1.Overview

Direct Tax Vivad Se Vishwas Scheme, 2024(DTVSV Scheme, 2024)is a scheme notified by the Government of India on 20th September, 2024 to resolve pending appeals in case of Income Tax disputes. The DTVSV Scheme, 2024 was enacted vide Finance (No. 2) Act, 2024. The said scheme shall come into effect from 01.10.2024. The rules and forms for enabling the scheme have been notified vide Notification No. 104/2024 dated 20.09.2024. Four separate Forms have been notified for the purposes of the Scheme. These are as follows:

- Form-1: Form for filing declaration and Undertaking by the declarant

- Form-2: Form for Certificate to be issued by Designated Authority

- Form-3: Form for Intimation of payment by the declarant

- Form-4: Order for Full and Final Settlement of tax arrears by Designated Authority

Taxpayers has to provide intimation of Payment in Form-3, as determined in Form-2 and is to be furnished to the Designated Authority along with proof of withdrawal of appeal, objection, application, writ petition, special leave petition, or claim.

The declarant must pay the determined amount within ‘fifteen days’ of receiving the certificate.

Form 1 and Form 3 shall be furnished electronically by the declarant on the e-filing portal of Income Tax Department i.ewww.incometax.gov.in.

2. Prerequisites for availing this service

- To upload Form 3, user should have a Certificate issued by Designated Authority in Form 2 to determine the amount payable by the taxpayer.

- A valid digital signature certificate, if the return of income is required to be furnished under digital signature or electronic verification code in other cases.

3. About the Form

3.1. Purpose

Taxpayers has to provide intimation of Payment in Form-3, as determined in Form-2 and is to be furnished to the Designated Authority.The declarant must pay the determined amount within ‘fifteen days’ of receiving the certificate.

3.2. Who can use it?

Any person who has a Certificate issued by Designated Authority in Form 2 to determine the amount payable by the taxpayer.

4. Form at a Glance

Form 3, DTVSVhas two parts–

- Payments Details

- Attachments

Here is a quick tour of the sections of Form 3 DTVsV, 2024:

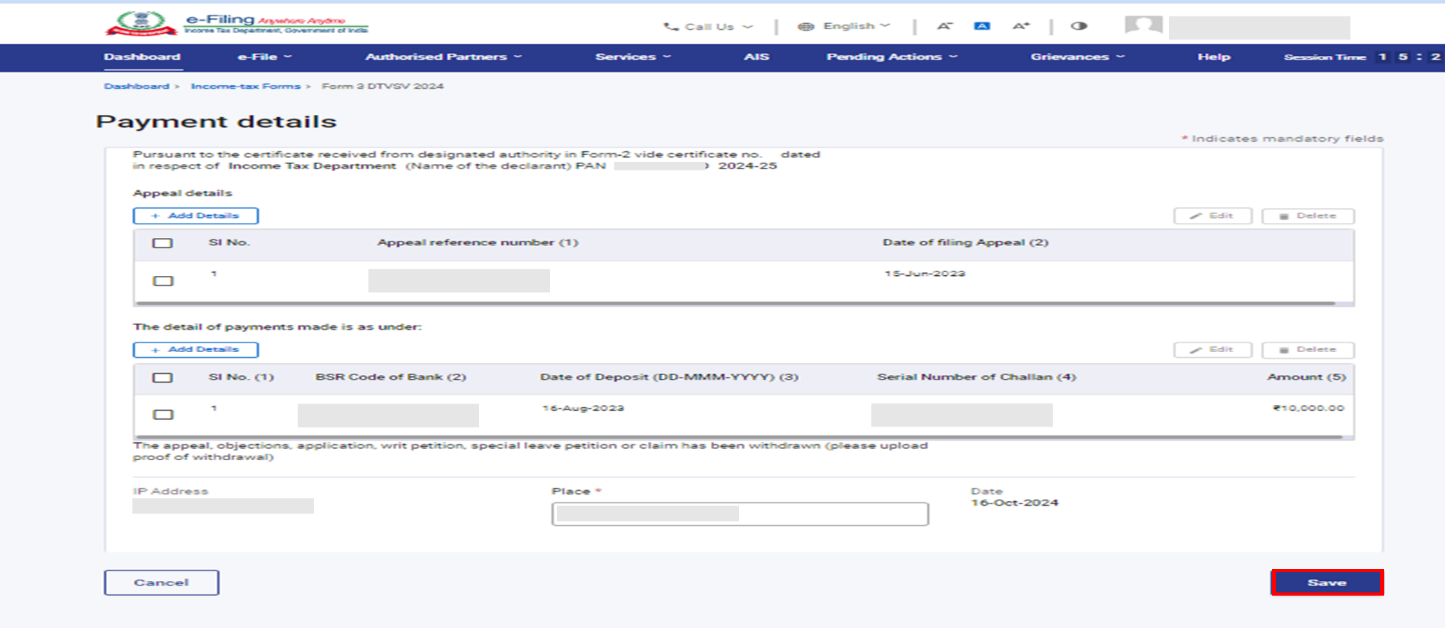

4.1. Payment Details

This section contains Appeal Details and Payment details.

4.2 Attachment

This section contains the Proof of withdrawal.

5. How to Access and Submit the form

Step 1: Login to the e-Filing portal using valid credentials.

Step 2: On your Dashboard, click e-File>View Filed Forms >Form 1 DTVSV 2024 >View All > Submit Form 3. Click on Submit Form-3.

Step 3: On the Form 3 page, Click on Payment Details Tab

Step 4: In the Payment Details Tab, Enter the Appeal Details and Payment Details and click Save.

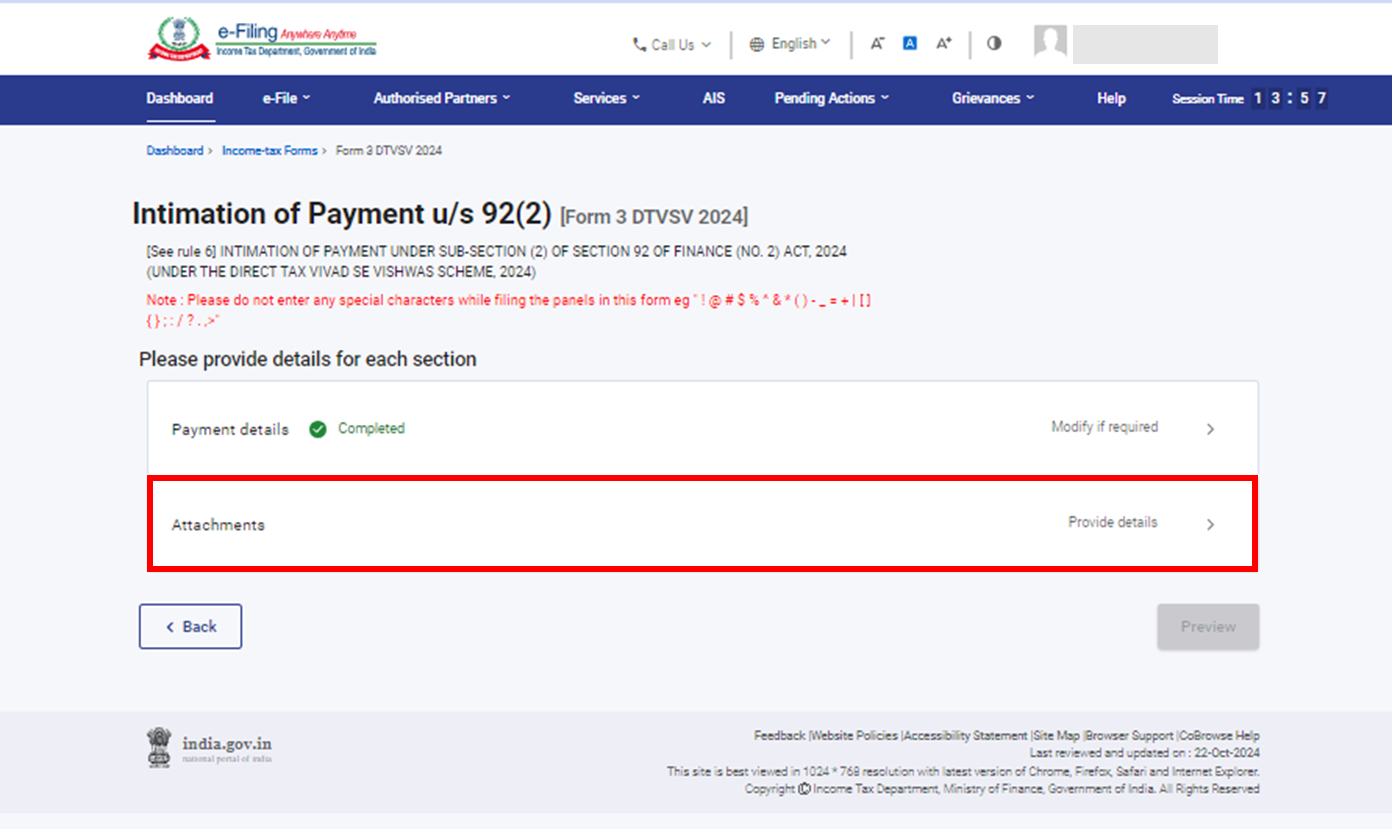

Step 5: Now the Payment Details Tab is confirmed. Click on Attachment Tab

Step 6: In the Attachment Tab, Attach the proof of withdrawal of appeal and click Save.

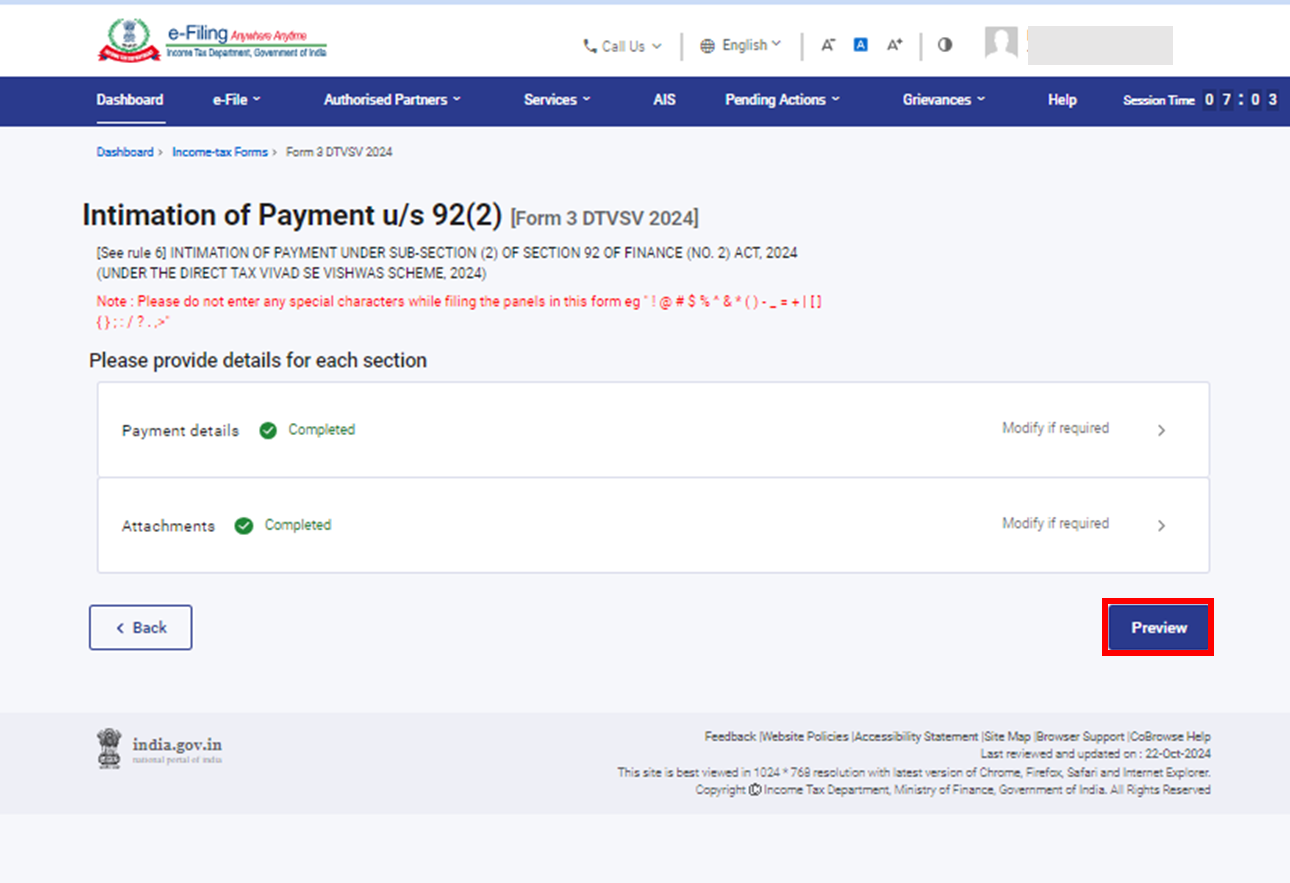

Step 7: Now, all the sections of the form are completed click on Preview button.

Step 8: Here is the preview of the form click on Proceed to e-verify

Step 9: Click on Proceed to e-Verify and clickYes on pop-up message to e-verify the form.

Step 10: Select the verification modes to verify the form and click continue.

After e-verification form will be submitted and you will get the Acknowledgement number of the form on your registered mail id and mobile no. The submitted form can also be viewed and downloaded from View Filed Forms Functionality.