1. Overview

The Tax Payment through Debit Card of Authorised Banks option is available to all taxpayers on the e-Filing portal. With this service, you can make tax payment online (in Pre-login or Post-login mode) by using the Debit Card of an Authorized Bank available for making online tax payment on e-Filing Portal.

Users for this service include:

- All Taxpayers;

- Type-1 and Type-2 ERI / Chartered Accountants (CA)

- Representative Assessee

- Tax Deductors / Collectors

2. Prerequisites for availing this service

You can make payment online pre-login (before logging in the e-Filing portal) or post-login (after logging in the e-Filing portal).

| Option | Prerequisites |

| Pre-Login |

|

| Post-Login |

|

3. Step-by-Step Guide

3.1. Pay for previously Generated Challan Forms (CRNs)

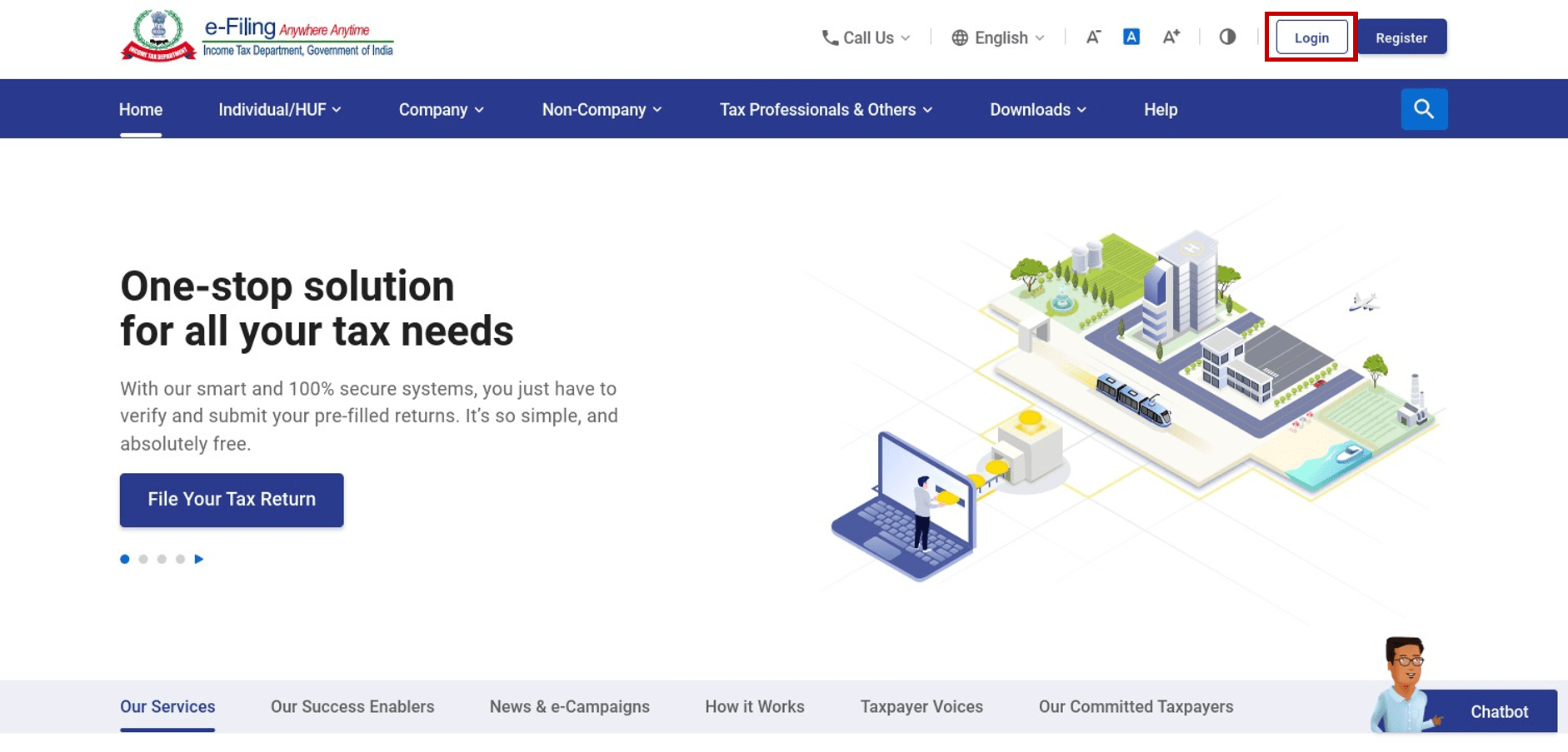

Step 1: Log in to the e-Filing portal with User ID and Password. (If you are a Representative Assessee, select the PAN of the Taxpayer, on whose behalf you want to log in.)

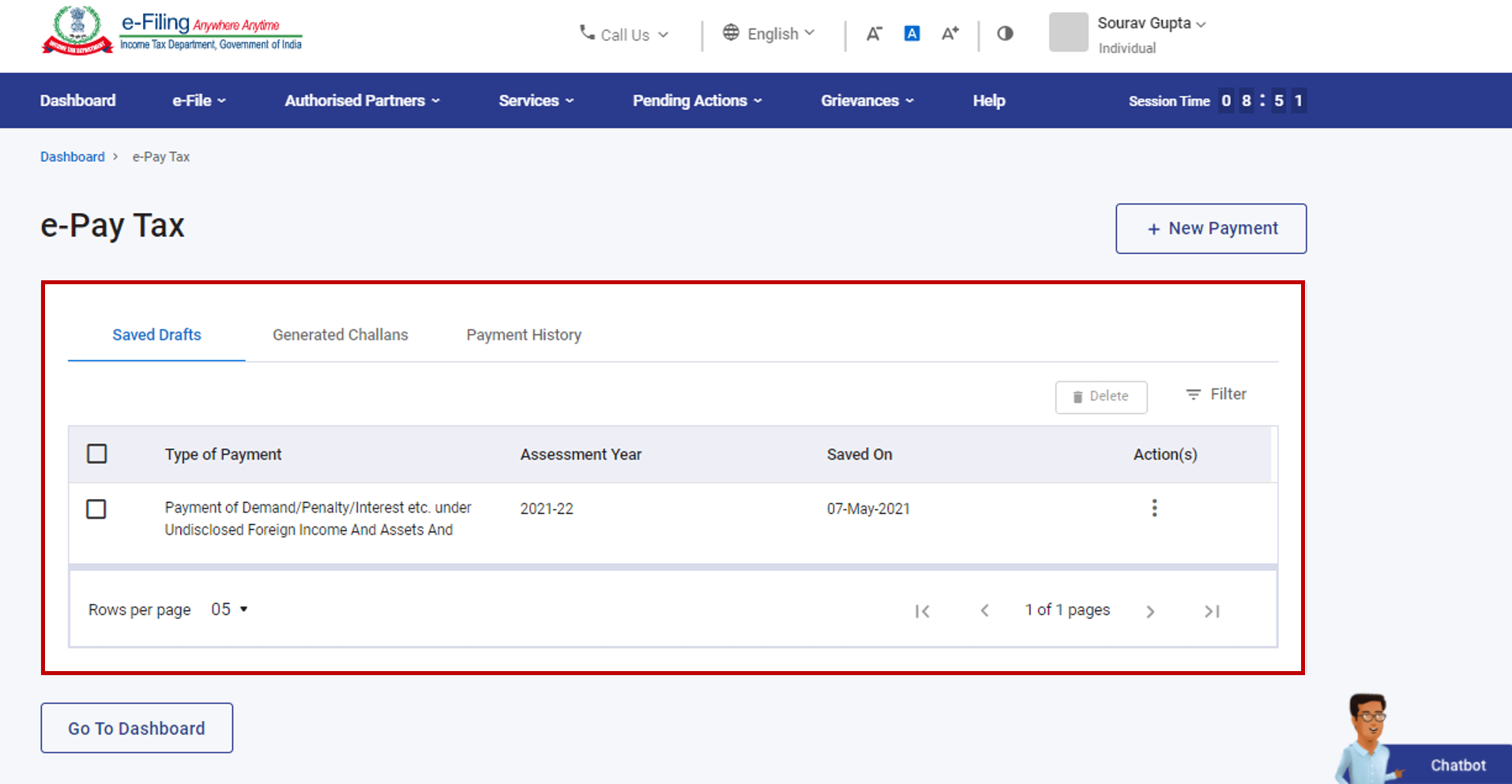

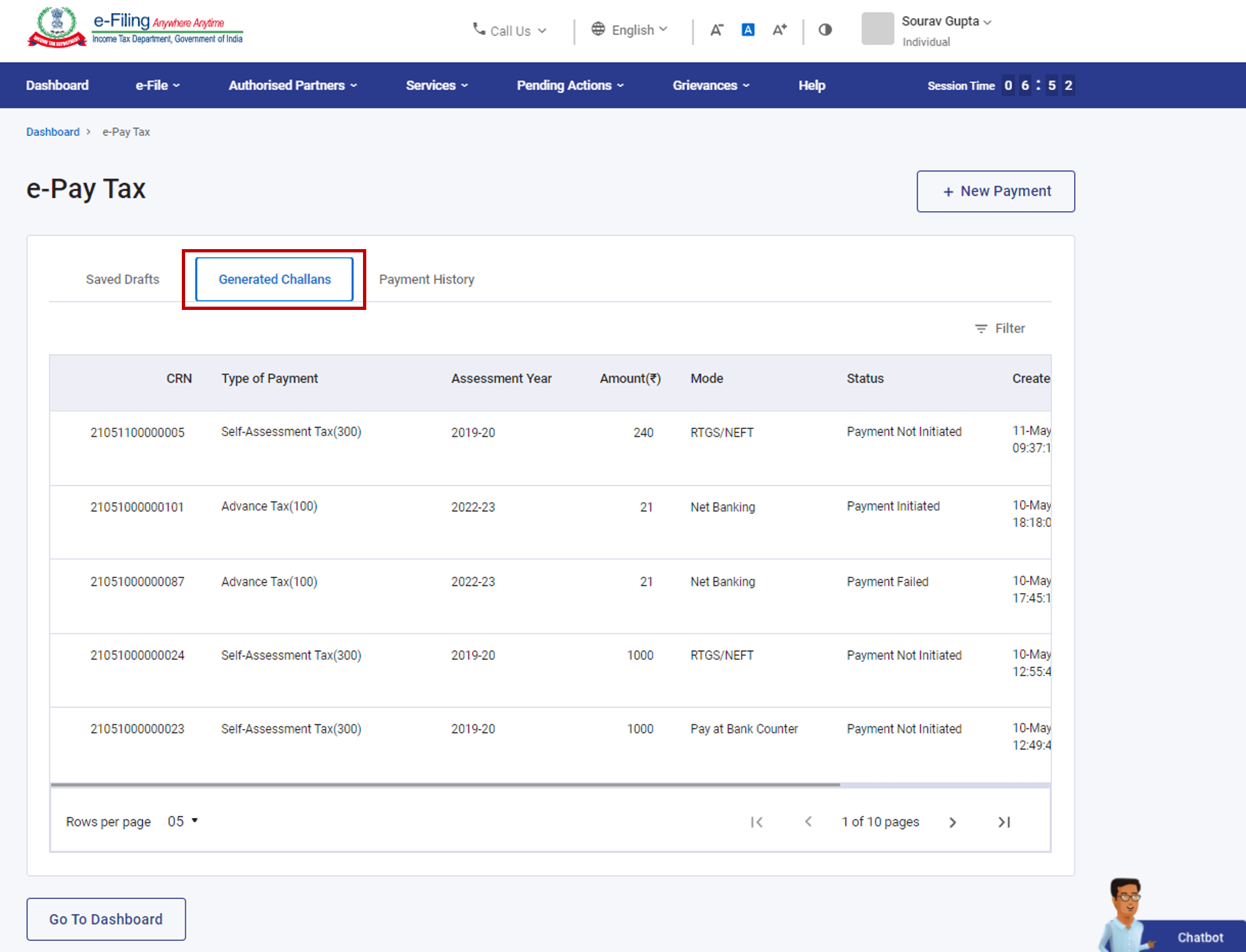

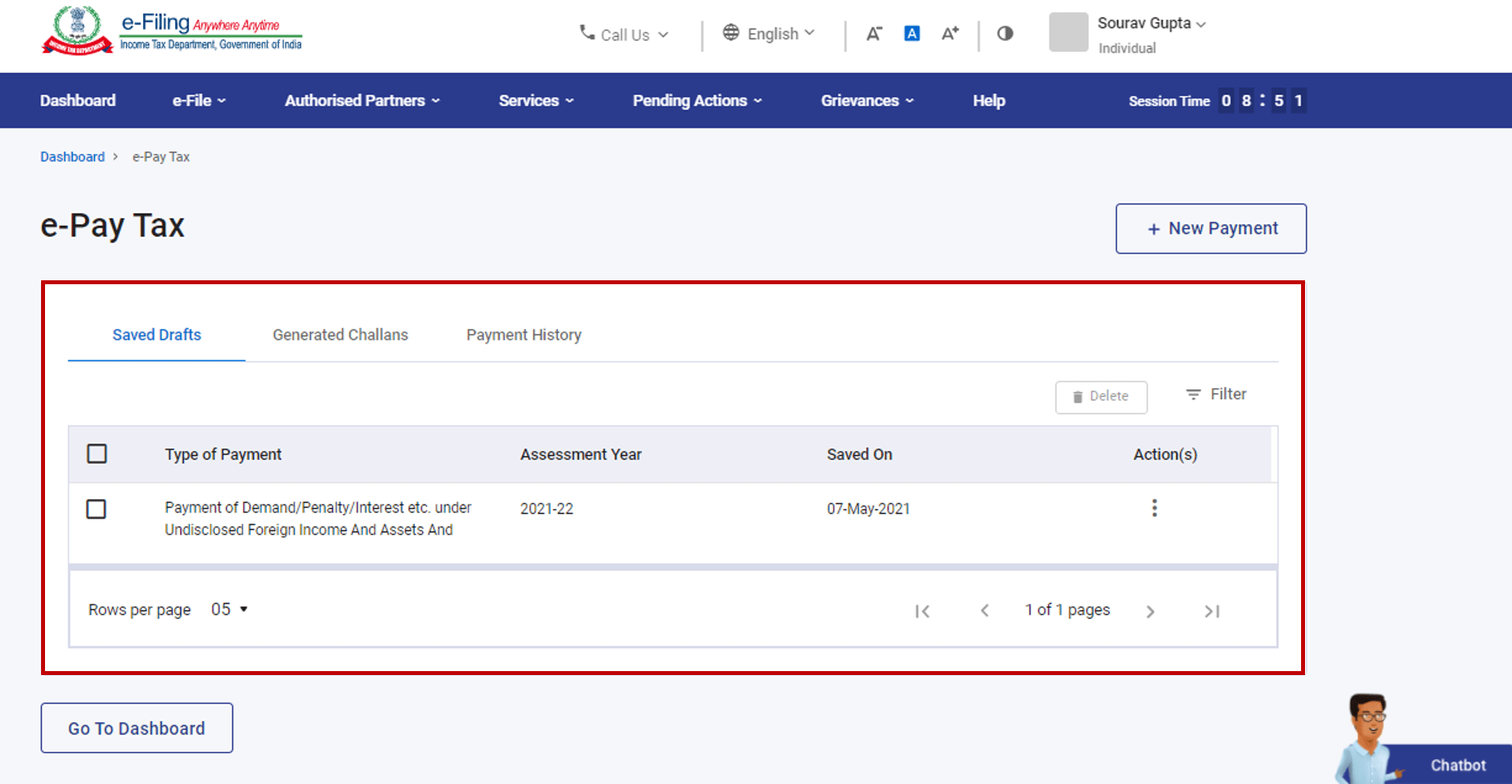

Step 2: On the Dashboard, click e-File > e-Pay Tax. (If you are a Type-1 ERI, select the PAN / TAN of the taxpayer on behalf of whom you want to generate a Challan Form (CRN) and click Continue.) You will be taken to the e-Pay Tax page where you can view details of Saved Drafts, Generated Challans and Payment History.

Step 3: On the e-Pay Tax page, click the Generated Challans menu.

Note: These are the records for which Challan Forms (CRNs) had already been generated (identified through their unique Challan Reference Number), but you have previously chosen Pay Later after selecting the mode of payment as Debit Card.

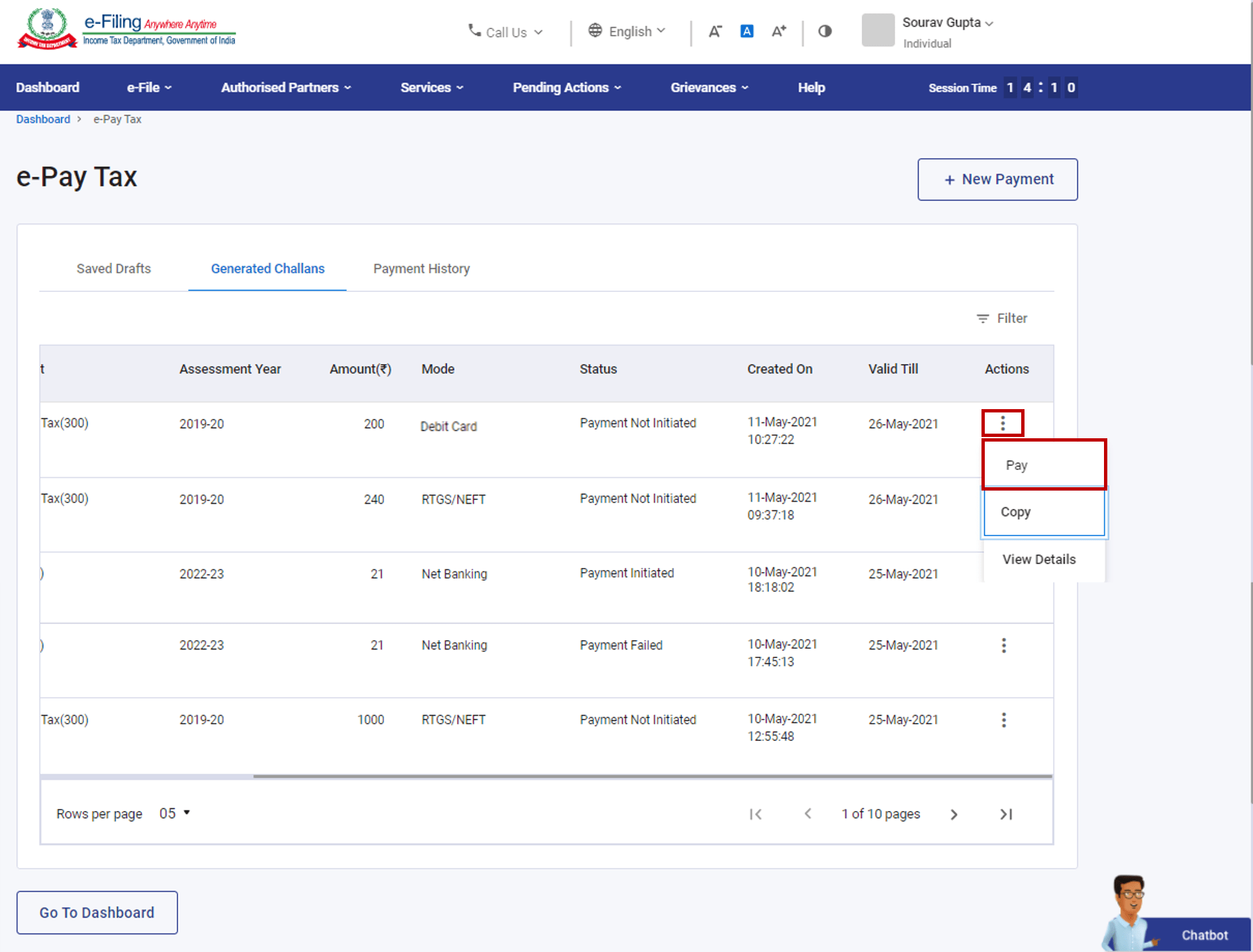

Step 4: On the e-Pay Tax page, under the Generated Challans, click Pay under Actions column for the selected Challan Form (CRN).

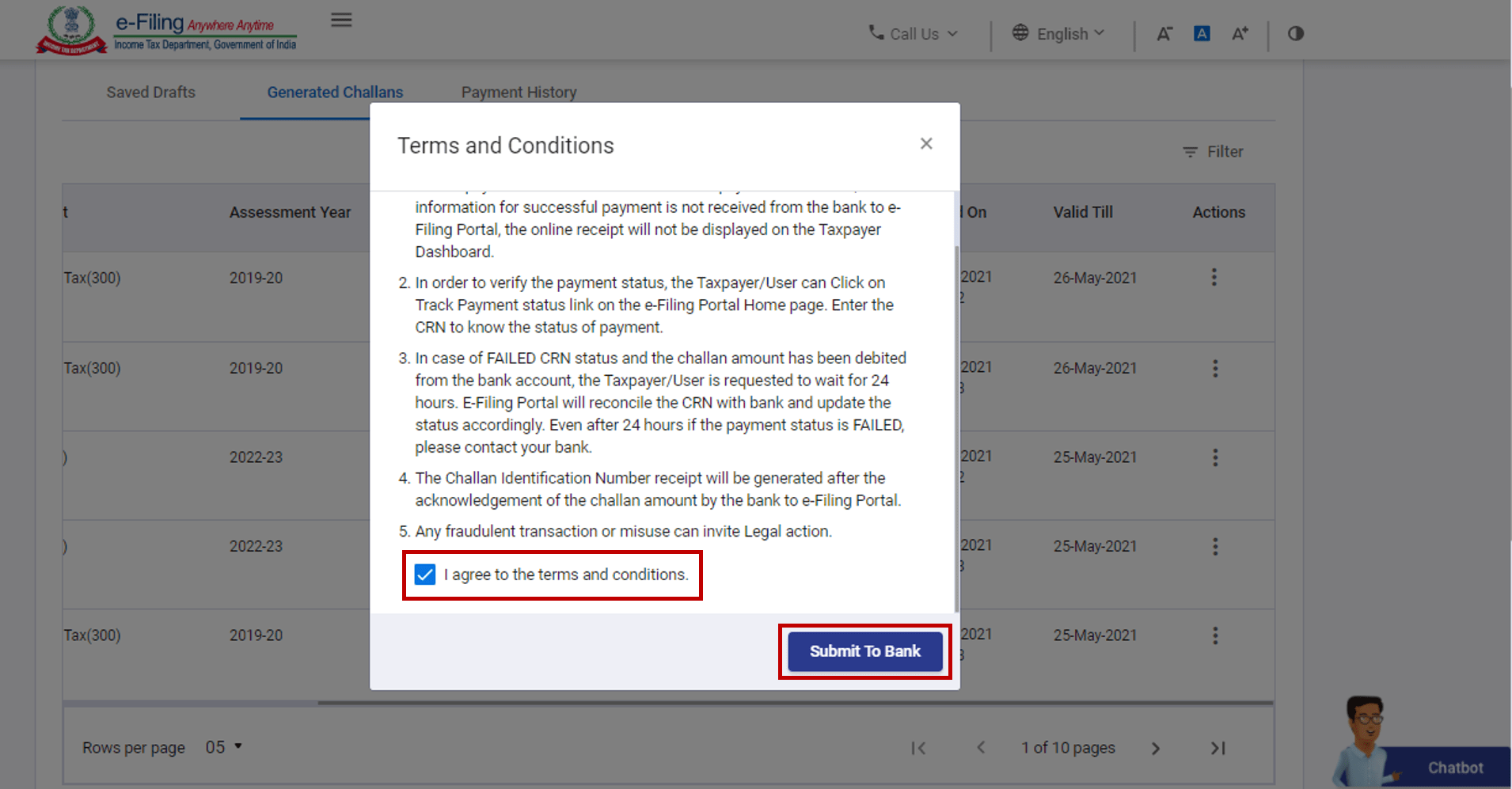

Step 5: Read and select the Terms and Conditions and click Submit to Bank. (You will be redirected to the website of the selected Bank where you can enter the Debit Card details and make the payment).

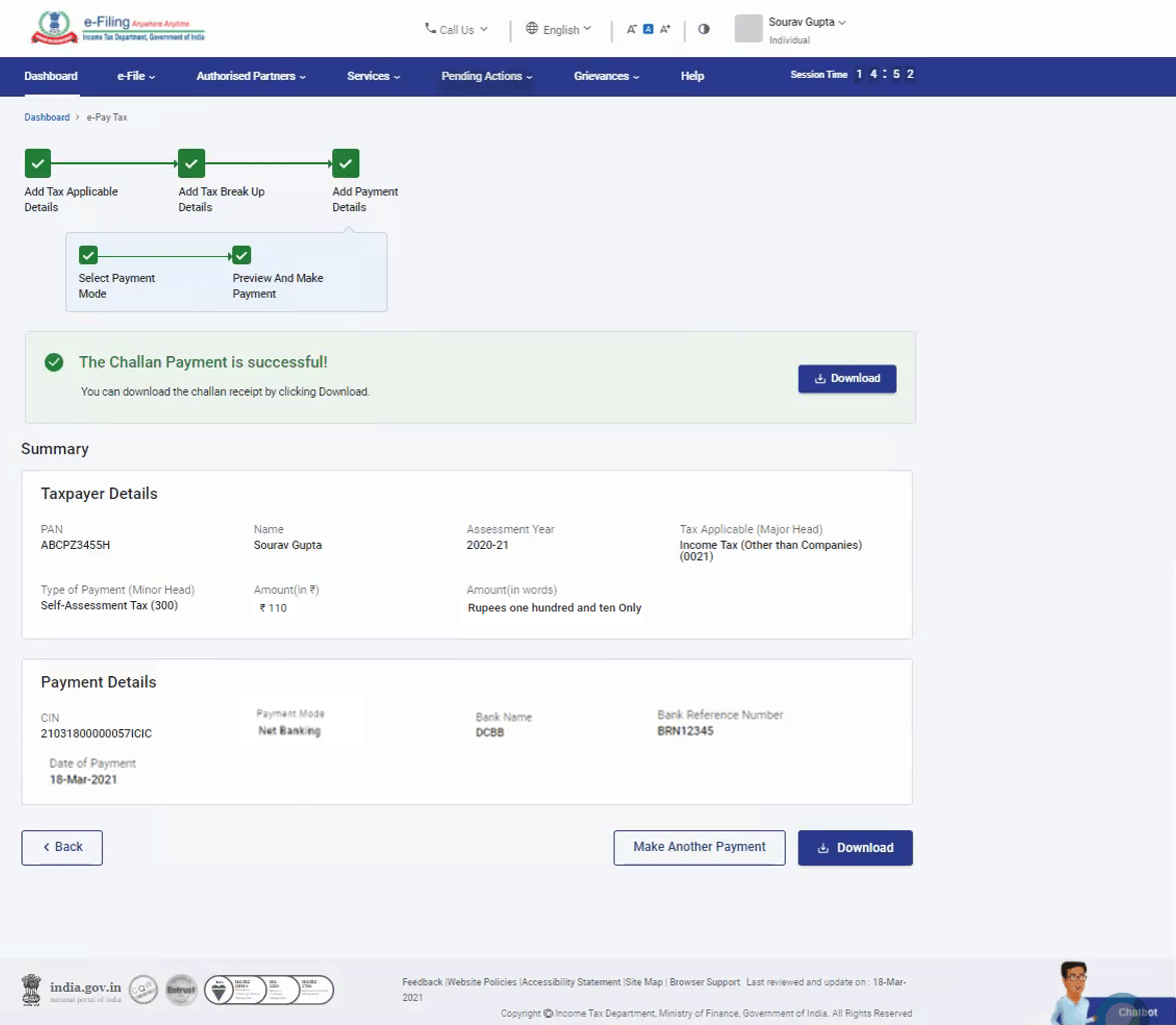

After successful payment, a success message will be displayed. You can download the Challan Receipt for future references. You will be able to view the details in the summary section available on the success message page or under Payment History menu on the e-Pay Tax page. You will receive a confirmation message on the email ID and Mobile number registered with the e-Filing portal.

3.2. Pay for previously Saved Drafts

Step 1: Log in to the e-Filing portal with your user ID and password. (If you are a representative Assessee, select the PAN of the Taxpayer, on whose behalf you want to log in.)

Step 2: On the Dashboard, click e-File > e-Pay Tax. (If you are a Type-1 ERI, select the PAN / TAN of the taxpayer on behalf of whom you want to generate a Challan Form (CRN) and click Continue.) You will be taken to the e-Pay Tax page where you can view details of Saved Drafts, Generated Challans and Payment History.

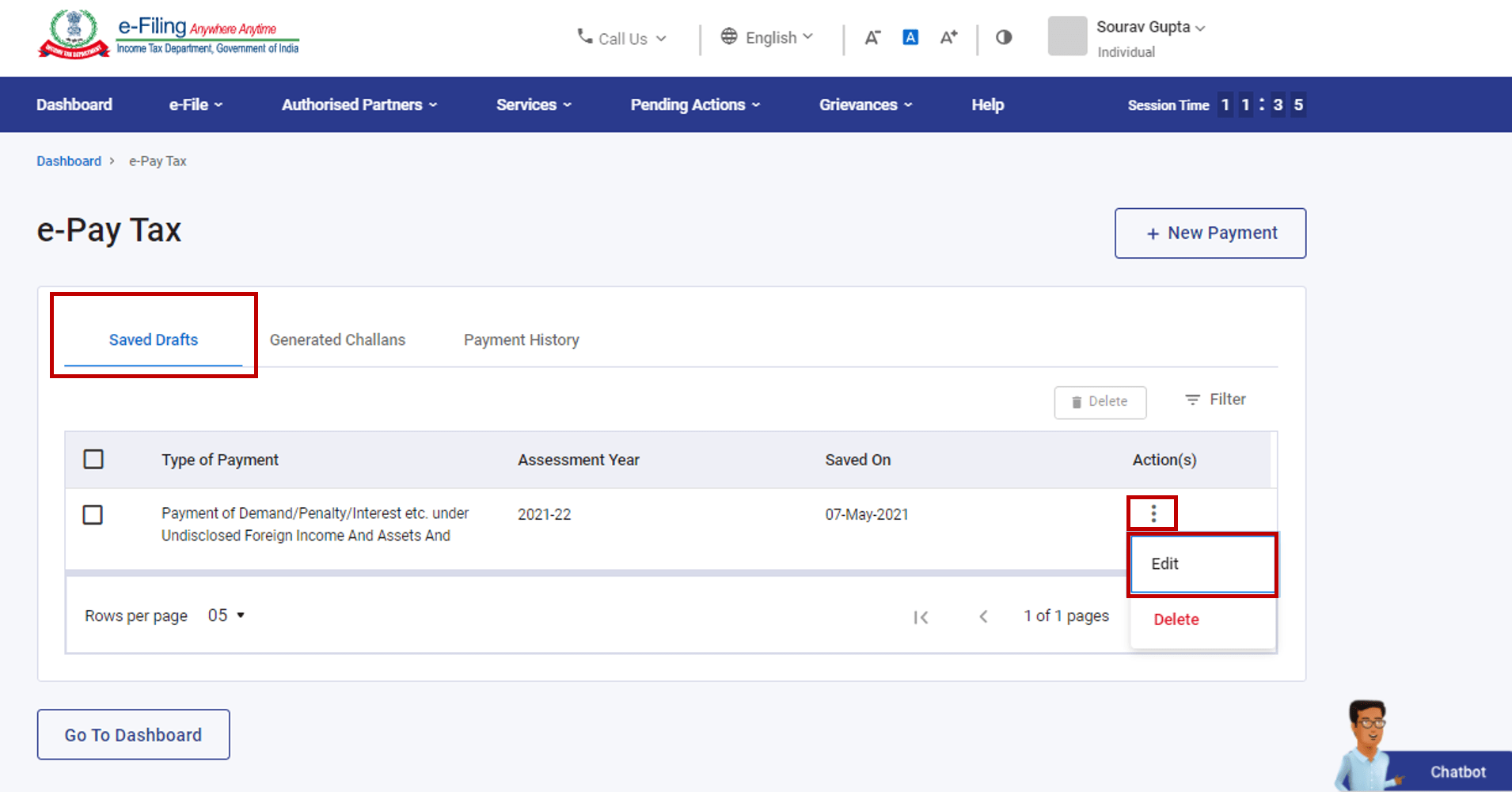

Step 3: On the e-Pay Tax page, click the Saved Drafts menu, click Edit under the Actions column for the selected draft.

Note: These are the drafts saved while creating the Challan Forms for which Challan Reference Number was not generated.

Step 4: On the Add the Tax Applicable page, select the Assessment Year, Type of Tax Payment (Minor Head) and click Continue.

Step 5: Follow Step 5 to Step 8 as per section 3.1. Create Challan Form (CRN) (Post Login) of Create Challan Form (CRN) user manual.

3.3. Pay after Generating a New Challan Form (CRN)

Step 1: Follow Step 1 to Step 8 as per section 3.1. Create Challan Form (CRN) (Post Login) of Create Challan Form (CRN) user manual.

3.4. Pay without logging in to the e-Filing portal

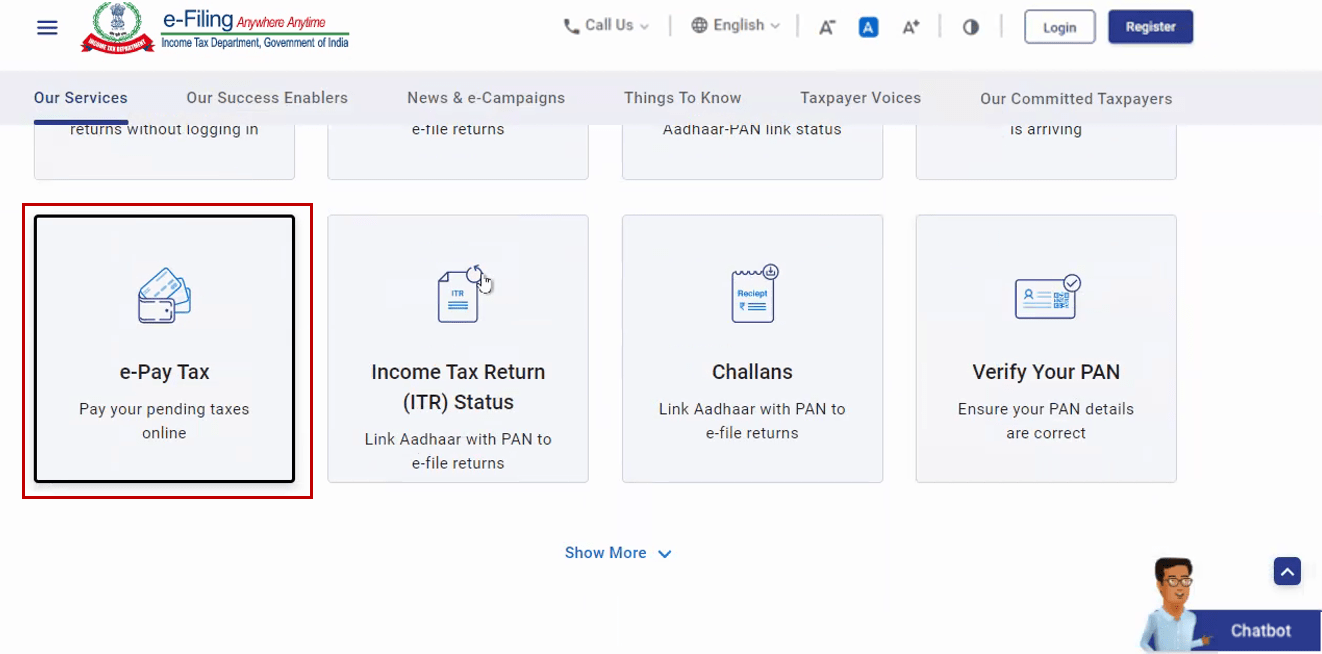

Step 1: Go to the e-Filing portal homepage and click e-Pay Tax.

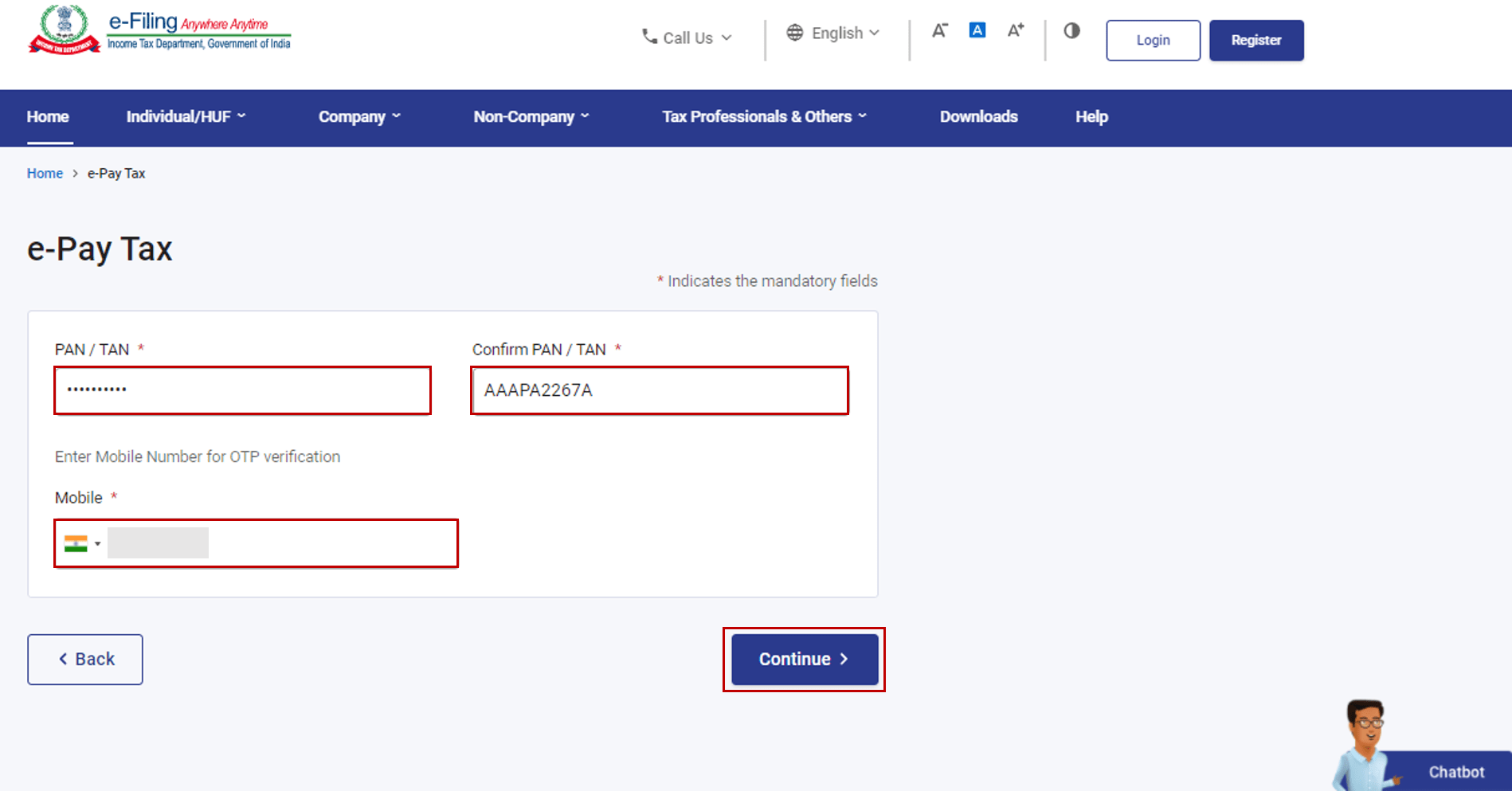

Step 2: On the e-Pay Tax page, enter PAN / TAN, enter it again in the Confirm PAN / TAN textbox and enter mobile number (available with you to receive One Time Password) and click Continue.

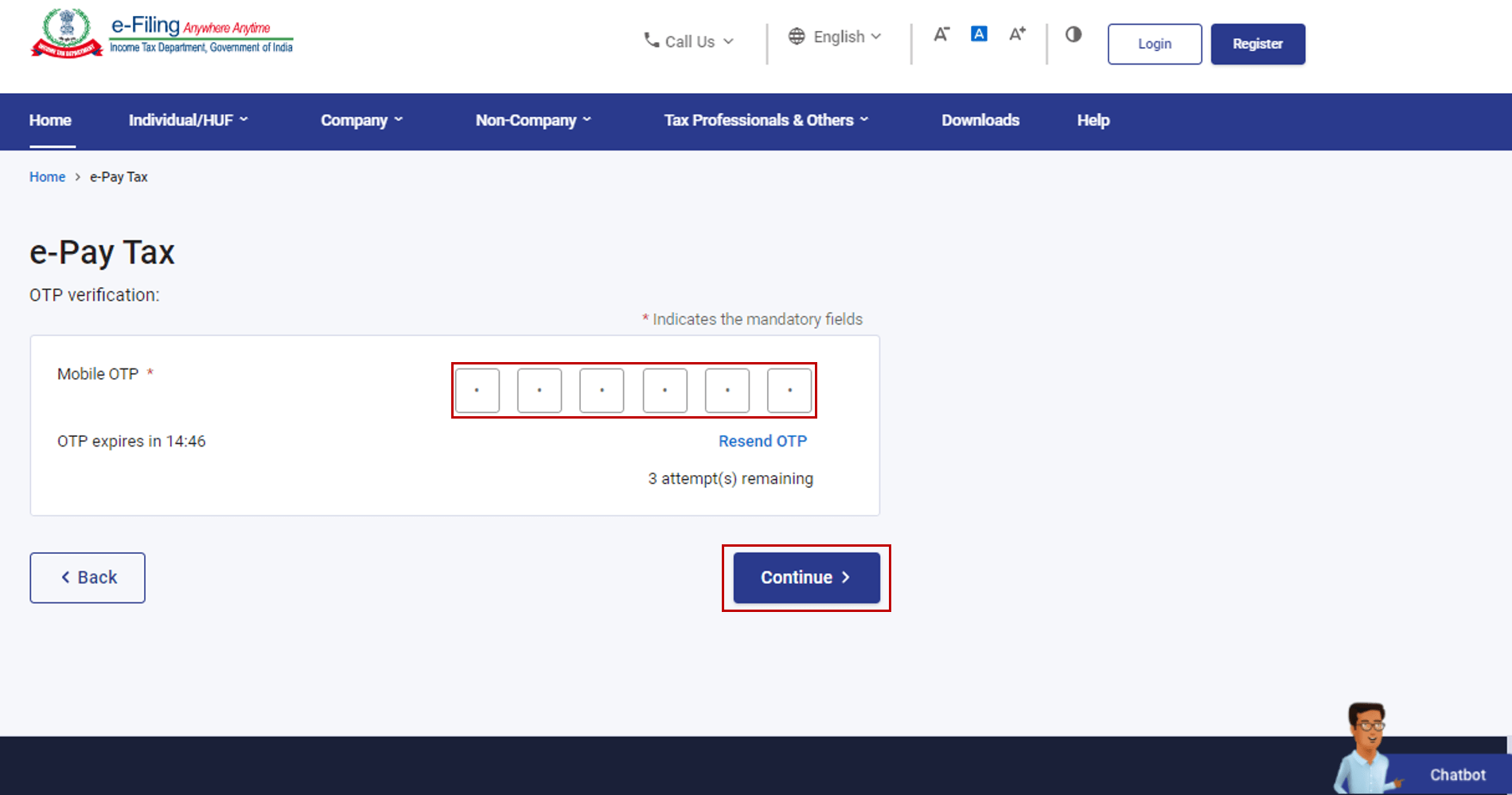

Step 3: On the OTP Verification page, enter the 6-digit OTP received on the mobile number entered in Step 2 and click Continue.

Note:

- OTP will be valid for 15 minutes only.

- You have 3 attempts to enter the correct OTP.

- The OTP expiry countdown timer on screen tells you when the OTP will expire.

- On clicking Resend OTP, a new OTP will be generated and sent.

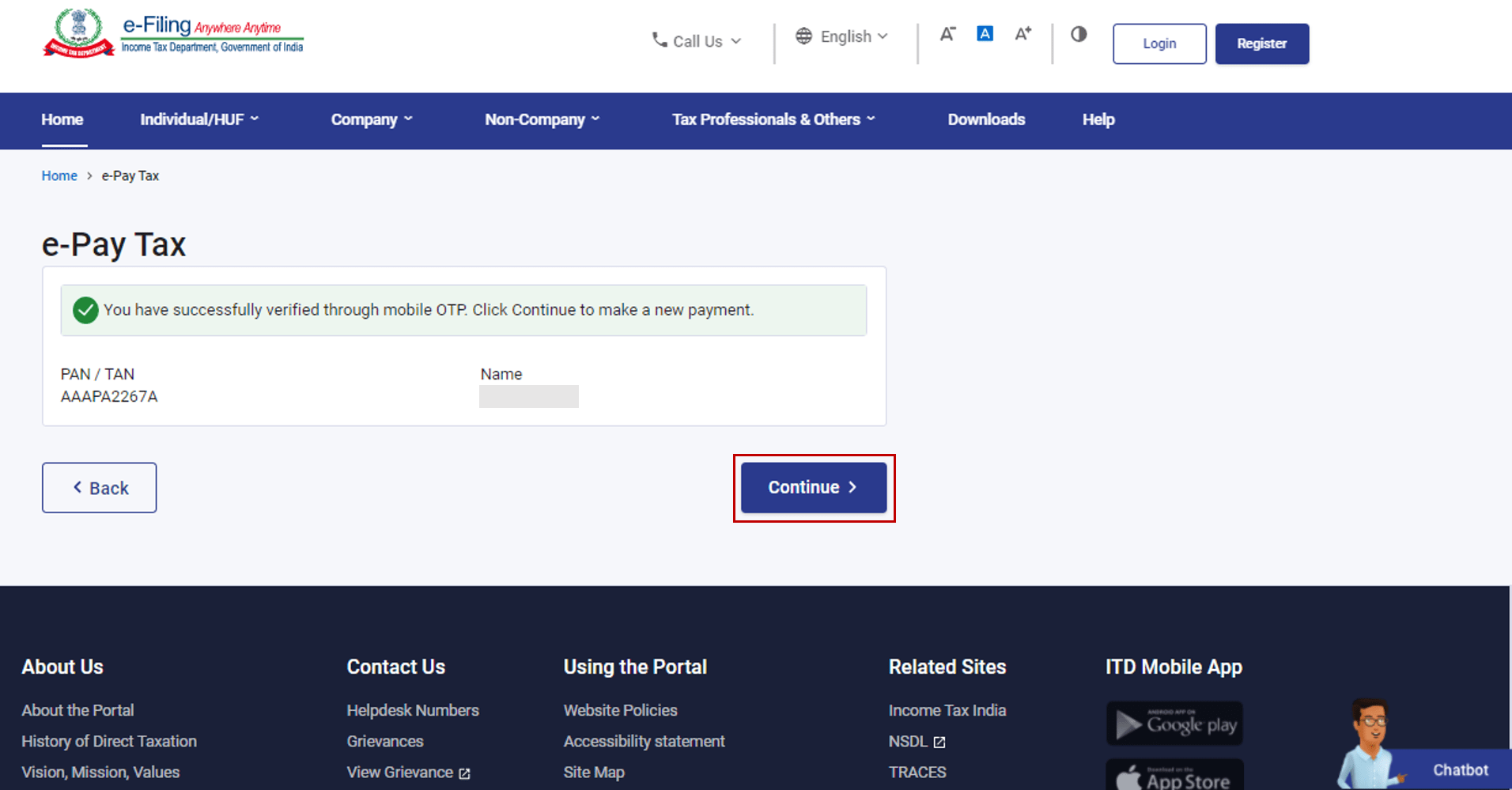

Step 4: After OTP verification, a success message with your PAN / TAN and Name will be displayed. Click Continue to proceed.

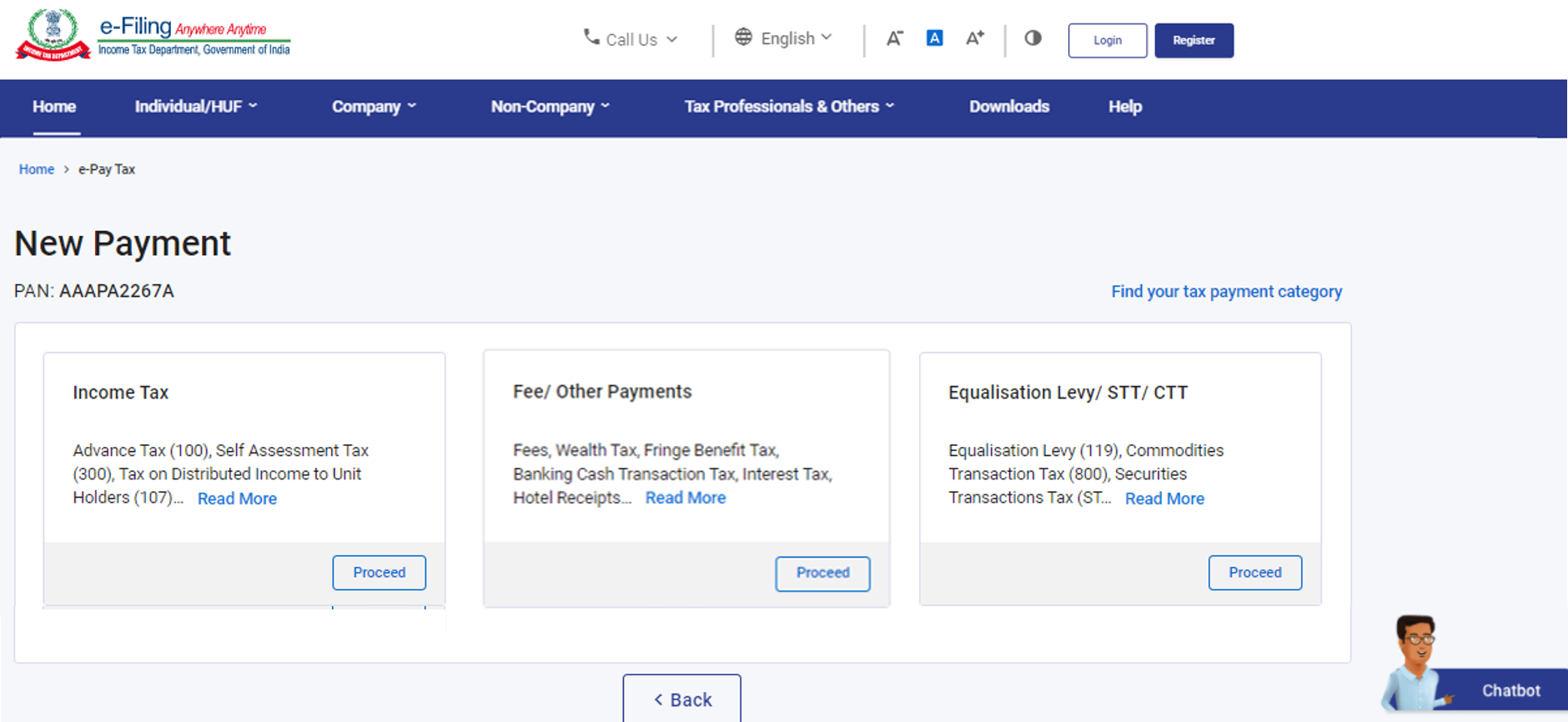

Step 5: On the e-Pay Tax page, verify the details and click Proceed on a tax payment category that applies to you.

Depending on the category, you will be able select from the following Type of Payment:

| For PAN holder (Depending on the category of the taxpayer) |

|

| For TAN holder |

|

Step 6: Follow Step 5 to Step 8 as per section 3.1. Create Challan Form (CRN) (Post Login) of Create Challan Form (CRN) user manual.