1. Overview

The Income and Tax Estimator service enables registered e-Filing users to estimate their tax as per the provisions of Income Tax Act, Income Tax Rules, and Notifications by providing inputs with respect to income(s) earned and deductions claimed as per the Act. This service also provides an estimation of tax under the old or new tax regime with a comparison of tax as per the old and new regime.

2. Prerequisites to Avail This Service

- Registered user on the e-Filing portal with valid user ID and password

3. Step-by-Step Guide

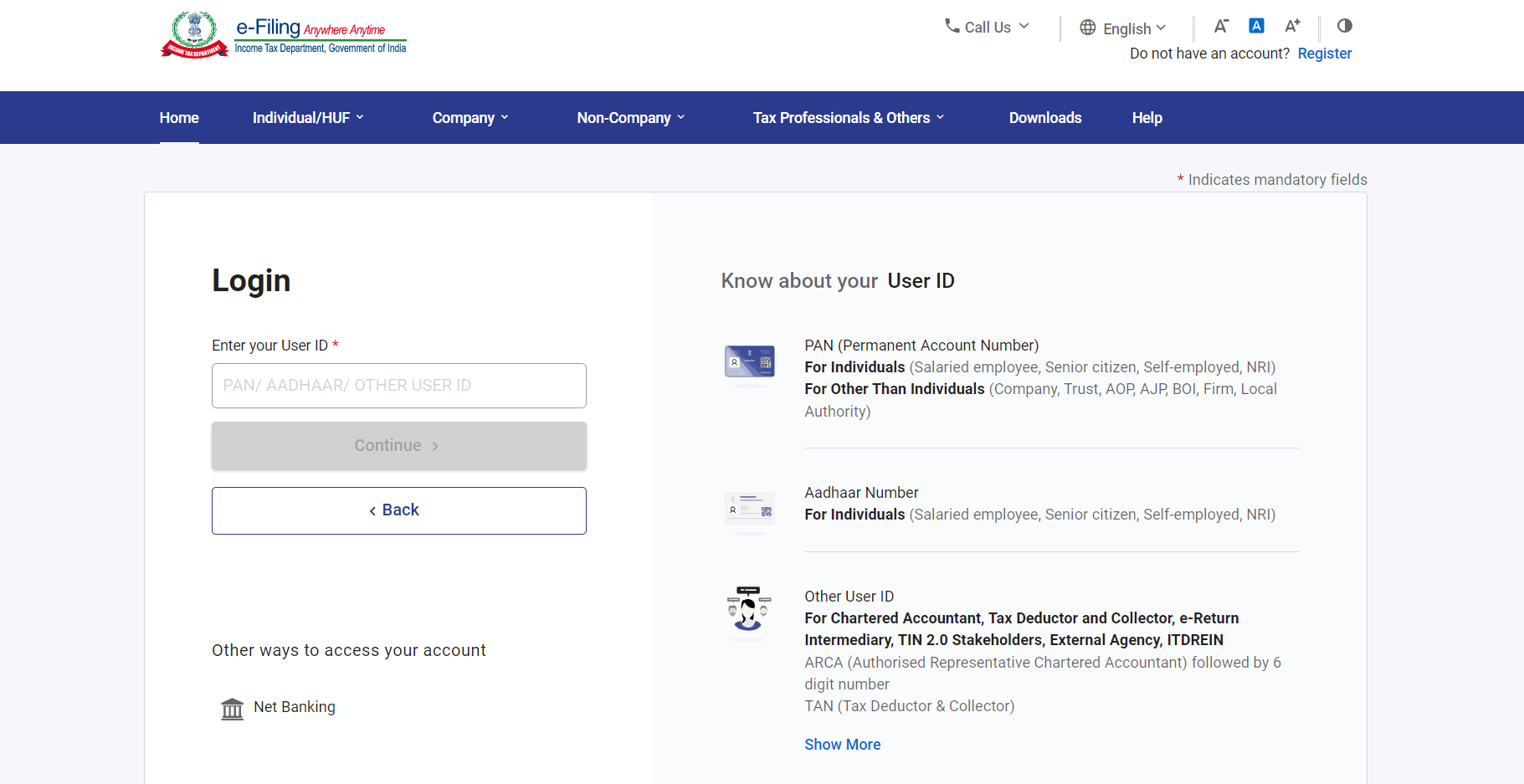

Step 1: Log in to the e-Filing portal using your user ID and password.

Step 2: From your Dashboard, click Income and Tax Estimator.

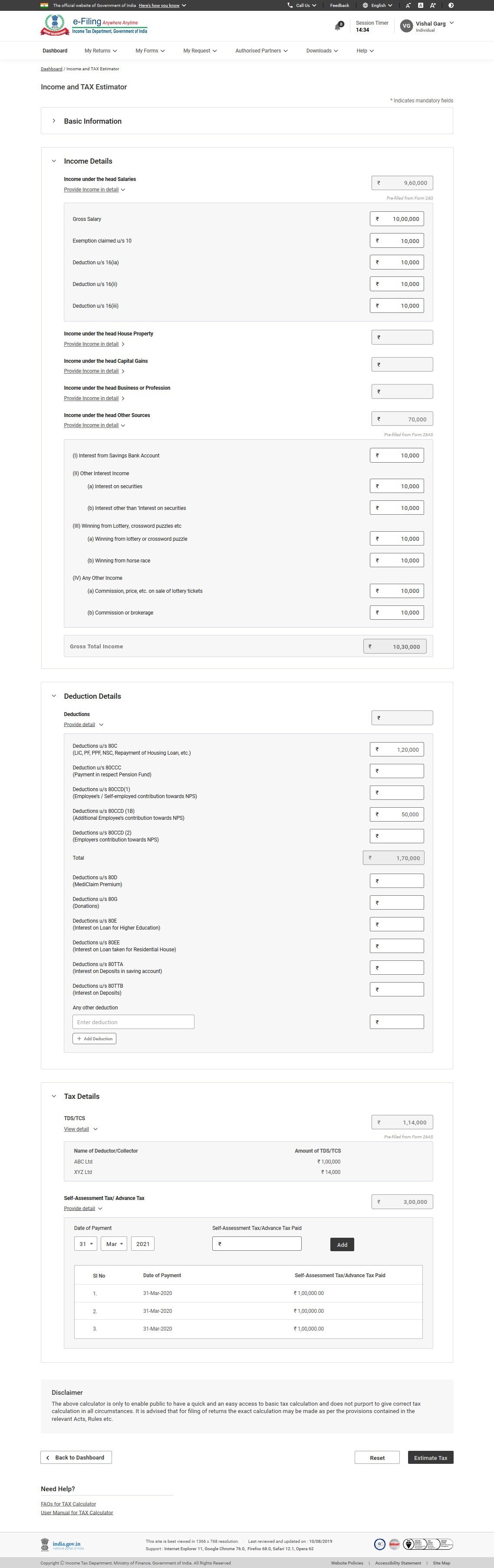

Step 3a: In the Basic Information tab, enter the required details such as AY, residential status, age, and due date for submission of return. Edit the pre-filled data if necessary.

Step 3b: In the Income Details tab, enter the required details of :

- Income under the head Salaries,

- Income under the head House Property,

- Income under the head Capital Gains,

- Income under the head Business or Profession, and

- Income under the head Other Sources

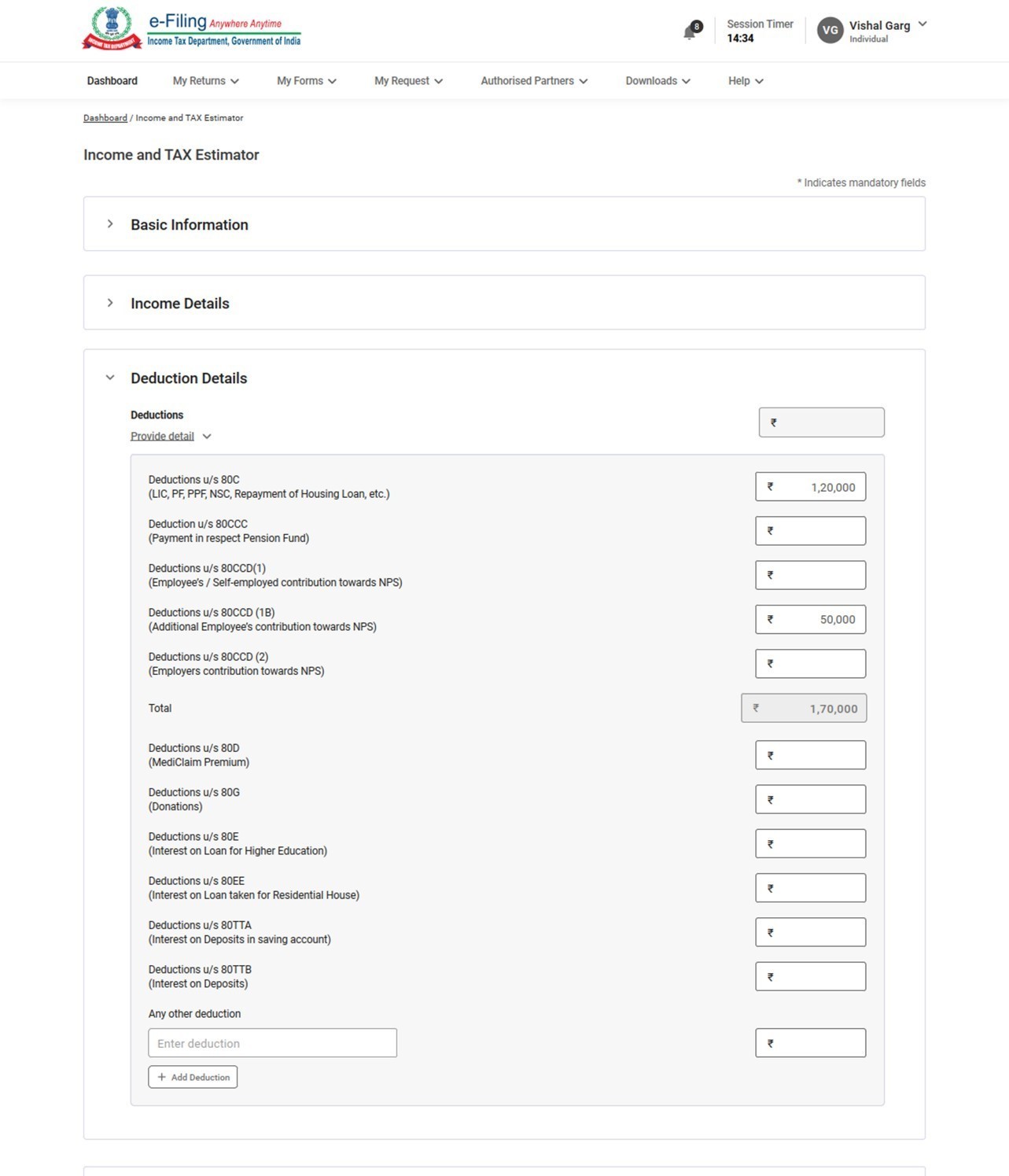

Step 3c: In the Deduction Details tab, enter the relevant deductions applicable to you including but not limited to PPF, LIC, Housing Loan, NPS, Mediclaim, Loan on Higher Education.

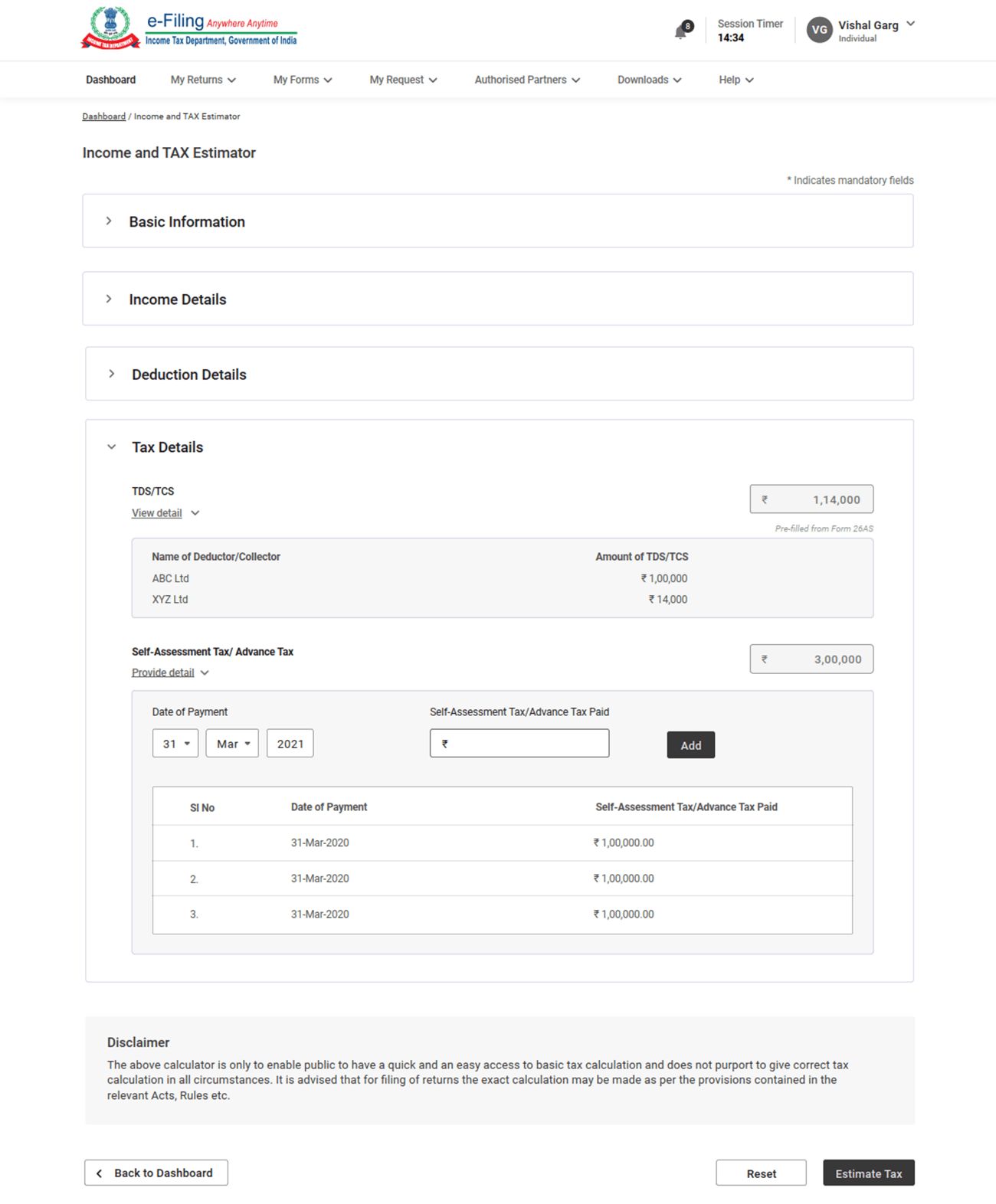

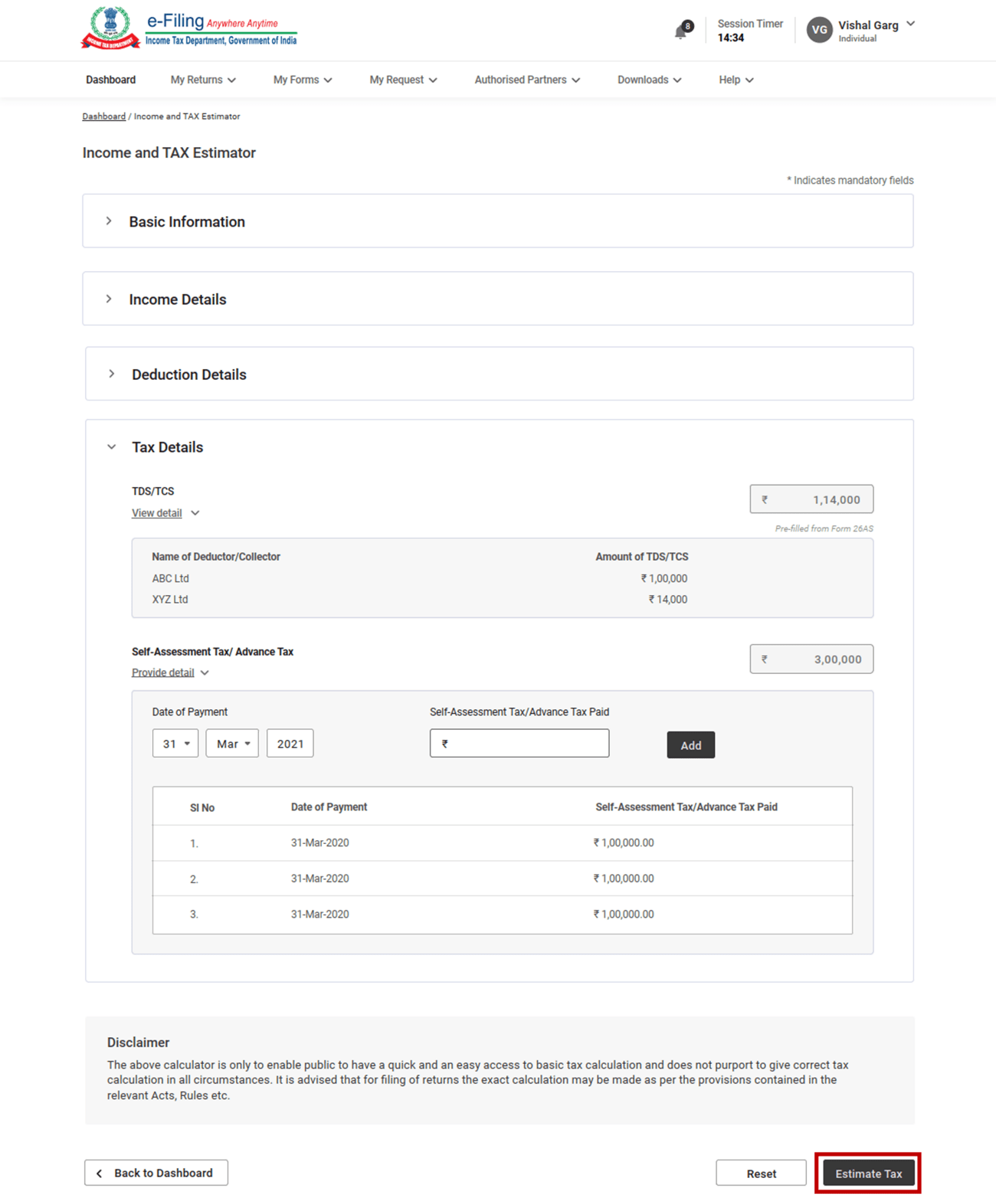

Step 3d: In the Tax Details tab, view TDS/TCS details and enter/edit the details of Self Assessment Tax/ Advance Tax where you have substantiating evidence available.

Step 4: Once done, click Estimate Tax.

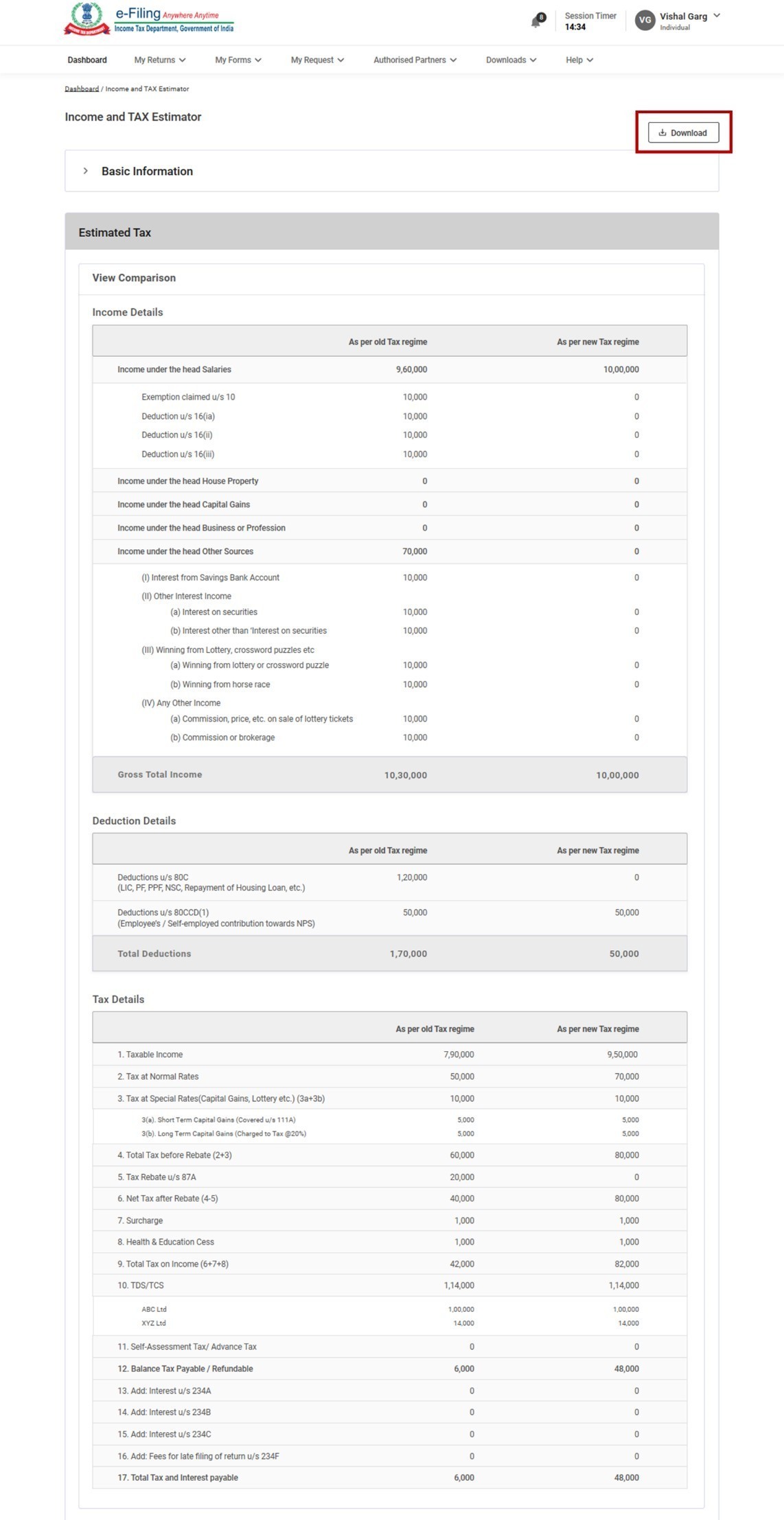

Step 5: The estimated tax payable by you will be computed and displayed. Click Download to save the estimated tax computation as a PDF on your computer.