1. Overview

The Generate Electronic Verification Code (EVC) service is only available to individual registered users of the e-Filing portal to Generate EVC. This service allows you to:

- e-Verify an item (Statutory forms, Income Tax Returns, refund reissue request and response against any notice)

- Login to e-Filing portal

- Reset password

2. Prerequisites to Avail This Service

- Registered user on e-Filing portal as Individual Taxpayer with valid user ID and password

- Validated and EVC enabled bank account in the e-Filing portal (For Bank Account option)

- Validated and EVC enabled demat account in the e-Filing portal (For Demat Account option)

- PAN linked with bank account (For Net banking option)

- Valid debit card (For Bank ATM option)

- Respective bank account should be linked with PAN and same PAN should be registered at e-Filing (For Bank ATM option)

3. Step-by-Step Guide

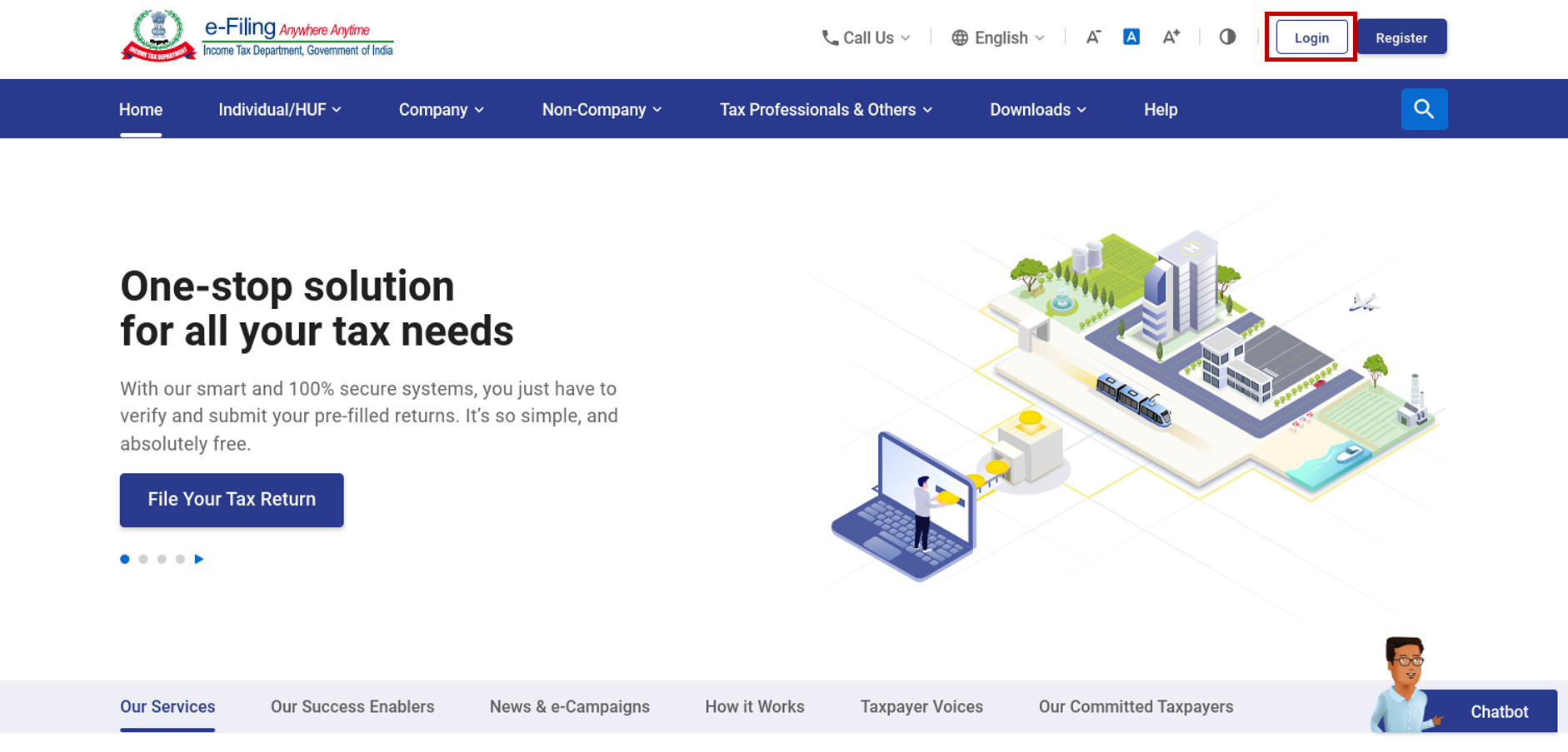

Step 1: Log in to the e-Filing portal using your user ID and password.

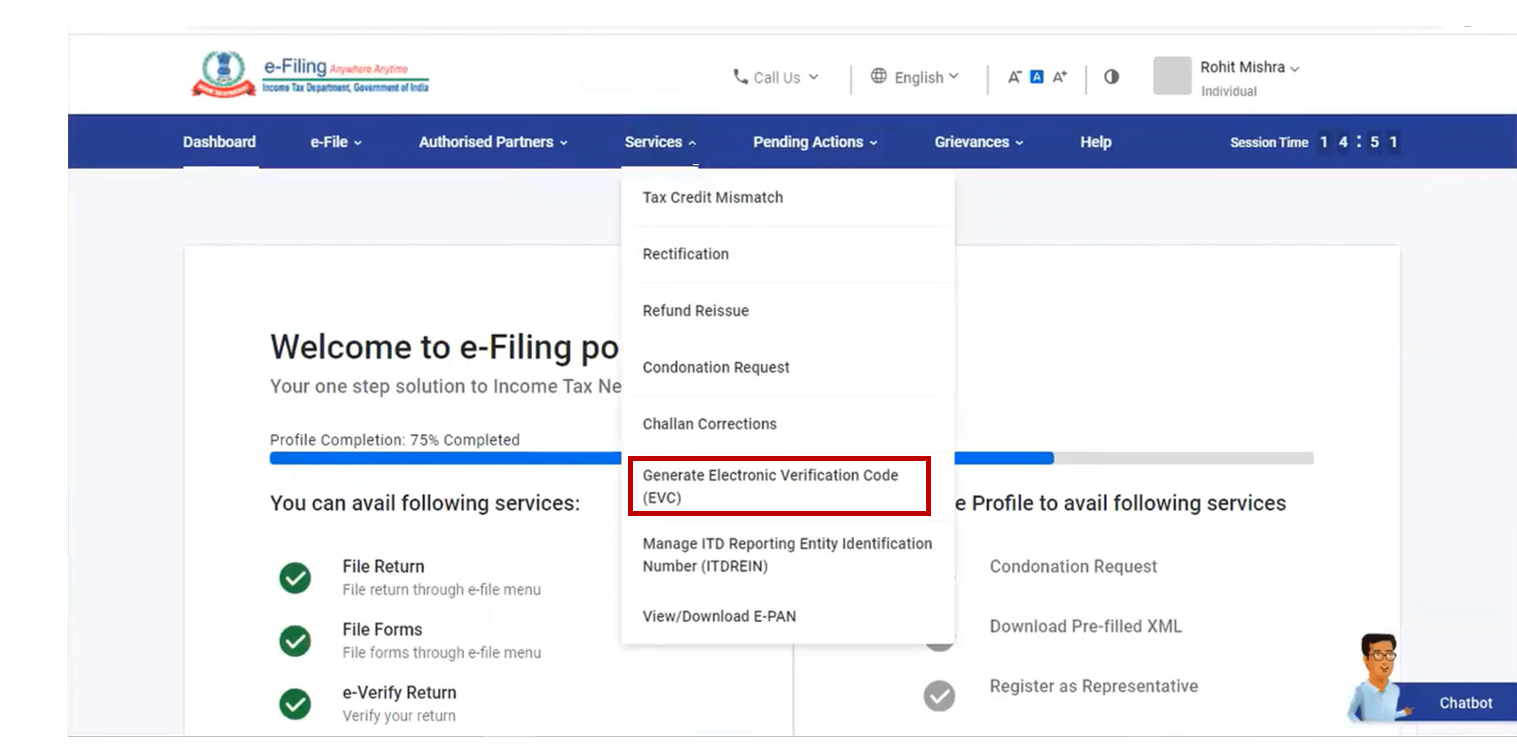

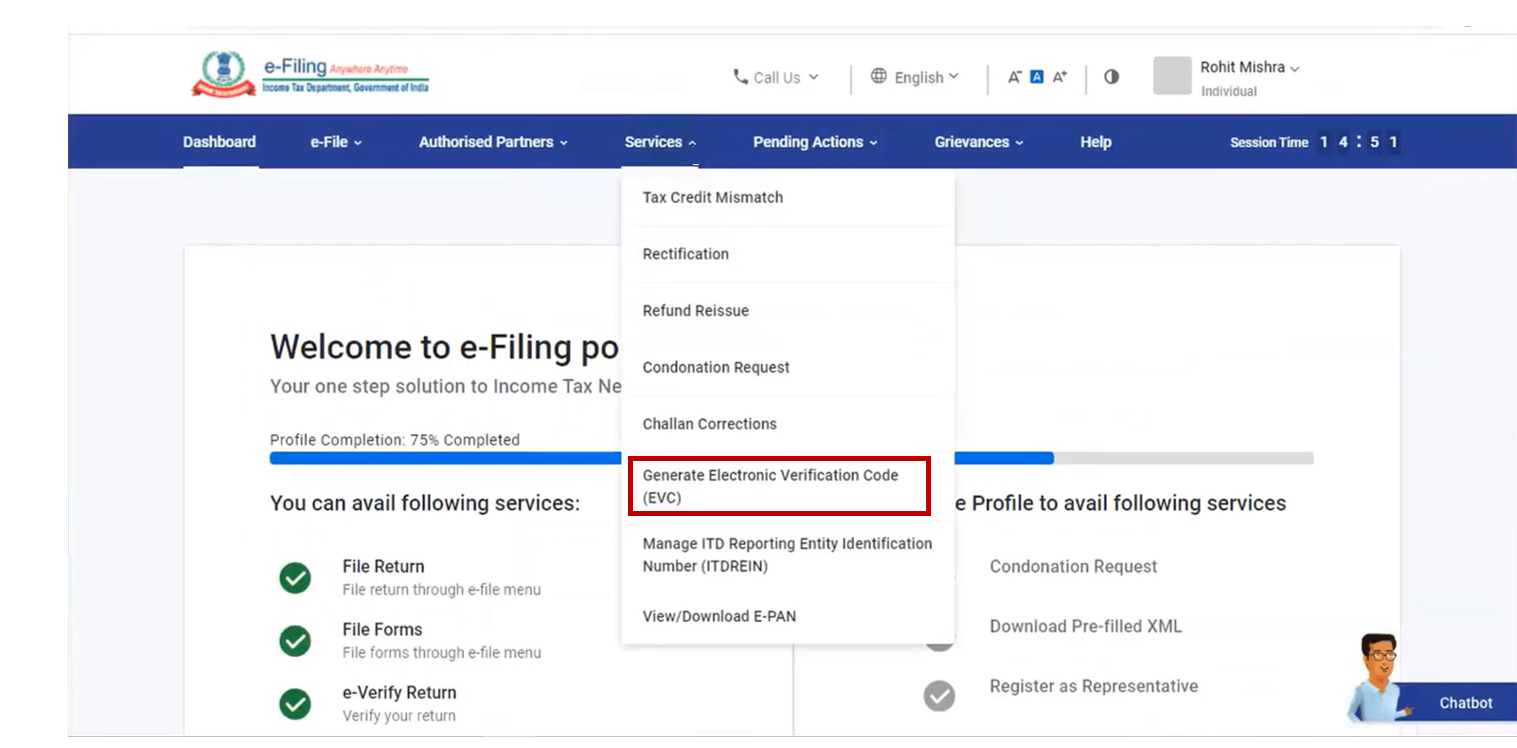

Step 2: On your Dashboard, click Services > Generate EVC.

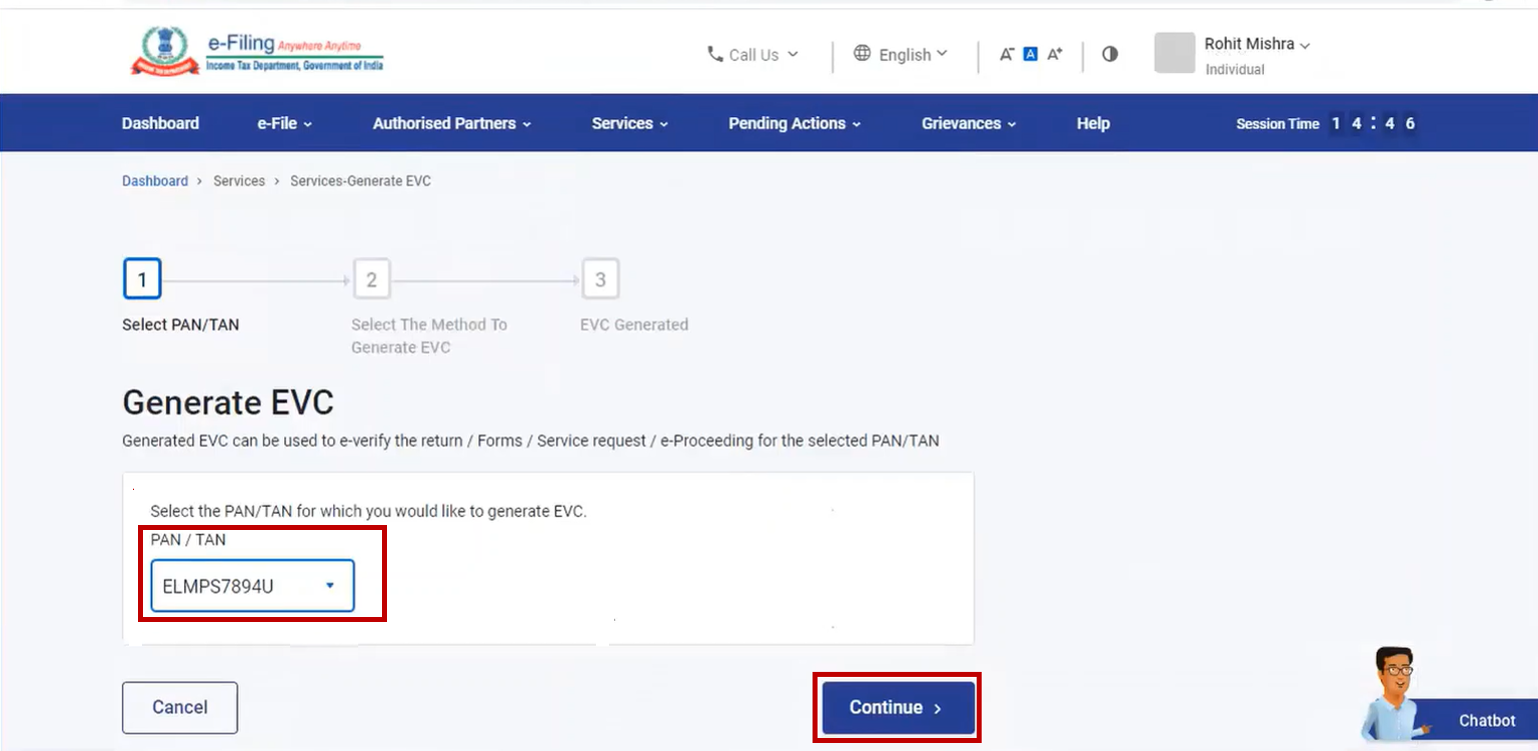

Step 3: On Generate EVC page, select PAN / TAN and click Continue.

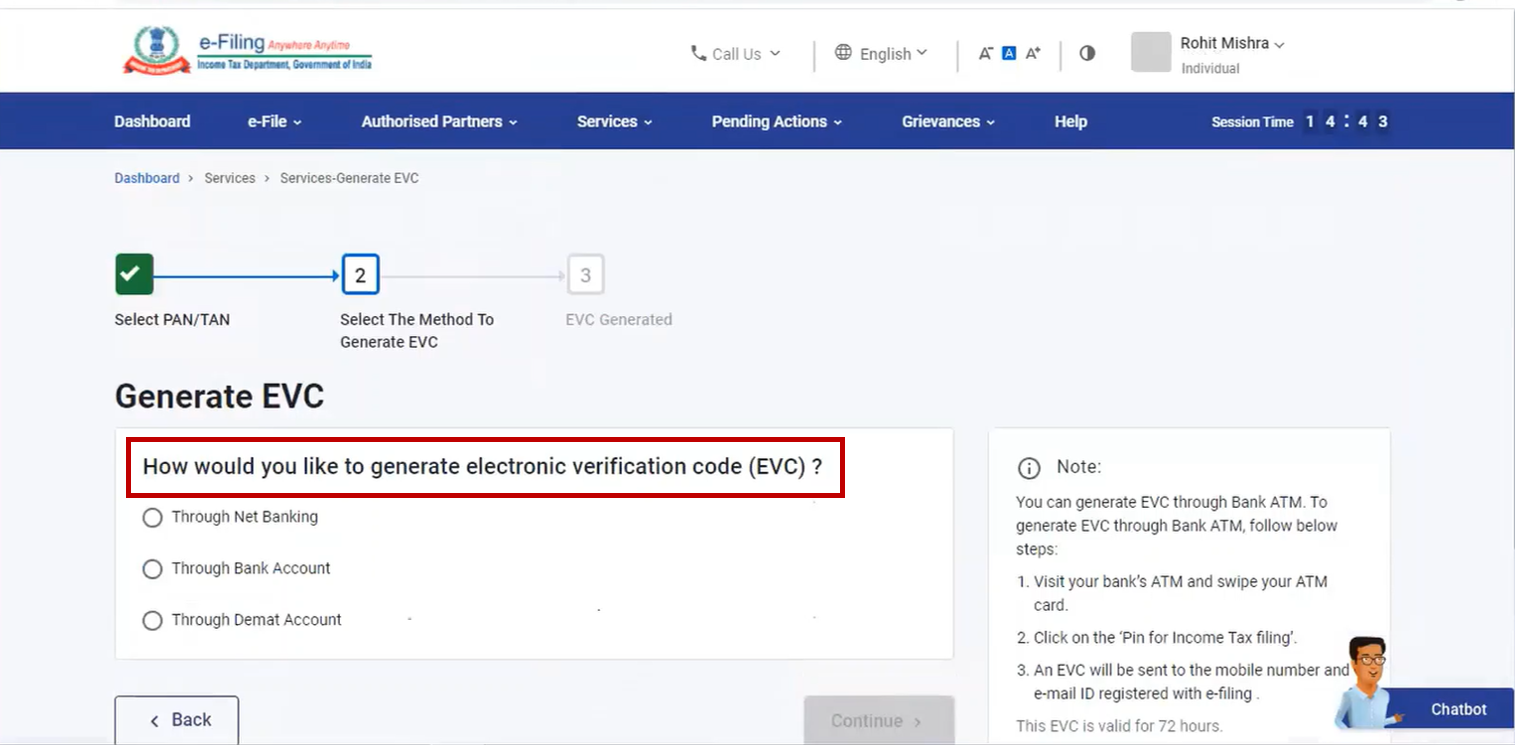

Step 4: On the Generate EVC page, select How would you like to generate electronic verification code (EVC)?

You can generate EVC using the following methods:

| Net Banking | Refer to Section 4.1 |

| Bank Account | Refer to Section 4.2 |

| Demat Account | Refer to Section 4.3 |

| Bank ATM | Refer to Section 4.4 |

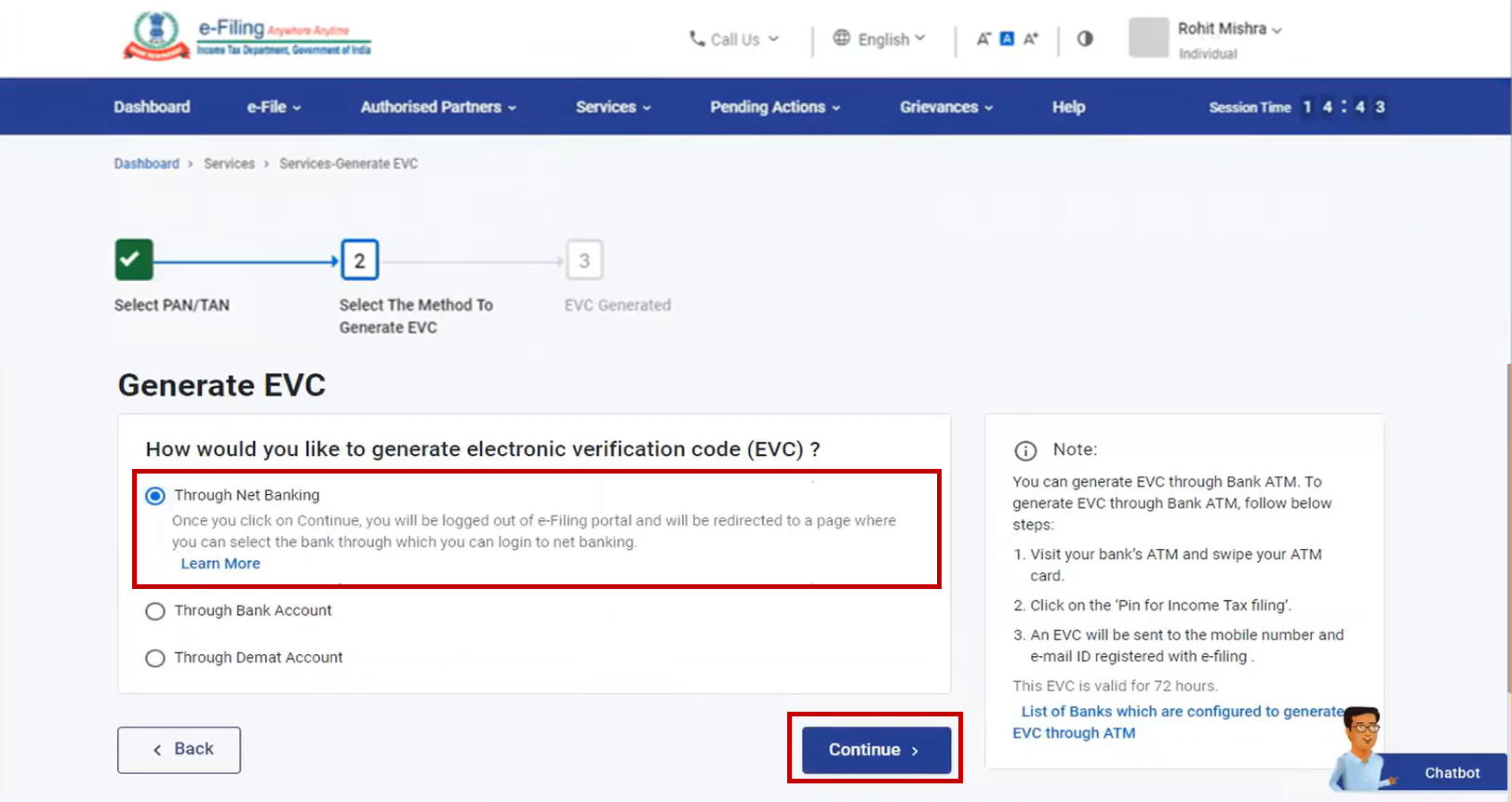

4.1 Generating EVC through Net Banking

Step 1: On the Generate EVC page, select Through Net Banking and click Continue.

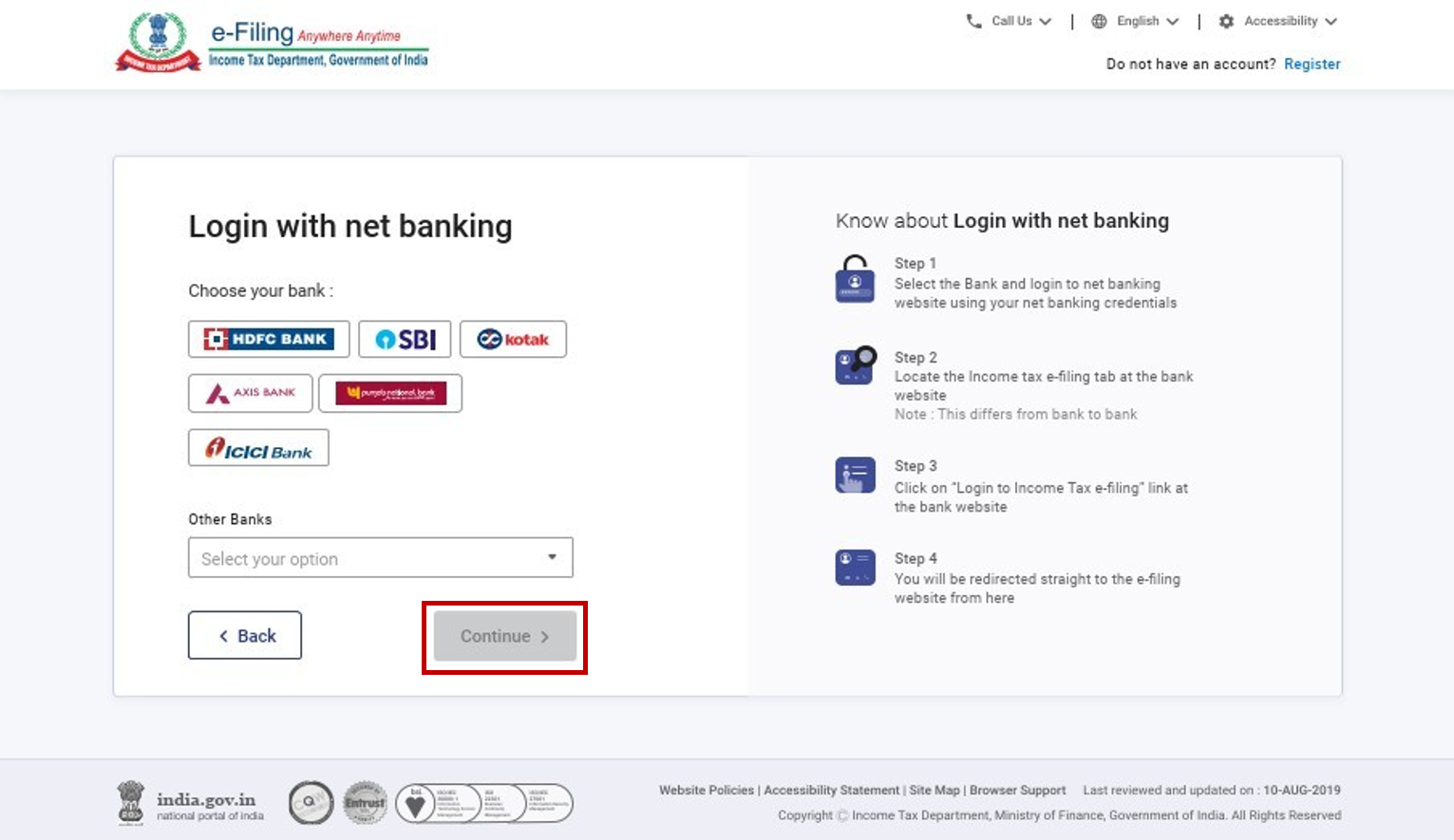

Step 2: On the e-Filing login Through Net Banking page, select the Bank Name.

Note: You will be logged out of the e-Filing portal when your bank's Net Banking login page appears.

Step 3: On your bank's Net Banking Login page, enter your Username as provided by your bank and Password.

Step 4: On your Net Banking website, click on the link to log in to the e-Filing portal.

Note: You will be logged out of your Net Banking website and logged in to your e-Filing account.

Step 5: On your Dashboard, click Services > Generate EVC.

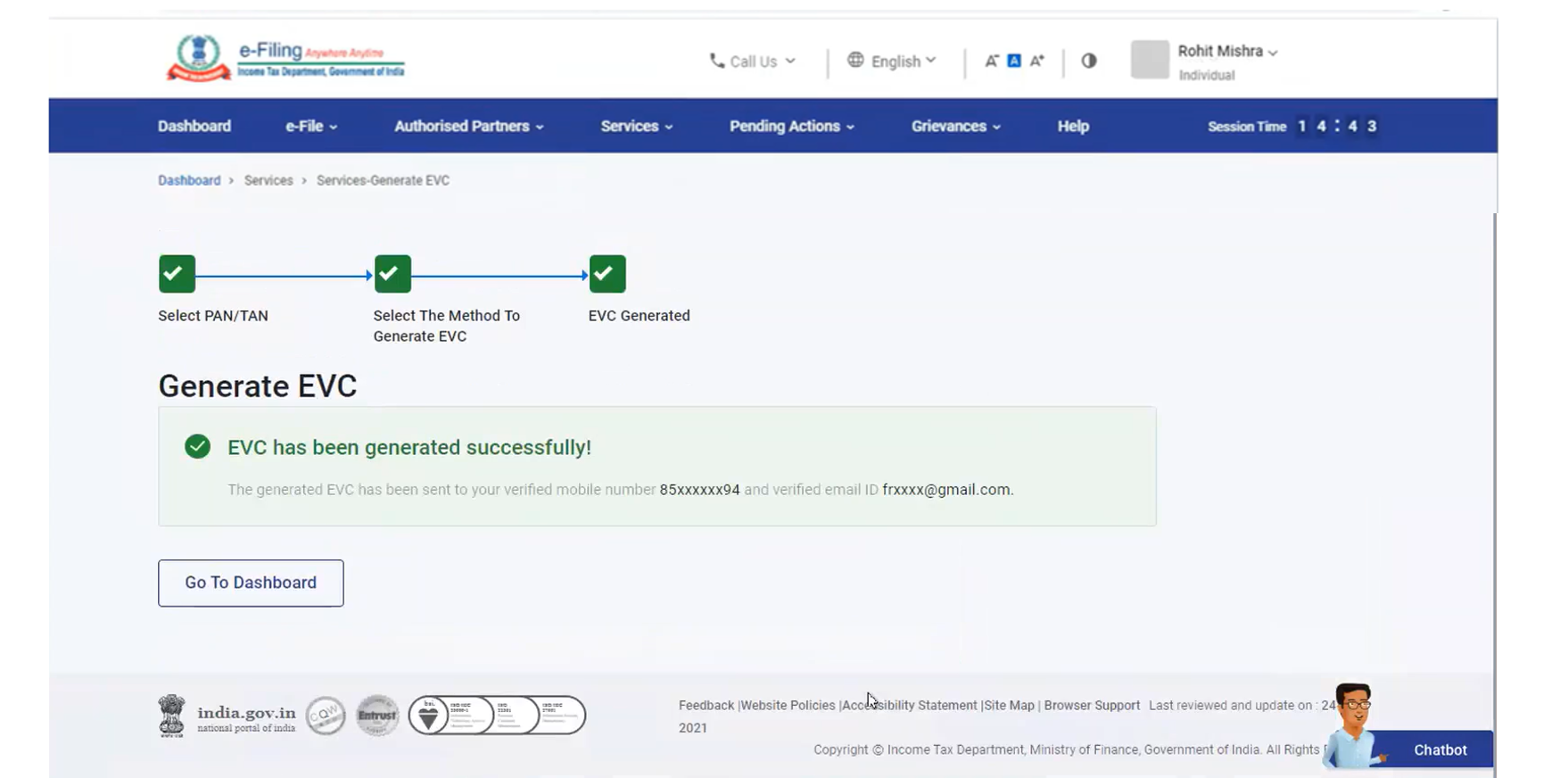

You will receive the generated EVC on your mobile number and e-mail ID registered on the e-Filing portal and success message will be displayed.

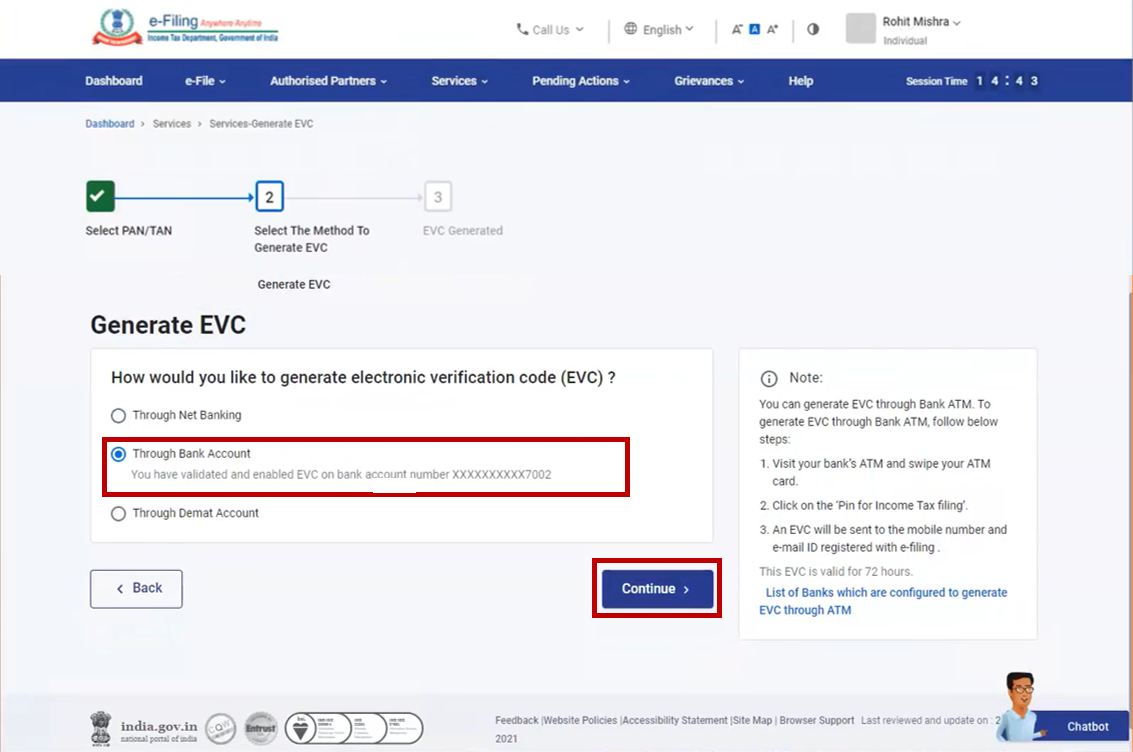

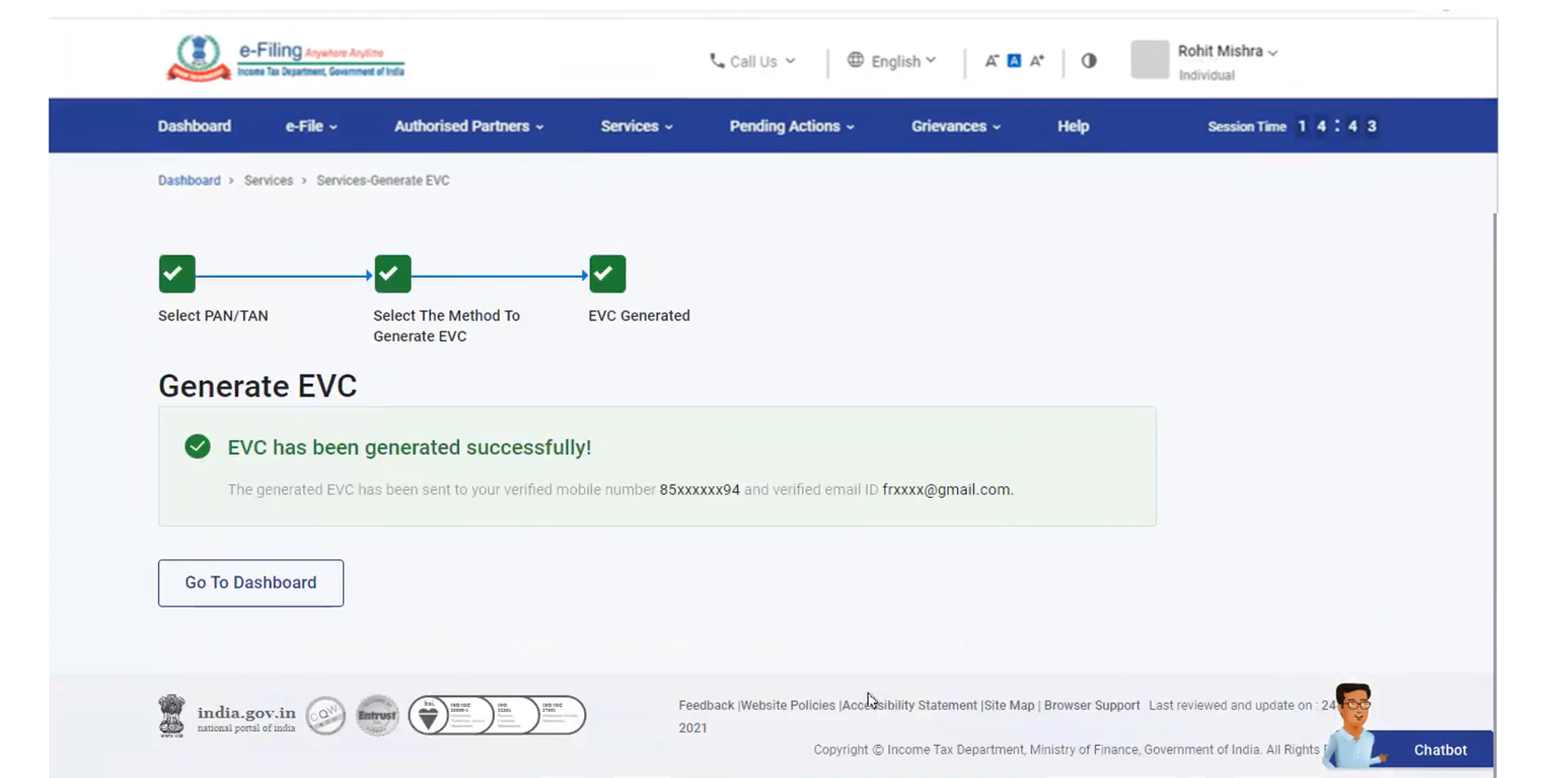

4.2. Generating EVC through Bank Account

Step 1: On the Generate EVC page, select Through Bank Account and click Continue.

A success message will be displayed, and you will receive the EVC on your mobile number and email ID verified by the bank.

Note:

- EVC through Bank Account option can be generated only if the bank account added is validated and EVC enabled.

- You will receive the EVC on your mobile number or your email ID only if and verified by the bank.

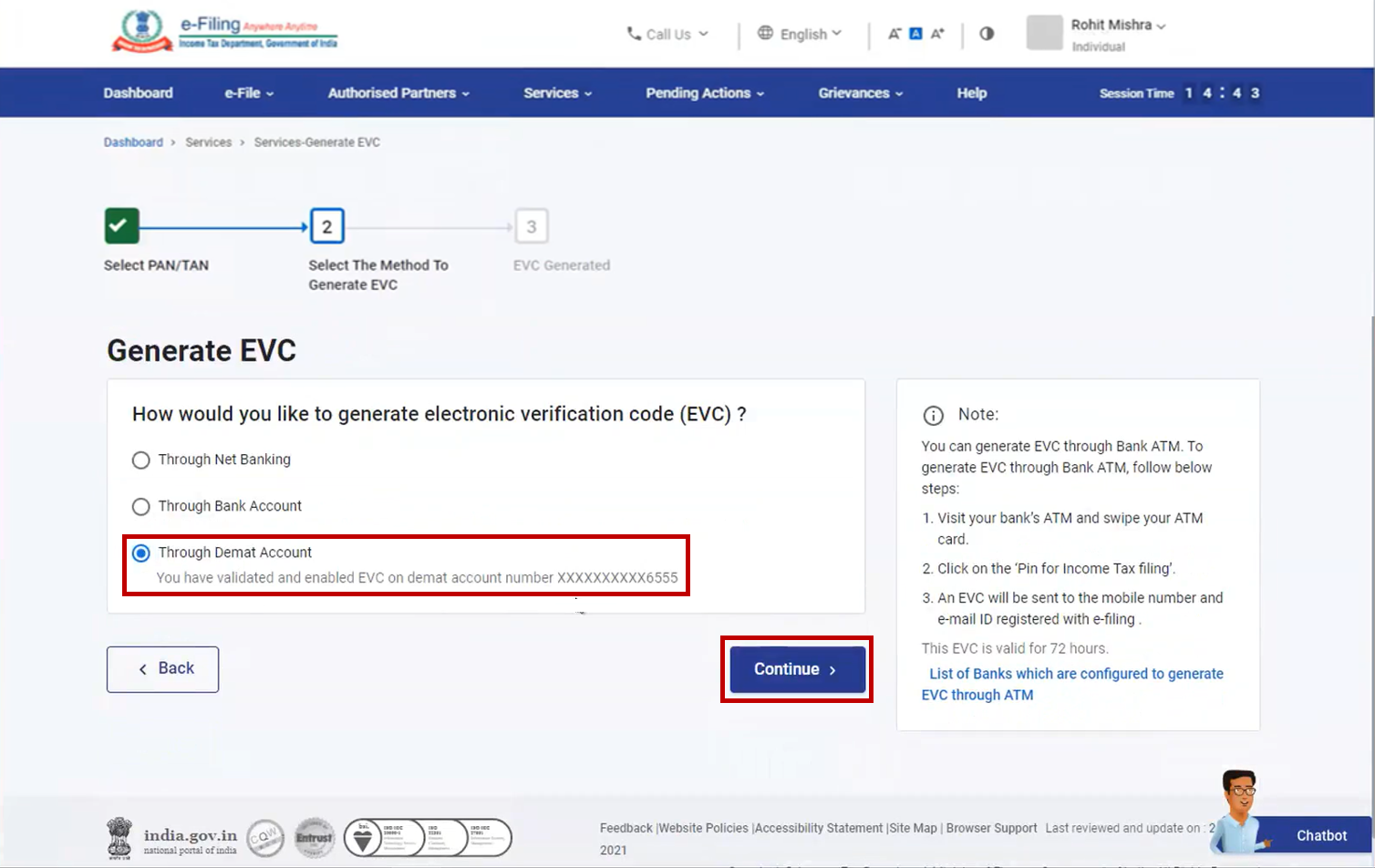

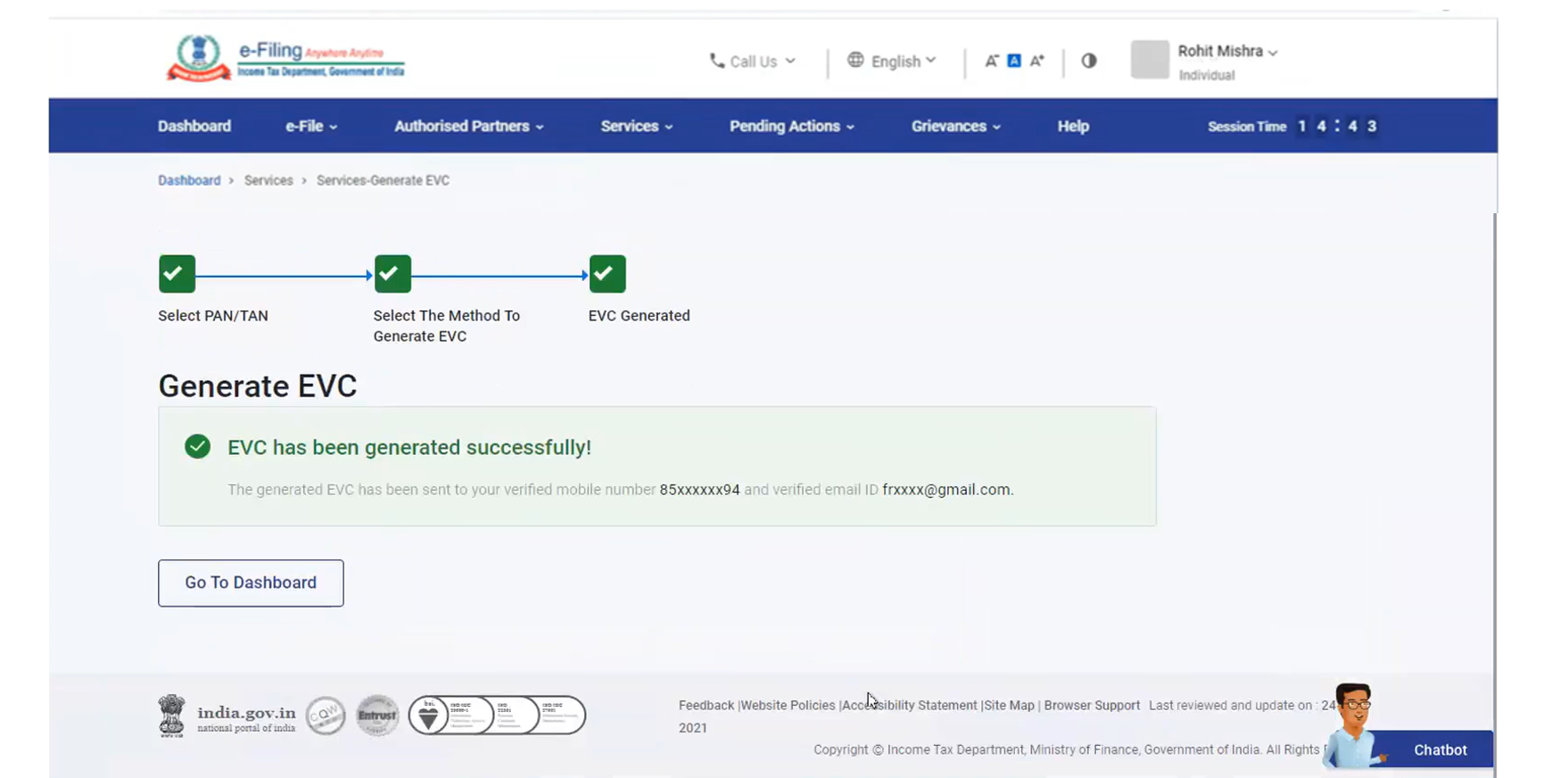

4.3. Generating EVC through Demat Account

Step 1: On the Generate EVC page, select Through Demat Account and click Continue.

A success message will be displayed, and you will receive the EVC on your mobile number and email ID verified by NSDL / CSDL.

Note:

- EVC through Demat Account option can be generated only if the demat account added is validated and EVC enabled.

- You will receive the EVC on your mobile number or your email ID only if they are verified by NSDL/CSDL.

4.4. Generating EVC through Bank ATM option (Offline method)

Step 1: Visit your nearest bank ATM and swipe your debit card.

Step 2: Enter PIN.

Step 3: Select Generate EVC for Income tax Filing.

An EVC will be sent to your mobile number and email ID registered with the e-Filing portal.

Note:

- You must have linked the PAN with your respective bank account and the same PAN should be registered with e-Filing portal.

- List of Banks through which you can generate EVC through Bank ATM option - Axis Bank Ltd, Canara Bank, Central Bank of India, ICICI Bank, IDBI Bank, Kotak Mahindra Bank and State Bank of India.