1. Overview

The TDS on Cash Withdrawal u/s 194N service enables taxpayers to view the TDS rate applicable on cash withdrawals made by them. This service is available pre-login to the following categories of taxpayers (both registered and unregistered):

- Individual taxpayer

- HUF

- Company

- AOP or BOI

- Partnership Firm or LLP

- Local Authority

This service is available post-login for registered TAN users (i.e., Public / Private / Co-operative Banks, Post Offices). It enables them to view the applicable TDS rate on cash withdrawals made by the taxpayers using bulk upload service.

2. Prerequisites for availing this service

- Valid and active PAN/TAN

- Valid and active mobile number

- TAN users registered on the e-Filing portal with valid user ID and password

3. Step-by-Step Guide

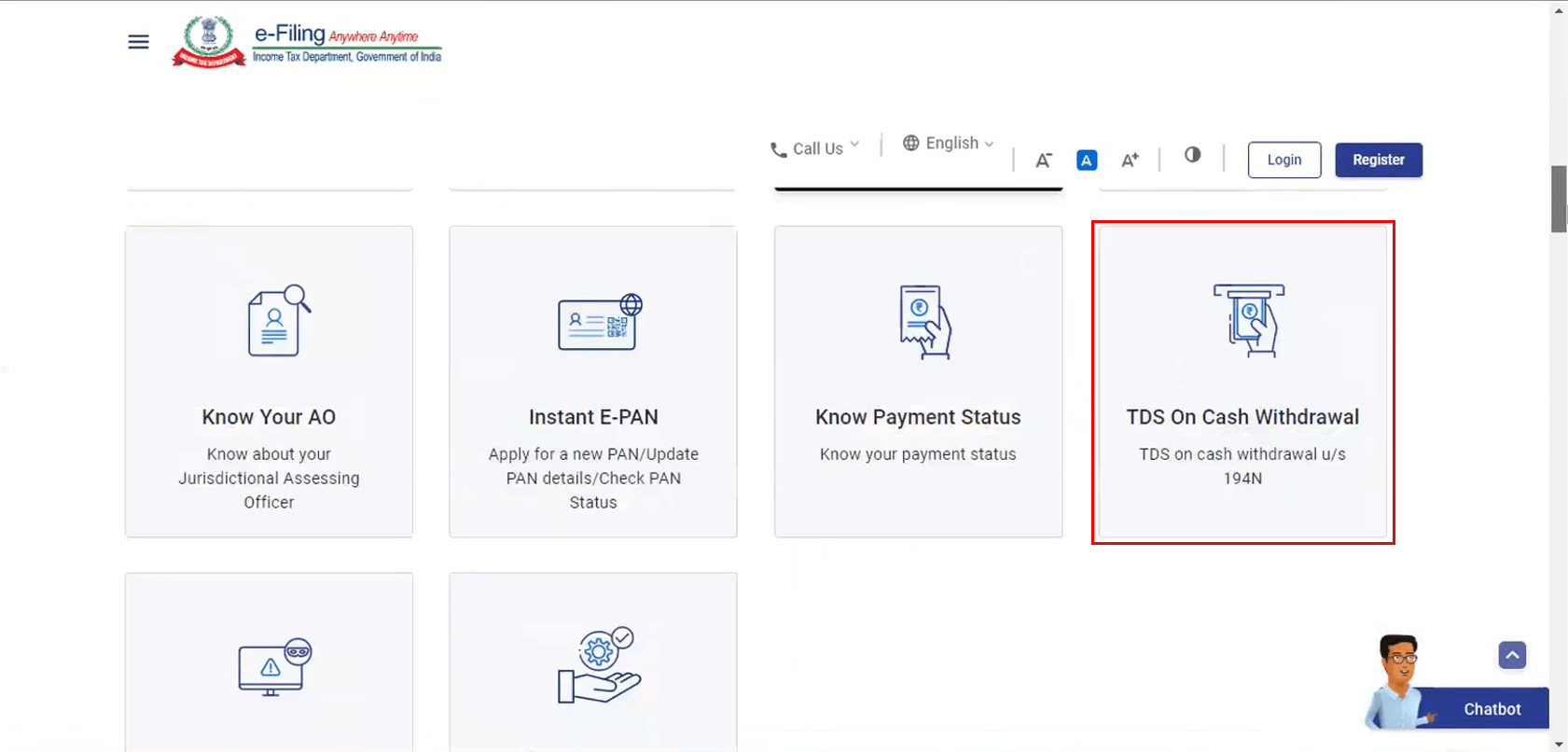

3.1. View TDS rates applicable on Cash Withdrawal (Pre-Login)

Step 1: Go to the e-Filing portal homepage and click TDS on Cash Withdrawal.

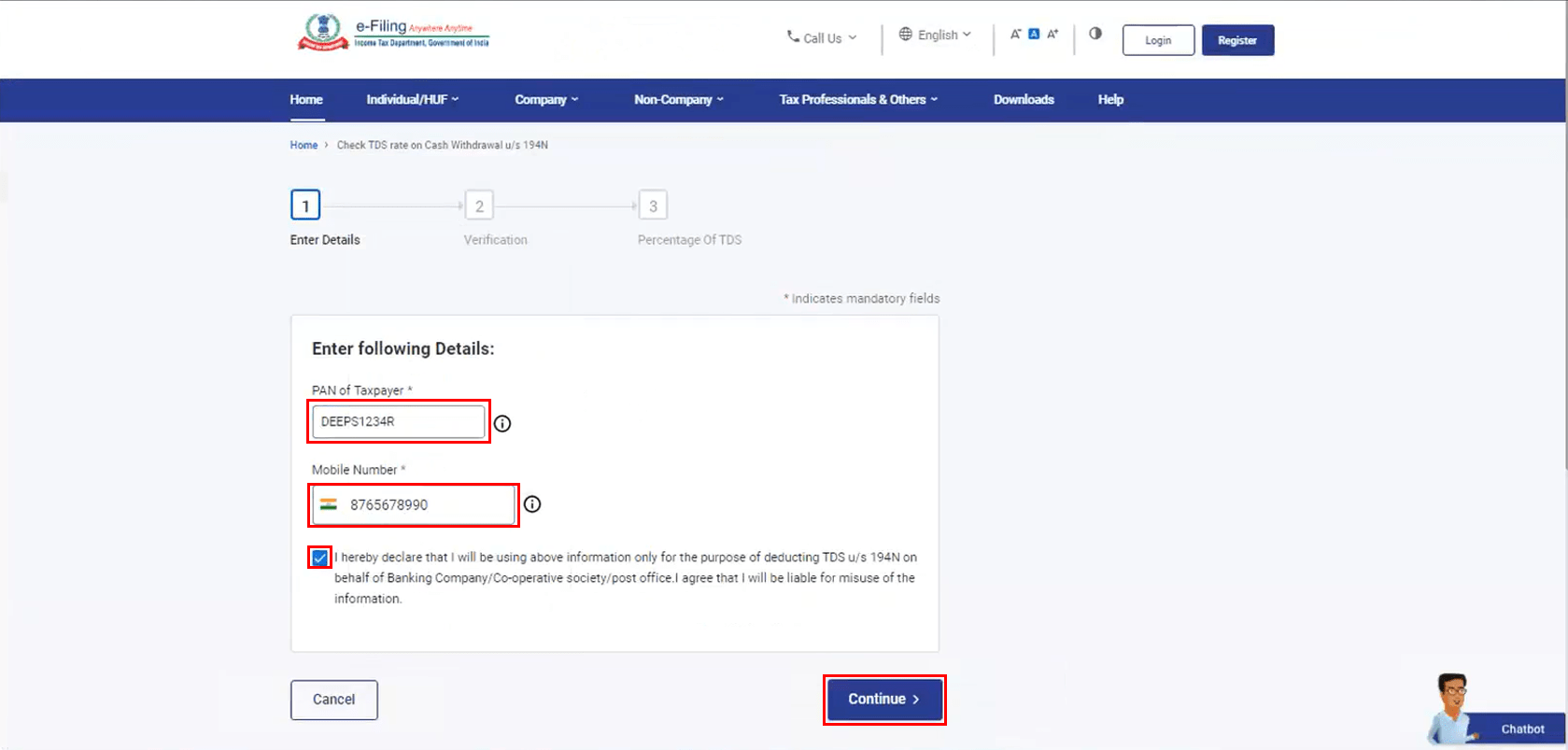

Step 2: Enter your PAN and a valid Mobile Number, select the Declaration checkbox and click Continue.

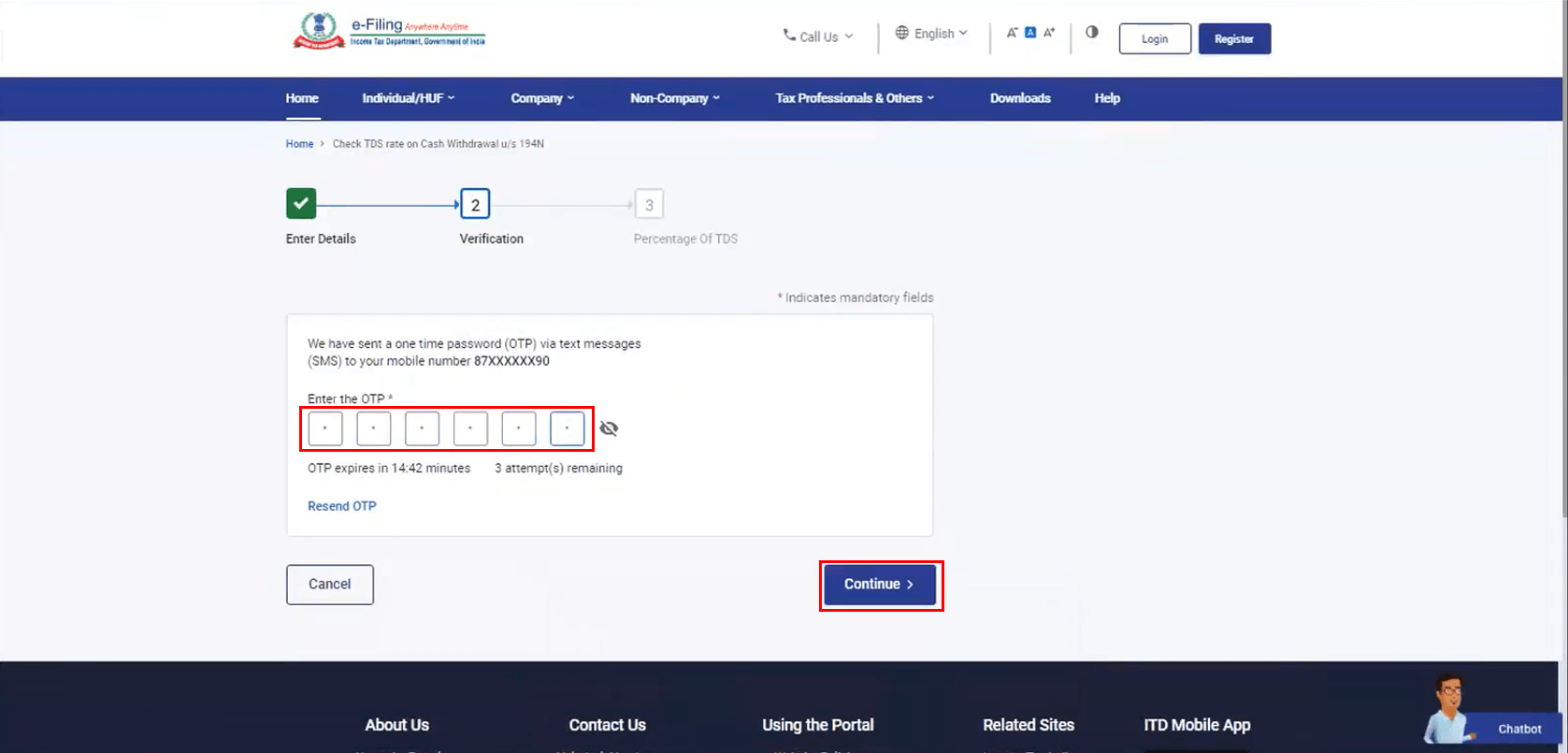

Step 3: You will receive a 6-digit OTP on the mobile number entered in Step 2. On the Verification page, enter OTP and click Continue.

Note:

- OTP will be valid for 15 minutes only.

- You have 3 attempts to enter the correct OTP.

- The OTP expiry countdown timer on screen tells you when the OTP will expire.

- On clicking Resend OTP, a new OTP will be generated and sent.

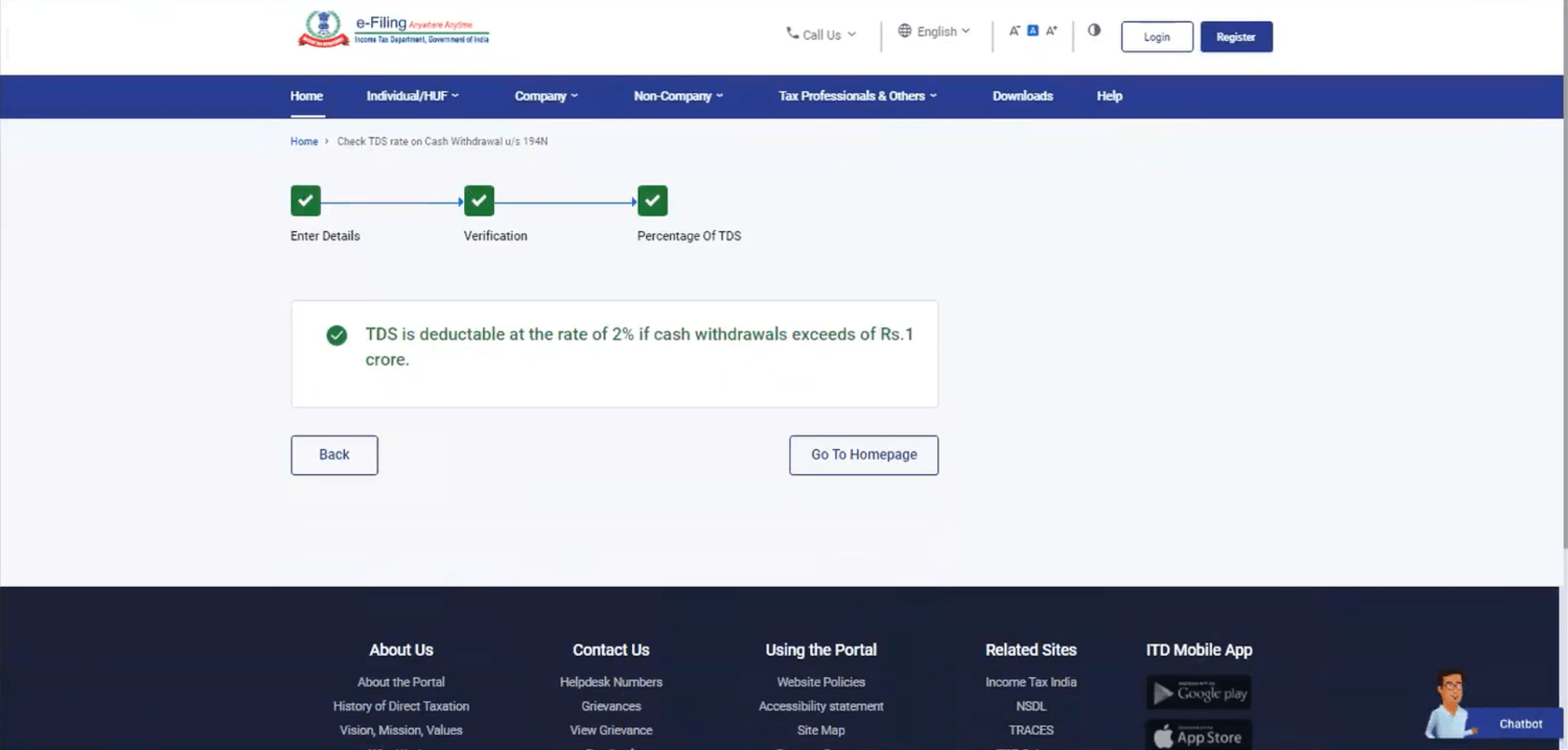

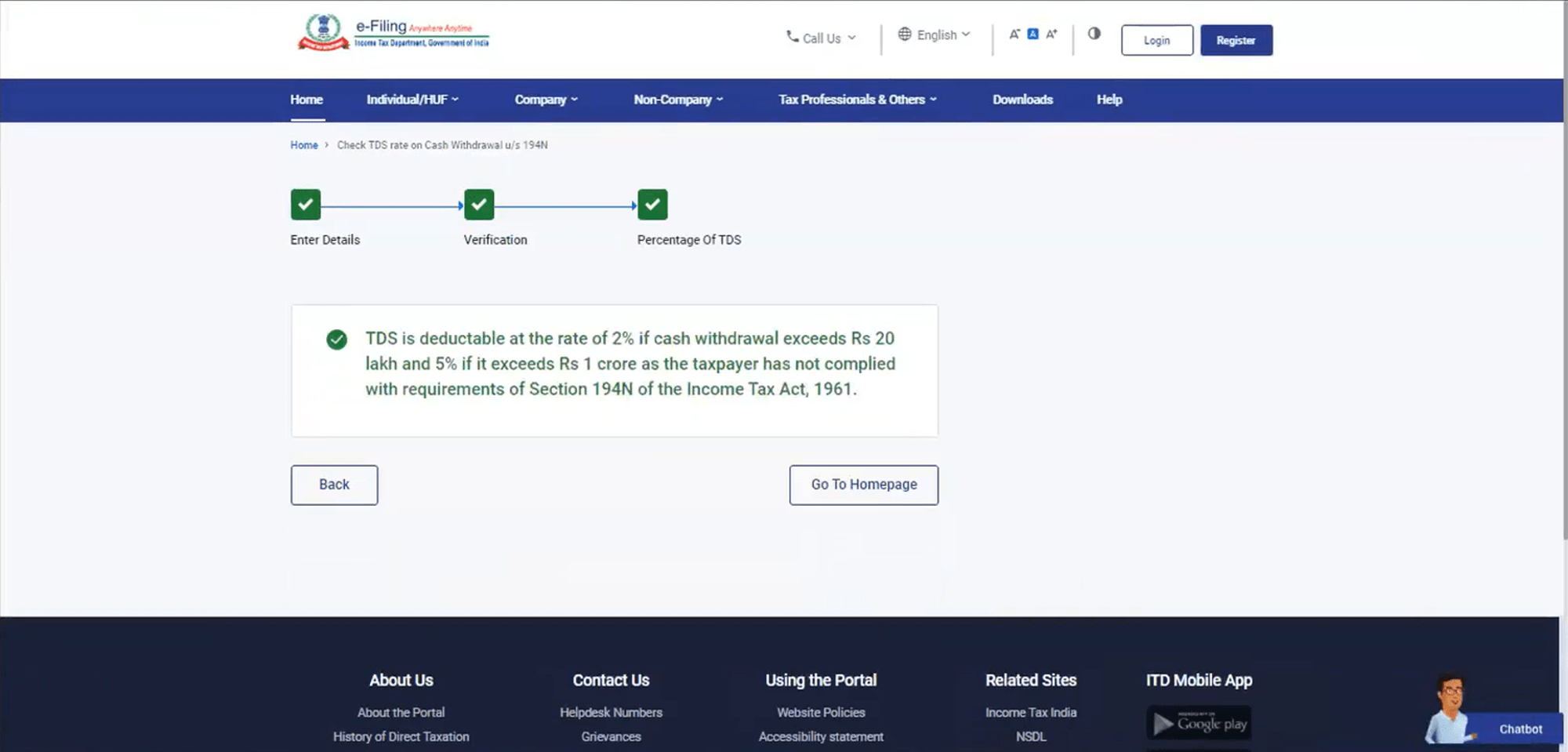

On successful validation, a success message is displayed along with the TDS rate applicable to you as follows:

- If your returns were filed for the past three years, you will get this message: "TDS is deductable at the rate of 2% if cash withdrawals exceeds of Rs. 1 crore."

- If you have not filed income tax returns for all or any year out of the three previous years, you will get this message: "TDS is deductable at the rate of 2% if cash withdrawal exceeds Rs. 20 lakh and 5% if it exceeds Rs. 1 crore as the taxpayer has not complied with requirements of Section 194N of the Income Tax Act, 1961."

3.2 TAN login - Bulk Verification of applicability u/s 194N (Post-Login)

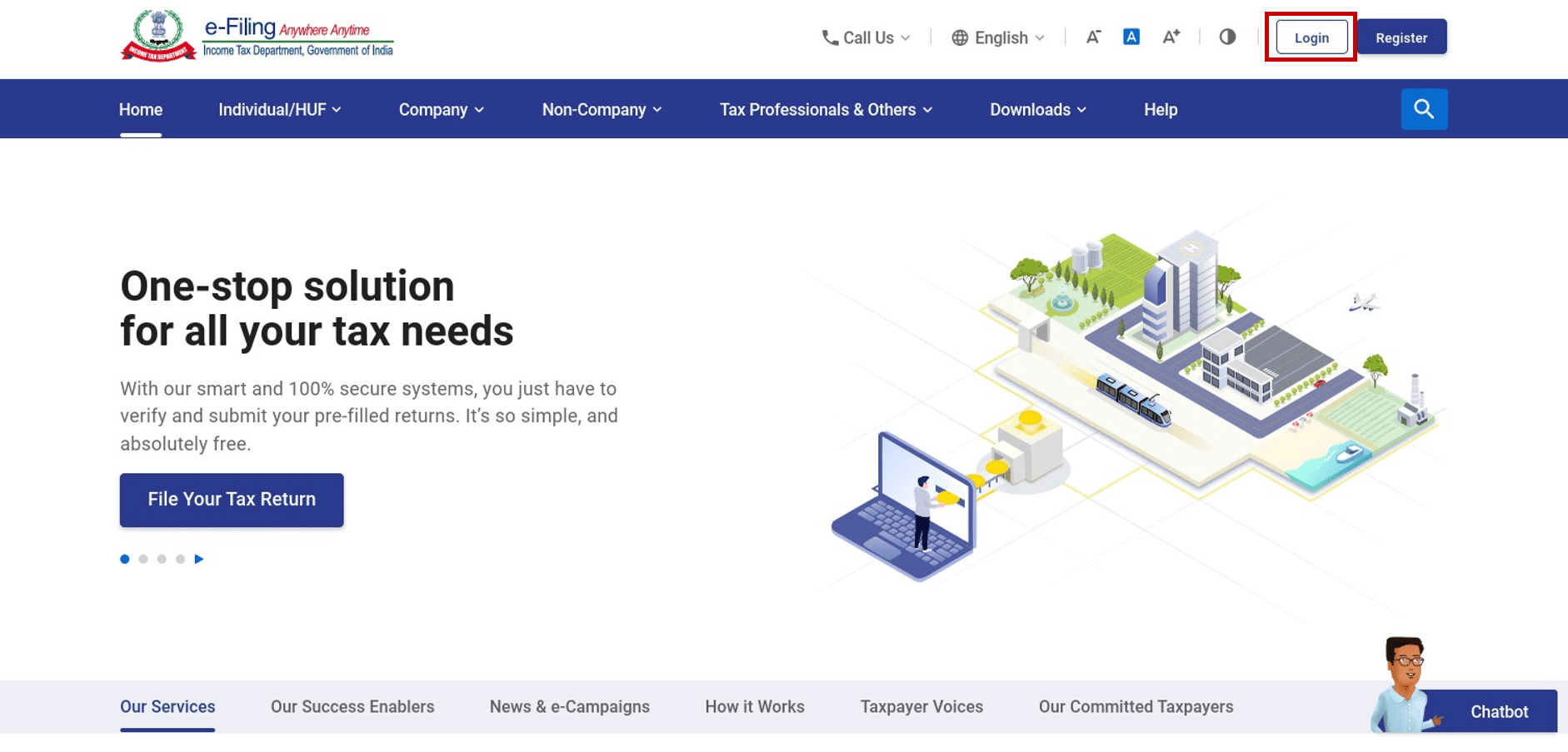

Step 1: Log in to the e-Filing portal using your user ID and password.

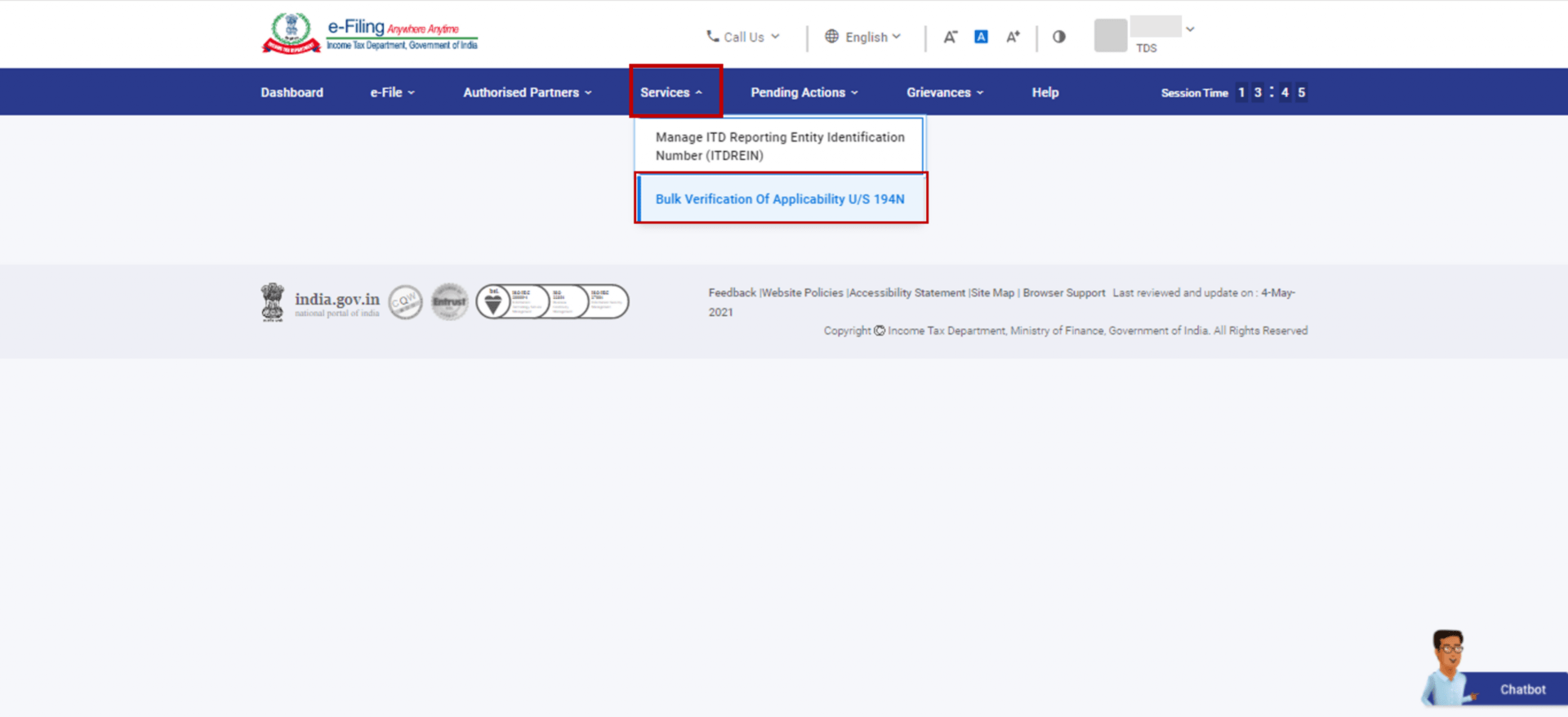

Step 2: Click Services > Bulk Verification of applicability u/s 194N.

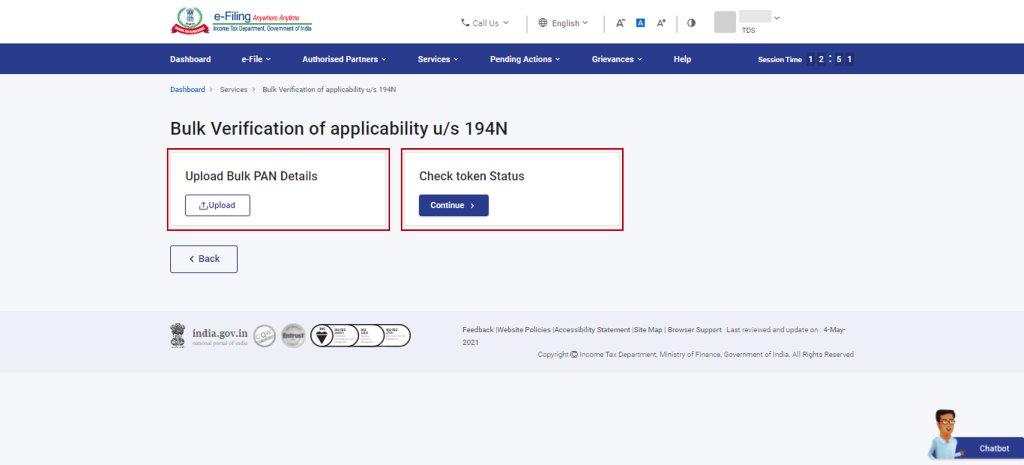

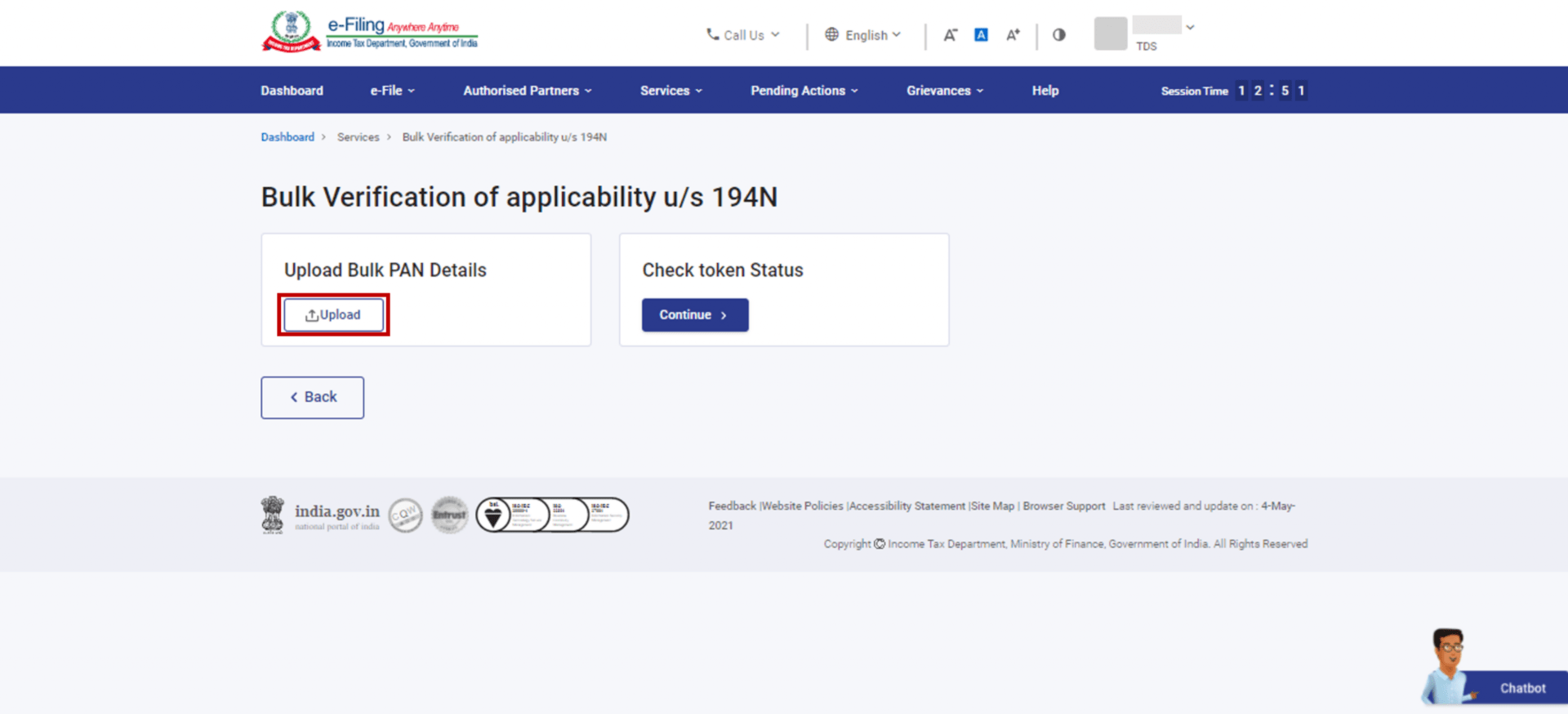

Step 3: On the Bulk Verification of applicability u/s 194N page, you will see two options:

| For Upload Bulk PAN Details | Follow Steps 4 to Step 7 |

| For Check Token Status | Follow Steps 8 to Step 11 |

Upload Bulk PAN Details

With Upload Bulk Pan Details, TAN users can enter details of up to a 1000 PANs in a CSV template (provided by e-Filing) to be checked by the system for status of return filing for each PAN. Accordingly, the system will populate the TDS rate on cash withdrawals applicable for each PAN in the uploaded CSV file.

Step 4: Click Upload.

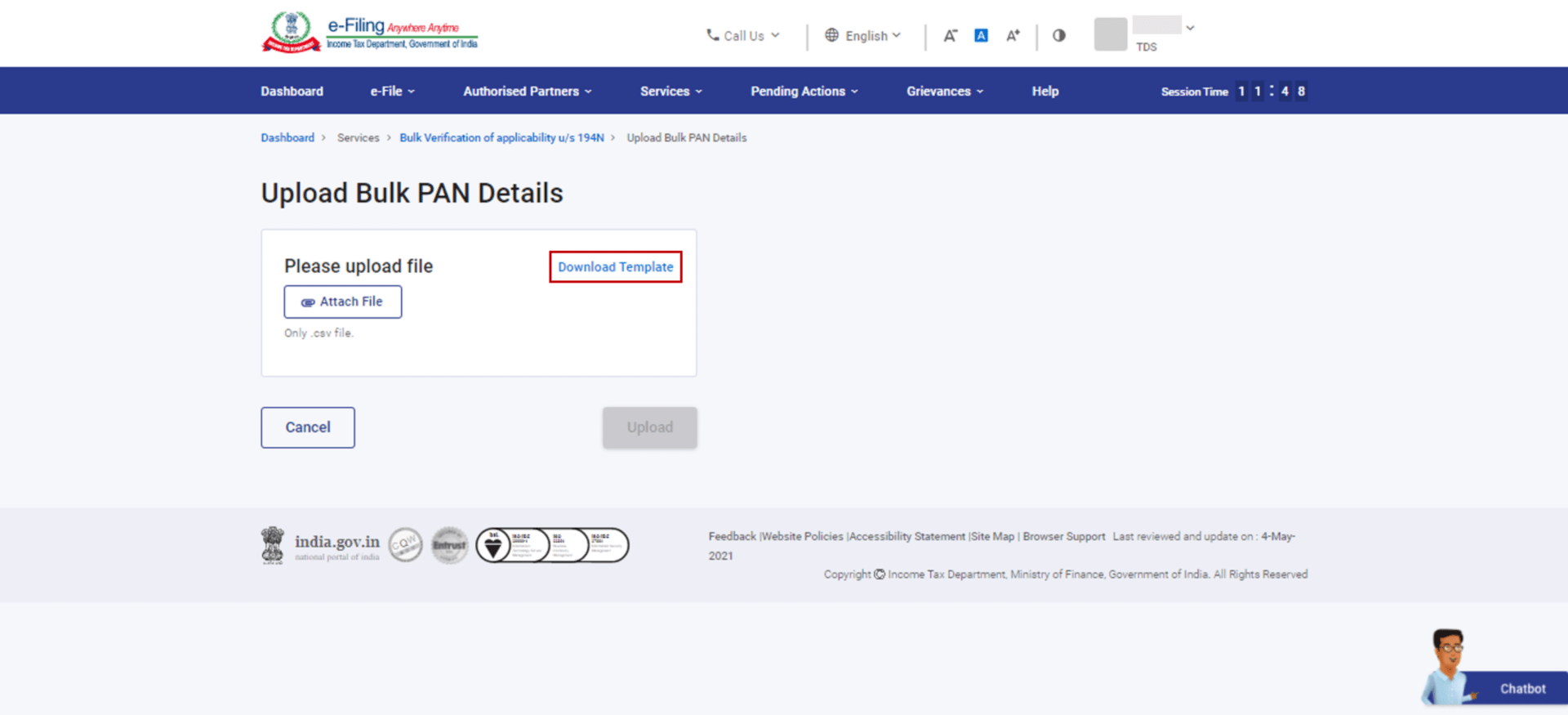

Step 5: On the Upload Bulk PAN Details page, click Download Template to get the CSV template to be filled with bulk PAN details.

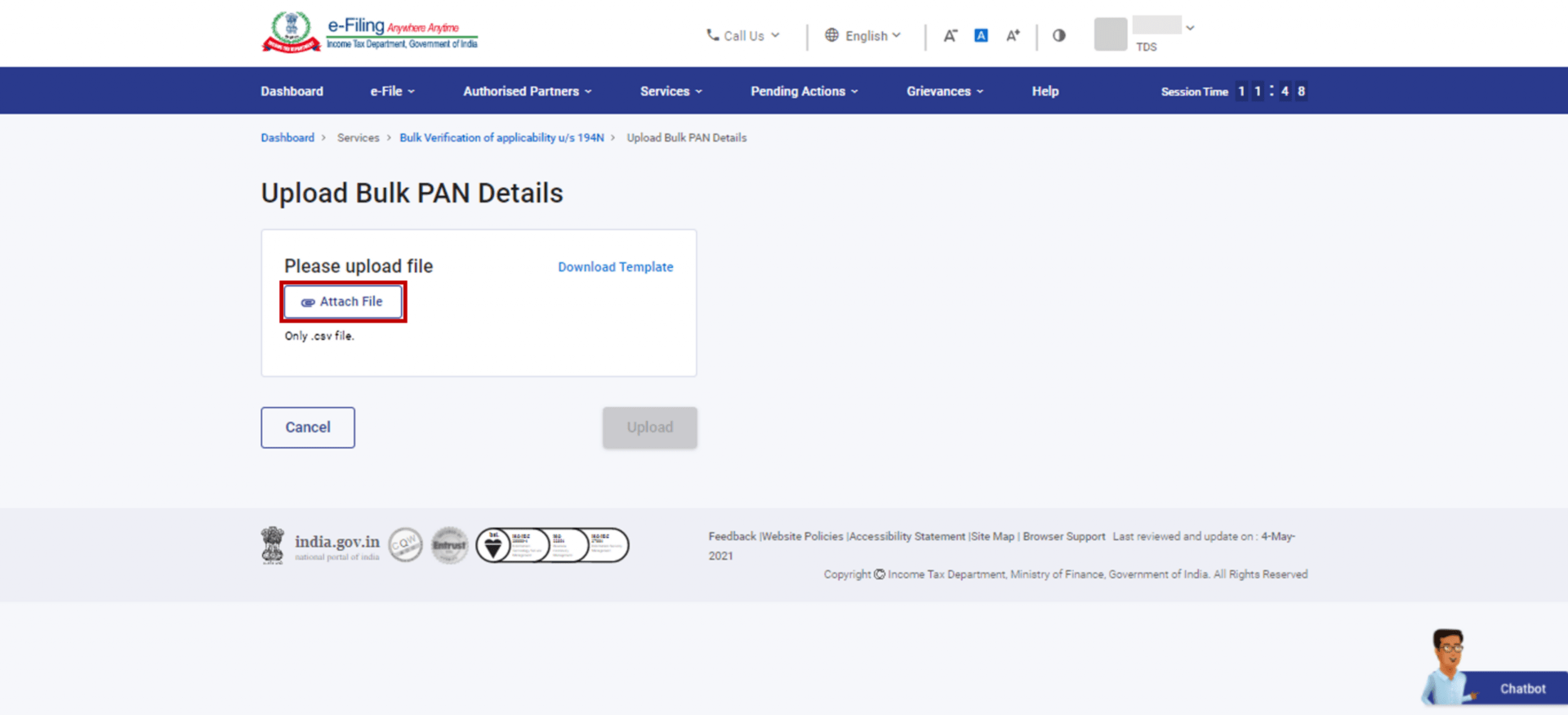

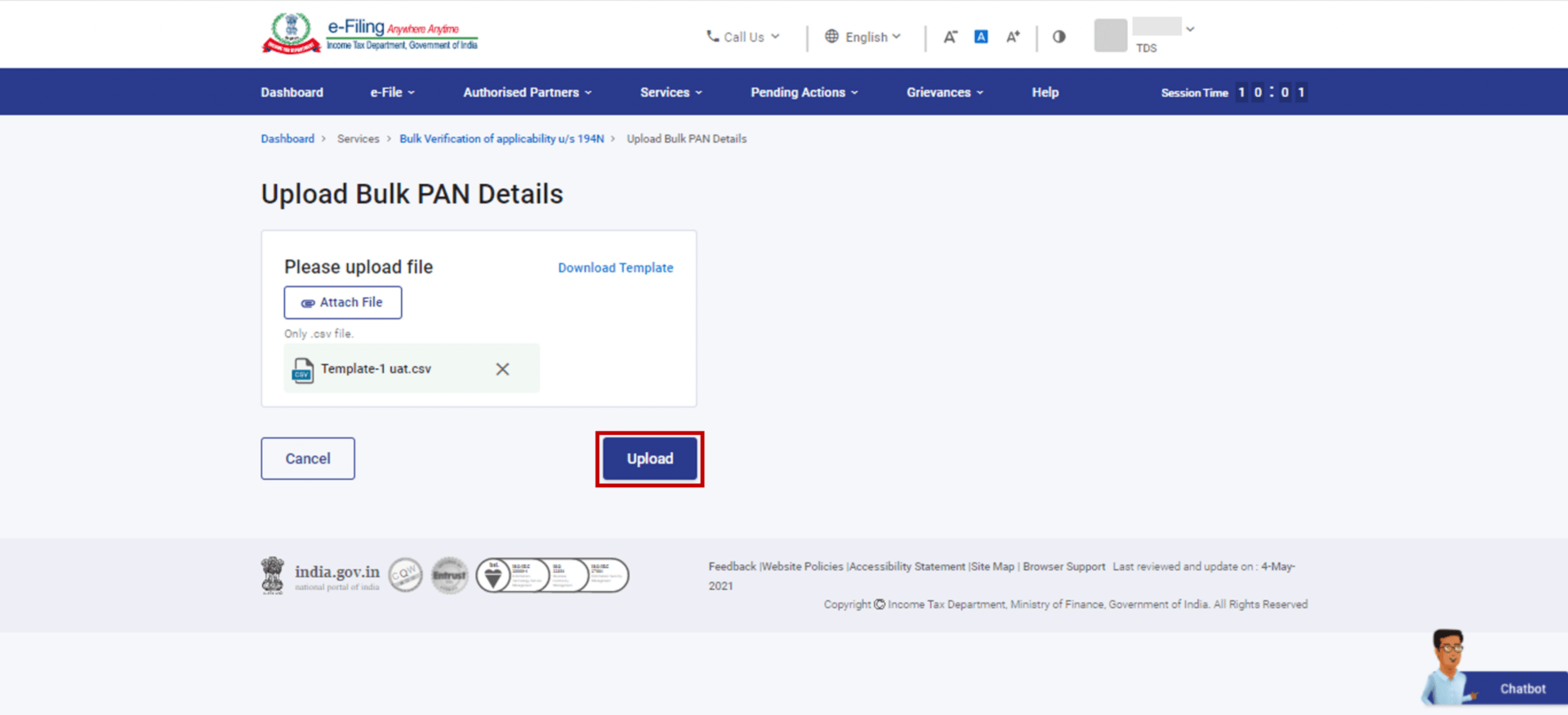

Step 6: Click Attach File to upload the CSV file comprising of the bulk PAN details.

Note: You can add up to 1000 PAN details for one CSV file upload. Attach the CSV file from the respective folder on your computer.

Step 7: Once the file is attached, click Upload.

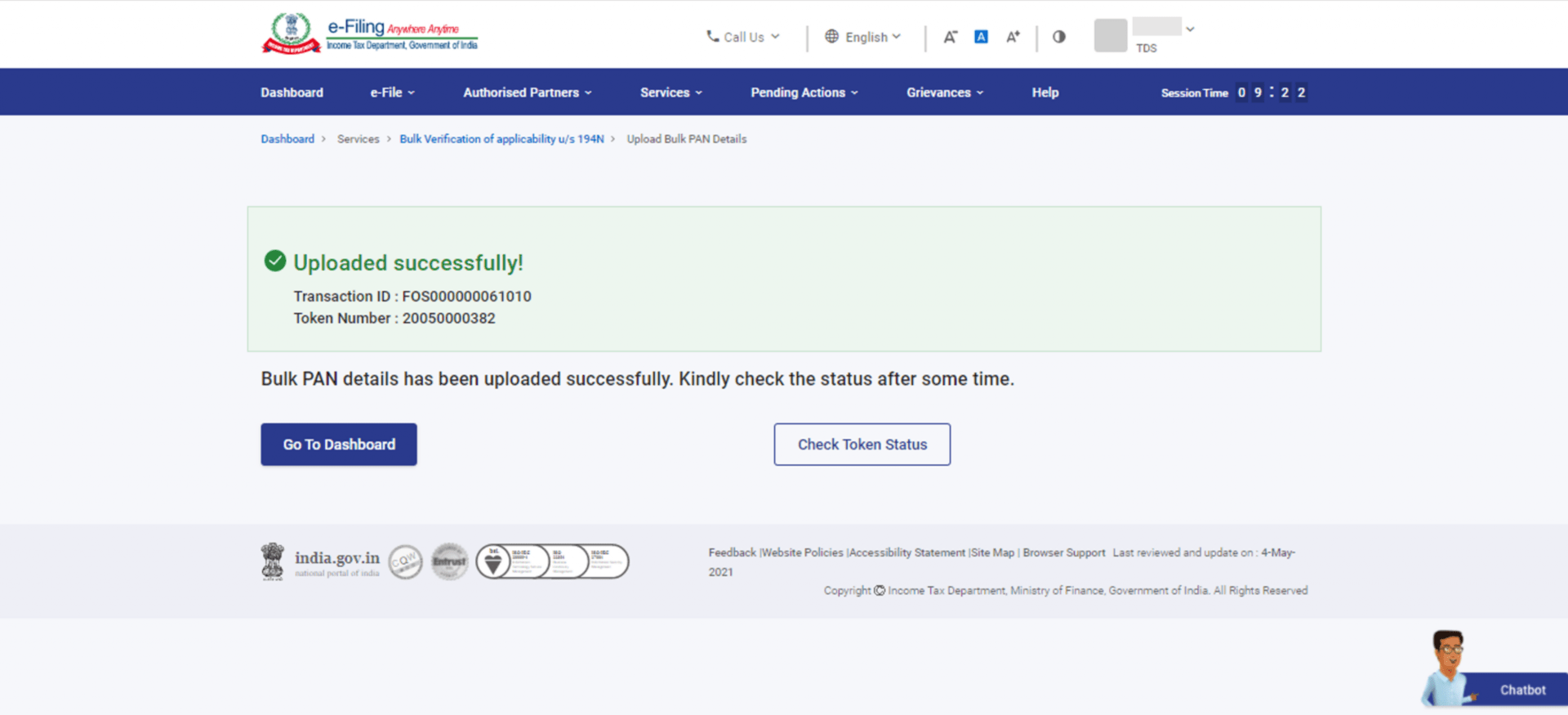

On successful upload, a success message along with a Transaction ID and Token Number. Please keep a note of the Transaction ID and Token Number for future reference. You will receive a confirmation message on your email ID and mobile number registered on the e-Filing portal.

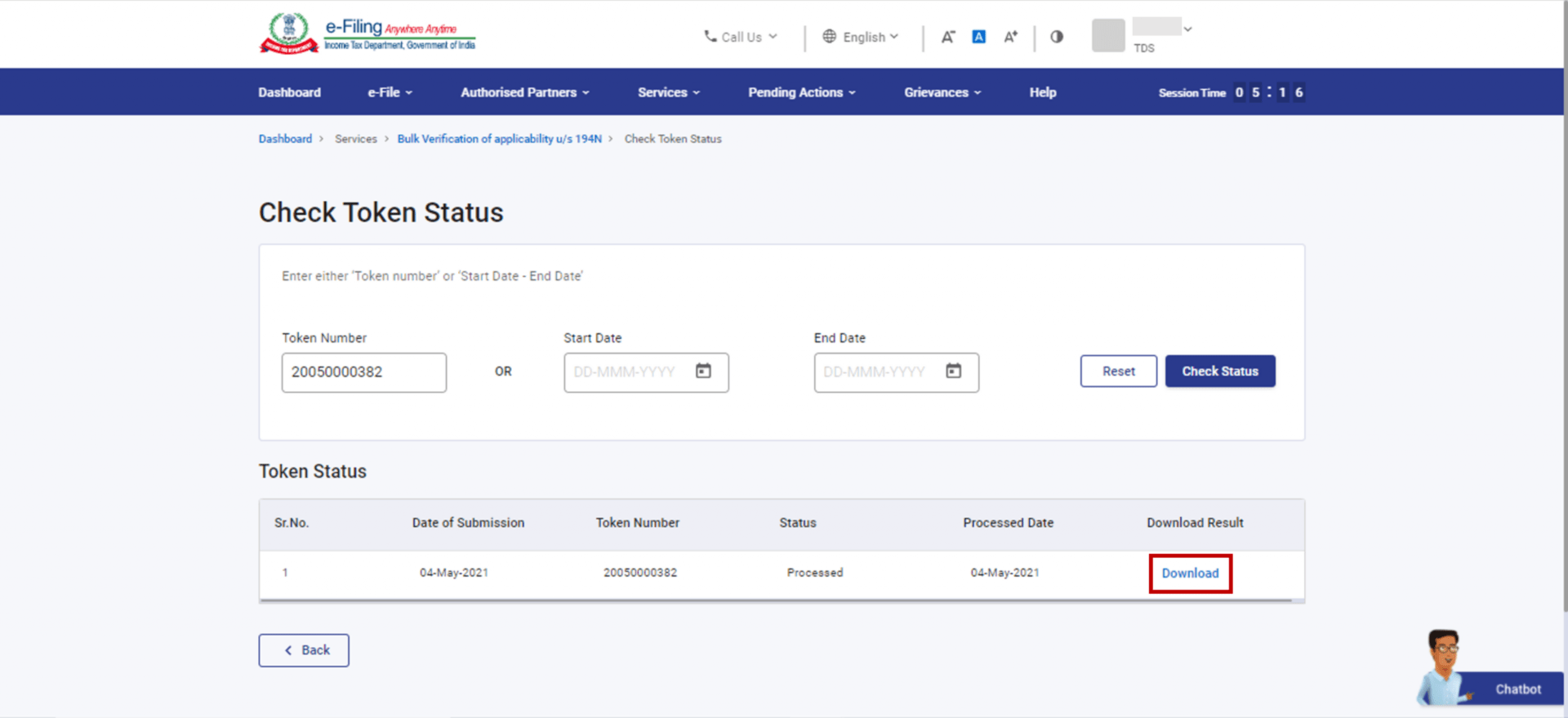

Check Token Status

Under Check Token Status, TAN users can download the records (CSV file populated by the system) with applicable TDS rates for each PAN.

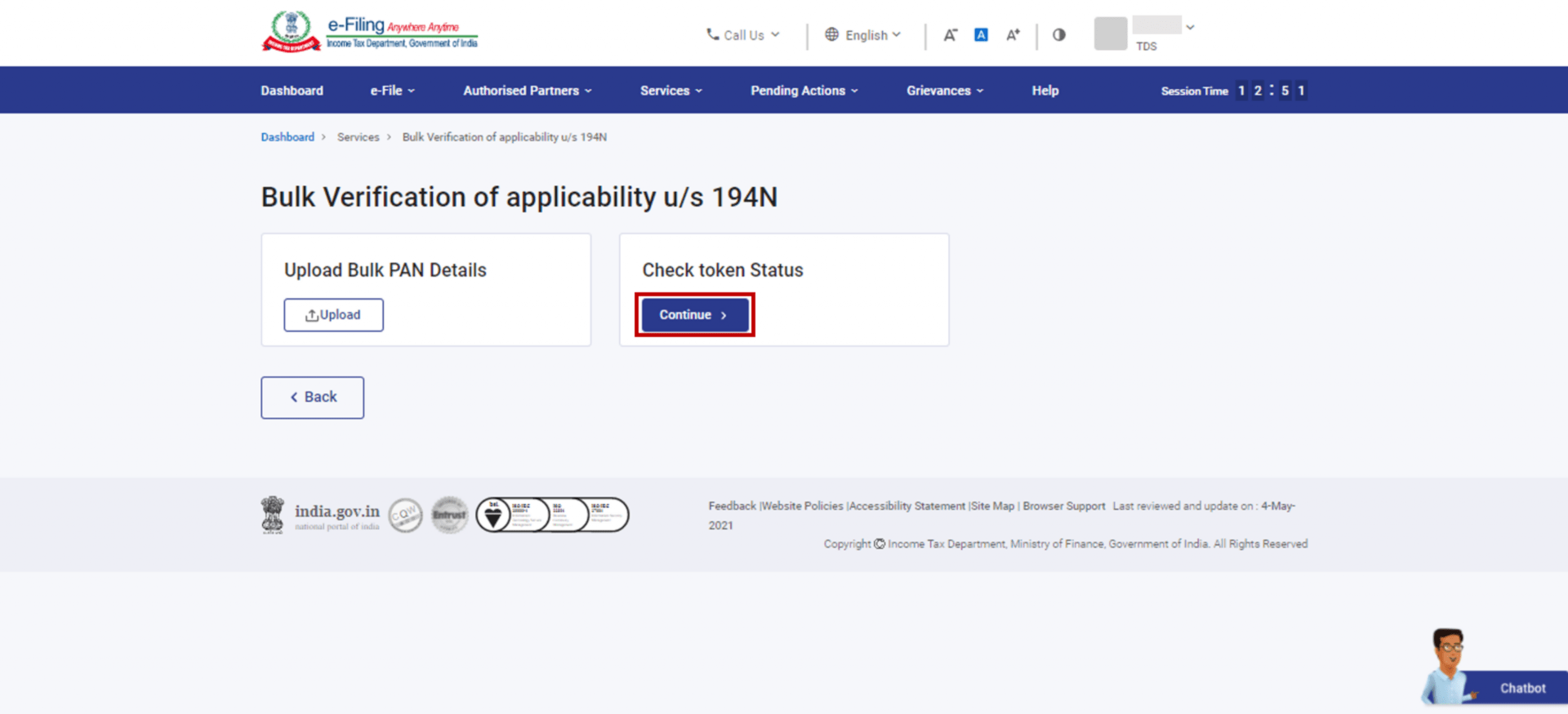

Step 8: Under the Check Token Status option, click Continue.

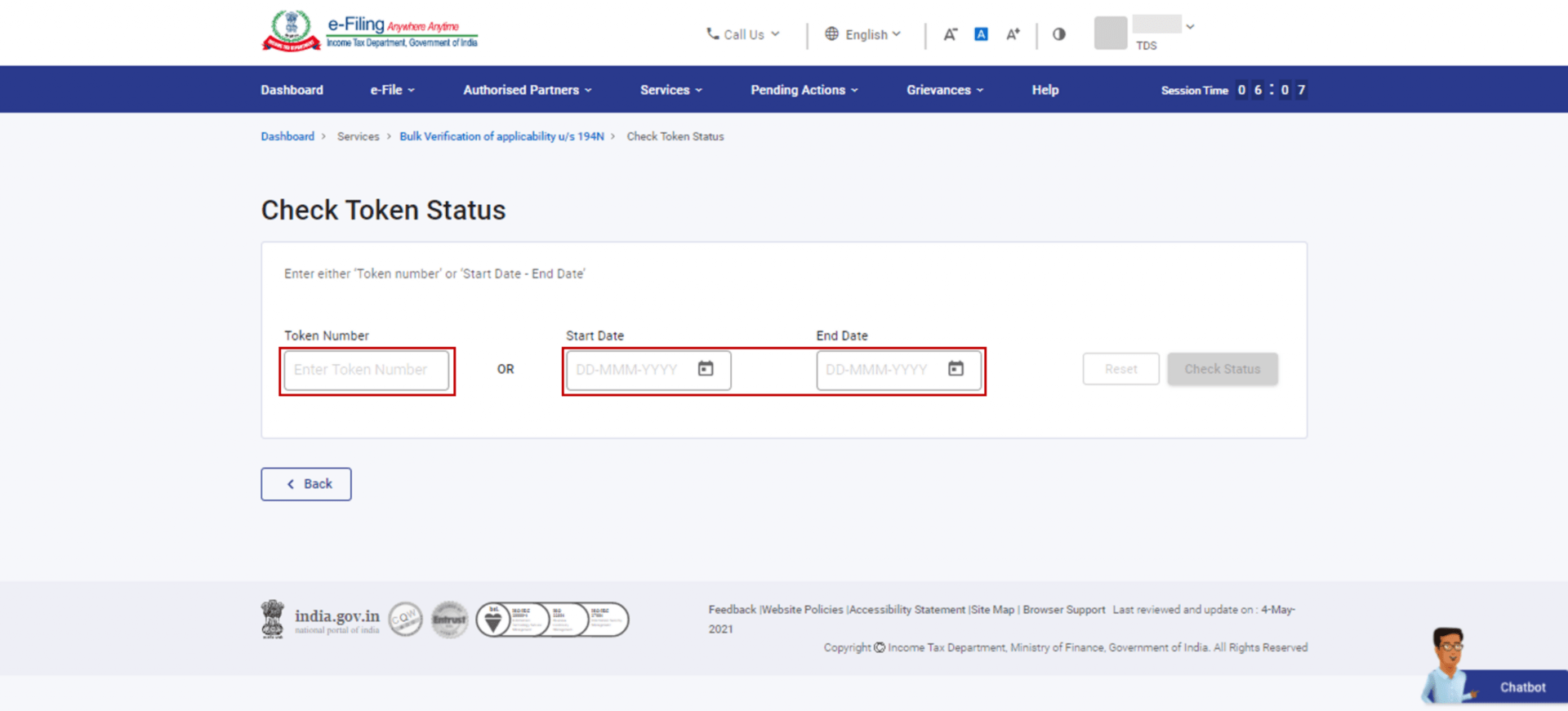

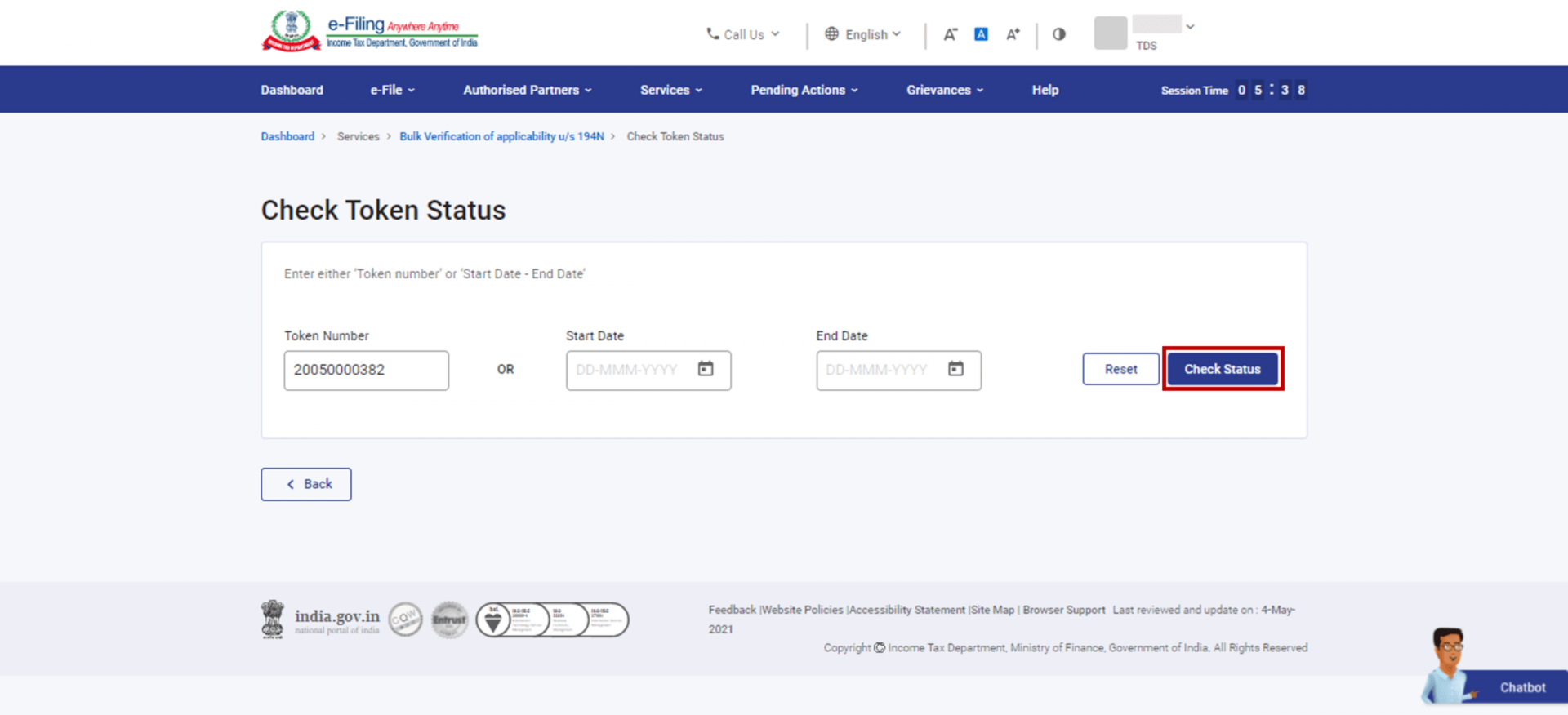

Step 9: On the Check Token Status page, enter either Token Number (that you received on your registered email ID or mobile number when you created the request), or Start Date and End Date (between which the token was generated in the e-Filing portal).

Step 10: Click Check Status.

Step 11: The records that match the selected criteria are displayed in a table. Click Download for a record you wish to download (CSV format).You will be able to view the applicable TDS rate on cash withdrawals made by each PAN in the CSV file downloaded.