Know TAN Details User Manual

1. Overview

The Know TAN Details service can be used by e-Filing users (both registered and unregistered). You need not log in to the e-Filing portal to use this service.This service allows you to view the TAN Details (Basic details and AO details) of a tax deductor and collector for a TAN. You can view the details by entering either the deductor name or the deductor TAN.

2. Prerequisites for availing this service

- Valid mobile number

- Deductor TAN or Deductor Name

- State of Deductor

3. Step-by-Step Guide

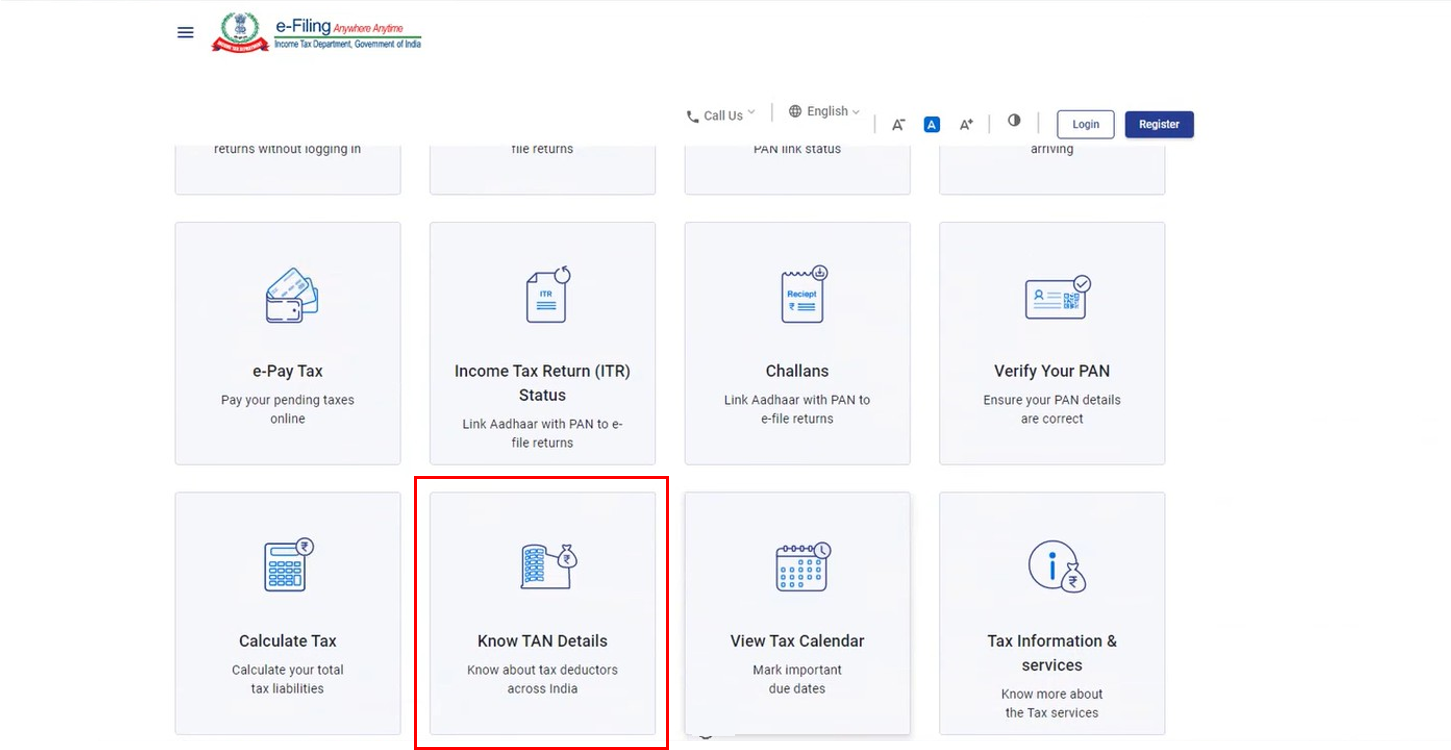

Step 1: Go to the e-Filing portal home page, and click Know TAN Details.

Step 1

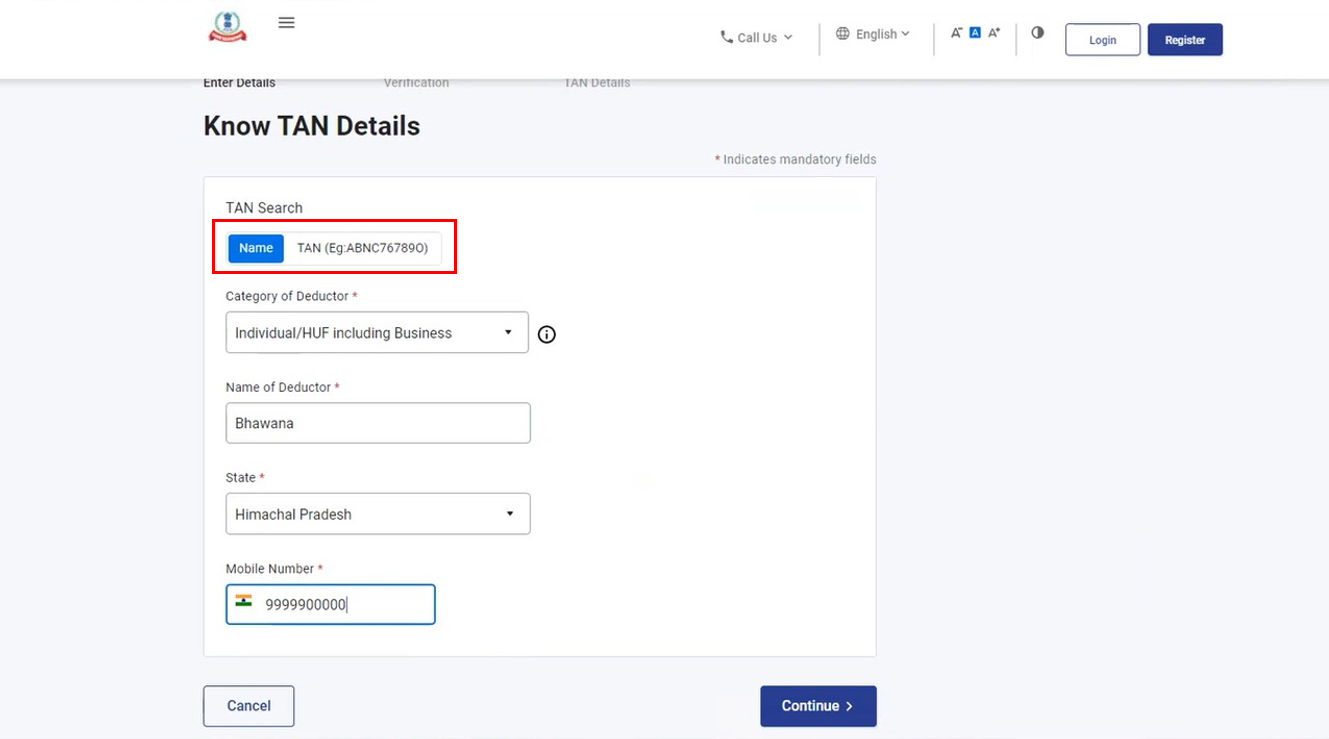

Step 2: On the Know TAN Details page, in case you do not know the TAN of deductor, select the Name option as the search criteria. Select the Category and State of deductor; enter the Name of Deductor, and a valid Mobile Number accessible to you.

Step 2: Choose Name

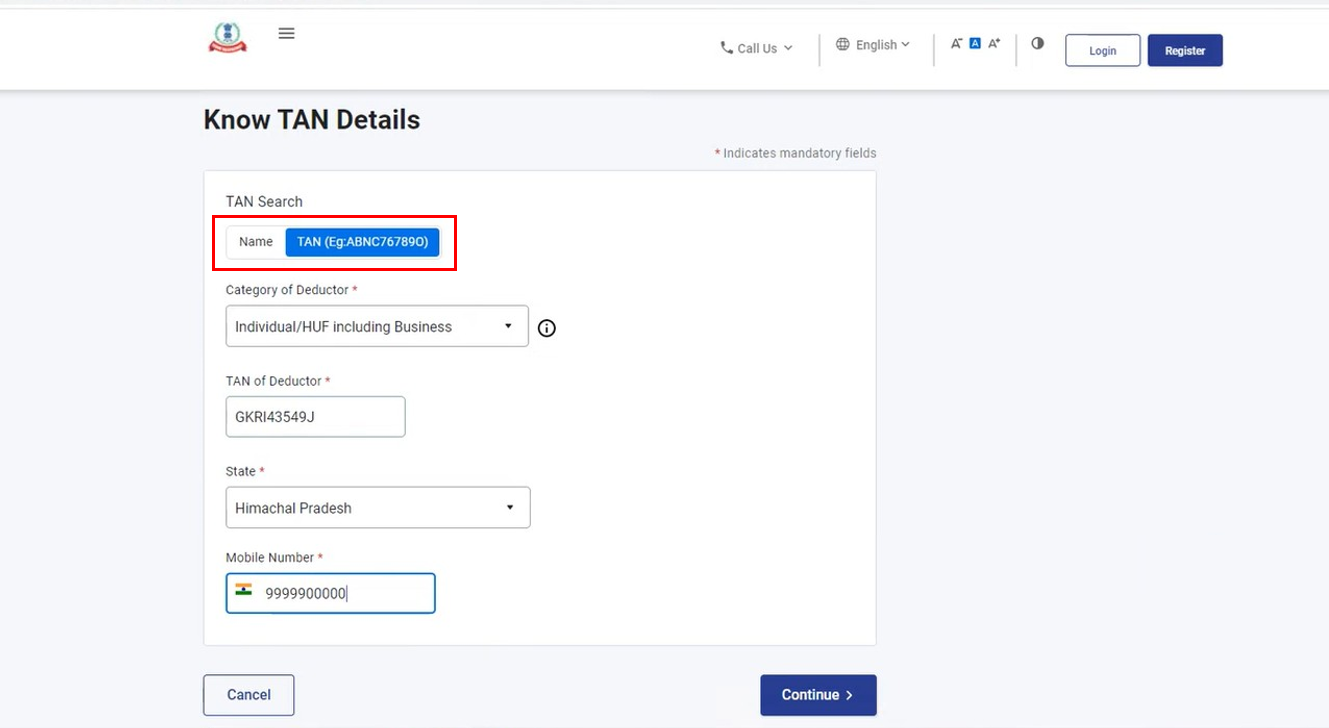

Alternatively, if you know the TAN of the deductor, select the TAN option as the search criteria. Select the Category and State of deductor; enter the TAN of Deductor, and a valid Mobile Number accessible to you.

Step 2: Choose TAN

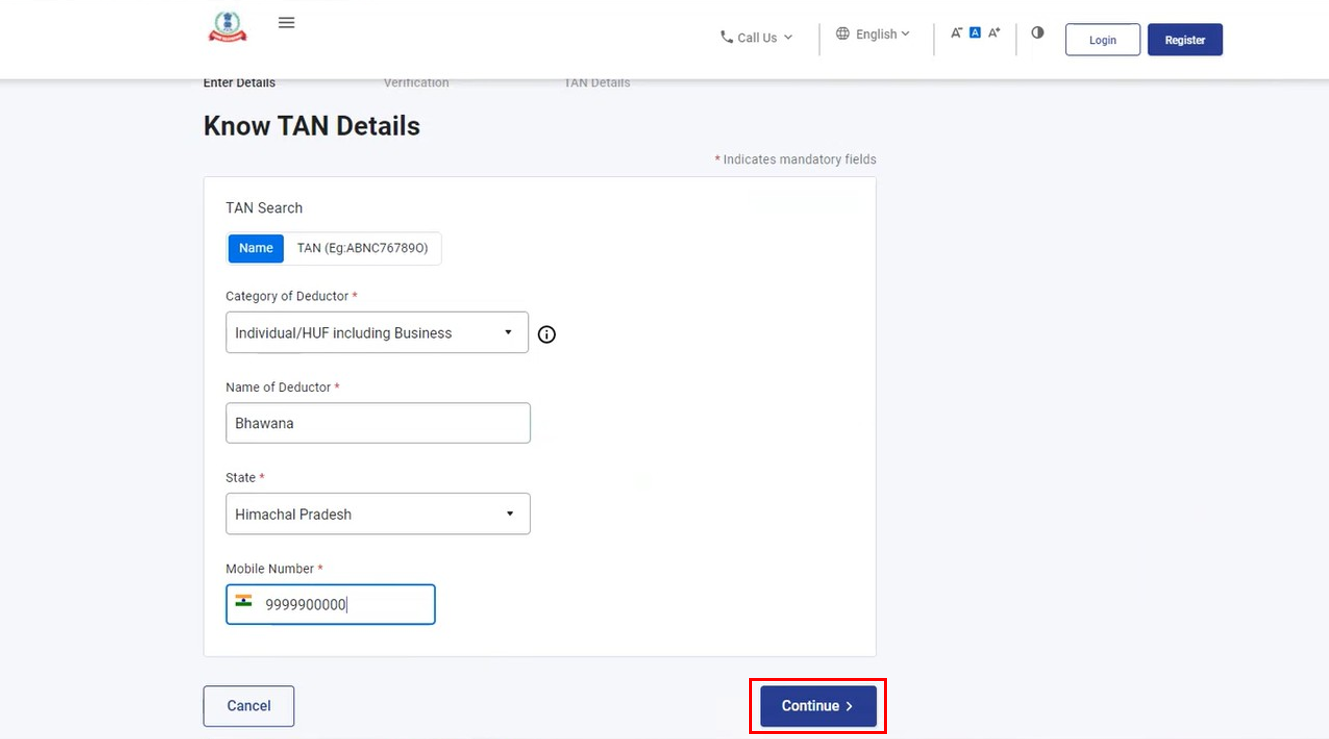

Step 3: Click Continue. You will receive a 6-digit OTP on the mobile number you entered in Step 2 .

Step 3

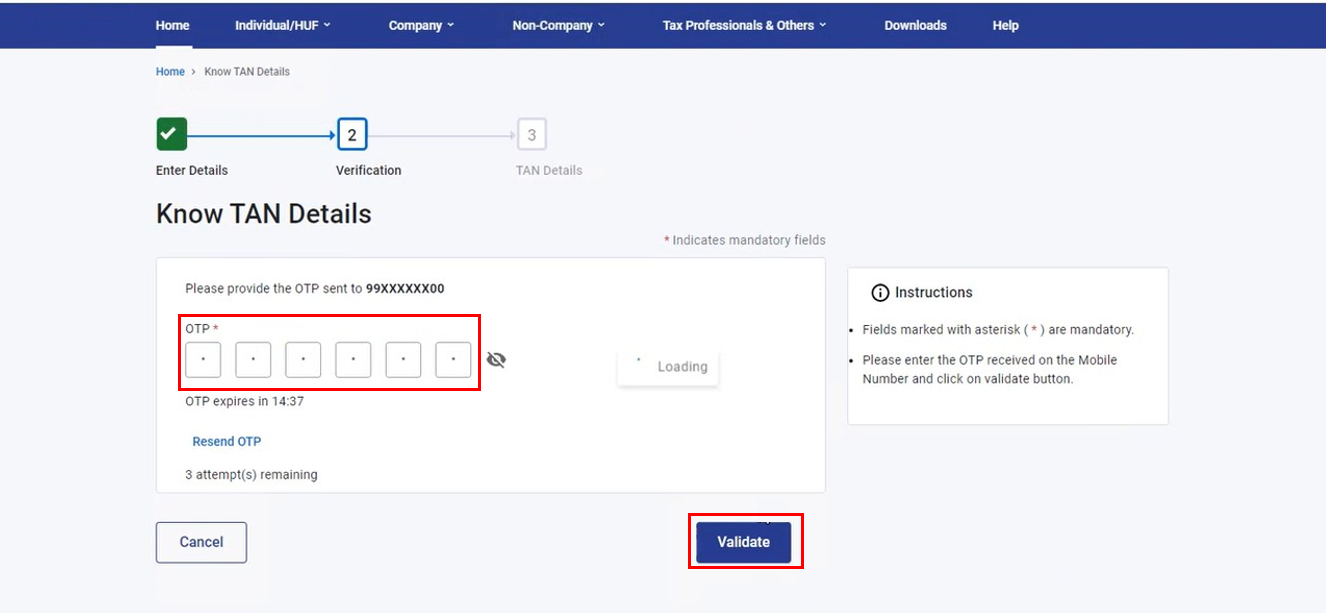

Step 4: On the Verification page, enter the 6-digit OTP and click Validate.

Step 4

Note:

- OTP will be valid for 15 minutes only.

- You have 3 attempts to enter the correct OTP.

- The OTP expiry countdown timer on screen tells you when the OTP will expire.

- On clicking Resend OTP, a new OTP will be generated and sent.

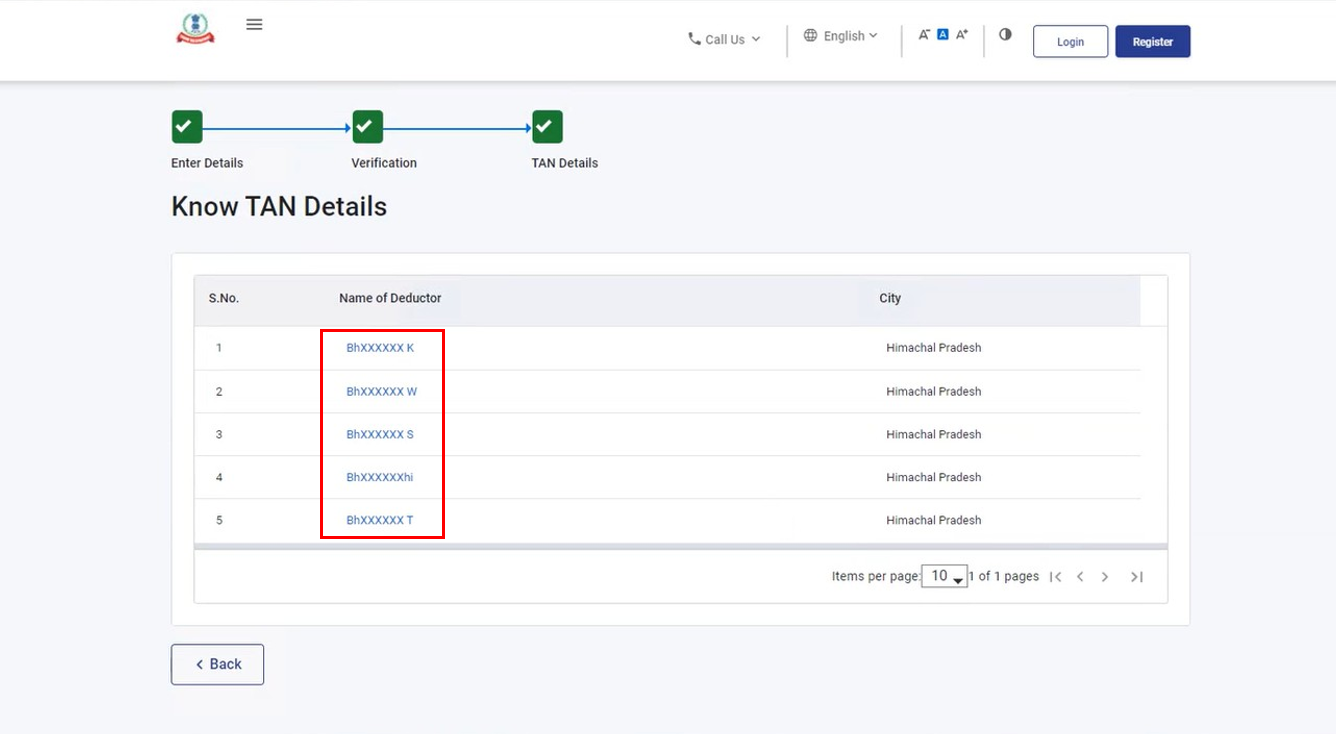

Step 5: In case you had entered the name of the deductor in Step 2, you will see a list of all records that match the name. Click the required Name of Deductor from the TAN Details table, and you will be able to view the deductor's individual TAN Details (Basic Details and AO Details).

Step 5

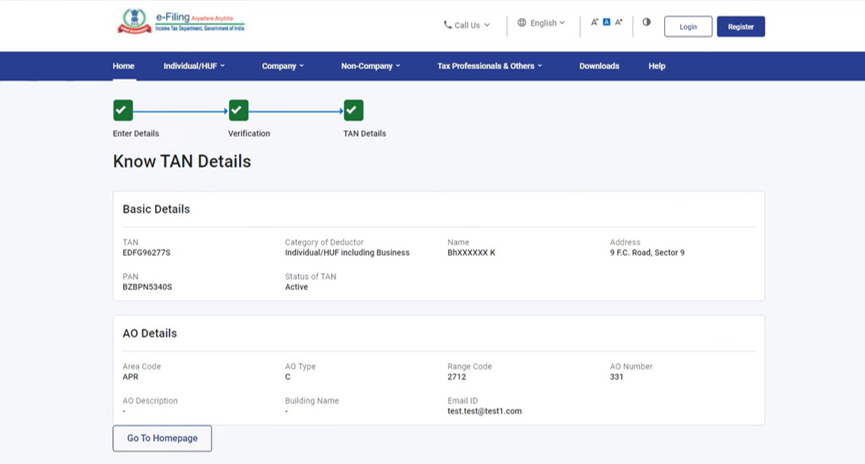

Alternatively, in case you had entered deductor TAN in Step 2, you will see the matching record (Basic Details and AO Details).

Step 5_1

4. Related Topics