1. Overview

Form 35 is available for use to any assessee / deductor for filing appeal to Commissioner (Appeal)/ Joint Commissioner (Appeals) if aggrieved by an order of the Assessing Officer (AO). An appeal is required to be filed along with Memorandum of Appeal, Statement of facts and the Grounds of appeal and should be accompanied by a copy of the order appealed against and the notice of demand.

CBDT has notified the 'Faceless Appeal Scheme, 2020', vide Gazetted Notification F.No. S.O. 3296 (E), dated 25-9-2020.

Under this Faceless Appeals Scheme, 2020, all Income Tax appeals before the first appellate authority i.e., the JCIT(Appeals) /CIT (Appeals), shall be finalized in a faceless manner under the faceless ecosystem.

The Scheme was amended and under the amended Faceless Appeal Scheme, 2021. The National Faceless Appeal Centre assigns the appeal, for disposal, directly, to a JCIT (Appeals) / CIT (Appeals) of a specific appeal unit, through an automated allocation system.

It has also been mandated that the appellant may request for a personal hearing through video conferencing, and on receipt of such a request of the appellant, the respective JCIT (Appeals) /CIT(Appeals), in the Appeal Unit shall grant such personal hearing to the appellant through video conferencing.

In 2023, CBDT has notified the 'e-Appeals Scheme, 2023', vide Gazetted Notification F.No. S.O. 2352 (E), dated 29-5-2023.

2. Pre-requisites for availing this service

• Registered PAN/TAN user on the e-Filing portal with valid user ID and password

• PAN and Aadhaar are linked (Recommended)

• Valid Digital Signature Certificate (DSC) registered on the e-Filing portal, which is not expired, if the Return of Income is required to be verified using DSC. In any other case, EVC is required.

Documents required for filing appeal :

• Copy of order. To download the order from e-filing portal, on the homepage go to the Pending Actions tab > E-proceedings

• Demand Notice

• Details of appeal fees paid

• Details of pending appeal

• Details of Taxes Paid

• Statement of Facts, Grounds of Appeal & Documentary Evidence

• Document Identification Number (DIN) or Order No.

3. Time limit for appeal

As per Section 249(2) of the Act, appeal should be filed within 30 days of the following date:

• Where the appeal relates to any assessment or penalty, the date of service of notice of demand relating to the assessment or penalty order.

• In any other case, the date on which intimation of the order sought to be appealed against is served.

4. Fee for Appeal

Appeal filing fees depend upon the total income determined by the AO in the assessment order which is as follows :

• If the total income determined by the Assessing officer is less than or equal to Rs. 1,00,000, the appeal fee is Rs.250.

• If the total income determined by the Assessing officer is more than Rs. 1,00,000 but less than Rs. 2,00,000, the appeal fee is Rs. 500.

• If the total income determined by the Assessing officer is more than Rs. 2,00,000, the appeal fee is Rs. 1,000.

• For other appeals, the fee would be Rs. 250.

5. How to make Payment of Appeal fee

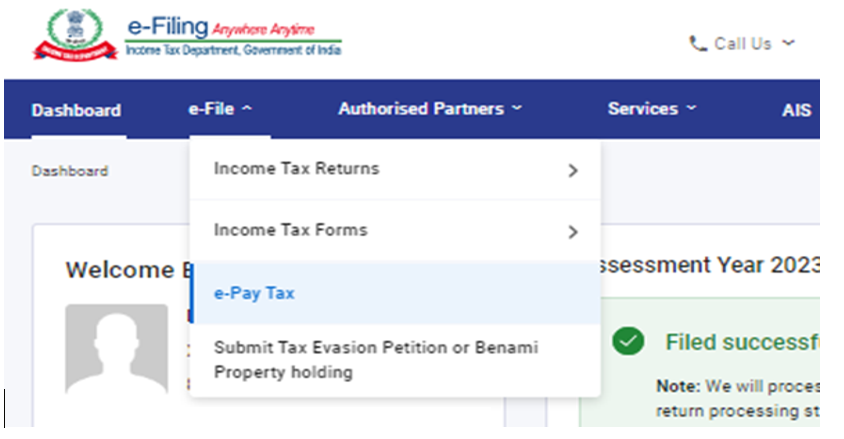

Step 1: After login to e-filing portal www.incometax.gov.in , Click on e-Pay Tax in e-File Menu on Dashboard.

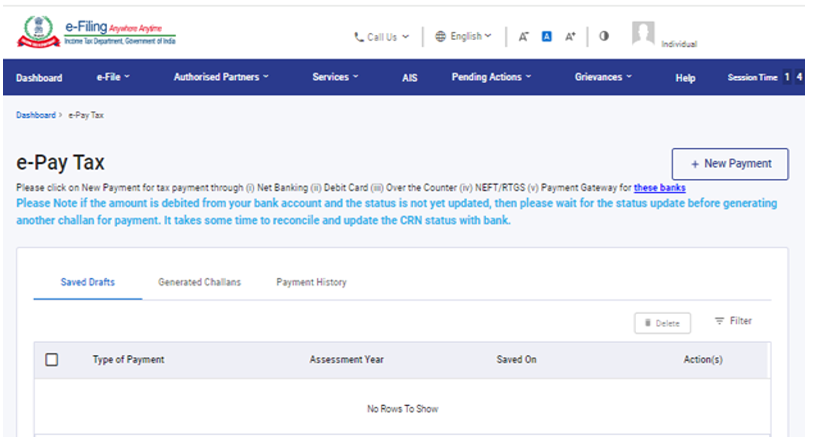

Step 2: On e-Pay Tax screen, Click on +New Payment.

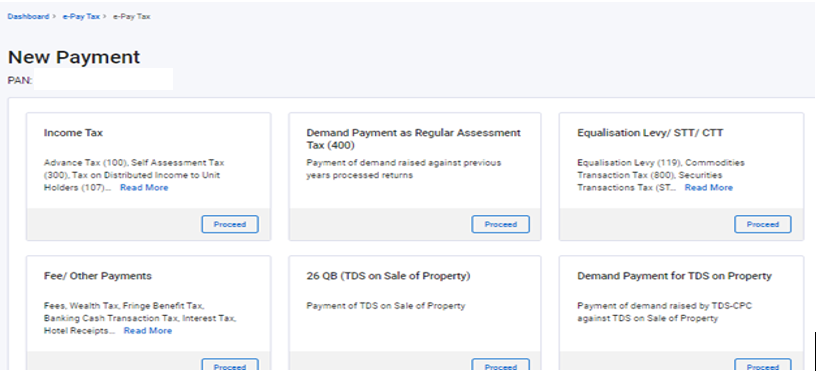

Step 3: Click on “Income Tax” tile.

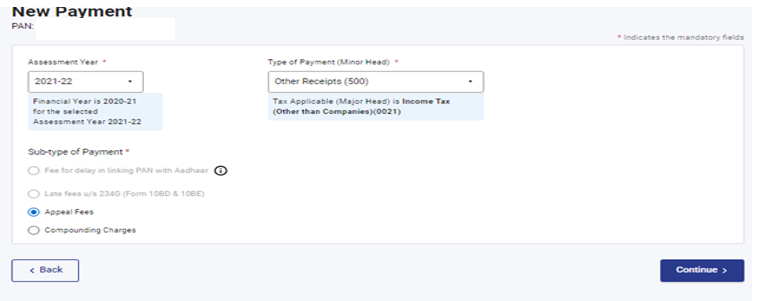

Step 4: Select Assessment Year, Type of Payment as Other Receipts (500) and subtype of payment as Appeal Fees.

Step 5: Enter the Appeal fee Amount in Others Column.

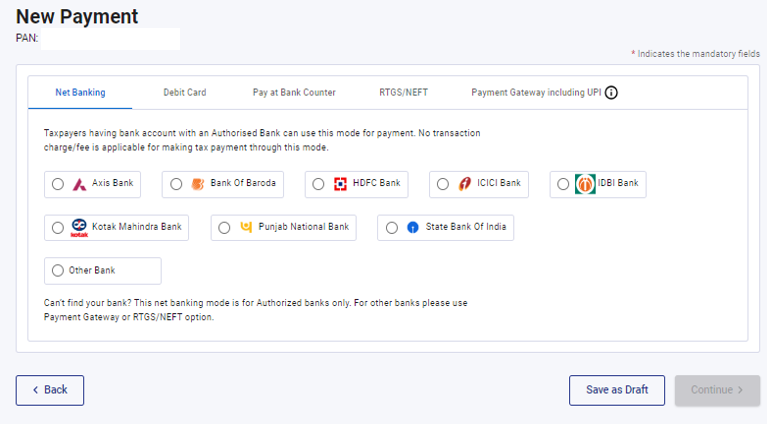

Step 6: Select the Mode of Payment and make the payment. To know the steps of payment refer to the User Manual on e-pay tax.

6. How to Access and Submit the form

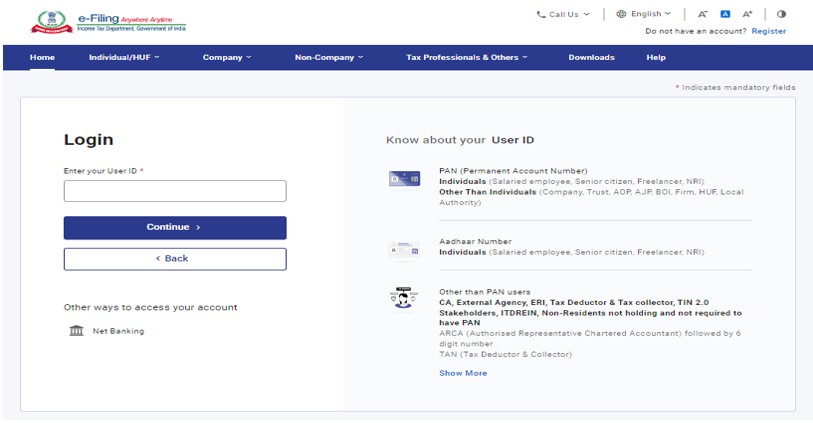

Step 1: Login to the e-Filing portal with PAN/TAN and Password.

Step 2.1: Go to Pending Actions > E-Proceedings > For your Information>File Appeal.

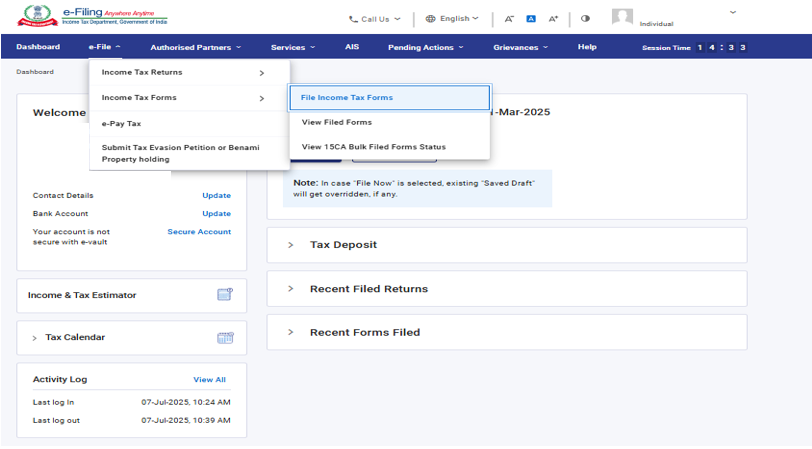

Step 2.2: Alternatively Go to e-file > Income Tax Forms > File Income Tax Forms.

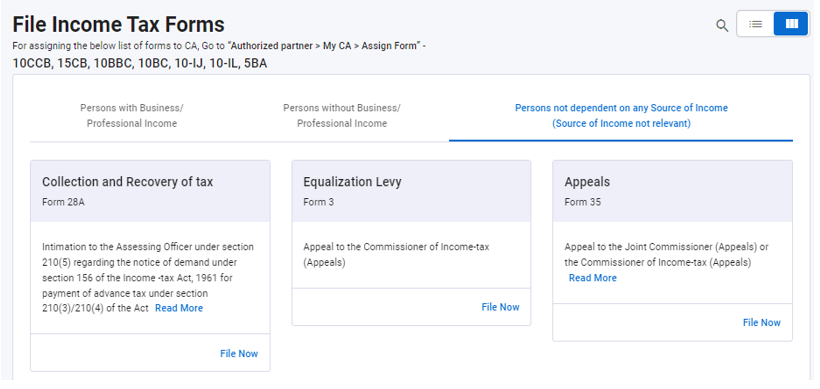

Step 2.2.1: Select the Form 35 from form category “Person not dependent on any Source of Income”.

In the TAN login , you can search Form 35 and click on File Now.

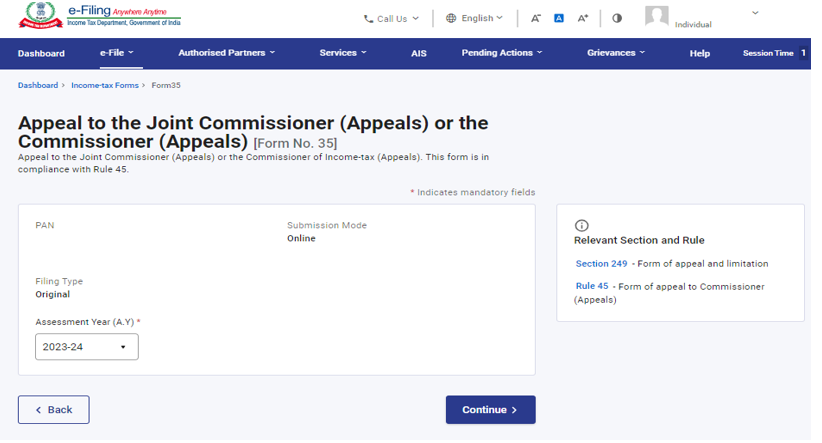

Step 3: Select the Assessment Year and click Continue

Note: If you are filing Appeal in TAN Login Year type will be Financial Year. Select the Financial year from the Dropdown menu and click Continue.

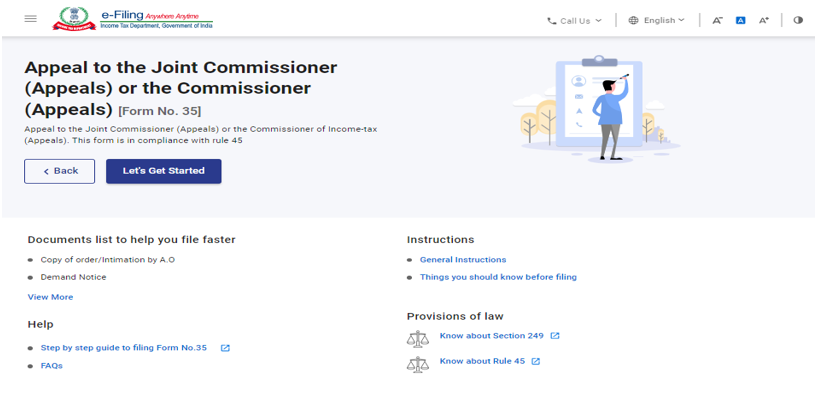

Step 4: Click on Let’s Get Started.

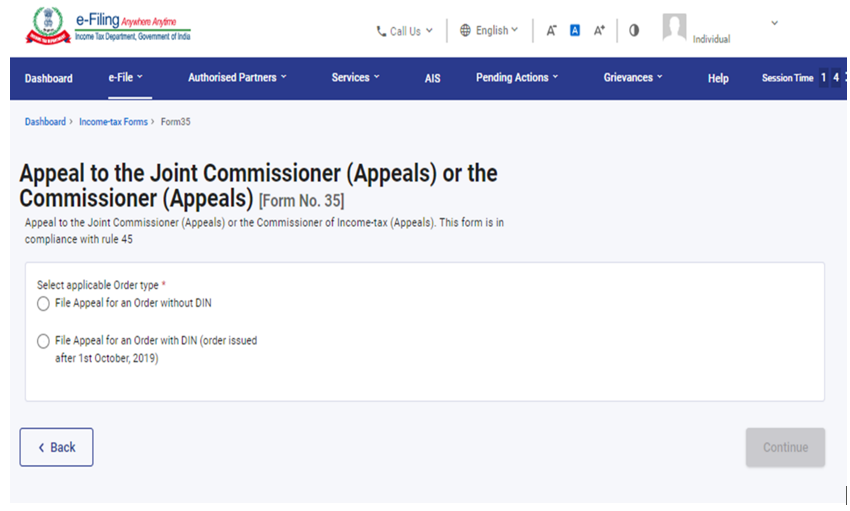

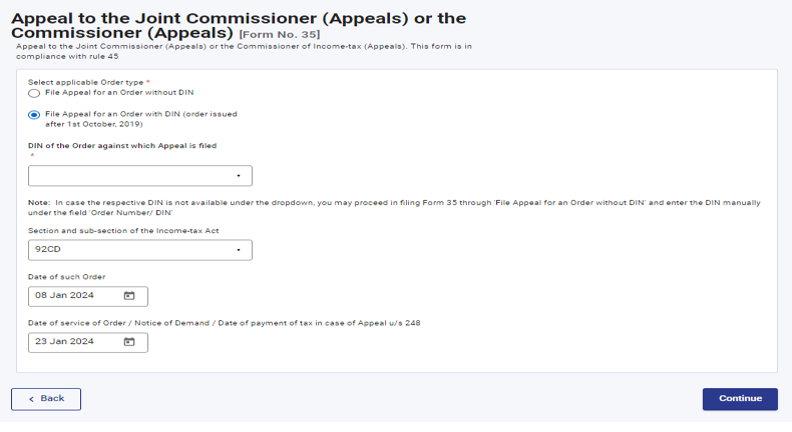

Step 5: Select the applicable order type (without DIN or with DIN) and click Continue.

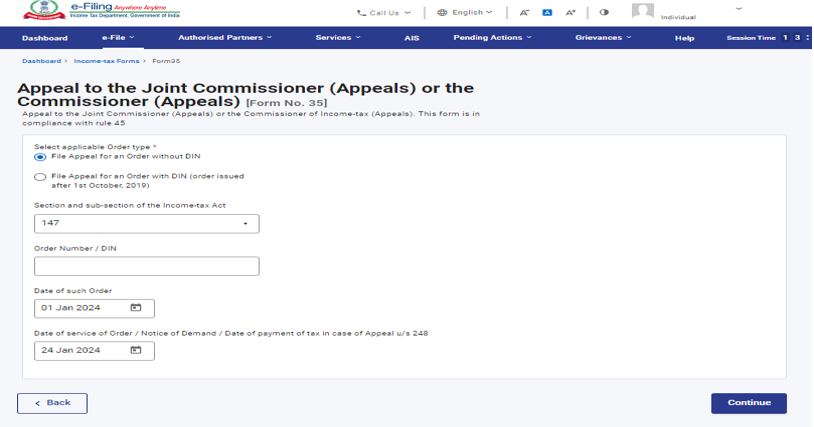

Option 1- Filing of Appeal Without DIN

Step 7 (a): If you select “File appeal for an order without DIN” Enter the relevant Income tax section, Order no., Date of order or notice of demand / Date of payment of tax in case of appeal u/s 248 and click continue.

Option 2- Filing of Appeal With DIN

Step 7 (b) : If you select “File appeal for an order with DIN” Select the DIN of order from dropdown menu , relevant Income tax section, Sub-section, Date of Such order /notice of demand / Date of payment of tax in case of appeal u/s 248 and click Continue.

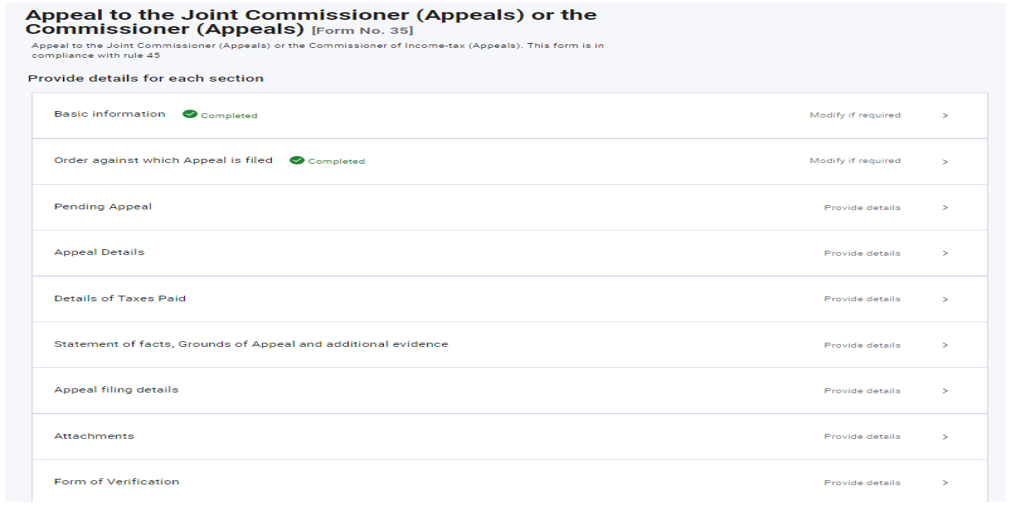

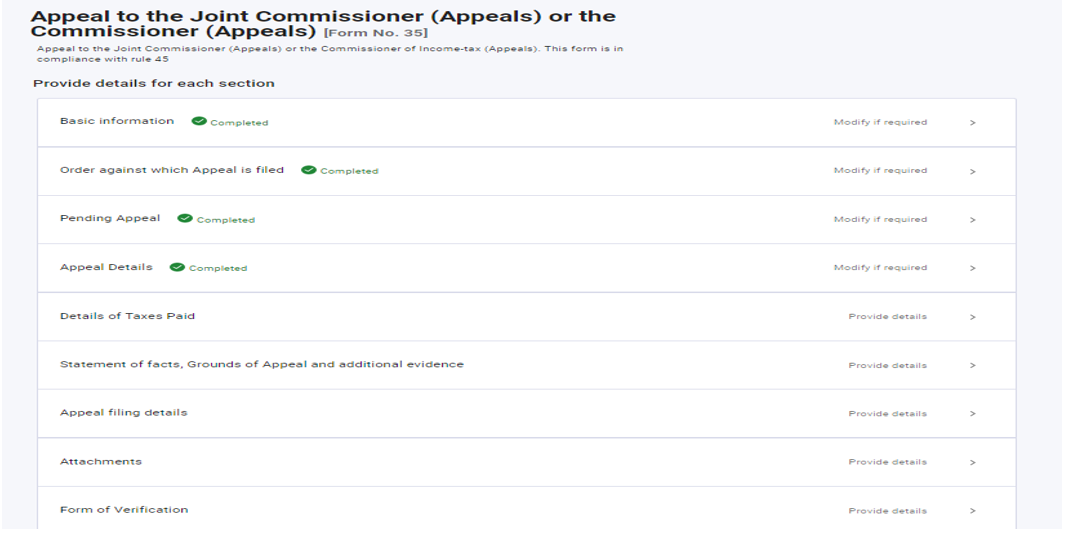

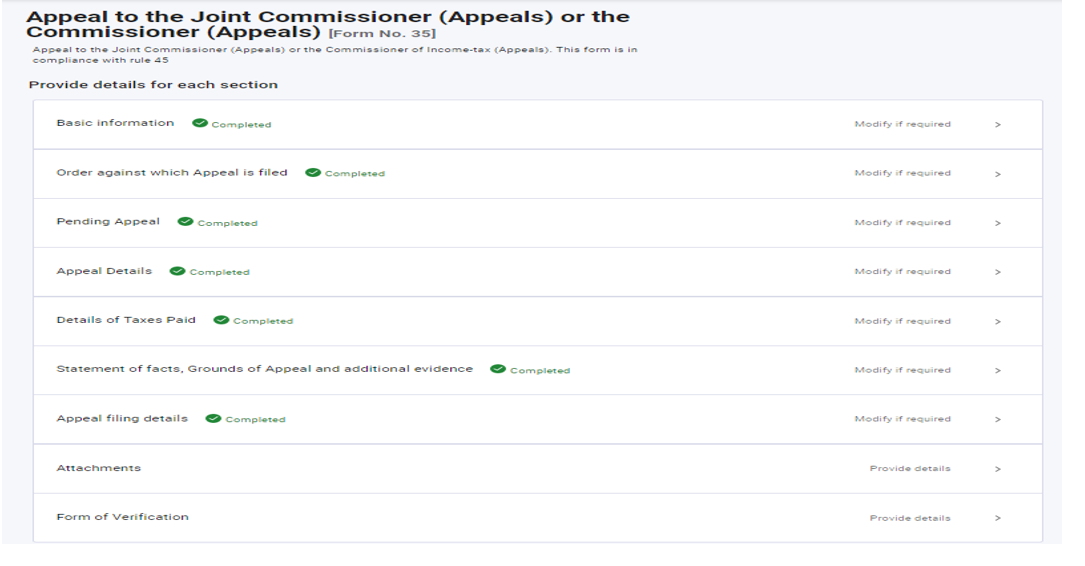

Step 8: Now, you need to enter the details and confirm all the tabs.

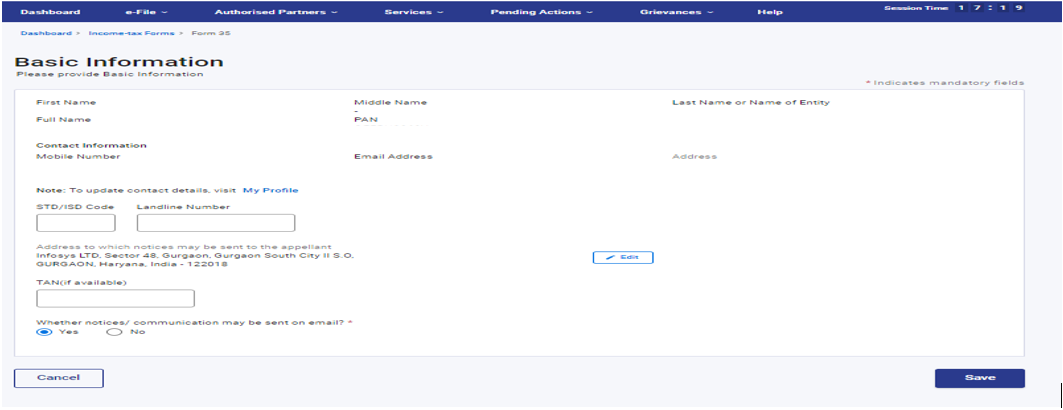

Step 9: Click on Basic information tab and click on Edit button in front of Address information. Add details in the mandatory fields and click on Save.

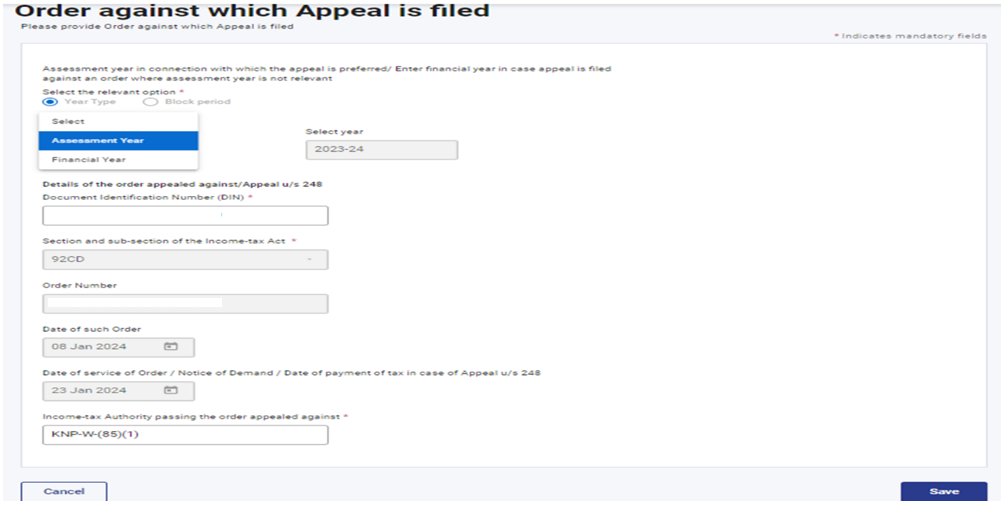

Step 10: Basic information tab is confirmed. Now, click on Order against which appeal is filed tab.

Step 11: Select the Year type (Assessment year/Financial year) from the dropdown menu and other information will be pre-filled. Click on Save.

Note: If you are filing Appeal in TAN Login Year types will be auto selected as financial year and other details will also be Auto filled. Click Save.

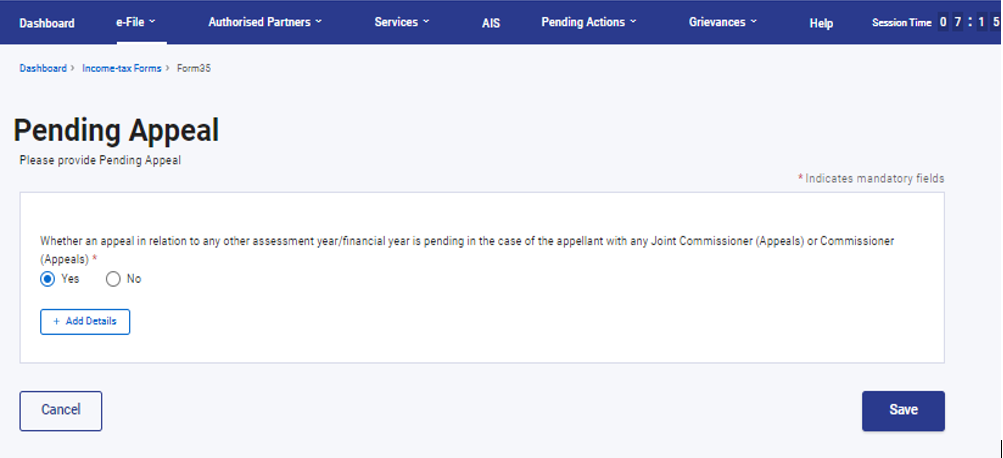

Step 12: Order against which appeal is filed tab is confirmed. Now, click on pending appeal tab.

Step 13: Select Yes/No if any appeal is pending with any Joint Commissioner(A) or Commissioner (A) and click on Save.

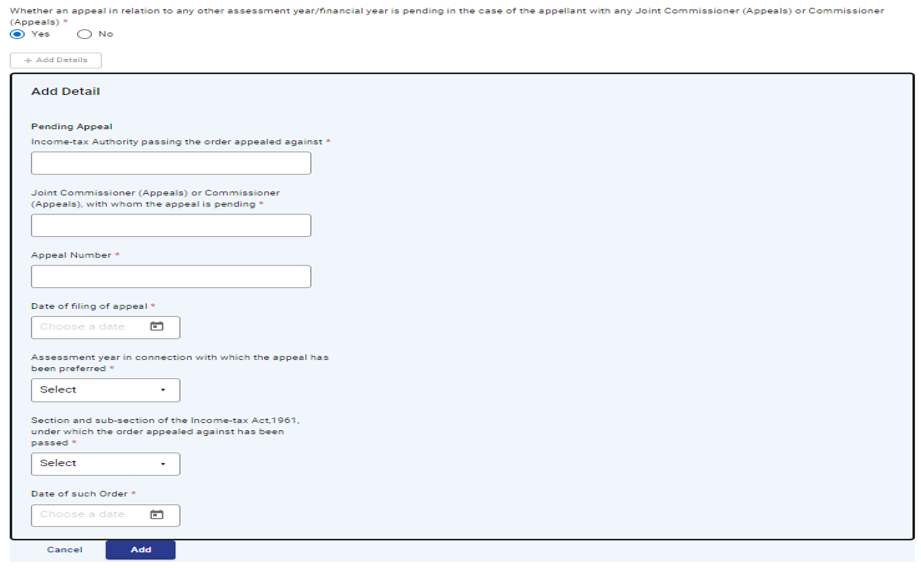

Step 13 (a): If You are selecting Yes then add the details.

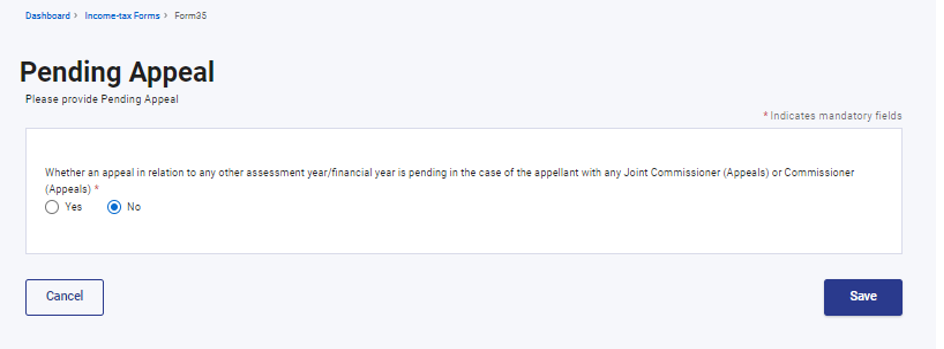

Step 13 (b): If You are selecting No, click on Save button to confirm the tab.

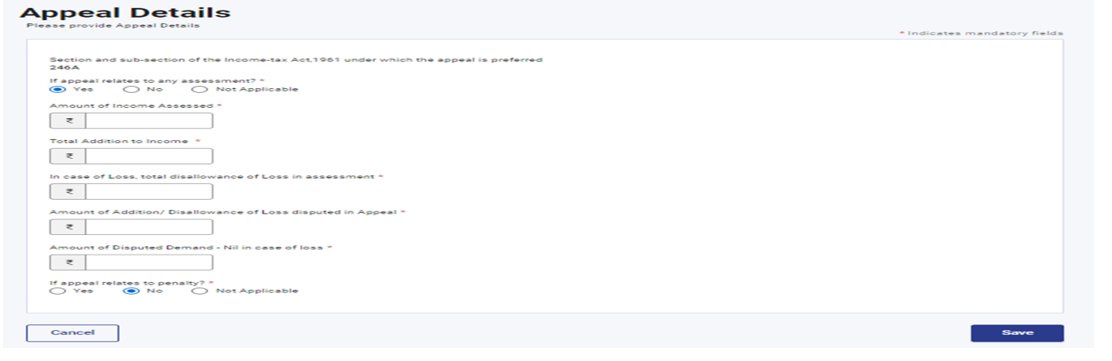

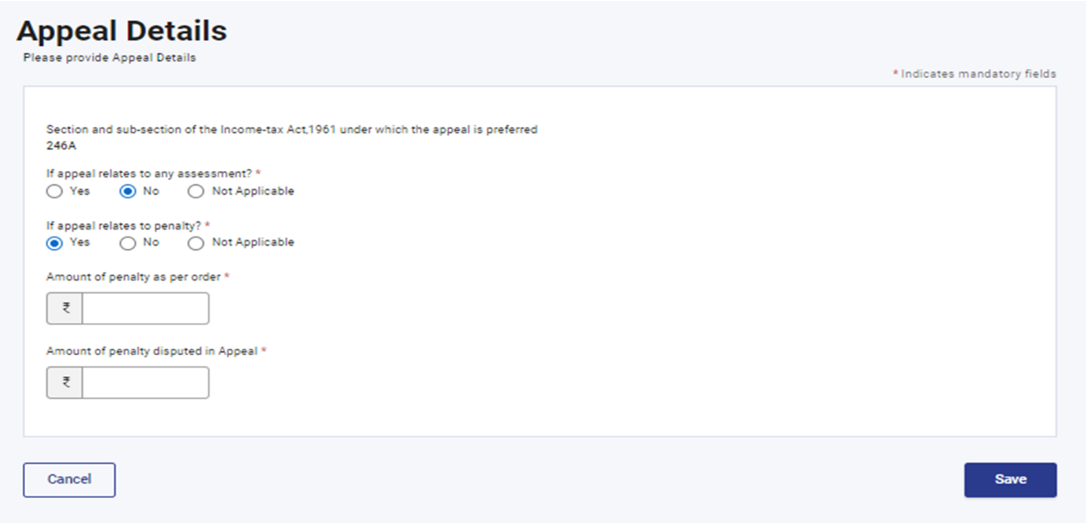

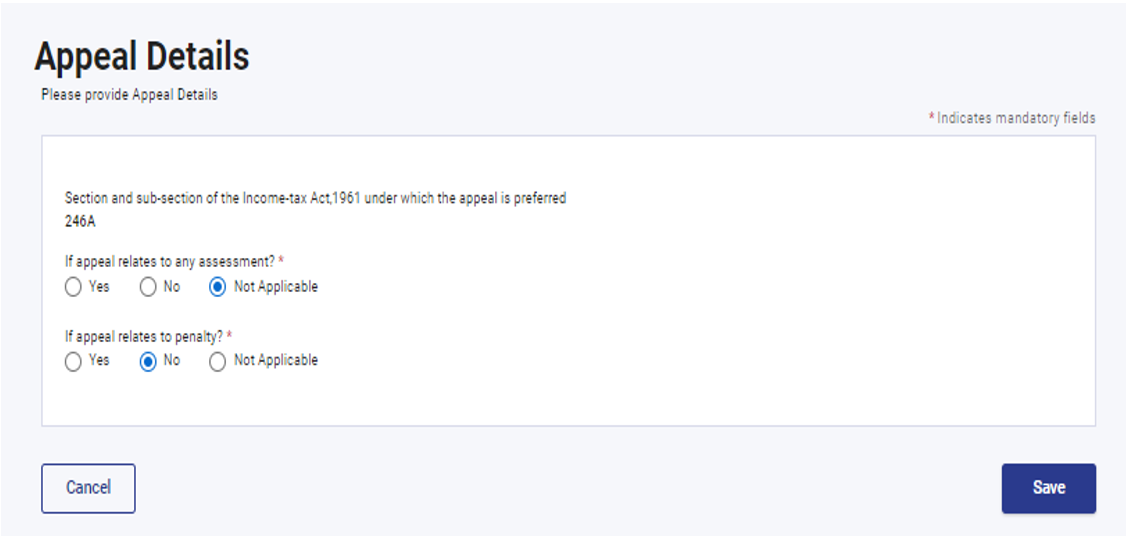

Step 14: Pending Appeal tab is confirmed. Click on Appeal Details tab.

Step 15: Select Yes/No/NA if appeal relates to any assessment or penalty.

Step 15 (a): If appeal relates to any Assessment.

If you select Yes (other fields will be auto selected) Enter the details and click Save.

Step 15 (b) : If appeal relates to any Assessment.

If you select No (other fields will be auto selected) Enter the details and click Save.

Step 15 (c): If appeal does not relate to any Assessment or Penalty, you can select Not Applicable and click Save.

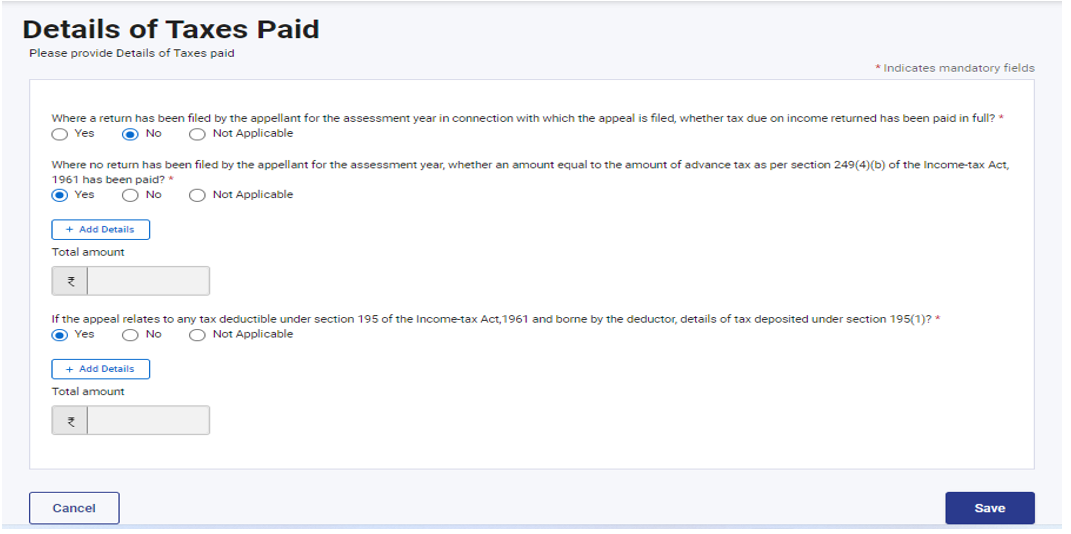

Step 16: Appeal Details tab is confirmed click on Details of Taxes Paid tab.

Step 17: Enter the details of taxes paid, if any.

Note: If you are filing Appeal in TAN login, first two fields will be auto selected as Not Applicable.

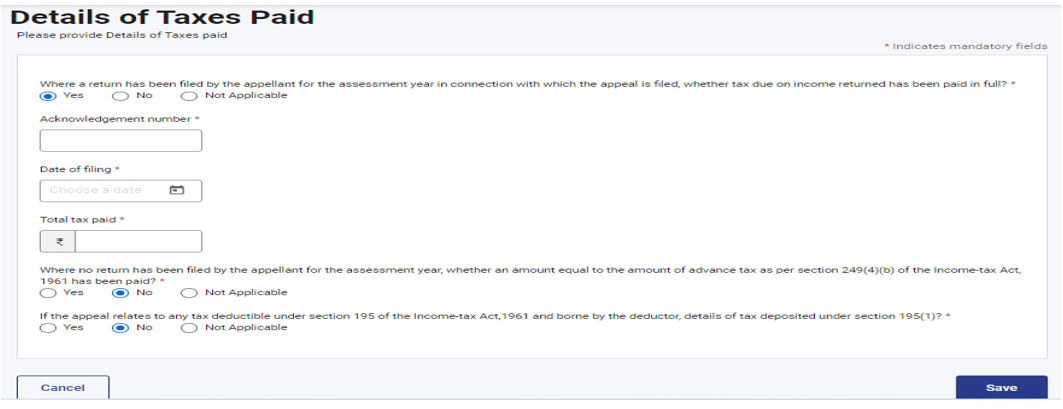

Step 17 (a): Where a return has been filed by the appellant for the assessment year in connection with which the appeal is filed, whether tax due on income returned has been paid in full?

If you Select Yes (other fields will be Auto selected) enter below details:

• Acknowledgement No.

• Date of filing and

• Total Taxes Paid.

Step 17 (b): Where a return has been filed by the appellant for the assessment year in connection with which the appeal is filed, whether tax due on income returned has been paid in full?

If you Select No or Not Applicable. click on save

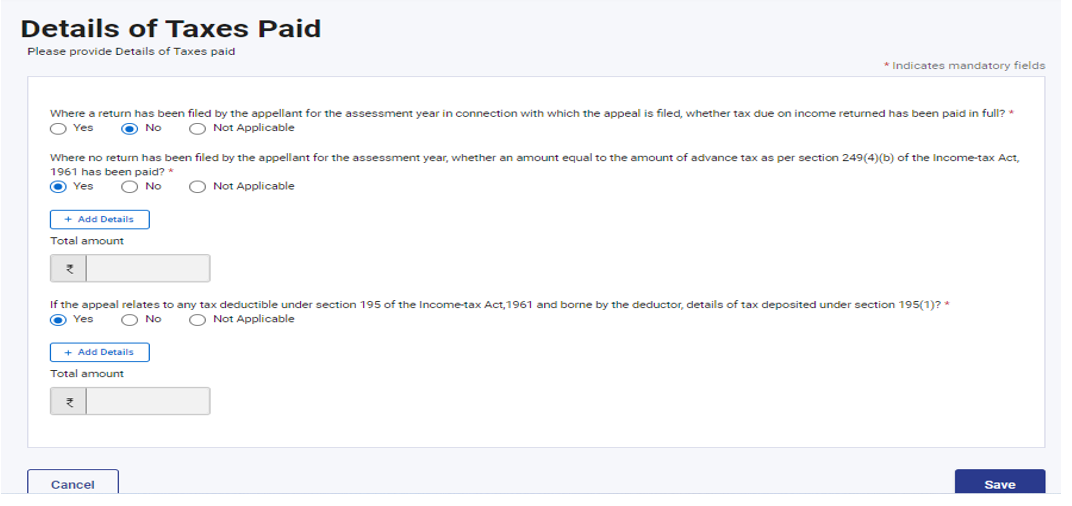

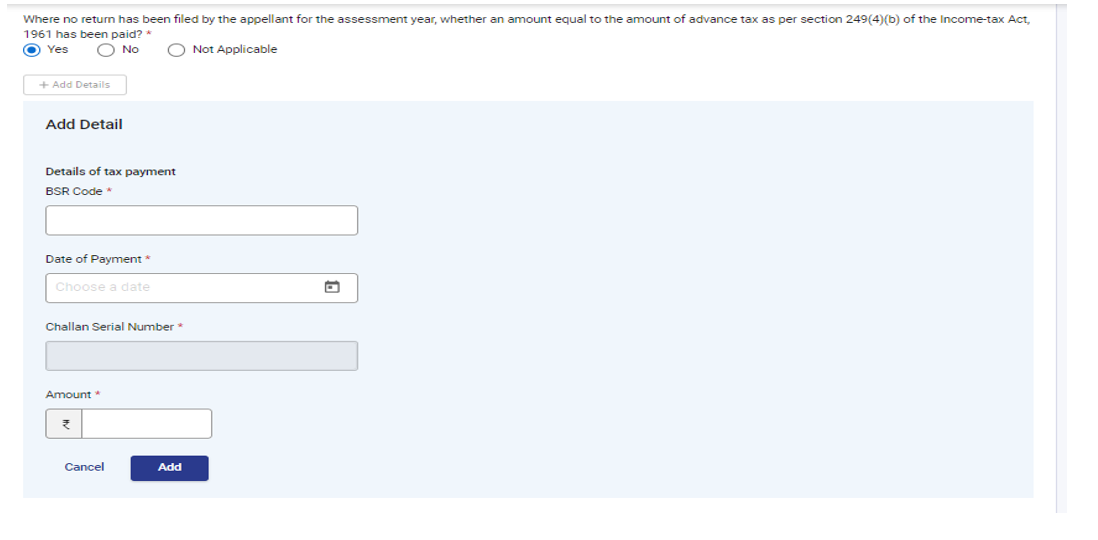

Step 17 (c): Where no return has been filed by the appellant for the assessment year, whether an amount equal to the amount of advance tax as per section 249(4)(b) of the Income-tax Act, 1961 has been paid ?

If you Select Yes Enter the details of payment & click Add:

• BSR Code

• Date of Payment

• Amount

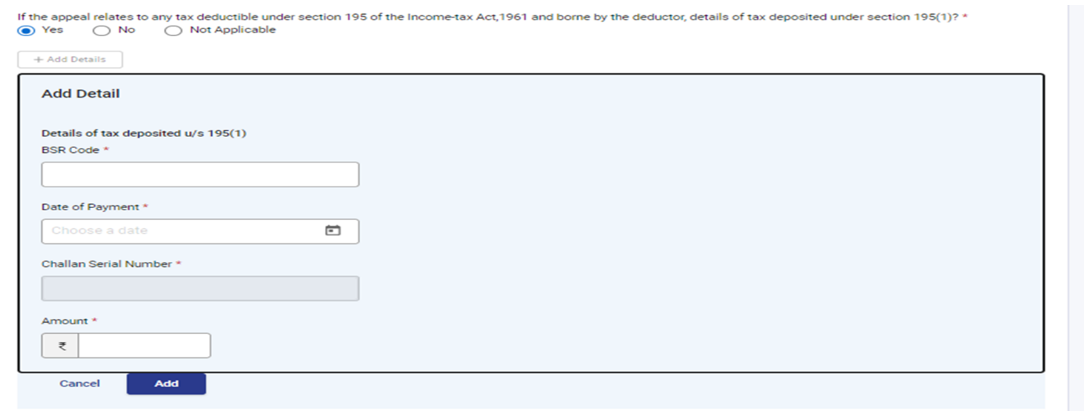

Step 17 (d): If the appeal relates to any tax deductible under section 195 of the Income-tax Act,1961 and borne by the deductor, details of tax deposited under section 195(1) ?

If you Select Yes Enter the details:

• BSR Code

• Date of Payment

• Amount

click Add

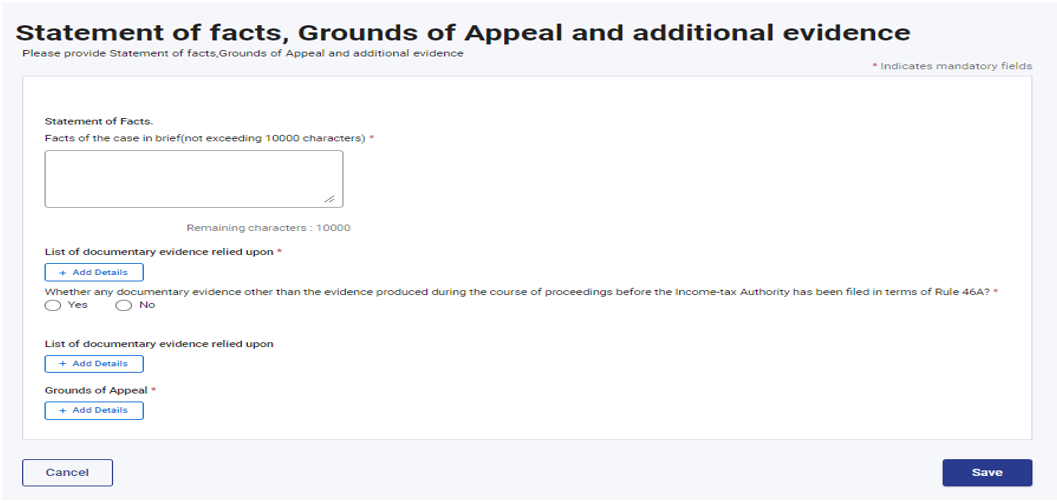

Step 18: Details of Taxes Paid tab is confirmed, click on Statement of Facts, Grounds and Additional Evidence of appeal.

Step 19: Write the facts of the case in brief up to 10000 characters and add the details of the documentary evidence relied upon, additional evidences detail (if any) and Grounds of appeal by clicking on Add details.

Step 20:. Statement of Facts, Grounds and additional evidence of appeal tab is confirmed, now click on appeal filing details tab.

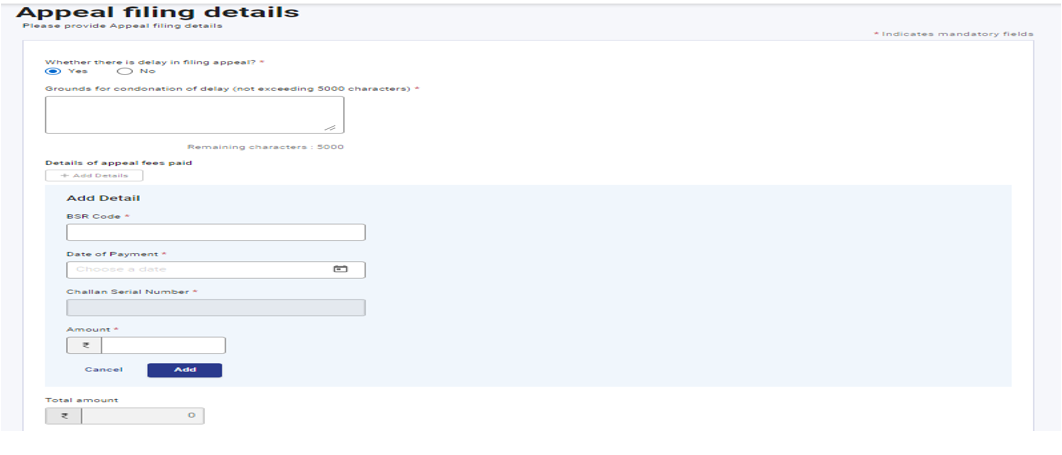

Step 21: Whether there is delay in filing appeal ?

If Yes enter the Grounds for condonation of delay, otherwise select No. Add details of appeal filing fees paid and click on Add button and click Save.

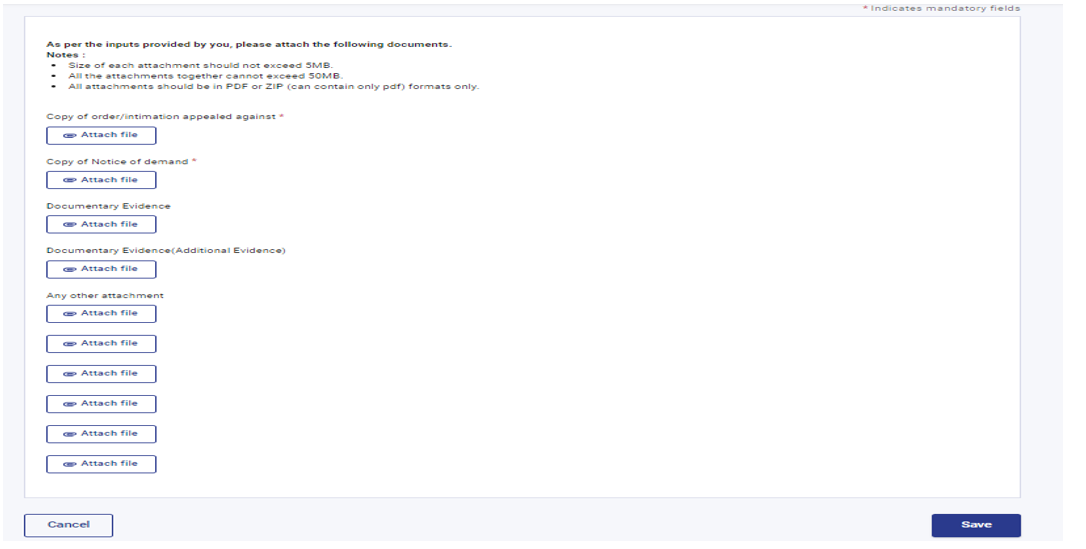

Step 22: Appeal Filing Details tab is confirmed, now click on Attachments tab.

Step 23: As per the input provided by you in previous steps, attach the evidences and Additional evidences and click Save.

Note :

• Size of each attachment should not exceed 5MB.

• All the attachments together cannot exceed 50MB.

• All attachments should be in PDF or ZIP (can contain only pdf) formats only.

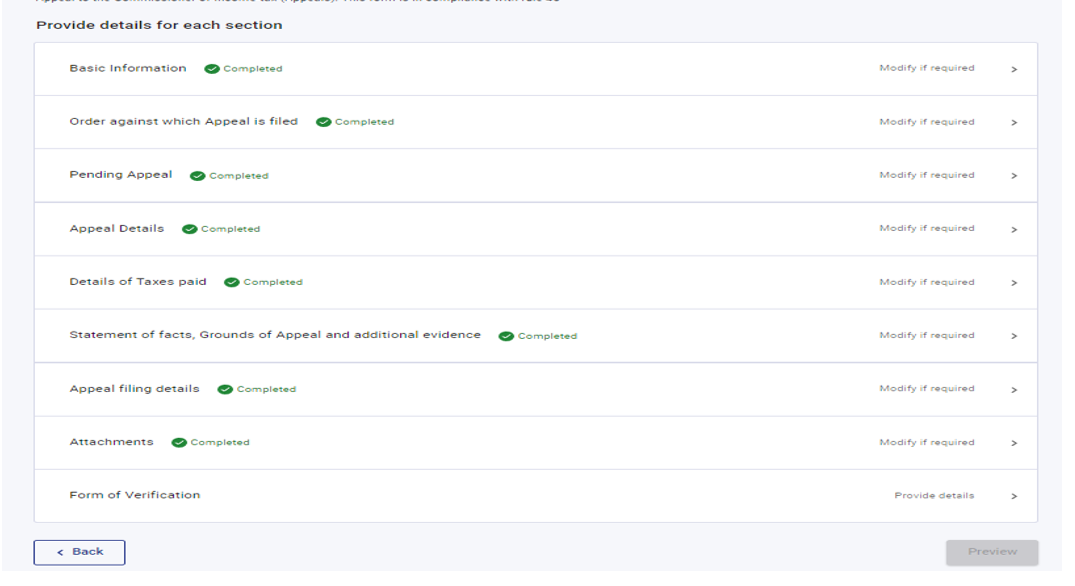

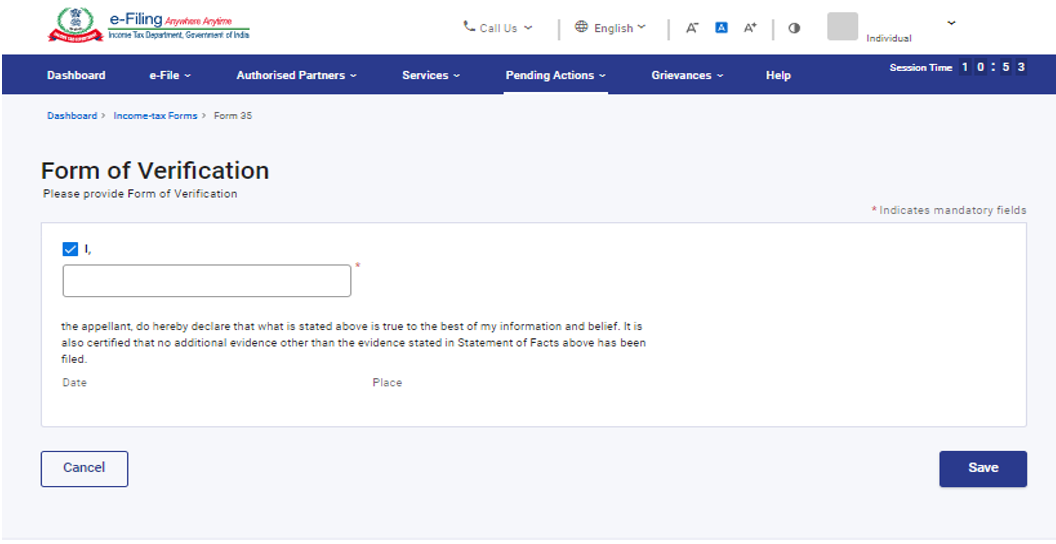

Step 24: Attachment tab is confirmed, click on Verification tab.

Step 25: Select the declaration and click on Save.

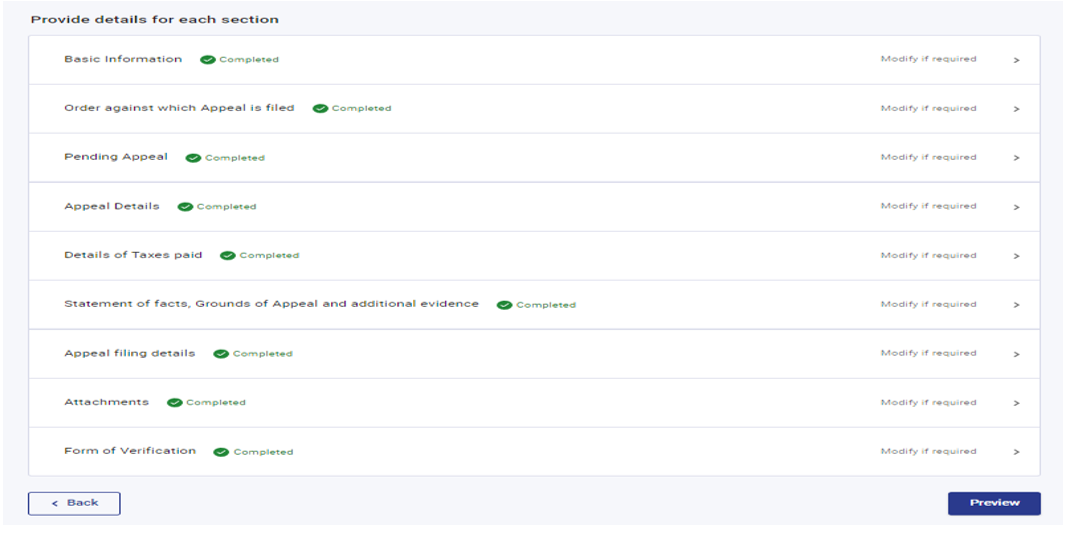

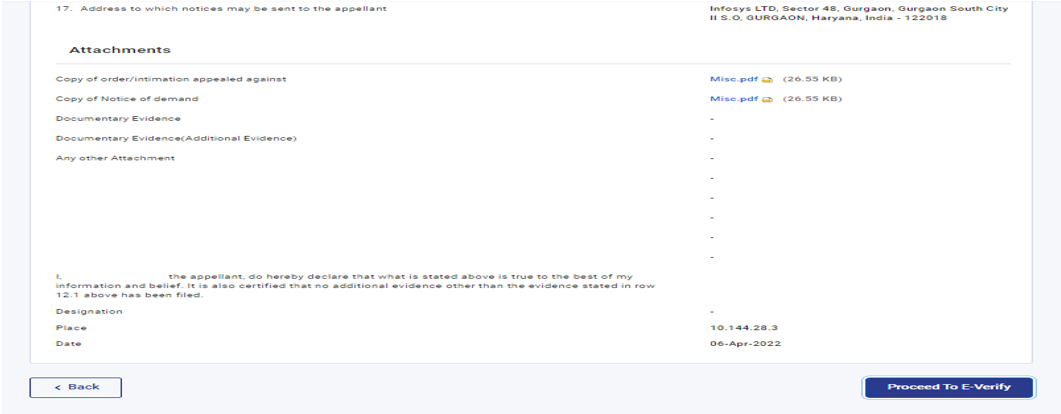

Step 26: All the tabs are confirmed, click on Preview.

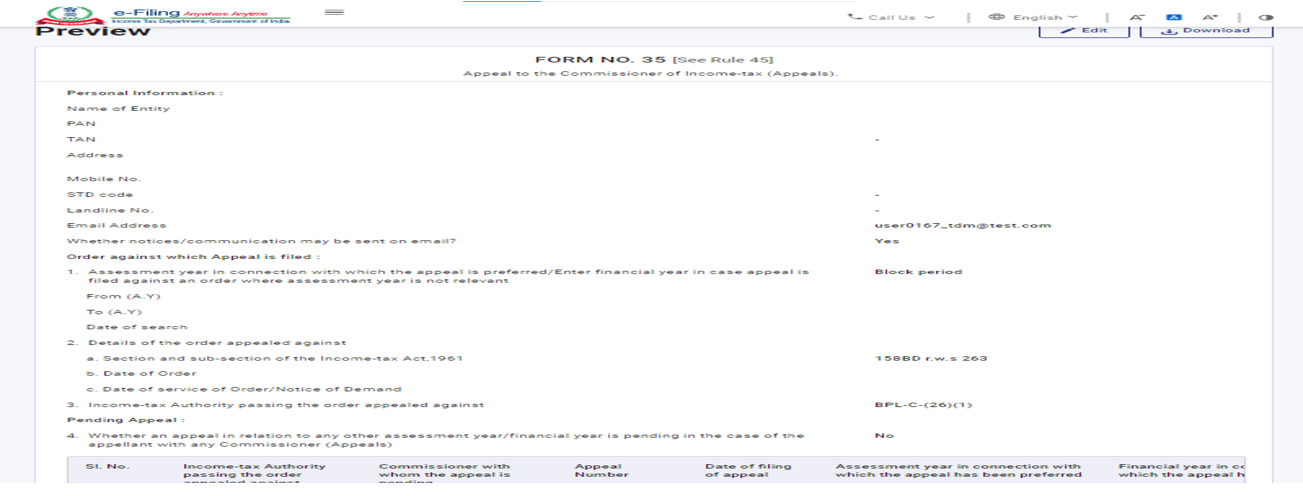

Step 27: This is the Preview of filing of appeal, click on proceed to e-Verify.

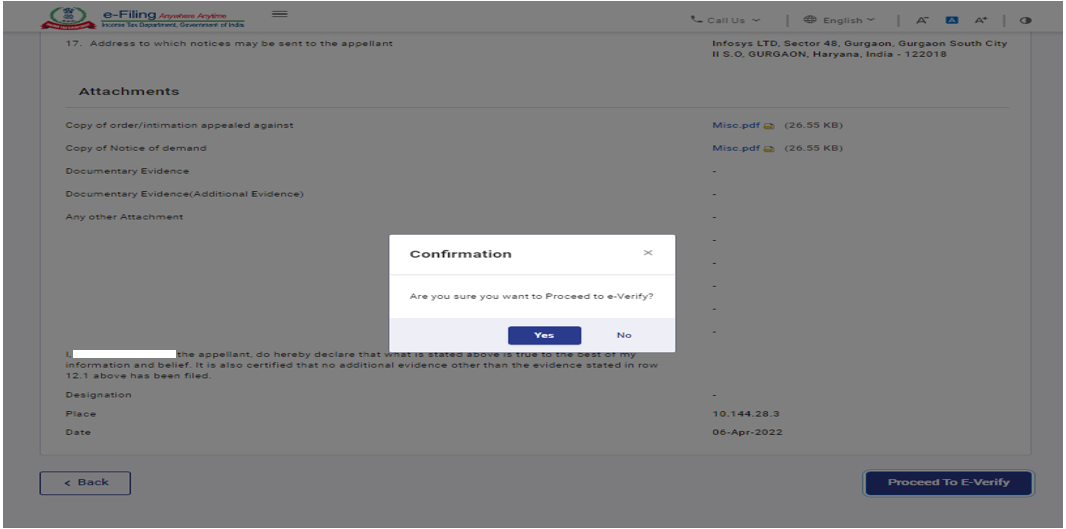

Step 28: Click Yes

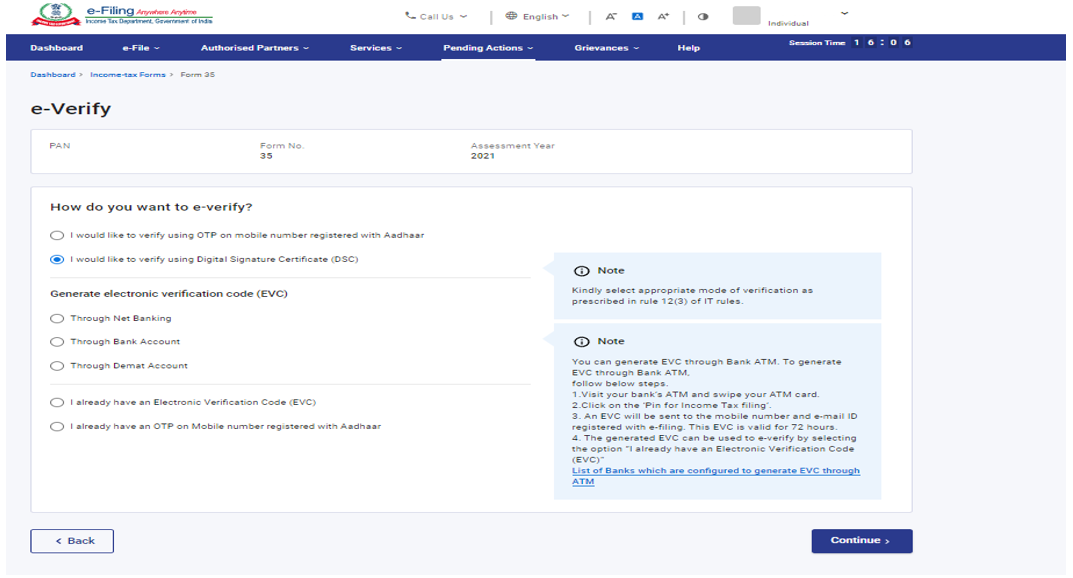

Step 29: Select the appropriate method for e-verification.

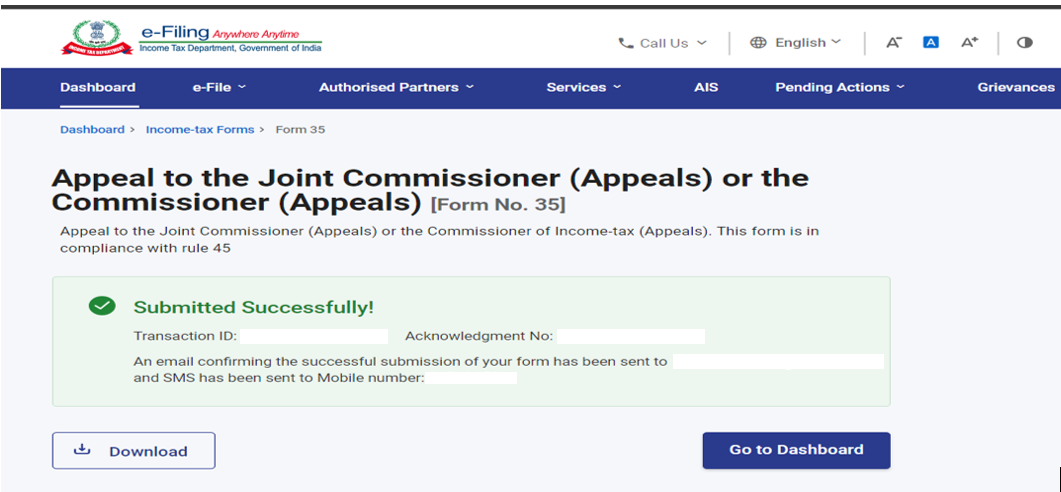

Step 30: After e-verification you will receive the success message on screen along with transaction ID.

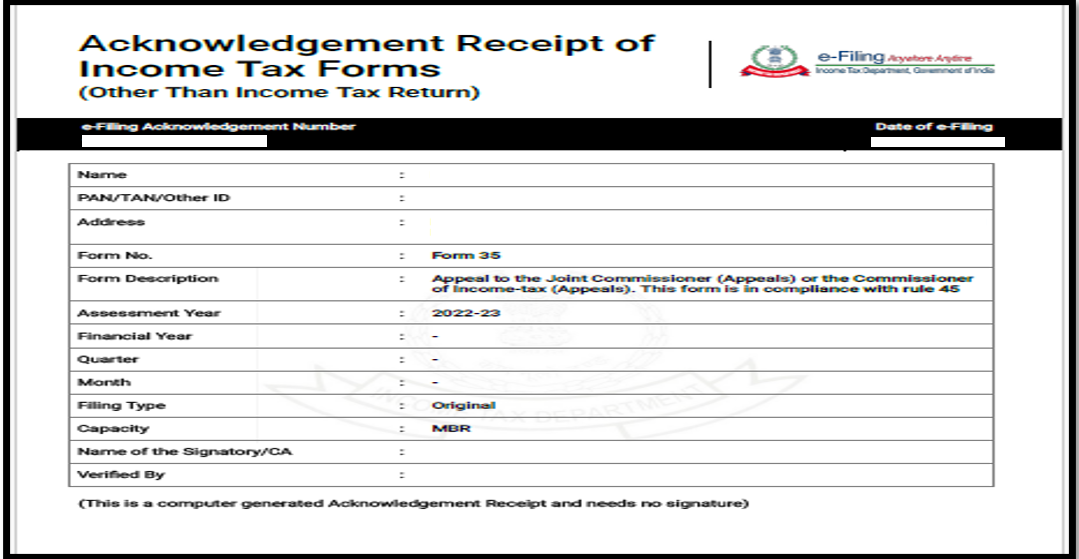

Click on download button to download the Acknowledgement receipt.

Step 31: This is the Acknowledgement receipt of Form 35.

Related Topics

Glossary

|

Acronym/Abbreviation |

Description/Full Form |

|

DSC |

Digital Signature Certificate |

|

EVC |

Electronic Verification Certificate |

|

ARN |

Acknowledgement Receipt Number |

|

AY |

Assessment Year |

|

PY |

Previous Year |

|

FY |

Financial Year |