1. Overview

The Tax Payment through Debit Card of Authorised Banks option is available to all taxpayers on the e-Filing portal https://www.incometax.gov.in/iec/foportal/ . With this service, you can make tax payment online (in Pre-login or Post-login mode) by using the Debit Card of an Authorized Bank available for making online tax payment on e-Filing Portal.

2. Prerequisites for availing this service

You can make Tax Payment using “Debit Card of Authorised Banks” in Pre-login (before logging in the e-Filing portal) or Post-login (after logging in the e-Filing portal) mode.

|

Option |

Prerequisites |

|

Pre-Login |

|

|

Post-login |

|

Important Note: Taxpayers having debit card issued by an Authorised Bank [DJ1] [DMG2] (offering tax payment through debit card on e-filing portal) can use this mode for tax payment. No transaction charge/fee is applicable for making tax payment through this mode. As of now, debit cards of Canara Bank, ICICI Bank, Indian Bank, State Bank of India and Punjab National Bank are being offered for tax payment on e-Filing Portal (e-Pay Tax service) through Debit Card mode. For other banks, please select payment gateway mode.

3. Step-by-Step Guide

3.1. Pay after generating a New Challan Form (CRN) – Post-Login Service

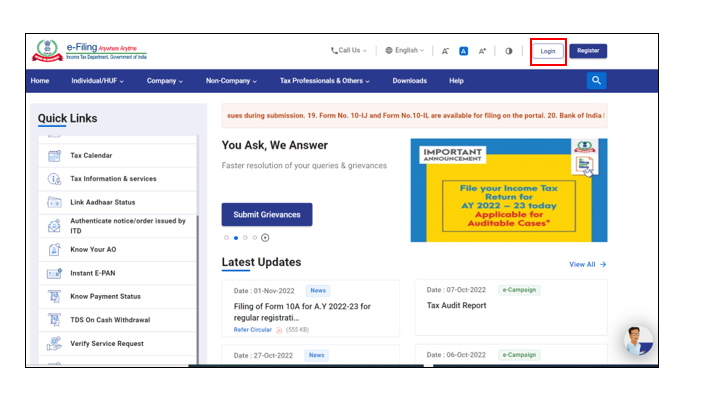

Step 1: Log in to the e-Filing portal with your User ID and Password.

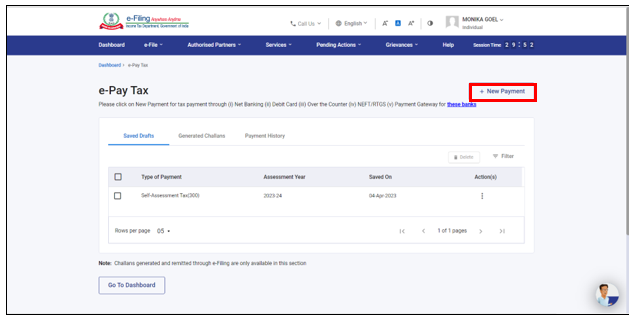

Step 2: On the Dashboard, click e-File > e-Pay Tax. You will be navigated to the e-Pay Tax. On the e-Pay Tax page, click the New Payment option to initiate the online tax payment.

Step 3: On the New Payment page, click Proceed on a tax payment tile applicable to you.

Step 4: After selecting the applicable Tax Payment tile, select Assessment Year, Minor head, other details (as applicable) and click Continue.

Step 5: On the Add Tax Breakup Details page, add the breakup of total amount of tax payment and click Continue.

Step 6: In the Select Payment Mode page, select the Debit Card mode and select the bank name from the options and click Continue.

Note: Please note that taxpayers having debit card issued by an Authorised Bank (offering tax payment through debit card on e-filing portal) can use this mode for tax payment. No transaction charge/fee is applicable for making tax payment through this mode. As of now, debit cards of Canara Bank, ICICI Bank, Indian Bank, State Bank of India and Punjab National Bank are being offered for tax payment on e-Filing Portal (e-Pay Tax service) through Debit Card mode. For other banks, please select payment gateway mode.

Step 7: In the Preview and Make Payment page, verify the details and tax break up details and click Pay Now.