Verify Service request of ERIs > User Manual

1. Overview

Verify Service Request is pre-login functionality on the e-Filing portal. With this service, you (client of an ERI) will be able to verify the request submitted by an e-Return Intermediary during performing particular actions on the e-Filing portal on your behalf, including filing of returns and forms.

ERIs can execute the following services on behalf of their client:

- Add Client (Registered and Unregistered Users)

- Activate Client

- Extend Client Validity

- Extend Service Validity

- Add Service

- File Income tax forms

- Refund Re-issue Request

Only after verification by client, the request submitted by the ERI will be completed.

2. Prerequisites for availing this service

- Valid and active PAN

- An e-Return Intermediary must have initiated a request for its client (taxpayer)

- Transaction ID of the request submitted by the ERI

- Transaction Id of the submitted request must be valid/active at time of verifying the request

- Active primary mobile number/ primary email id to receive OTP

- For verification of forms/refund re-issue request, taxpayer must have one of the following: Aadhaar linked with PAN or EVC enable bank or demat account/ Netbanking login/ registered DSC

3. Step-by-Step Guide

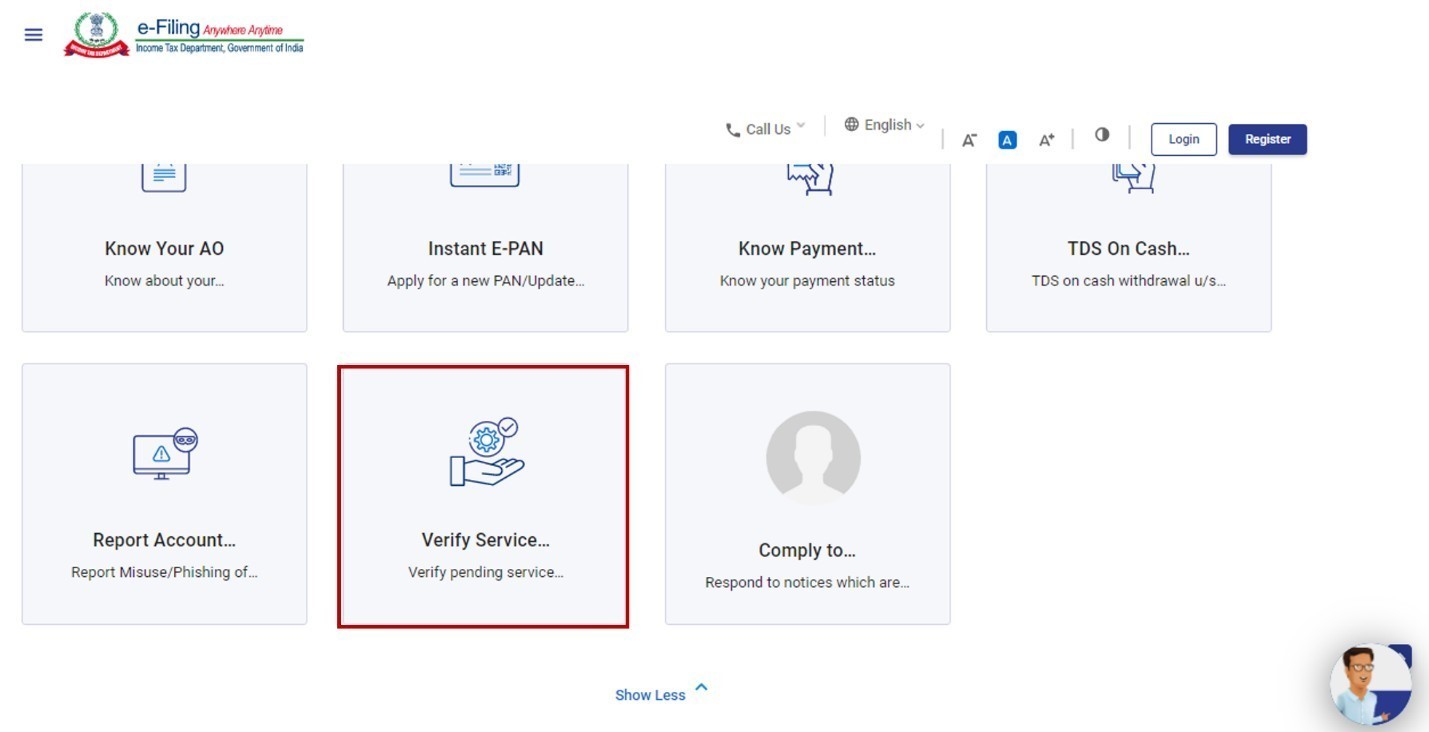

Step 1: Go to the e-Filing portal homepage and click Verify Service Request.

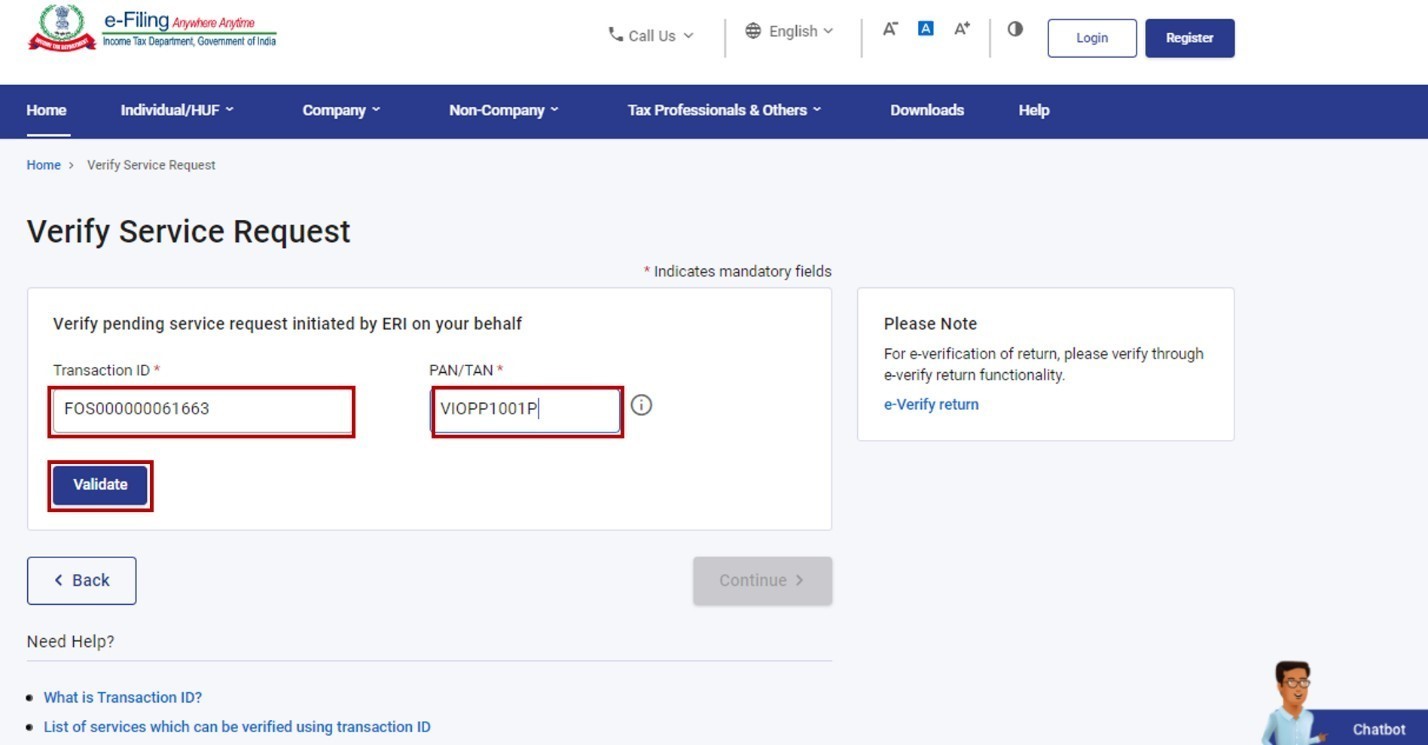

Step 2: On the Verify Service Request page, enter Transaction ID and PAN of the request received on your email ID and mobile number (registered on the e-Filing portal). Click Validate.

Note: If verification request is for registration on the portal, enter the Transaction ID received on your email ID and mobile number provided by the ERI during submission of the registration request.

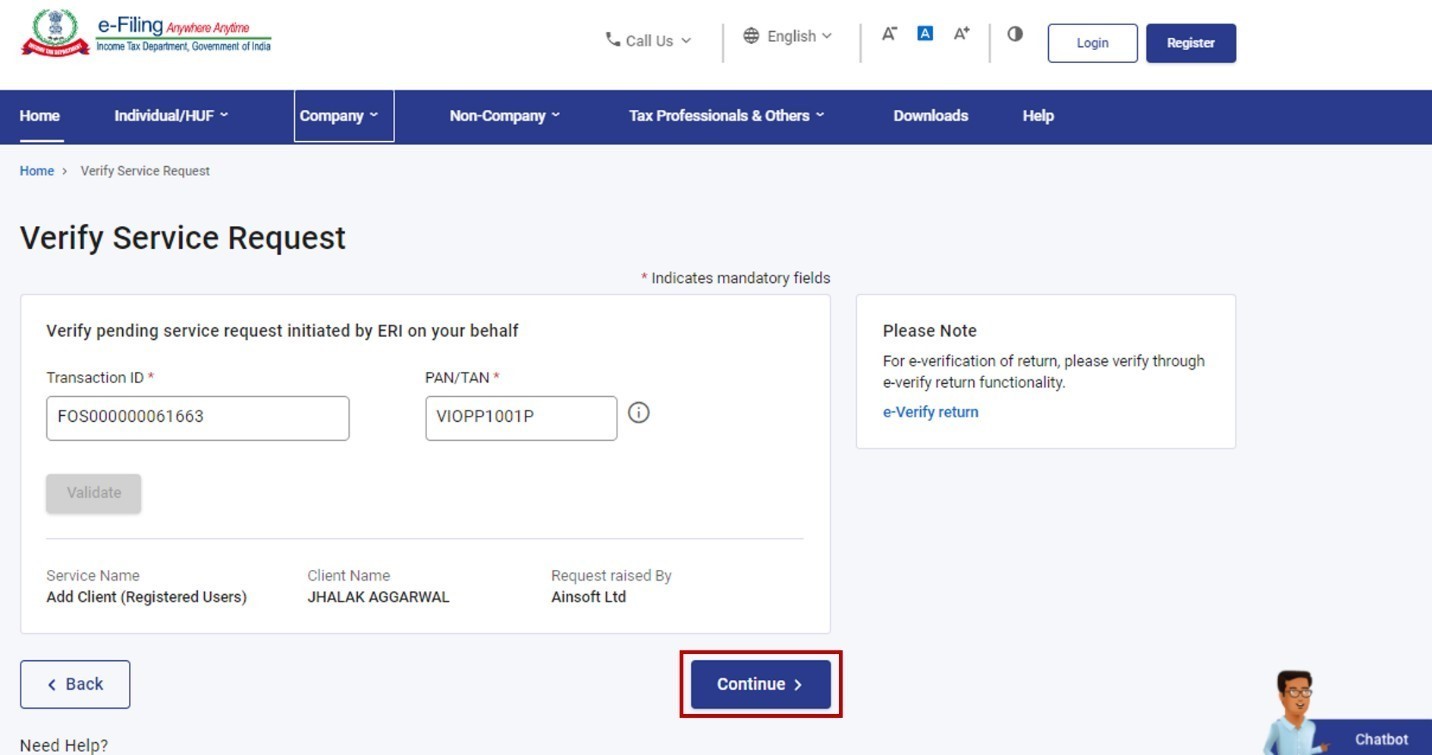

Step 3: After successful validation, click Continue.

Step 4: The mode of verification will depend on the type of request submitted by the ERI.

|

Type of Request Submitted |

Mode of Verification |

|

6-digit OTP received on email ID and mobile number registered on e-Filing portal |

|

Two separate 6-digit OTPs received on email ID & mobile number registered on e-Filing portal |

|

e-Verification |

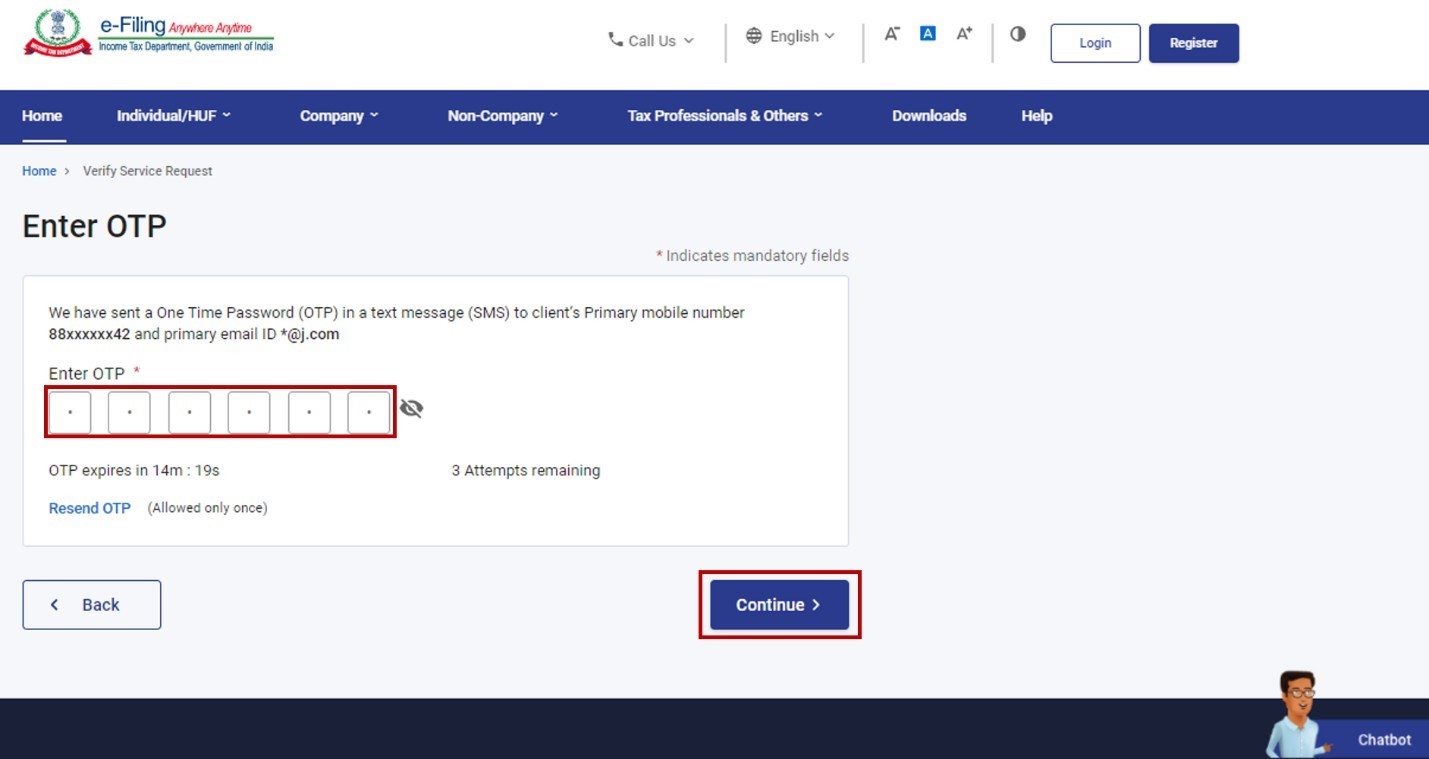

Step 5a: Enter the 6-digit OTP/OTPs (refer to the table in Step 4 for further details). Click Continue.

Note:

- OTPs will be valid for 15 minutes only.

- You have 3 attempts to enter the correct OTP

- The OTP expiry countdown timer on screen tells you when the OTP will expire.

- On clicking Resend OTP, a new OTP will be generated and sent.

- If you are an unregistered user, you will have to enter two separate 6-digit OTPs received on your email ID and mobile number provided by your ERI while adding you as client.

Step 5b: If the ERI has requested for performing services like File Income tax forms, Refund re-issue request, on your behalf, you have to e-Verify the request using the available options.

Note: Refer to the How to e-Verify user manual to learn more.

On successful verification, a success message will be displayed along with a Transaction ID. Please keep a note of the Transaction ID for future reference. You will also receive a confirmation message on your email ID and mobile number registered on the e-Filing portal.

4. Related Topics

Login

Dashboard

View client & Type 1 ERI services

How to e-Verify

Registration

Verify Service request of ERIs > FAQs

1. What is Verify Service Request of ERIs service?

With this service, the client of Type 1 ERI will be able to verify requests submitted by ERIs on their behalf.

2. Who can verify the service requests submitted by ERIs?

All users (registered / unregistered) can verify the service requests submitted by ERIs.

3. What kind of services can be performed by an ERI on my behalf?

ERIs can execute the following services on behalf of their client:

- Add Client (Registered and Unregistered Users)

- Activate Client

- Extend Client Validity

- Extend Service Validity

- Add Service

- Condonation Request for delay in submission of ITR-V

- Add Authorized Representative

- Authorize another person to act on behalf of self

- Register as Representative Assessee

- Register to act on behalf of other person

- File Income tax forms

- Refund Re-issue Request

- Rectification Request

- Condonation Request for filing ITR after time barred

- Update Primary Contact details as per Bank Account verified contact details

- Update Primary Contact details as per Demat Account verified contact details

4. If an ERI has submitted refund reissue request on my behalf, will the request be valid if I do not verify?

No. Any request submitted by ERI on your behalf will not be completed if it is not verified by you.

5. Is there a time period within which I need to verify the request submitted by ERIs on my behalf?

You have to verify the request within 7 days of generation of the Transaction ID after which it will be invalid.

6. What details do I need for verifying the service request submitted by an ERI??

You will need your PAN and the Transaction ID of the submitted request.

Glossary

|

Acronym/Abbreviation |

Description/Full Form |

|

AY |

Assessment Year |

|

ITD |

Income Tax Department |

|

ITR |

Income Tax Return |

|

HUF |

Hindu Undivided Family |

|

TAN |

TDS & TCS Account Number |

|

ERI |

e-Return Intermediary |

Metadata

Add clients

Type 1 ERIs

Type 2 ERIs

Verify service request

ERIs

Assessment Questions

(Note: The correct answer is in boldface.)

Q1. What is the duration for which the request for adding clients (by ERIs) is active?

a) 24 hours

b) 5 days

c) 7 days

d) 30 days

Answer – c) 7 days

Q1. If an ERI has submitted a refund reissue request, the taxpayer can verify the request using? (You can choose more than one option)

a) OTP on mobile number entered during submission of the request

b) OTP on mobile number registered with e-Filing portal

c) EVC

d) OTP on mobile number registered with Aadhaar

Answer – b) OTP on mobile number registered with e-Filing portal & d) OTP on mobile number registered with Aadhaar