1. Overview

The Tax Payment using “RTGS/NEFT” is available to all taxpayers on the e-Filing portal www.incometax.gov.in (in pre-login or post-login mode). With this service, you can make tax payment through RTGS/NEFT.

2. Prerequisites for availing this service

You can make Tax Payment using “RTGS/NEFT” in Pre-login (before logging in the e-Filing portal) or post-login (after logging in the e-Filing portal) mode.

|

Option |

Prerequisites |

|

Pre-Login |

|

|

Post-login |

|

Important Note:

- The taxpayer can also make payment using RTGS/NEFT mode through any bank.

- This facility needs to be availed only after generating a CRN using e-Pay Tax service on e-Filing portal.

- The taxpayer needs to visit the bank with the Mandate Form generated through this CRN, also the taxpayer can use the online facility provided by their bank to do this RTGS/NEFT transaction with details available in Mandate Form.

3. Step-by-Step Guide

3.1. Pay after generating a New Challan Form (CRN) – Post-Login Service

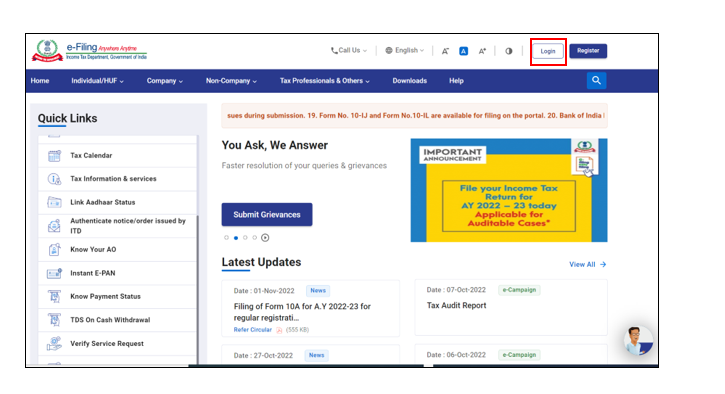

Step 1: Log in to the e-Filing portal with your User ID and Password.

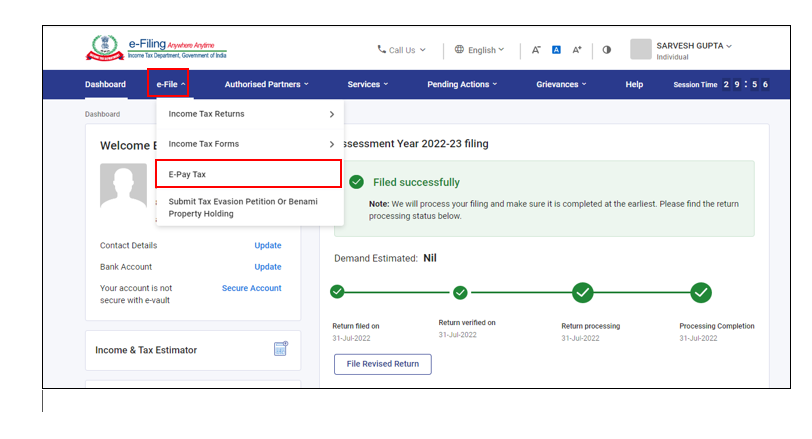

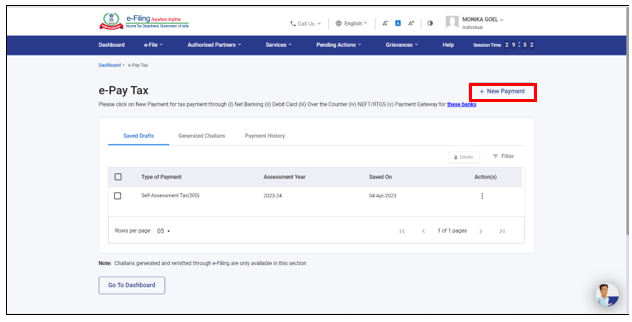

Step 2: On the Dashboard, click e-File > e-Pay Tax. You will be navigated to the e-Pay Tax. On the e-Pay Tax page, click the New Payment option to initiate the online tax payment.

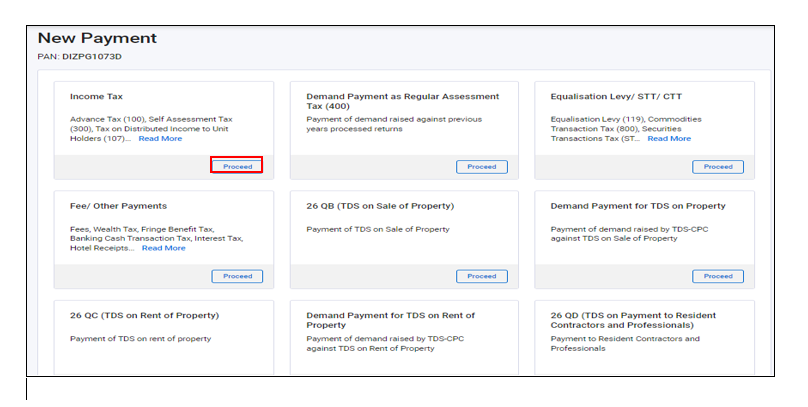

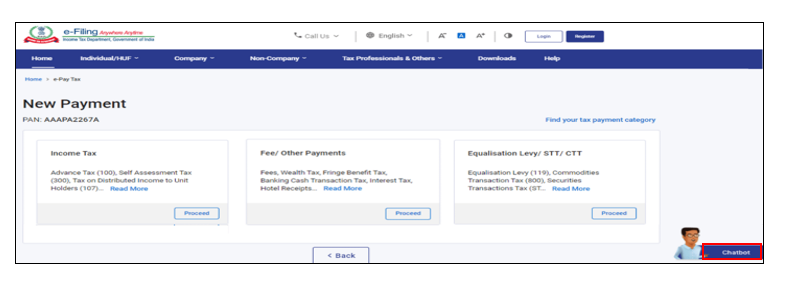

Step 3: On the New Payment page, click Proceed on a tax payment tile applicable to you.

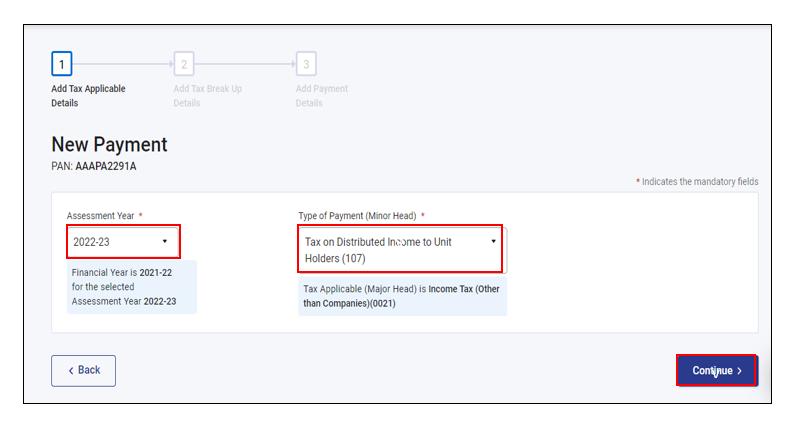

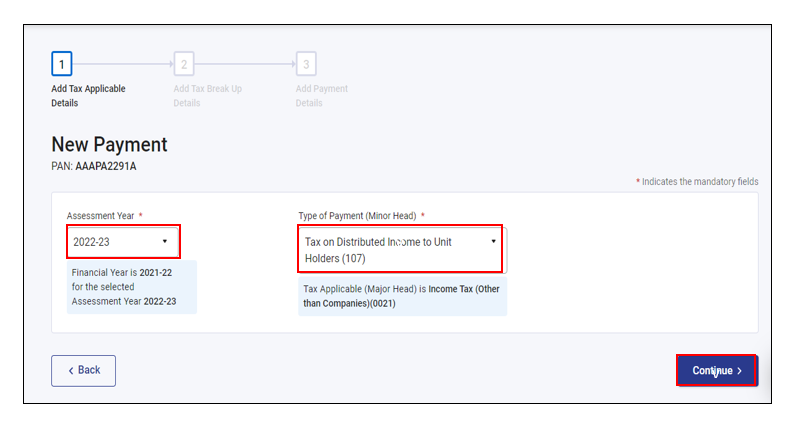

Step 4: After selecting the applicable Tax Payment tile, select Assessment Year, Minor head, other details (as applicable) and click Continue.

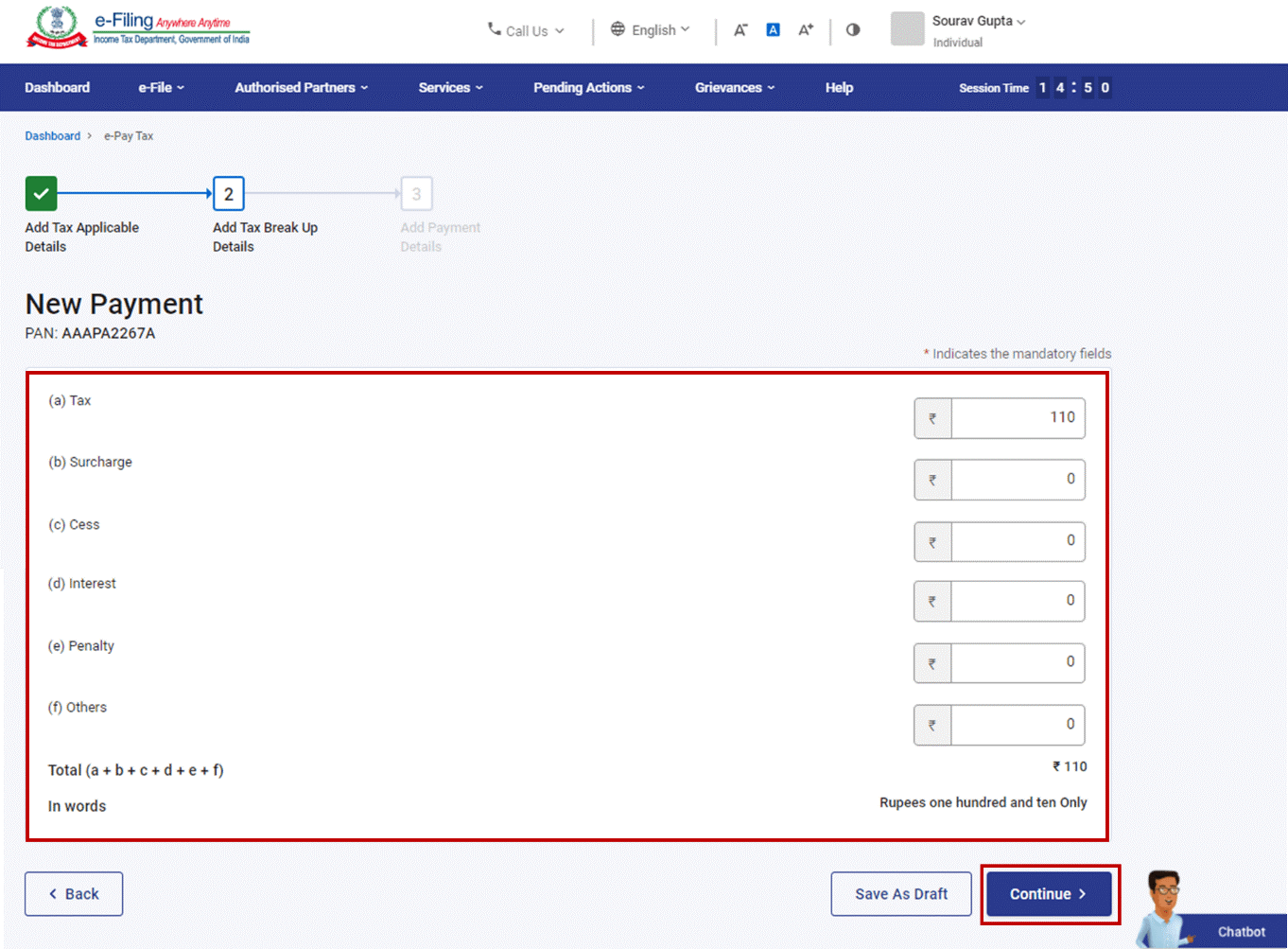

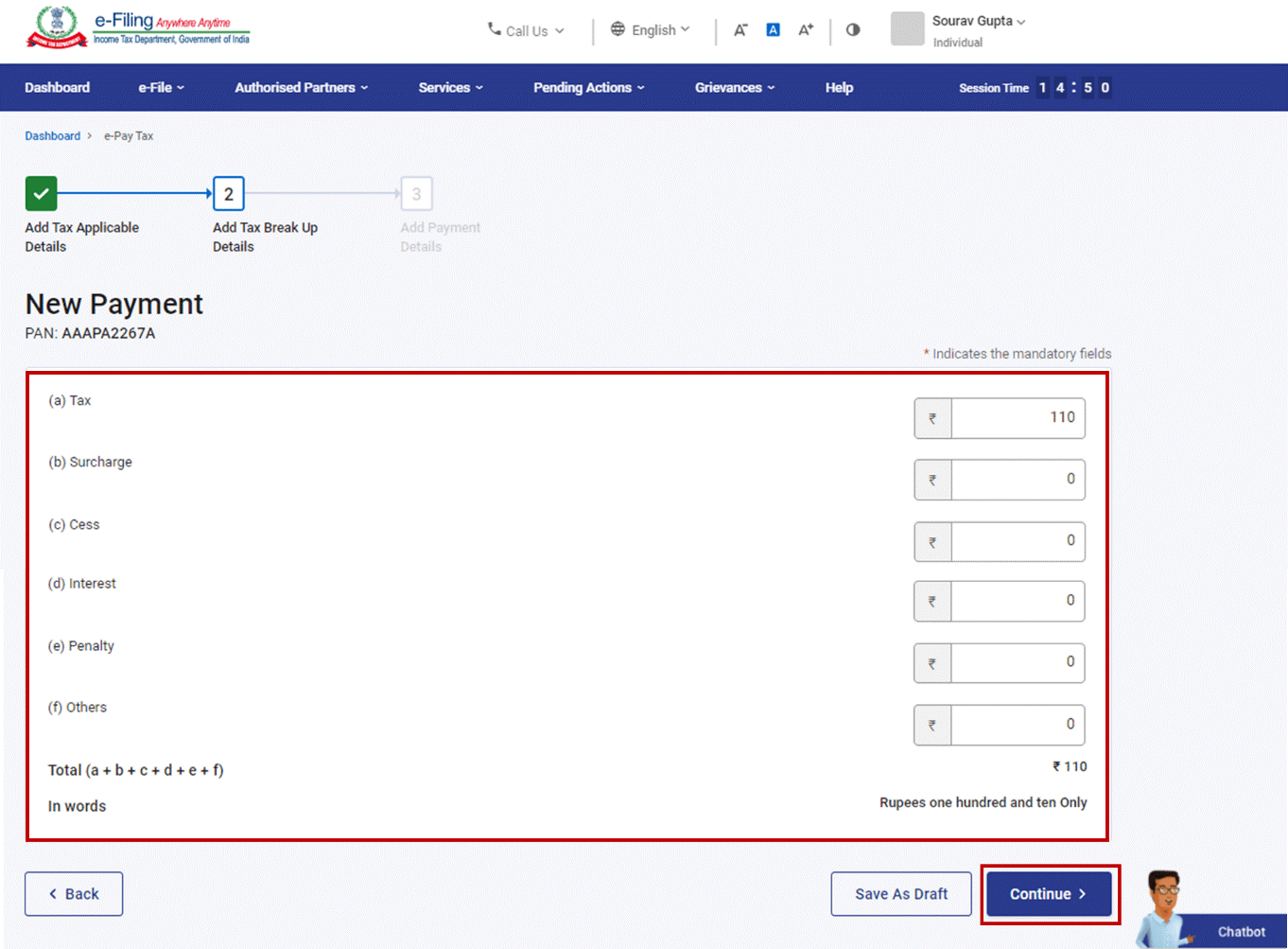

Step 5: On the Add Tax Breakup Details page, add the breakup of total amount of tax payment and click Continue.

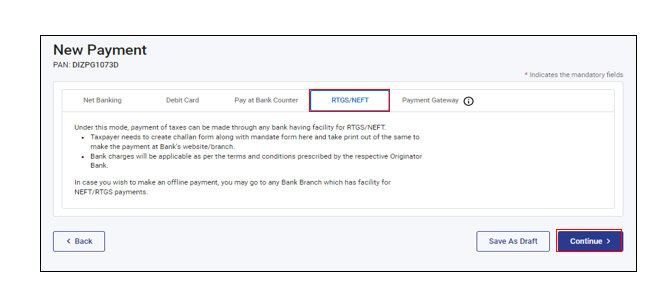

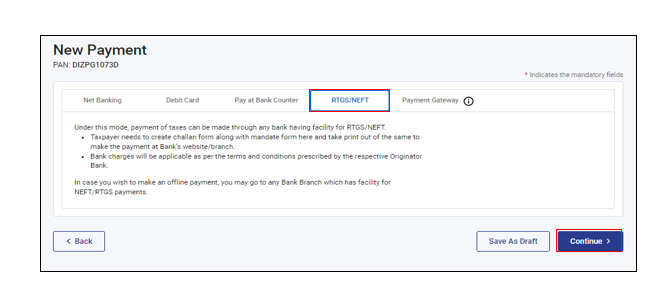

Step 6: In the Select Payment Mode page, select RTGS/NEFT mode and click Continue.

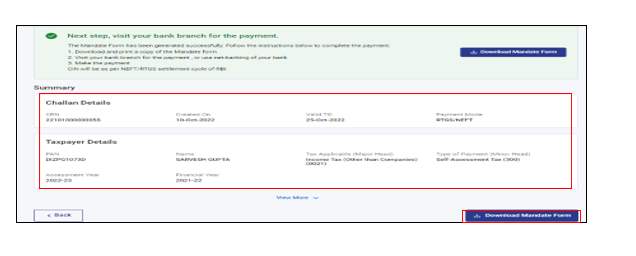

Step 7: In the Preview and Download Mandate Form page, verify the details and tax break up details and click Continue.

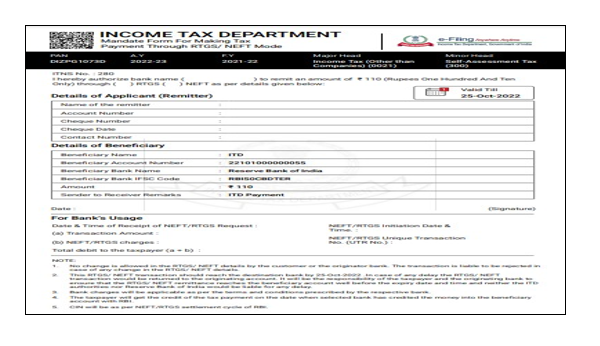

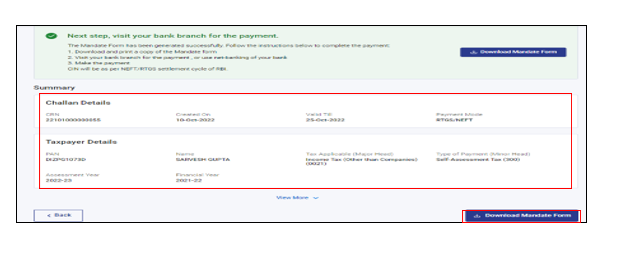

Step 8: The Mandate Form will be generated successfully. Print the Mandate Form (CRN) and visit any bank branch providing RTGS/NEFT facility for making the payment. You can also remit the tax amount by using Net banking facility of the bank available [For this beneficiary needs to be added in your bank account with beneficiary details available in Mandate Form and tax amount needs to be transferred to the added account].

Note: After successful payment, you will receive a confirmation e-Mail and an SMS on the e-Mail ID and Mobile number registered with the e-Filing portal. Once the payment is successful, details of payment and Challan Receipt are available under Payment History Tab on the e-Pay Tax page.

3.2. Pay without logging in to the e-Filing portal – Pre-Login Service

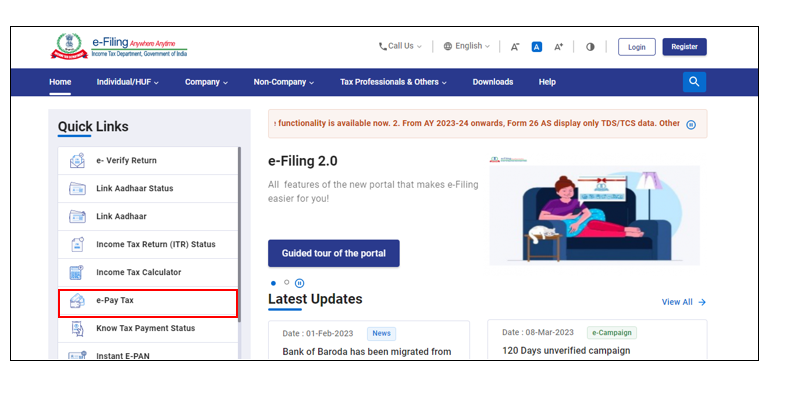

Step 1: Go to the e-Filing portal www.incometax.gov.in and click e-Pay Tax.

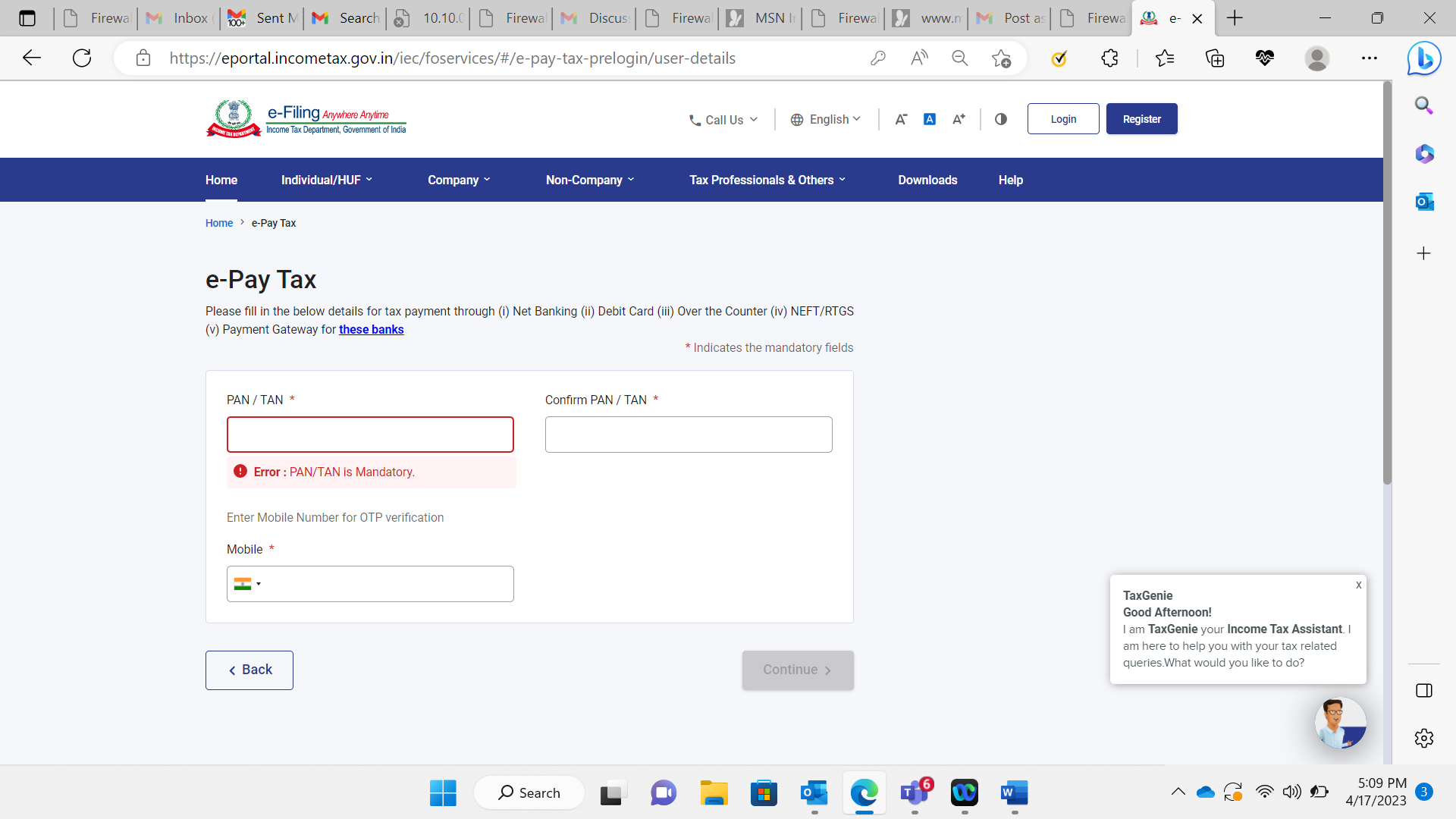

Step 2: On the e-Pay Tax page, fill the required details and click Continue.

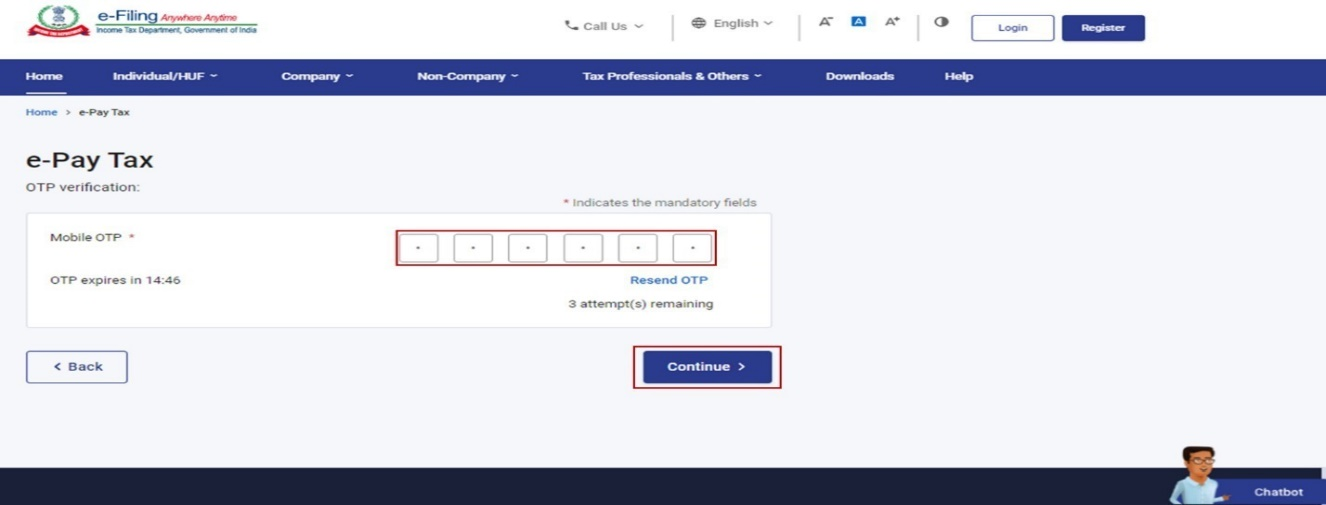

Step 3: On the OTP Verification page, enter the 6-digit OTP received on the mobile number entered in Step 2 and click Continue.

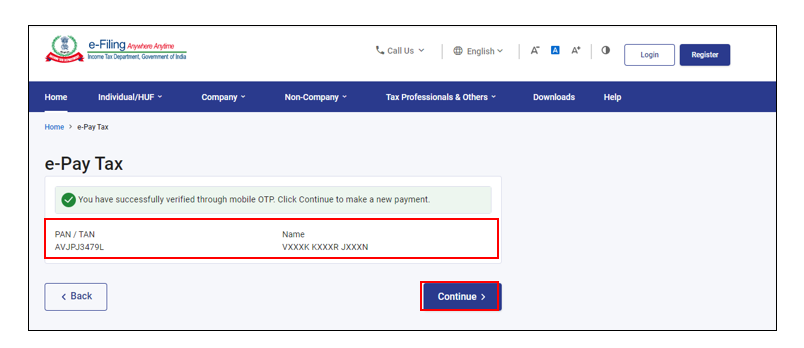

Step 4: After OTP verification, a success message with your PAN/TAN and masked name will be displayed. Click Continue to proceed.

Step 5: On the e-Pay Tax page, click Proceed on a tax payment category that applies to you.

Step 6: After selecting the applicable Tax Payment tile, select Assessment Year, Minor head, other details (as applicable) and click Continue.

Step 7: On the Add Tax Breakup Details page, add the breakup of total amount of tax payment and click Continue.

Step 8: In the Select Payment Mode page, select RTGS/NEFT mode and click Continue.

Step 9: In the Preview and Download Challan Form page, verify the details and tax break up details and click Continue.

Step 10: The Mandate Form will be generated successfully. Print the Mandate Form (CRN) and visit any bank branch providing RTGS/NEFT facility for making the payment. You can also remit the tax amount by using Net banking facility of the bank available [For this beneficiary needs to be added in your bank account with beneficiary details available in Mandate Form and tax amount needs to be transferred to the added account].