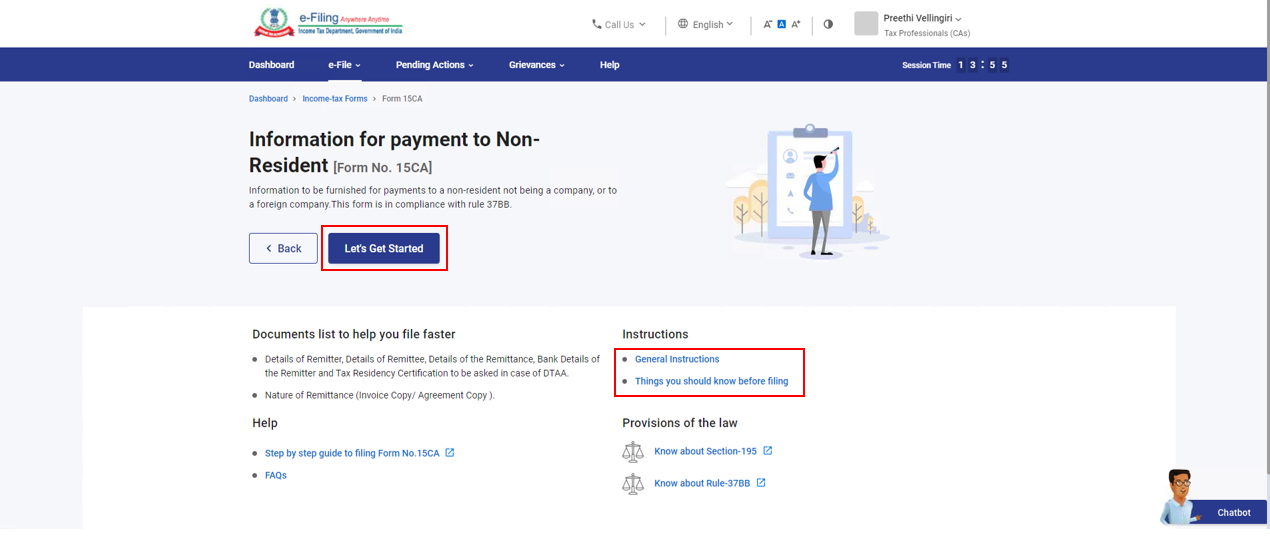

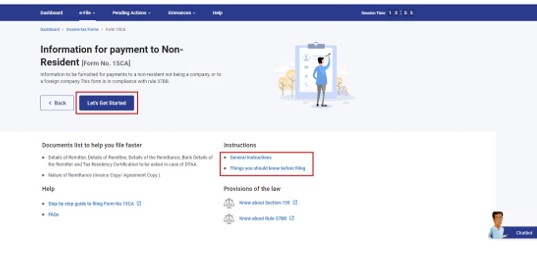

Step 4: On the instructions page, click Let’s Get Started.

Step 5: On click of Let’s Get Started, Form 15CA is displayed. Select the applicable section and fill all the required details. Click Proceed.

Step 6: On the Preview page, verify the details and click Proceed to e-Verify.

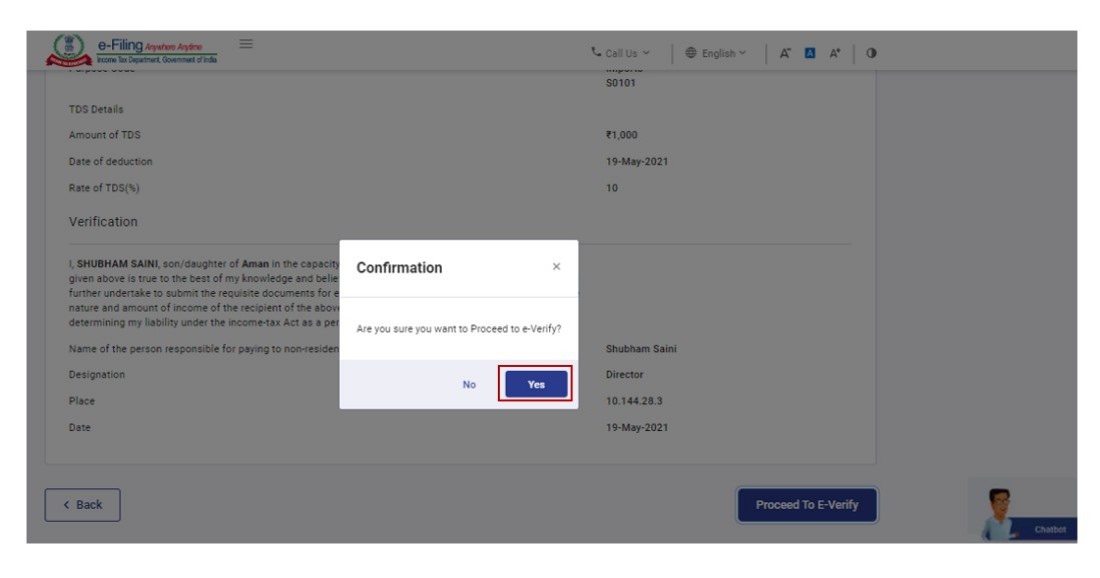

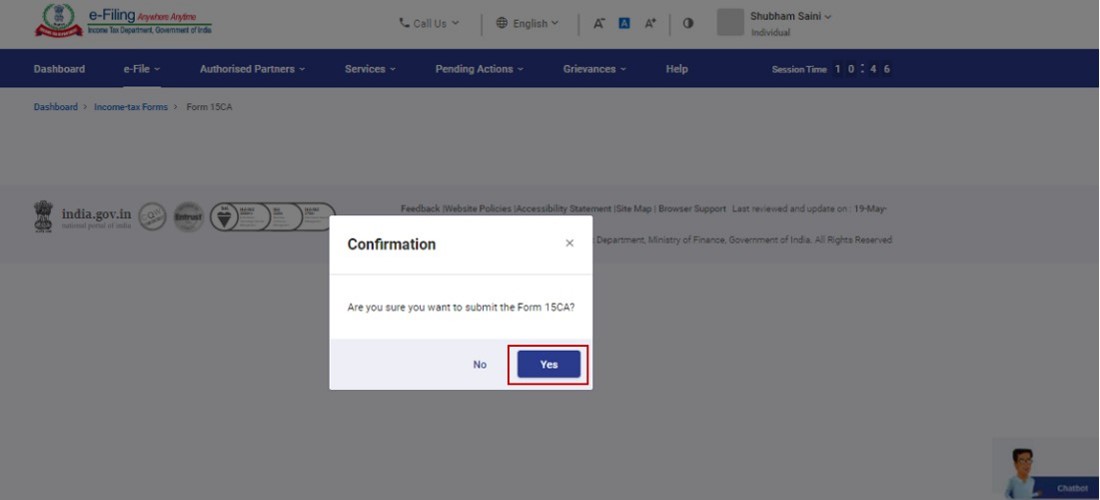

Step 7: Click Yes to submit

Step 8: On clicking Yes, you will be taken to the e-Verify page.

Note:

Refer to the How to e-Verify user manual to learn more.

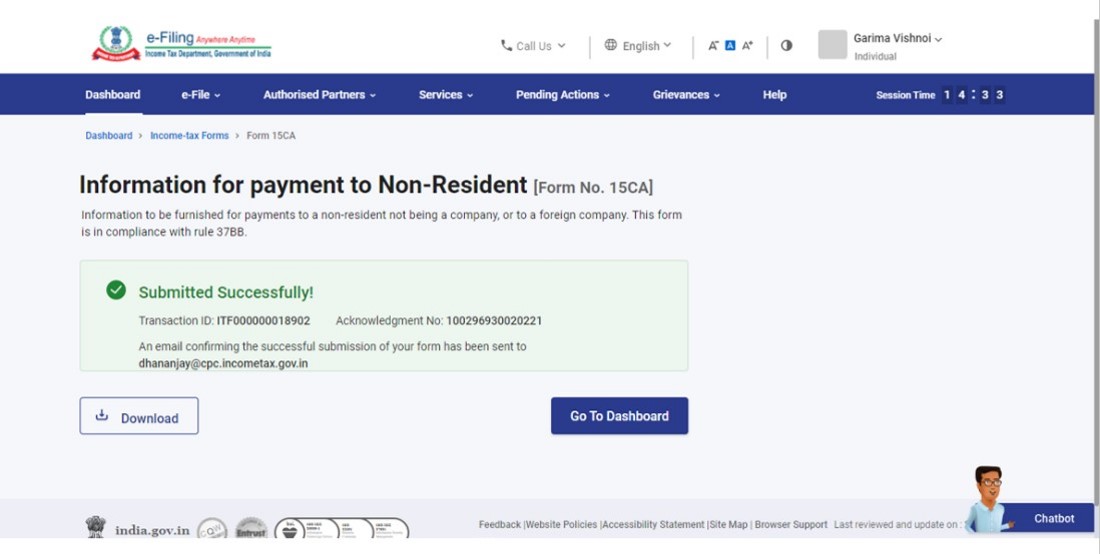

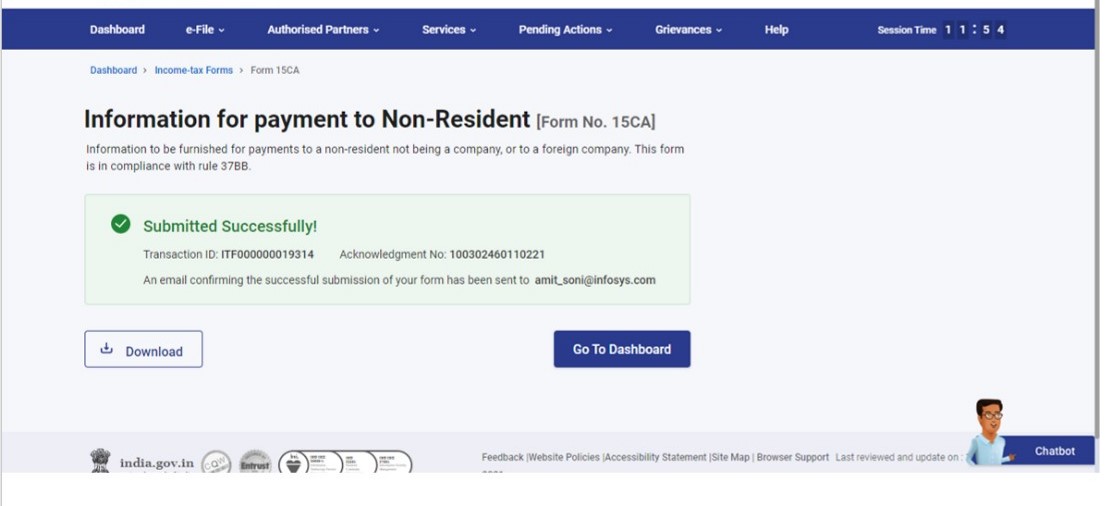

After successful e-Verification, success message is displayed along with a Transaction ID and Acknowledgement Number. Please keep note of the Transaction ID and Acknowledgment Number for future reference. You will also receive a confirmation message on the email ID registered in the e-Filing portal.

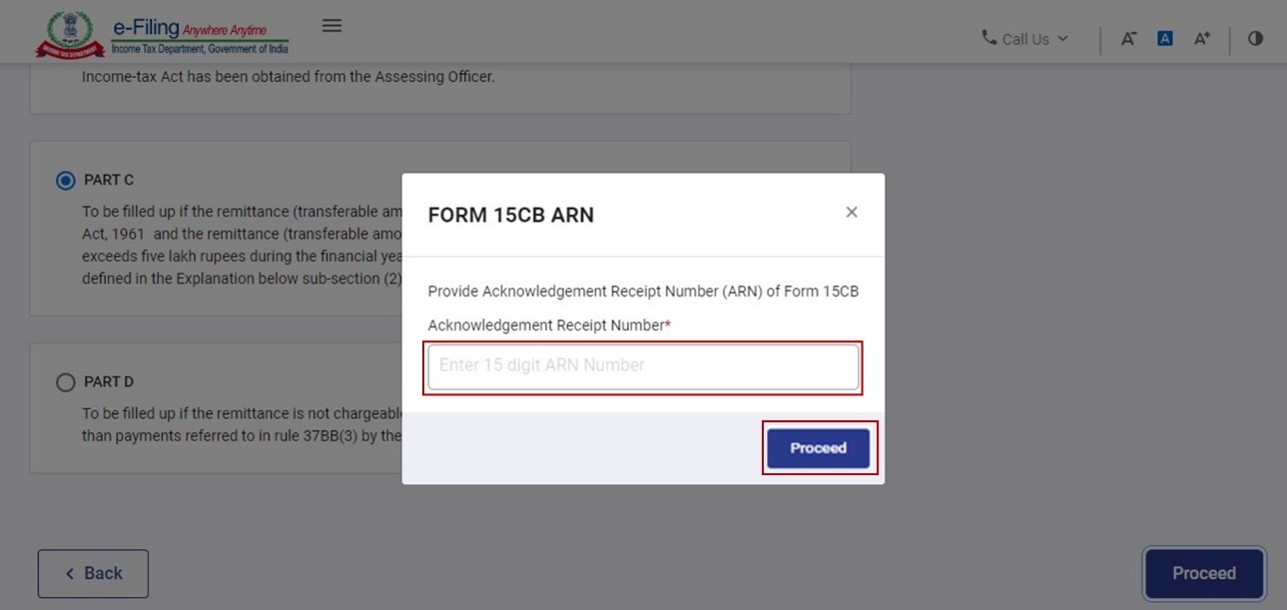

5.2 If you want to fill Form 15CA – Part C

In case the amount of remittance chargeable to Income Tax is more than Rs 5 Lakh during a Financial Year, and the order from the Assessing Officer (u/s 197 / 195(2) / 195 (3)) has not been obtained, Part C of Form 15CA will be applicable and it is required to be filled along with a certificate of Chartered Accountant in Form 15CB.

Before filing Part C of Form 15CA, a CA is required to file Form 15CB and generate an Acknowledgement Receipt Number (ARN).

Step 1: Login to the e-Filing portal using your user ID and password.

Step 2: On your dashboard, click e-file > Income tax forms

Step 3: On the File Income Tax Forms page, select the Form 15CA. Alternatively, enter Form 15CA in the search box to file the form.

Step 4: On the Instructions page, click Let’s Get Started.

Step 5: On click of Let’s Get Started, Form 15CA is displayed. Choose Part C of the form and click Proceed.

Step 6: Enter the valid Acknowledgement Receipt No. (ARN) of the Form 15CB filed by the Chartered Accountant. Click Proceed.

Note: Only one Form 15CB ARN can be used for filing one Form 15CA Part C.

Step 7: Confirm all sections of the Part C and click Preview.

Step 8: On the Preview page, verify the details and click Proceed to e-Verify

Step 9: Click Yes to submit the Form after filling the relevant details.

On clicking Yes, you will be taken to the e-Verify page where you can e-Verify the Form.

Note: Refer to the How to e-Verify user manual to learn more.

After successful e-Verification, a success message is displayed along with a Transaction ID and Acknowledgment Number. Please keep a note of the Transaction ID and Acknowledgement Number for future reference. You will also receive a confirmation message on the email ID registered on the e-Filing portal.

4. Related Topics

- My Profile

- Login

- Dashboard

- Income Tax Forms

- Register DSC

- Generate EVC

- E-Verify

- Worklist

- Authorised Signatory

- My CA

- Form 15CB

- Know my AO