1. Overview

Income tax refund means a refund amount that is initiated by the income tax department if the amount paid in taxes exceeds the actual amount due (either by way of TDS or TCS or Advance Tax or Self-Assessment Tax). The tax is calculated after taking into consideration all the deductions and exemptions at the time of assessment by income tax department.

Refund processing by the tax department starts only after the return is e-verified by the taxpayer. Usually, it takes 4-5 weeks for the refund to be credited to the account of the taxpayer. However, if refund is not received during this duration, the taxpayer must check for intimation regarding discrepancies in ITR; check email for any notification from the IT department regarding the refund. The taxpayer can also check refund status on the e-filing as per the process detailed hereunder.

2. Pre-requisites for availing this service

- Valid User ID and Password

- PAN is linked with Aadhaar number

- ITR filed claiming refund

3. Process/Step-by-Step Guide

3.1 Refund Status

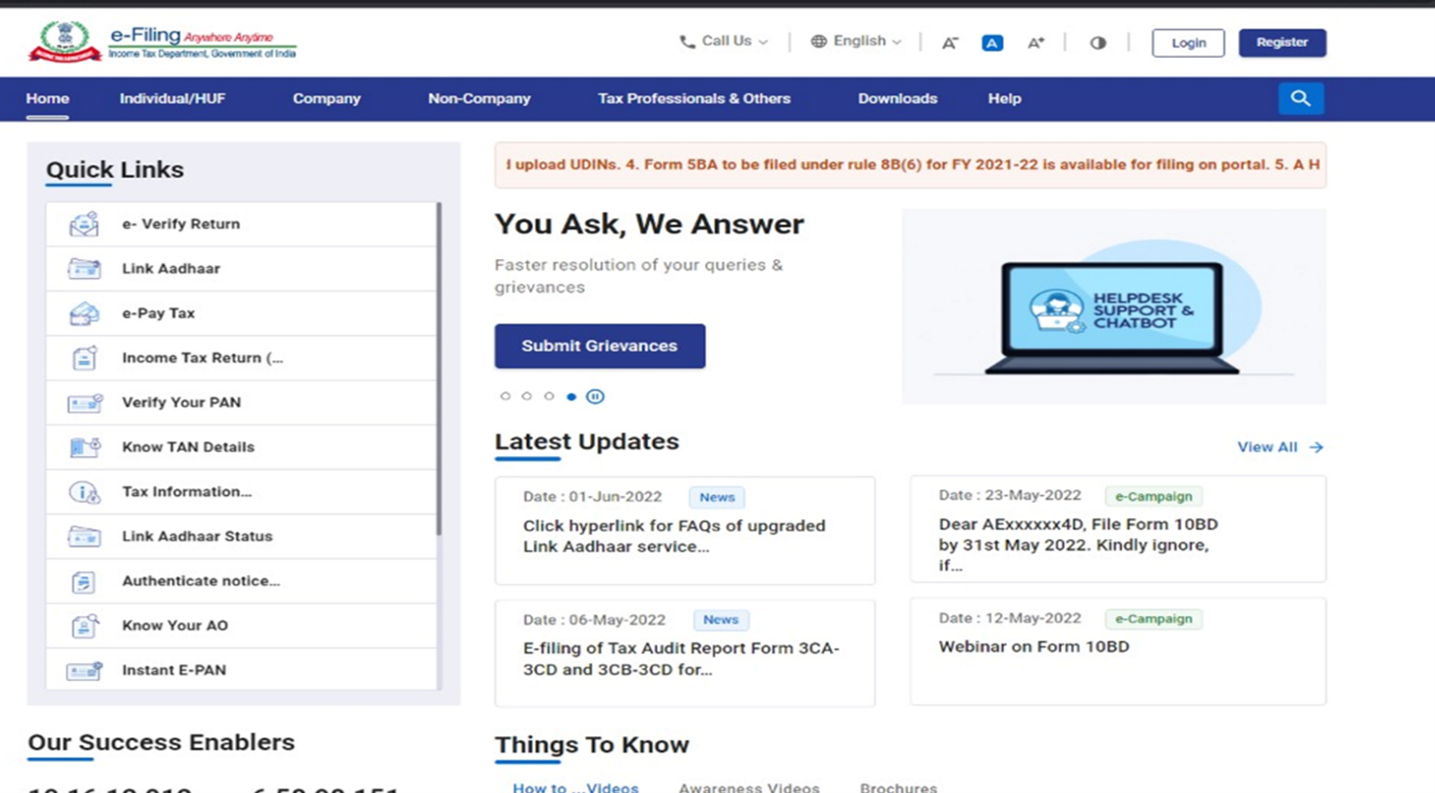

Step 1: Go to the e-Filing portal homepage.

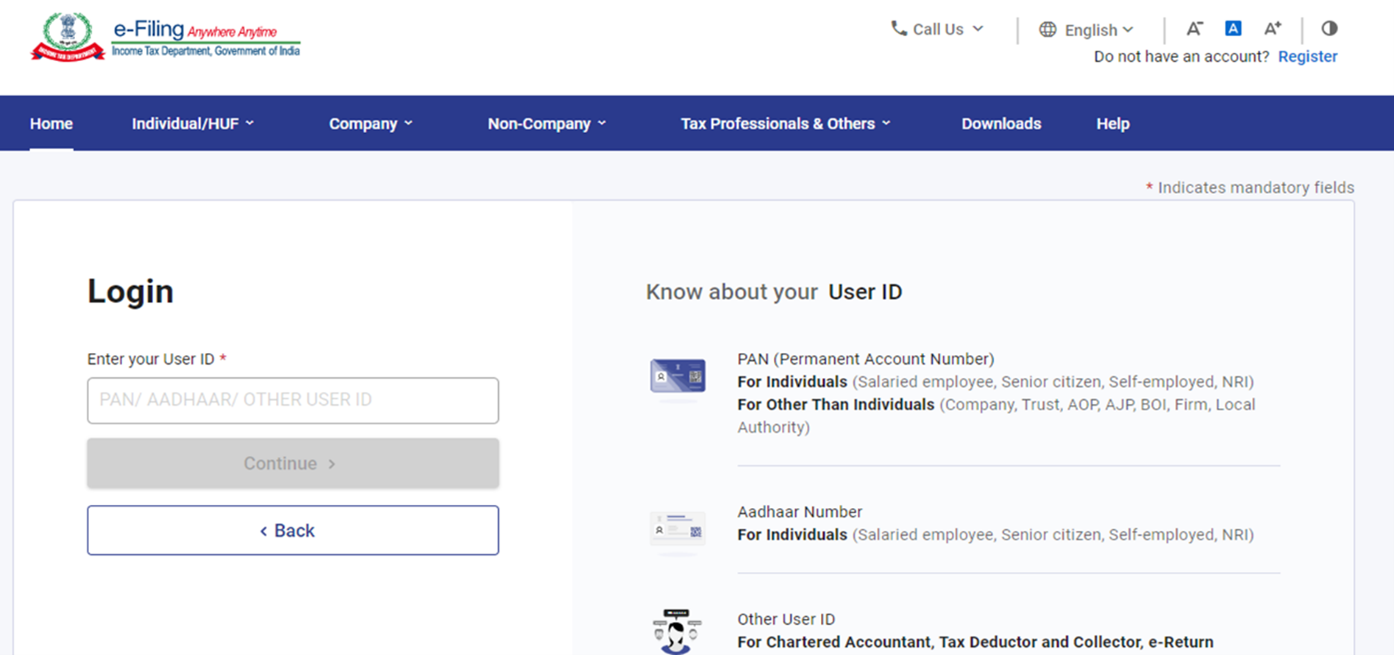

Step 2: Enter the user ID and password.

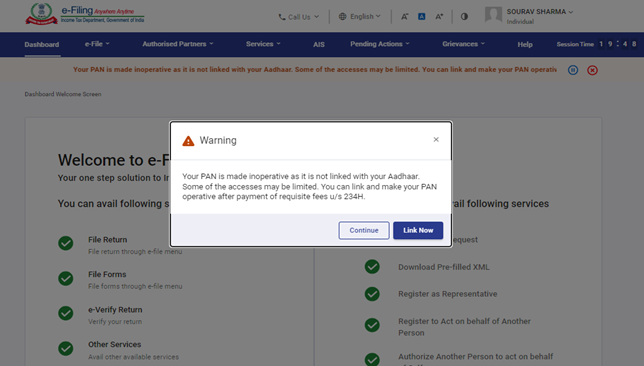

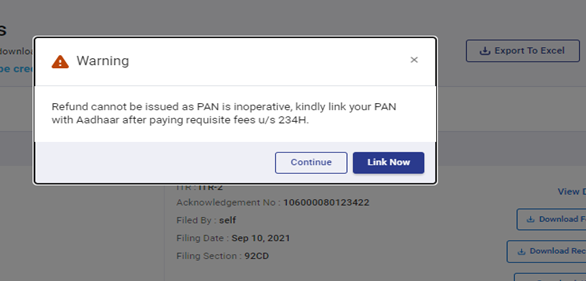

For individual users, if PAN is not linked with the Aadhaar, you will see a pop-up message that your PAN is made inoperative as it is not linked with your Aadhaar.

To link the PAN with Aadhaar, click on Link Now button else click Continue.

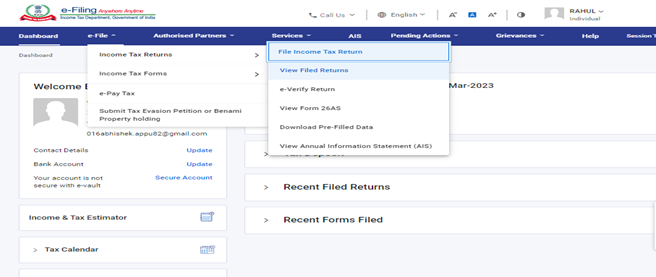

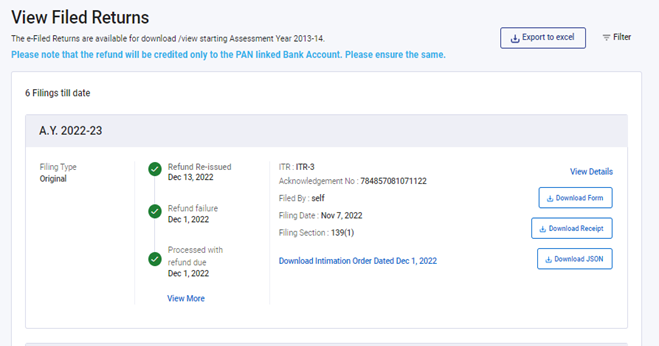

Step 3: Go to e-File tab > Income Tax Returns > View Filed Returns.

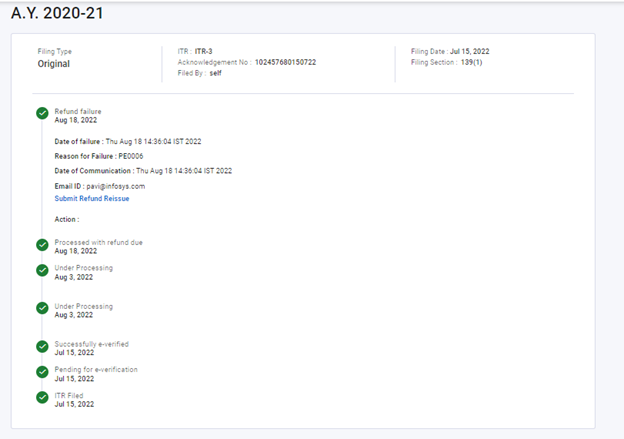

Step 4: Now you can check the refund status for the desired Assessment year.

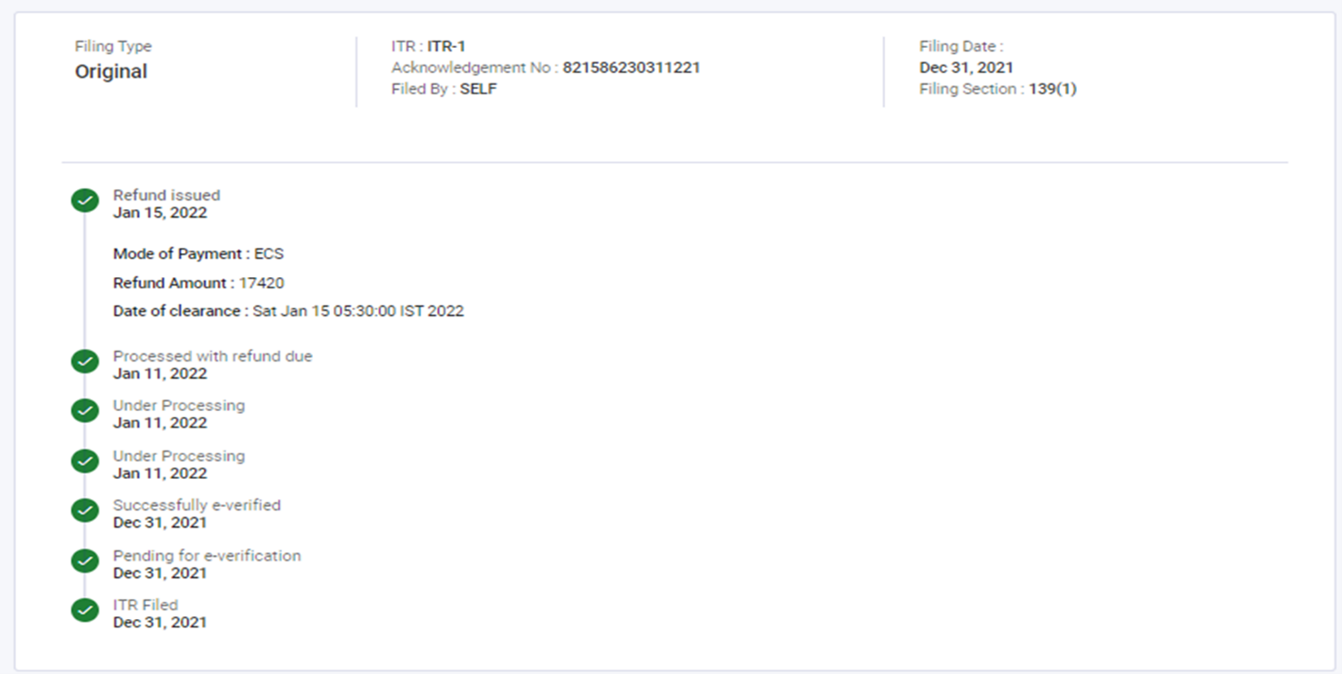

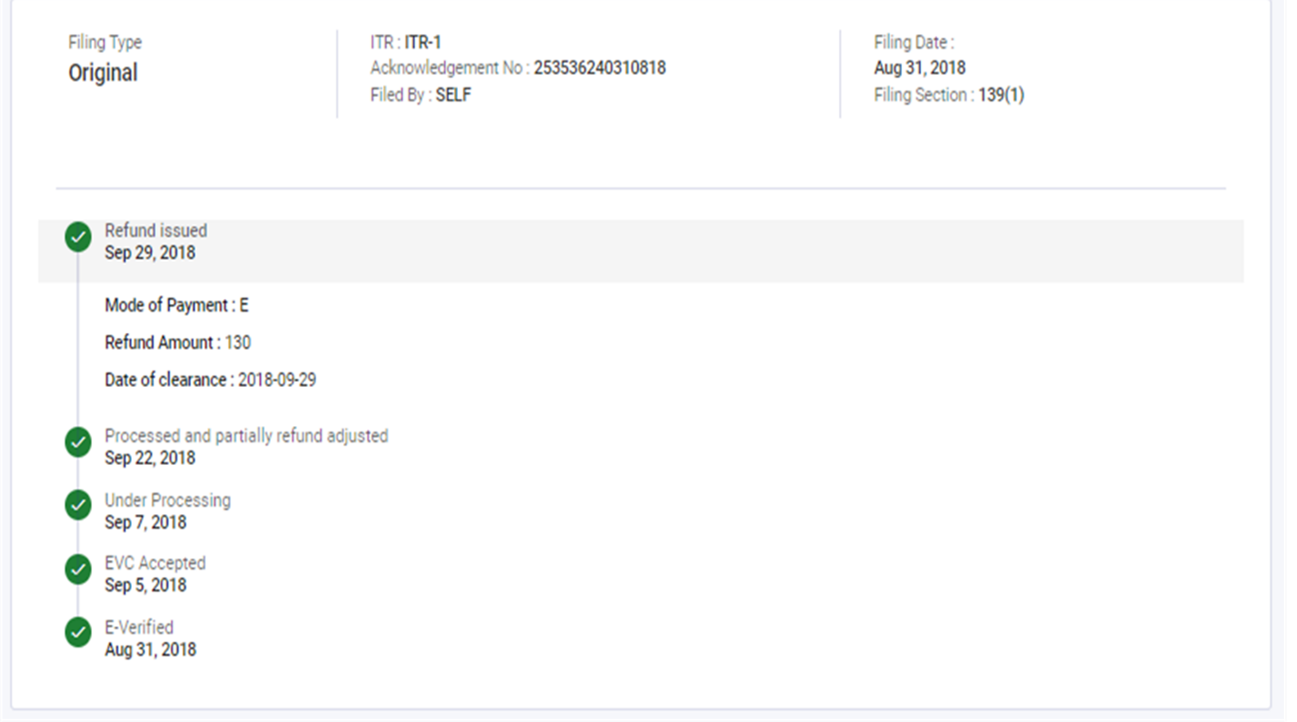

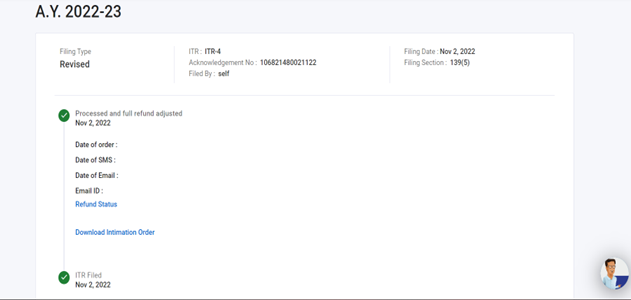

Click on View Details and here you can also check the life cycle of filed ITR.

Status 1: When refund is issued:

Status 2: When refund is partially adjusted:

Status 3: When full refund adjusted:

Status 4: When refund is failed:

Note: If your PAN is inoperative, your refund will get failed and you will see a warning message to link your PAN with the Aadhaar.

Other reasons of refund failure:

In addition to above, a refund from the Income Tax Department scheduled to be paid may fail to get credited to your bank account for the following reasons:

1. In case the bank account is not pre-validated. It is now compulsory to pre-validate your bank account.

2. The name mentioned in the bank account does not match with PAN card details.

3. In case of an invalid IFSC code.

4. If the account that you have mentioned in the ITR has been closed.