1. Overview

This pre-login service is available to all external agencies (only Central and State Government Departments and Banks) who want to register on and access the e-Filing portal. Central and State Government can use PAN and TAN verification services. Banks can use Prevalidate Bank account , Login though Netbanking and EVC generation through ATM. The Registration service enables the user to access requested webservices post ITD approval and to allow login to e-filing portal as external agency user.

2. Prerequisites for availing this service

- Valid and active TAN/ PAN of organization for registering as External Agency

- Valid and active PAN of Principal Contact registered on the e-Filing portal

- Signed Requisition letter in given format based on Type of External Agency <Refer Step 6 for requisition letter formats>

3. Step-by-Step Guide

3.1 Submit Registration request

Step 1: Go to the e-Filing portal homepage, click Register.

Step 2: Click Others and select Category as External Agency and click Continue.

Step 3: Enter all the mandatory details including Agency Type, TAN / PAN of the Organization, Organization Name and DOI in the Basic Details page and click Continue.

Step 4: Enter the required details including Primary Mobile Number, email ID and Postal Address on the Principal Contact Details page and click Continue.

Step 5: Two separate OTPs are sent to the primary mobile number and email ID entered in step 4. Enter the separate 6-digit OTPs received on your mobile number and email ID and click Continue.

Note:

- OTP will be valid for 15 minutes only.

- You will have 3 attempts to enter the correct OTP.

- The OTP expiry countdown timer on screen tells you when the OTP will expire.

- On clicking Resend OTP a new OTP will be generated and sent.

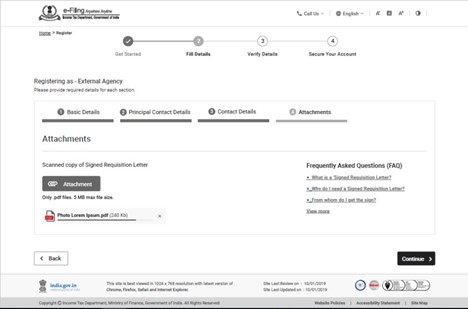

Step 6: Attach a scanned copy of the signed requisition letter and click Continue.

Requisition_Letter_For_Central_and_State_Government_departments_or_agencies

Note:

- The maximum size of a single attachment should be 5 MB.

- If you have multiple documents to upload, put them together in a zipped folder and upload the folder. The maximum of all attachments in a zipped folder should be 50 MB.

Step 7: On the Verify Details page edit the details in the page if required. Validate the details provided in the page and click Confirm.

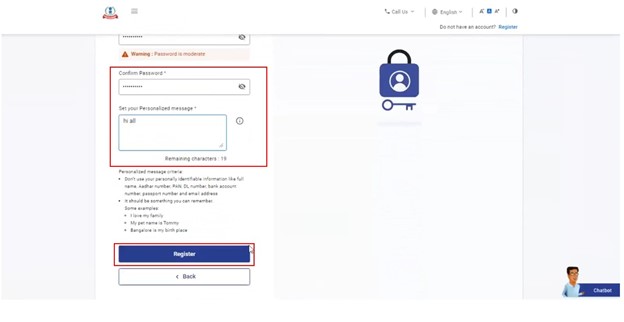

Step 8: On the Set Password page, enter your desired password in both the Set Password and Confirm Password textbox and click Register.

Note:

- Do not click Refresh or Back.

- While entering your new password, be careful of the password policy:

- It should be at least 8 characters and at most 14 characters.

- It should include both uppercase and lowercase letters.

- It should contain a number.

- It should have a special character (e.g. @#$%).

Step 9: Upon approval from ITD, you will receive an email containing the External Agency user ID of format (EXTPXXXXXX) on your primary email ID registered on the e-Filing Portal.

You will be able to login to the e-Filing portal with the user ID received and password set by you during registration.

3.2 Onboarding on e-Filing portal

In order to successfully complete registration on the e-Filing portal, you will have seek approval from the competent authority in Income Tax Department by sharing necessary details.

Step 1: Share details of your IP addresses with efilingwebmanager@incometax.gov.in with the subject: External Agency- UAT Source IP details for testing.

Step 2: You will be registered temporarily on a testing portal. You will be provided the associated API Gateway authentication credentials, along with the URL, technical details, Test Scenarios, Test Data and Test Report Template.

Step 3: You will have to share the final UAT test report for seeking approval from the competent authority in Income Tax Department at efilingwebmanager@incometax.gov.in with email subject: External Agency- UAT test report for ITD approval.

Step 4: Only after approval by the competent authority in Income Tax Department, API Gateway authentication credentials of the e-Filing portal will be shared with you.