1. Overview

The Rectification Request service is available to:

- All taxpayers registered on the e-Filing portal

- Registered ERI Users / Registered Authorized Signatories / Registered Representative Assessees (applicable only if the taxpayer wants to engage one)

This service is available only after logging in to the e-Filing portal. It allows you to rectify any mistake apparent from record in the intimation sent or order passed by CPC for processed returns.

2. Prerequisites for availing this service

- Registered user on the e-Filing portal with valid user ID and password

- For registered taxpayers (or Authorized Signatory / Representative Assessee on behalf of the taxpayer):

- Received an intimation u/s 143(1) of the Income Tax Act, 1961 or u/s 16(1) of the Wealth Tax Act from CPC, Bengaluru

- Add ERI using the My ERI service (applicable only if the taxpayer wants to engage an ERI)

- For registered ERI users:

- Add the taxpayer as a client using the Add Client service

- ERI status is Active

- Both registered taxpayers and registered ERI users:

- Register valid DSC in e-Filing (not expired) to exercise Using Digital Signature Certificate (DSC) option; or

- Generate EVC

3. Step-by-Step Guide

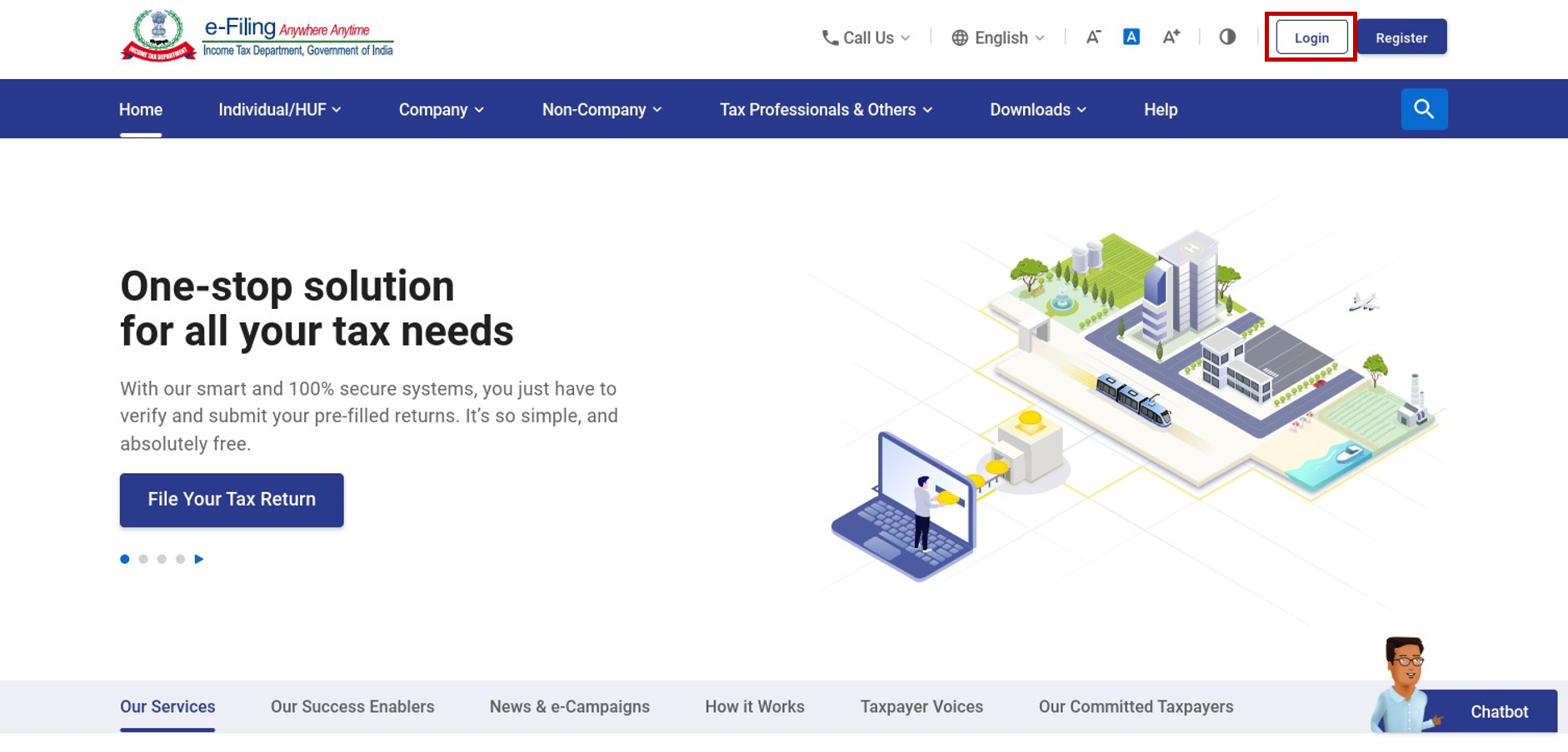

Step 1: Log in to the e-Filing portal using your valid user ID and password.

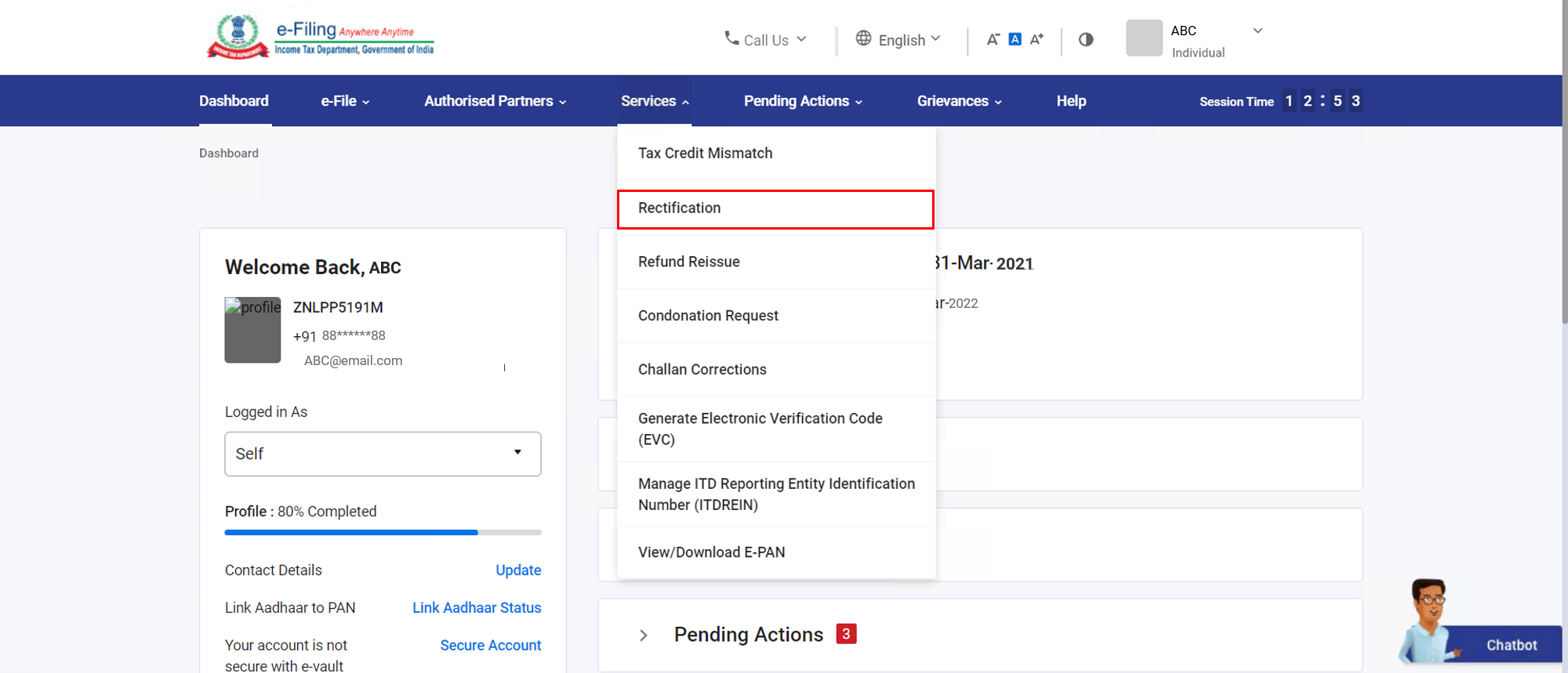

Step 2: Click Services > Rectification.

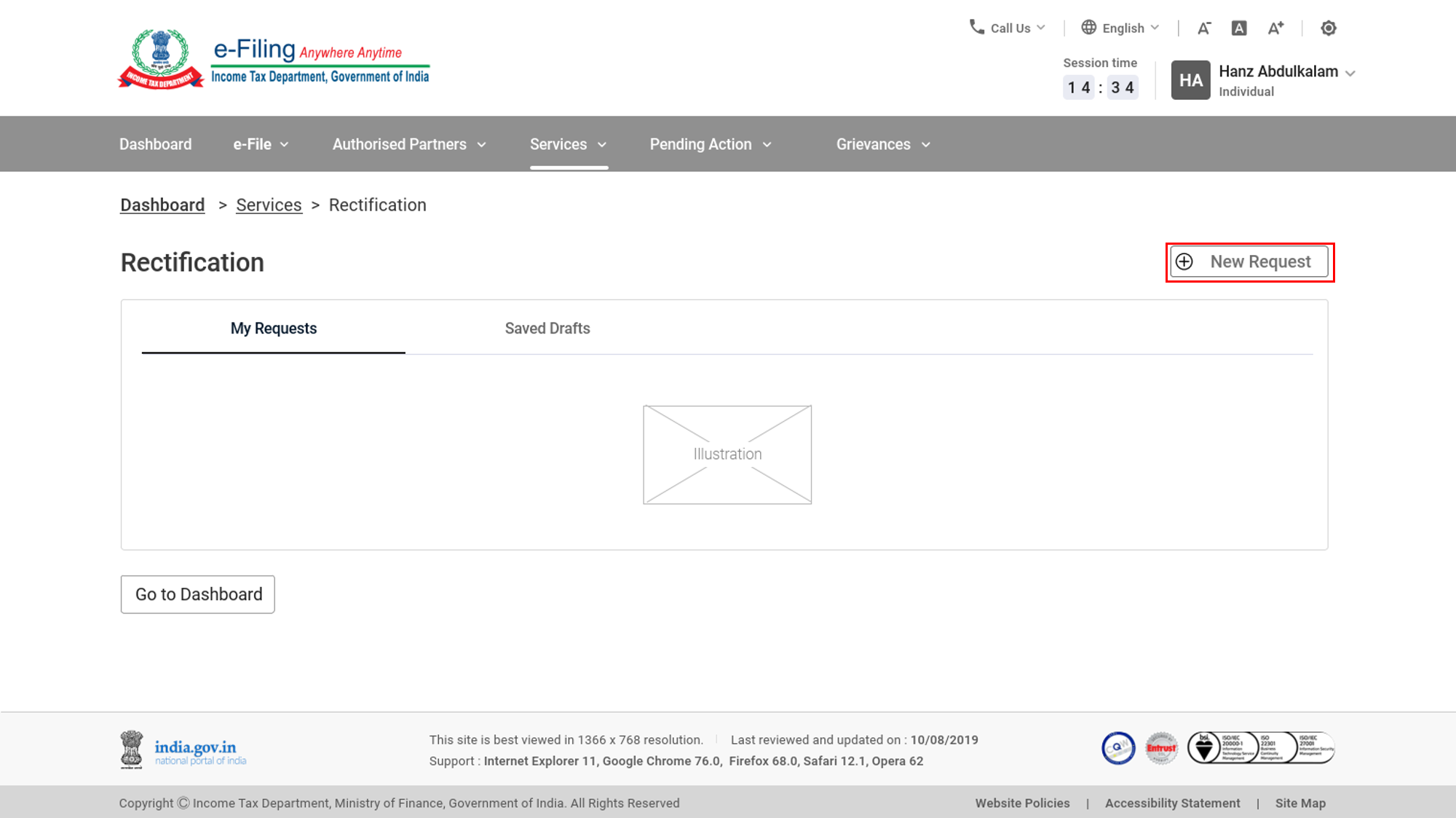

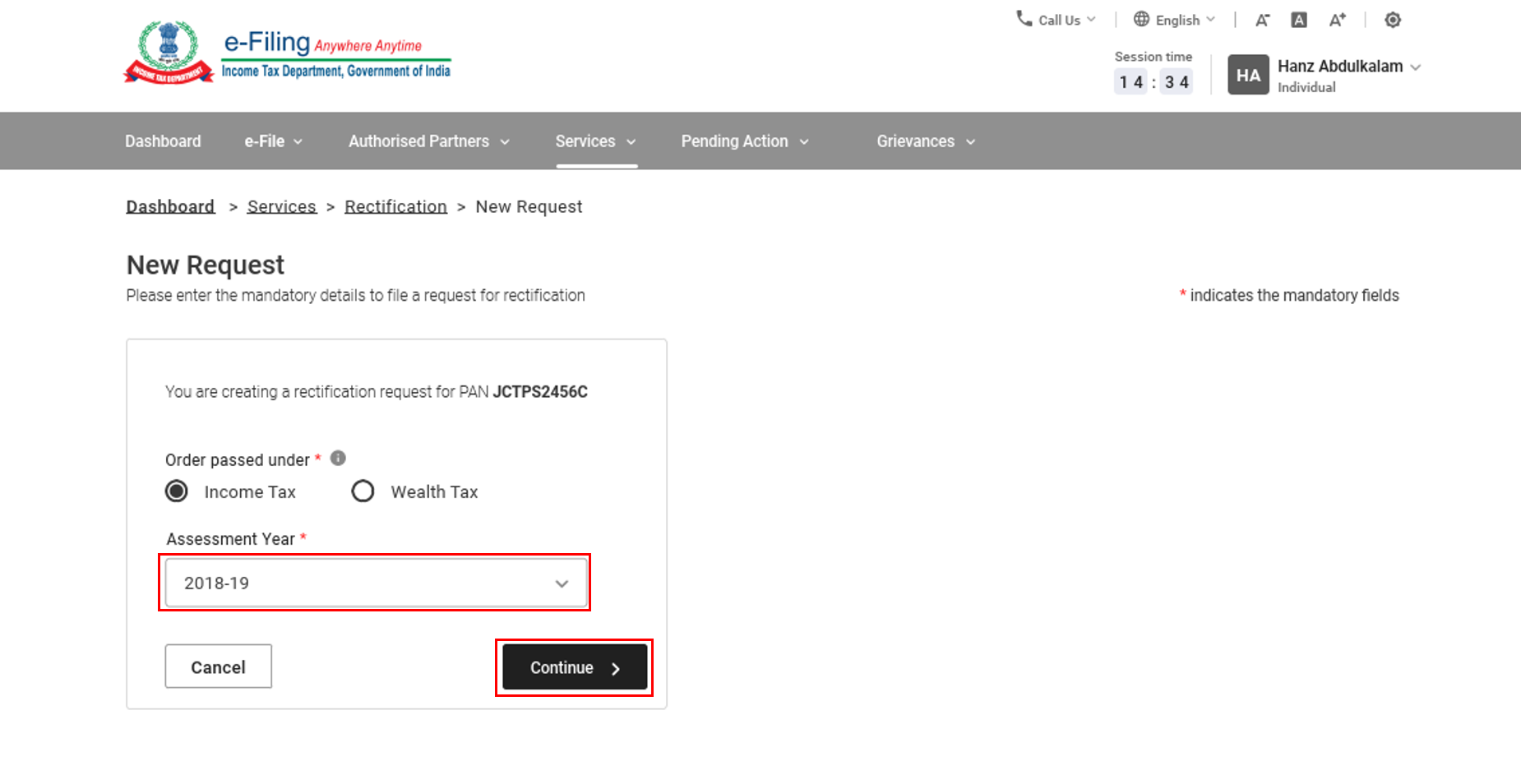

Step 3: On the Rectification page, click New Request.

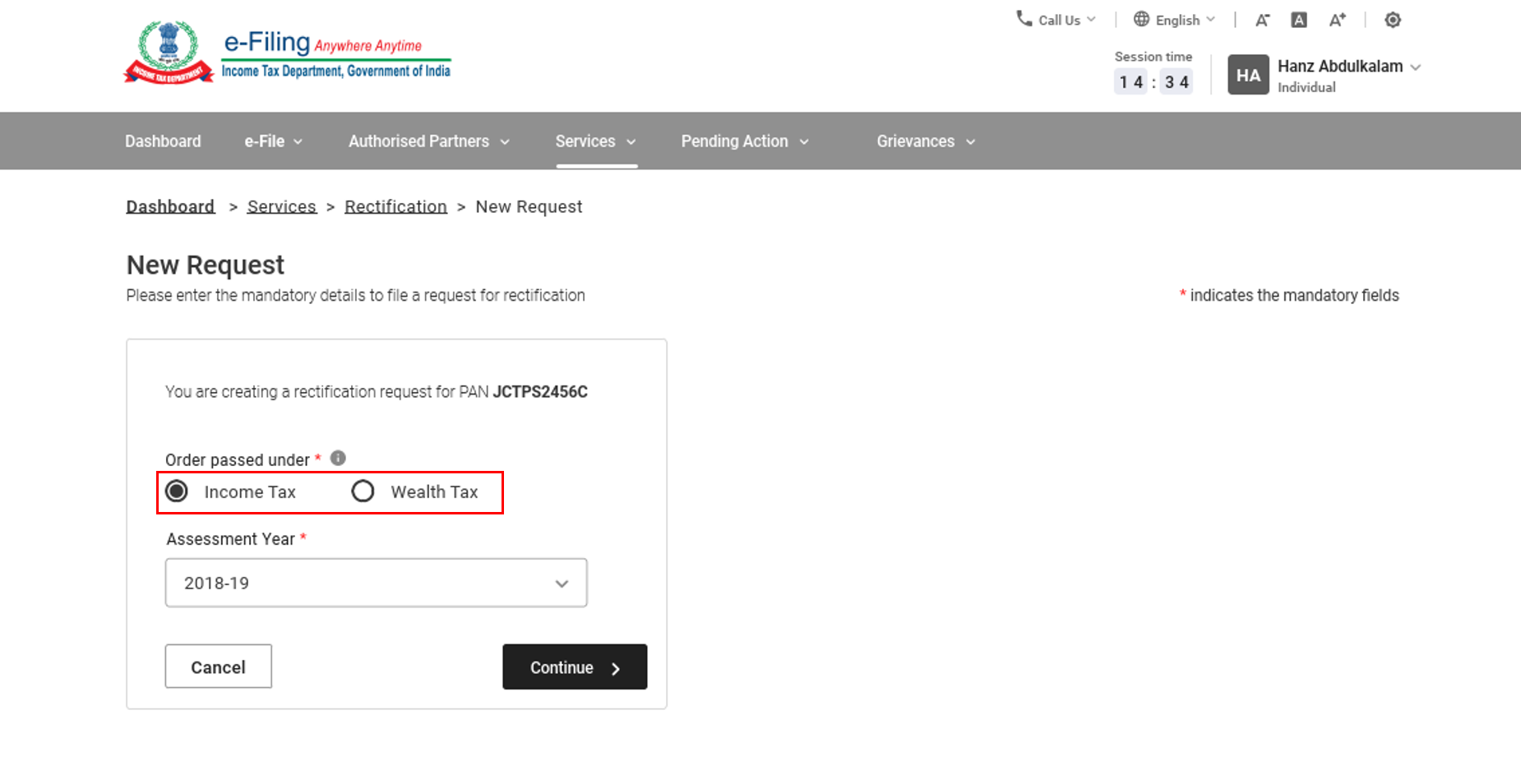

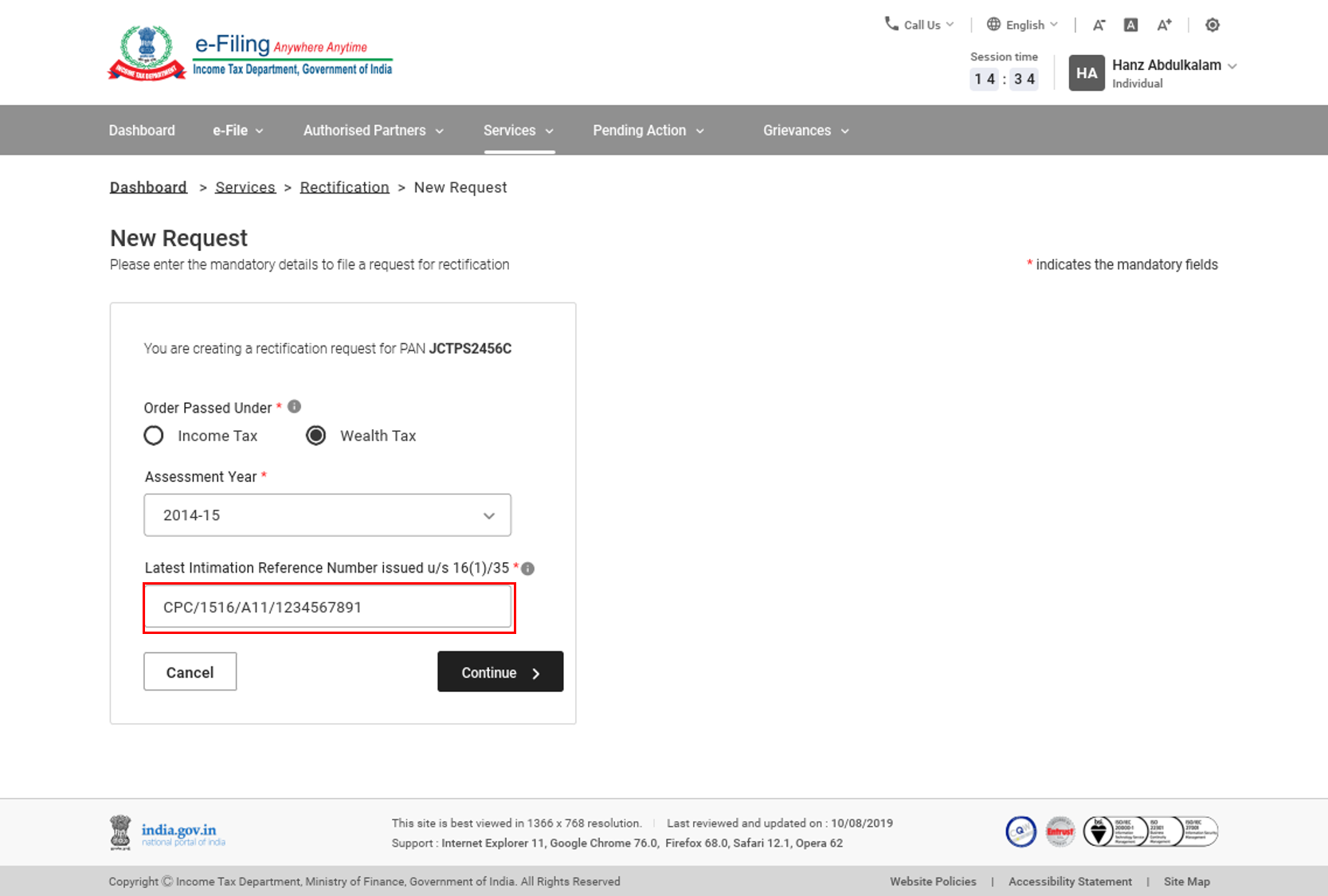

Step 4a: On the New Request page, your PAN will be auto-filled. Select Income Tax or Wealth Tax.

Step 4b: Select the Assessment Year from the dropdown. Click Continue.

Note: If you select the Wealth Tax option, you also need to enter the latest intimation reference number, and click Continue.

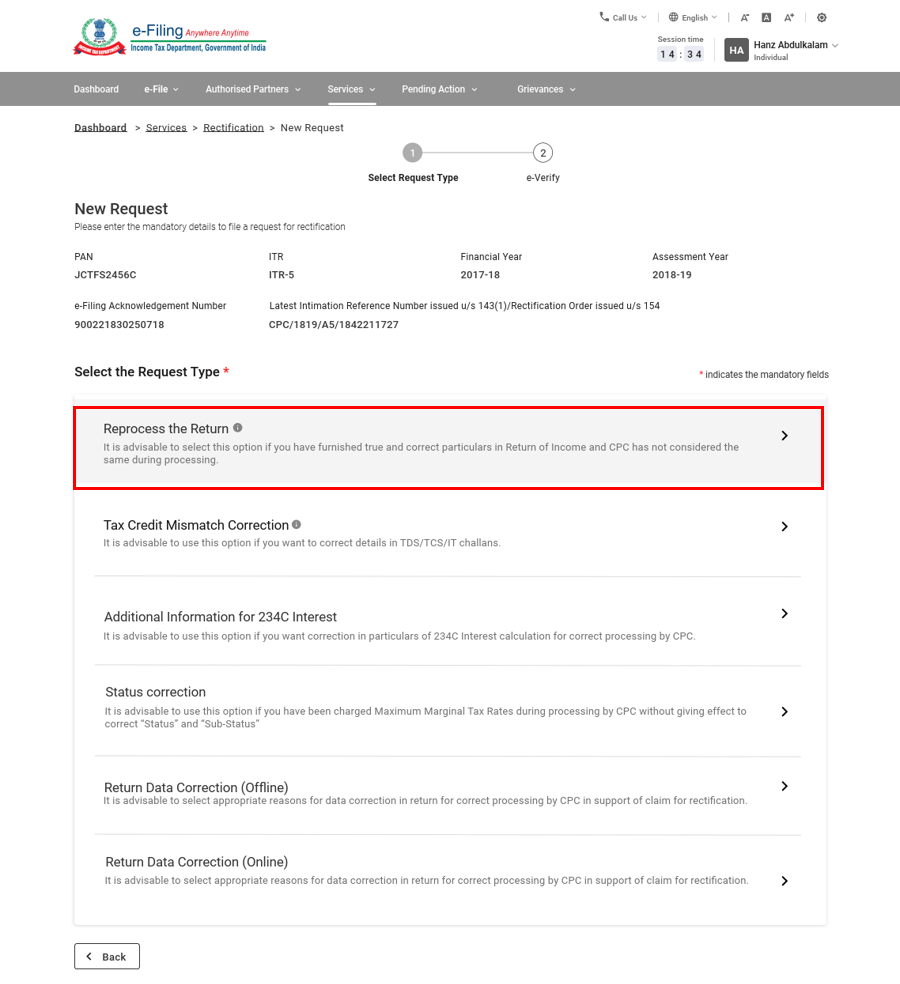

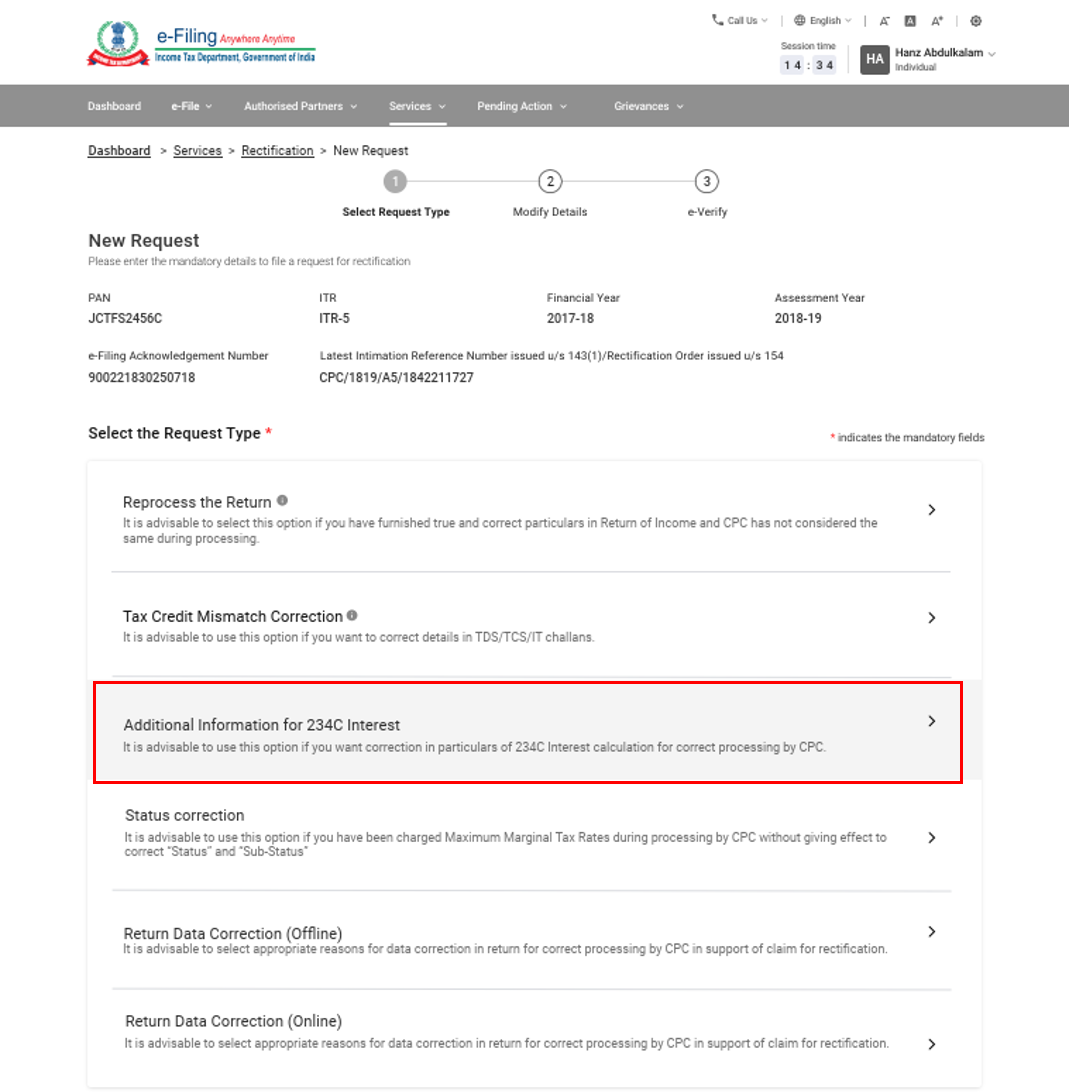

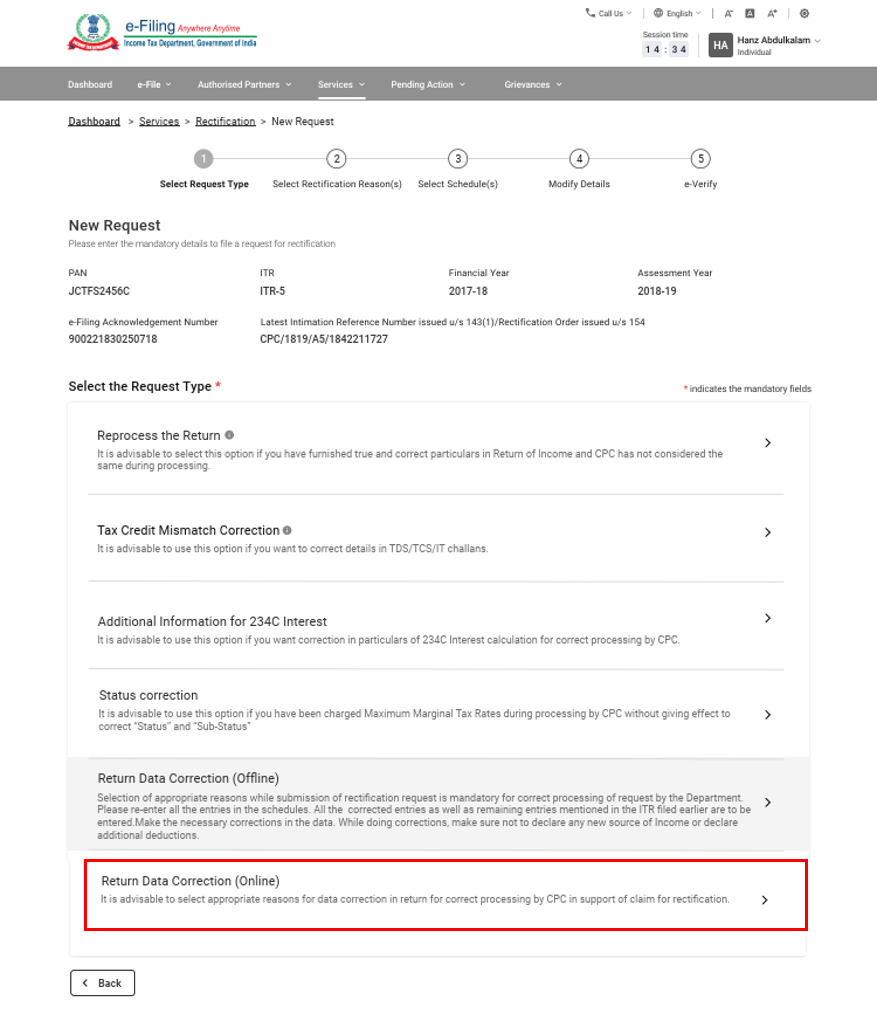

Step 5: Rectification requests have the following classification:

|

Income Tax Rectification |

Reprocess the return |

Refer to Section 5.1 |

|

Tax credit mismatch correction |

Refer to Section 5.2 |

|

|

Additional information for 234C interest |

Refer to Section 5.3 |

|

|

Status Correction |

Refer to Section 5.4 |

|

|

Exemption section correction |

Refer to Section 5.5 |

|

|

Return data correction (Offline) |

Refer to Section 5.6a |

|

|

Return data correction (Online) |

Refer to Section 5.6b |

|

|

Wealth Tax Rectification |

Reprocess the Return |

Refer to Section 5.7 |

|

Tax Credit Mismatch Correction |

Refer to Section 5.8 |

|

|

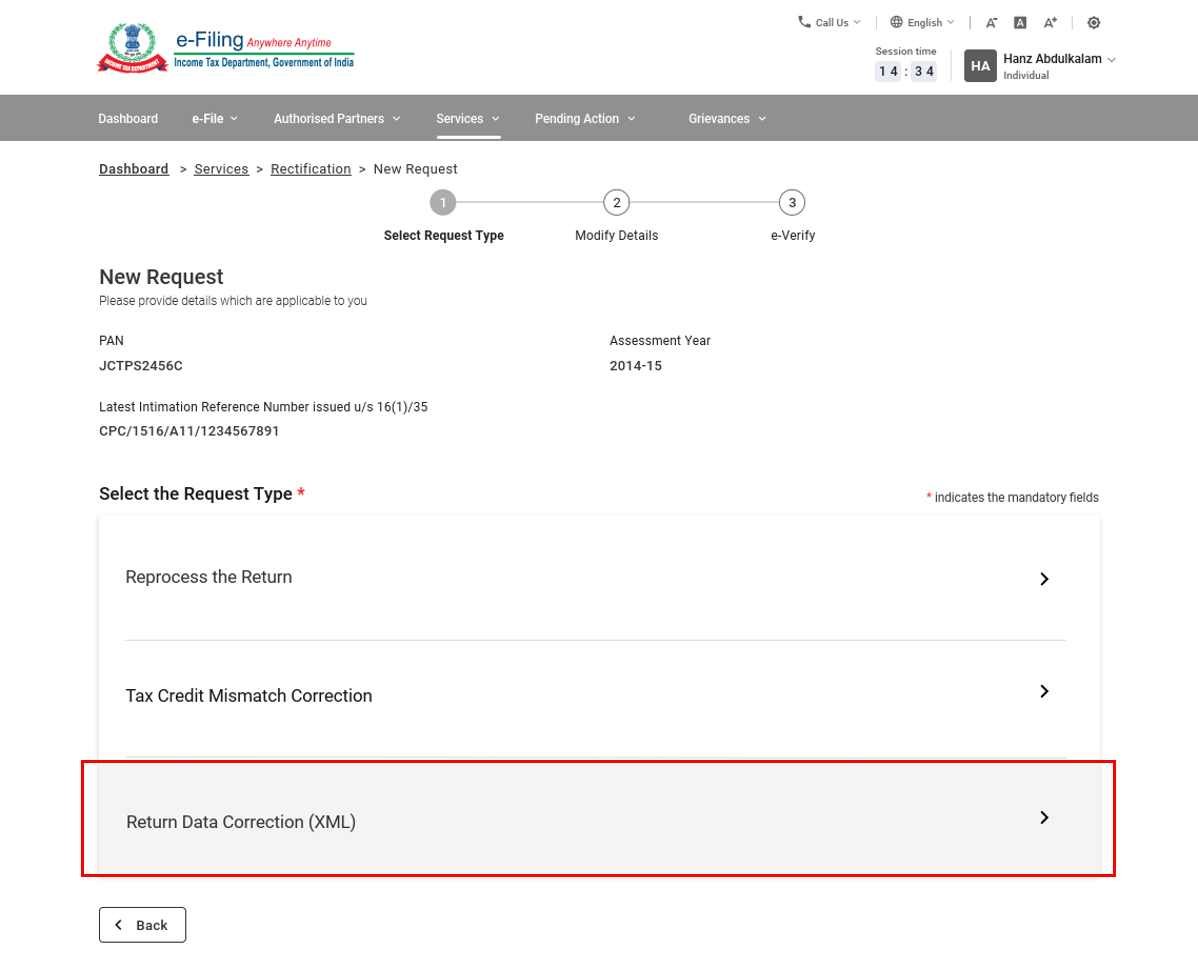

Return Data Correction (XML) |

Refer to Section 5.9 |

Note: Rectification of Wealth Tax Return can be filed using this service for AY 2014-15 and AY 2015-16 only.

Income Tax Rectification Request

5.1 Income Tax Rectification: Reprocess the Return

Step 1: Select the request type as Reprocess the Return.

Step 2: With this option, you just need to submit the rectification request - Click Continue to submit the request.

Step 3: On submission of your request, you will be taken to the e-Verification page.

Note: Refer to the How to e-Verify user manual to learn more.

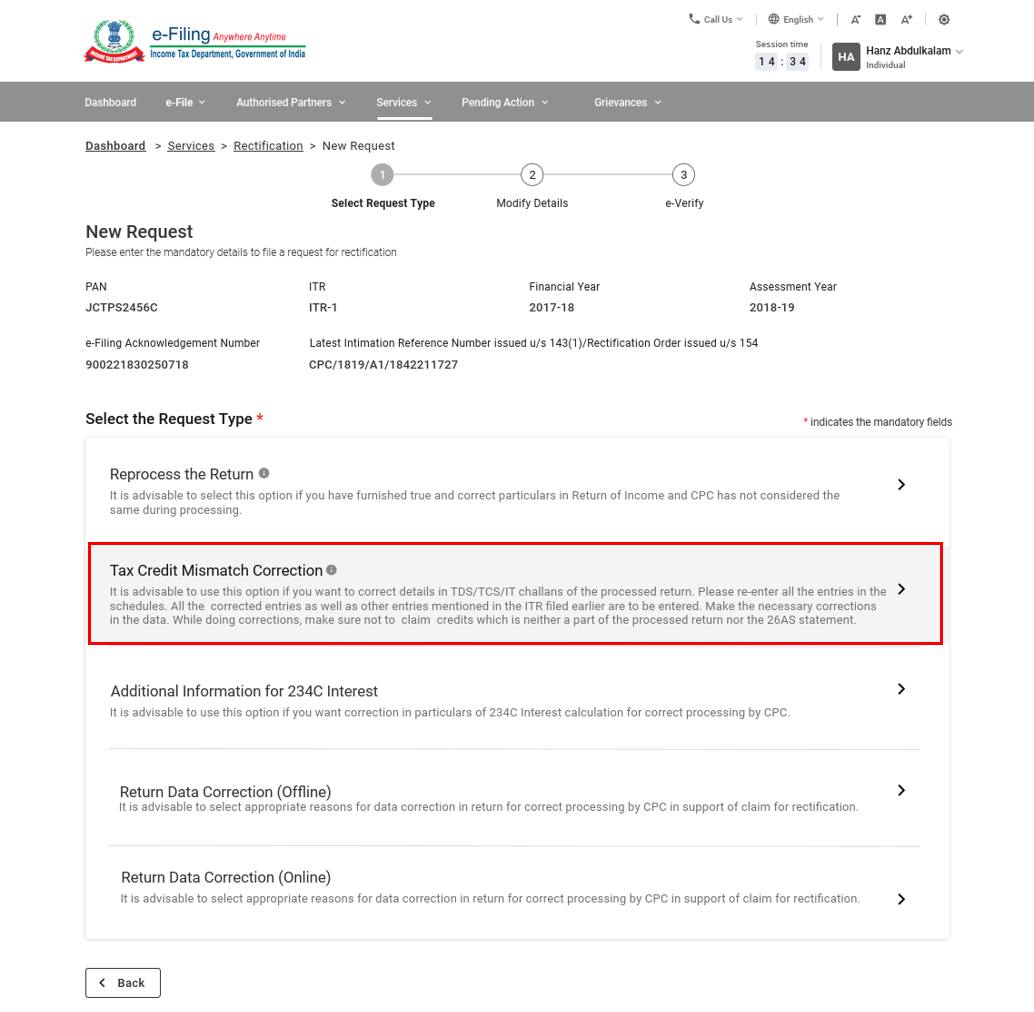

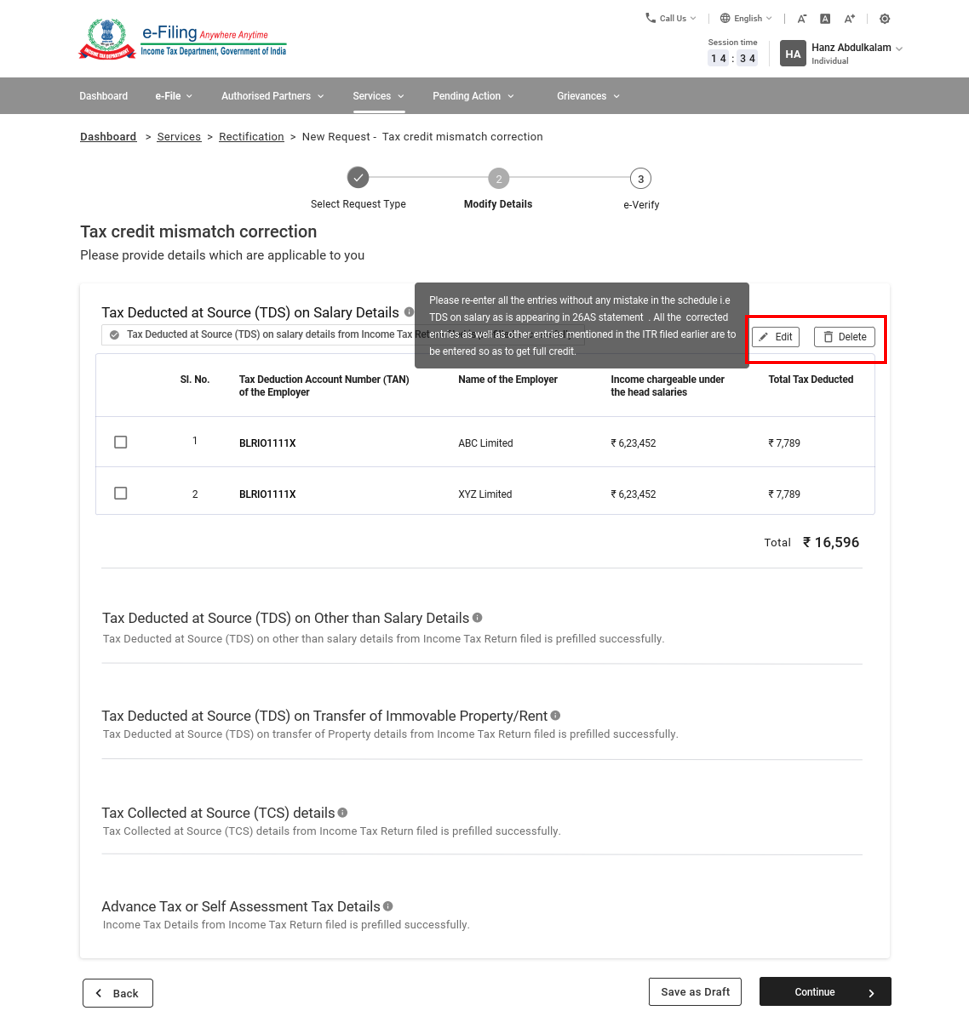

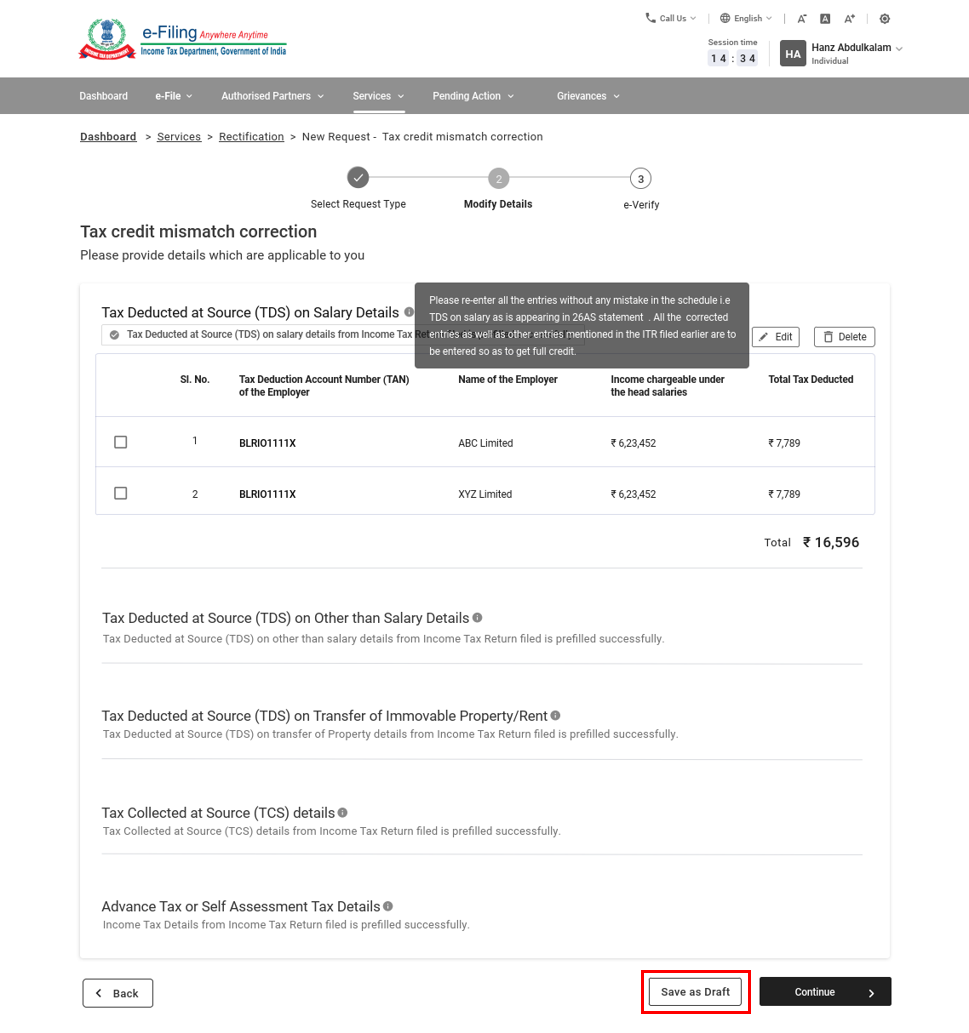

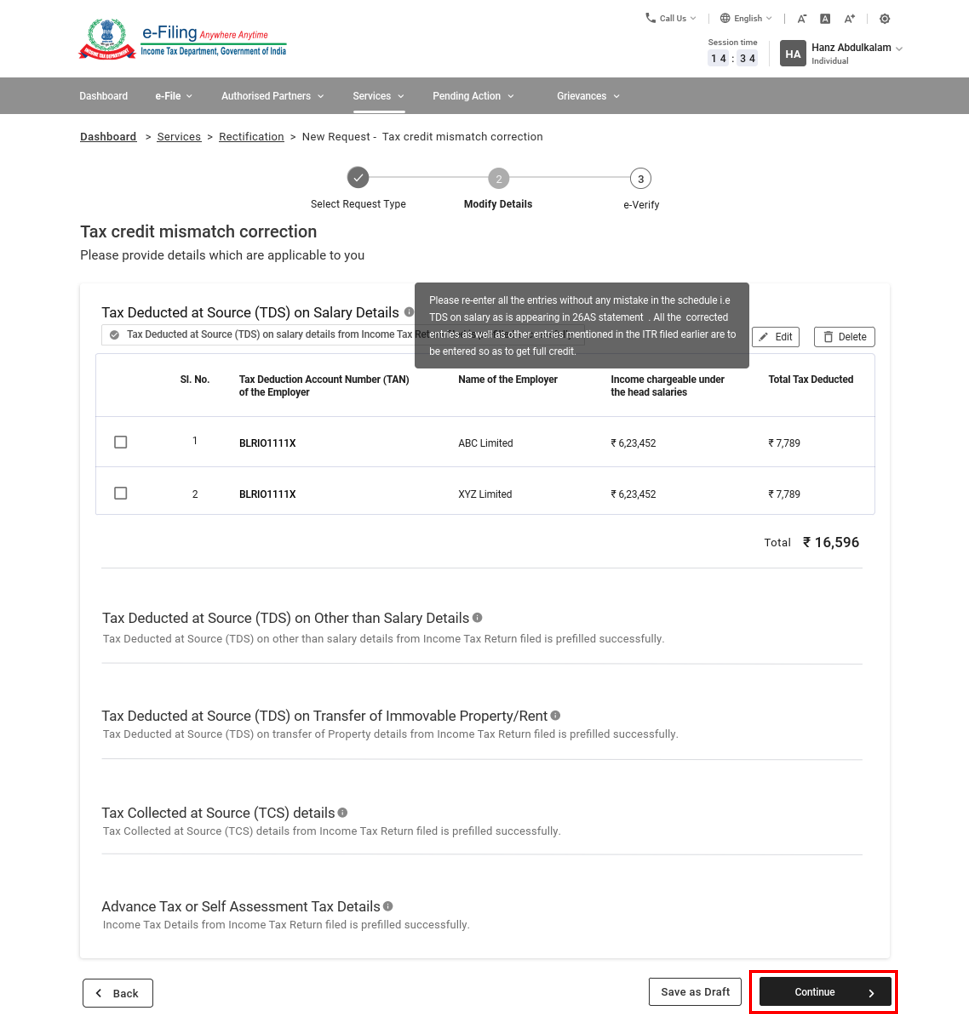

5.2: Income Tax Rectification: Tax Credit Mismatch Correction

Step 1: Select the request type as Tax Credit Mismatch Correction.

Step 2: The schedules under this request type are auto-populated based on the records available in the corresponding processed return. If you need to edit or delete a schedule, select the schedule, then click Edit or Delete.

Step 3: Enter the details under the following schedules: Tax Deducted at Source (TDS) on Salary Details, Tax Deducted at Source (TDS) on Other than Salary Details, Tax Deducted at Source (TDS) on Transfer of Immovable Property/Rent, Tax Collected at Source (TCS), Advance Tax or Self Assessment Tax Details. Click Save as Draft.

Step 4: Click Continue to submit the request.

Step 5: On submission, you will be taken to the e-Verification page.

Note: Refer to the How to e-Verify user manual to learn more.

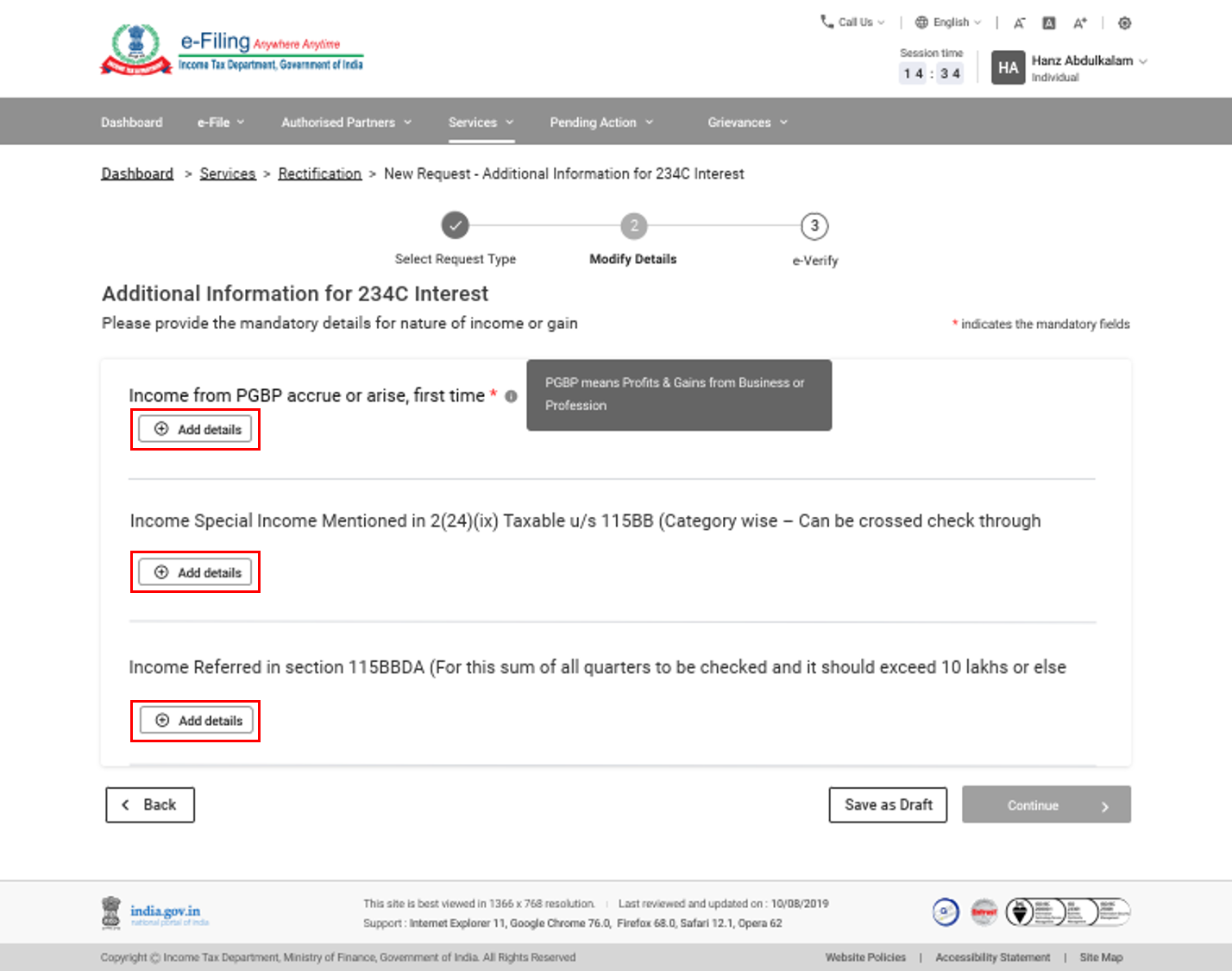

5.3 Income Tax Rectification: Additional Information for 234C Interest

Step 1: Select the request type as Additional Information for 234C Interest.

Step 2: Click Add Details on any of these records, as applicable to you:

- Income from PGBP accrue or raise, first time (Applicable for 2016-17 onwards)

- Special Income Mentioned in 2(24)(ix) Taxable u/s 115B

- Income Referred in Section 115BBDA (Applicable for 2017-18 onwards)

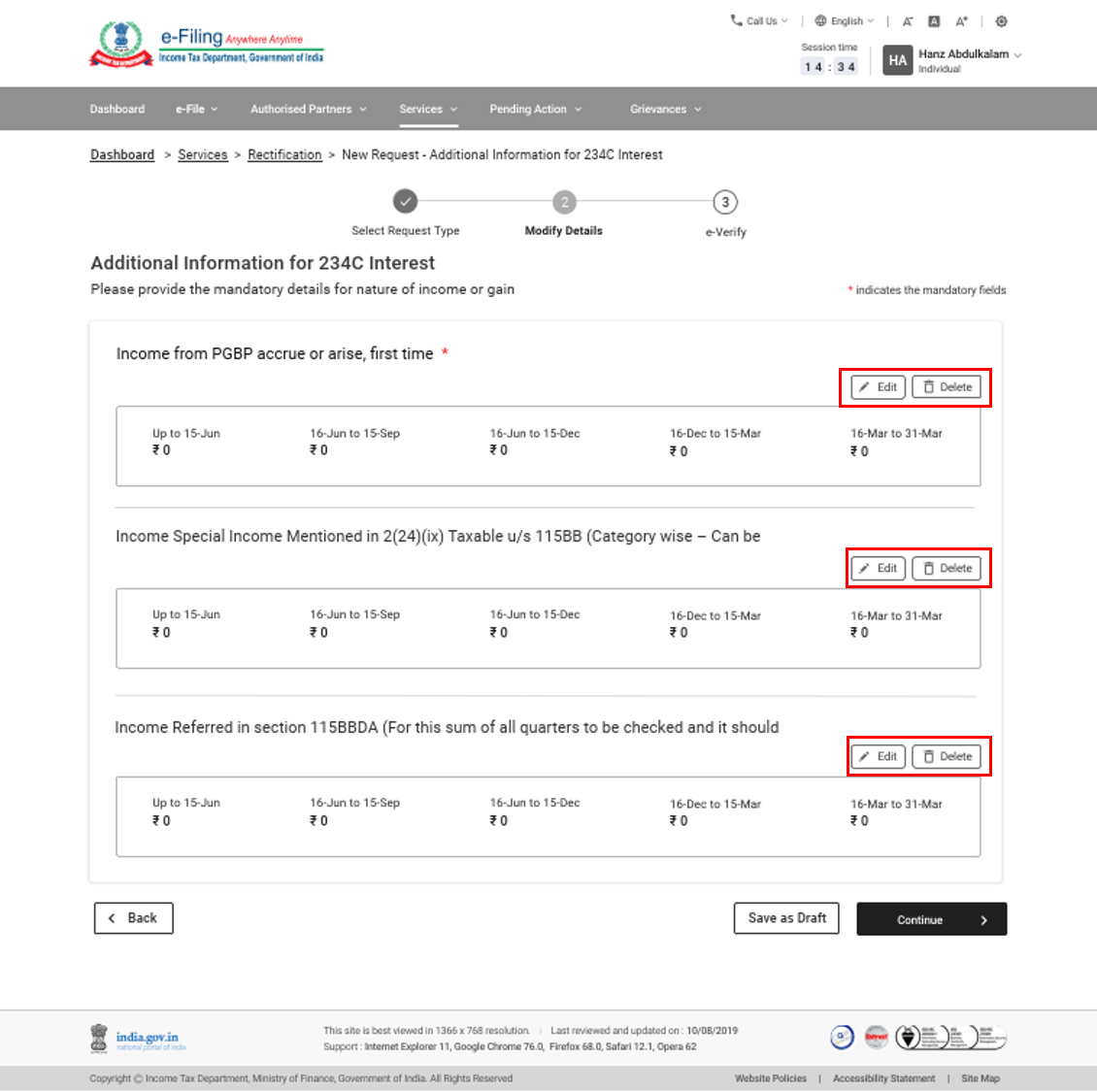

Step 3: If you need to edit or delete a completed record, click Edit or Delete.

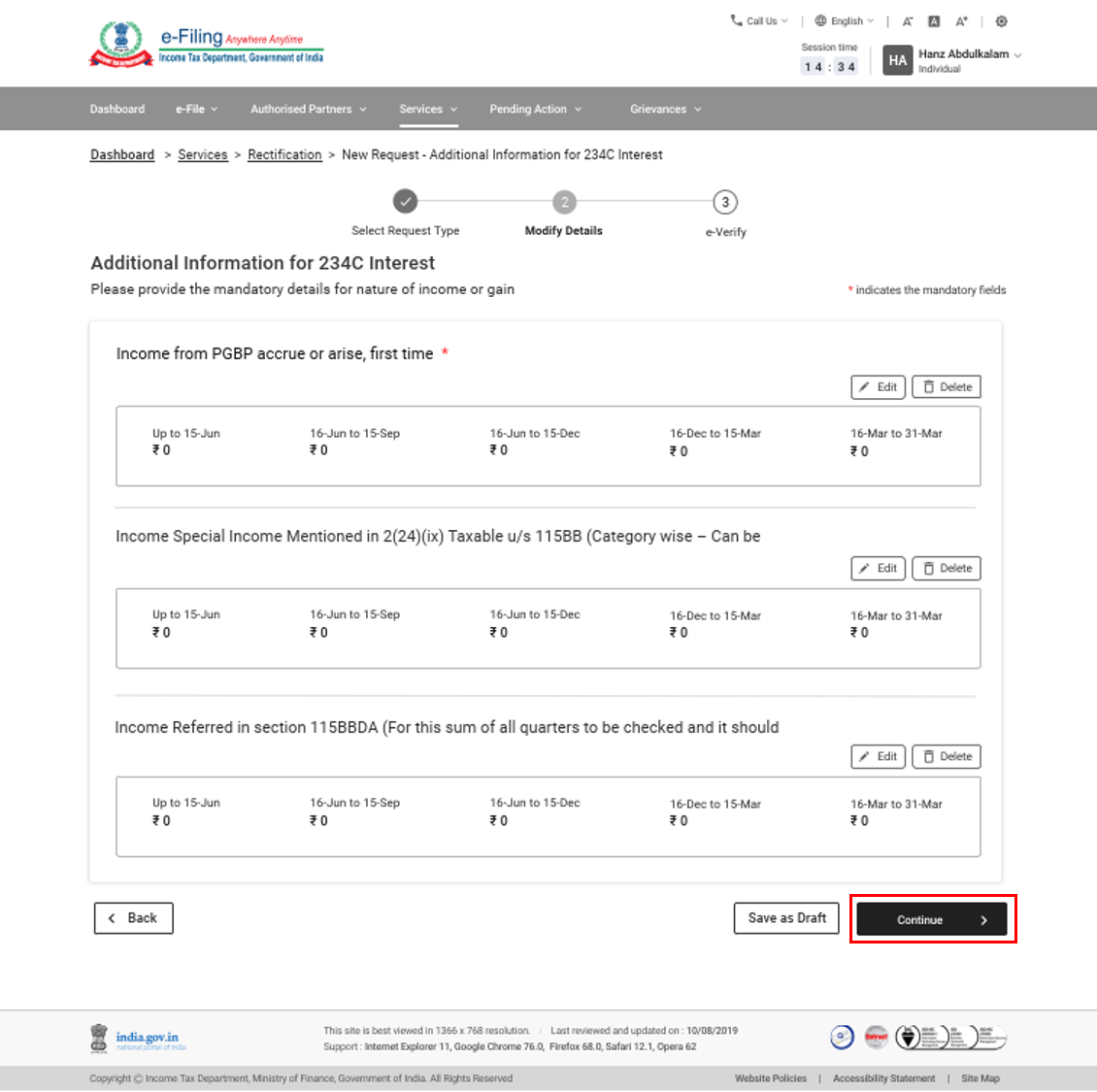

Step 4: Click Continue to submit your request.

Step 5: On submission of your request, you will be taken to the e-Verification page.

Note: Refer to the How to e-Verify user manual to learn more.

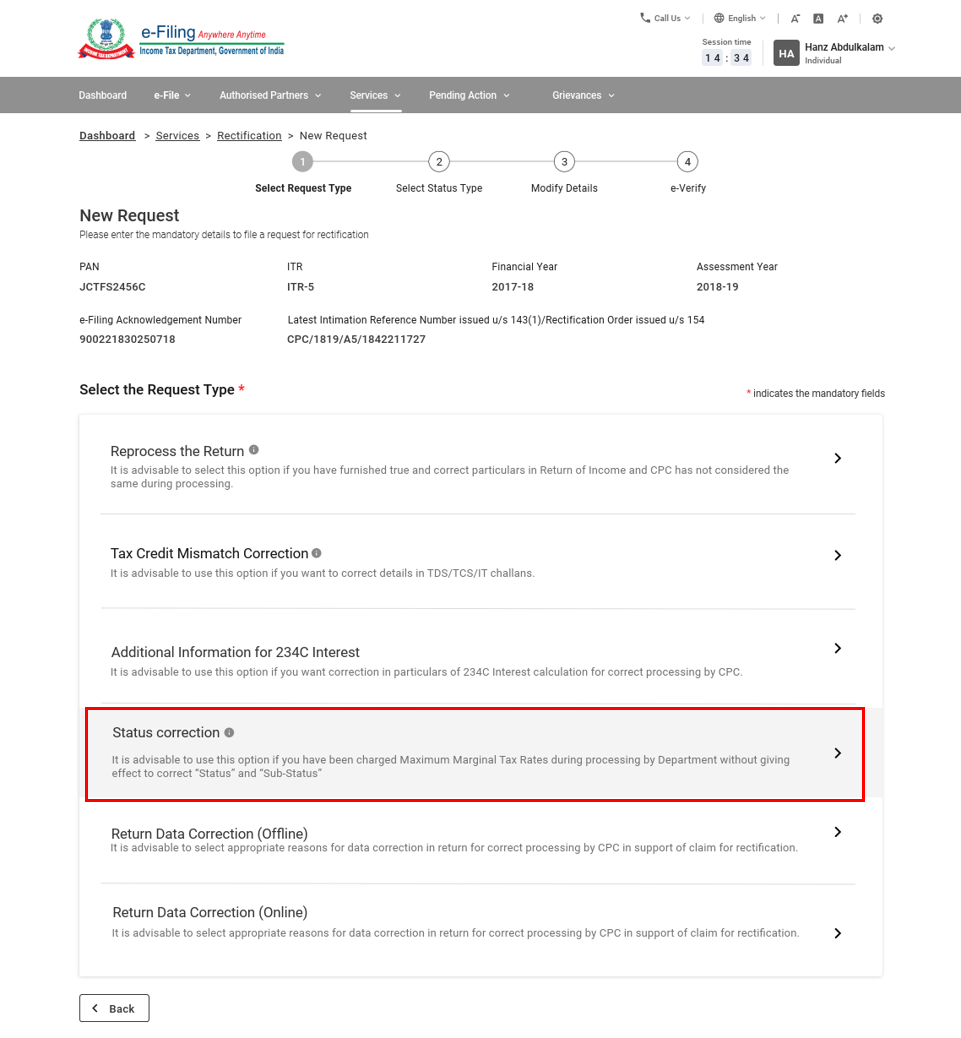

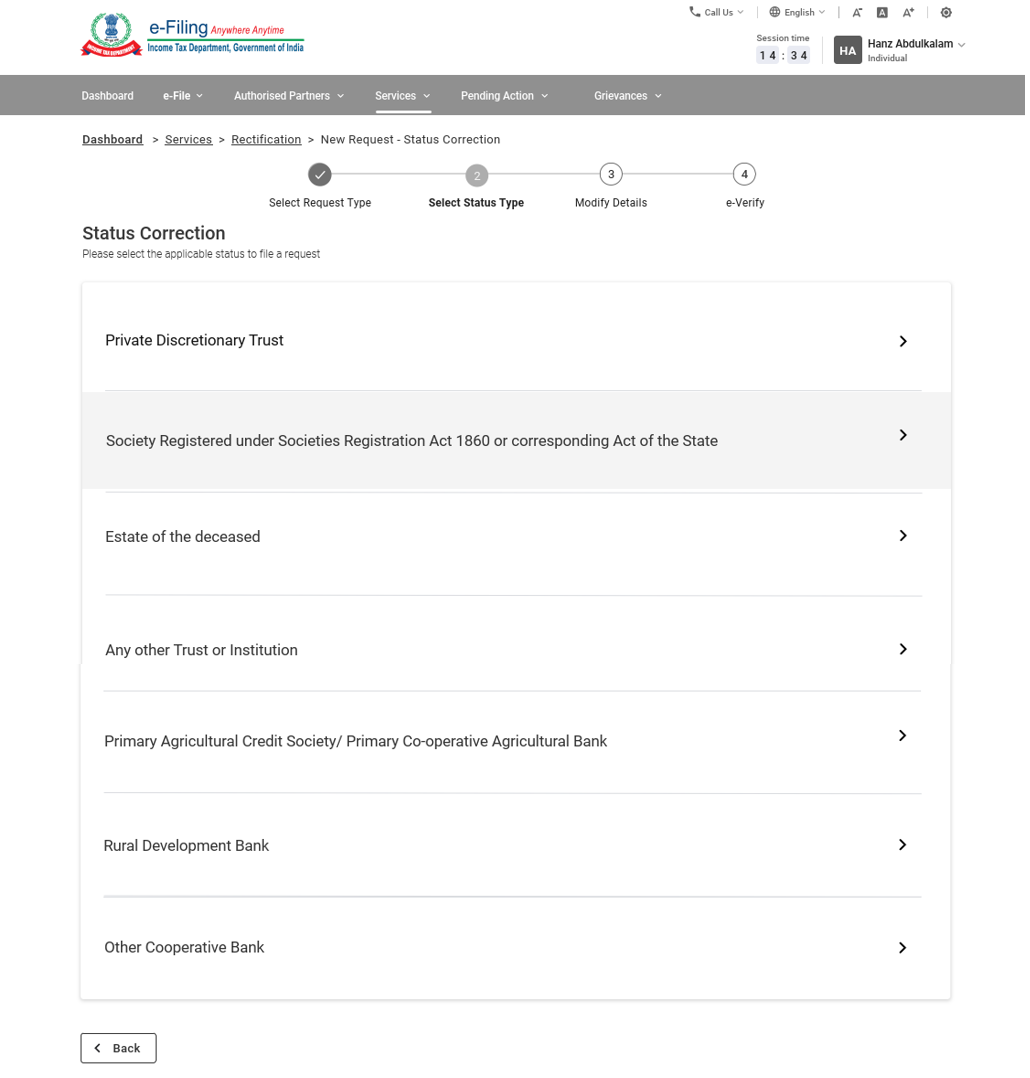

5.4 Income Tax Rectification Request: Status Correction

Step 1: Select the request type as Status Correction.

Note: Status correction is applicable only for ITR-5 and ITR-7 up to AY 2018-19.

Step 2: Select the status applicable to you from the list:

- Private Discretionary Trust

- Society Registered under Societies Registration Act 1860 or corresponding Act of the State

- Estate of the deceased

- Any other Trust or Institution

- Primary Agricultural Credit Society/ Primary Co-operative Agricultural Bank

- Rural Development Bank

- Other Cooperative Bank

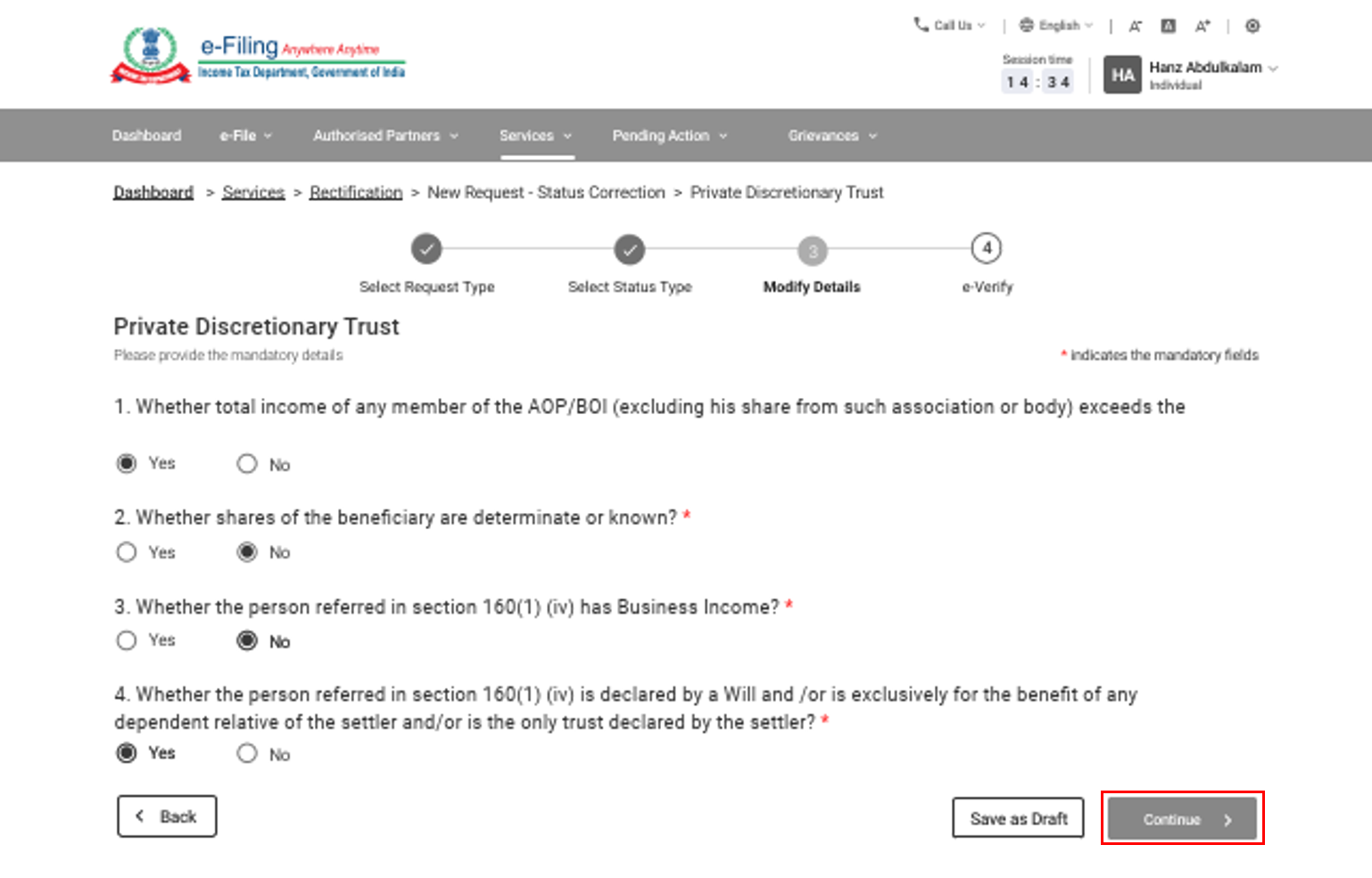

Step 3: On the Add Details page, answer the additional questions listed by selecting the Yes / No options as applicable. Click Continue.

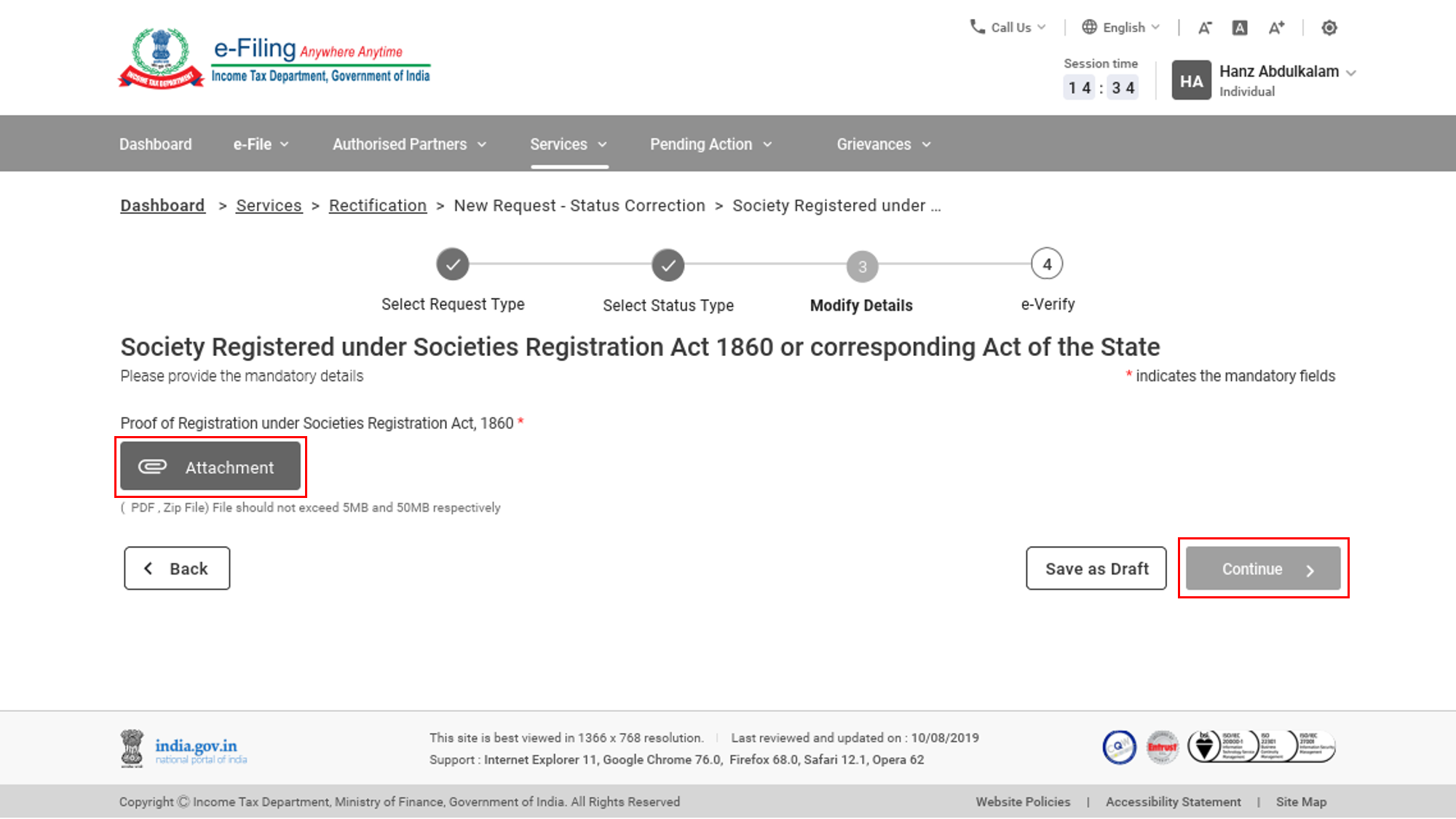

Your selected status correction may require you to upload supporting documents. On the Add Details page, click Attachment, and upload the required document(s), which should be in PDF format. Click Continue.

Note:

- The maximum size of a single attachment should be 5 MB.

- If you have multiple documents to upload, put them together in a zipped folder and upload the folder. The maximum size of all attachments in a zipped folder should be 50 MB.

Step 4: On submission of your request, you will be taken to the e-Verification page.

Note: Refer to the How to e-Verify user manual to learn more.

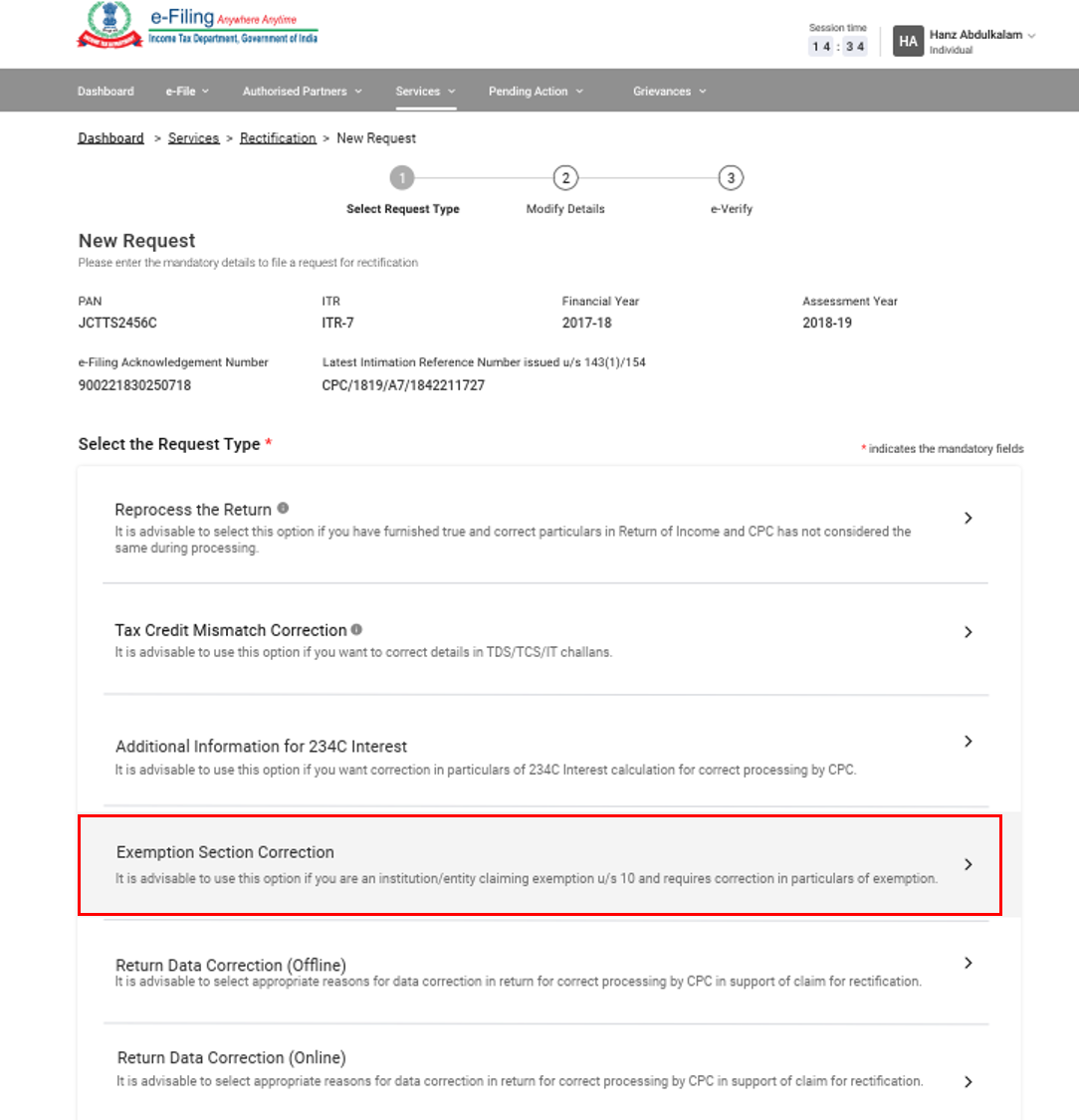

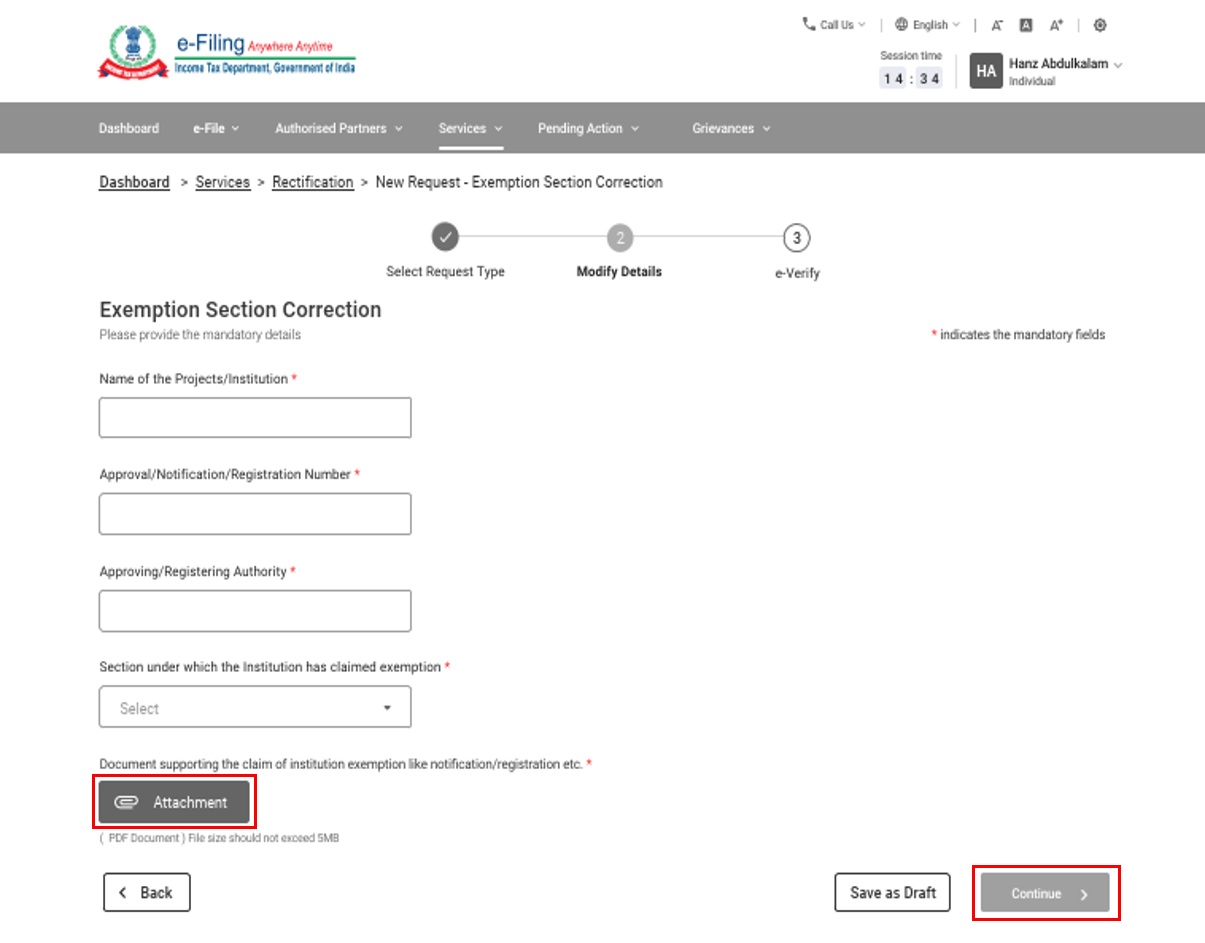

5.5 Income Tax Rectification: Exemption Section Correction

Step 1: Select the request type as Exemption Section Correction.

Note: Exemption Section Correction details is applicable only for ITR-7 from AY 2013-14 to A.Y 2018-19.

Step 2: On the Add Details page, enter your details in all the following fields: Name of the Projects/Institution, Approval/Notification/Registration Number, Approving/Registering Authority, and Section under which the institution has claimed exemption. Click Attachment to upload the necessary supporting document(s) in PDF format. Click Continue to submit the request.

Note: The maximum size of a single attachment should be 5 MB.

Step 3: On submission of your request, you will be taken to the e-Verification page.

Note: Refer to the How to e-Verify user manual to learn more.

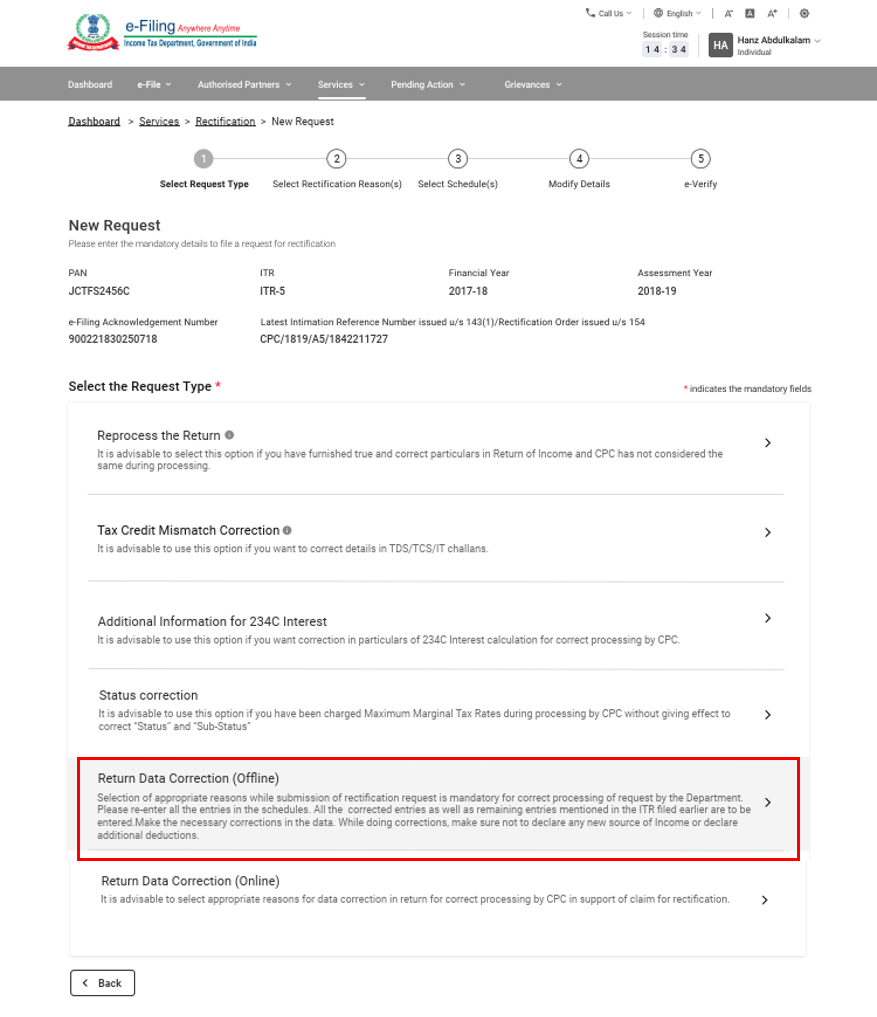

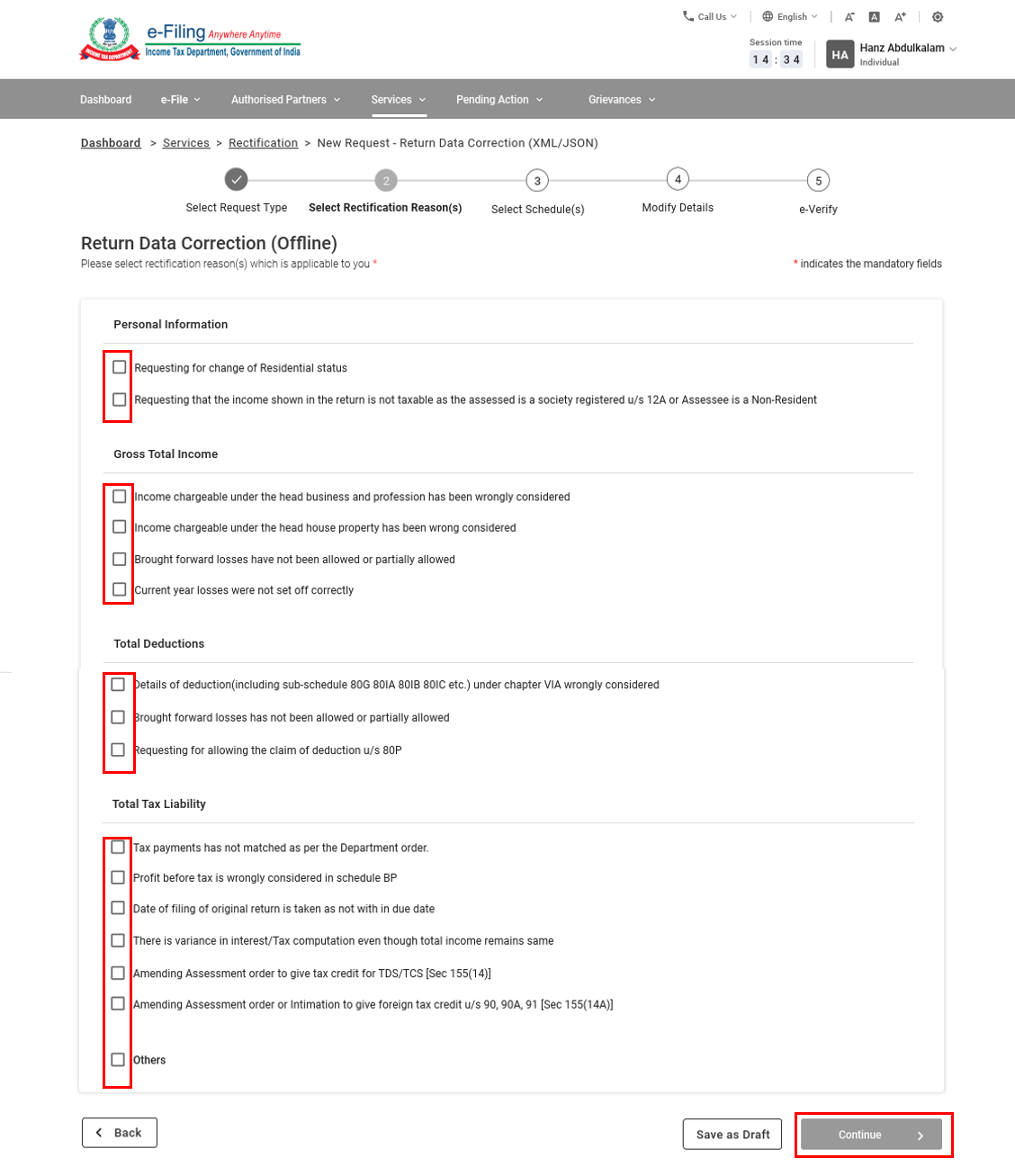

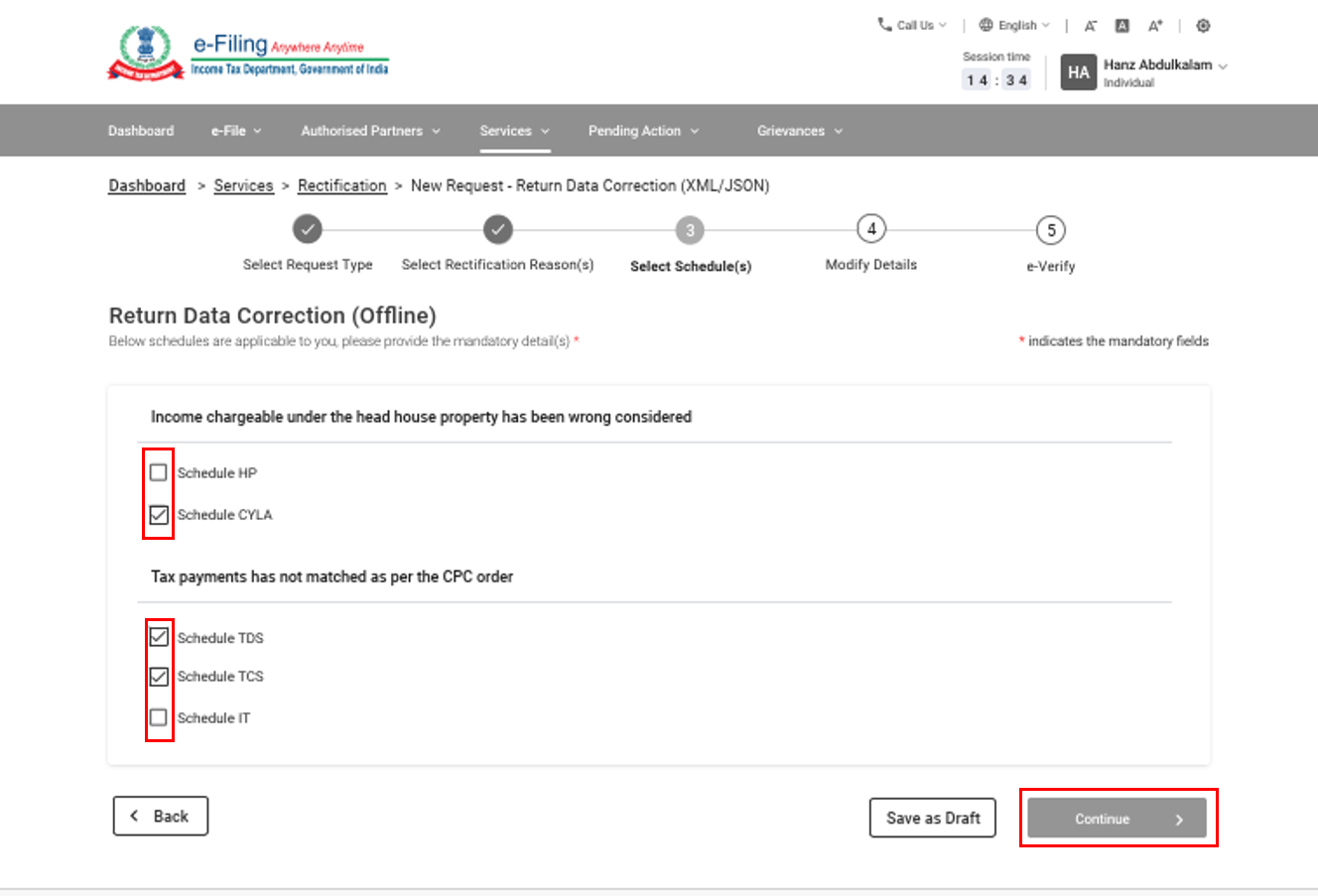

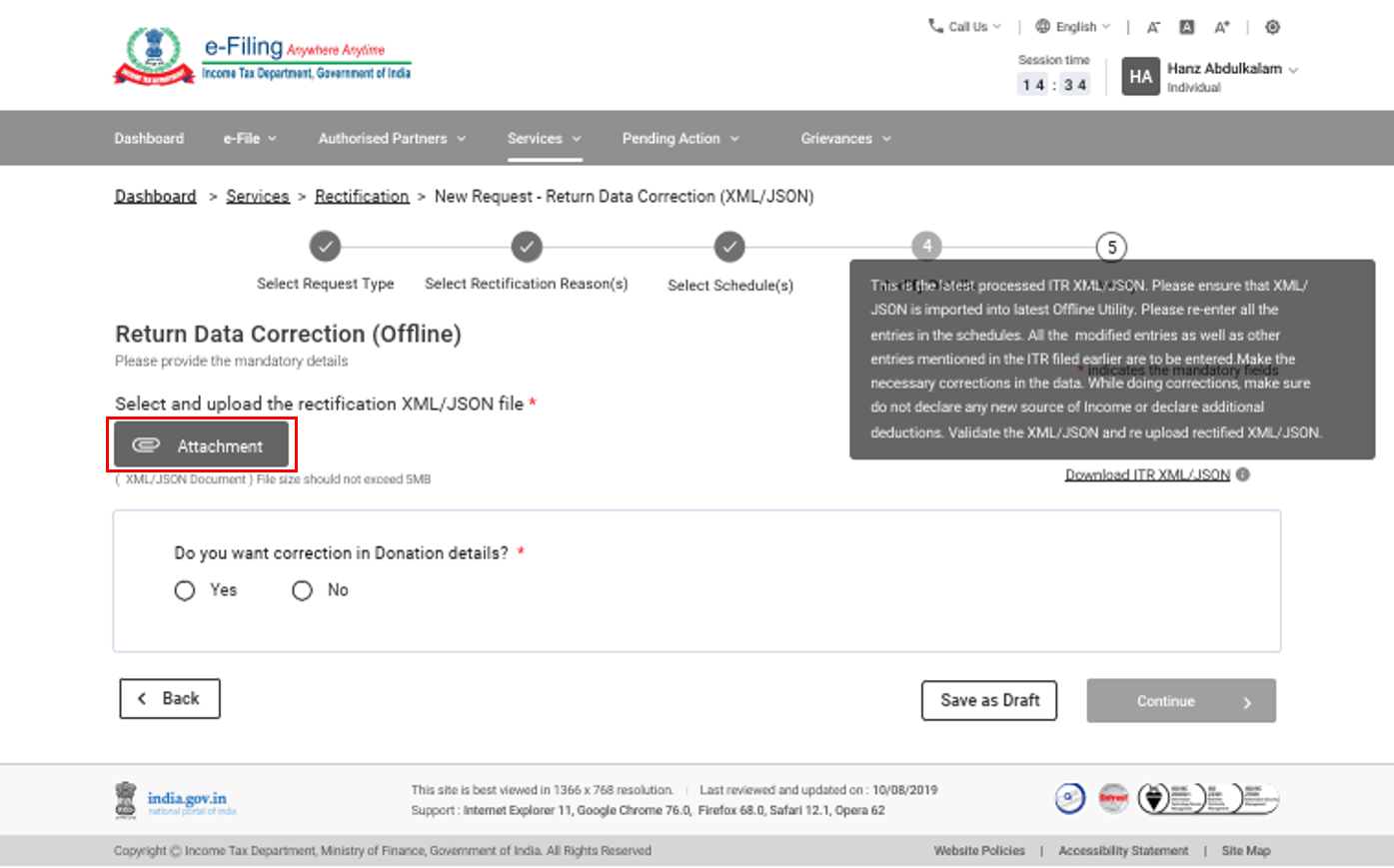

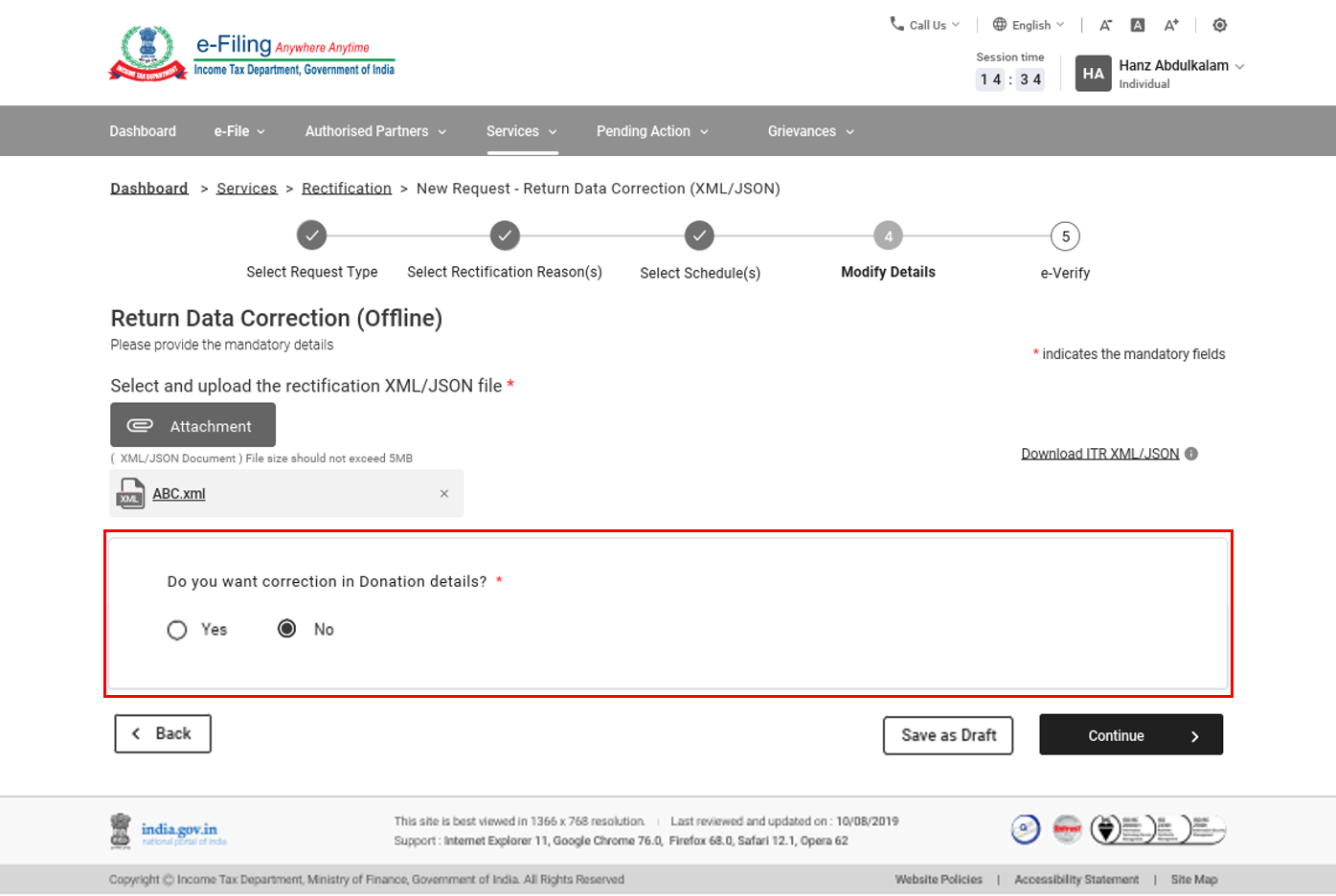

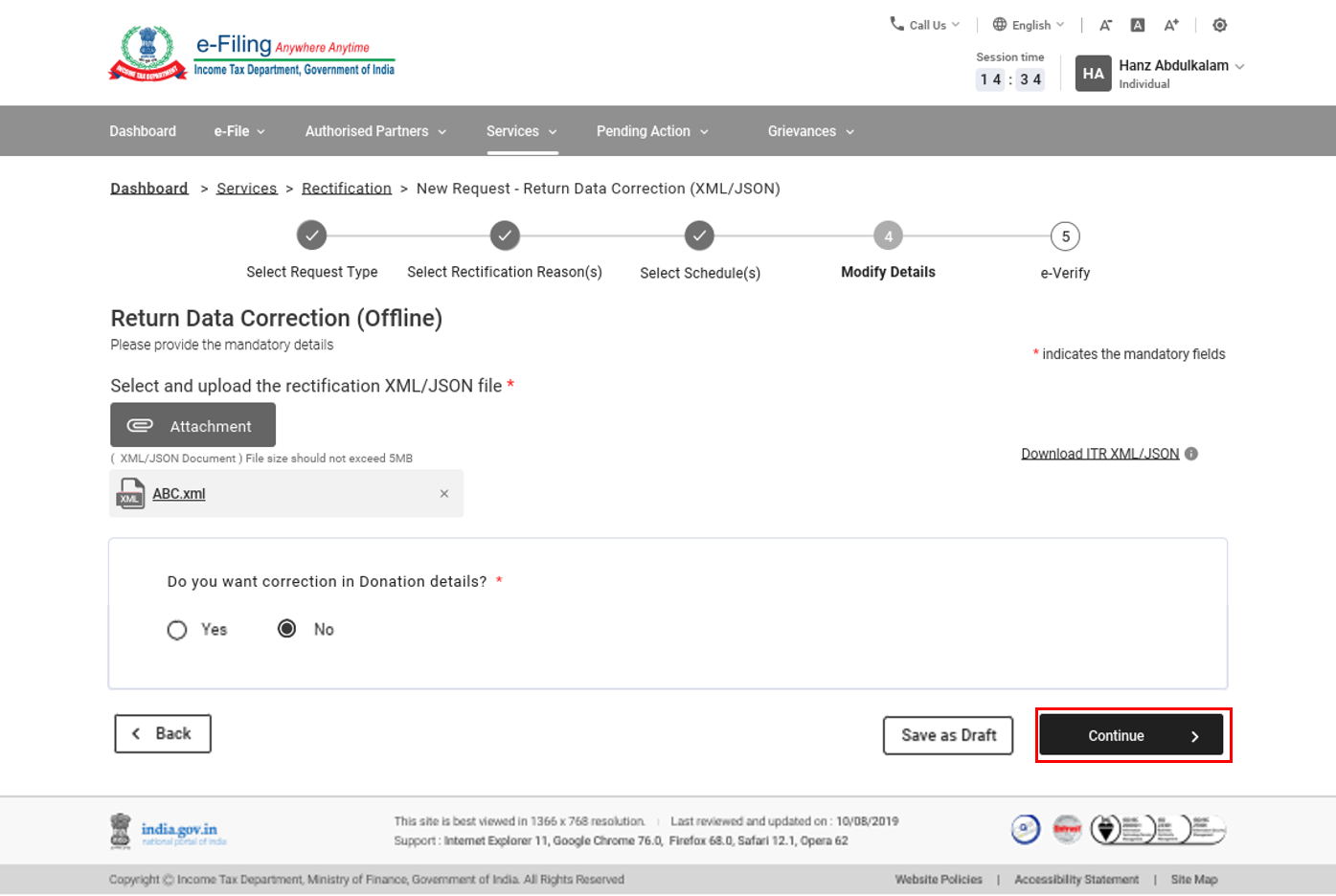

5.6a Income Tax Rectification: Return Data Correction (Offline)

Step 1: Select the request type as Return Data Correction (Offline).

Step 2: Select the applicable rectification reasons - you can select multiple reasons under each category, if applicable. Then, click Continue.

Step 3: Select the schedules that need to be changed, then click Continue.

Step 4: Click Attachment and upload the Rectification XML / JSON generated from the ITR offline utility.

Note: The maximum size of a single attachment should be 5 MB.

Step 5: Enter the Donation and Capital Gains details, if applicable.

Step 6: Click Continue to submit the request.

Step 7: On submission, you will be taken to the e-Verification page.

Note: Refer to the How to e-Verify user manual to learn more.

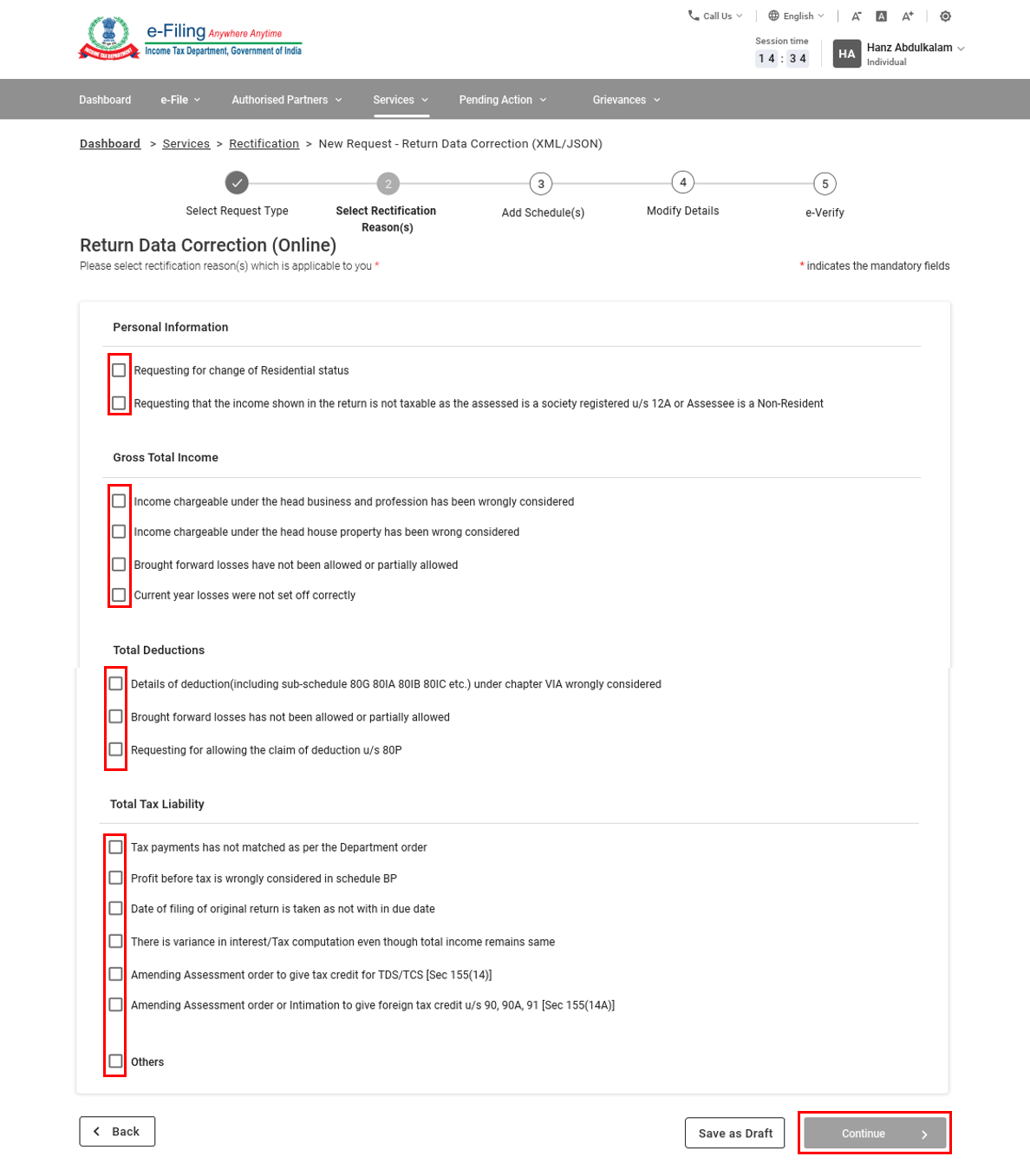

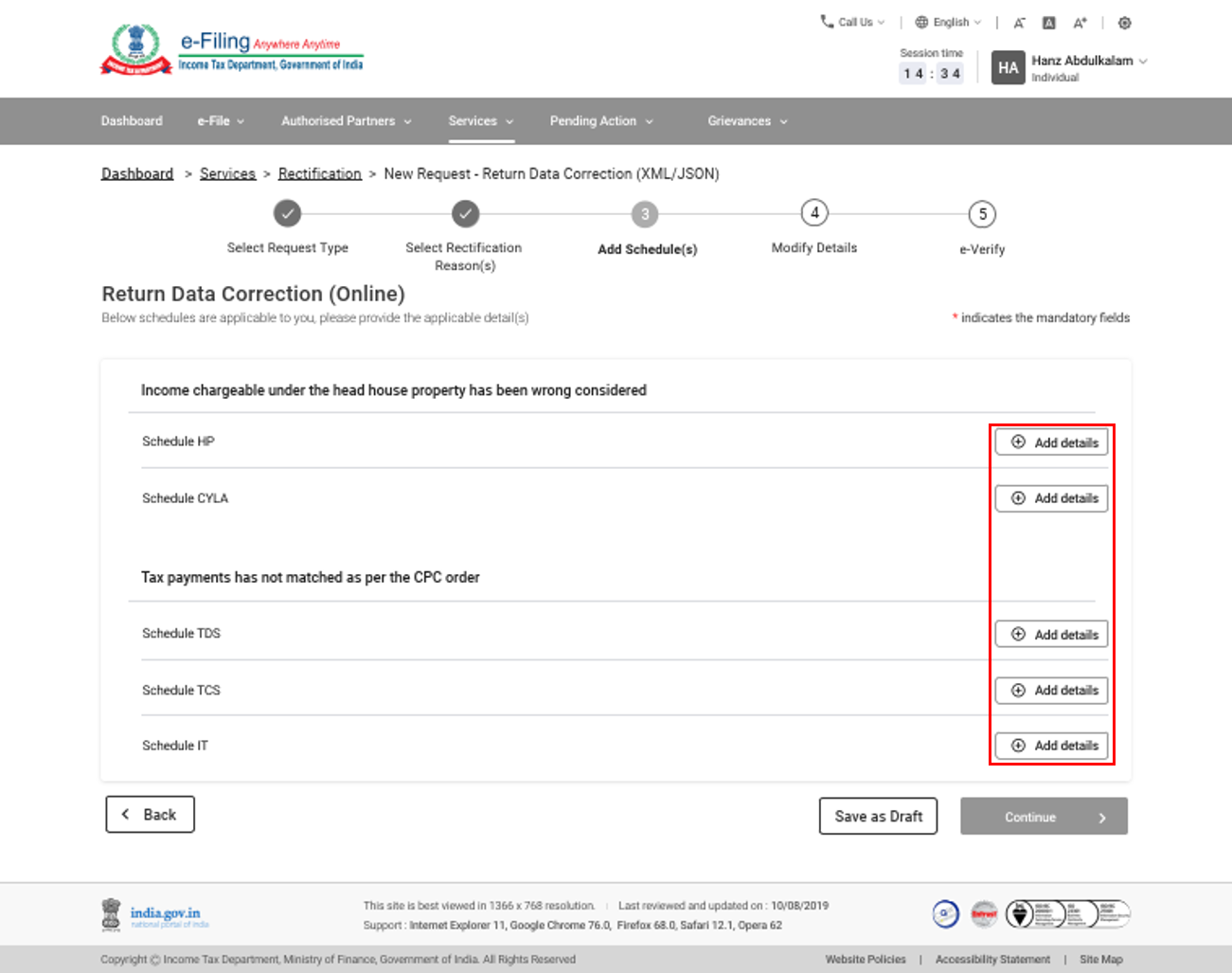

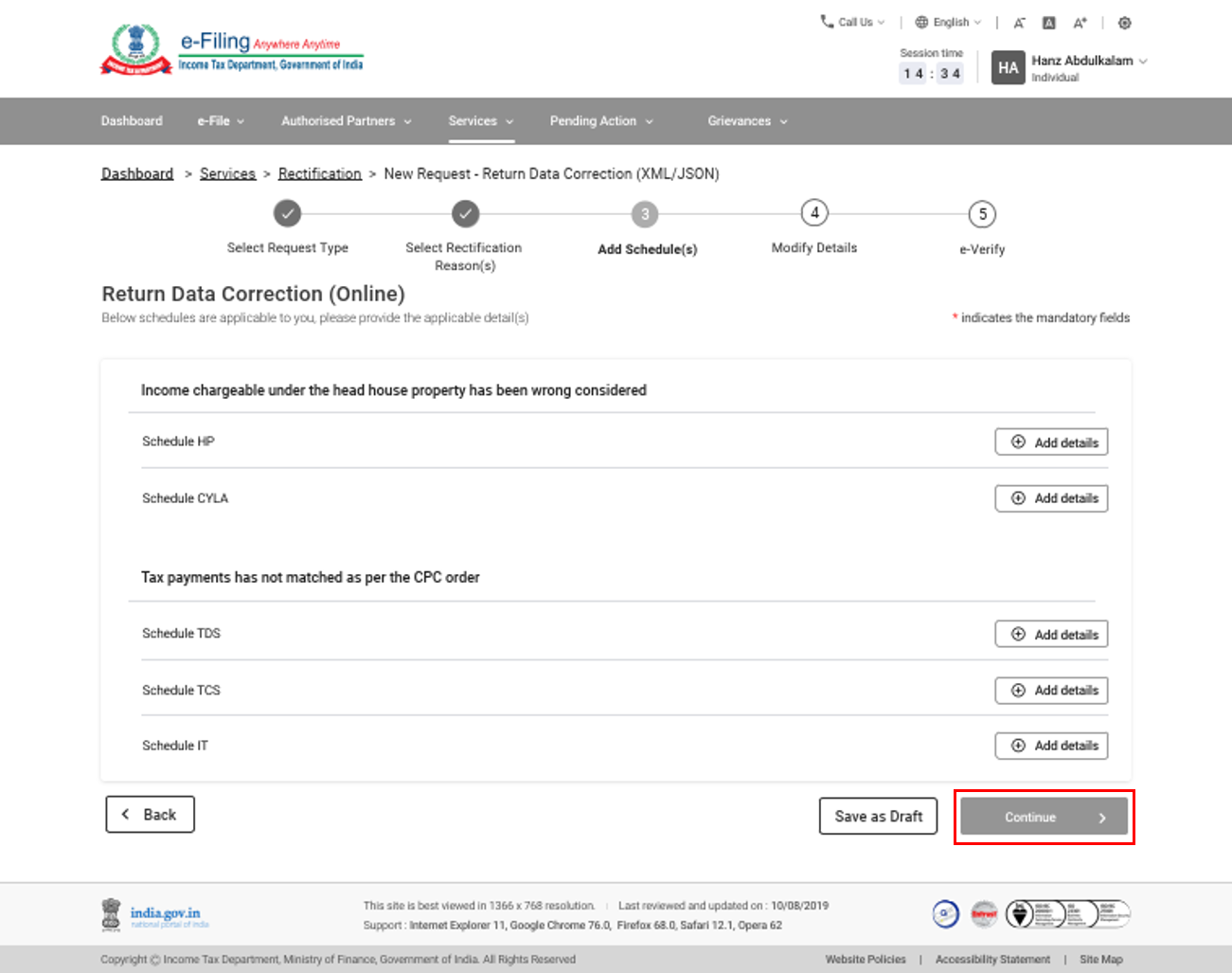

Step 5.6b Income Tax Rectification: Return Data Correction (Online)

Step 1: Select the request type as Return Data Correction (Online).

Step 2: Select the rectification reasons - you can select multiple reasons under each category, if applicable. Then, click Continue.

Step 3: Click Add Details on the applicable schedule(s) to correct the details under them.

Step 4: When you have finished updating all schedules, click Continue.

Step 5: On submission, you will be taken to the e-Verification page.

Note: Refer to the How to e-Verify user manual to learn more.

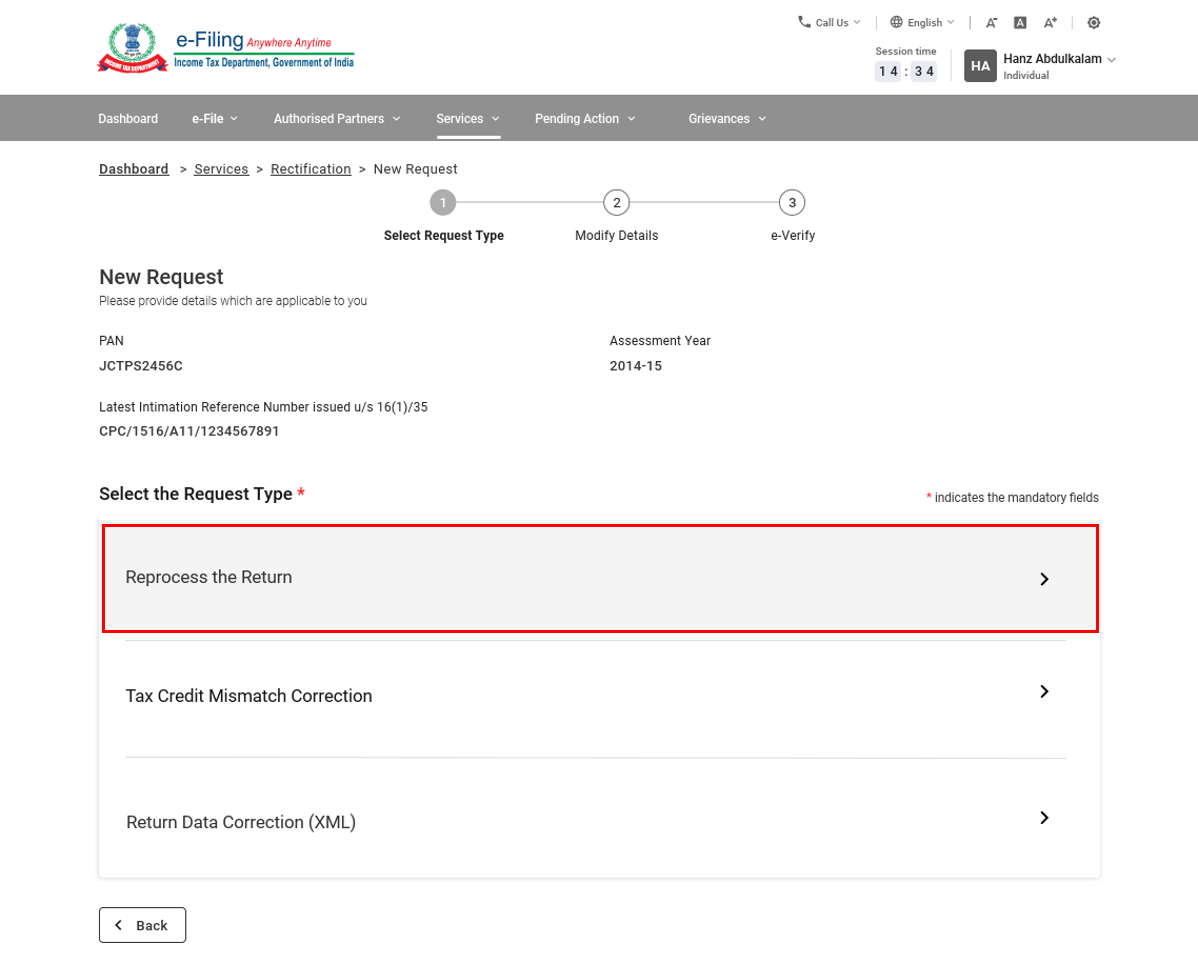

Wealth Tax Rectification Request

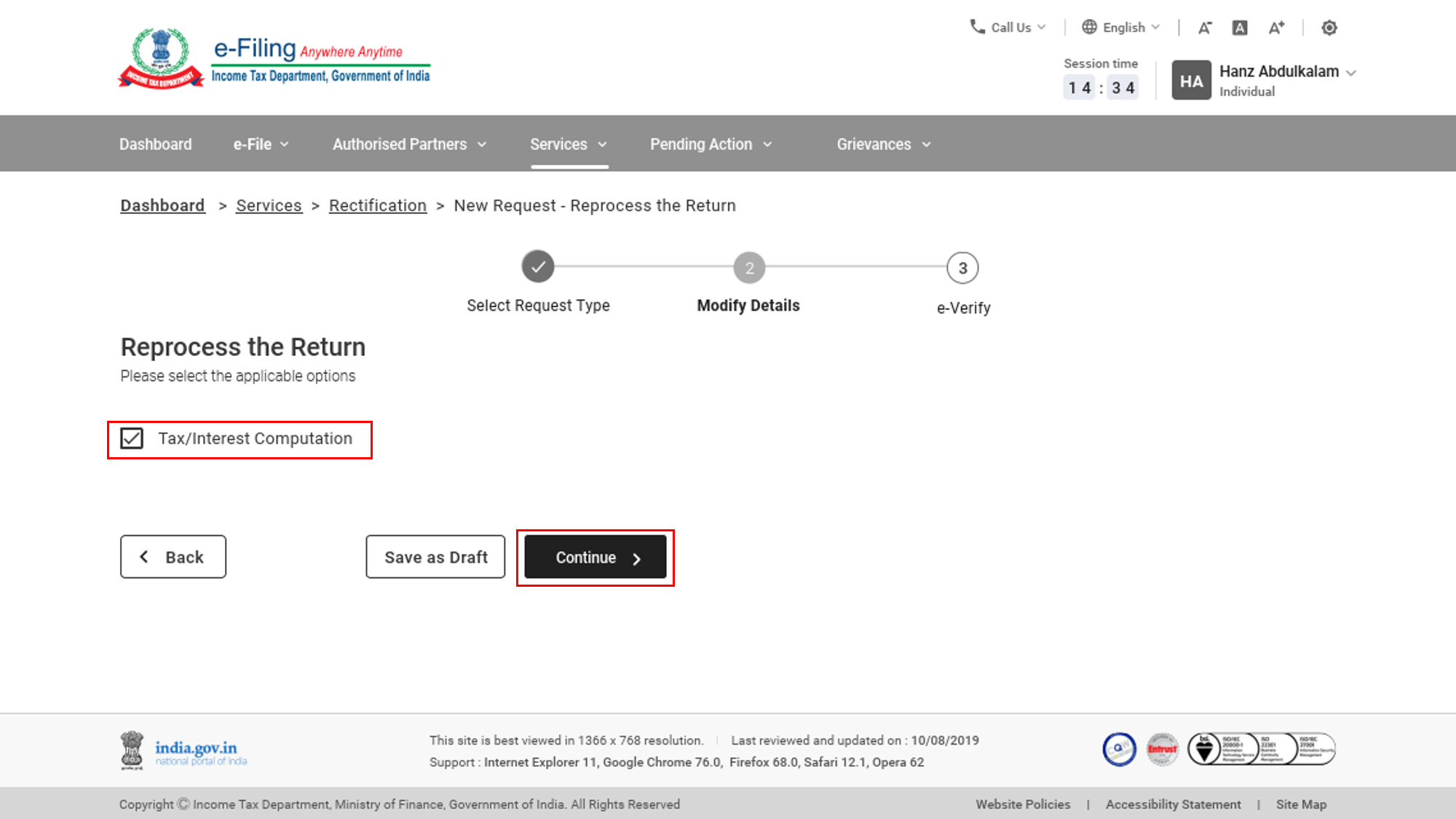

5.7 Wealth Tax Rectification: Reprocess the Return

Step 1: Select the request type as Reprocess the Return.

Note: This request is available only for AY 2014-15 and 2015-16, as Wealth Tax was abolished in the Union Budget 2016-17.

Step 2: Select Tax / Interest Computation and click Submit.

Step 3: On submission, you will be taken to the e-Verification page.

Note: Refer to the How to e-Verify user manual to learn more.

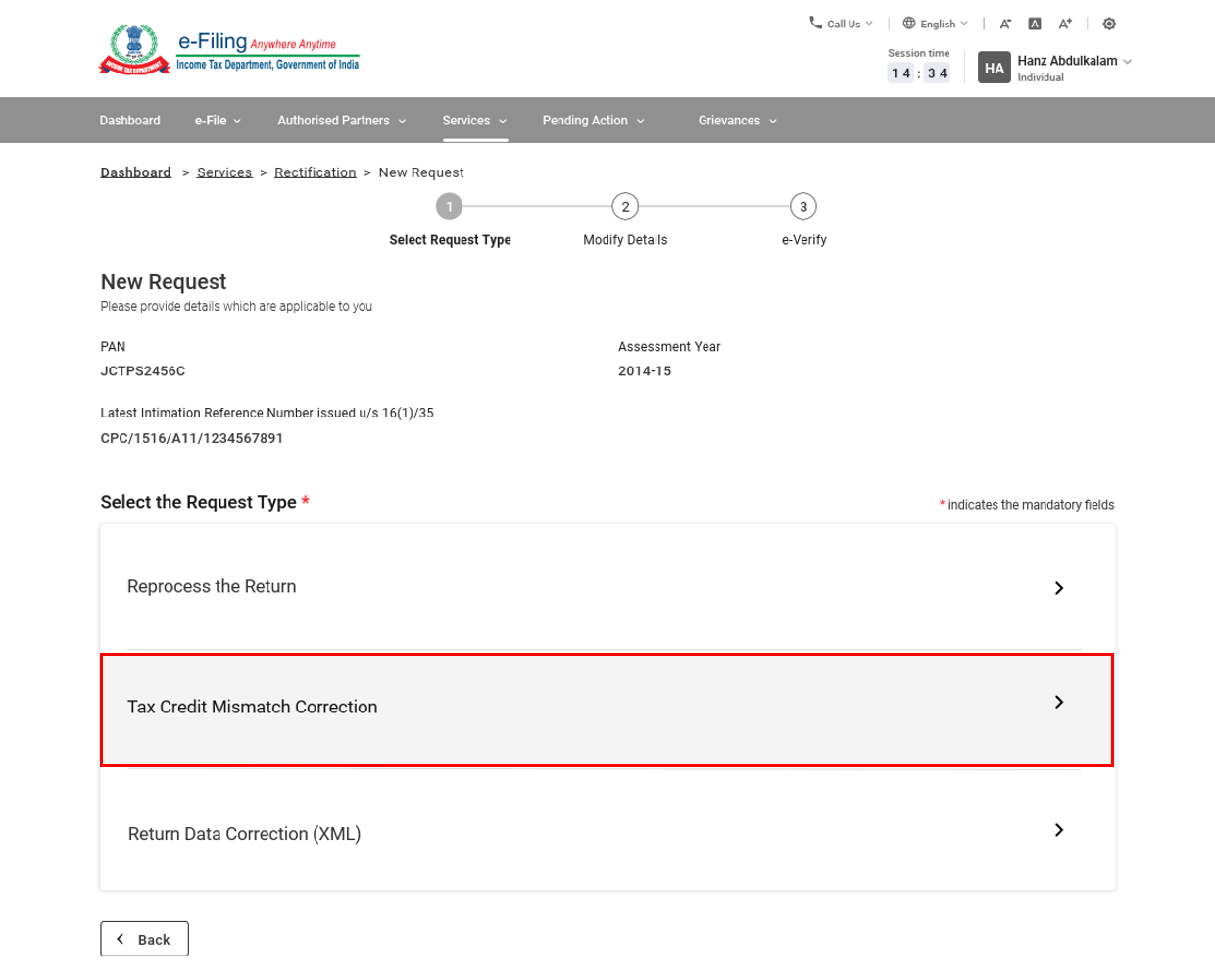

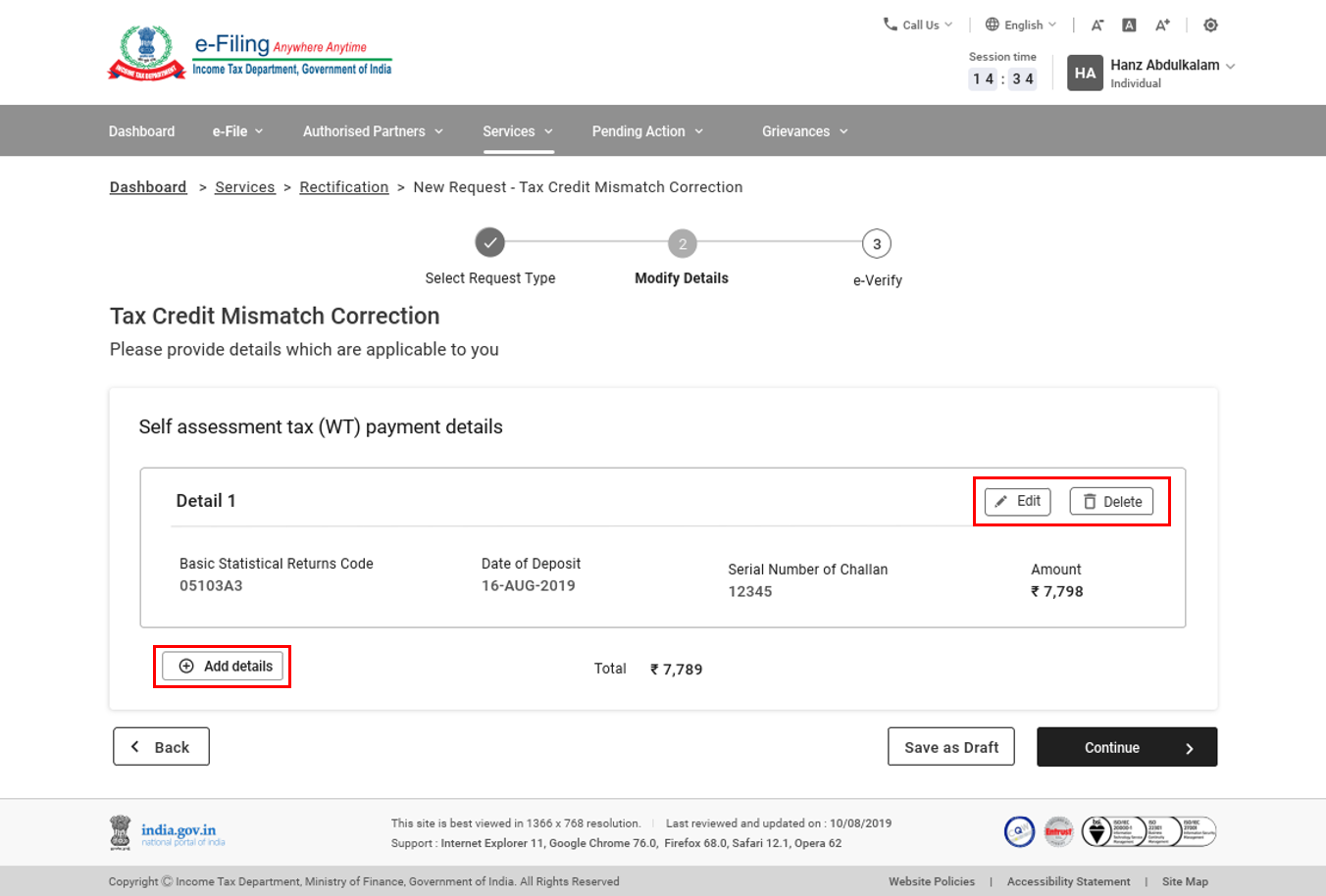

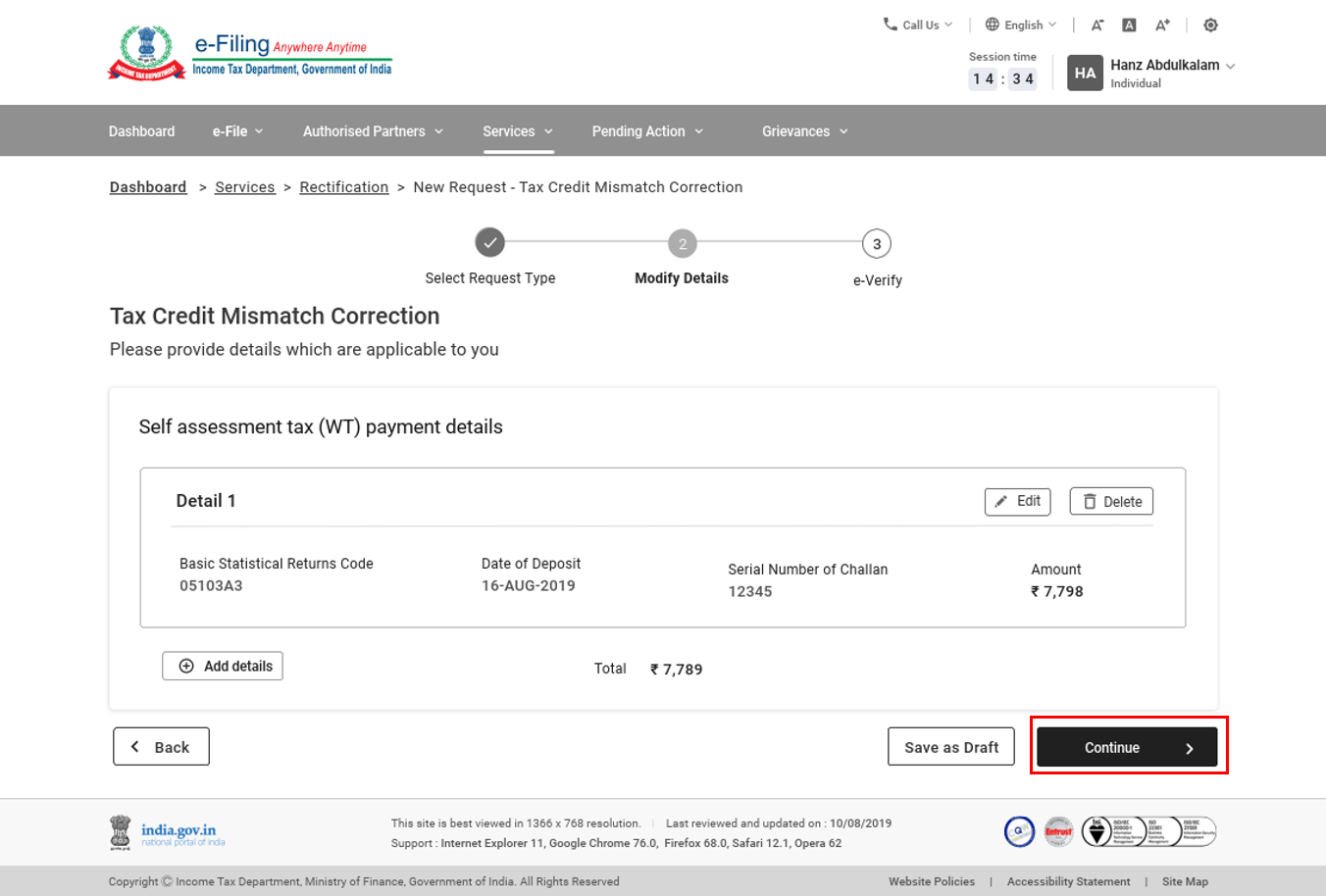

5.8 Wealth Tax Rectification: Tax Credit Mismatch Correction

Step 1: Select the request type as Tax Credit Mismatch Correction.

Step 2: Details from your processed return will be displayed for editing and correction. If you need to edit or delete a record, click Edit or Delete. If your record is incomplete, click Add details.

Step 3: Click Continue to submit the request.

Step 4: On submission, you will be taken to the e-Verification page.

Note: Refer to the How to e-Verify user manual to learn more.

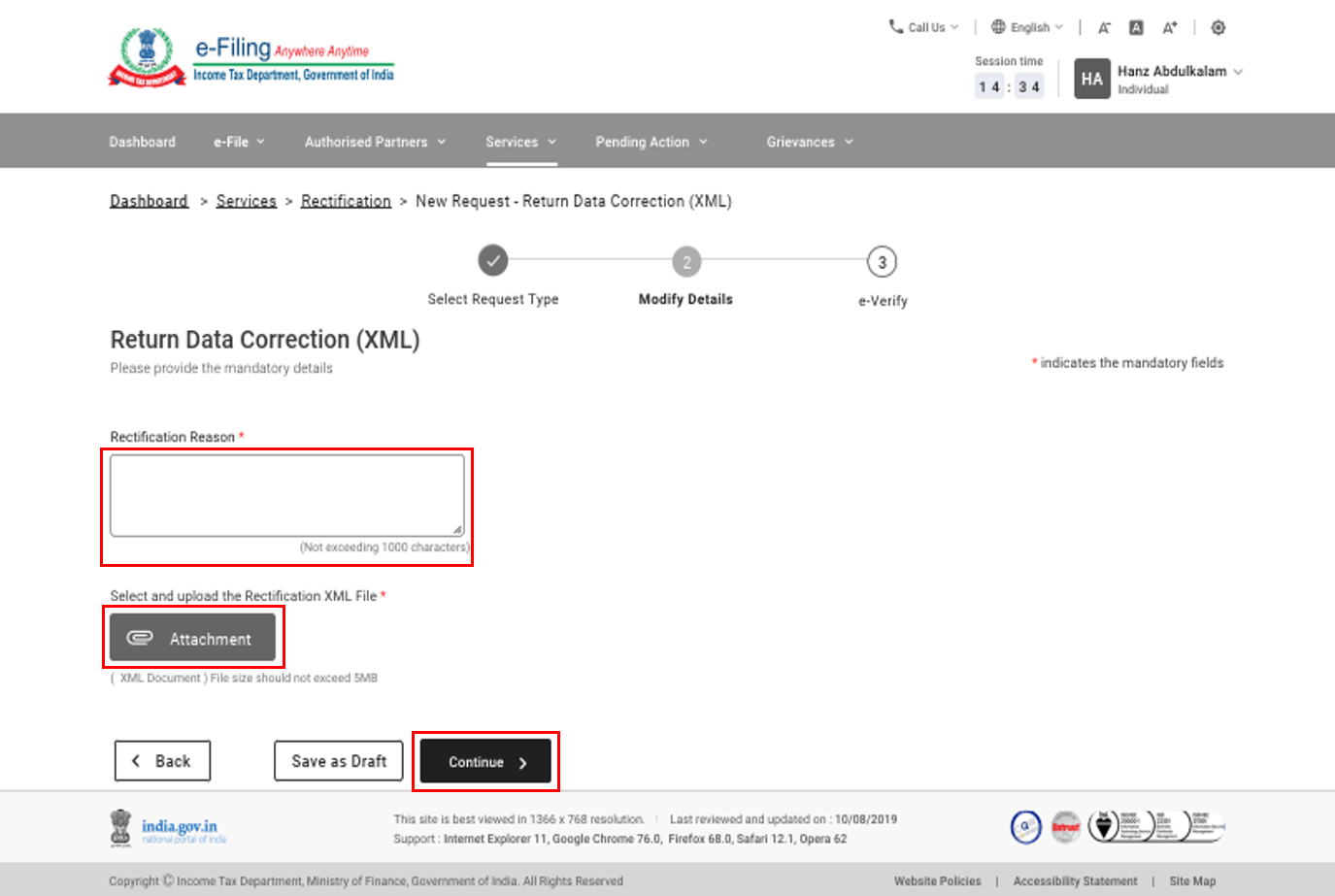

5.9 Wealth Tax Rectification: Return Data Correction (XML)

Step 1: Select the request type as Return Data Correction (XML).

Step 2: Enter rectification reason in the text box, and click Attachment to upload the Rectification XML generated from the ITR offline utility. Then, click Submit.

Note: The maximum size of a single attachment should be 5 MB.

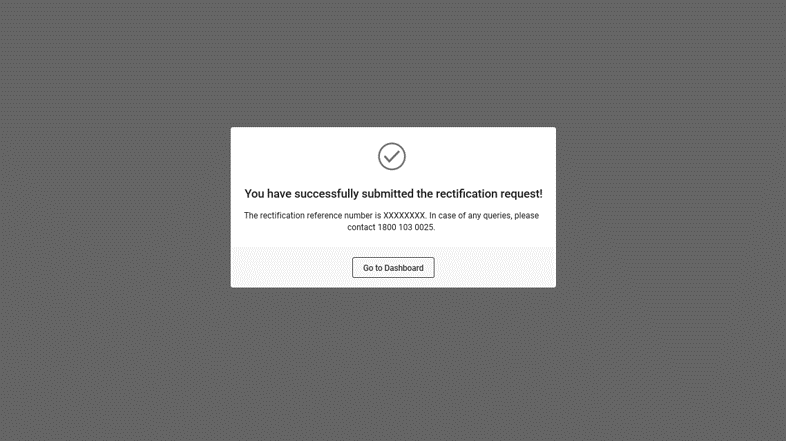

Step 4: On submission, you will be taken to the e-Verification page.

Note: Refer to the How to e-Verify user manual to learn more.

On successful validation, your request will be submitted. A success message will be displayed. You will also receive a confirmation message on your e-mail ID and mobile number registered with the e-Filing portal.

4. Related Topics

- Login

- Dashboard and Worklist (Taxpayer)

- Raise Service Requests

- Know your ITR Status

- View Tax Credit Mismatch

- Offline Utility

- Upload Form BB (Wealth Tax Return)

- Register Digital Signature Certificate (DSC)

- My ERI (For Taxpayers)

- Add Clients (For ERI)

- View Client Details (For ERI)

- Generate EVC

- Authorize / Register as Representative

- File ITR (ITR-1 to ITR-7)

- How to e-Verify

- Rectification Status

- e-Proceedings