Condonation request for Form 10A u/s 12A

1. Overview

In case taxpayers did not file Form 10A before the specified due date, there was no Existing functionality on e-Filing portal to condone the delay for filing of Form 10A. Now, the Taxpayer can file the Condonation request for filing Form 10A under section 12A on e-filing portal .

As per the Finance (No. 2) Act, 2024, the Income-tax Act, 1961 has been amended to empower the Principal Commissioner or Commissioner to condone delays in filing Form 10A, in accordance with the proviso to clause (ac) of section 12A(1).

In this User Manual we will discuss the step-by-step process of Filing condonation requests and discuss some FAQs related to the same.

2. Prerequisites for availing this service

• Valid User ID and Password

• Due date of Form 10A has lapsed.

• Valid reason for Delay

3. Step-by-Step Guide

3.1 Condonation request for Form 10A u/s 12A

Application for Filing of condonation request for the relevant Assessment years to PCIT/CIT(E) to condone the delay.

(Kindly note that Condonation request for Form 10A can be filed using online mode only, the option of offline filing is not available)

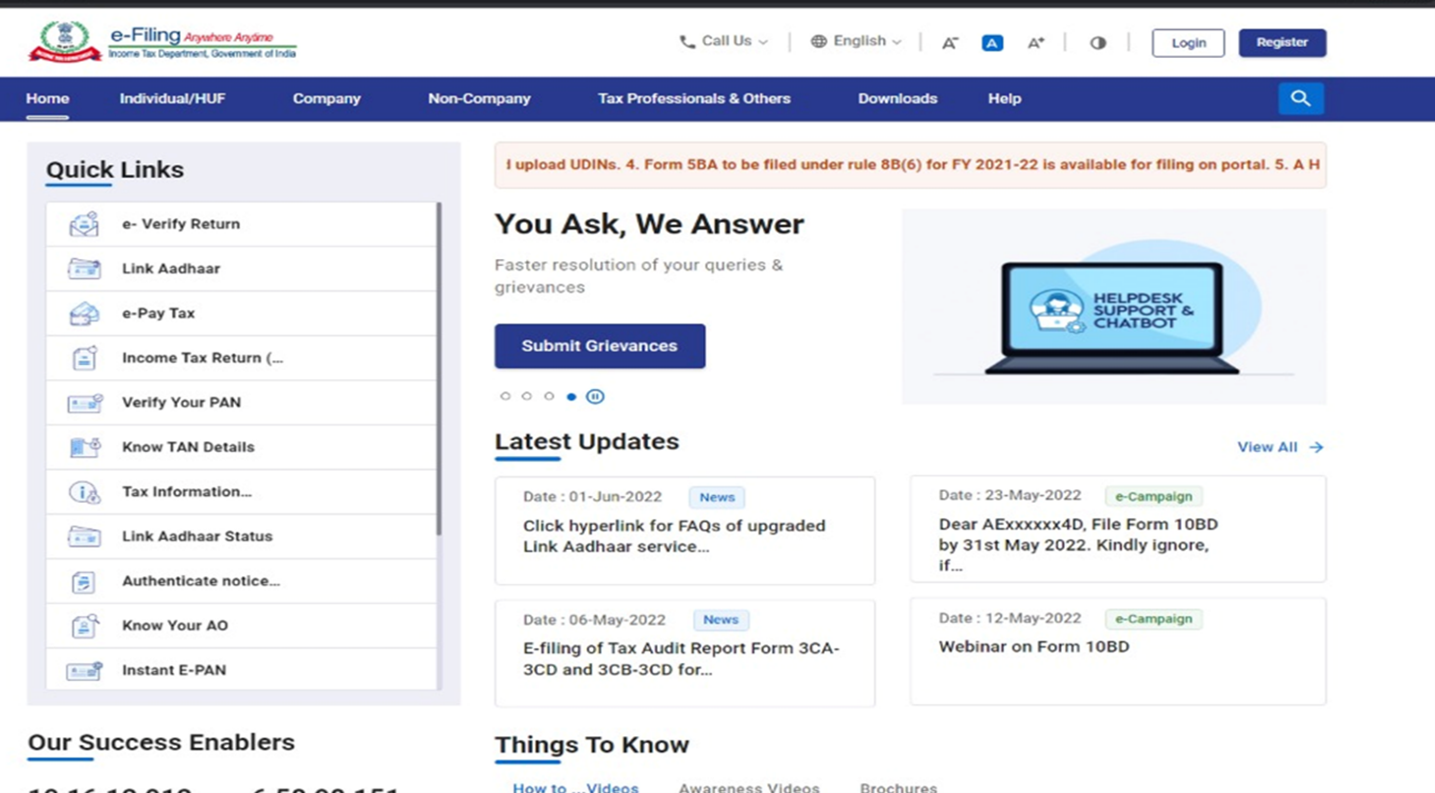

Step 1: Go to the e-Filing portal homepage.

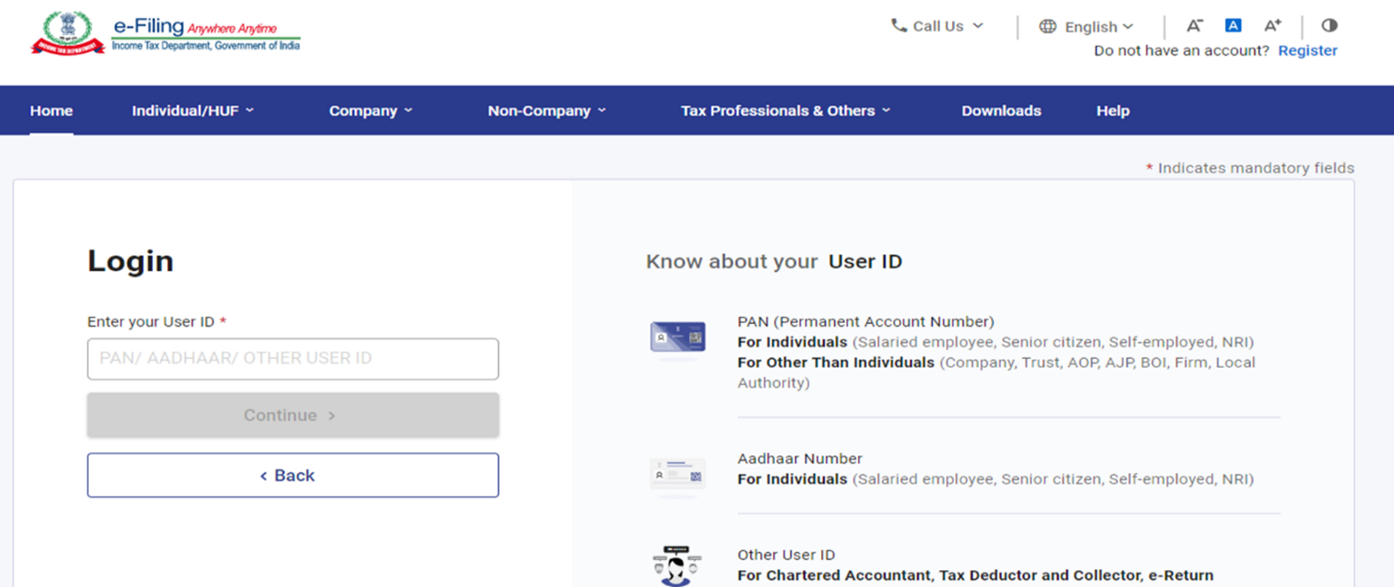

Step 2: Enter the User ID and Password.

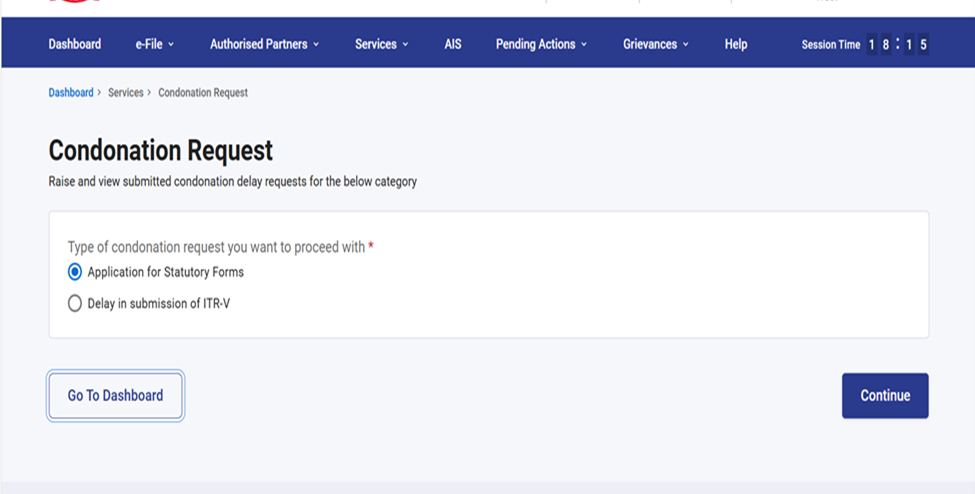

Step 3: Go to Services > Condonation request > Application for statutory Forms.

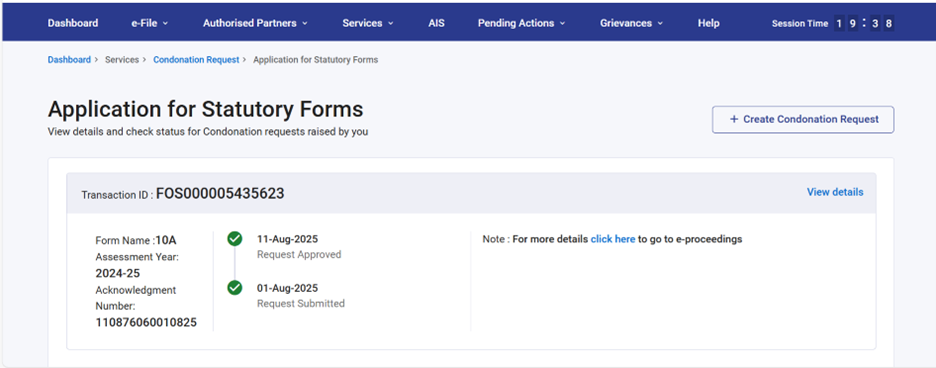

Step 4: Click on +Create Condonation request. If you want to view previously raised request, click on “View Details”

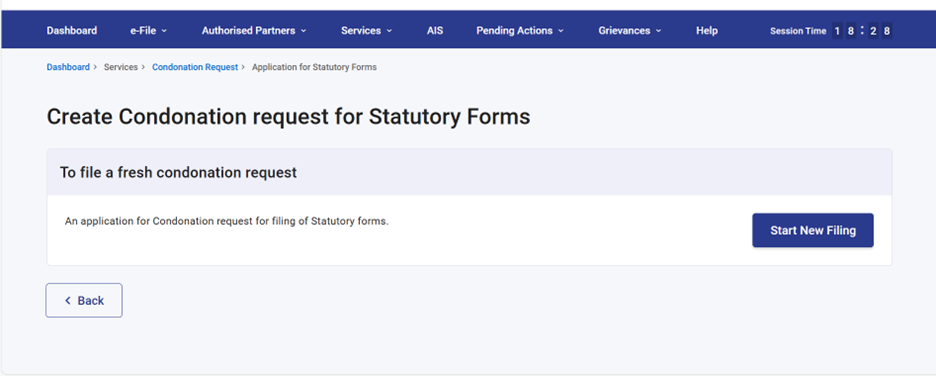

Step 5: Click on Start new filing.

Step 6: Fill the Condonation application form:

1. Details of Taxpayer

2. Details of Form.

• Select Section under which condonation is being filed, Form Name, Section code, Assessment Year, Due date by which the said compliance was due to be made applicable on Form.

• If Form 10A is already filed, enter the Acknowledgement no. and date of filing of Form 10A.

• Enter the reason of delay of filing Form 10A.

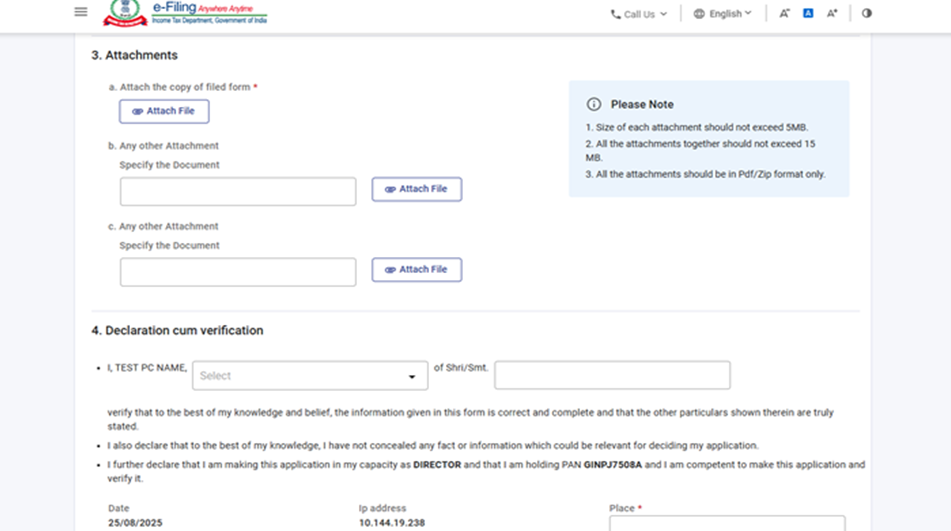

3. Attachment: If you select yes for the field "Whether the form has already been filed?", then uploading the PDF of the filed Form 10A is mandatory. Further, if you want to attach any other document, please attach in any other attachment field by providing the description.

4. Click on proceed to e-verify

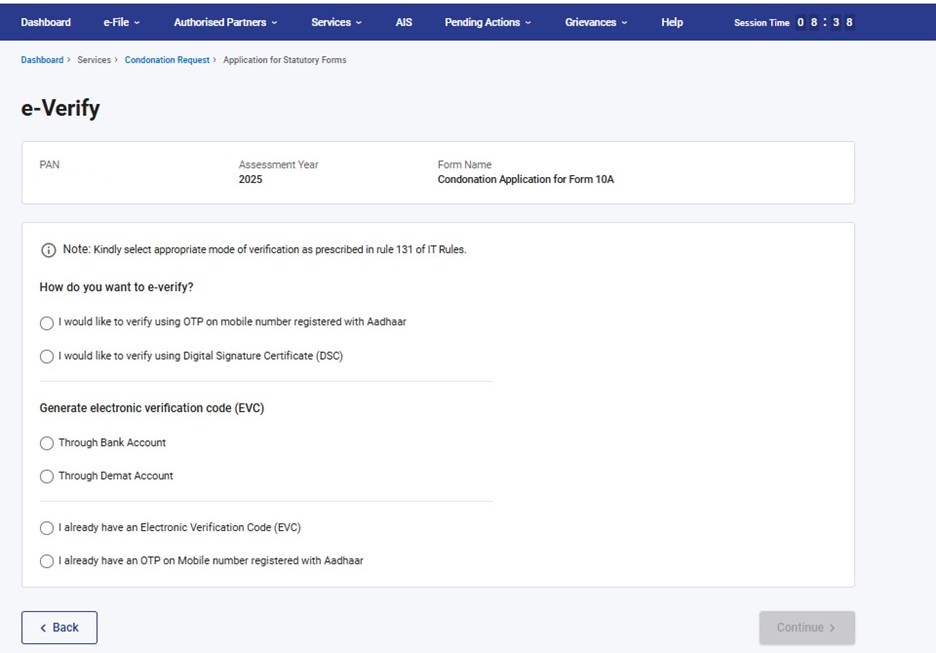

Step 7: Select mode of E-Verify and click continue.

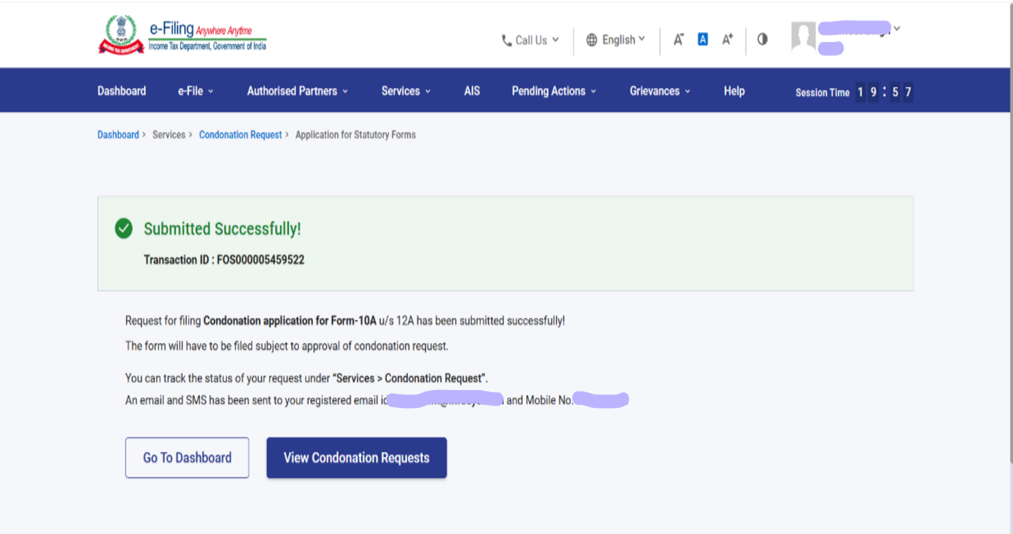

Step 8: After E-VERIFICATION your form will be submitted. Note the transaction ID for future reference.