FO_61_View Client and Type 1 ERI Services_User Manual_FAQ_V0.1

1. Overview

The View Client Details service is available to Type 1 ERIs registered on e-Filing portal. Type 1 ERI can access this service by login to e-Filing portal. ERIs can view the number of active and inactive clients for them.

The following actions can be performed by Type 1 ERIs:

- View the total count of their active and inactive or deactivated clients and count of active and inactive clients in a particular selected combination of month and year.

- Search for their added clients by the PAN or Name of client.

- View the list of services that the ERI can access on behalf of their active client.

2. Prerequisites for availing this service

- ERI must be registered on the e-Filing Portal

- ERI must have Valid PAN client

- PAN of taxpayer should be added as a client by ERI, or the taxpayer should add an ERI through My ERI post login taxpayer service

- For ERI to access default services or any additional available service on behalf of the client, the PAN of the client (taxpayer) should be active.

3. Step-by-Step Guide

Step 1: Log in to the e-Filing portal using your user ID and password.

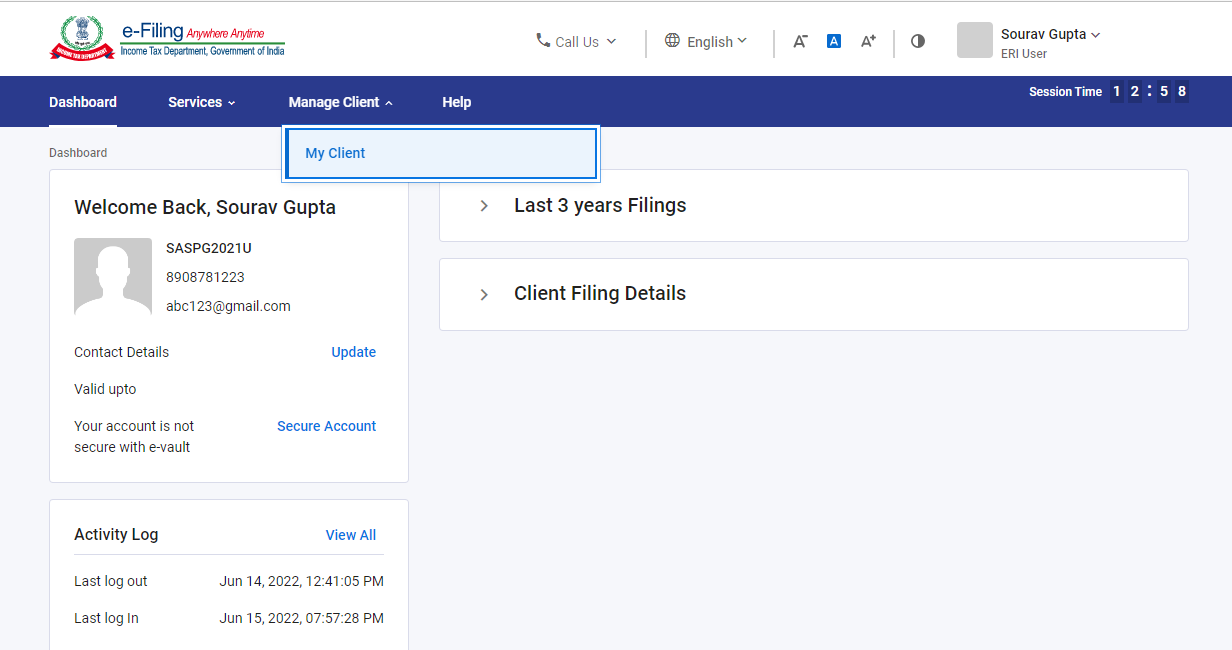

Step 2: On the Dashboard, click Manage Client > My Client.

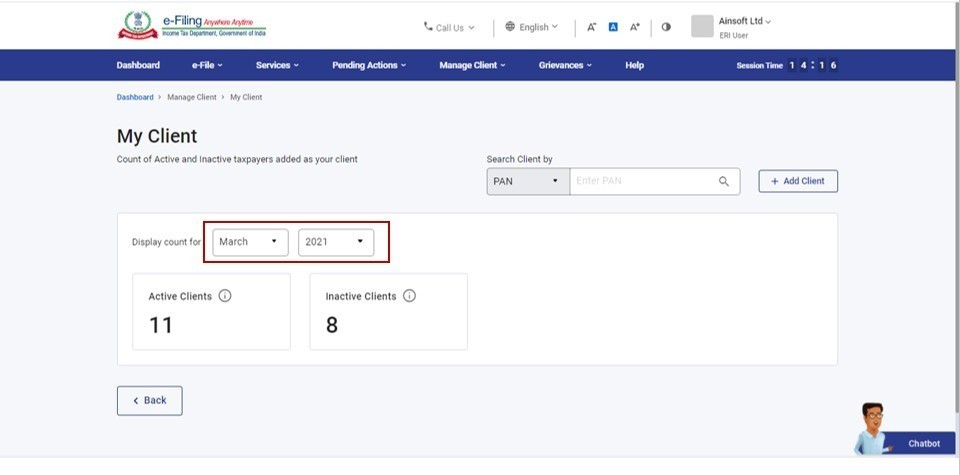

Step 3: You can now view the count of active and inactive clients for you. . Select Month and Year to view the count of active and inactive clients for the specified time period.

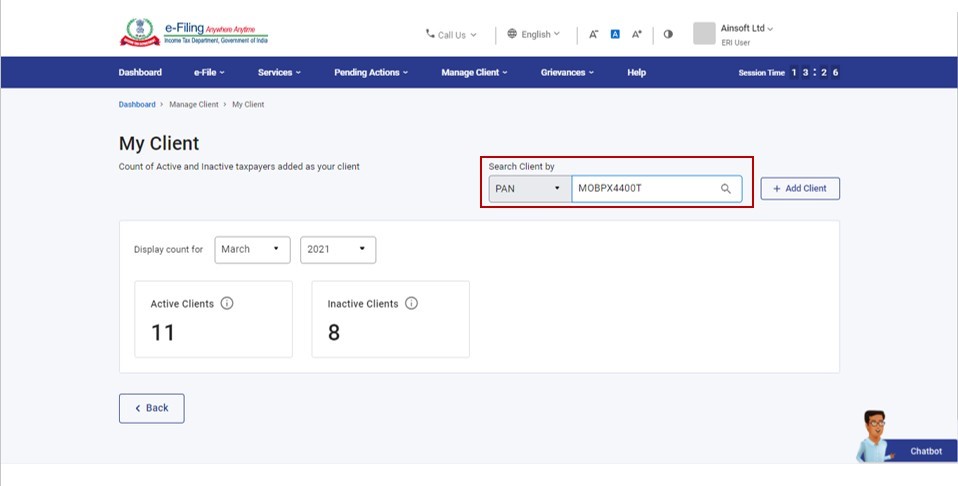

Step 4: To search for a client, select search client by PAN or Client Name, enter PAN/ Client Name based on selection and click Search icon.

Step 5: Upon validation of PAN, client details are made available. If you search by Client Name, all results corresponding to first 4 letters entered is made available.

As an ERI, you can access ERI services for added clients, like deactivate clients, extend validity of clients, Add services (consent based) for added clients. And service like activate client for Inactive clients.

Refer to the table below to proceed further:

|

Access and Add ERI Services |

Go to Section 5.1 |

|

Deactivate added Client |

Go to Section 5.2 |

|

Activate the deactivated added client |

Go to Section 5.3 |

|

Extend Validity |

Go to Section 5.4 |

|

Complete list of ERI services |

Go to Section 5.5 |

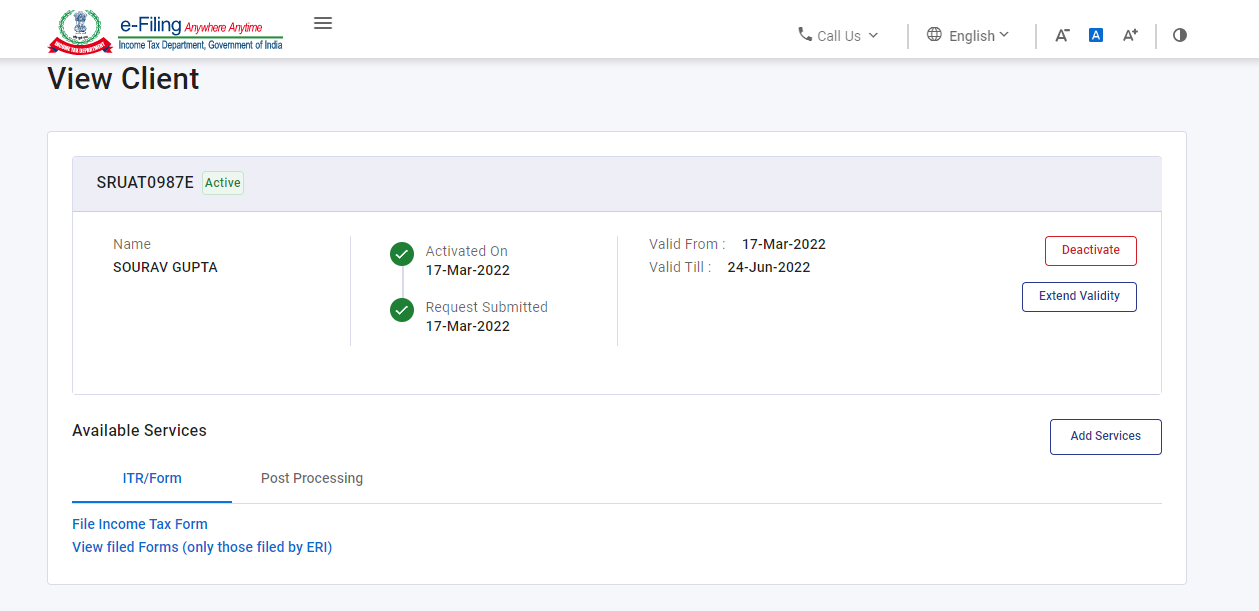

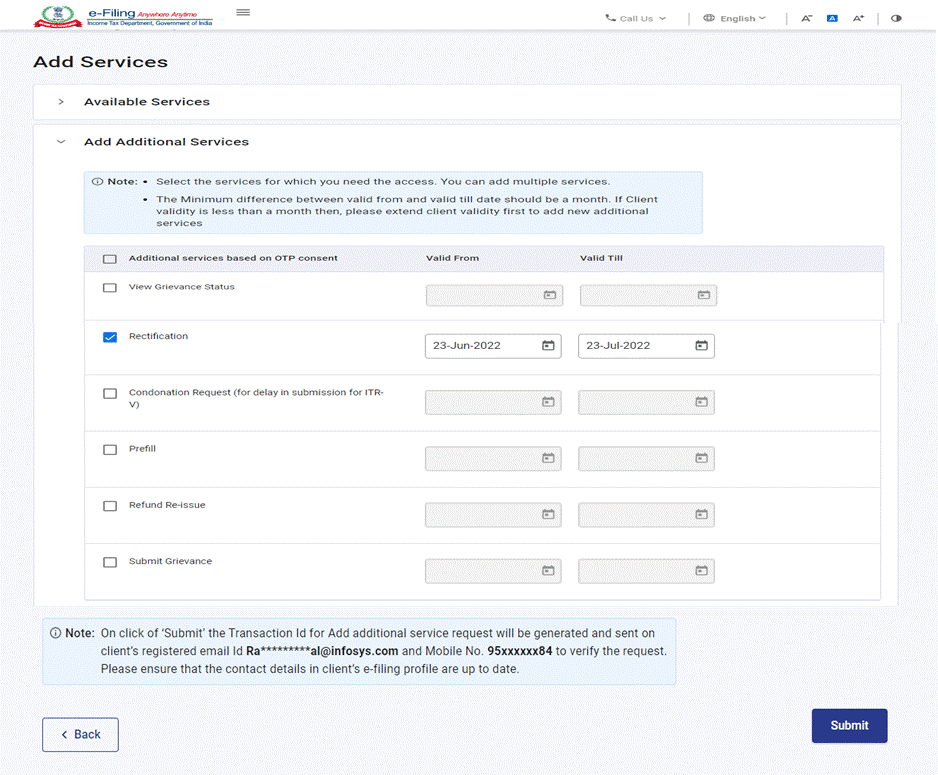

5.1 Access Add ERI Services

Step 1: Click Add Services to request for additional services.

Step 2: Select the additional service required, select the validity period and click Submit.

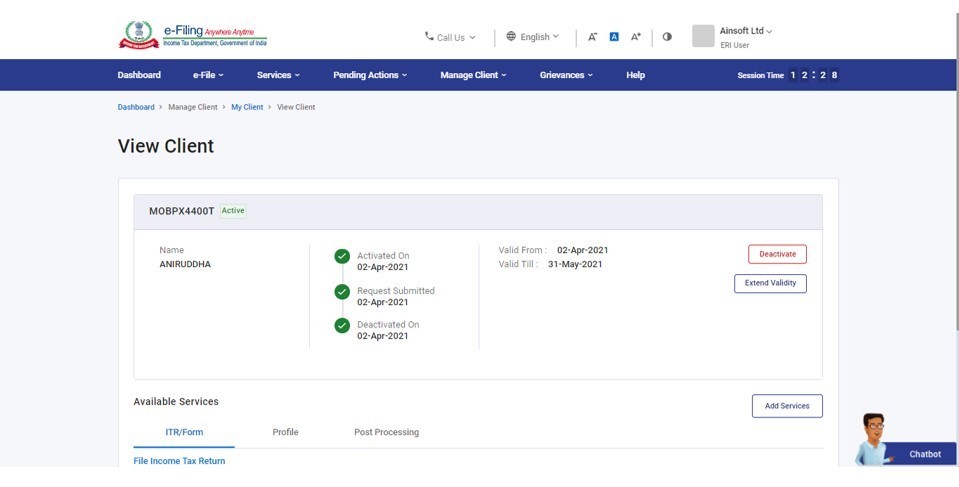

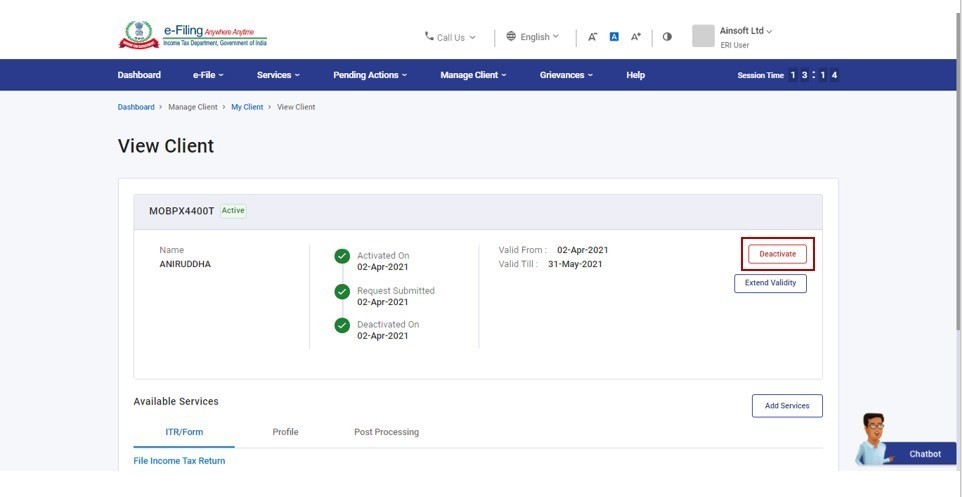

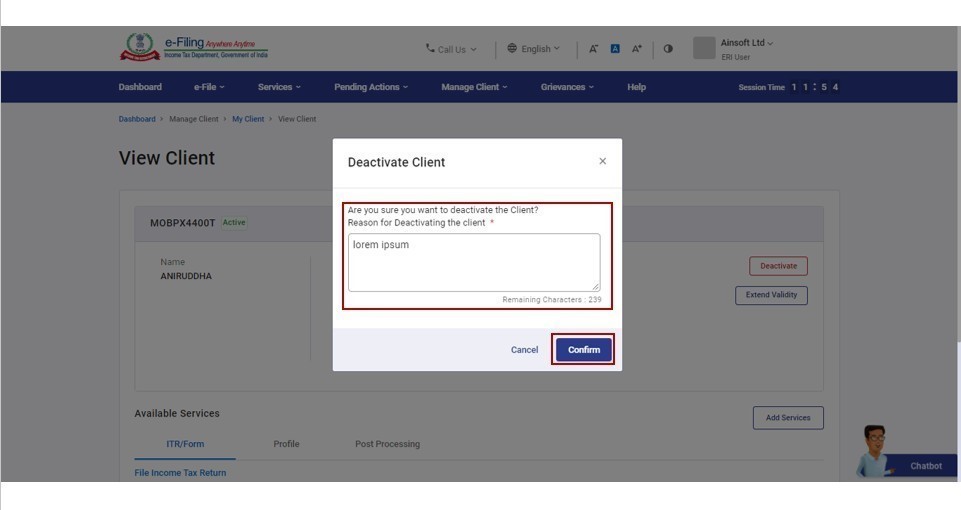

5.2 Deactivate Added Client

Step 1: Click Deactivate against the active client to be deactivated.

Step 2: Enter Reason for Deactivating the Client and click Confirm.

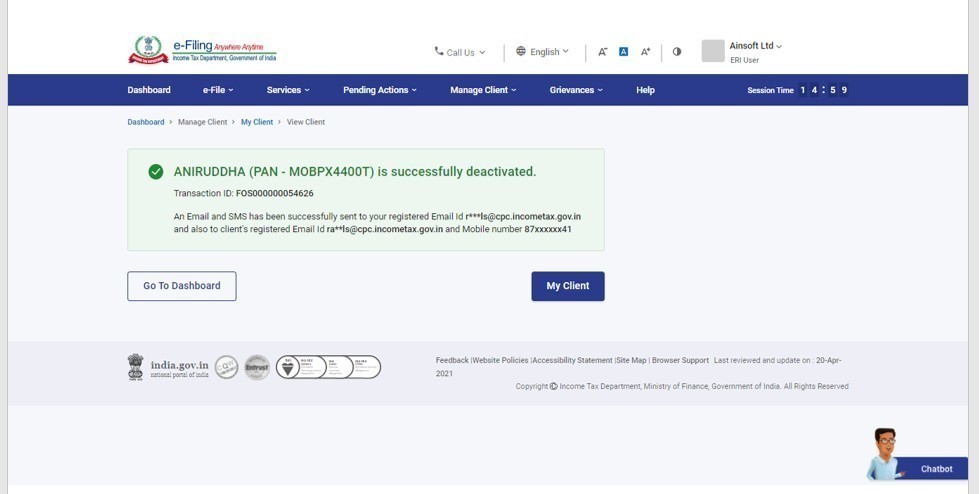

On deactivation, a success message is displayed along with a Transaction ID. Please keep a note of the Transaction ID for future reference.

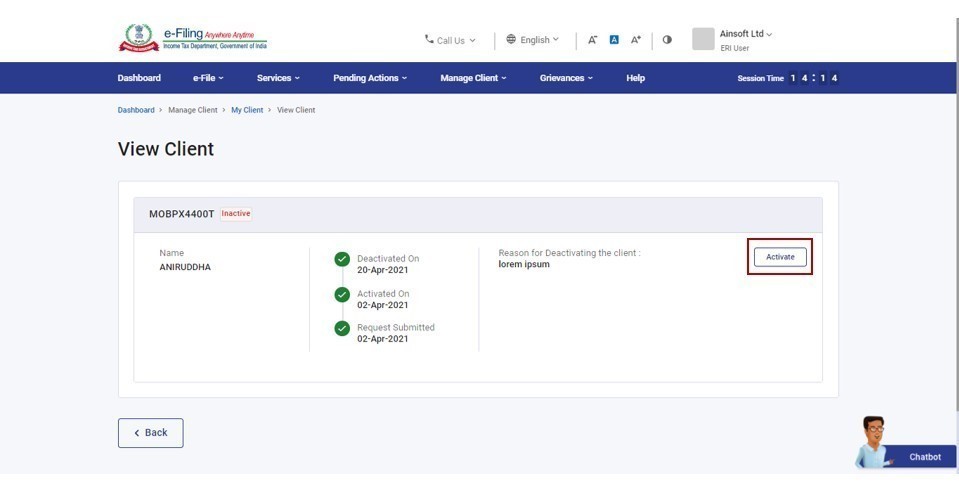

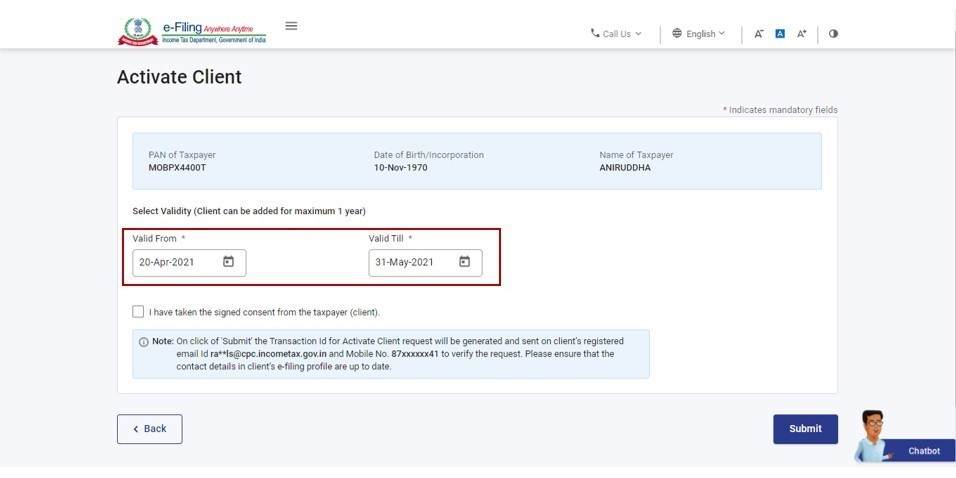

5.3 Activate the Deactivated Added Client

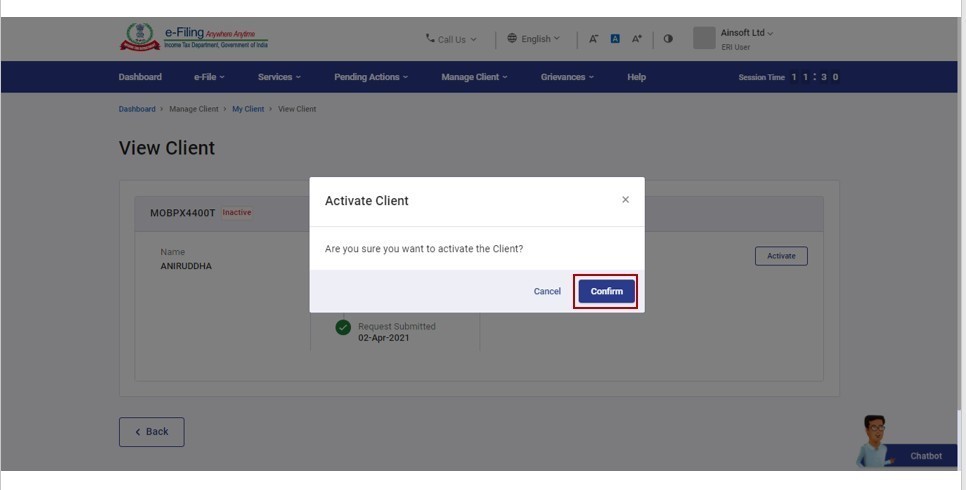

Step 1: Click Activate against the name of the client you want to activate.

Step 2: Click Confirm.

Step 3: Select the validity period for which you want to activate the client.

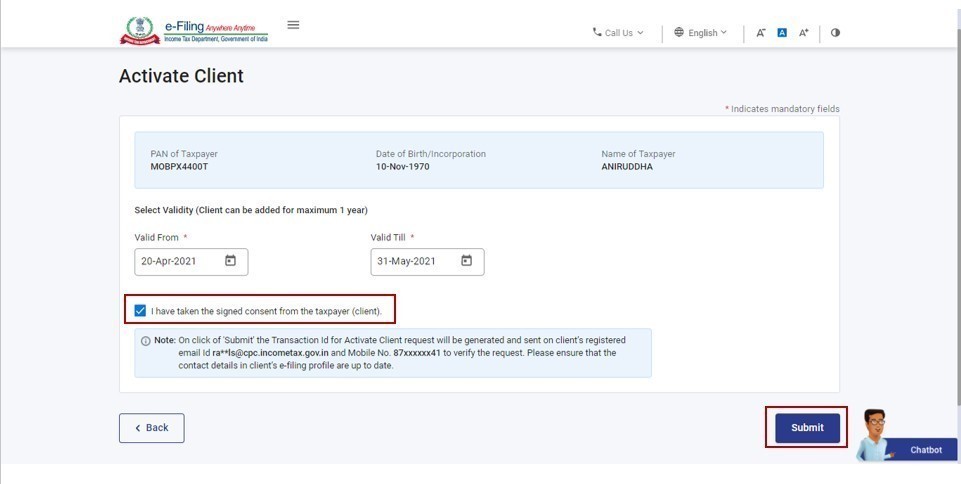

Step 3: Select the checkbox to confirm consent of the taxpayer and click Submit.

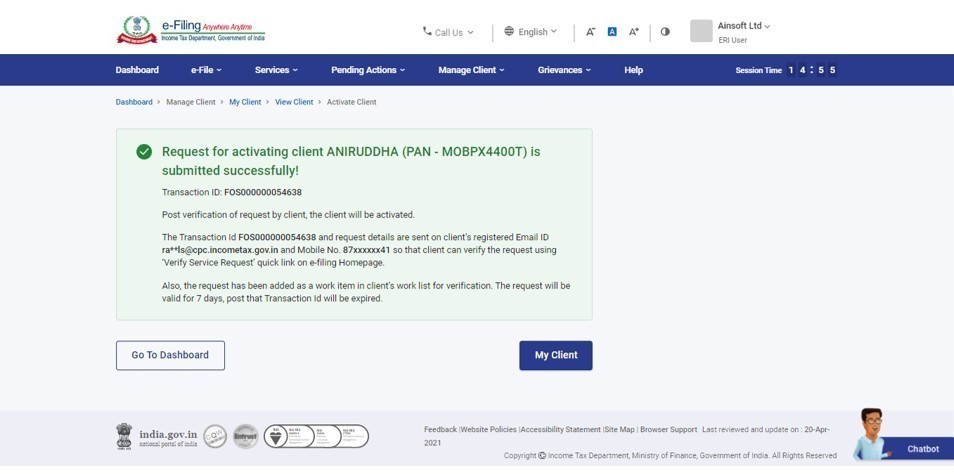

On successful activation, a success message is displayed along with a Transaction ID. Please keep a note of the Transaction ID for future reference.

Note:

- The Transaction ID is also sent to the client's registered email ID and mobile number, where the client can verify the request using Verify Service Request on the e-Filing homepage.

- The Transaction Id will be valid for 7 days, after which it will get expired.

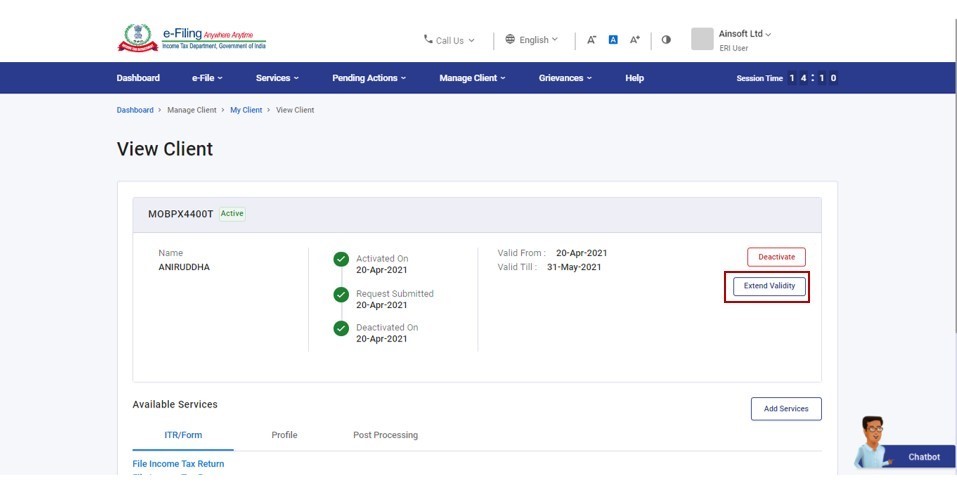

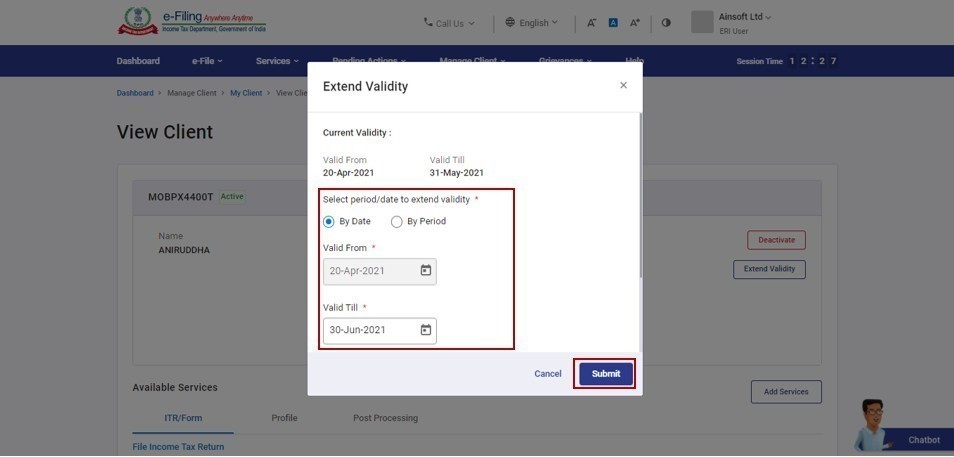

5.4 Extend Validity

Step 1: Click Extend Validity against the name of the client.

Step 2: Select the time period to extend validity and click Submit.

Note: The validity of a client can be extended to a maximum of one year. And minimum for 1 month.

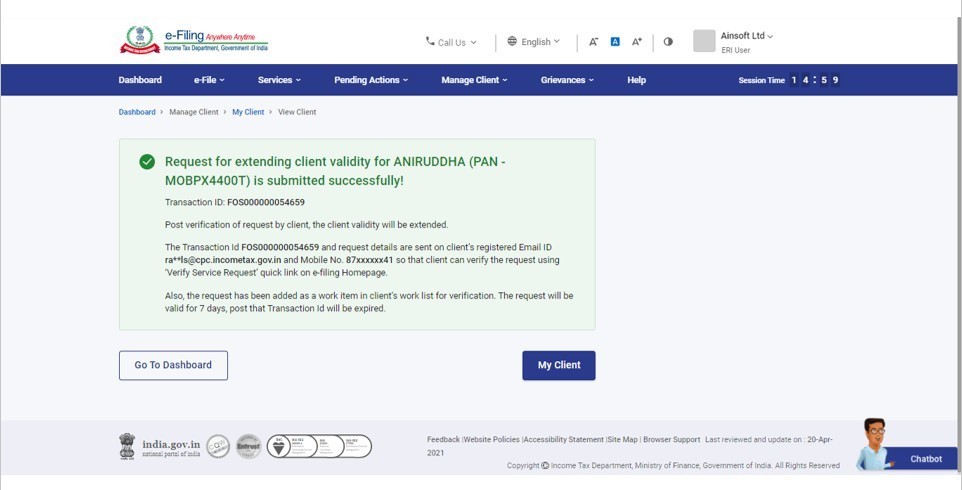

On successful extension of the validity, a success message is displayed along with a Transaction ID. Please keep a note of the Transaction ID for future reference.

Note:

- The Transaction ID is also sent to the client's registered email ID and mobile number, where the client can verify the request using the Verify Service Request quicklink in the homepage.

- The request will be valid for 7 days after which the transaction ID will be expired.

5.5 Complete list of services (default & additional) with Use Case ID for reference

All the Type 1 ERI Services are tabulated as below. For each of the service, the user manual corresponding to the respective use case ID can be referred to by clicking on the link provided. In case of differences in steps or points to be noted in specific to Type 1 ERI services, the same has been mentioned in the last column of the table.

|

Sl. |

Services |

Consent Based (one-time) |

Points to note |

|

|

ITR / Form |

||||

|

1 |

File Income Tax Form |

No |

|

|

|

2 |

View filed Forms |

No |

|

|

|

Post-Processing |

|

|||

|

3 |

Outstanding Tax Demand |

No |

ERI can view outstanding tax demands if any, |

|

|

4 |

View Tax Credit Mismatch |

No |

ERI can view tax-credit mismatch |

|

|

5 |

Rectification |

Yes |

|

|

|

6 |

Service Request- Condonation Request for delay in submission of ITR-V |

Yes |

|

|

|

7 |

Refund Reissue |

Yes |

|

|

|

Grievances |

|

|||

|

31 |

Submit Grievance |

Yes |

ERI can Submit Grievance on behalf of the added client |

|

|

32 |

View Grievance Status |

Yes |

ERI can view the status/update on submitted grievance for its added client |

|

4. Related Topics

- Login

- Dashboard

- Add Client

- My ERI

- Profile

- Bulk ITR Upload/View

View Client and Type 1 ERI Services > FAQs

- What are Type 1 ERI? What are the Type 1 ERI Services available?

ERIs who file Income Tax Returns / Forms using the Income Tax Department utilities / Income Tax Department approved utilities fall under Type 1.The following are the Type 1 ERI services. For all the services, the ERI can view / edit / review his or her client information.

- Bulk Income Tax Return Upload

- File Income Tax Form

- View Bulk Filed Return

- View Filed Form

- View Tax Credit Mismatch

- Rectification

- Service Request - Condonation Request for delay in submission of ITR-V

- Refund Reissue

- Submit Grievance

- View Grievance Status

2. Can an ERI e-Verify an IT Return for the taxpayer who is his client?

After successfully filing and uploading the IT return for his/ her client, the ERI has to e-Verify the same. However, the process doesn't get completed here. The Acknowledgement Number is sent to the taxpayer / client on his / her registered email ID and the taxpayer has to e-Verify his / her return with the Acknowledgement Number.

4. Are all Type 1 ERI services based on consent from the taxpayer / client? If no, what are the services that do not require consent?

Not all Type 1 ERI Services require a one-time consent from the taxpayer / client. Such services are listed below. The below services can be performed by an ERI after the ERI is added by the client.

- File Income Tax Form

- View Filed Form

- File Income Tax Return(Bulk)

- View Income Tax Return (Bulk)

- View Tax Credit Mismatch

5. For how long is the Transaction ID valid?

After generation of the Transaction ID, it is valid for 7 days. You will also receive a mail after the Transaction ID is generated successfully.

6. What if the client does not verify the activation request raised by the ERI?

Once activation request is successful, a Transaction ID is generated which is valid for 7 days. If the client does not verify the activation request by then, the request has to be raised again.

Glossary

|

Acronym/Abbreviation |

Description/Full Form |

|

DOB |

Date of Birth |

|

ITD |

Income Tax Department |

|

NRI |

non-resident Indians |

|

NSDL |

National Securities Depository Limited |

|

OTP |

One Time Password |

|

PAN |

Permanent Account Number |

|

SMS |

Short message service |

|

UIDAI |

Unique Identification Authority of India |

|

UTIISL |

UTI Infrastructure Technology & Services Limited |

|

AY |

Assessment Year |

|

ERI |

e Return Intermediary |

|

DTT |

Data Transmission Test |

|

API |

Application programming interface |

Assessment Questions

Q1. What among the following are function(s) that can be performed by an ERI?

- Add bank account to client using net banking facility

- Extend the validity of client

- View ITBA Notices of client

- Link Aadhaar for client

Ans: 1. Extend the validity of client

Q2. An ERI can extend the validity of client up to 6 months only.

- True

- False

Ans: 2. False