1. Overview

The Tax Credit Mismatch service is available to all registered users (including ERIs) on the e-Filing portal. With this service, you can view the tax credit mismatch of your e-Filed Income Tax Returns immediately after you have uploaded the Income Tax Return for the relevant Assessment Year for any number of records.

This service highlights any mismatch in Tax Deducted at Source, Tax Collected at Source, Advance Tax or Regular assessment tax amounts reported by you while filing Income Tax Return. In case of a mismatch, you may rectify the errors at your end or get them corrected by Tax Deductors by making a correction in TDS Returns/Forms like 24Q, 26Q, 27Q, 27EQ (either by filing a Rectification Request or by filing a Revised Return).

2. Prerequisites for availing this service

- Registered user on the e-Filing portal with valid user ID and password

- Valid and active PAN

- At least one Income Tax Return is filed for the relevant Assessment Year (AY) for checking Tax Credit Mismatch of that year

- TDS and/or TCS and/or Income Tax paid is reflected in Form 26AS on the e-Filing portal

- For ERIs: ERIs should have been added and the ERI should have added the taxpayer as a Client

- For ERIs: The status of the ERI should be active

3. Step-by-Step Guide

3.1. View Tax Credit Mismatch

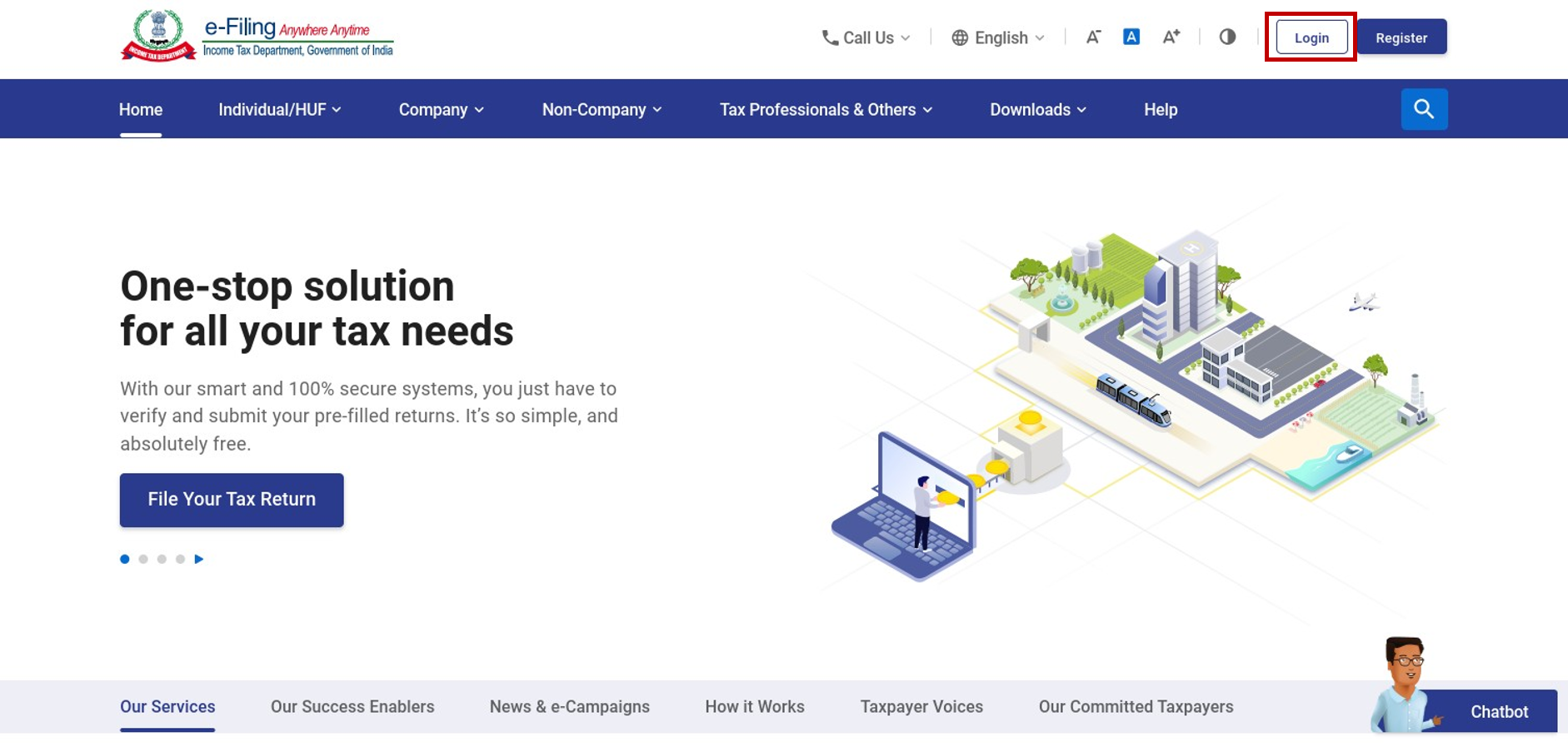

Step 1: Log in to the e-Filing portal using your user ID and password.

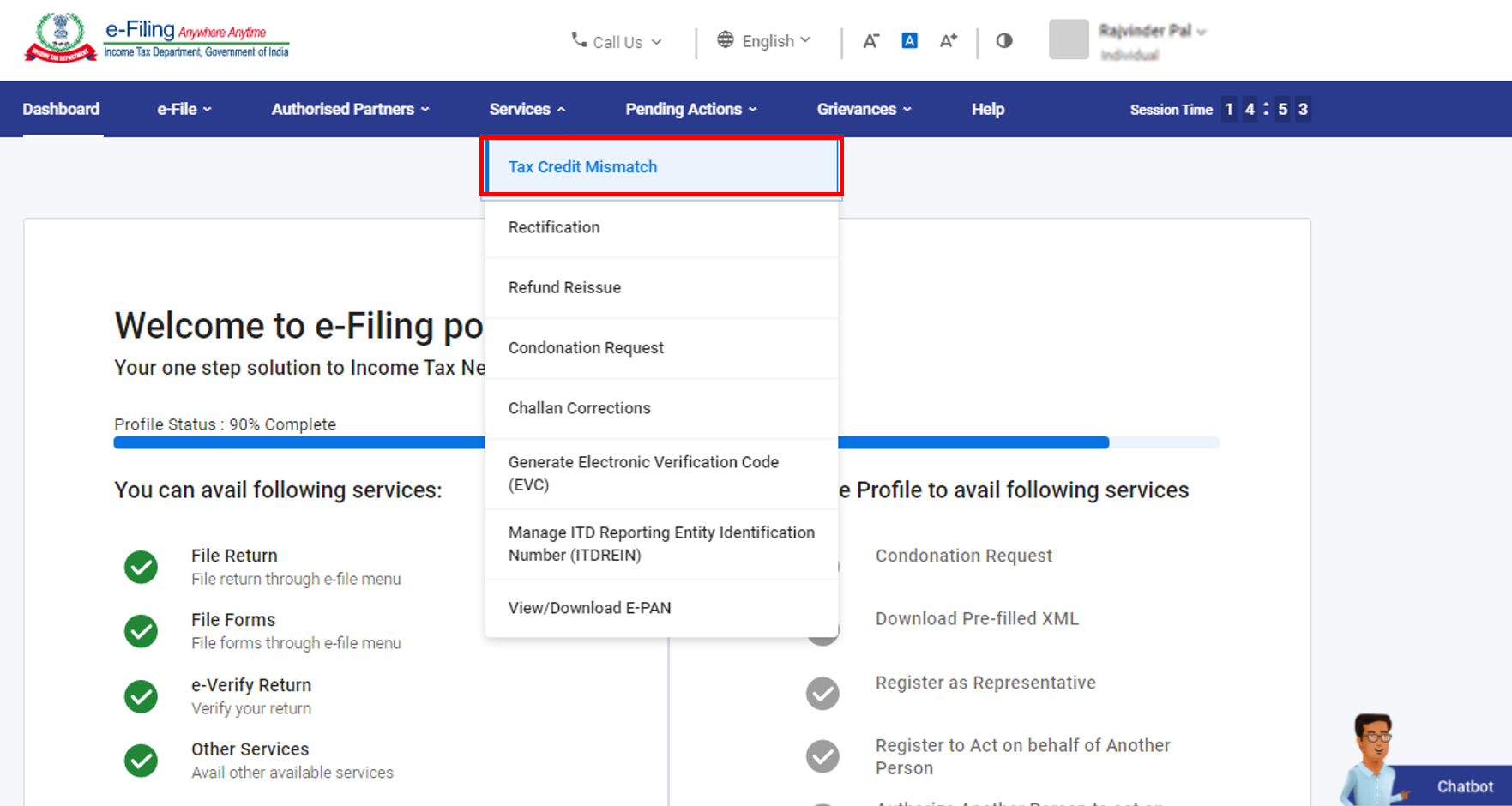

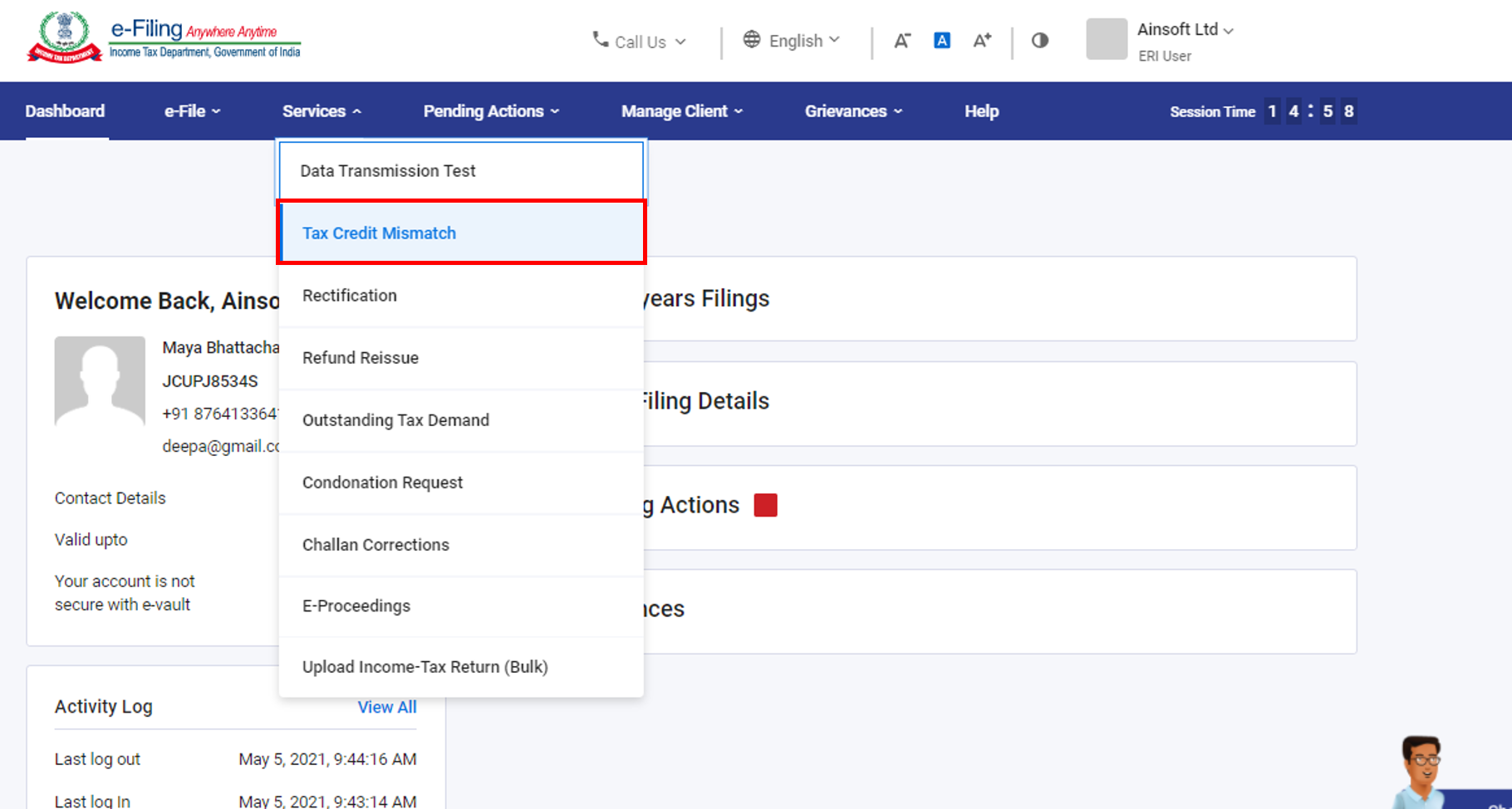

Step 2: On your Dashboard, click Services > Tax Credit Mismatch.

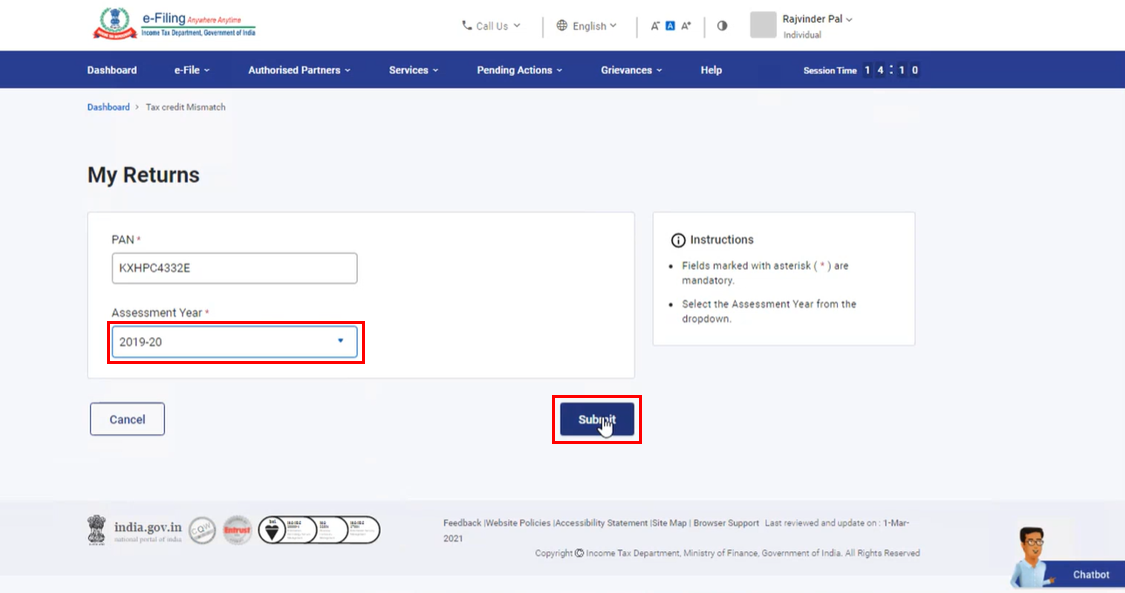

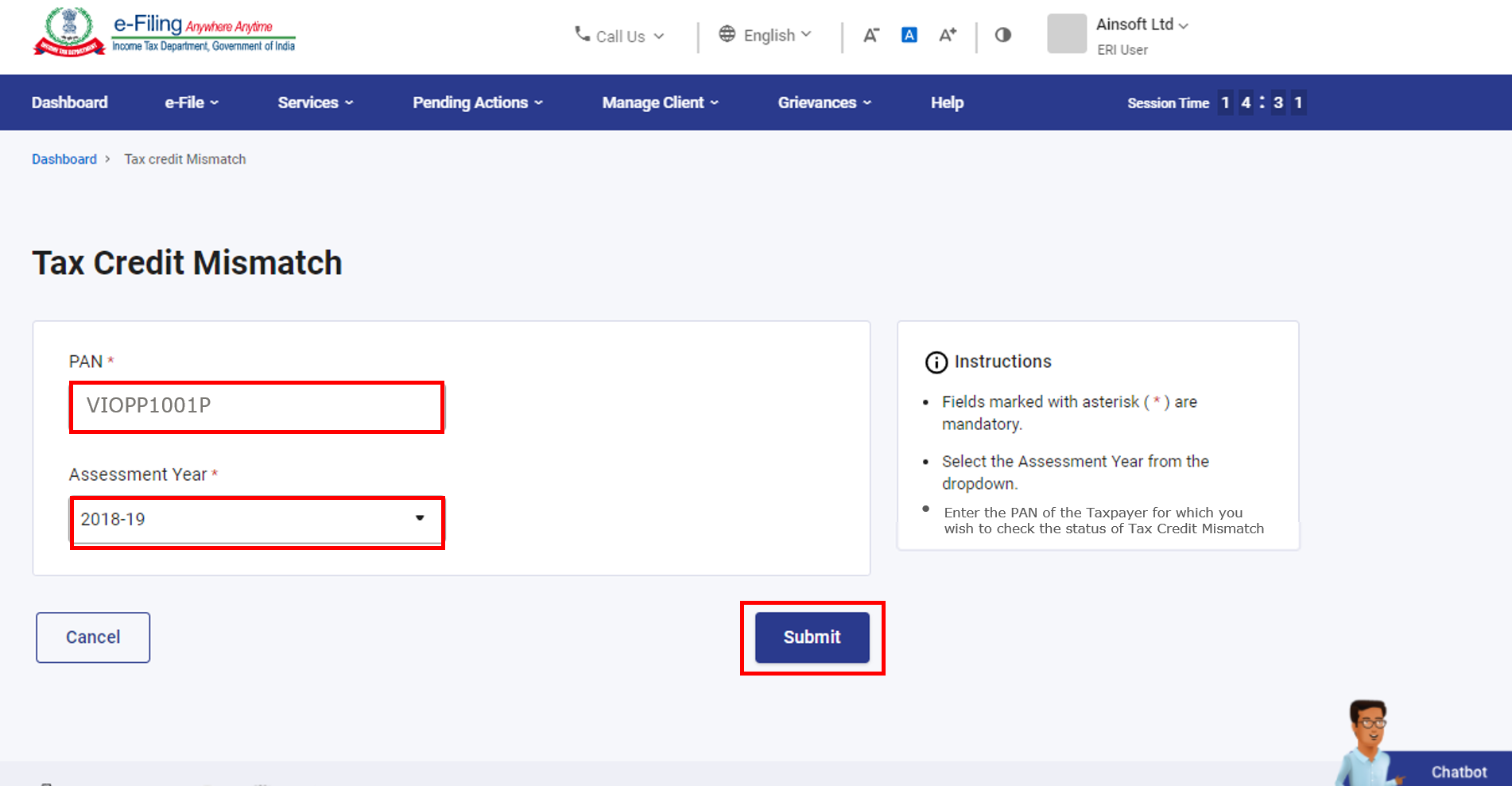

Step 3: On the Tax Credit Mismatch page, select the Assessment Year (for which you want to view the mismatch details) and click Submit.

Note: Your PAN will get pre-filled under the PAN option.

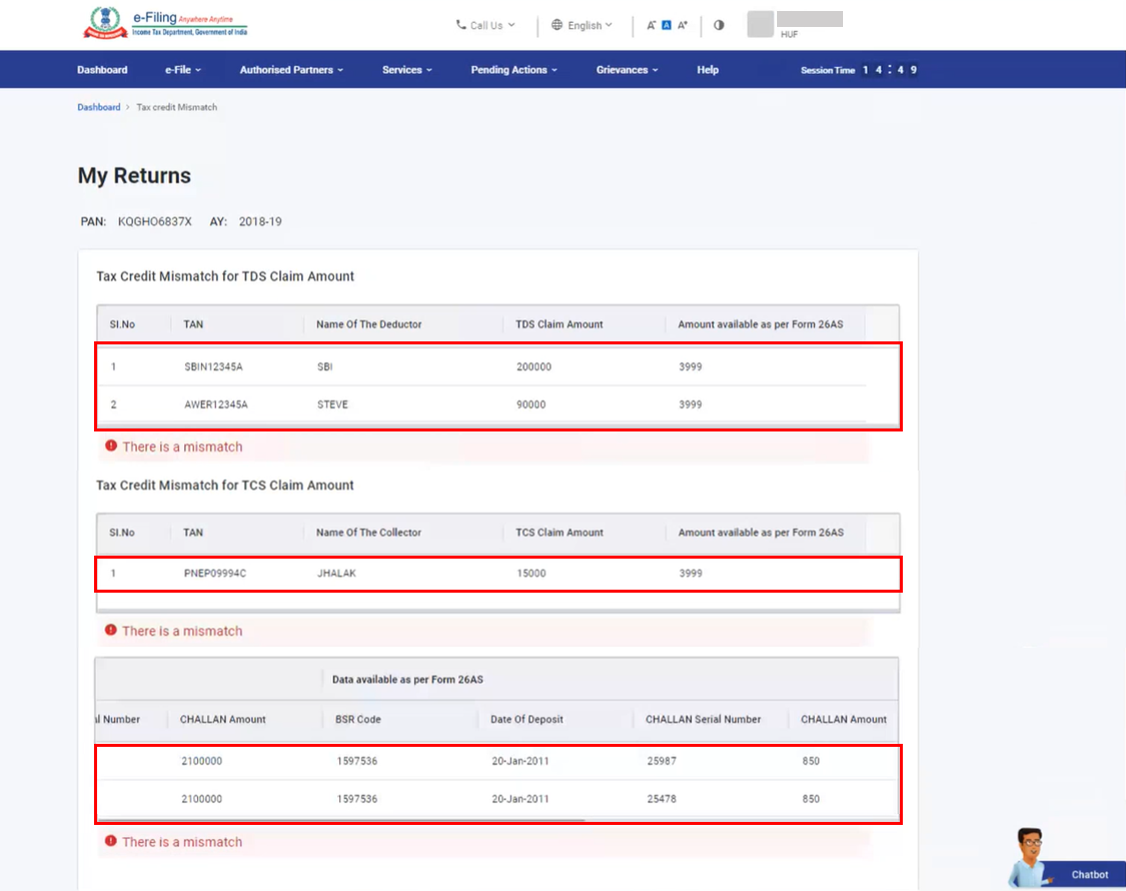

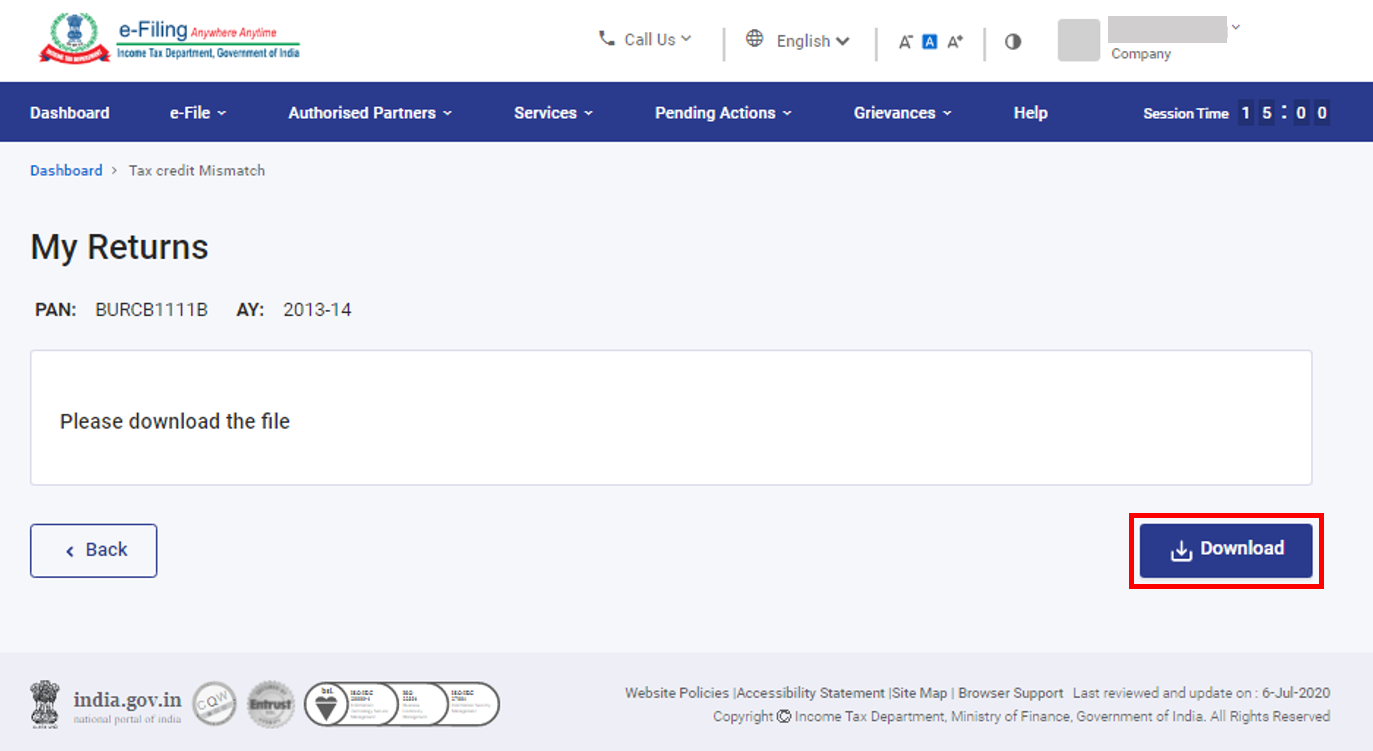

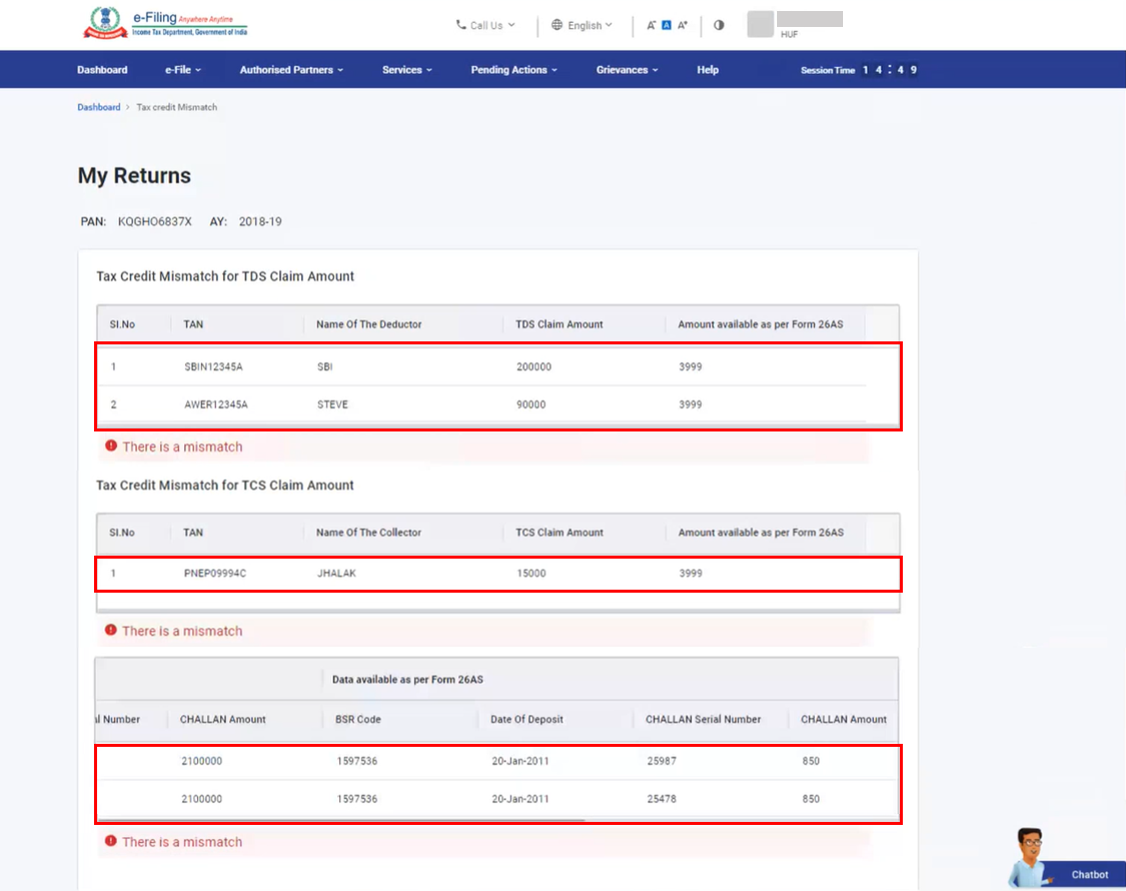

Step 4: The mismatch between TDS and/or TCS and/or Income Tax paid details provided by you in the Income Tax Return and as reflected in Form 26AS is displayed.

Note:

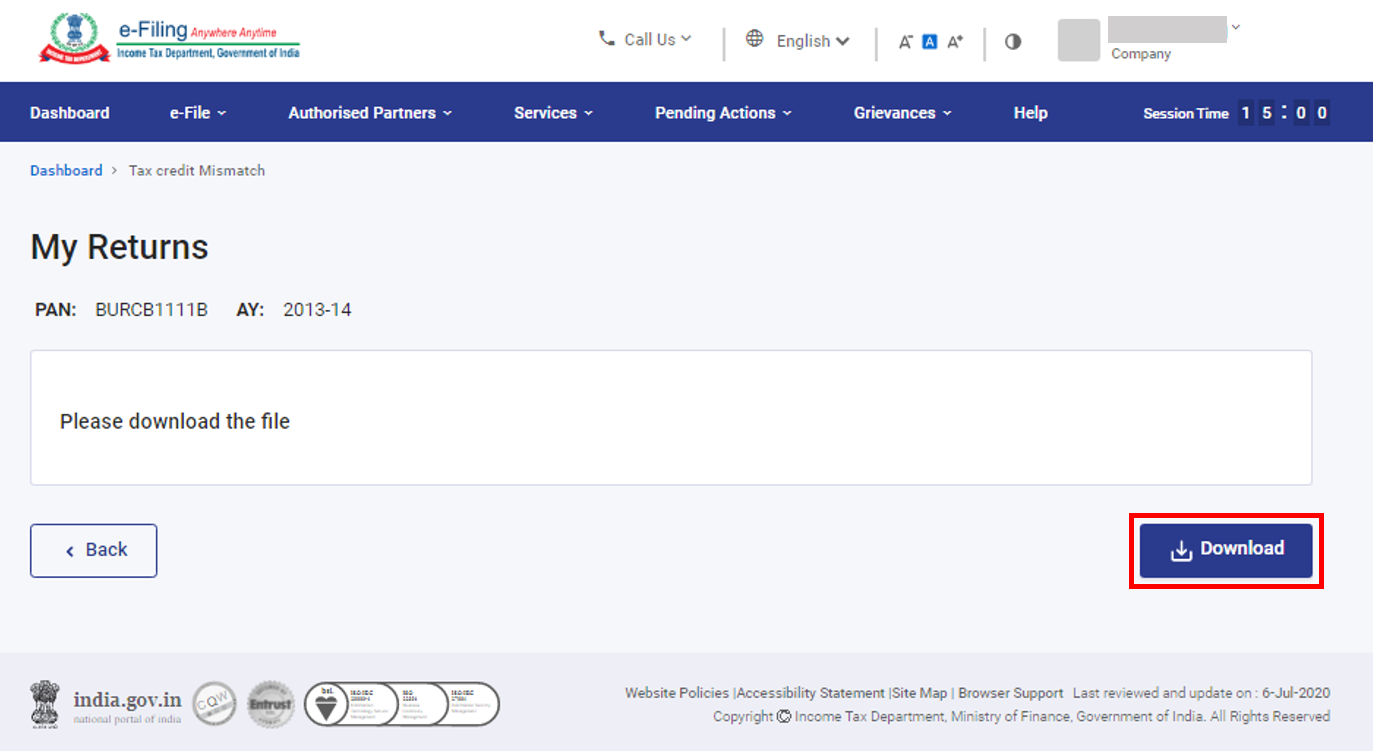

- If there are more than 10 records of mismatch, click Download to download it (in PDF /XLS format).

- If there are 10 or fewer records of mismatch, you can view them on the Tax Credit Mismatch page. You can also download it (in PDF / XLS) by clicking Download.

3.2. View Tax Credit Mismatch (for ERIs)

Step 1: Log in to the e-Filing portal using your user ID and password.

Step 2: On your Dashboard, click Services > Tax Credit Mismatch.

Step 3: On the Tax Credit Mismatch page, enter the PAN (whose details you want to check), select the Assessment Year (for which you want to view the mismatch details) and click Submit.

Step 4: The mismatch between TDS and/or TCS and/or Income Tax paid (Other than TDS / TCS) details provided in the ITR filed for the selected PAN and that reflected in Form 26AS is displayed.

Note:

- If there are more than 10 records of mismatch, click Download to download it (in PDF/ XLS format).

- If there are 10 or lesser records of mismatch, you can view them on the Tax Credit Mismatch page. You can also download it (in PDF / XLS format) by clicking Download.

4. Related Topics

- Login

- Income Tax Returns (Upload)

- Respond to an Outstanding Demand

- Rectification Request

- Service Request