1. Overview

This pre-login service is available to all tax deductors/collectors who want to register on and access the e-Filing portal. The Registration service enables the user to access and track all tax-related activities.

2. Prerequisites for availing this service

- Valid and active TAN

- PAN of the Principal Contact should be registered on the e-Filing portal

3. Step-by-Step Guide

Step 1: Go to the e-Filing portal homepage, click Register.

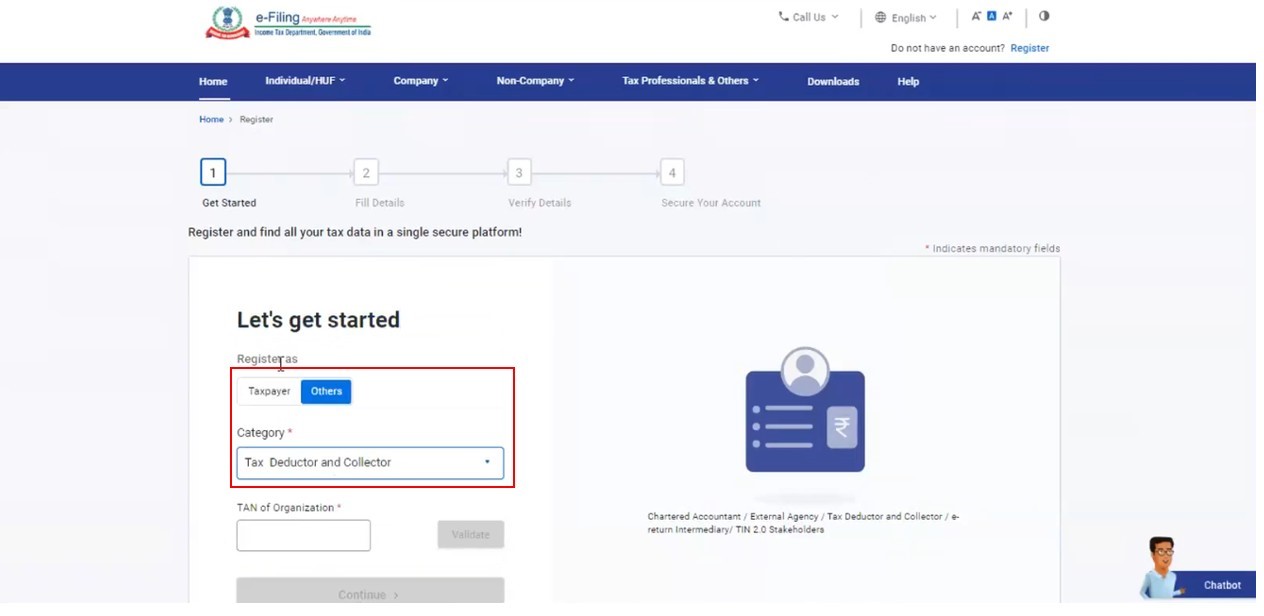

Step 2: Click Others and select the Category as Tax Deductor and Collector.

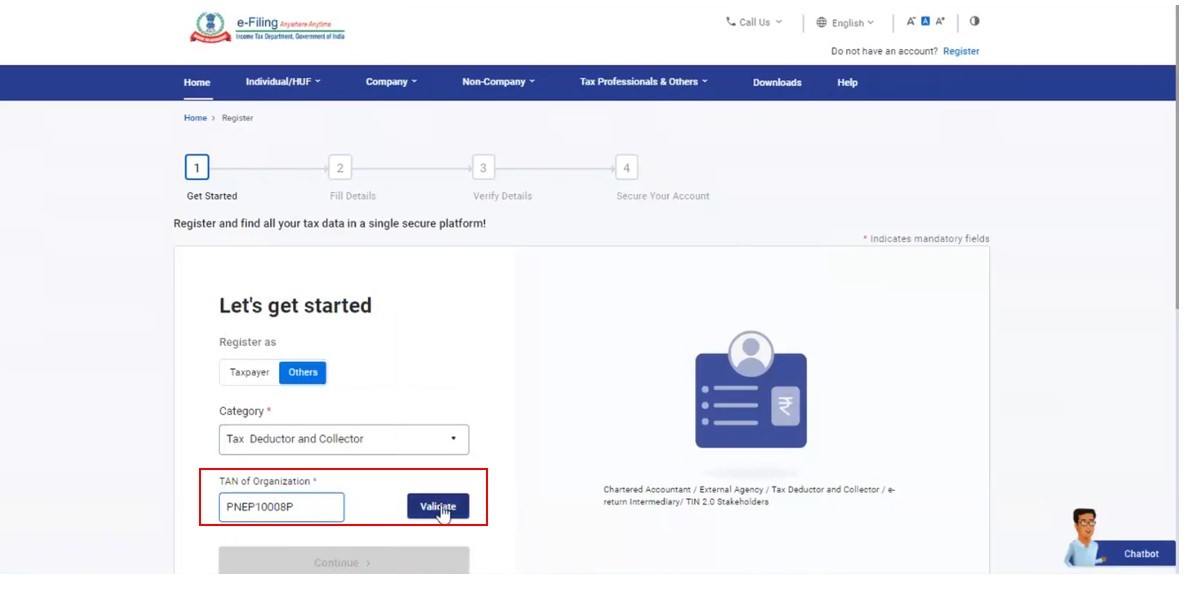

Step 3: Enter the TAN of the Organization and click Validate.

Step 4a: If the TAN is available in the database, registered with TRACES and the registration request is not raised already and pending for approval:

- Click Continue to view the Basic Details page.

- The basic details are pre-filled. Click Continue.

Step 4b: If the TAN is available in the database, but not registered with TRACES and registration request is not raised already and pending for approval:

- Click Continue to view the TRACES page.

- Click Register with e-Filing on TRACES to view the Basic Details page.

- Enter the basic details as required and click Continue.

Note: You first have to first register on TRACES. From there, you will be taken to the e-Filing Registration page on clicking Register with e-Filing.

Step 4c: If the TAN is available in the database, registration request is raised already and pending for approval:

- An error message is displayed and you can choose to withdraw the registration process.

Step 5: Enter the details of the person making payments or collecting tax and click Continue.

Step 6: Provide the contact details including Primary Mobile Number, email ID and Postal Address. Click Continue.

Step 7: Two separate OTPs are sent to your primary mobile number and email ID as entered in Step 6. Enter the separate 6-digit OTPs received on your mobile number and email ID and click Continue.

Note:

- OTP will be valid for 15 minutes only.

- You have 3 attempts to enter the correct OTP.

- The OTP expiry countdown timer on screen tells you when the OTP will expire.

- On clicking Resend OTP, a new OTP will be generated and sent.

Step 8: On the Verify Details page, review the details provided and edit the details if necessary. Click Confirm.

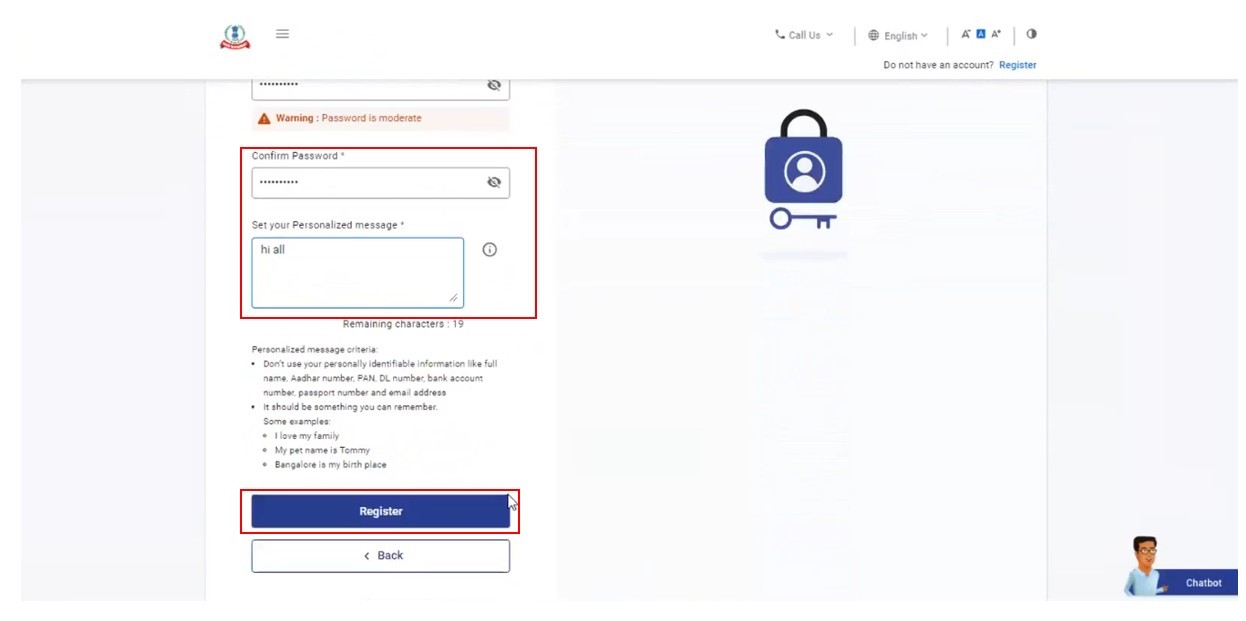

Step 9: On the Set Password page, enter your desired password in both the Set Password and Confirm Password textboxes, set your personalized message, and click Register.

Note:

- Do not click Refresh or Back.

- While entering your new password, be careful of the password policy:

- It should be at least 8 characters and at most 14 characters.

- It should include both uppercase and lowercase letters.

- It should contain a number.

- It should have a special character (e.g. @#$%).

A success message is displayed along with the transaction ID. Please keep a note of the Transaction ID for future reference. The registration process is complete upon receiving approval from the competent authority.