Tax Payment using Net Banking of Authorised Banks > User Manual

1. Overview

The Tax Payment using “Net Banking of Authorised Banks” is available to all taxpayers having bank account in an Authorized Bank with Net Banking facility on the e-Filing portal Home | Income Tax Department (in pre-login or post-login mode). With this option of payment, you can make tax payment online (in pre-login or post-login mode) by using the Net Banking Service of the Authorised Banks.

2. Prerequisites for availing this service

You can make Tax Payment using “Net Banking of Authorised Banks” in Pre-login (before logging in the e-Filing portal) or Post-login (after logging in the e-Filing portal) mode.

|

Option |

Prerequisites |

|

Pre-Login |

|

|

Post-login |

|

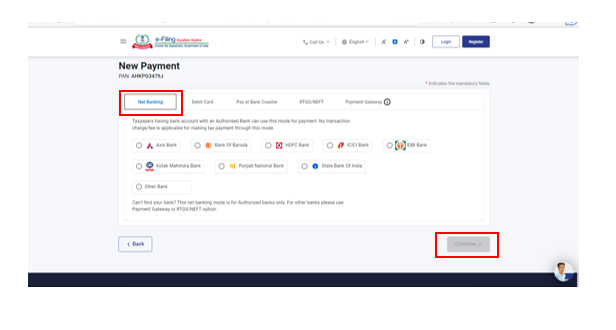

Important Note: As of now, the tax payment on e-Filing Portal (e-Pay Tax service) through Net Banking mode is available through authorized Banks namely: Axis Bank, Bank of Baroda, Canara Bank, City Union Bank, Central Bank of India, DCB Bank, Federal Bank, HDFC Bank, IDBI Bank, IndusInd Bank, Bank of India, ICICI Bank, Indian Bank, Indian Overseas Bank, J&K Bank, Kotak Mahindra Bank, Karur Vysya Bank, Bank of Maharashtra, Punjab National Bank, Punjab & Sindh Bank , RBL Bank Ltd, State Bank of India, South Indian Bank, UCO Bank and Union Bank of India. For other banks, please use the Payment Gateway or RTGS/NEFT option.

Please Note: The above bank list is dynamic in nature, Banks can be added or removed in future dates. This information is as on 25th July,2023.

3. Step-by-Step Guide

3.1. Pay after generating a New Challan Form (CRN) – Post-Login Service

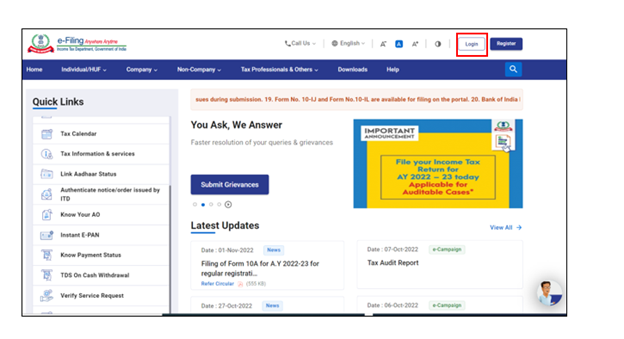

Step 1: Log in to the e-Filing portal with your User ID and Password.

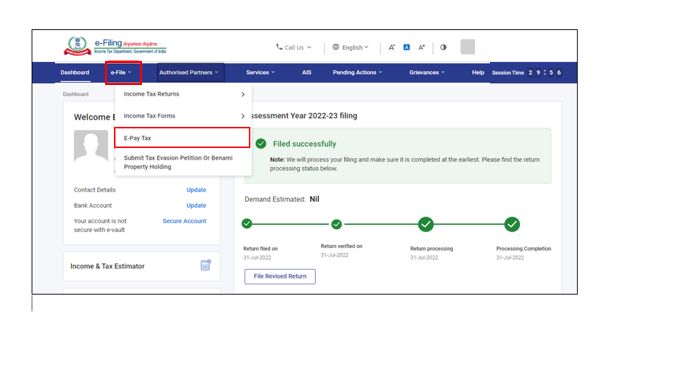

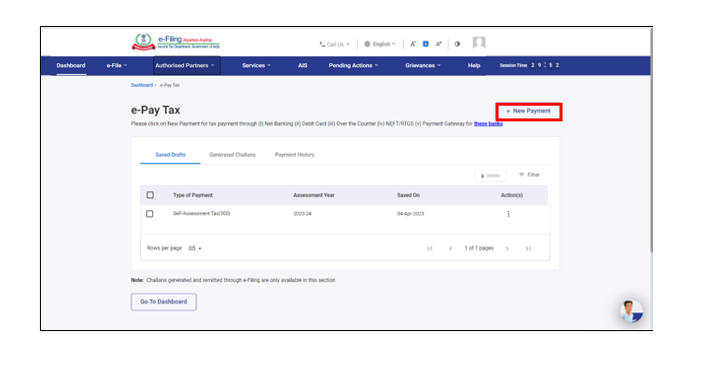

Step 2: On the Dashboard, click e-File > e-Pay Tax. You will be navigated to the e-Pay Tax. On the e-Pay Tax page, click the New Payment option to initiate the online tax payment.

Note: Making tax payment through this mode is currently available through Authorized Banks namely Axis Bank, Bank of Baroda, Canara Bank, City Union Bank, Central Bank of India, DCB Bank, Federal Bank, HDFC Bank, IDBI Bank, IndusInd Bank, Bank of India, ICICI Bank, Indian Bank, Indian Overseas Bank, J&K Bank, Kotak Mahindra Bank, Karur Vysya Bank, Bank of Maharashtra, Punjab National Bank, Punjab & Sindh Bank , RBL Bank Ltd, State Bank of India, South Indian Bank, UCO Bank and Union Bank of India.

For other banks, please use the Payment Gateway or RTGS/NEFT option.

Please Note: The above bank list is dynamic in nature, Banks can be added or removed in future dates. This information is as on 25th July,2023.

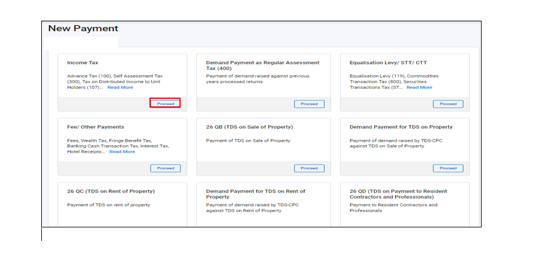

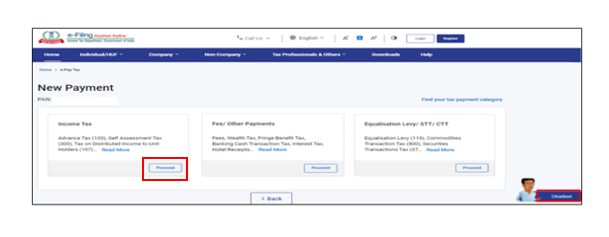

Step 3: On the New Payment page, click Proceed on a tax payment tile applicable to you.

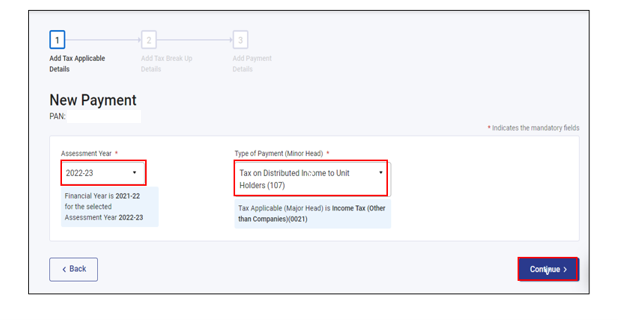

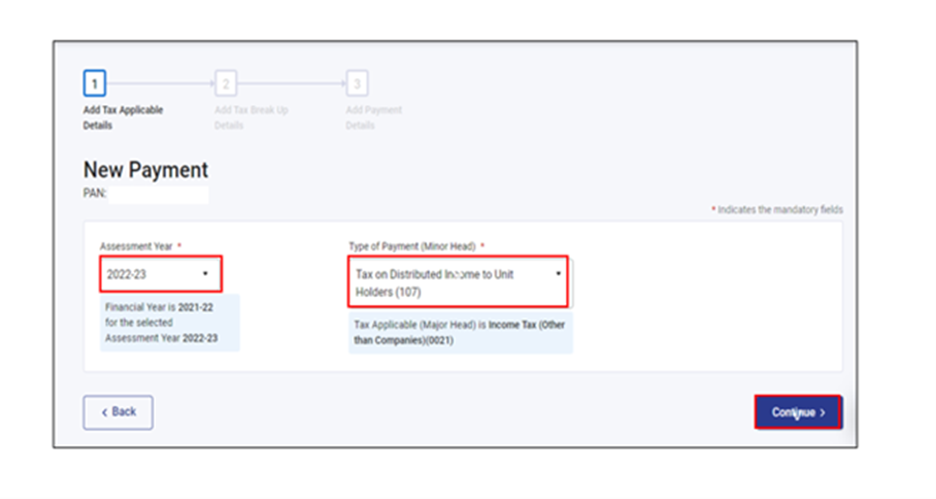

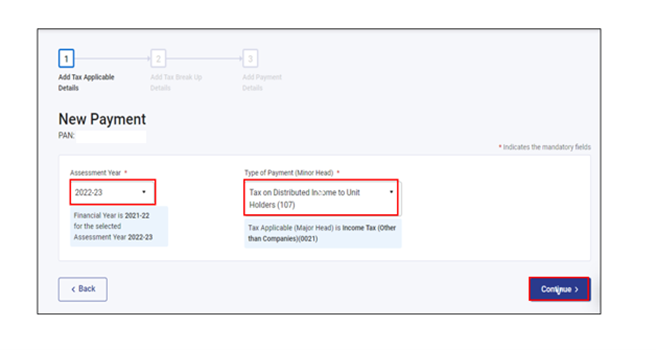

Step 4: After selecting the applicable Tax Payment tile, select Assessment Year, Minor head, other details (as applicable) and click Continue.

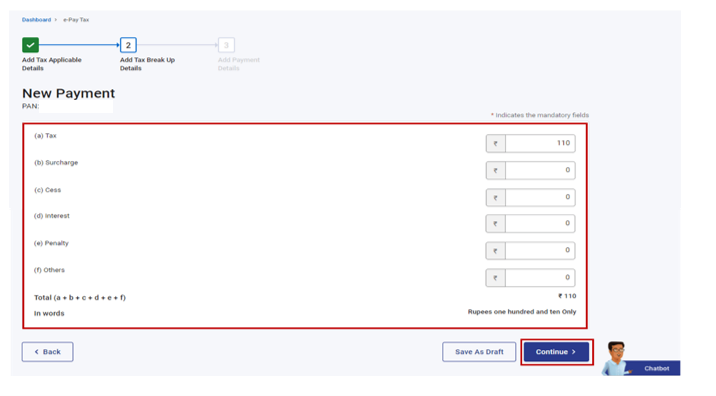

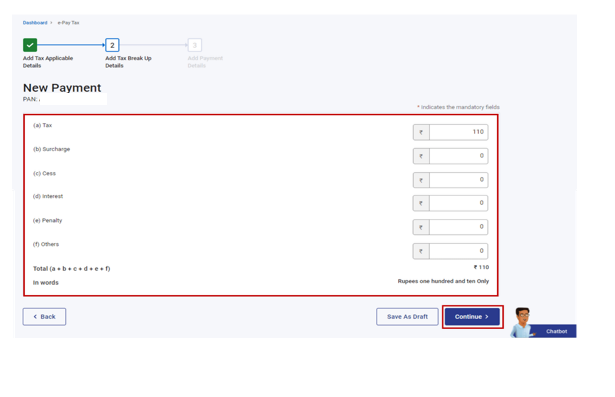

Step 5: On the Add Tax Breakup Details page, add the breakup of total amount of tax payment and click Continue.

Step 6: In the Select Payment Mode page, select the Net Banking mode and select the bank name from the options and click Continue.

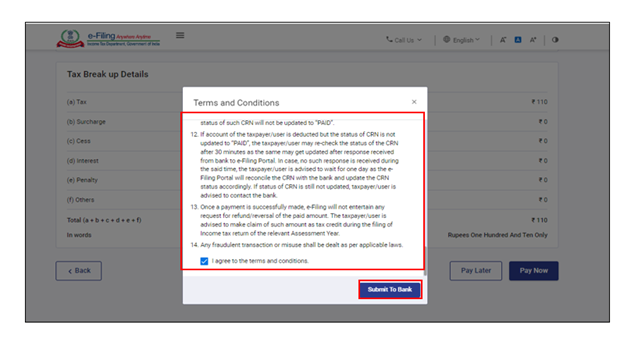

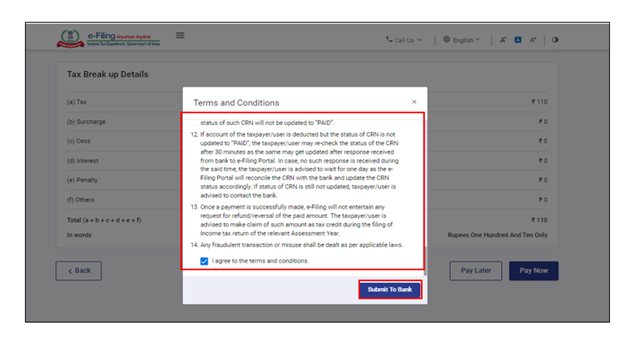

Step 7: In the Preview and Make Payment page, verify the details and tax break up details and click Pay Now.

Note: After successful payment, you will receive a confirmation e-Mail and an SMS on the e-Mail ID and Mobile number registered with the e-Filing portal. Once the payment is successful, details of payment and Challan Receipt are available under Payment History Tab on the e-Pay Tax page.

Note:

- Functionalities like “Pre-authorized account debit” & “Maker-Checker” will also be available on the bank’s page, if provided by your bank.

- Under the Pre-authorized account debit option, you will be able to schedule the payment to a future date. However, the scheduled date of payment must be on or before the “Valid Till” date of the Challan Form (CRN).

3.2. Pay without logging in to the e-Filing portal – Pre-Login Service

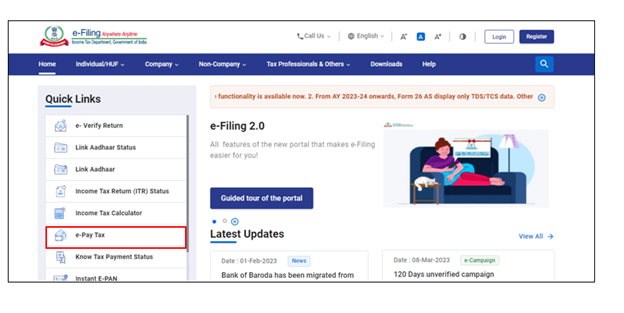

Step 1: Go to the e-Filing portal and click e-Pay Tax.

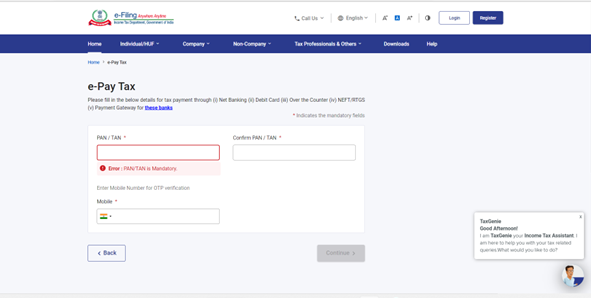

Step 2: On the e-Pay Tax page, fill the required details and click Continue.

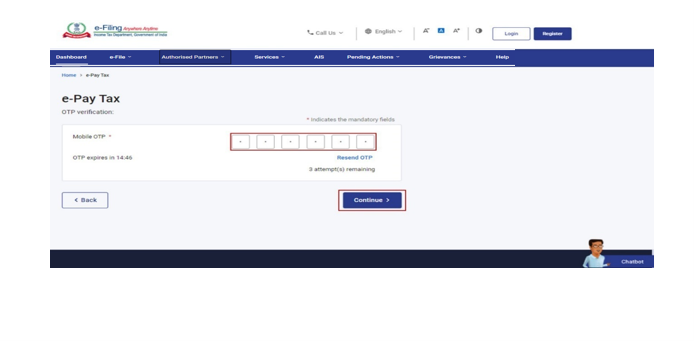

Step 3: On the OTP Verification page, enter the 6-digit OTP received on the mobile number entered in Step 2 and click Continue.

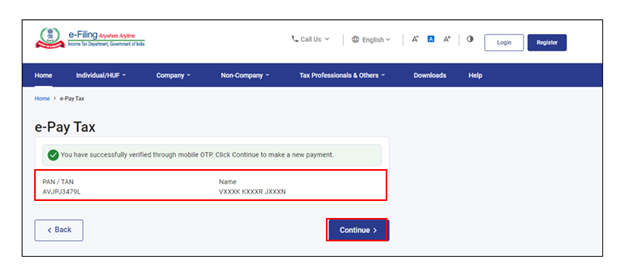

Step 4: After OTP verification, a success message with your PAN/TAN and masked name will be displayed. Click Continue to proceed.

Step 5: On the e-Pay Tax page, click Proceed on a tax payment category that applies to you.

Step 6: After selecting the applicable Tax Payment tile, select Assessment Year, Minor head, other details (as applicable) and click Continue.

Step 7: On the Add Tax Breakup Details page, add the breakup of total amount of tax payment and click Continue.

Step 8: In the Select Payment Mode page, select the Net Banking mode and select the Bank Name from the options and click Continue.

Step 9: In the Preview and Make Payment page, verify the details and tax break up details and click Pay Now

Note: After successful payment, you will receive a confirmation e-Mail and an SMS on the e-Mail ID and Mobile number registered with the e-Filing portal. Once the payment is successful, Challan Receipt may be downloaded for future references. The details of payment and Challan Receipt are also available under Payment History Tab on the e-Pay Tax page post-login.