The new and intuitive official website of Income Tax Department which deals with e-Filing of returns/forms and other related functionalities.

e-filing and Centralized Processing Center

e-Filing of Income Tax Return or Forms and other value added services & Intimation, Rectification, Refund and other Income Tax Processing Related Queries

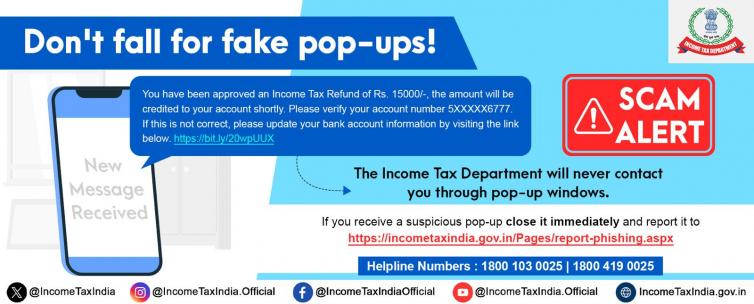

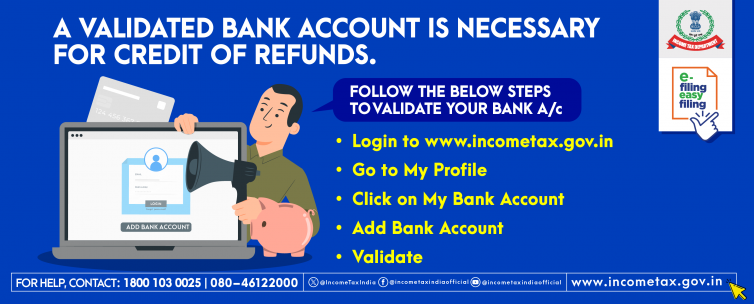

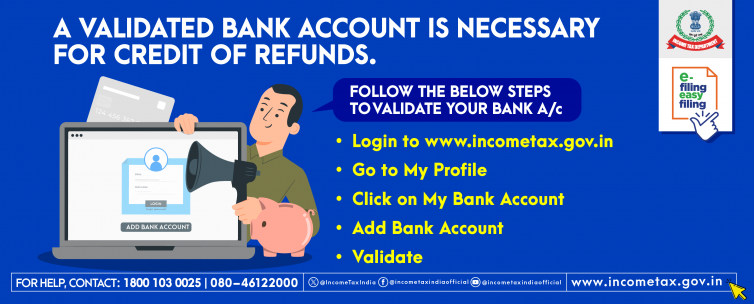

1800 103 0025 (or)

1800 419 0025

+91-80-46122000

+91-80-61464700

08:00 hrs - 20:00 hrs

(Monday to Friday)

Tax Information Network - NSDL

Queries related to PAN & TAN application for Issuance / Update through NSDL

+91-20-27218080

07:00 hrs - 23:00 hrs

(All Days)

AIS and Reporting Portal

Queries related to AIS, TIS, SFT Preliminary response, Response to e-campaigns or e-Verification

1800 103 4215

09:30 hrs - 18:00 hrs

(Monday to Friday)