Form 10 IEA > User Manual

1.Overview

With effect from A.Y 2024-25, new tax regime has been set as the default tax regime. This means that if the taxpayer does not specify their intent to choose the old regime, the income tax shall be payable as per new regime.

As per section 115BAC(6)(ii) taxpayers without any professional or business income can opt out of the new tax regime directly at the time of filing tax returns.

However, for Individuals, HUF, AOP (other than co-operative societies), BOI & Artificial Judicial Persons (AJP) having income from business and profession, Form 10 IEA is required to be filed to indicate the preference for the old tax regime. Such persons should mandatorily submit Form 10-IEA within the specified time frame under section 139(1) if they want to switch their tax regime from new to old or if they want to re-enter in the new scheme.

2. Prerequisites for filing the Form

- Valid User ID and Password.

- Total Income of the Taxpayer includes Business Income.

3. About the Form

3.1. Purpose.

For business cases, form 10-IEA has been notified vide Notification No.43/2023 dated 21st June 2023 which can be used by taxpayers to exercise their right to choose between the old or the new regime .This form can be filed twice in lifetime i.e. one for opt out of new tax regime and one for re-entering in to the new tax regime.

3.2. Who can use it?

Taxpayer having Business Income can use Form 10 IEA to “Opt out or Re-enter” in the New Tax Regime.

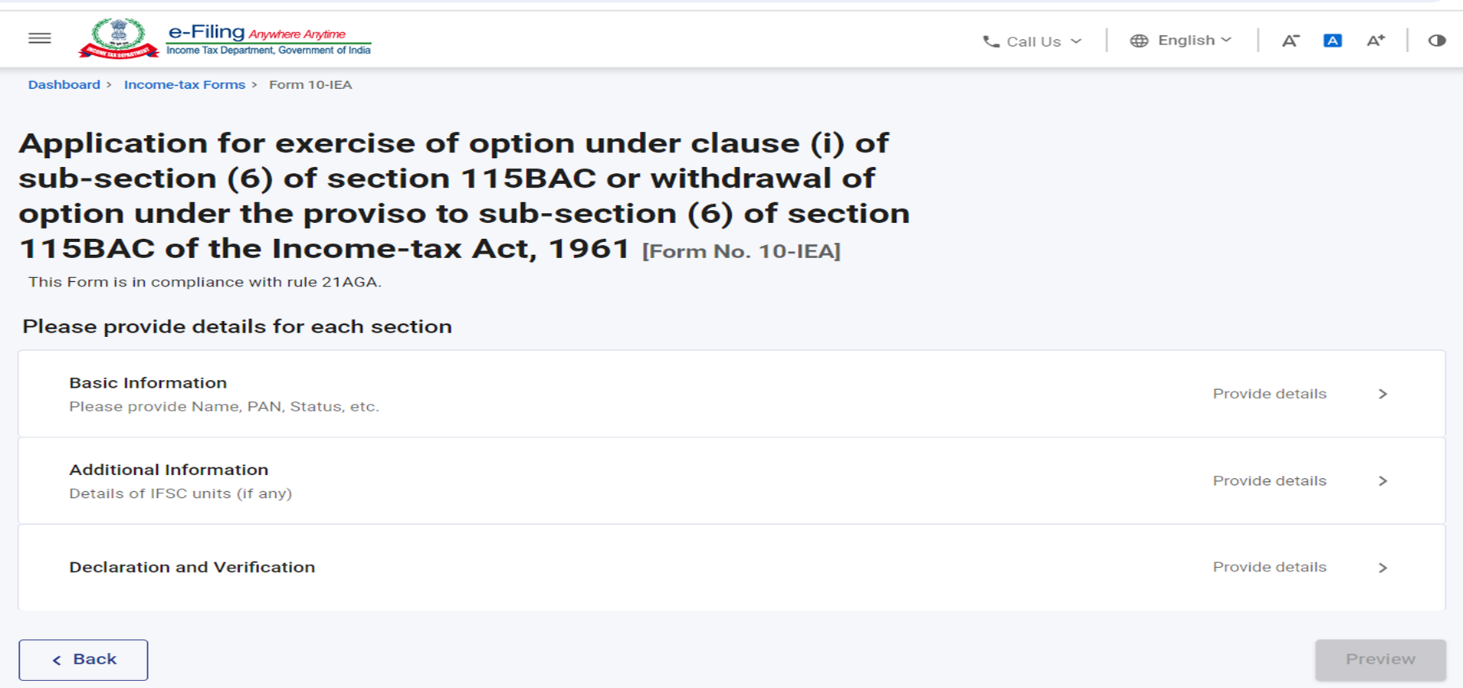

4. Form at a Glance

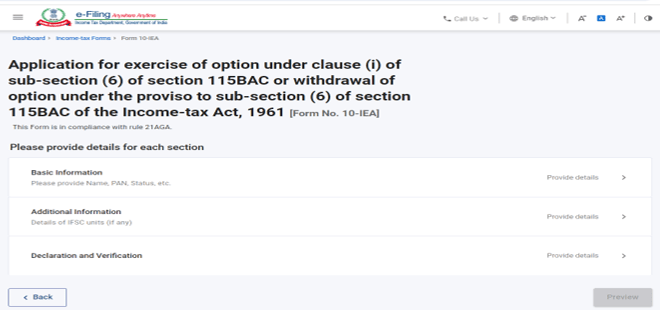

The form 10 IEA is divided into three parts:

- Basic information,

- Additional Information

- Declaration and verification

Here is a quick tour of the sections of Form 10 IEA:

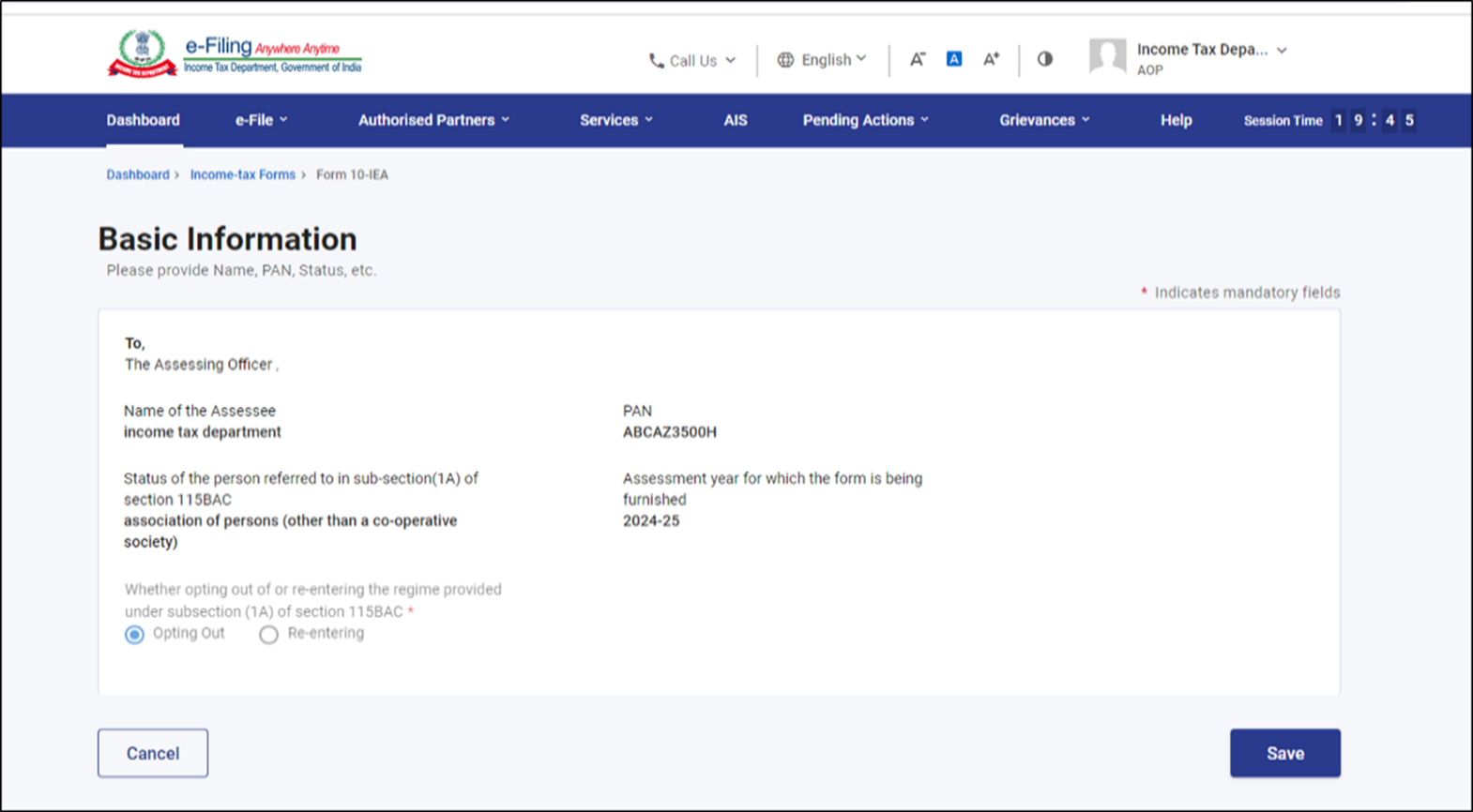

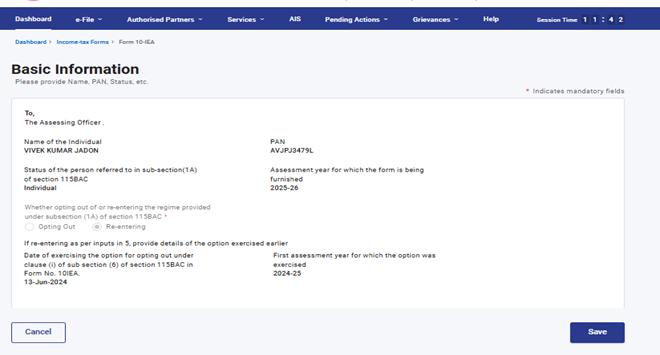

4.1. Basic Information

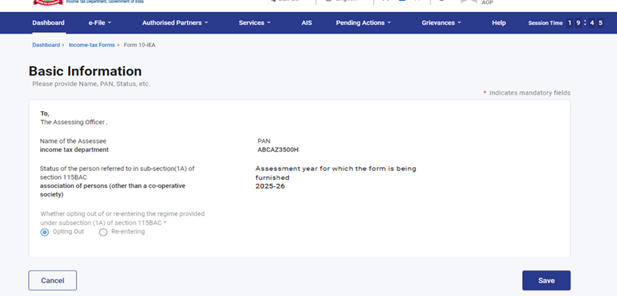

Part 1 is the Basic Information (Name of Asseseee, PAN, AY and status of person) which will be. prefilled in the form. If it is first time filing of form then opting out option will be auto-selected and if system has valid form with opting out option, then re-entering option will be auto-selected.

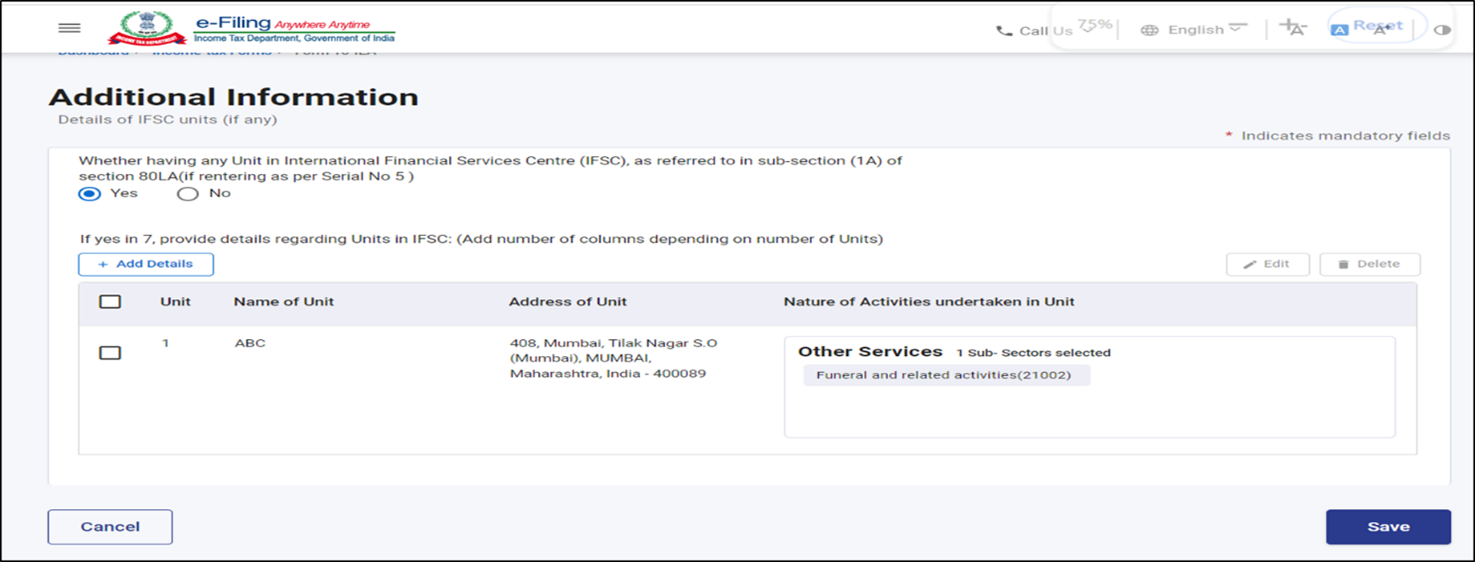

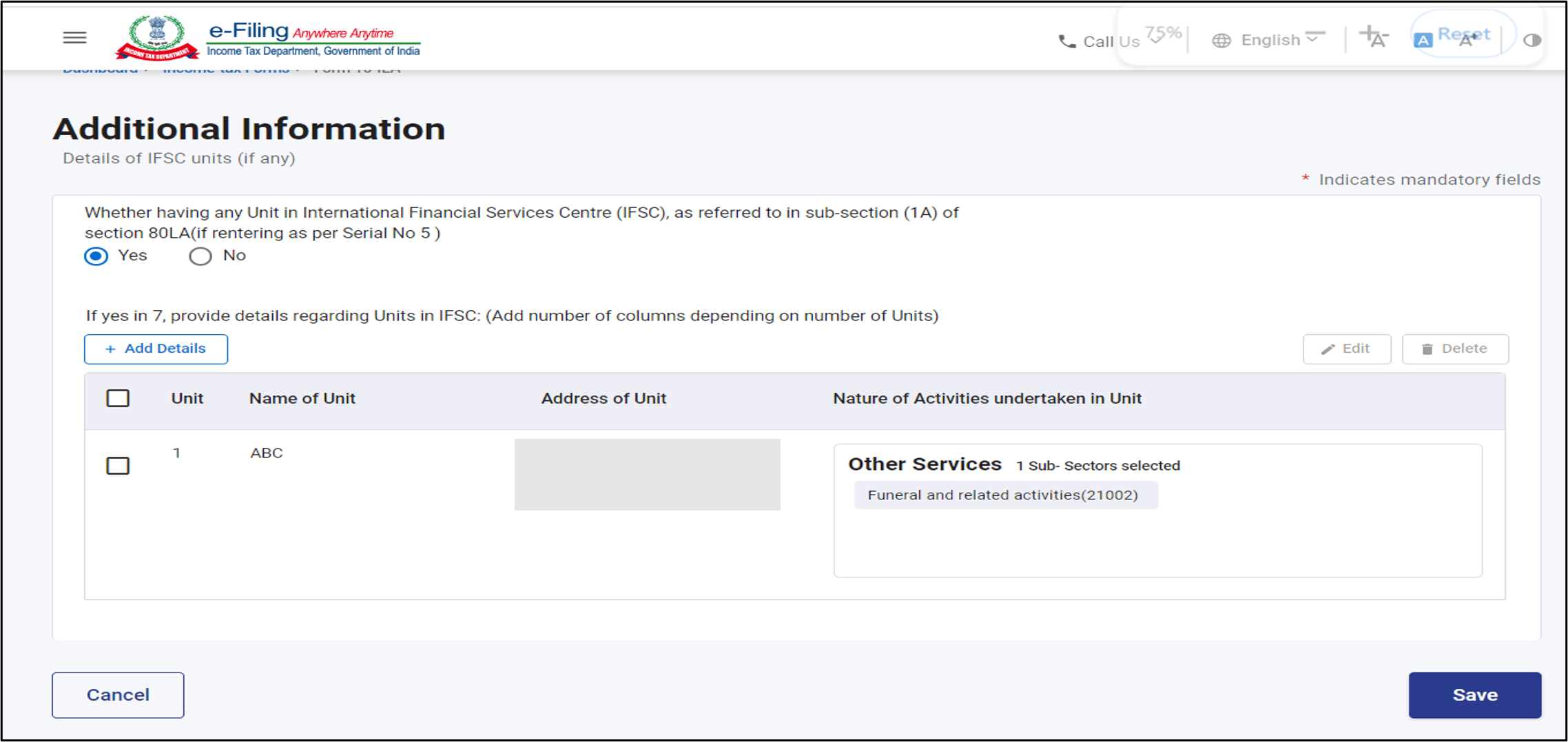

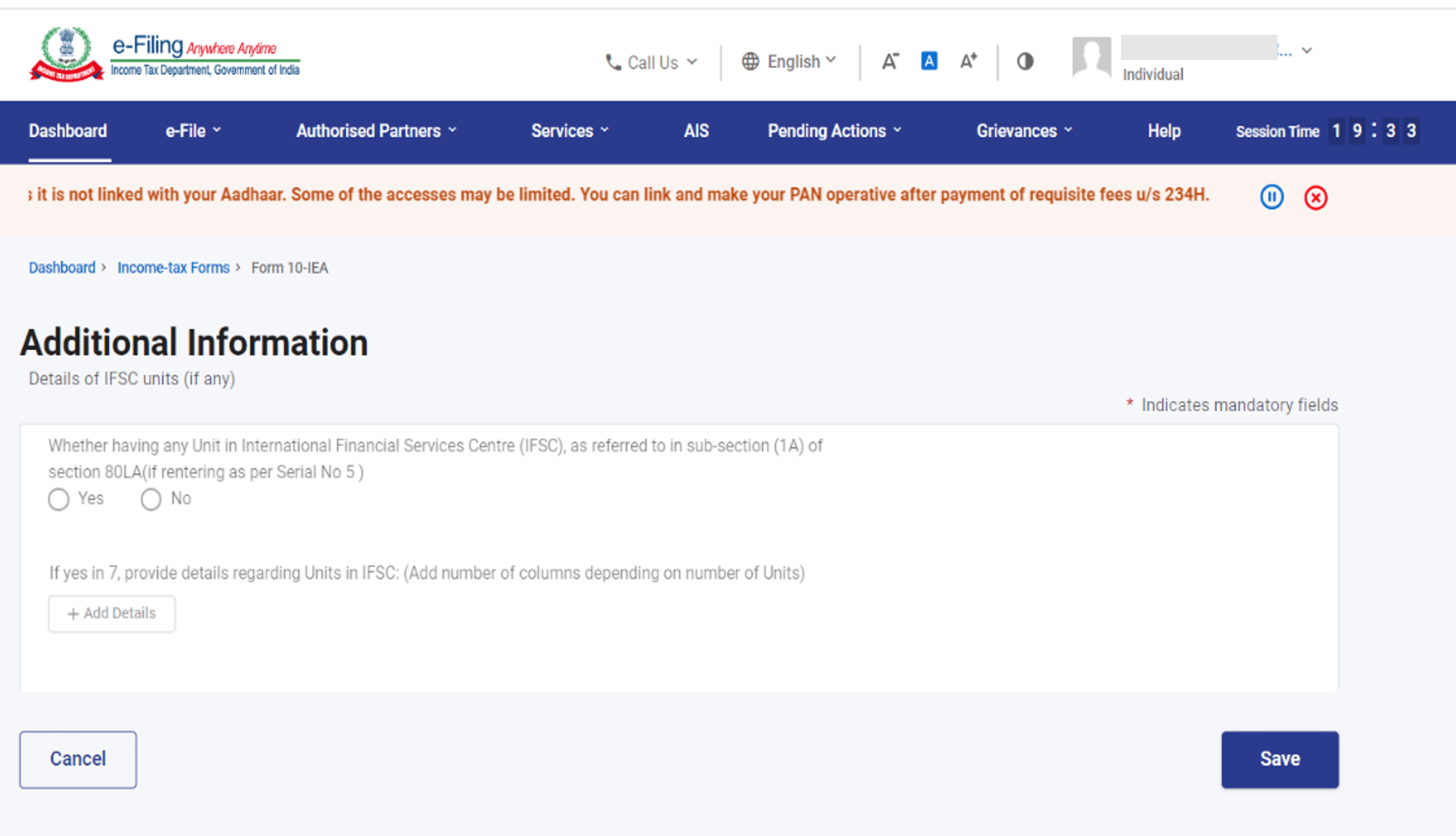

4.2. Additional information

Part 2 is Related to Additional information where Assessee has to give Additional information related to IFSC unit (if any).

Please Note: If you are opting out of new Tax regime this Additional Information panel will be greyed off

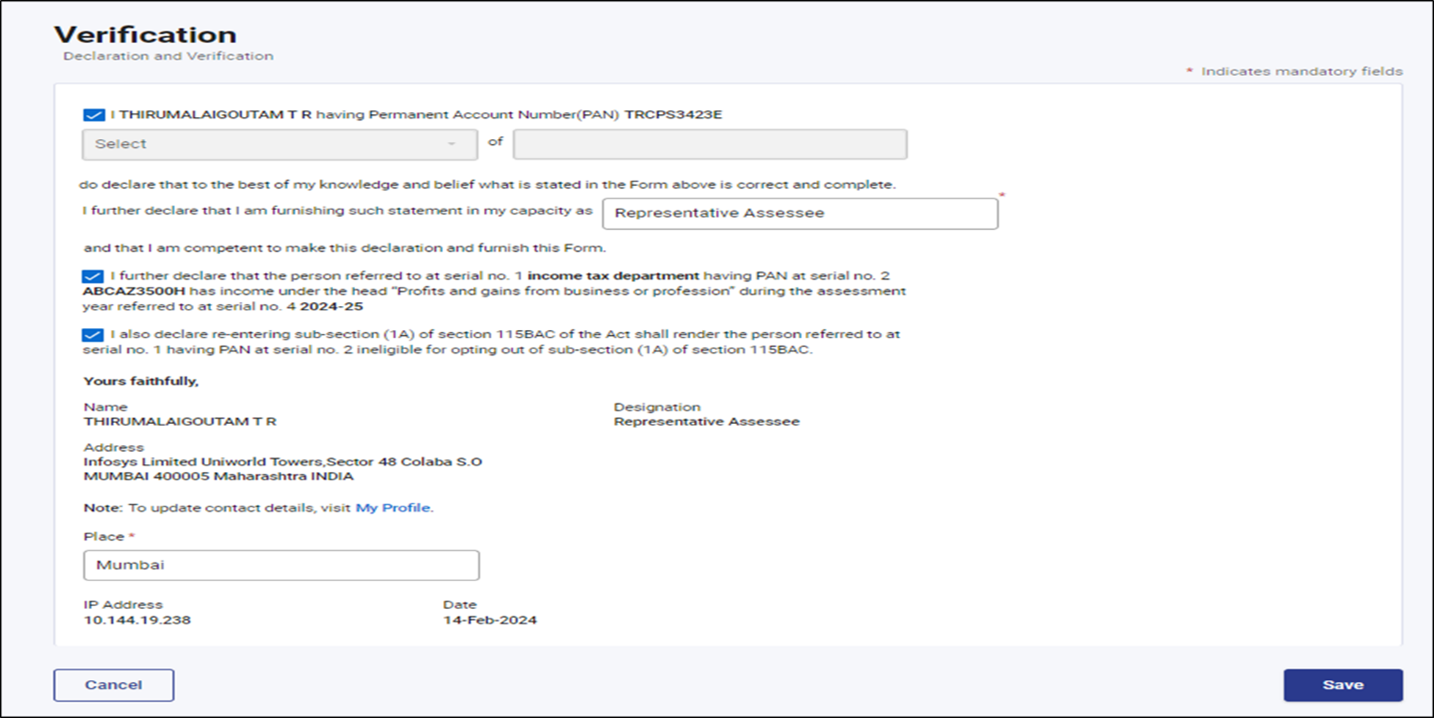

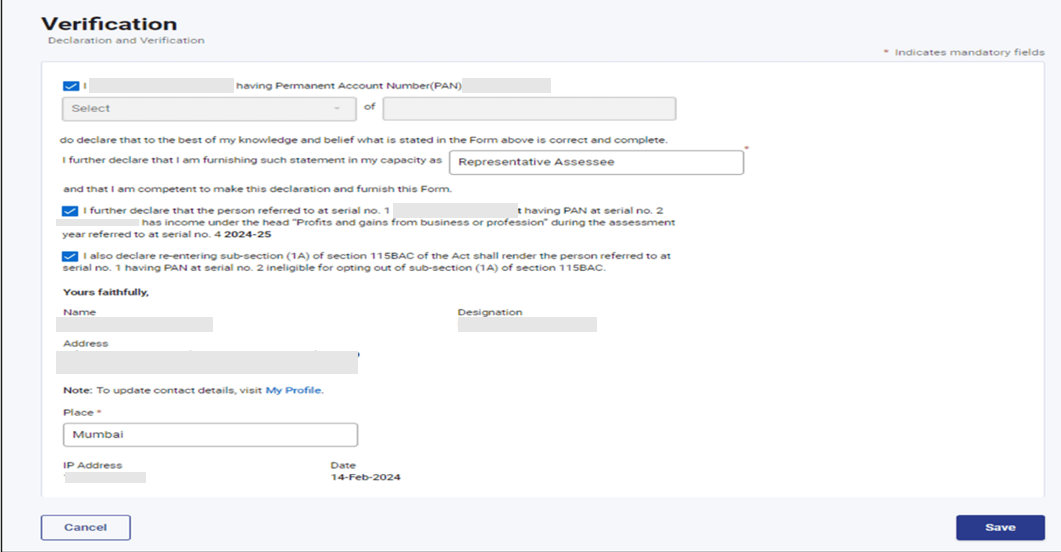

4.3. Declaration and verification

Part 3 is Declaration and verification by the taxpayer for Opting out or Re-entering in to the new Tax Regime.

5. How to Access and Submit

5.1. Filing of Form 10 IEA by taxpayer

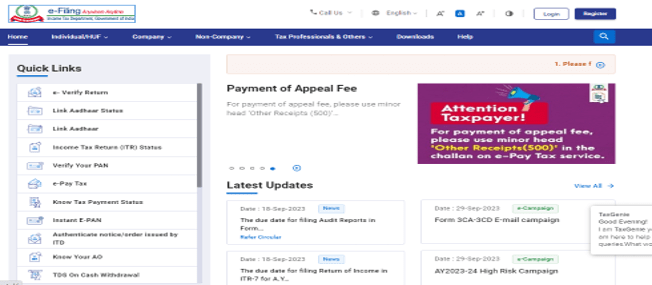

Step 1: Go to the e-Filing portal and click login.

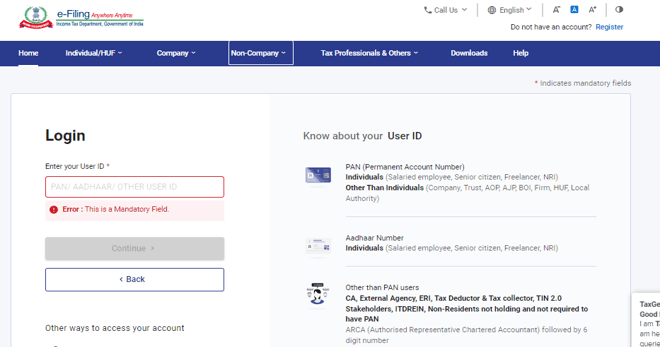

Step 2: On Login Page enter your user ID and password.

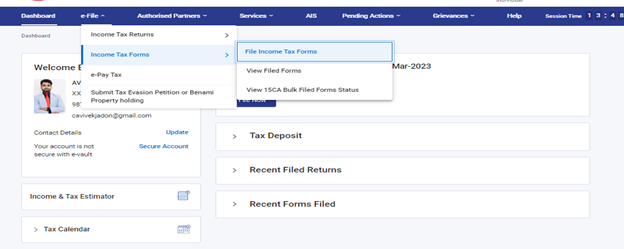

Step 3: On your Dashboard, Go to e- File menu > Income Tax Forms > File Income Tax Forms.

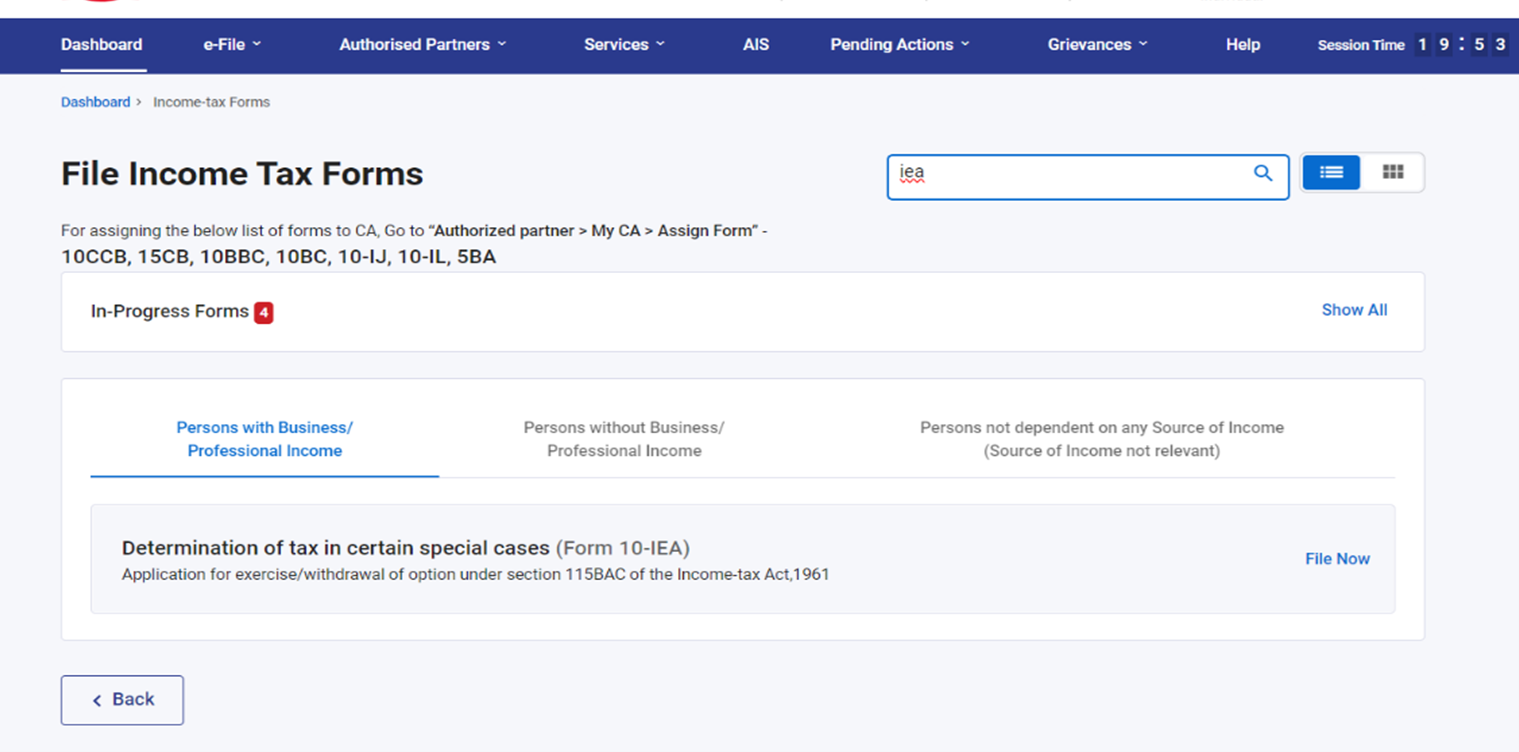

Step 4: On the page- File Income Tax Forms -‘Persons with Business/Professional Income -select the option-Form-10IEA.

Alternatively, enter Form 10IEA in the search box to file the form.

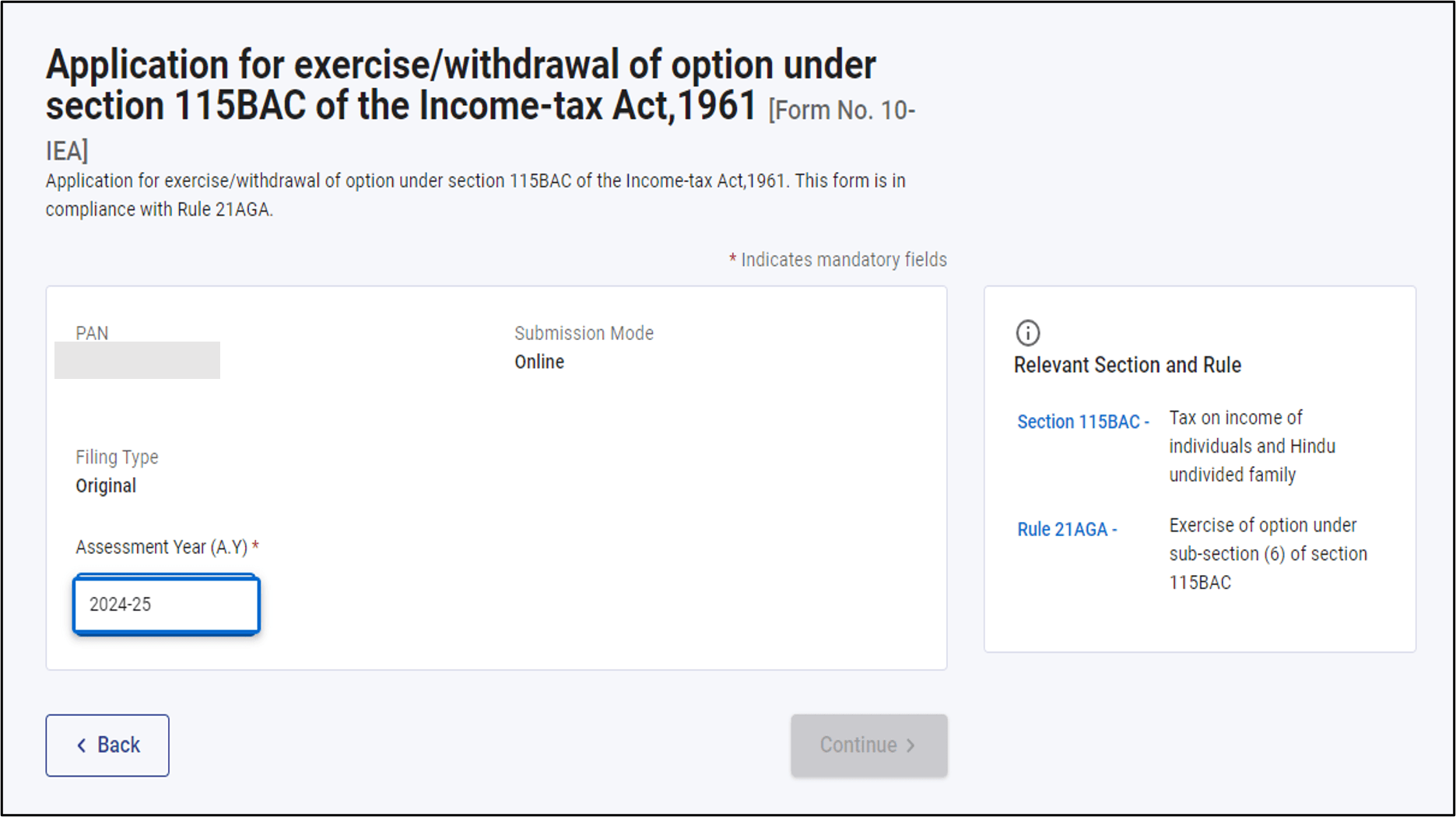

Step 5: On the Form 10 IEA page, select the relevant Assessment Year and click on continue.

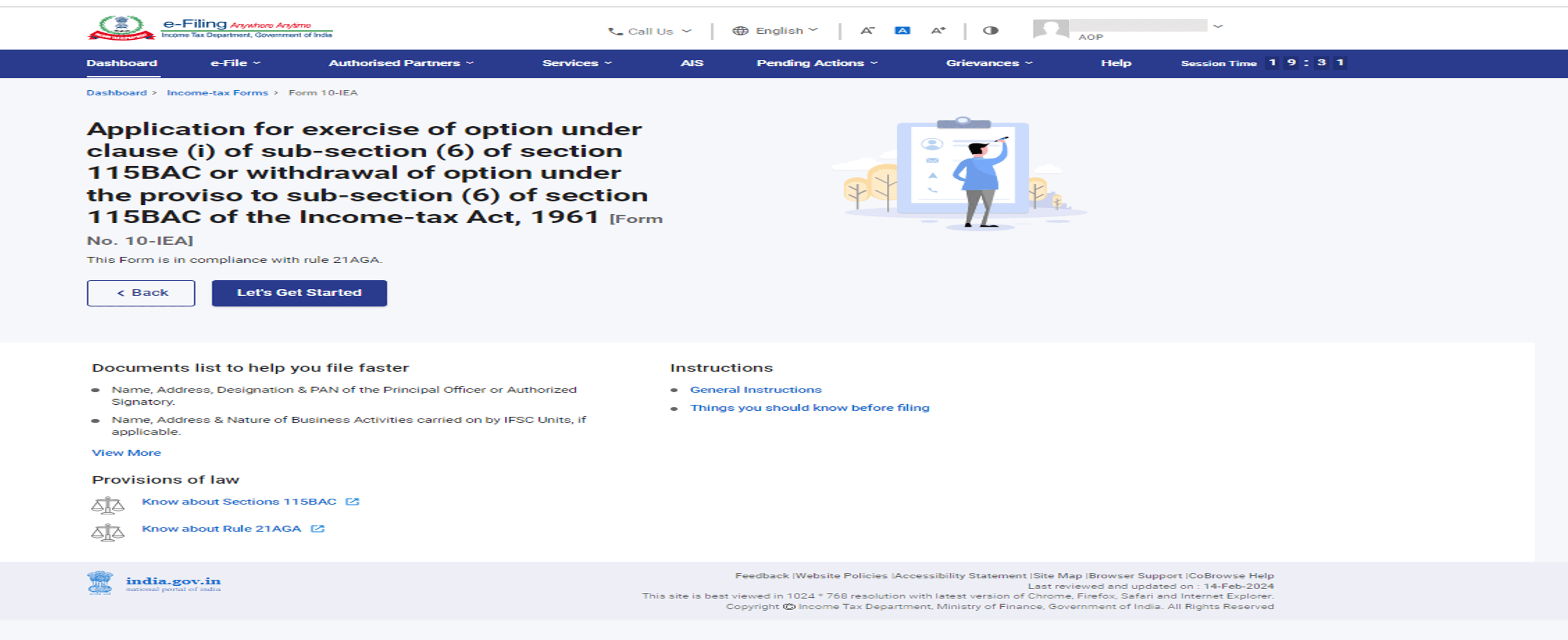

Step 6: Check the documents required for filing the form and Click on Let’s Get started

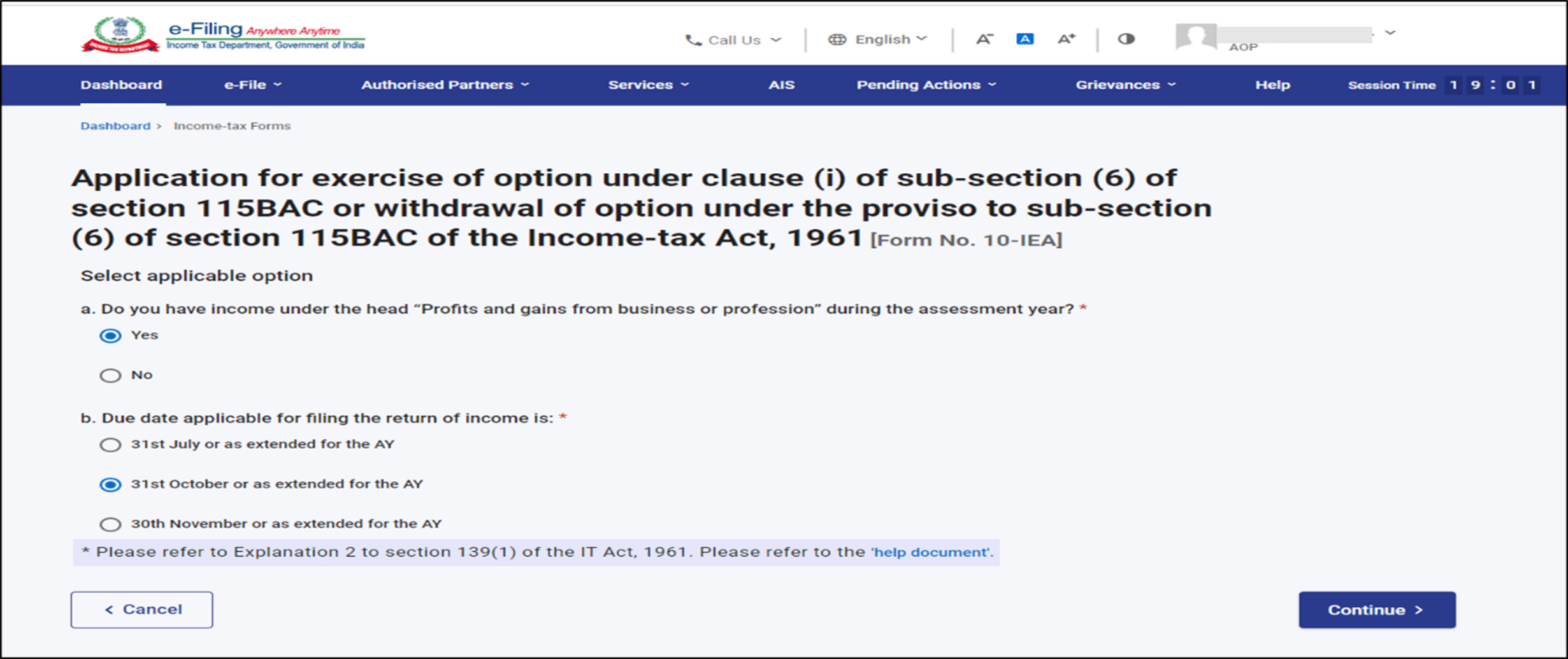

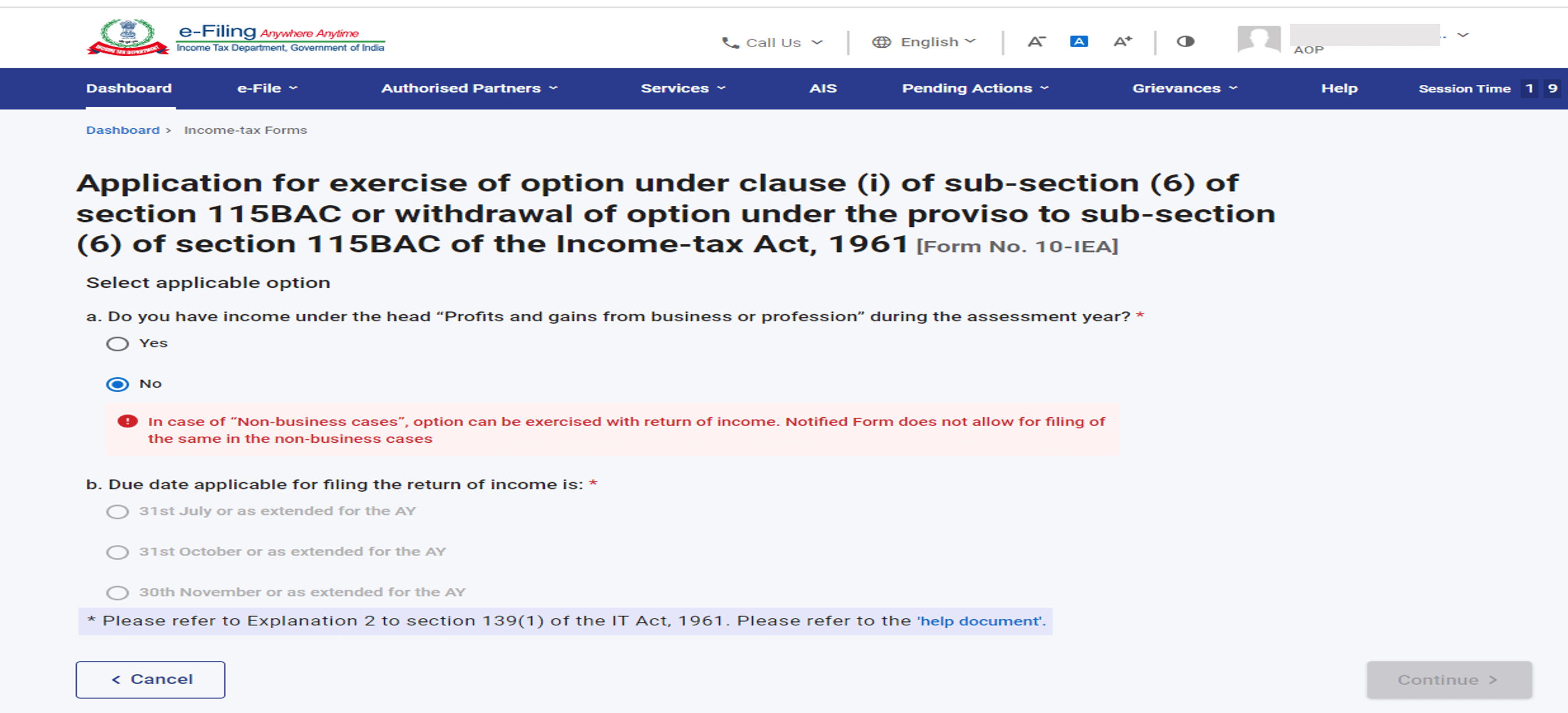

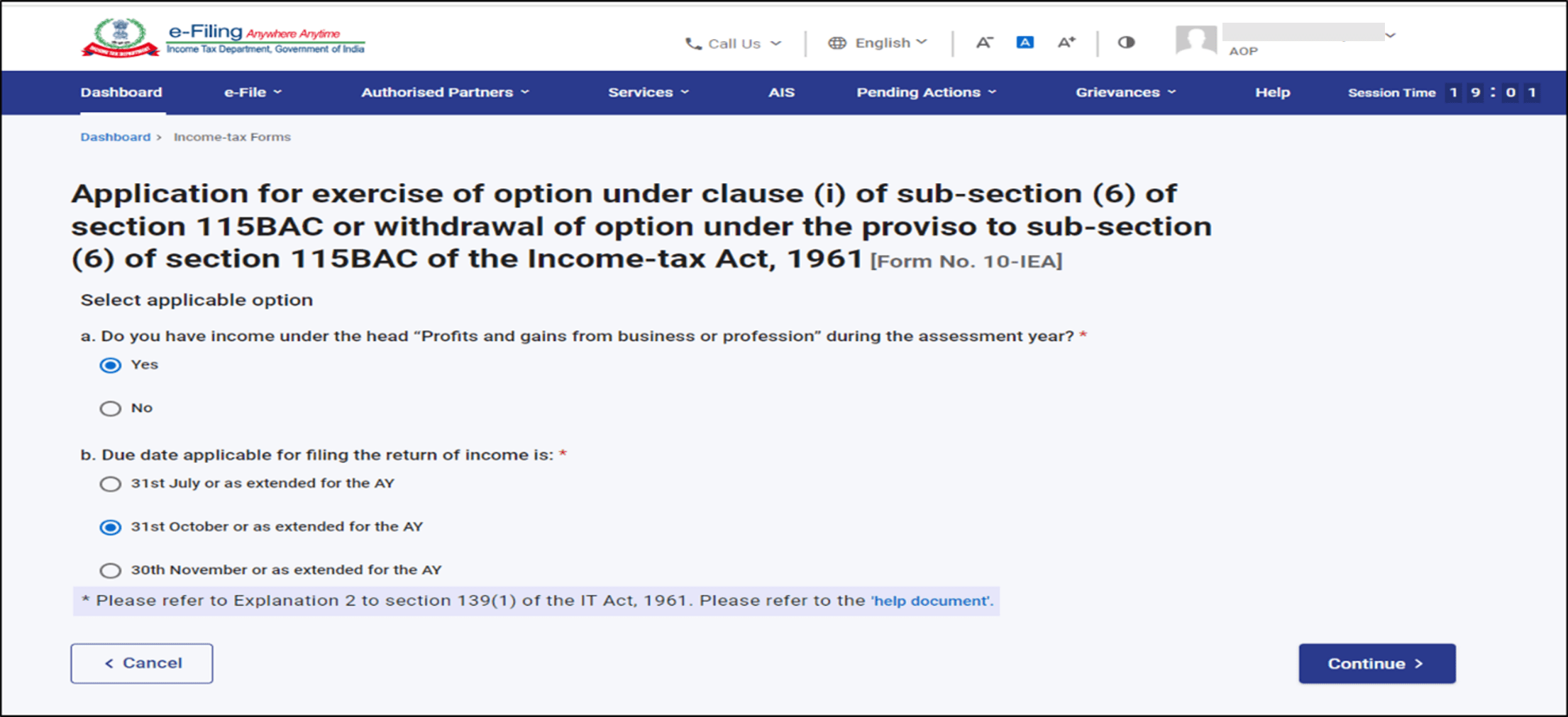

Step 7: Select Yes if you have Income under the head “Profits and gains from business or profession” during the assessment year.

Please Note:

- It is mandatory to submit Form 10-IEA for Opt out or Re-entering in to New Tax regime by Individuals, HUF, AOP (other than co-operative societies),BOI & AJP who have income from business or profession.

- Individuals, HUF without any business or professional income can opt out of the New Tax regime or Re-enter in to the New Tax Regime directly when they file their Income tax returns.

Step 8: Select the Due date applicable for of filing of return of income and click Continue.

Note: You may also use “Help document” by clicking on help document hyperlink for the help for selecting the applicable due date.

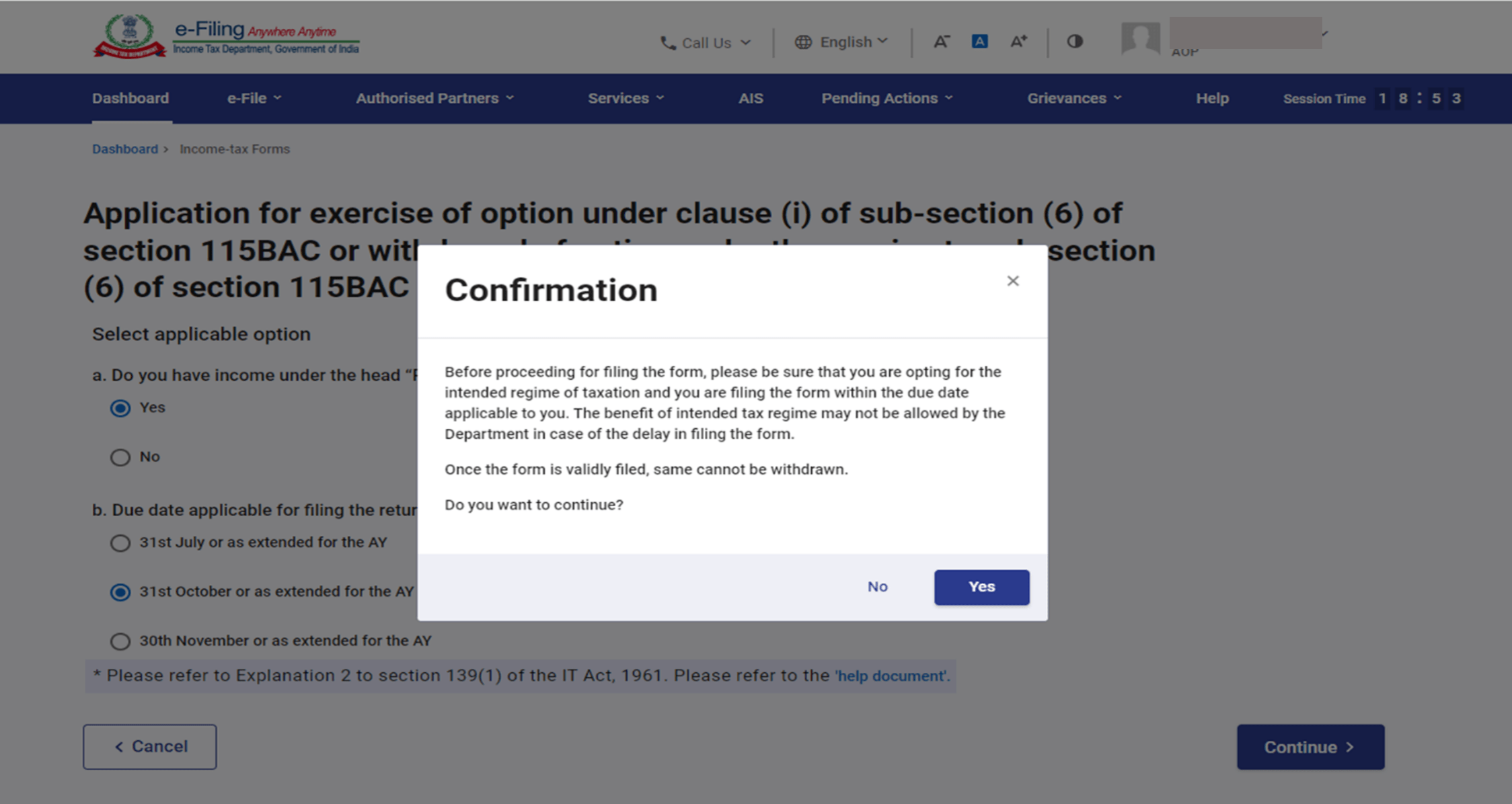

Step 9: Confirm the selection of the regime.

Step 7: Form has three section -confirm each section. Click on Basic Information section

Step 7: In Basic Information section, your basic information will be prefilled. If it is first time filing of form then opting out option will be auto-selected and if system has valid form with opting out option, then re-entering option will be auto-selected. Click on Save.

Opting out:

Re-entering:

Step 8: Fill the necessary details in Additional information section related to IFSC unit (if any) and click on save.

If you are opting out of new Tax regime this Additional Information panel will be greyed off

Step 8: Fill the necessary details in Declaration and verification section of the form, and click on save.

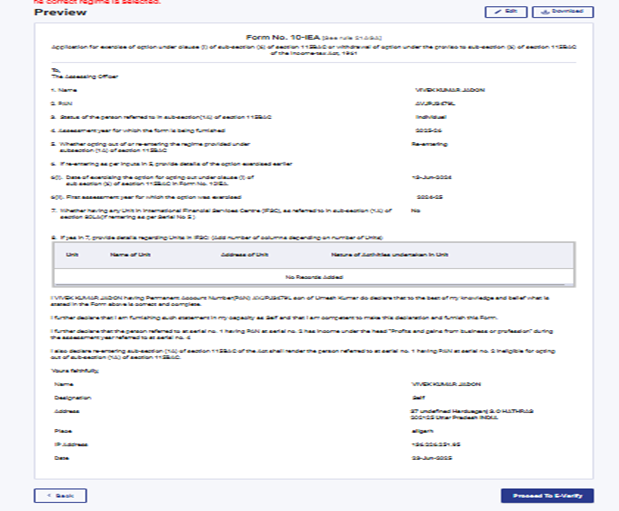

Step 9: Check the all the details furnished in the form. you can edit the details by clicking on edit button otherwise click on Proceed to e-verify button.

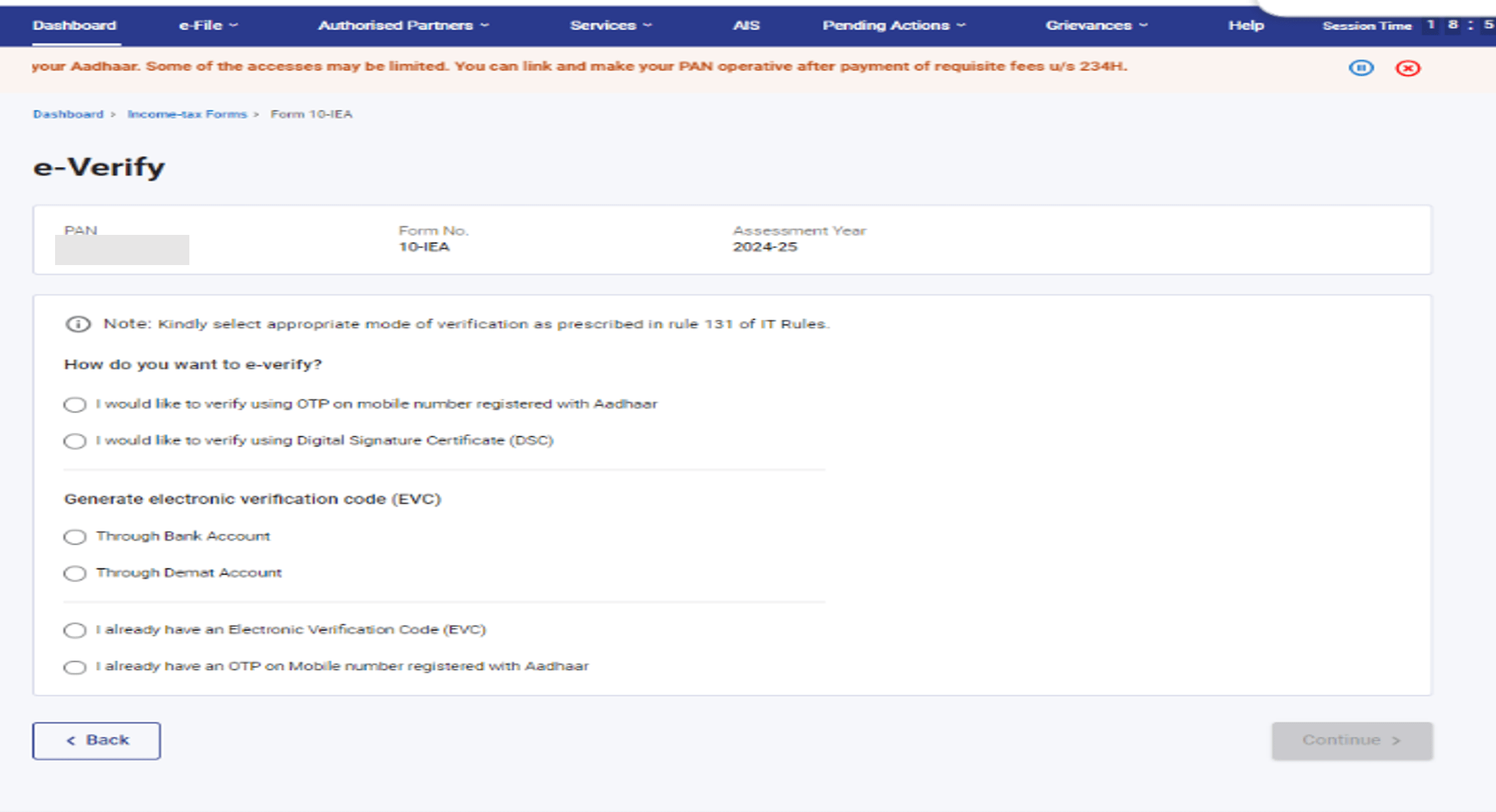

Step 10: Choose to e-verify from below options to verify the form.

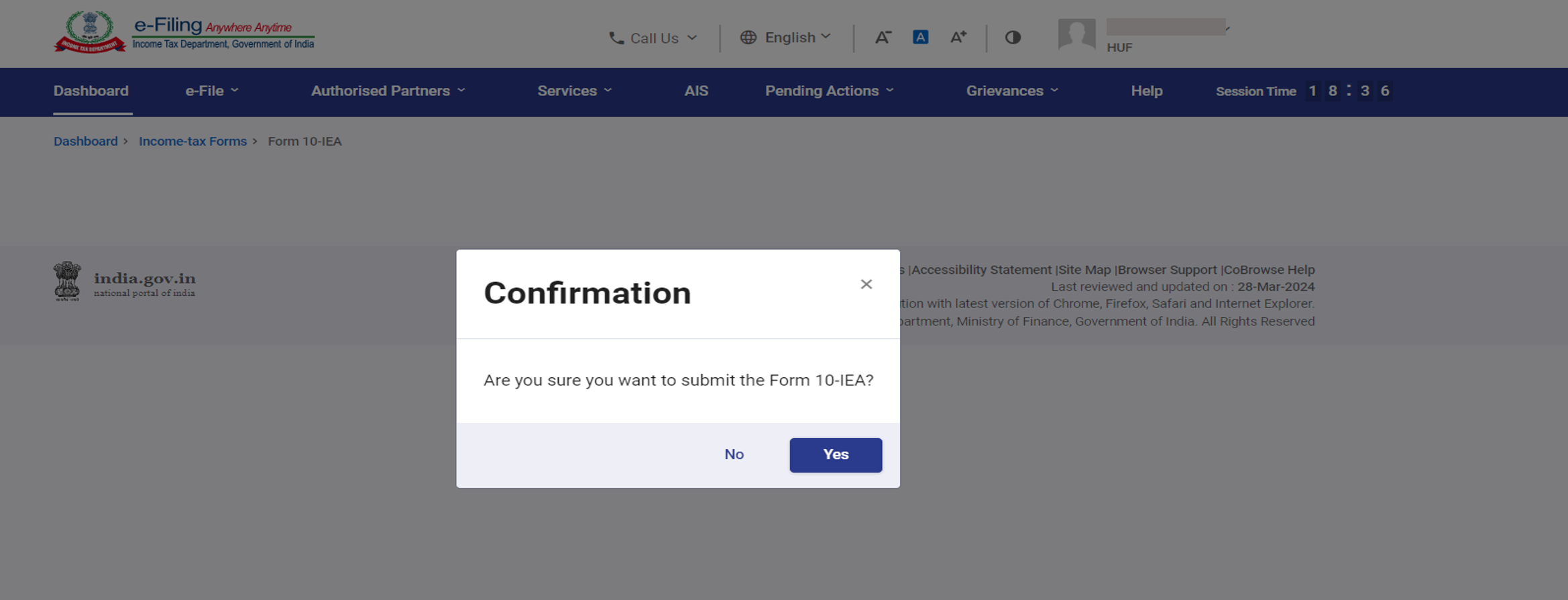

Step 11: After verification Click on ''Yes'' to Submit the Form.

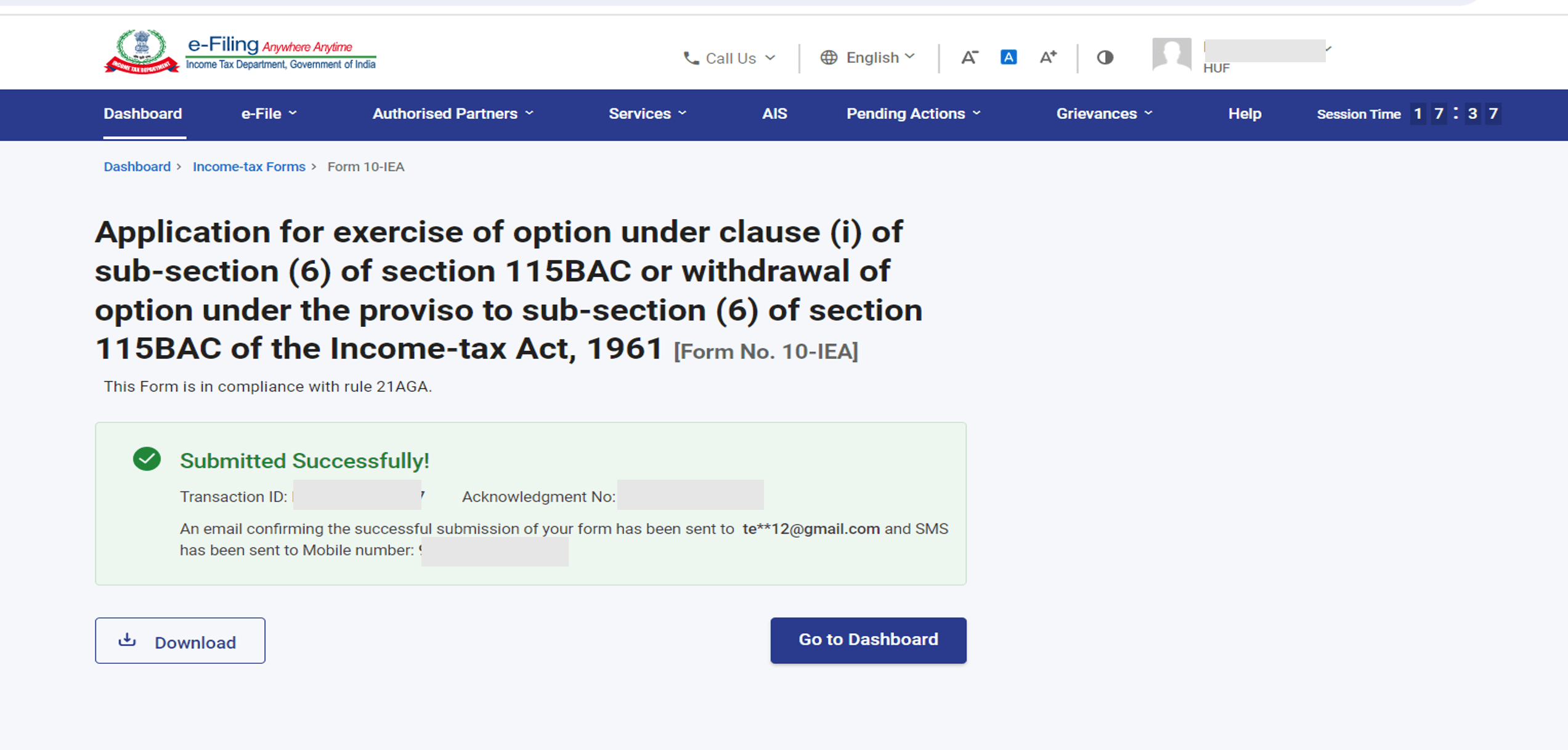

Step 12: Now Form is submitted Successfully Note the Transaction Id for the future reference.

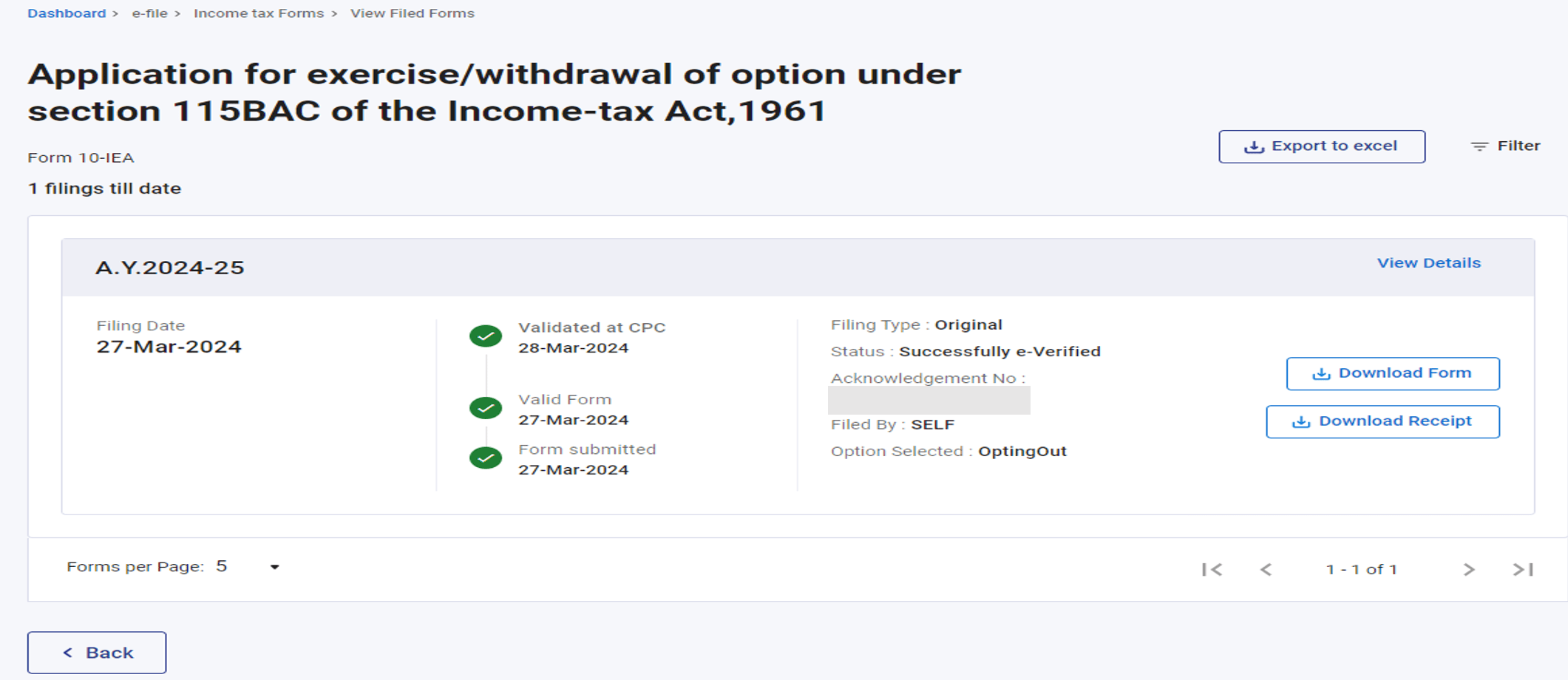

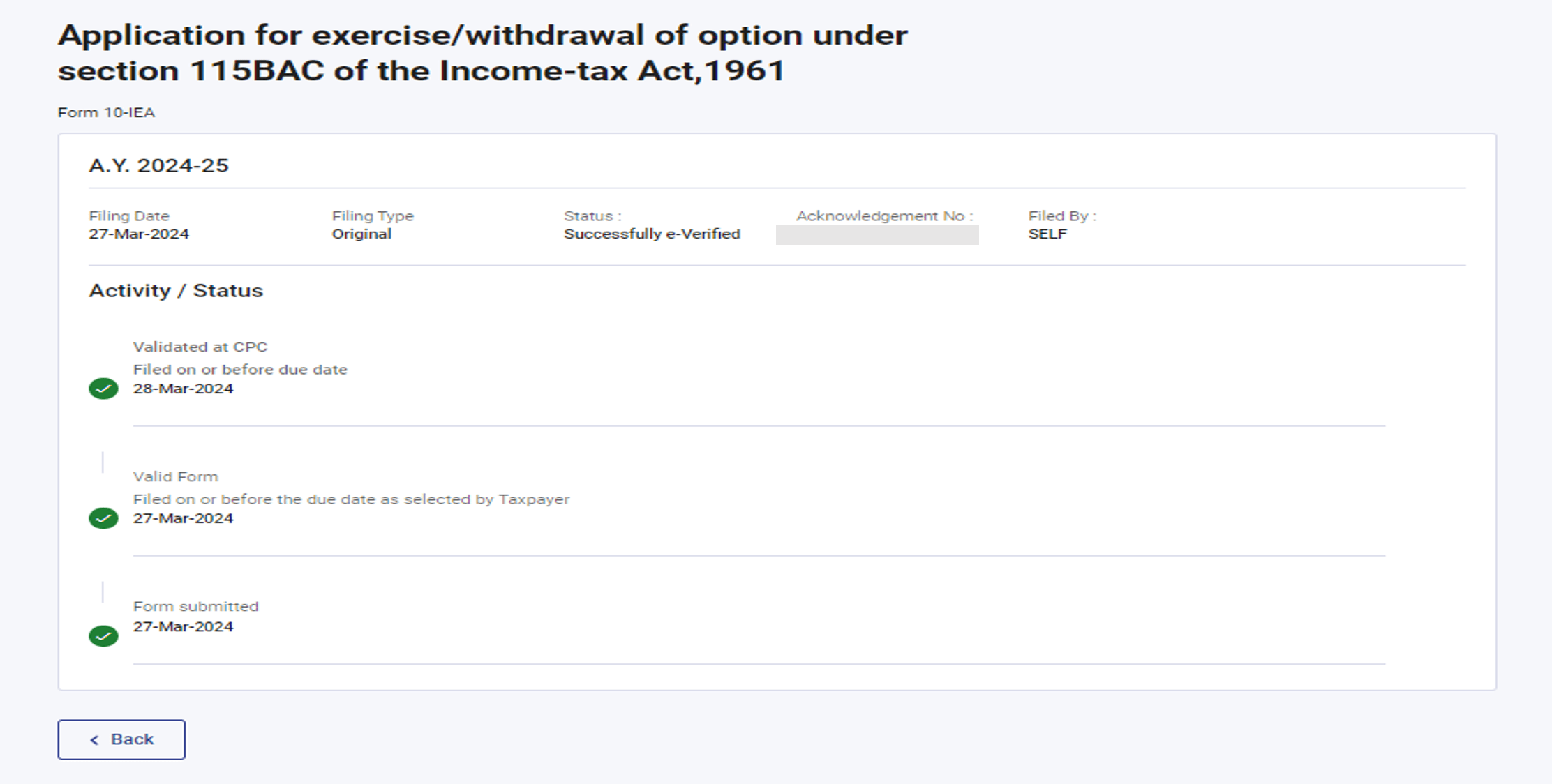

Now, if taxpayer wants to View filed form Go to the e-file menu > View filed forms > Form 10 IEA You can download the Form and receipt. Click on View details to see the life cycle of form

6. Related Topics

Login

Dashboard

How to e-Verify

Income Tax Forms