1. Overview

The total Income Tax liability is calculated on the total income earned during a particular Financial Year. However, if the income for the particular Financial Year includes an advance or arrear payment in the nature of salary, the Income Tax Act allows relief (u/s 89) for the additional burden of the tax liability.

Form 10E needs to be filed to claim such a relief. It is advisable that Form 10E is filed before filing Income Tax Return. The said form is available for filing on e-filing portal. If Form 10E is not filed and the taxpayer claims relief u/s 89, the ITR filed will be processed but the relief claimed will not be allowed. It is mandatory to file Form 10E to claim a tax relief on arrear/advance income under Salary.

Form 10E can be submitted through online mode only.

2. Prerequisites for availing this service

- You should be a registered user on the e-Filing portal

- Status of PAN of the taxpayer should be "Active"

3. About the Form

3.1 Purpose

The Income Tax Act u/s 89 provides relief to an assessee for any salary or profit in lieu of salary or family pension received by an assessee in advance or arrears in a Financial Year. This relief is granted as the total income assessed is at a rate higher than that at which it would otherwise have been assessed. Such relief can be claimed by furnishing particulars of your income in Form 10E.

3.2 Who can use it?

All registered users, being an Individual, on the e-Filing portal can furnish particulars of their income in Form 10E for claiming relief as per Section 89 of Income Tax Act, 1961.

3.3 Form at a Glance

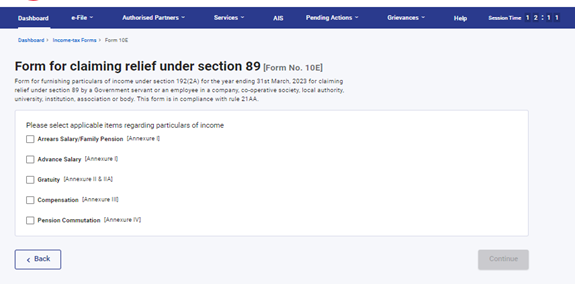

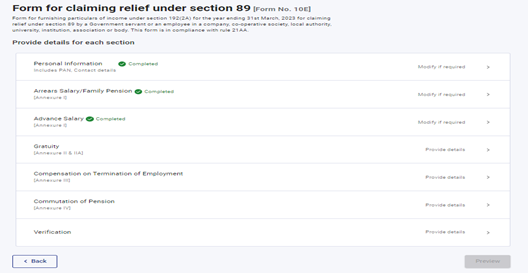

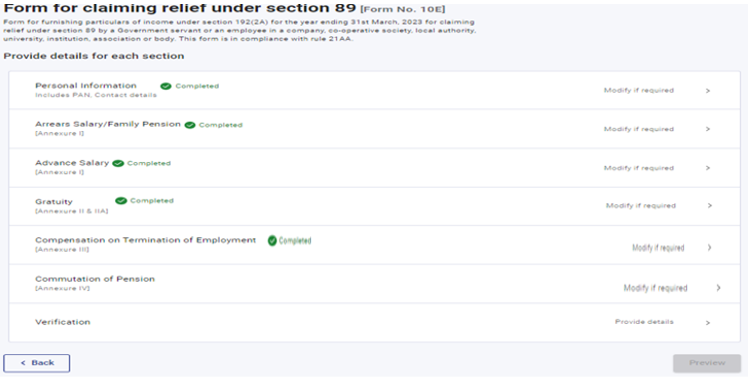

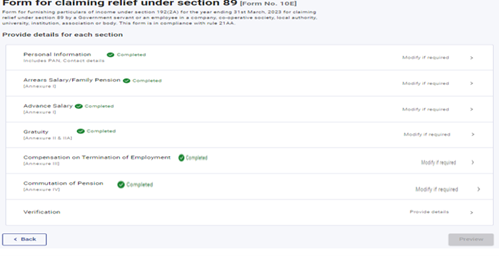

Form 10E has seven parts:

- Annexure I - Arrears Salary / Family Pension received in arrears

- Annexure I - Salary / Family Pension received in advance

- Annexure II & IIA – Payment in nature of Gratuity in respect of past services

- Annexure III – Payment in nature of compensation from the employer or previous employer at or in connection with termination of employment after continuous service of not more than 3 years or where the unexpired portion of term of employment is also not less than 3 years.

- Annexure IV – Commutation of pension

Based on the nature of amount received, appropriate annexure needs to be selected while filing Form 10E.

4. Step-by-Step Guide

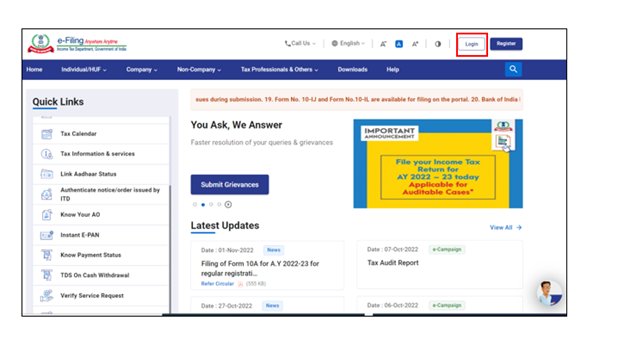

Step 1: Log in to the e-Filing portal with your User ID and Password.

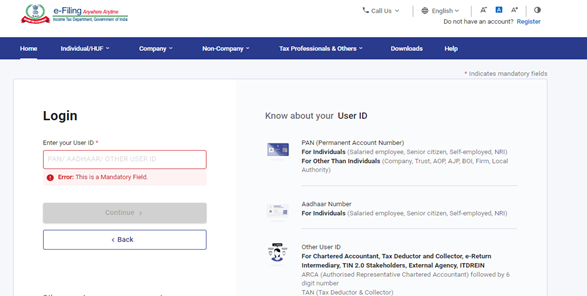

Step 2: Enter the User ID (PAN) and Password.

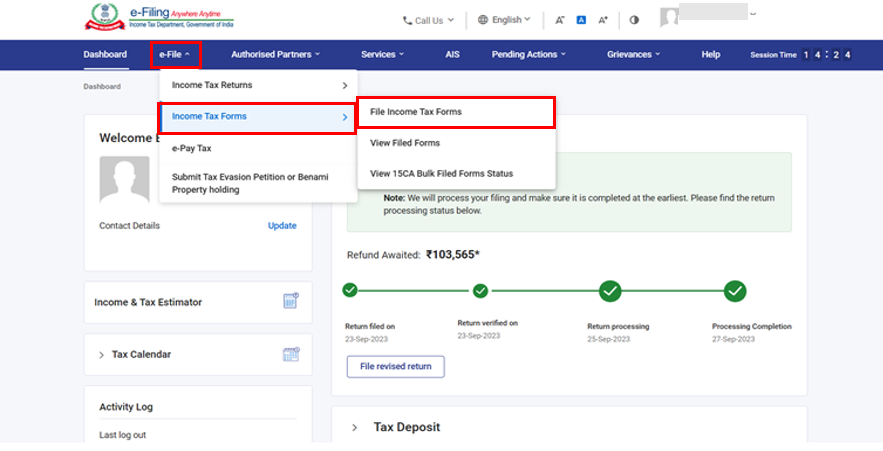

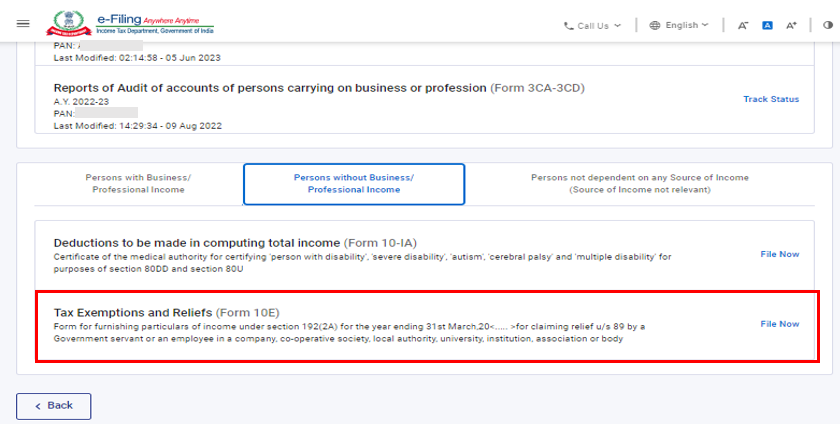

Step 3 : Go to e-file >Income Tax Forms > File Income Tax Forms

Step 4 : Select/ Search Form 10E

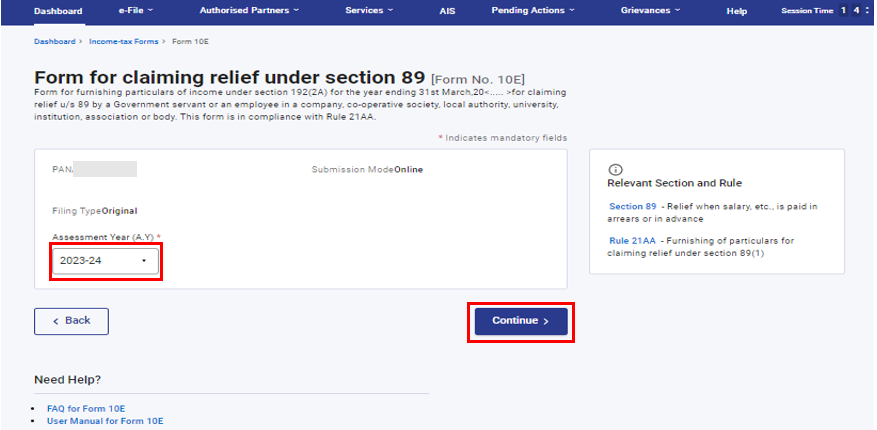

Step 5: Select AY and click Continue.

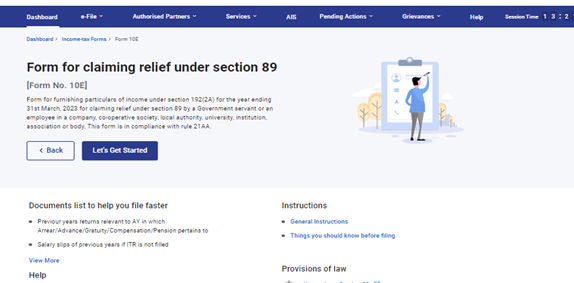

Step 6: Click on Let’s Get Started

Step 7 : Select the applicable items regarding particulars of income

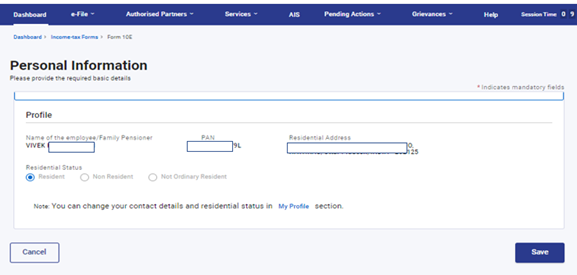

Step 8: Confirm the Personal Information and click Save.

Note : Please ensure that all mandatory details under "My Profile" section including residential status is completed. You can change your contact details and residential status by clicking on hyperlink “My Profile”.

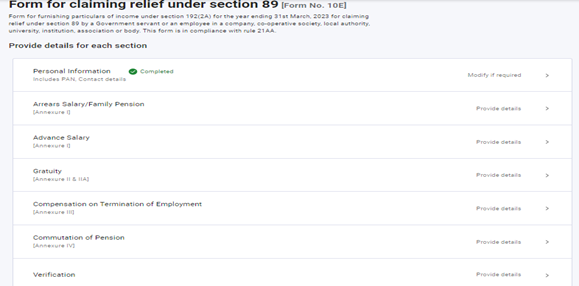

Step 9.1.a : Personal Information Tab is confirmed now, click on Arrears Salary/Family pension (if applicable to you)

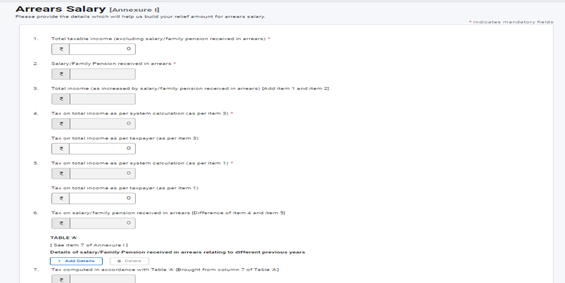

Step 9.1.b : This part contains general details of salary / Family Pension received in arrears.

Enter the details and click Save

The details in field "Salary/Family Pension received in arrears" shall be populated based on the information provided in Table A to be added after S. No. 6. "Details of salary/Family Pension received in arrears relating to different previous years".

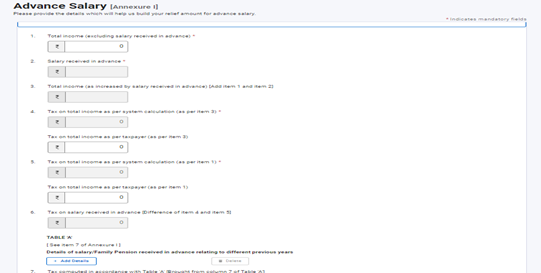

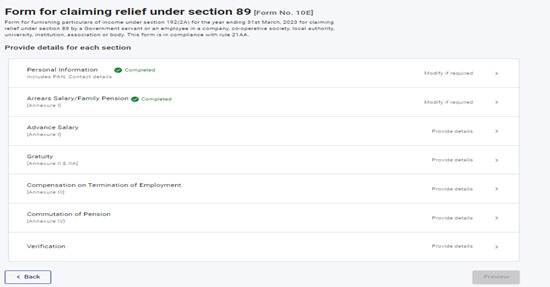

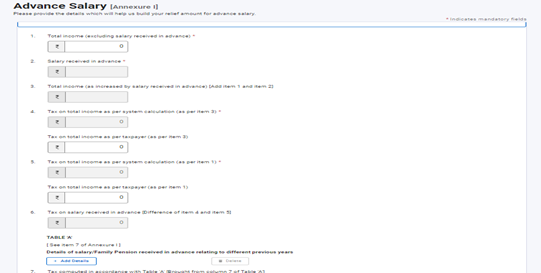

Step 9.2.a : Arrear Salary tab is confirmed now, click on Advance Salary (if applicable to you)

Step 9.2.b: This part contains general details of salary / Family Pension received in advance.

Enter the details and click Save

The details in field “Salary received in Advance” shall be populated based on the information provided in Table A to be added after S. No. 6. "Details of Salary/Family Pension received in advance relating to different previous years".

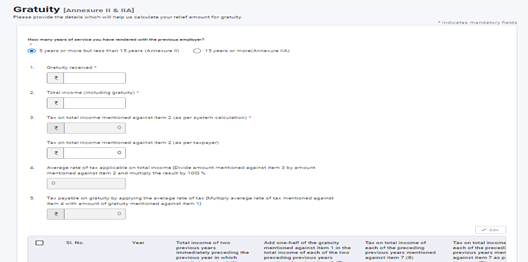

Step 9.3.a : Advance salary tab is confirmed now, click on Gratuity (if applicable to you)

Step 9.3.b : This part contains general details of payment in nature of Gratuity in respect of past services.

Enter the details and click Save

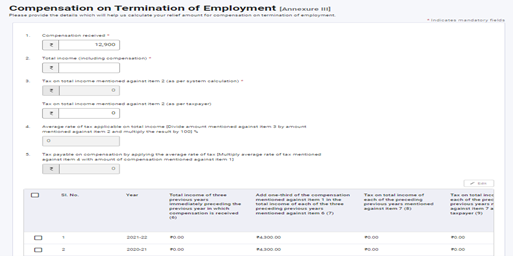

Step 9.4.a : Gratuity tab is confirmed now, click on Compensation on Termination of Employment tab (if applicable to you)

Step 9.4.b : This part contains general details of payment in nature of compensation from the employer or previous employer at or in connection with termination of employment after continuous service of not more than 3 years or where the unexpired portion of term of employment is also not less than 3 years.

Enter the details of Compensation on Termination of Employment tab and click Save

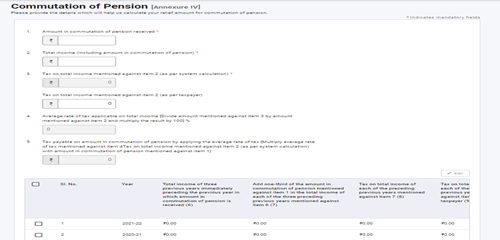

Step 9.5.a : Compensation on Termination of Employment tab is confirmed now, click on Commutation of Pension tab (if applicable to you)

Step 9.5.b: This part contains general details of Payment in commutation of pension.

Enter the details of Commutation of Pension tab and click Save

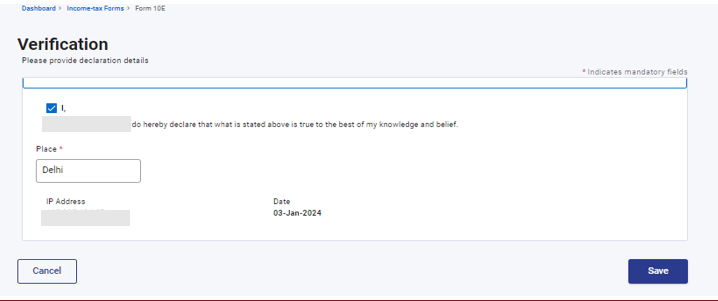

Step 10: Commutation of Pension tab is confirmed now, click on Verification tab

Step 11 : Select the check box, enter the Place and click Save

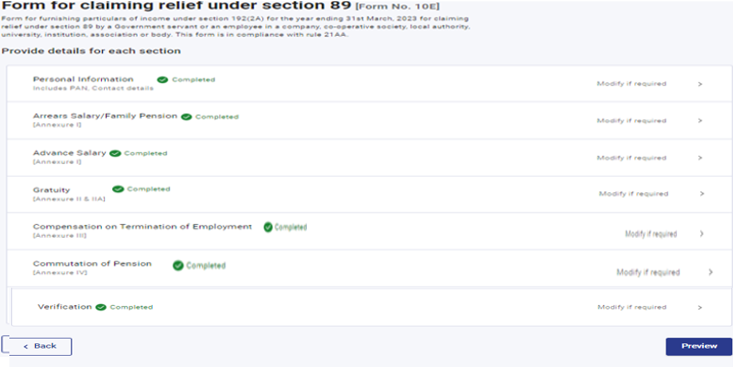

Step 12: All the tabs are confirmed now. Click on Preview

Step 13 : This is the Preview of the Form. Click on Proceed to e-Verify, if details are correct in Preview, else you can edit the details.

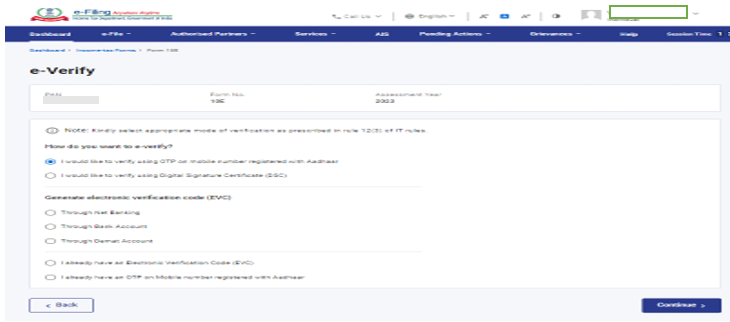

Step 14 : You can e-Verify the Form through any of the modes of Verification.

After e-Verification, Form 10E will be submitted. Acknowledgement number will be generated and communicated on registered e-mail Id and Mobile Number.